Updated on October 13th, 2023 by Nikolaos Sismanis

Companies that have at least 50 years of dividend growth are considered Dividend Kings.

Dividend growth investors won’t be surprised to find large cap names like Johnson & Johnson (JNJ) and 3M (MMM) among the Dividend Kings. These large cap names are some of the most widely owned and followed stocks among income investors.

You can see the full list of all 51 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

You might be surprised to find that there are some small cap names that have also raised their dividend for at least the past 50+ years. One such company is SJW Group (SJW), a ‘water stock‘ utility company.

This article will examine SJW’s business, growth prospects, and valuation in order to determine if shares are worth purchasing now.

Business Overview

SJW was founded in 1866 and was initially known as the San Jose Water Company. With a market cap of $1.9 billion, SJW is one of the smallest Dividend Kings.

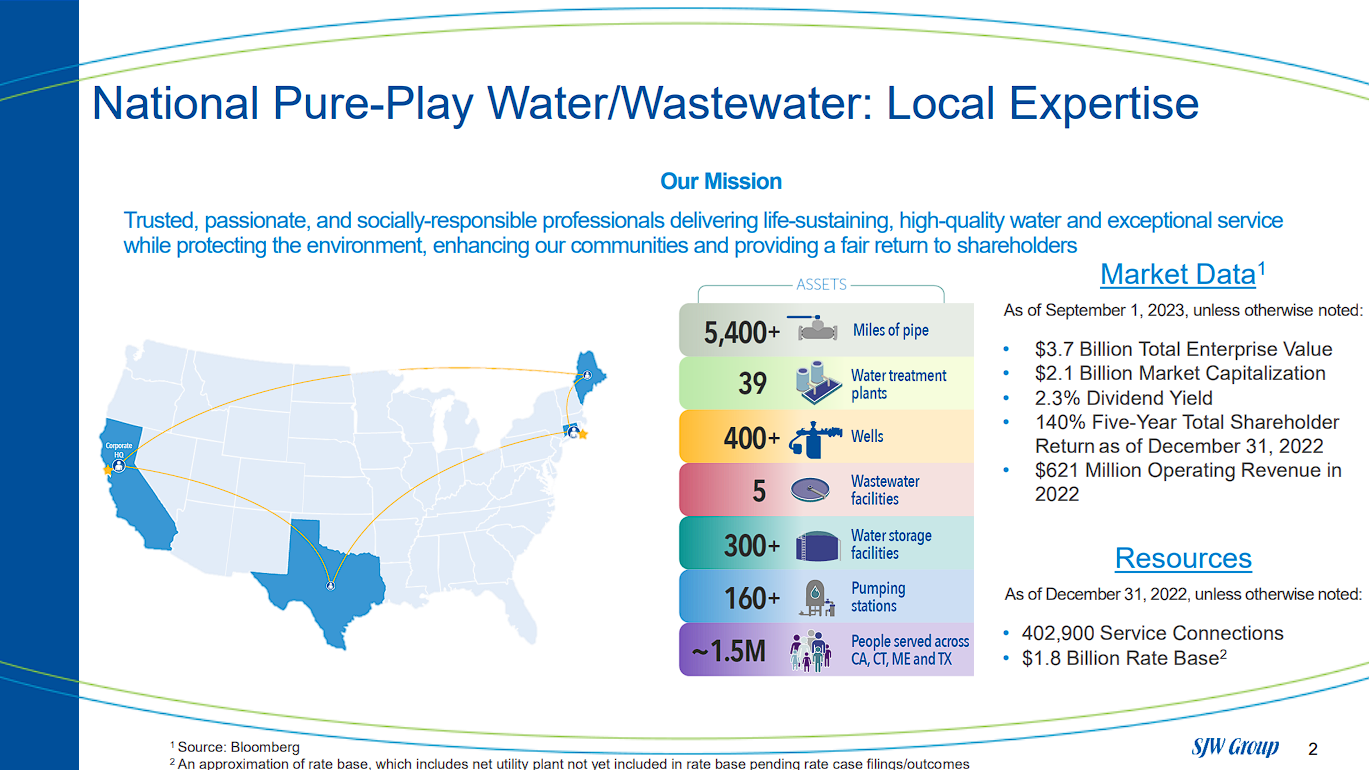

SJW is a water utility company that purchases, stores, purifies, and distributes water to consumers and businesses.

Source: Investor Presentation

Following the completed merger with Connecticut Water Service (CTWS), SJW currently consists of five subsidiaries:

- San Jose Water

- Connecticut Water

- Maine Water

- SJWTX

- SJW Land Company

San Jose Water Company, a regulated utility, has nearly 230,000 connections and provides water to roughly one million well-educated and affluent customers in the Silicon Valley area. The purchase of CTWS added 138,000 connections and 450,000 customers in Connecticut and Maine.

SJWTX is a regulated water utility company that has 25,000 connections in the area between San Antonio and Austin, Texas. Water utilities supply almost all revenues for SJW, but there is a real estate portion of the company as well. SJW Land owns and develops properties for both residential and warehouse customers in California and Tennessee. SJW uses the rental income from these properties to reinvest in its water utility business.

Growth Prospects

On July 31st, 2023, SJW Group reported Q2 results, posting a 5.3% revenue growth to $156.9 million, slightly below estimates. Earnings-per-share at $0.58, though lower than the prior year’s $0.69, exceeded expectations by $0.02.

Factors included water rate increases and new customers contributing $14.7 million and $0.9 million, respectively, while reduced customer usage decreased revenue by $9.0 million. Water production expenses also rose by $2.2 million to $61.9 million, somewhat impacting profitability.

Source: Investor Presentation

Prior to the merger, California contributed 92% of SJW’s income. In the most recent quarter, however, this figure was down to 53%. Connecticut is the second-largest source of income at 33%, with the remaining states of Texas, Tennessee, and Maine making up the rest.

SJW still relies on just two states for the vast majority of its income but is slightly less top-heavy than before the merger. The combination of SJW and CTWS has made the combined company the third-largest investor-owned water utility company in terms of both enterprise value and rate base. The combined entity has nearly 403,000 service connections and provides services to 1.5 million people.

SJW compounded earnings-per-share at a rate of 6.2% over the last decade. CTWS was no slouch either when it came to earnings growth, as the company has compounded earnings-per-share by 6.7% annually in the decade leading up to the merger.

We expect that the combined company will be able to generate earnings growth of 8.0% annually through 2028.

Competitive Advantages & Recession Performance

As a regulated utility, SJW is limited in how much it can raise rates for customers. Fortunately for the company, they operate in areas, i.e., Silicon Valley and Central Texas, that have seen high population growth rates. As these populations grow, they need reliable access to water. To encourage SJW to spend on improving the water infrastructure in these areas, local governments allow the company to raise rates at fairly high levels.

For example, San Jose Water received approval for a rate increase of 9.8%, 3.7%, and 5.2% for 2019, 2020, and 2021, respectively. Large rate increases should flow right to the company’s bottom line.

Another advantage for SJW was tax reform legislation that went into effect in 2018. Tax reform actually lowered SJW’s tax rate from 37% in 2017 to 20% in 2018. The impact of tax reform will continue going forward. In the first half of 2023, the company actually posted a negative effective tax rate of 9% due to the partial release of uncertain tax position reserve. However, even in the prior period, when no such one-off circumstance took place, the company paid a 17% consolidated income tax rate.

Between a lower tax rate and the additional income from the merger with CTWS, SJW has an opportunity to offer robust dividend growth going forward. SJW has paid an uninterrupted dividend for the past 79 years. The company has increased its dividend for the past 55 years. The average raise in the decade before the merger was 4.8%.

In recent years, the company rewarded shareholders with a 7.1% increase in 2019, a 6.7% raise in 2020, a 6.3% increase in 2021, a 5.9% raise in 2022, and a 5.6% raise in 2023. Shares of SJW yield 2.5% at the moment.

Source: Investor Presentation

While future growth looks attractive due to the company’s merger with CTWS, it is also important to examine how a company performed during tough economic times. SJW’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share: $1.04 (12.6% decline)

- 2008 earnings-per-share: $1.08 (4% increase)

- 2009 earnings-per-share: $0.81 (25% decline)

- 2010 earnings-per-share: $0.84 (4% increase)

SJW was not immune to the last recession as earnings-per-share declined 22% from 2007 through 2009. While earnings growth did return the next year, it took the company until 2014 to top its pre-recession high.

Water remains a crucial resource for consumers even during a recession, but SJW’s performance during and after the last financial crisis shows that growth can be elusive. That said, the company’s more diversified business model today makes it likely that the next recession won’t be as severe for SJW.

Valuation & Expected Returns

SJW reaffirmed its guidance for 2023 and expects earnings-per-share of $2.40 to $2.50 for 2023. Using the current share price of $61.14 and the midpoint of expected EPS for the year, the stock has a price-earnings ratio of 25.0.

This compares favorably to our target price-to-earnings ratio of 26, which is a premium to the stock’s pre-merger 10-year average multiple. Converging to our target valuation by 2028 would boost annual results by 0.9% over this period of time.

Going forward, investors can expect total returns to be the following:

- 8.0% earnings per share growth

- 0.9% multiple expansion

- 2.5% dividend yield

In total, we expect shares of SJW to offer an annual return above 11% over the next five years.

Final Thoughts

SJW’s merger with CTWS has helped to diversify the company’s business model, making the combined entity less reliant on just California for income. SJW is still top-heavy, with just two states contributing over 85% of income, but this is an improvement over each individual company prior to the merger.

SJW also has a very long history of dividend growth and is one of just 50 companies with at least five decades of dividend growth. This is an impressive accomplishment.

With an impressive track record of dividend growth and SJW’s projected to achieve double-digit returns over the medium term, we assign the stock a buy rating.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks