Updated on February 7th, 2023 by Nikolaos Sismanis

Regarding dividend growth stocks, the Dividend Aristocrats are the “cream of the crop.” These are stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases. Additionally, the Dividend Aristocrats must meet certain market cap and liquidity requirements.

It is relatively difficult to become a Dividend Aristocrat, which is why only 68 of them exist. With that in mind, we created a full list of all 68 Dividend Aristocrats. You can download your copy of the Dividend Aristocrats list, along with important metrics like price-to-earnings ratios and dividend yields, by clicking on the link below:

At the same time, Real Estate Investment Trusts (REITs) seem like natural fits for the Dividend Aristocrats Index. REITs are required to distribute at least 90% of their earnings to shareholders, which leads to steady dividend growth for the asset class, provided earnings grow over time.

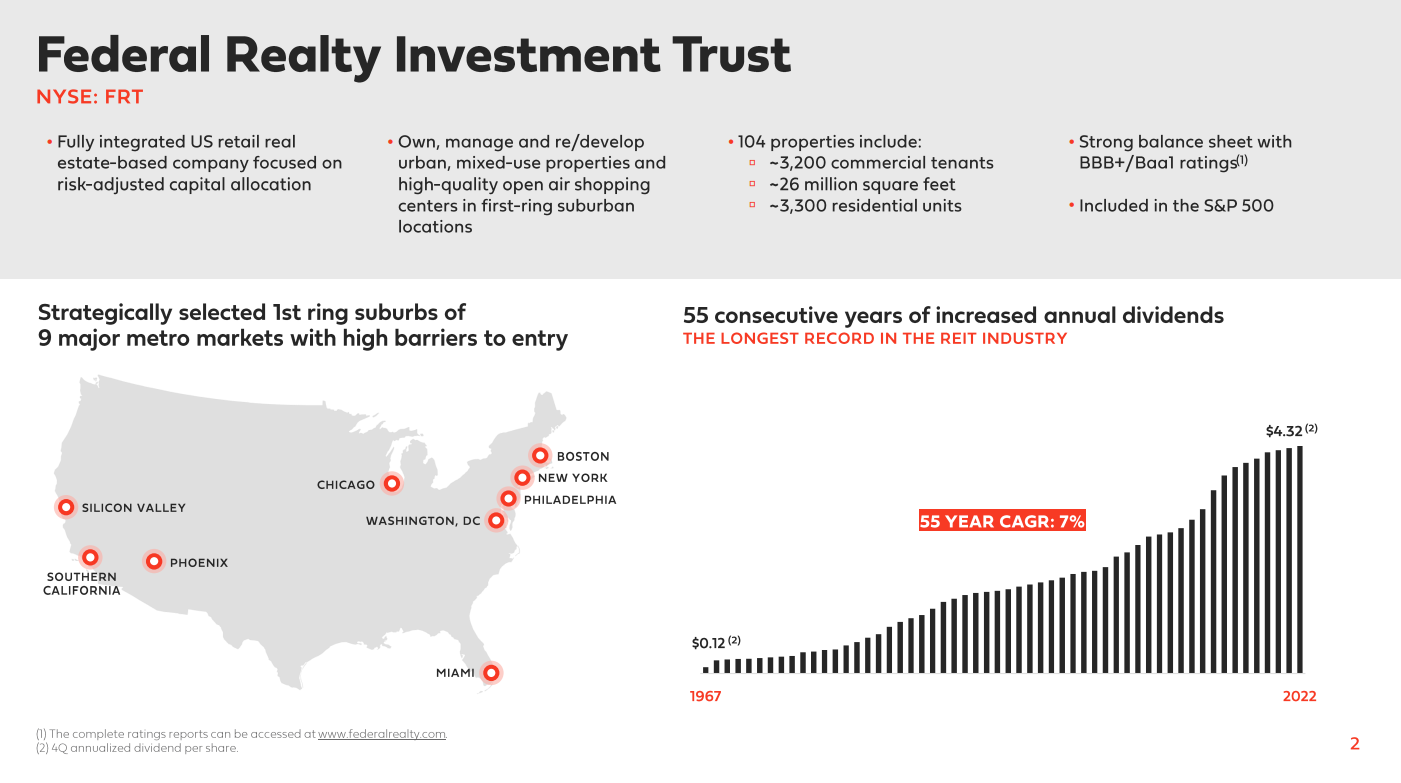

And yet, there are only 3 REITs on the list of Dividend Aristocrats, including Federal Realty Investment Trust (FRT). The reason for the relative lack of REITs in the Dividend Aristocrats Index is primarily due to the high payout requirement of REITs. It’s challenging to grow dividends year-in-and-year-out when the bulk of income is being distributed, as this leaves little margin for error.

Federal Realty has a very impressive dividend history, particularly for a REIT. Federal Realty has increased its dividend for 55 years in a row, which also makes it a Dividend King. This article will discuss the only REIT on the list of Dividend Aristocrats and Dividend Kings.

Business Overview

Federal Realty was founded in 1962. Federal Realty’s business model is to own and rent out real estate properties as a Real Estate Investment Trust. It uses a significant portion of its rental income and external financing to acquire new properties. This helps create a “snowball” effect of rising income over time.

Federal Realty primarily owns shopping centers. However, it also operates in the redevelopment of multi-purpose properties, including retail, apartments, and condominiums. The portfolio is highly diversified in terms of the tenant base. Federal Realty has a high-quality tenant portfolio.

Source: Investor Presentation

The trust’s investment strategy is to pursue densely populated, affluent communities with high commercial and residential real estate demand. This strategy has fueled strong growth over the past several years.

Lately, Federal Realty has sustained a strong post-COVID recovery, as reflected in its fiscal Q3 2021 results reported on November 3rd, 2022. For the quarter, the company generated funds from operations per diluted share of $1.59 compared to $1.51 in the prior-year period.

Federal Realty also generated comparable property operating income growth of 3.7% for the third quarter and 8.8% year-to-date. It also achieved continued record levels of leasing with 119 signed leases for 562,859 square feet of comparable space in the third quarter, the highest third-quarter volume on record. Federal Realty’s portfolio was 92.1% occupied, and 94.3% leased, representing year-over-year increases of 190 basis points and 150 basis points, respectively, and 10 basis point and 20 basis point increase, respectively, quarter-over-quarter.

Following better-than-expected results, management increased the fiscal 2022 FFO per diluted share guidance to $6.27 – $6.32. To be prudent, we expect the company to deliver an FFO per diluted share of $6.28 for the year.

