Updated on February 26th, 2024 by Bob Ciura

DRIP stands for Dividend Reinvestment Plan. When an investor is enrolled in DRIP stocks, it means that incoming dividend payments are used to purchase more shares of the issuing company – automatically.

Many businesses offer DRIPs that require the investors to pay fees. Obviously, paying fees is a negative for investors. As a general rule, investors are better off avoiding DRIP stocks that charge fees.

Fortunately, many companies offer no-fee DRIP stocks. These allow investors to use their hard-earned dividends to build even larger positions in their favorite high-quality, dividend-paying companies – for free.

The Dividend Champions are a group of quality dividend stocks that have raised their dividends for at least 25 consecutive years.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Think about the powerful combination of DRIPs and Dividend Champions…

You are reinvesting dividends into a company that pays higher dividends every year. This means that every year you get more shares – and each share is paying you more dividend income than the previous year.

This makes a powerful (and cost-effective) compounding machine.

This article takes a look at the top 15 Dividend Champions that are no-fee DRIP stocks, ranked in order of expected total returns from lowest to highest.

The updated list for 2024 includes our top 15 Dividend Champions, ranked by expected returns according to the Sure Analysis Research Database, that offer no-fee DRIPs to shareholders.

You can skip to analysis of any individual Dividend Champion below:

- #15: Illinois Tool Works (ITW)

- #14: A.O. Smith (AOS)

- #13: Emerson Electric (EMR)

- #12: Tompkins Financial (TMP)

- #11: York Water Company (YORW)

- #10: UGI Corp. (UGI)

- #9: Hormel Foods (HRL)

- #8: Realty Income (O)

- #7: Universal Corporation (UVV)

- #6: S&P Global (SPGI)

- #5: Northwest Natural Gas (NWN)

- #4: Johnson & Johnson (JNJ)

- #3: National Fuel Gas (NFG)

- #2: Telephone & Data Systems (TDS)

- #1: 3M Company (MMM)

Additionally, please see the video below for more coverage.

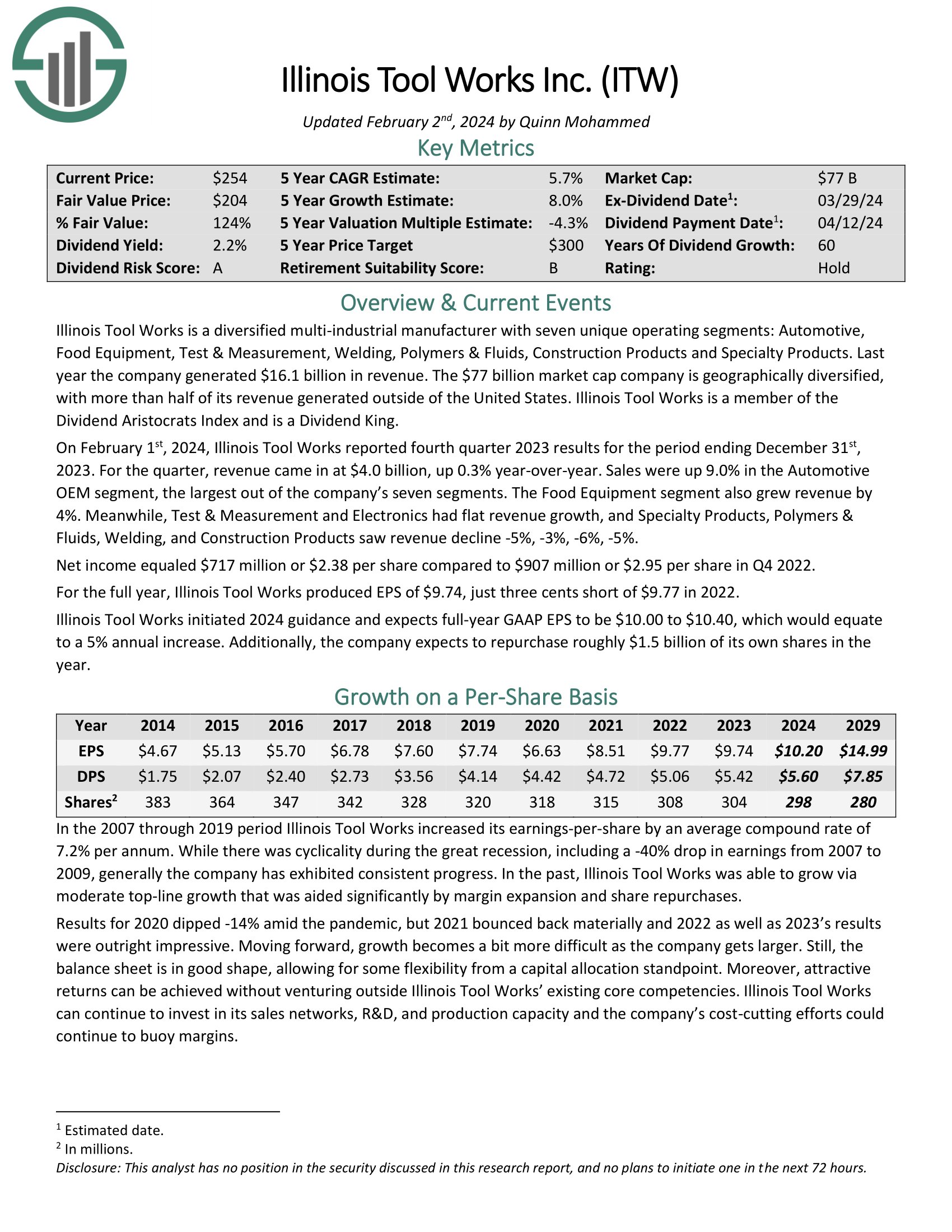

#15: Illinois Tool Works (ITW)

- 5-year expected annual returns: 5.1%

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products.

On February 1st, 2024, Illinois Tool Works reported fourth quarter 2023 results for the period ending December 31st, 2023. For the quarter, revenue came in at $4.0 billion, up 0.3% year-over-year. Sales were up 9.0% in the Automotive OEM segment, the largest out of the company’s seven segments. The Food Equipment segment also grew revenue by 4%.

Illinois Tool Works initiated 2024 guidance and expects full-year GAAP EPS to be $10.00 to $10.40, which would equate to a 5% annual increase. Additionally, the company expects to repurchase roughly $1.5 billion of its own shares in the year.

Click here to download our most recent Sure Analysis report on ITW (preview of page 1 of 3 shown below):

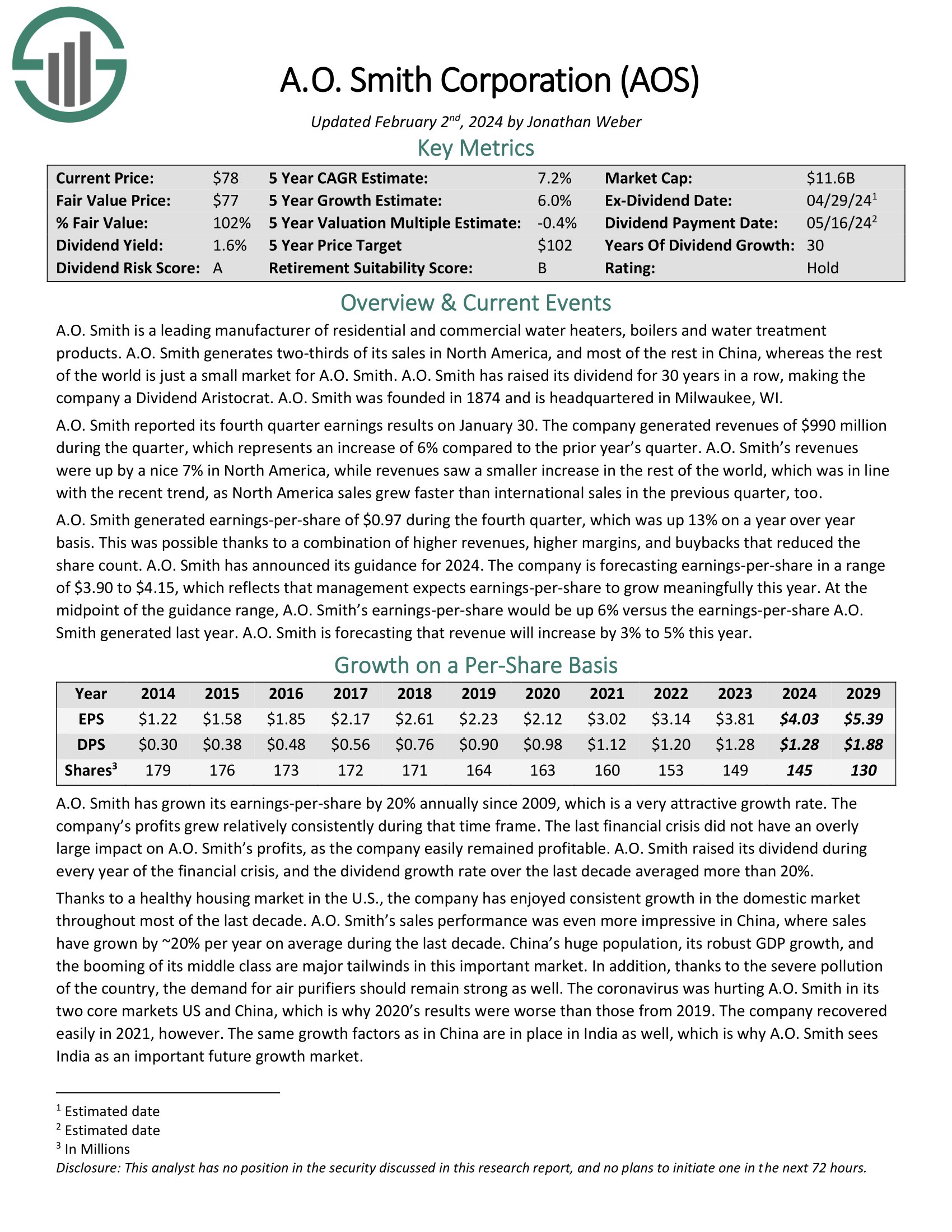

#14: A.O. Smith (AOS)

- 5-year expected annual returns: 6.4%

A.O. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment products. A.O. Smith generates the majority of its sales in North America, with the remainder from the rest of the world.It has category-leading brands across its various geographic markets.

A.O. Smith reported its fourth quarter earnings results on January 30. The company generated revenues of $990 million during the quarter, which represents an increase of 6% compared to the prior year’s quarter. A.O. Smith’s revenues were up by 7% in North America, while revenues saw a smaller increase in the rest of the world.

A.O. Smith generated earnings-per-share of $0.97 during the fourth quarter, which was up 13% on a year over year basis. This was possible thanks to a combination of higher revenues, higher margins, and buybacks that reduced the share count.

Click here to download our most recent Sure Analysis report on A.O. Smith (preview of page 1 of 3 shown below):

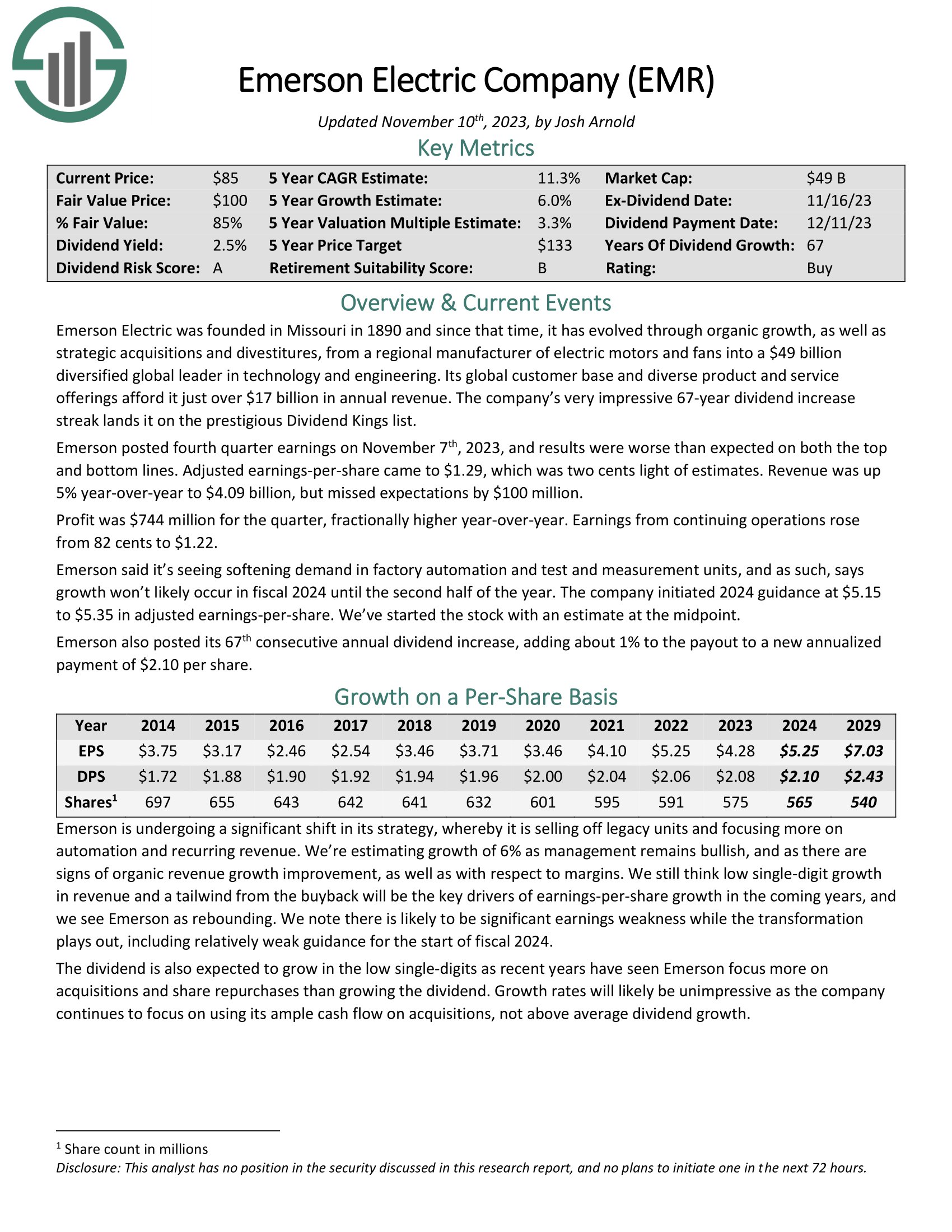

#13: Emerson Electric (EMR)

- 5-year expected annual returns: 7.1%

Emerson Electric is an ideal candidate for a no-fee DRIP program, as the company has increased its dividend for over 60 years in a row.

Emerson Electric was founded in Missouri in 1890 and since that time, it has evolved through organic growth, as well as strategic acquisitions and divestitures, from a regional manufacturer of electric motors and fans into a $49 billion diversified global leader in technology and engineering.

Its global customer base and diverse product and service offerings afford it about $20 billion in annual revenue. The company has increased its dividend for 66 years in a row.

Click here to download our most recent Sure Analysis report on EMR (preview of page 1 of 3 shown below):

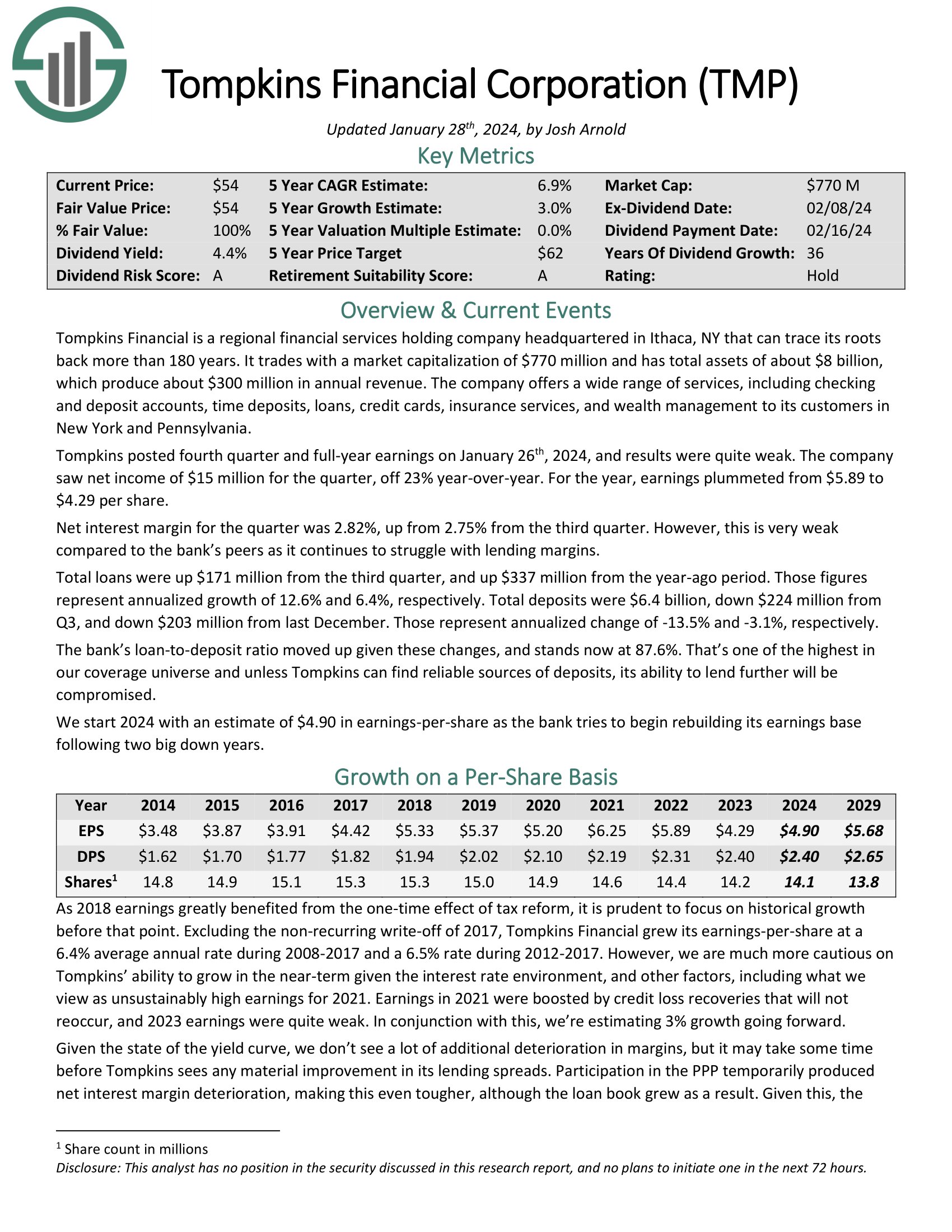

#12: Tompkins Financial (TMP)

- 5-year expected annual returns: 9.1%

Tompkins Financial is a regional financial services holding company headquartered in Ithaca, NY that can trace its roots back more than 180 years. It has total assets of about $8 billion, which produce about $300 million in annual revenue. The company offers a wide range of services, including checking and deposit accounts, time deposits, loans, credit cards, insurance services, and wealth management to its customers in New York and Pennsylvania.

Tompkins posted fourth quarter and full-year earnings on January 26th, 2024. The company saw net income of $15 million for the quarter, off 23% year-over-year. For the year, earnings plummeted from $5.89 to $4.29 per share. Net interest margin for the quarter was 2.82%, up from 2.75% from the third quarter. However, this is very weak compared to the bank’s peers as it continues to struggle with lending margins.

Total loans were up $171 million from the third quarter, and up $337 million from the year-ago period. Those figures represent annualized growth of 12.6% and 6.4%, respectively. Total deposits were $6.4 billion, down $224 million from Q3, and down $203 million from last December.

Click here to download our most recent Sure Analysis report on TMP (preview of page 1 of 3 shown below):

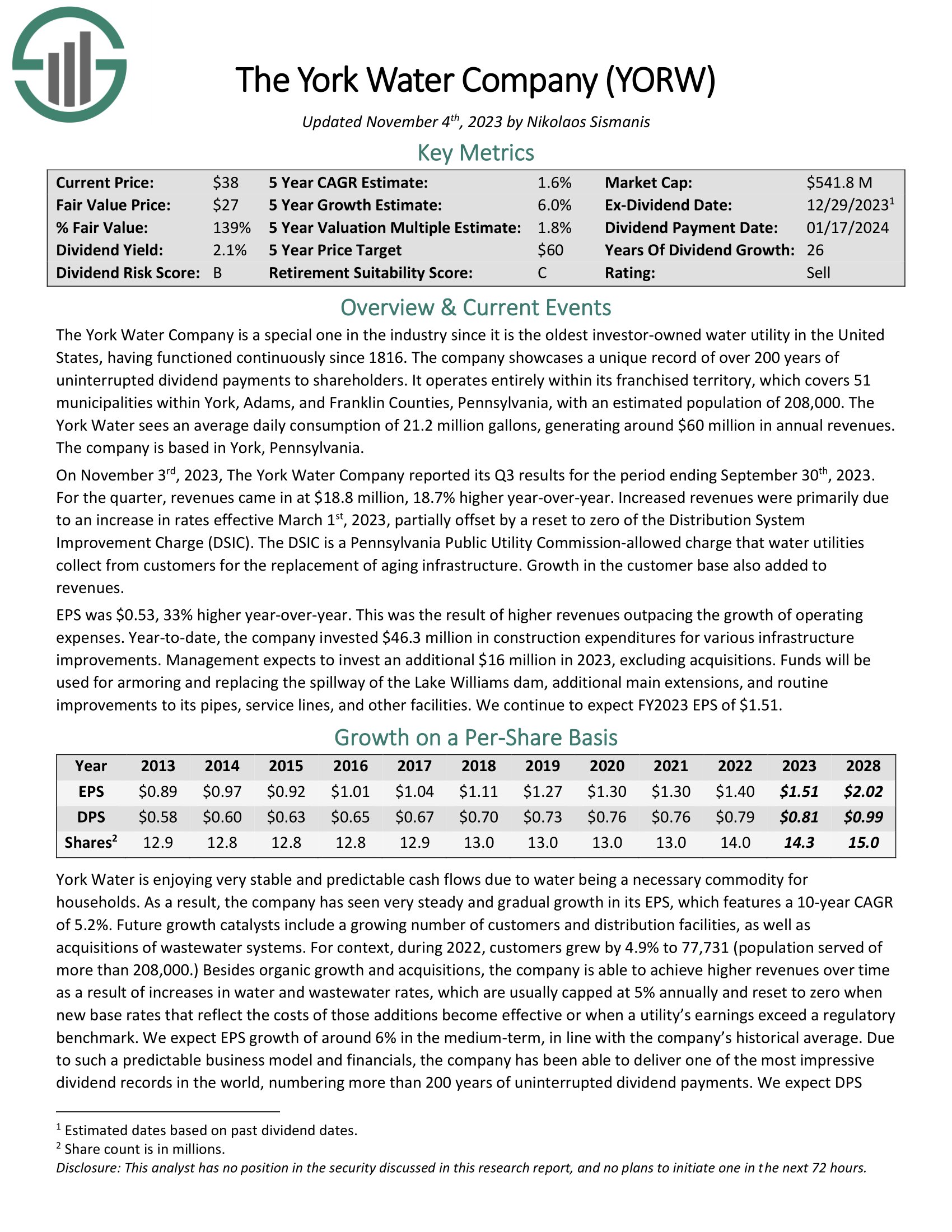

#11: York Water Company (YORW)

- 5-year expected annual returns: 9.2%

The York Water Company is a special one in the industry since it is the oldest investor-owned water utility in the United States, having functioned continuously since 1816. The company showcases a unique record of over 200 years of uninterrupted dividend payments to shareholders.

It operates entirely within its franchised territory, which covers 51 municipalities within York, Adams, and Franklin Counties, Pennsylvania. The York Water sees an average daily consumption of 21.2 million gallons, generating around $60 million in annual revenues.

On November 3rd, 2023, The York Water Company reported its Q3 results for the period ending September 30th, 2023. For the quarter, revenues came in at $18.8 million, 18.7% higher year-over-year. Increased revenues were primarily due to an increase in rates effective March 1st, 2023, partially offset by a reset to zero of the Distribution System Improvement Charge (DSIC). Growth in the customer base also added to revenues.

Click here to download our most recent Sure Analysis report on YORW (preview of page 1 of 3 shown below):

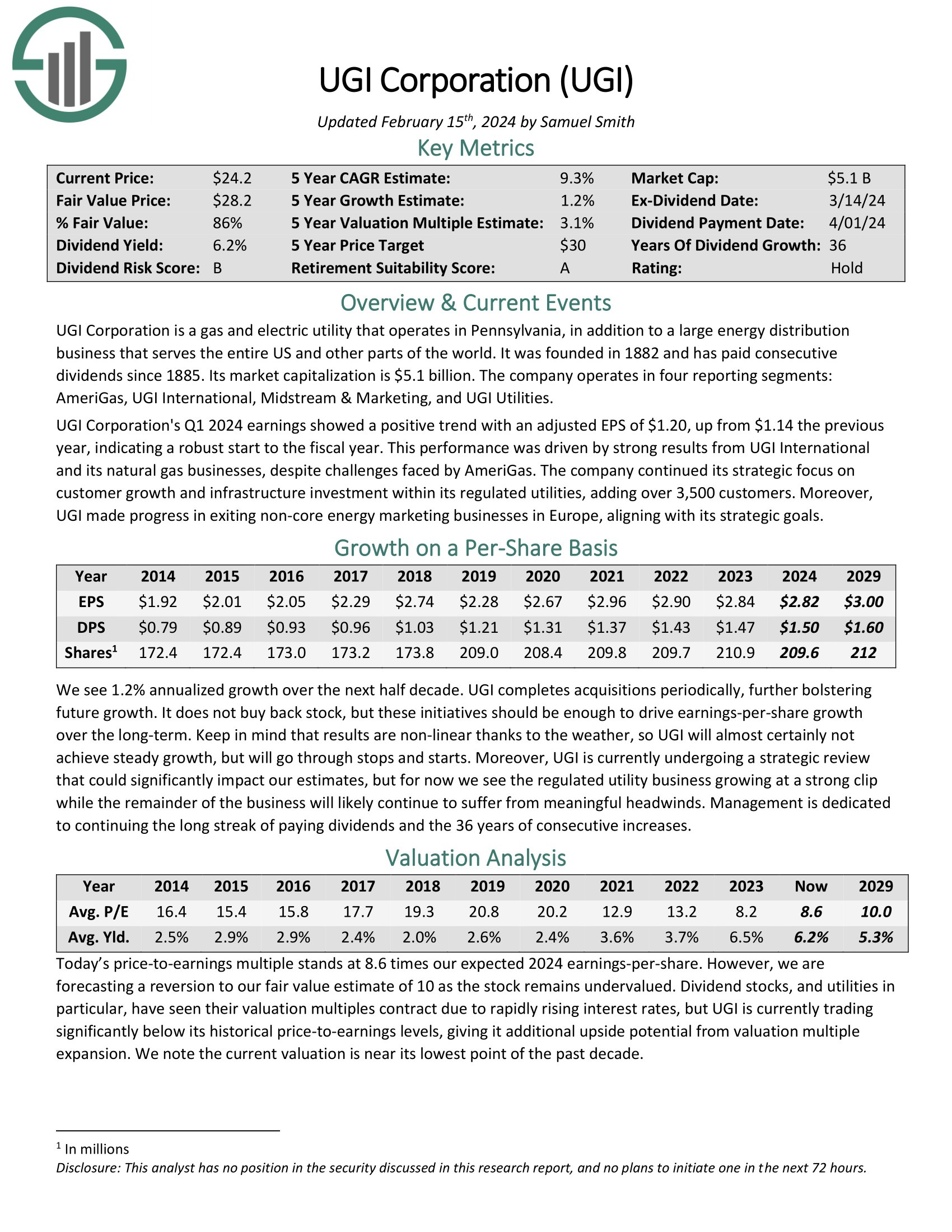

#10: UGI Corp. (UGI)

- 5-year expected annual returns: 9.3%

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire US and other parts of the world. It was founded in 1882 and has paid consecutive dividends since 1885. The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

UGI Corporation’s Q1 2024 earnings showed a positive trend with an adjusted EPS of $1.20, up from $1.14 the previous year, indicating a robust start to the fiscal year. This performance was driven by strong results from UGI International and its natural gas businesses, despite challenges faced by AmeriGas.

The company continued its strategic focus on customer growth and infrastructure investment within its regulated utilities, adding over 3,500 customers. Moreover, UGI made progress in exiting non-core energy marketing businesses in Europe, aligning with its strategic goals.

Click here to download our most recent Sure Analysis report on UGI (preview of page 1 of 3 shown below):

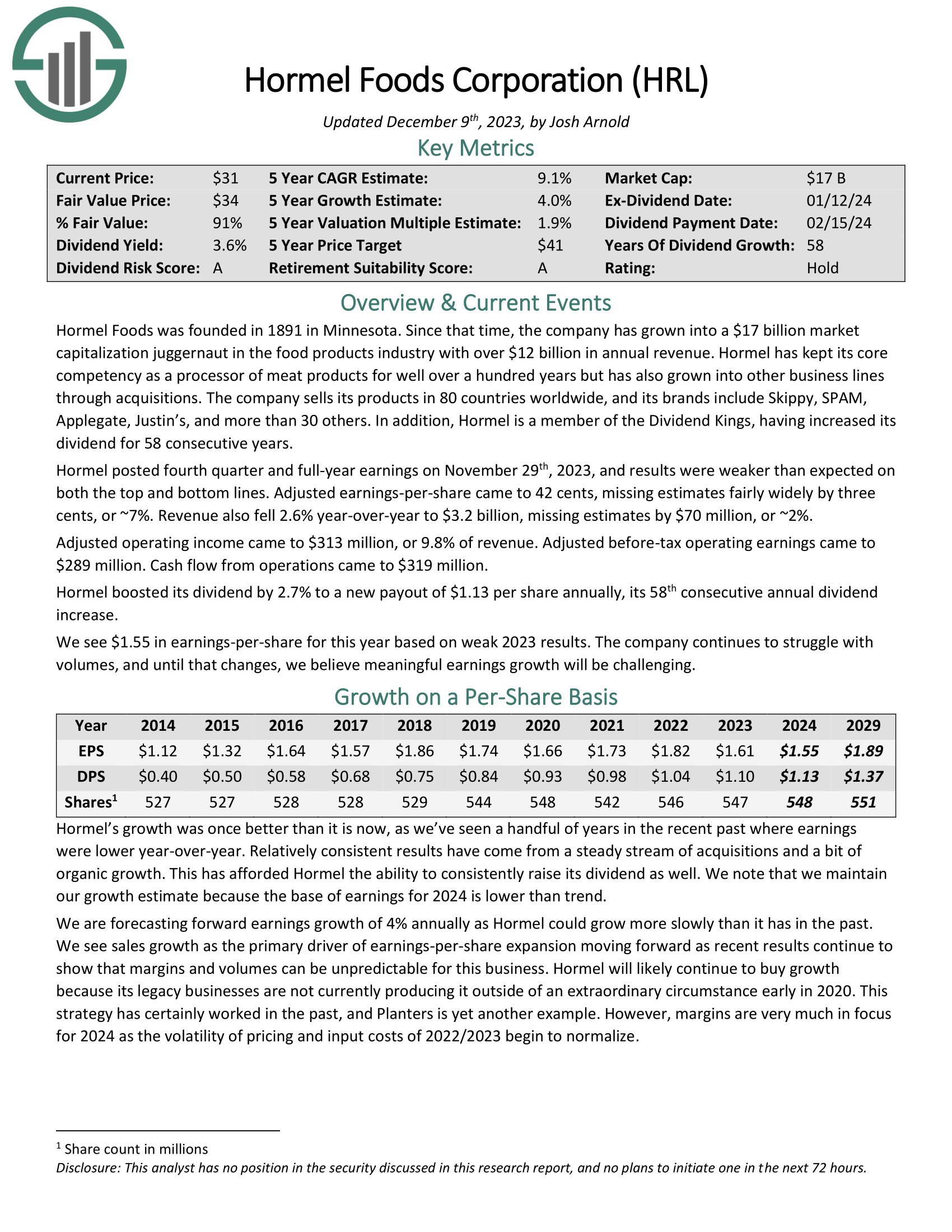

#9: Hormel Foods (HRL)

- 5-year expected annual returns: 9.4%

Hormel Foods was founded back in 1891 in Minnesota. Since that time, the company has grown into a juggernaut in the food products industry with nearly $10 billion in annual revenue.

Hormel has kept with its core competency as a processor of meat products for well over a hundred years, but has also grown into other business lines through acquisitions.

Hormel has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

Click here to download our most recent Sure Analysis report on Hormel (preview of page 1 of 3 shown below):

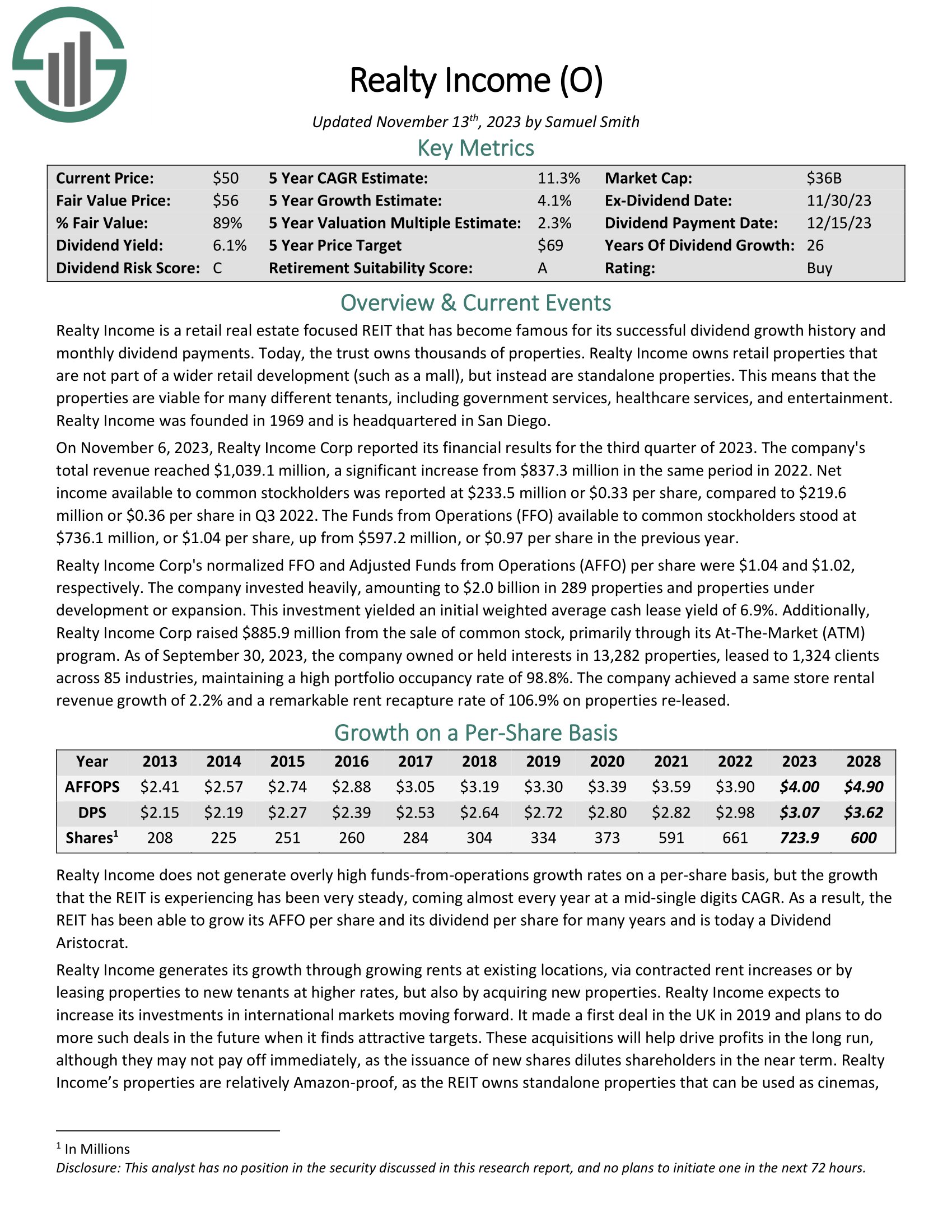

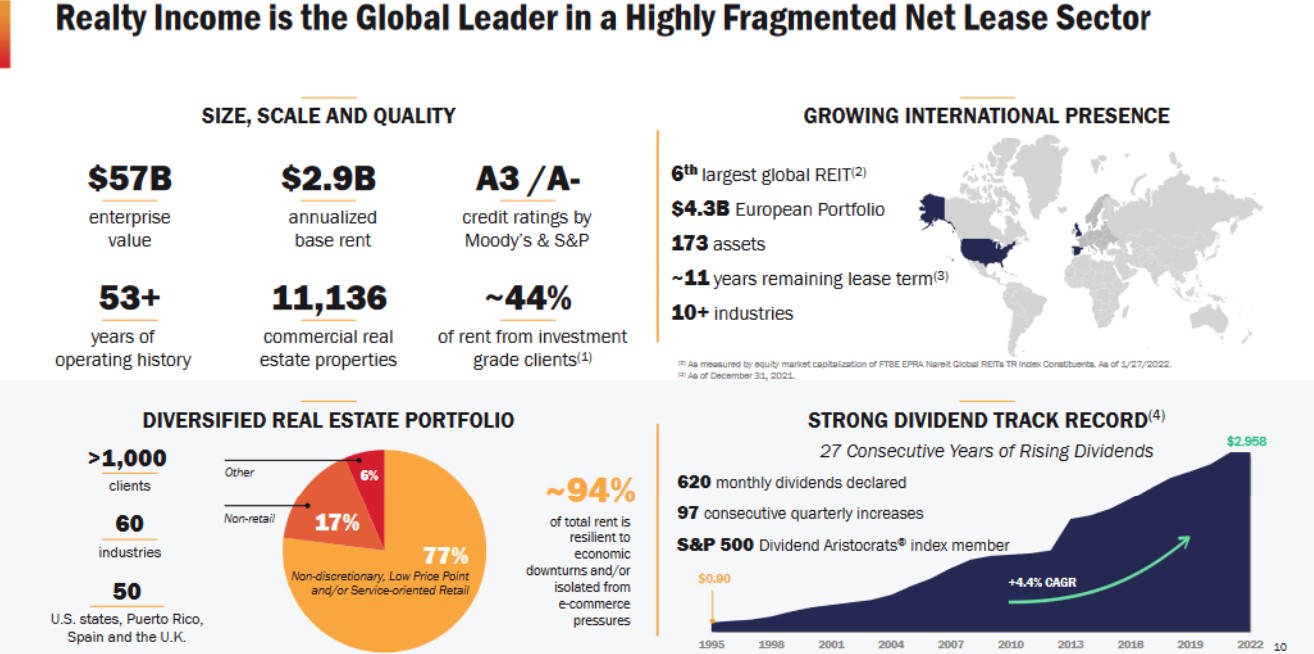

#8: Realty Income (O)

- 5-year expected annual returns: 10.0%

Realty Income is a retail-focused REIT that owns more than 6,500 properties. It owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Source: Investor Presentation

The dividend growth streak stands at 26 years. The last five years have seen dividend growth at a rate of 3% annually, but the stock yields 5.2%. The projected payout ratio for the year is 76%, which should be considered safe for REIT.

Click here to download our most recent Sure Analysis report on Realty Income (O) (preview of page 1 of 3 shown below):

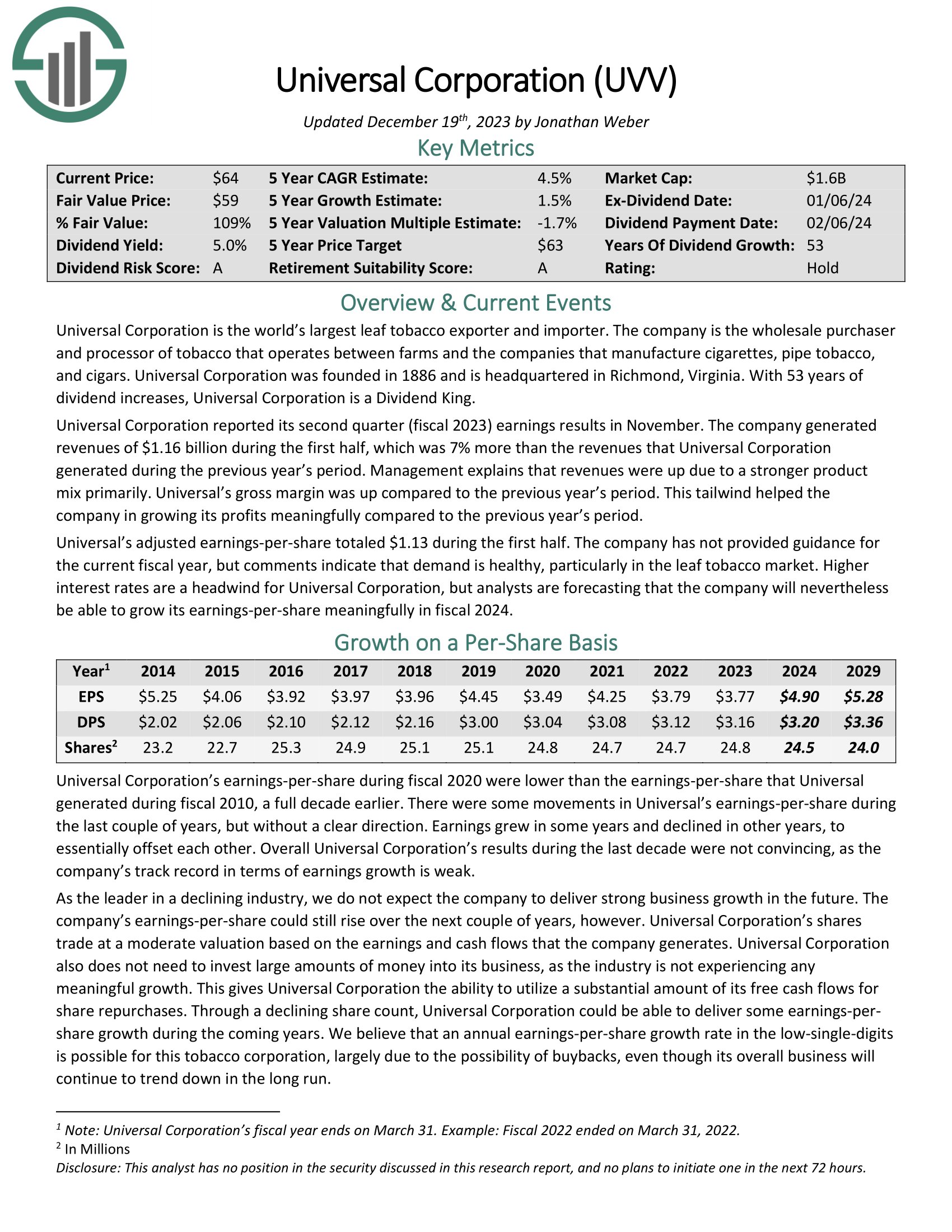

#7: Universal Corporation (UVV)

- 5-year expected annual returns: 10.1%

Universal Corporation is a tobacco stock. It is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates as an intermediary between tobacco farms and the companies that manufacture cigarettes, pipe tobacco, and cigars.

Universal is attempting a transition to a producer of fruits, vegetables, and ingredients which the company hopes will diversify its business and provide renewed growth. Universal acquired FruitSmart, an independent specialty fruit and vegetable ingredient processor. FruitSmart supplies juices, concentrates, blends, purees, fibers, seed and seed powders, and other products to food, beverage and flavor companies around the world.

It also acquired Silva International, a privately-held dehydrated vegetable, fruit, and herb processing company. Silva procures over 60 types of dehydrated vegetables, fruits, and herbs from over 20 countries.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

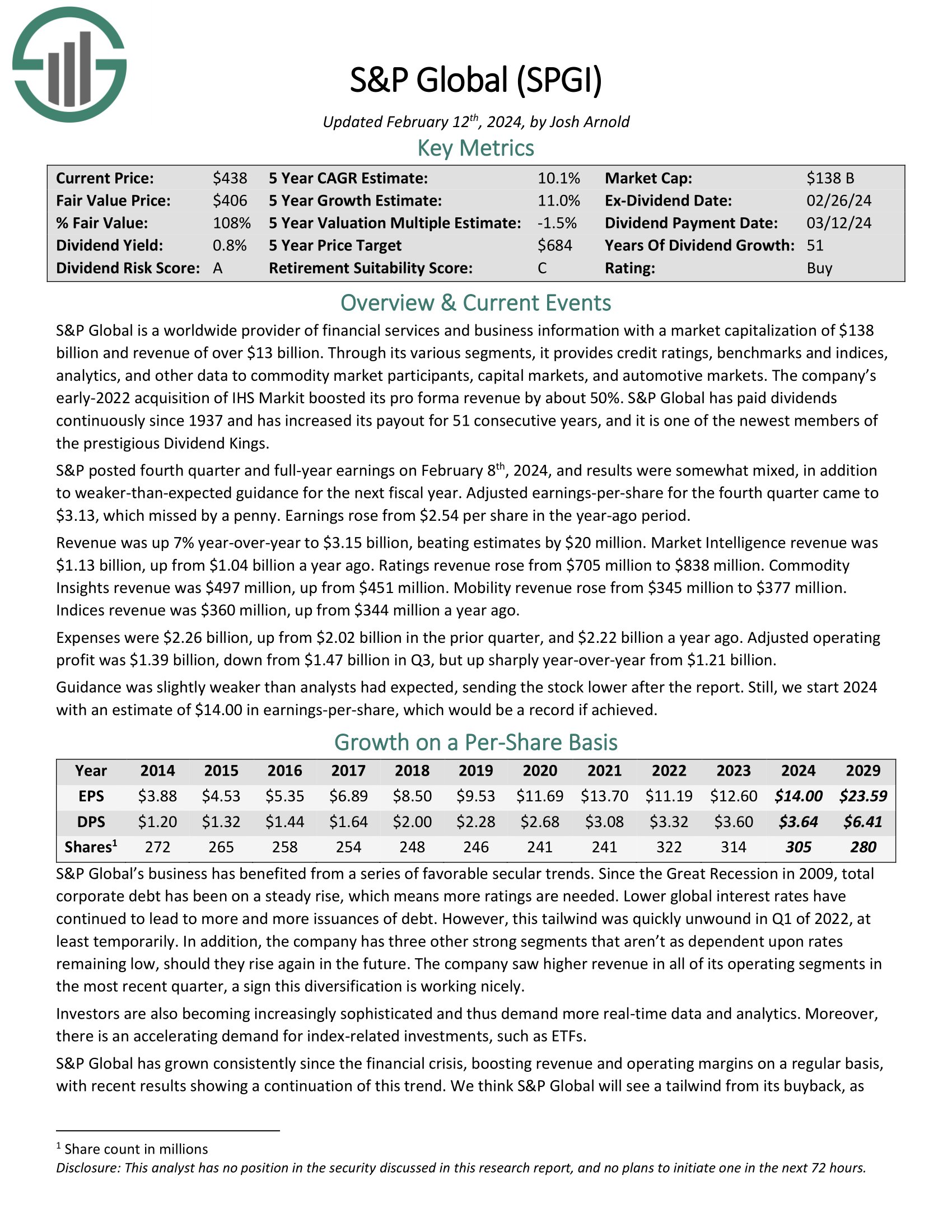

#6: S&P Global Inc. (SPGI)

- 5-year expected annual returns: 10.2%

S&P Global is a worldwide provider of financial services and business information. The company has generated strong growth over the past several years. It has increased its dividend for 50 consecutive years. It operates in the highly concentrated financial ratings industry where the three well-known rating agencies control over 90% of global financial debt ratings.

S&P posted fourth quarter and full-year earnings on February 8th, 2024, and results were somewhat mixed. Adjusted earnings-per-share for the fourth quarter came to $3.13, which missed by a penny. Earnings rose from $2.54 per share in the year-ago period. Revenue was up 7% year-over-year to $3.15 billion, beating estimates by $20 million.

Market Intelligence revenue was $1.13 billion, up from $1.04 billion a year ago. Ratings revenue rose from $705 million to $838 million. Commodity Insights revenue was $497 million, up from $451 million. Mobility revenue rose from $345 million to $377 million. Indices revenue was $360 million, up from $344 million a year ago.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

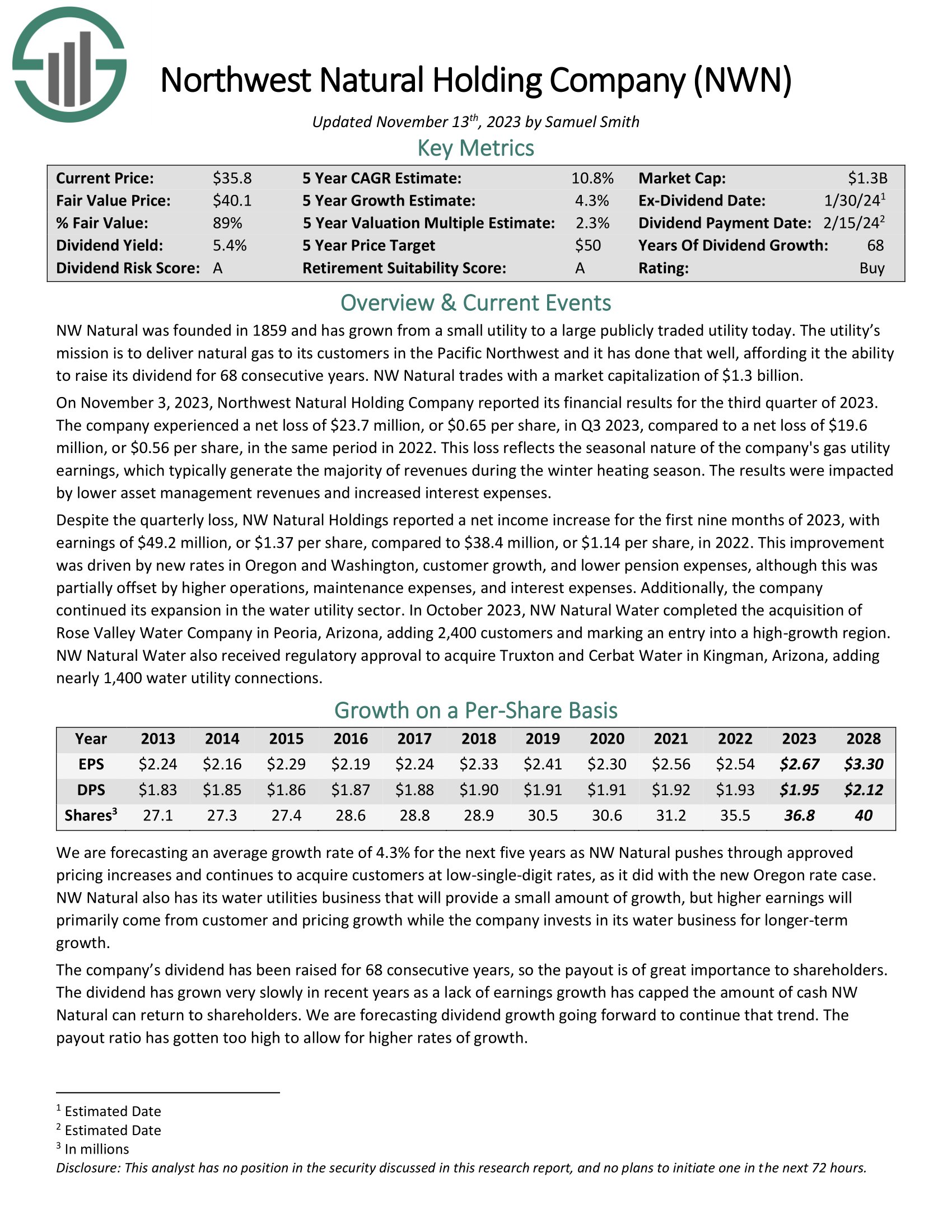

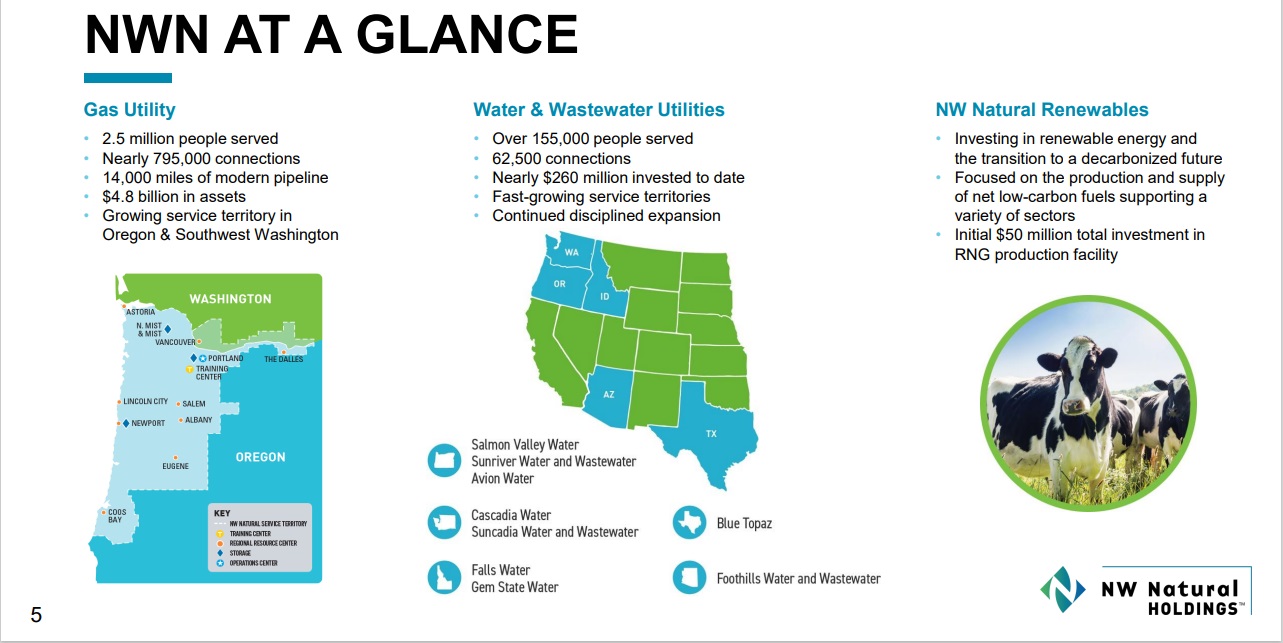

#5: Northwest Natural Gas (NWN)

- 5-year expected annual returns: 10.8%

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest and it has done that well, affording it the ability to raise its dividend for 66 consecutive years.

Source: Investor Presentation

On November 3, 2023, Northwest Natural Holding Company reported its financial results for the third quarter of 2023. The company experienced a net loss of $23.7 million, or $0.65 per share, in Q3 2023, compared to a net loss of $19.6 million, or $0.56 per share, in the same period in 2022. This loss reflects the seasonal nature of the company’s gas utility earnings, which typically generate the majority of revenues during the winter heating season.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

