Updated on March 21st, 2024 by Bob Ciura

Investing in high-quality dividend growth stocks can lead to outstanding long-term returns. Investors looking for dividend income and sustainable growth should start with the Dividend Aristocrats, an exclusive group of companies that have raised their dividends for 25+ consecutive years.

With this in mind, we created a full list of all 68 Dividend Aristocrats and essential financial metrics like dividend yields and price-to-earnings ratios.

You can download an Excel spreadsheet with the full list of Dividend Aristocrats by using the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

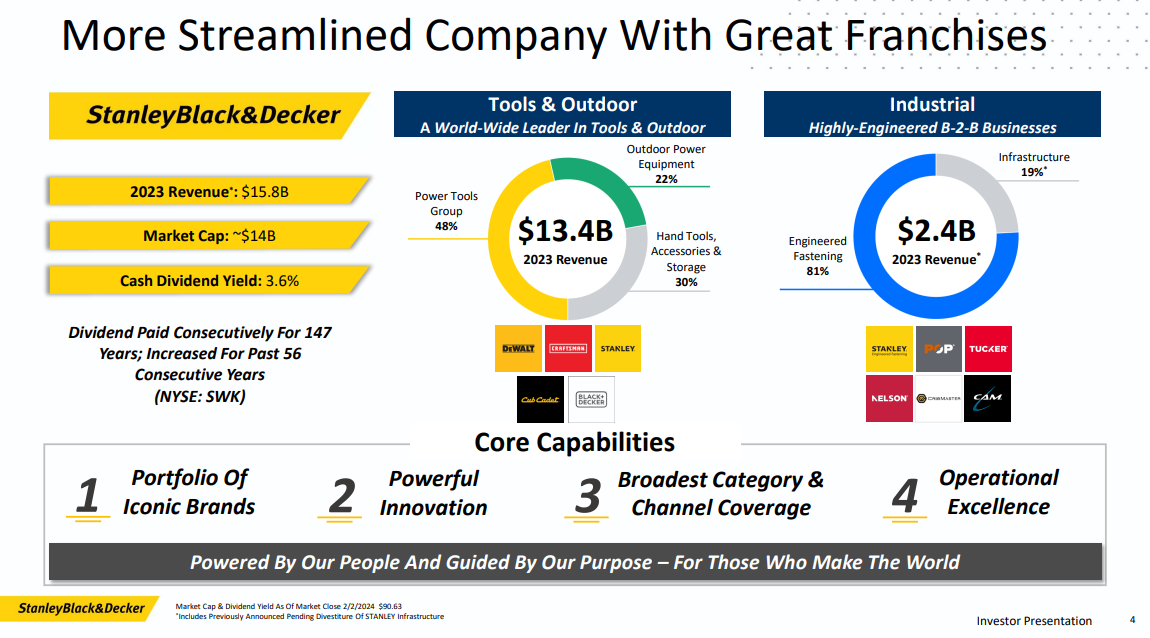

There are only 68 Dividend Aristocrats. This article will review diversified industrial manufacturer Stanley Black & Decker (SWK).

Stanley Black & Decker has an amazing track record of dividend payments. The company has paid dividends for 147 years and has increased its dividend yearly for 56 consecutive years. Today, the company’s dividend appears safe relative to its underlying fundamentals.

This article will discuss the qualities that have made Stanley Black & Decker a time-tested dividend growth stock.

Business Overview

Stanley Black & Decker is the result of Stanley Works’ $3.5 billion acquisition of Black & Decker in 2009. Stanley Works and Black & Decker were both named after their respective founders. Stanley Works was formed in 1843 when Frederick Stanley started a small shop in New Britain, Connecticut, where he manufactured bolts, hinges, and other hardware. His products developed a reputation for their quality.

Meanwhile, Black & Decker was started by Duncan Black and Alonzo Decker in 1910. Like Stanley, they opened a small hardware shop. In 1916, they obtained a patent to manufacture the world’s first portable power tool.

Over the next 175 years, Stanley Black & Decker has steadily grown into one of the world’s largest industrial product manufacturers.

Source: Investor Presentation

Its main products include hand tools, power tools, and related accessories. It also produces electronic security solutions, healthcare solutions, engineered fastening systems, and more.

The company has annual sales of more than $15 billion. It operates three business segments: Tools & Storage, Security, and Industrial products.