Growth Prospects

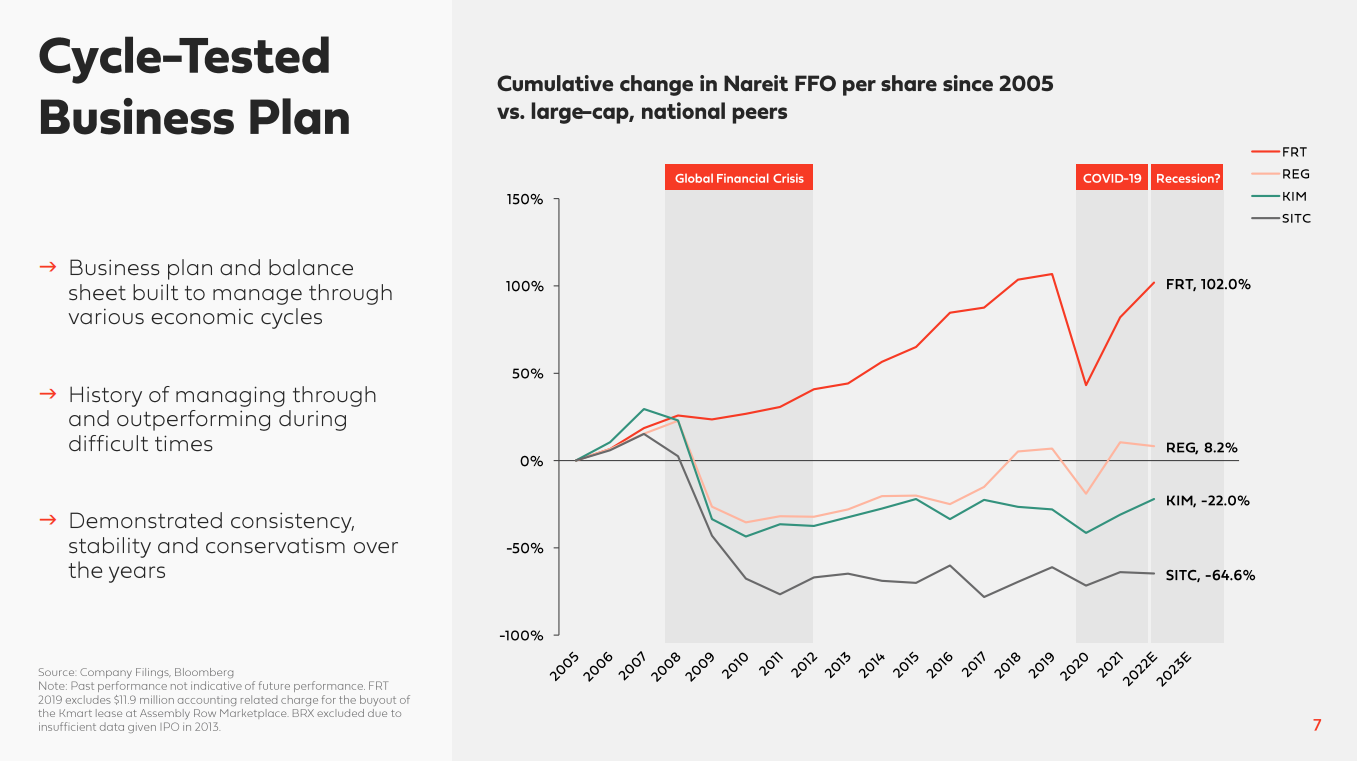

Prior to 2020, Federal Realty’s funds-from-operations had not dipped year-over-year at any point in the past decade, a tremendously impressive feat given that the trust operates in the highly cyclical real estate sector.

While growth numbers have not always been impressive, the simple fact that it has such a consistent track record of safety and stability regarding funds-from-operations and dividends per share makes it one of the most desirable REITs in the market.

Federal Realty’s growth moving forward will be comprised of a continuation of higher rent rates on new leases and its impressive development pipeline fueling asset base expansion. Margins are expected to rise slightly as it redevelops pieces of its portfolio, and same-center revenue continues to increase.

As the economy emerges from the COVID-19 crisis, we expect results to support the long-term thesis for Federal Realty as same-store NOI continues to grow and occupancy remains robust. The industry has seen some high-profile bankruptcies, although Federal Realty has largely been immune.

Competitive Advantages & Recession Performance

One way in which REITs establish a competitive advantage is through investing in the highest-quality portfolios. Federal Realty has done this by focusing on affluent areas of the country where demand exceeds supply. This is also how it can continue to boost its cash basis rollover growth over time; it owns properties in the most desirable areas, and tenants are willing to pay more to gain access to the best consumers.

Federal Realty benefits from a favorable economic backdrop, with high occupancy rates and the ability to raise rents over time.

Source: Investor Presentation

Another competitive advantage for Federal Realty is a strong balance sheet. The trust’s senior unsecured debt holds a credit rating of A- from Standard & Poor’s, which is solidly investment-grade and is a high rating for a REIT. A strong balance sheet helps keep borrowing costs low, which is critical for the REIT business model.

These competitive strengths allowed Federal Realty to perform well during the last recession. Federal Realty’s FFO during the Great Recession is shown below:

- 2007 FFO-per-share of $3.63

- 2008 FFO-per-share of $3.87 (6.6% increase)

- 2009 FFO-per-share of $3.87 (flat)

- 2010 FFO-per-share of $3.88 (0.3% increase)

- 2011 FFO-per-share of $4.00 (3% increase)

FFO either held steady or increased during each year of the recession. This was a remarkable achievement that speaks to the strength of the business. We expect Federal Realty to hold up well during the next downturn, but we note that growth will certainly slow during such a period. Thanks to its strong balance sheet, Federal Realty would likely be a net acquirer during the next downturn to build for future growth.

Valuation & Expected Returns

Based on 2022 expected FFO-per-share of $6.28, Federal Realty stock trades for a price-to-FFO ratio of 17.8. Investors can think of this as similar to a price-to-earnings ratio.

On a valuation basis, Federal Realty appears overvalued. Our fair value estimate is a P/FFO ratio of 15, implying notable downside potential due to the high current P/FFO ratio.

Therefore, future returns could be reduced by -3.4% per year over the next five years if the P/FFO ratio declines from 17.8 to 15. FFO-per-share growth, expected to reach 4% per year, plus the 3.9% dividend yield, results in total expected returns of 4.3% per year.

A retail REIT’s current dividend yield of 3.9% is a fairly low yield. However, Federal Realty helps make up for this with strong dividend growth and its impeccable track record. It has increased its dividend for 55 years in a row.

Dividend growth has slowed in recent years as a result of Federal Realty paying less of its FFO-per-share in distributions. We expect growth to return in the future to past levels as the trust has seen ups and downs in its payout growth rate, but it always moves higher.

Final Thoughts

Investors flock to REITs for dividends, and with high yields across the asset class, it is easy to see why they are so popular for income investors.

Federal Realty does not have a tremendous dividend yield, particularly for a REIT. This is because the stock consistently trades for a relatively high valuation. However, high-quality businesses tend to sport above-average valuations.

That said, Federal Realty is a strong choice for dividend investors, and we rate the stock a hold due to its impressive dividend history.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The 20 Highest Yielding Dividend Aristocrats

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 40 stocks with 50+ years of consecutive dividend increases.

- The 20 Highest Yielding Dividend Kings

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: