Updated on February 28th, 2023 by Nikolaos Sismanis

Business development companies, or BDCs, are an attractive investment vehicle for those focused on generating income. They generally distribute most of their earnings to shareholders and, as a result, typically have very high yields.

Gladstone Capital Corporation (GLAD) is a BDC with a current dividend yield of nearly 9%. It is one of more than 180 stocks with a 5%+ dividend yield. You can see the full list of established 5%+ yielding stocks here.

And, including Gladstone Capital, there are 84 stocks that pay dividends each month, versus the more traditional quarterly or semi-annual payment schedules.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Gladstone Capital’s dividend yield towers above the rest of the market. The S&P 500 Index, on average, has a dividend yield of just 1.6%, which is less than one-fifth the yield of Gladstone Capital.

But a high yield is not enough if the underlying business is weak or the dividend is at risk of being cut. This article will discuss whether or not Gladstone Capital is a good investment option for income investors.

Business Overview

Gladstone Capital operates as a Business Development Company and invests in debt and equity securities, generating income primarily from its debt investments. These investments are made via a variety of equity (10% of portfolio) and debt instruments (90% of portfolio), generally with very high yields. Loan size is typically in the $7 million to $30 million range and has terms of up to seven years.

Gladstone Capital chooses targets in stable industries with sustainable margins and cash flows and favorable growth characteristics. The company focuses on non-cyclical and non-financial companies in order to avoid peaks and valleys in its target companies’ earnings. These are companies with leadership positions in their respective industries, growth potential, and annual EBITDA between $3 million and $15 million.

In order for Gladstone Capital to keep paying its hefty dividends to shareholders, which is its primary stated goal, it is critical that its investment portfolio continues to generate interest and dividend income and capital gains in excess of its operating and financial expenses.

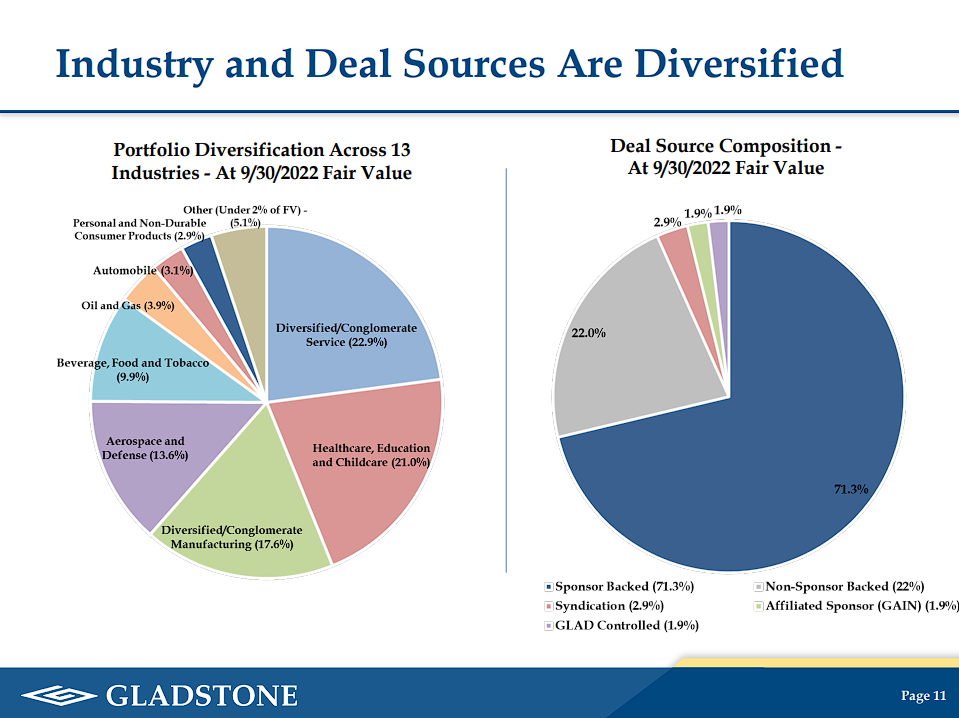

It has a diversified portfolio, both in terms of deal sourcing and industry groups.

Source: Investor Presentation

Equity investments include preferred or common stock. Gladstone Capital seeks to maintain a 90%-10% split between debt investments and equity investments.

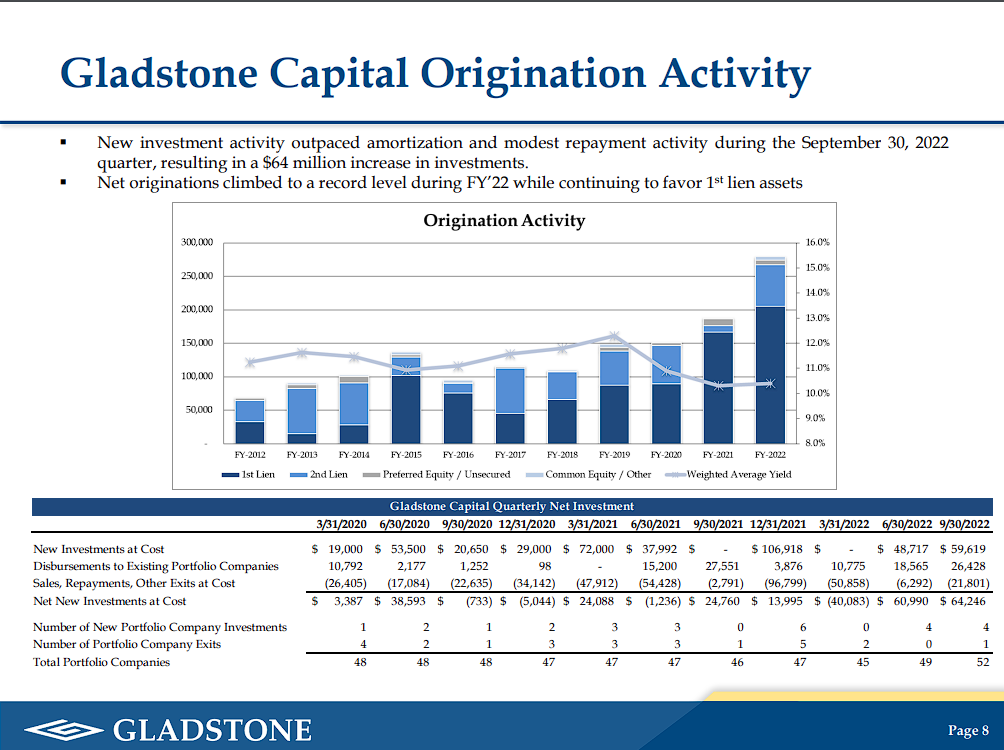

At the end of 2022, Gladstone Capital’s portfolio had a fair value of $621.7 million, with diversification across 50 companies and 13 different industries. The asset mix is fairly conservative at 90% of investments in secured loans, with 72% in lower-risk first-lien loans.

Gladstone reported its fiscal first-quarter results on February 6th, 2023, and results were slightly better than expected. Net investment income came to 25 cents per share, which was a penny better than expected. Total investment income, which is akin to revenue, was up 21% year-over-year to $19.3 million.

This was nearly a million dollars better than estimates. The gain in the top line was due to higher interest income, driven by increased weighted average yield, as well as higher balances of interest-bearing investment.

Secured first-lien assets rose to 72% of the total portfolio, while Gladstone’s weighted average yield on debt rose 980 bps to 12.3%.

On a per-share basis, NAV declined by 0.2% quarter-over-quarter to $9.06.

Thanks to its robust investment strategy, the company has considerable growth opportunities to look forward to.

Growth Prospects

One of the most compelling growth catalysts for Gladstone Capital is rising interest rates. The company stands to benefit from higher interest rates because the majority of its debt portfolio is in variable-rate securities.

Looking further back, Gladstone has had a difficult time generating growth. Gladstone’s share issuances have funded higher NII in dollar terms but haven’t earned enough above its cost of capital to move the needle on NII-per-share. Given this history, we reiterate our estimate of Gladstone’s medium-term growth rate at 1%.

The yields on the company’s portfolio influence its ability to earn income and, therefore, cover its expenses and pay distributions to shareholders. Over time, the company’s portfolio yield has drifted higher to just over 12%. As of December 31st, 2022, the company’s investment portfolio had a weighted average yield of 12.3%. However, higher expenses have offset that growth recently, which is part of the reason why NII-per-share continues to be flat over time.

Gladstone’s portfolio continues to grow in dollar terms, but given its offsetting rising expenses, and loan non-accruals, NII has struggled to grow.

Source: Investor Presentation

Gladstone Capital will aim to continue growing its new investments and adding new companies to the total portfolio. In recent years, the weighted average yield has fallen. The company has $108 million available on its bank line of credit, which could also be used to grow the investment portfolio and increase net interest income.

Dividend Analysis

Gladstone Capital pays a monthly dividend, which allows shareholders to receive 12 dividend payments per year, more frequently than four quarterly distributions. It currently pays a monthly dividend of $0.075 per share after a 7.1% increase in the dividend in January 2023. Previously in 2020, Gladstone Capital had cut the dividend by about 7%. However, after two dividend hikes, monthly payouts have now grown larger than their pre-pandemic levels.

We believe that Gladstone Capital’s current dividend is sustainable and could even slightly grow over the medium-term. On an annual basis, Gladstone Capital’s dividend represents a high yield of 8.9%.

Gladstone Capital has a solid track record of steady payouts, even during the Great Recession of 2008-2009. The company can maintain its high yield thanks to its tax classification and its favorable fundamentals. BDCs are required to distribute at least 90% of any taxable income. This eliminates income tax at the corporate level, allowing capital gains to be passed through to shareholders, similar to a REIT.

With a projected dividend payout ratio of 86% for 2023, Gladstone Capital’s dividend payout is secure but without much cushion. BDCs will always have high payout ratios due to the tax rule of distributing nearly all of their income, but it is easy to see why Gladstone Capital hasn’t raised its payout for such a long time.

Still, this is a relatively elevated payout ratio, which means the company may not be able to sustain a major economic downturn and maintain its dividend. As a result, were another significant financial crisis to occur, Gladstone Capital’s dividend could be in jeopardy.

Assuming continued economic growth, its dividend appears to be sustainable. But the high payout ratio introduces a relatively high risk to the sustainability of the dividend, particularly during a recession.

Final Thoughts

Investors should approach high dividend yields with caution. High yields are commonplace in the BDC asset class, but many have cut their dividends over the past few years. For its part, Gladstone Capital reduced its dividend modestly in 2020 but has since grown it above its pre-COVID level. For the time being, we do not believe another dividend cut is imminent.

However, investors will need to pay close attention to the company’s future earnings reports. It has a very tight payout ratio, and any significant deterioration in the performance of its investment portfolio could threaten the dividend.

Overall, Gladstone Capital is likely only attractive for income investors looking for high yields.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more