Updated on March 20th, 2024 by Bob Ciura

Nucor Corporation (NUE) is the largest steel producer in North America. Despite operating in the notoriously volatile raw materials sector, Nucor is also a remarkably consistent dividend growth stock. The company is in the S&P 500 Index and has increased its annual dividend for over 50 consecutive years, which qualifies it to be a member of the Dividend Aristocrats list.

The Dividend Aristocrats have long histories of raising their dividends each year, even during recessions, which makes them relatively rare finds within the broader S&P 500. With this in mind, we created a list of all 68 Dividend Aristocrats, along with important financial metrics like price-to-earnings ratios and dividend yields.

You can download an Excel spreadsheet with the full list of Dividend Aristocrats by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Nucor’s dividend consistency allows it to stand out in its industry. Steel is a particularly difficult industry due to the cyclical nature of the business model, which makes Nucor’s streak of annual dividend increases even more impressive.

This article will analyze Nucor’s business model, growth prospects, and valuation to determine whether the stock is a buy right now.

Business Overview

Nucor is the largest steel producer in North America after decades of growth. The company is headquartered in Charlotte, North Carolina, and has a market capitalization of $39.5 billion.

Nucor was not always a leader in the steel manufacturing industry. The company has a long and convoluted corporate history that can be traced back to the company’s founder, Ransom E. Olds (the creator of the Oldsmobile automobile). Olds left his own automotive company over a disagreement with shareholders to form the REO Motor Company, which eventually transformed into the Nuclear Corporation of America – Nucor’s first predecessor.

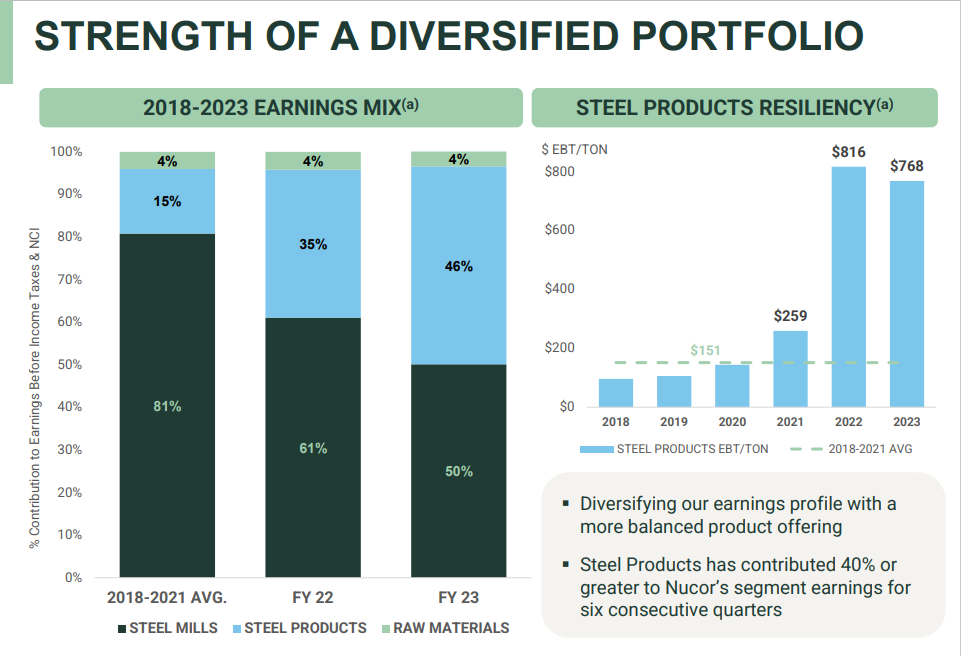

The company currently operates in three segments: Steel Mills (the largest segment by revenue), Steel Products, and Raw Materials.

Source: Investor presentation

Nucor manufactures a wide variety of material types, including sheet steel, steel bars, structural formations, steel plates, downstream products, and raw materials. The majority of the company’s production comes from a combination of sheet and bar steel, as has been the case for many years.

Nucor has been successful over the long-term because of a focus on low-cost production. This allows it to maintain profitability during downturns, as well as to produce significant operating leverage during better times. In addition, it has worked to expand its product offerings to new markets, and maintain and grow its market leadership in existing channels.

Growth Prospects

The past several years have been volatile for Nucor and its competitors around the globe. Steel prices have been fluctuating wildly, driven primarily by a supply glut coming out of international markets, specifically China. However, the industry outlook has been quite favorable lately.

Nucor Corporation disclosed its Q4 2023 earnings on January 30, 2024, demonstrating resilience amid challenging market conditions. The company reported earnings of $3.16 per share for the quarter, a decrease from the previous year’s $4.89 per share but surpassing the consensus estimate of $2.83.

Nucor’s net sales for the quarter amounted to $7.70 billion, marking an 11.7% decrease year-over-year, yet exceeding the consensus estimates. The decline in earnings during the fourth quarter was primarily attributed to lower prices, reflecting the volatile steel market conditions.

For the full year 2023, Nucor reported net earnings of $4.52 billion or $18 per share, a decrease from 2022’s net earnings of $7.61 billion or $28.79 per share. The total net sales for the year stood at $34.71 billion, showing a 16% decrease from the previous year.

Overall, we expect Nucor’s earnings-per-share to decline by 0.9% per year over the next five years, as the company is coming off a multi-year period of record earnings.

Competitive Advantages & Recession Performance

Nucor is a manufacturer and distributor of raw materials and steel. Accordingly, the company is a ‘commodity business’ – one in which the single largest differentiator between competitors is price.

Warren Buffett has the following to say about commodity businesses:

“Stocks of companies selling commodity-like products should come with a warning label: ‘Competition may prove hazardous to human wealth.’” – Warren Buffett

Certainly, commodity businesses are not the most defensive businesses, thanks to their cyclicality. This can be seen by looking at Nucor’s performance during the 2007-2009 financial crisis:

- 2007 adjusted earnings-per-share: $4.98

- 2008 adjusted earnings-per-share: $6.01

- 2009 adjusted earnings-per-share: net loss of ($0.94)

- 2010 adjusted earnings-per-share: $0.42

- 2011 adjusted earnings-per-share: $2.45

Nucor’s earnings-per-share were decimated by the financial crisis. The company is one of few Dividend Aristocrats whose earnings actually turned negative during this tumultuous time period. Earnings have only recently caught up to their pre-recession levels, although Nucor has continued to steadily increase its dividend payments.

Valuation & Expected Returns

Nucor is expected to report adjusted earnings-per-share of about $13.60 in fiscal 2024. That puts the price-to-earnings ratio at ~14.1, which is above our fair value estimate of 12.0. For steel producers, we remain more cautious than the general market, in part due to the volatility of commodity prices.

We see fair value at 12 times earnings, meaning Nucor is overvalued today. If the P/E multiple contracts from 14.1 to 12, it would reduce annual returns by -3.2% over the next five years.

The current yield is 1.1%, and we expect EPS to decline by 0.9% each year over the next five years. We see negative total annual returns of -3% in the next five years.

Nucor has a highly impressive dividend history. It has increased its dividend for 51 consecutive years. It has paid over 200 consecutive quarterly dividends. That said, the rate of dividend growth has lagged average over the last decade, with most annual increases in the low single-digits on a percentage basis.

Final Thoughts

Nucor’s status as a Dividend Aristocrat and, following its most recent dividend increase as a Dividend King, helps it to stand out among the highly volatile materials sector. There are a handful of raw materials businesses that have multi-decade track records of compounding their adjusted earnings-per-share.

Despite Nucor featuring a long history of annual dividend increases and having a strong industry position and a healthy balance sheet, Nucor now has a lower dividend yield than the S&P 500 Index average due to its rising share price in recent years.

The share price rally has also elevated Nucor’s valuation, and we now see the stock as significantly overvalued. Overall, the stock has a sell recommendation at the current price.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.