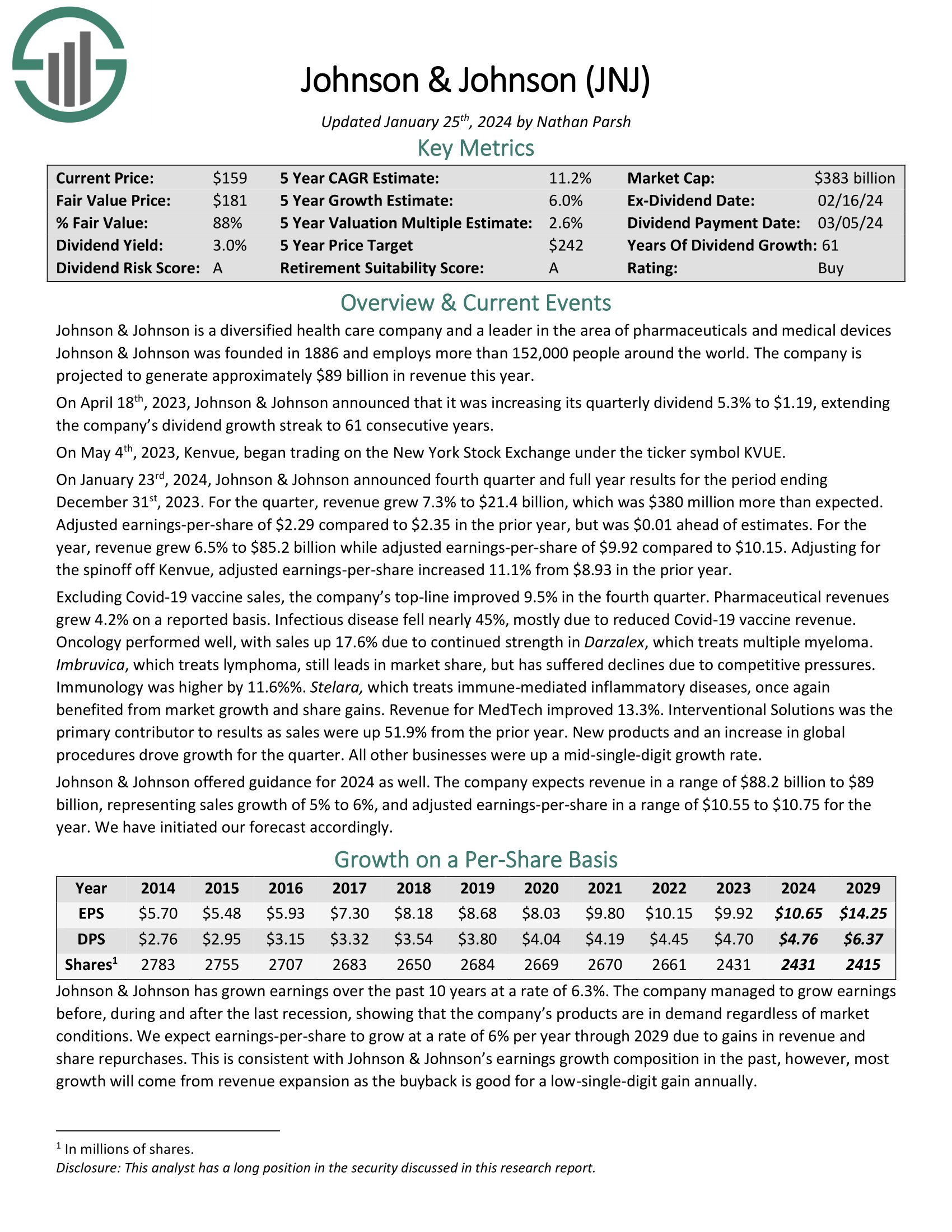

#4: Johnson & Johnson (JNJ)

- 5-year expected annual returns: 10.8%

Johnson & Johnson is a diversified health care company and a leader in the area of pharmaceuticals (~49% of sales), medical devices (~34% of sales) and consumer products (~17% of sales). The company has annual sales in excess of $93 billion.

Johnson & Johnson’s key competitive advantage is the size and scale of its business. The company is a worldwide leader in several healthcare categories. Johnson & Johnson’s diversification allows it to continue to grow even if one of the segments is underperforming.

The company has increased its dividend for 60 consecutive years, making it a Dividend King. The stock is owned by many well-known money managers. For example, J&J is a Kevin O’Leary dividend stock.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

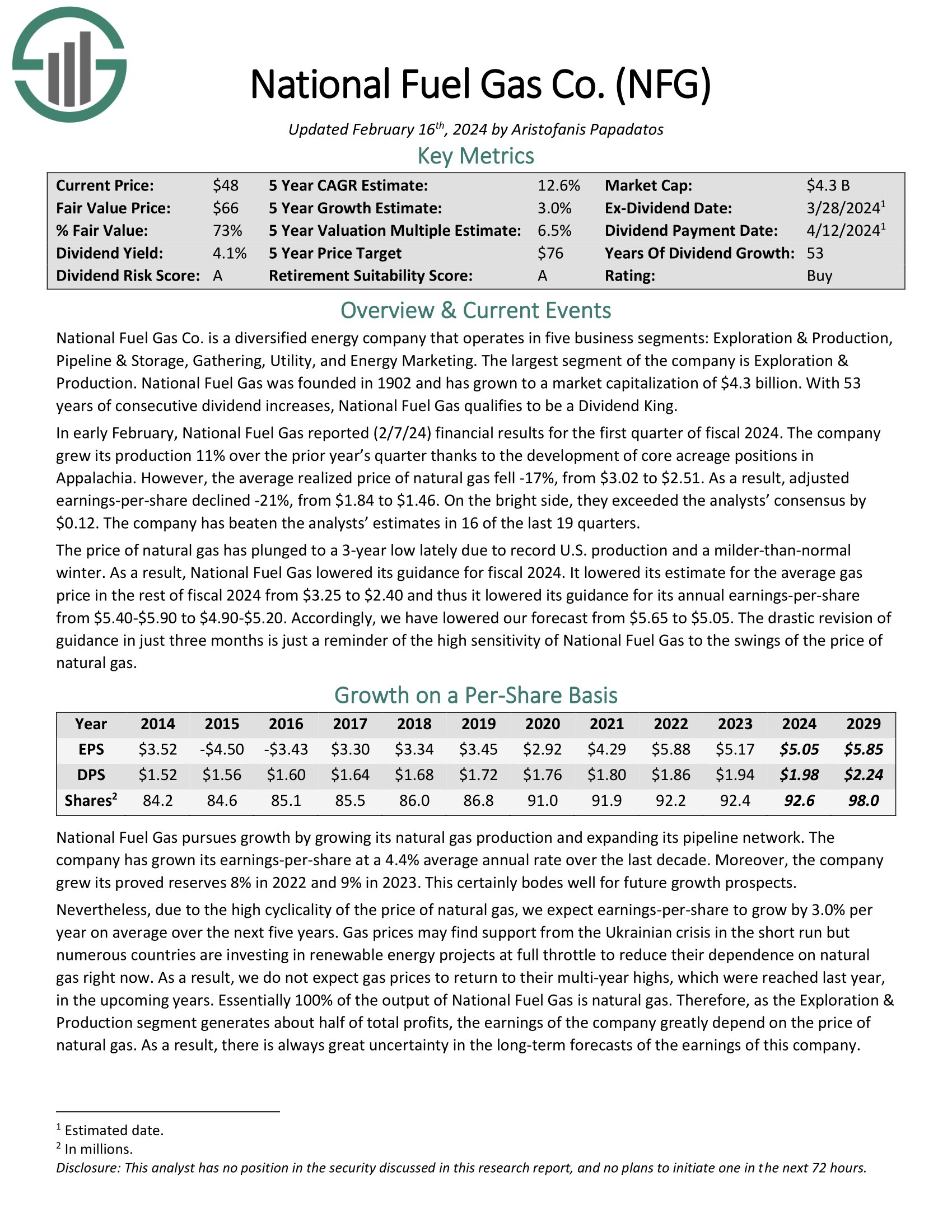

#3: National Fuel Gas (NFG)

- 5-year expected annual returns: 12.2%

National Fuel Gas Co. is a diversified energy company that operates in five business segments: Exploration & Production, Pipeline & Storage, Gathering, Utility, and Energy Marketing. The largest segment of the company is Exploration & Production.

In early February, National Fuel Gas reported (2/7/24) financial results for the first quarter of fiscal 2024. The company grew its production 11% over the prior year’s quarter thanks to the development of core acreage positions in Appalachia. However, the average realized price of natural gas fell -17%, from $3.02 to $2.51. As a result, adjusted earnings-per-share declined -21%, from $1.84 to $1.46.

Click here to download our most recent Sure Analysis report on NFG (preview of page 1 of 3 shown below):

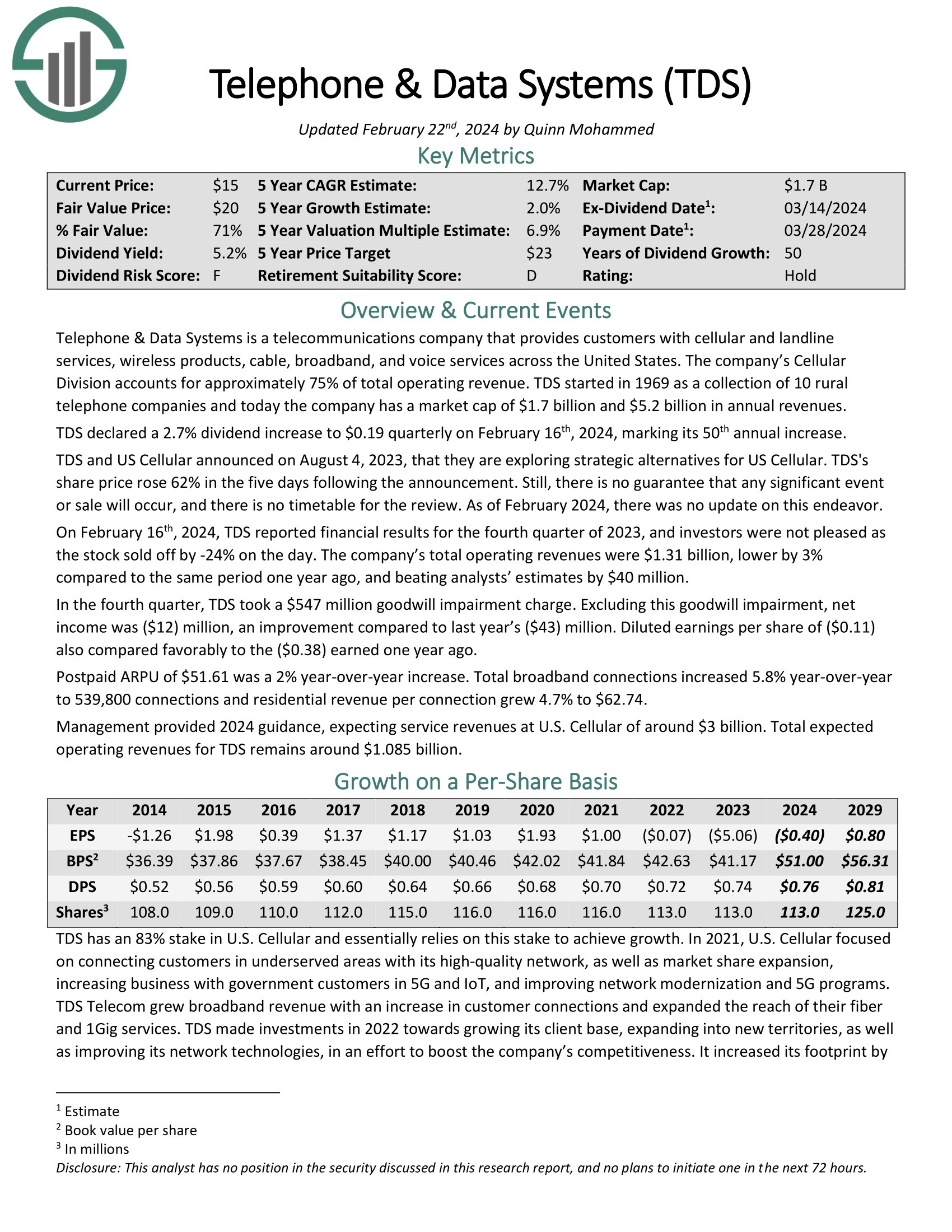

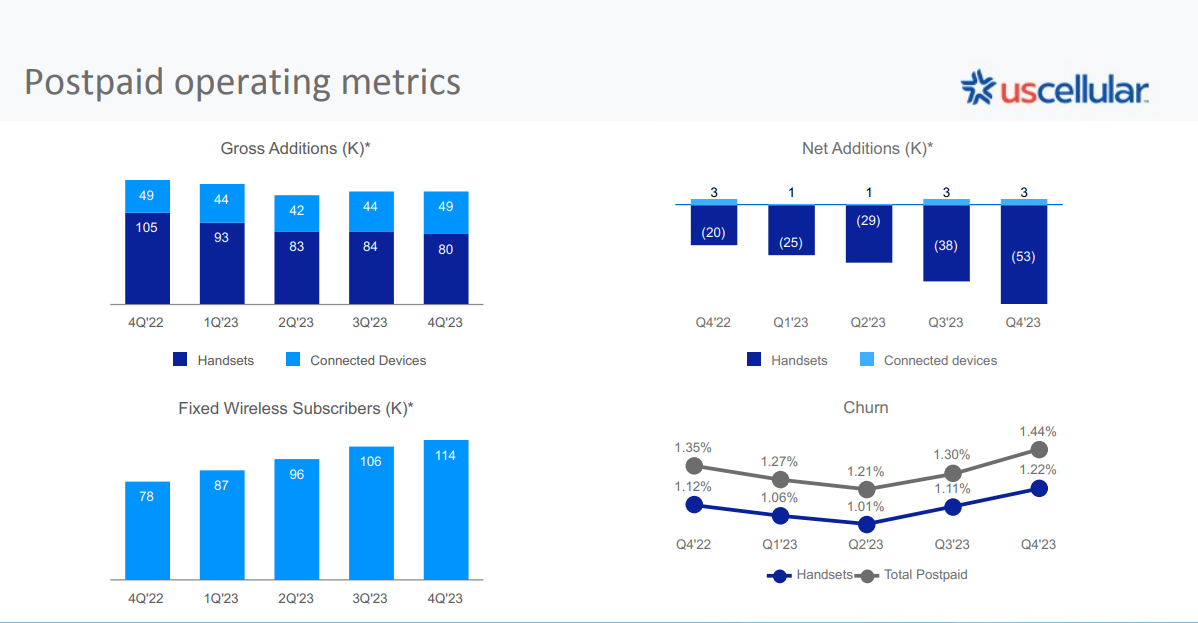

#2: Telephone & Data Systems (TDS)

- 5-year expected annual returns: 13.2%

Telephone & Data Systems is a telecommunications company that provides customers with cellular and landline services, wireless products, cable, broadband, and voice services across the United States. The company’s Cellular Division accounts for more than 75% of total operating revenue.

TDS posted fourth-quarter earnings on February 16th. Quarterly revenue of $1.32 billion beat estimates by $40 million, while adjusted earnings-per-share came to a loss of $0.11 per share.

Revenue declined 3.2% from the 2022 fourth quarter. The net loss of $0.38 per share for the fourth quarter was due primarily to a $547 million non-cash impairment charge at TDS Telecom.

At US Cellular, postpaid average revenue per user grew 2% for the full year 2023. Fixed wireless customers grew 46% to 114,000 while tower rental revenues grew 8% to $100 million.

Along with quarterly results, the company raised its dividend by 2.7% to $0.19 per share.

Click here to download our most recent Sure Analysis report on TDS (preview of page 1 of 3 shown below):

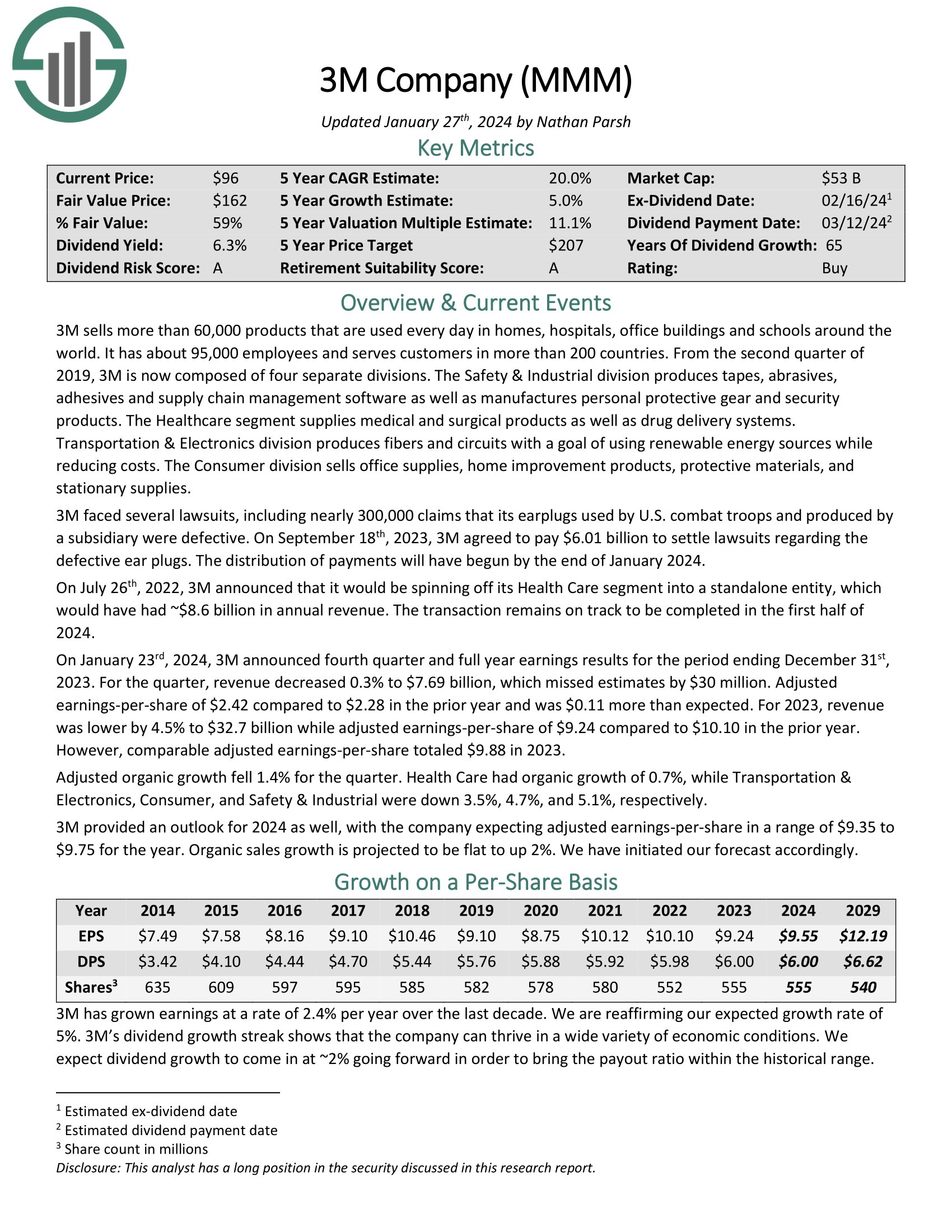

#1: 3M Company (MMM)

- 5-year expected annual returns: 20.9%

3M is an industrial manufacturer that sells more than 60,000 products used daily in homes, hospitals, office buildings, and schools worldwide. It has about 95,000 employees and serves customers in more than 200 countries.

On January 23rd, 2024, 3M announced fourth quarter and full year earnings results for the period ending December 31st, 2023. For the quarter, revenue decreased 0.3% to $7.69 billion, which missed estimates by $30 million. Adjusted earnings-per-share of $2.42 compared to $2.28 in the prior year and was $0.11 more than expected.

For 2023, revenue was lower by 4.5% to $32.7 billion while adjusted earnings-per-share of $9.24 compared to $10.10 in the prior year. However, comparable adjusted earnings-per-share totaled $9.88 in 2023.

Click here to download our most recent Sure Analysis report on 3M Company (preview of page 1 of 3 shown below):

Final Thoughts and Additional Resources

Enrolling in DRIP stocks can be a great way to compound your portfolio income over time. Additional resources are listed below for investors interested in further research for DRIP stocks.

For dividend growth investors interested in DRIP stocks, the 15 companies mentioned in this article are a great place to start. Each business is very shareholder friendly, as evidenced by their long dividend histories and their willingness to offer investors no-fee DRIP stocks.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.