The company has produced excellent growth rates in recent years primarily due to an aggressive acquisition strategy.

Growth Prospects

On February 1st, 2024, Stanley Black & Decker announced fourth quarter and full year results for the period ending December 31st, 2023. For the quarter, revenue declined 6.3% to $3.7 billion, which was $104 million below estimates. Adjusted earnings-per-share of $0.92 compared favorably to -$0.10 in the prior year and was $0.14 better than expected. For 2023, revenue fell 6.5% to $15.8 billion while adjusted earnings-per-share was $1.45.

Company-wide organic growth declined 7%. Organic sales for Tools & Outdoor, the largest segment within the company, decreased 8% due to continued weakness in consumer outdoor and DIY categories. North America was lower by 10% while Europe and Emerging Markets were both down by 1%. U.S. point of sales remain higher compared to 2019 levels.

The Industrial segment decreased 4%, as gains in Engineered Fastening were more than offset by weaker Infrastructure results. Adjusted gross margin expanded 220 basis points to 29.8% due to cost controls and lower inventory destocking.

On a sequential basis, the adjusted operating margin improved 180 basis points. The company’s cost reduction program remains on track to deliver $2 billion in pre-tax savings by 2025. Stanley Black & Decker has achieved $1.1 billion of cost savings since starting the program. Inventory was reduced by $1.1 billion in Q4 compared to the prior year.

Acquisitions have helped shape Stanley Black & Decker’s product portfolio. For example, in 2017, Stanley Black & Decker closed on the $1.95 billion acquisition of the Tools business of Newell Brands (NWL). This acquisition strengthened the company’s foothold in tools and added the high-quality Irwin and Lennox brands to the product portfolio.

Competitive Advantages & Recession Performance

Stanley Black & Decker’s main competitive advantages are its brand portfolio and global scale. Innovation and scalability are at the core of the company’s growth strategy. It has a leadership position in its three product categories, and its brand strength gives the company pricing power, leading to high-profit margins.

Furthermore, it is relatively easy for the company to scale up its brands, thanks to distribution efficiencies.

To retain these competitive advantages, Stanley Black & Decker constantly invests in product innovation. That said, Stanley Black & Decker is not immune from recessions. Earnings declined significantly in 2008 and 2009. As an industrial manufacturer, Stanley Black & Decker is reliant on a strong economy and a financially-healthy consumer.

Stanley Black & Decker’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $4.00

- 2008 earnings-per-share of $3.41 (15% decline)

- 2009 earnings-per-share of $2.72 (20% decline)

- 2010 earnings-per-share of $3.96 (46% increase)

Despite the steep decline in earnings from 2007-2009, Stanley Black & Decker recovered just as quickly. Earnings-per-share increased another 32% in 2011 and reached a new high. Earnings have continued to grow in the years since.

Valuation & Expected Returns

Using the current share price of ~$96 and expected earnings-per-share for 2024 of ~$4.00, Stanley Black & Decker has a price-to-earnings ratio of 24. This is higher than the long-term average valuation of 12.

Stanley Black & Decker stock appears to be overvalued, given that its price-to-earnings ratio is higher than its historical norm, which is also our fair value estimate for the stock. If the stock’s valuation were to compress to meet its historical average by 2029, investors would experience a -12.9% headwind to annualized total returns over this time.

Going forward, returns will, therefore, likely be comprised of earnings growth, dividends, and valuation multiple compression. Due to organic growth and acquisitions, we feel that an expected EPS growth rate of 8% per year is sustainable.

The stock has a current dividend yield of 3.5%. Based on this, total returns would reach approximately -1.4% per year, consisting of earnings growth, dividends, and valuation multiple compression. This is a negative expected rate of return, meaning Stanley Black & Decker stock has a sell recommendation.

Final Thoughts

Stanley Black & Decker is not a high-yield stock, but it has all of the qualities of a strong dividend growth stock. It has a top position in its industry, strong cash flow, and durable competitive advantages.

The company’s positive growth outlook bodes well for the dividend. The stock appears overvalued today. Additionally, Stanley Black & Decker will very likely continue to hike its dividend each year for the foreseeable future.

Since the stock is expected to produce negative annualized total returns over the next five years, Stanley Black & Decker stock remains a sell for long-term dividend growth investors.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: