Updated on June 14th, 2023 by Ben Reynolds

The snowball effect shows the power of compounding.

When you push a small snowball down a hill, it continuously picks up snow. When it reaches the bottom of the hill it is a giant snow boulder.

The snowball compounds during its travel down the hill. The bigger it gets, the more snow it packs on with each revolution. The snowball effect explains how small actions carried out over time can lead to big results.

Source: Calvin & Hobbes

In the same way, investing in high-quality dividend growth stocks can generate large amounts of dividend income over long periods of time. That’s because dividend growth stocks tend to pay rising dividends every year. And then you can reinvest those rising dividends to purchase more shares each year. This results in an increase in the total number of shares you own, as well as an increase in the dividend per share, for a powerful wealth compounding effect.

Investors looking for the best dividend growth stocks should consider the Dividend Aristocrats, a group of 67 stocks in the S&P 500 with 25+ consecutive years of dividend growth.

You can download an Excel spreadsheet of all 67 (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

This article shows how to harness the power of the snowball effect to multiply your wealth and income many times over.

It also includes 5 real world examples of the ‘snowball effect’ stocks that have compounded investor wealth.

Table of Contents

You can instantly jump to any specific section by clicking on the links below:

- The Power of The Snowball Effect

- How You Can Harness The Snowball Effect

- Example #1: The Coca-Cola Company (KO)

- Example #2: Lowe’s Companies (LOW)

- Example #3: Procter & Gamble (PG)

- Example #4: Colgate-Palmolive (CL)

- Example #5: Johnson & Johnson (JNJ)

- Snowball-Effect Stocks For The Next 25 Years

The Power of The Snowball Effect

Before we discuss how to harness the power of the snowball effect we must understand the power of compounding.

The snowball metaphor visually shows the power of compounding.

“The most powerful force in the world is compound interest”

– Attributed to Albert Einstein

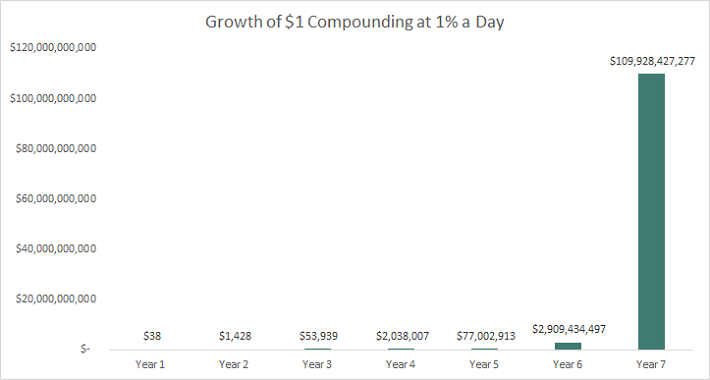

Here’s the power of compound interest:

Imagine you invested $1 that compounded at 1% a day. In 5 years your $1 would grow to over $77 million. You would be the richest person in the world by year 7.

Keep in mind that compounding is not a get rich quick scheme. It takes time – and lots of it. There are no investments that compound at 1% a day in the real world.

The stock market has compounded wealth (adjusting for inflation) at ~6.9% a year over the long run. At this rate an investment in the stock market has historically doubled every 10.4 years.

It takes more time to compound wealth in the real world – but that doesn’t make the principle of compounding any less powerful.

Take Warren Buffett as an example. Warren Buffett is worth over $110 billion. Warren Buffett’s wealth comes from the tremendous benefits of the snowball effect through time.

Warren Buffett compounded his wealth through a specific type of investment.

Buffett invests in:

- Shareholder-friendly businesses

- With strong competitive advantages

- Trading at fair or better prices

“All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.”

– Warren Buffett

The next section of this article discusses how to harness the power of the snowball effect by investing in the same type of businesses Warren Buffett does.

How You Can Harness The Snowball Effect

You can harness the power of the snowball effect by investing in the same type of businesses that have made Warren Buffett so wealthy over time. Specifically, companies with strong and durable competitive advantages and shareholder friendly managements, trading at fair or better prices.

The good news is you don’t even have to search for these businesses. There is a list of 48 businesses with 50+ years of consecutive dividend increases called the Dividend Kings list.

Nothing says ‘strong and durable competitive advantages and shareholder friendly management’ like 50 or more years of paying rising dividends in a row.

Coca-Cola (one of Buffett’s biggest investments) is a Dividend King. There are many other well-known stocks in the Dividend Kings list, including:

You may read this and think: “these businesses may have a history of success, but isn’t their run over”?

Investors have wasted tremendous sums of money chasing ‘the new hot stock’. It is steady dependable results that lead to long-term wealth multiplication.

What would happen if you had invested in some of the most well-known Dividend Kings in 1990?

The 7 example businesses below all had 25+ years of consecutive dividend increases by the end of 1990. They were well-known, blue-chip stocks in 1990.

It didn’t take a genius to buy and hold them…

But the results speak for themselves. Five examples of the snowball effect in action are below. All examples assume dividends were reinvested.

Example #1: The Coca-Cola Company (KO)

Coca-Cola compounded investor wealth at 10.4% a year (including dividends) from 1991 through 2022. $1 invested in Coca-Cola at the start of 1991 would be worth $23.62 by the end of 2022.

Coca-Cola was the largest soda brand in the United States in 1990… And had a 98 year operating history at the time. It was not a start-up.

Example #2: Lowe’s Companies (LOW)

Lowe’s is the second-largest home improvement store in the United States, behind only The Home Depot (HD). In 1991 Lowe’s was one of the largest home improvement stores in the United States. It had a dividend history of over 25 consecutive years of increases even then.

Investing in Lowe’s at the start of 1991 (32 years ago) has worked out very well…

The company’s stock has compounded (including dividends) at an incredible 20.4% annually over this time period. $1 invested in Lowe’s at the start of 1991 would e worth $379.74 at the end of 2022.

Example #3: Procter & Gamble (PG)

Procter & Gamble was just as well-known in 1990 as it is today. The company has an iconic brand portfolio with names like Tide, Bounty, Gillette, and Charmin (among many others).

The company was founded in 1837. In 1990, Procter & Gamble had been around for 153 years… Not exactly a young company.

Still, long-term investors in Procter & Gamble have done well. The stock has produced 32-year annualized total returns of 11.3% a year. $1 invested in Procter & Gamble at the start of 1991 would be worth $31.08 by the end of 2022.

Example #4: Colgate-Palmolive (CL)

Colgate-Palmolive traces its history back to 1806. Both the Colgate and Palmolive brands are easily recognized.

In addition to these brands, Colgate-Palmolive owns the Speed Stick, Soft Soap, and Hill’s brands (among many others).

Colgate-Palmolive has paid dividends since 1893. The company has paid increasing dividends for over 50 consecutive years. In 1991 the company had a streak of 28 consecutive dividend increases.

How did 1991 investors do? Colgate-Palmolive generated a compound annual returns of 11.7% during this 32-year period. $1 invested in Colgate-Palmolive at the start of 1991 would be worth $32.64 by the end of 2022.

Example #5: Johnson & Johnson (JNJ)

Johnson & Johnson is one of the most stable businesses in the world. This stability is reflected in Johnson & Johnson’s long history of dividend payments to shareholders. This ‘slow and steady’ business has been a boon for shareholders over the long-run.

The company generated compound total returns of 12.4% a year for shareholders during the 1991 through 2022 time period. $1 invested in Johnson & Johnson would be worth $42.41.

The company’s low stock price beta and volatility only adds to its appeal. Investors have historically generated excellent returns with Johnson & Johnson stock without as many gut-wrenching ups and downs as compared to other stocks.

Snowball-Effect Stocks For The Next 25 Years

All 5 examples above trounced the market despite being well established businesses with long dividend histories.

But…

What stocks will be the next snowball effect compounders?

There’s no need to reinvent the wheel. Anyone holding the serial compounders above should continue to do so.

For those looking to enter into new positions in snowball effect stocks should look for the following:

- Above average dividend yield

- Below average price-to-earnings ratio

- Long dividend history

The biggest constraint of the 3 is the long dividend history. We will start by selecting only from stocks with 25+ years of rising dividends.

Out of these long dividend history stocks, we will screen for:

- A dividend yield above the S&P 500’s 1.6% yield

- A price-to-earnings below the S&P 500’s ratio long-term average of 16.0

We will then sort these by expected total return. Total return is the expected earnings-per-share growth rate, plus the current dividend yield, as well as the net impact of any positive or negative changes in the price-to-earnings multiple.

The 10 highest expected total return stocks with 25+ years of rising dividends, a dividend yield above 1.60%, and a price-to-earnings ratio (using data from Sure Analysis), are listed below:

- Telephone & Data Systems (TDS) | Expected total return of 20.0%

- MDU Resources (MDU) | Expected total return of 18.3%

- Arrow Financial (AROW) | Expected total return of 18.1%

- 3M Company (MMM) | Expected total return of 16.7%

- Sonoco Products (SON) | Expected total return of 16.6%

- UGI Corp. (UGI) | Expected total return of 16.2%

- Chesapeake Financial | Expected total return of 16.1%

- Walgreens Boots Alliance (WBA) | Expected total return of 15.9%

- Norwood Financial (NWFL) | Expected total return of 15.4%

- Westamerica Bancorporation (WABC) | Expected total return of 15.1%

The 10 stocks listed above best match the criteria to best take advantage of the snowball effect.

‘Snowball stocks’ have durable competitive edges. Evidence of their competitive advantages is seen by their long operating history and consistent dividend increases.

Long-term investing in great businesses with shareholder-friendly managements at fair or better prices will very likely produce compound wealth gains over time.

Related: The video below discusses long-term investing and wealth creation.

Remember the snowball effect when choosing your investments.

Other Dividend Lists

The Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Growth Stocks List: 14+ years of rising dividends using data from Sure Analysis.