Published on March 31st, 2023 by Aristofanis Papadatos

High dividend stocks means more income for every dollar invested. All other things equal, the higher the dividend yield, the better.

In this research report, we analyze 20 stocks trading below $10.00 per share and offering high dividend yields of 5.0% and greater. These stocks are ranked based on their dividend yield, from highest to lowest.

In this article, we will discuss the prospects of 20 stocks that are trading below $10 and are offering a dividend yield above 5.0%. We have ranked these stocks based on their dividend yield, from highest to lowest.

Additionally, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Keep reading to see analysis on these 20 high-yielding securities trading below $10.00 per share.

Table of Contents

- Low-Priced High Dividend Stock #1: Armour Residential REIT (ARR)

- Low-Priced High Dividend Stock #2: Brandywine Realty Trust (BDN)

- Low-Priced High Dividend Stock #3: Chimera Investment Corporation (CIM)

- Low-Priced High Dividend Stock #4: Medical Properties Trust (MPW)

- Low-Priced High Dividend Stock #5: Apollo Commercial Real Estate Finance (ARI)

- Low-Priced High Dividend Stock #6: PermRock Royalty Trust (PRT)

- Low-Priced High Dividend Stock #7: Ares Commercial Real Estate Corporation (ACRE)

- Low-Priced High Dividend Stock #8: AGNC Investment Corporation (AGNC)

- Low-Priced High Dividend Stock #9: Piedmont Office Realty Trust (PDM)

- Low-Priced High Dividend Stock #10: Prospect Capital (PSEC)

- Low-Priced High Dividend Stock #11: Ladder Capital (LADR)

- Low-Priced High Dividend Stock #12: Gladstone Capital (GLAD)

- Low-Priced High Dividend Stock #13: Global Medical REIT (GMRE)

- Low-Priced High Dividend Stock #14: Kronos Worldwide (KRO)

- Low-Priced High Dividend Stock #15: Telephone & Data Systems (TDS)

- Low-Priced High Dividend Stock #16: Macerich (MAC)

- Low-Priced High Dividend Stock #17: The Gap (GPS)

- Low-Priced High Dividend Stock #18: Clipper Realty (CLPR)

- Low-Priced High Dividend Stock #19: RPT Realty (RPT)

- Low-Priced High Dividend Stock #20: Whitestone REIT (WSR)

Low-Priced High Dividend Stock #1: Armour Residential REIT (ARR) – Dividend Yield of 18.7%

ARMOUR Residential is a mortgage REIT that was formed in 2008. The trust invests primarily in residential mortgage-backed securities that are guaranteed or issued by a United States government entity, including Fannie Mae, Freddie Mac and Ginnie Mae.

ARMOUR Residential borrows funds at short-term interest rates and invests in long-term securities. As a result, the company is extremely sensitive to the underlying interest rates and the yield curve, i.e., the difference between long-term and short-term interest rates.

The REIT is currently facing a perfect storm due to the aggressive interest rate hikes implemented by the Fed in an effort to restore inflation to normal levels. Due to the efforts of the Fed to cool the economy, short-term interest rates have risen above long-term interest rates.

As ARMOUR Residential borrows funds at short-term interest rates and invests funds at long-term rates, it has become extremely hard for the company to make profitable new deals under the prevailing conditions. Nevertheless, the company will likely remain profitable thanks to its existing investment portfolio. In addition, most of the damage has probably been done in reference to the stock price, as the Fed is not likely to raise interest rates much further.

ARMOUR Residential is currently offering an exceptionally high dividend yield of 18.7%, with a payout ratio of 86%. While its dividend is far from safe, it is likely to remain high even in the event of a dividend cut. On the other hand, the company has exhibited a highly volatile performance record. As a result, the stock is suitable only for risk-tolerant investors, who can endure high stock price volatility.

Click here to download our most recent Sure Analysis report on Armour Residential REIT (ARR) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #2: Brandywine Realty Trust (BDN) – Dividend Yield of 17.6%

Brandywine Realty Trust is a REIT that owns, develops, leases and manages an urban town center and transit-oriented portfolio, including 163 properties in Philadelphia, Austin and Washington, D.C. The trust generates 75% of its operating income in Philadelphia, 19% of its operating income in Austin and the remaining 6% in Washington.

As Brandywine Realty Trust generates a vast portion of its operating income in Philadelphia and Austin, it greatly benefits from the unique advantages of these two areas. According to official reports, approximately 80% of all the pharmaceutical and biotechnology companies have offices in Greater Philadelphia. In addition, 87% of all the cell and gene therapy treatments approved by the FDA in 2020 originated in Philadelphia. Overall, Philadelphia offers great advantages to a REIT like Brandywine Realty Trust.

Just like most REITs, Brandywine Realty Trust is currently facing a strong headwind, namely the impact of rising interest rates on the interest expense of the REIT. As a result, the stock has plunged to a 14-year low, trading at an all-time low price-to-FFO ratio of 3.3 and offering an all-time high dividend yield of 17.6%.

Brandywine Realty Trust has a healthy payout ratio of 66%, but it has a high leverage ratio (Net Debt to EBITDA) of 7.0. It also has a debt maturity in October-2024 and another one in June-2026. As a result, the trust may cut its dividend in the near future. The high debt load is the primary reason behind the freeze of the dividend for 17 consecutive quarters. Moreover, Brandywine Realty Trust is sensitive to recessions due to its debt load and the sensitivity of its tenants to recessions. Nevertheless, even if the REIT cuts its dividend, it will still be offering an above average yield. In addition, when inflation and interest rates revert to normal levels, the stock is likely to rebound thanks strongly to its depressed valuation.

Click here to download our most recent Sure Analysis report on Brandywine Realty Trust (BDN) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #3: Chimera Investment Corporation (CIM) – Dividend Yield of 16.9%

Chimera Investment Corporation is a REIT that is a specialty finance company. Through its subsidiaries, it invests in a diversified portfolio of mortgage assets, such as residential mortgage loans, non-agency residential mortgage assets, and other real estate related securities.

Chimera borrows funds based on short-term interest rates and invests in mortgage assets whose yield depends on long-term interest rates. Consequently, the company is extremely sensitive to the prevailing interest rates and the yield curve, i.e., the difference between long-term and short-term interest rates.

Just like ARMOUR Residential, Chimera has been severely hurt by the aggressive interest rate hikes implemented by the Fed since early last year. Due to the efforts of the Fed to cool the economy, short-term interest rates have risen above long-term interest rates. In other words, the market expects a recession to show up in the near future.

The negative slope of the yield curve has made it challenging for Chimera to make a profit in new transactions. Nevertheless, the company will likely remain profitable thanks to its existing investment portfolio.

Chimera is trading at a nearly 10-year low price-to-earnings ratio of 6.1 and is offering a 10-year high dividend yield of 16.9%. Given the extreme payout ratio of 102% and the vulnerability of Chimera to the current investing environment, its dividend is far from safe. Nevertheless, even after a dividend cut, the stock will still be offering an above average yield. Thanks to its cheap valuation, the stock is attractive from a long-term perspective, particularly given that the worse seems to be behind the company as interest rates are not likely to rise much further from current levels.

Click here to download our most recent Sure Analysis report on Chimera Investment Corporation (CIM) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #4: Medical Properties Trust (MPW) – Dividend Yield of 15.6%

Founded in 2003, Medical Properties Trust is the only pure-play hospital REIT today. It owns a well-diversified portfolio of over 400 properties which are leased to over 30 different operators. The great majority of the assets are general acute care hospitals. The portfolio of assets is well diversified across different geographies, with properties in 29 states. The geographic diversification mitigates the risk of demand and supply imbalances in individual markets. On top of its U.S. portfolio, Medical Properties has a strategic exposure to key European markets, including Germany, the UK, and Italy, as well as Australia.

Medical Properties Trust has a weak balance sheet. Its net debt is $8.2 billion, nearly double the market capitalization of the stock ($4.4 billion). As a result, the REIT is highly vulnerable to the environment of fast-rising interest rates. This is the key behind the 65% plunge of the stock over the last 12 months, to a new 10-year low.

On the bright side, thanks to the essential nature of its business, Medical Properties Trust is resilient to recessions. In the Great Recession, it cut its dividend by 31%, but it performed better than most REITs. Moreover, the stock currently offers a 10-year high dividend yield of 15.6%, with a decent payout ratio of 68%. Due to the weak balance sheet of the REIT, its dividend is not safe. Nevertheless, even if the dividend is cut, the yield will likely remain above average. Given also its 10-year low price-to-FFO ratio of 4.4, the stock is highly attractive from a long-term point of view.

Click here to download our most recent Sure Analysis report on Medical Properties Trust (MPW) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #5: Apollo Commercial Real Estate Finance (ARI) – Dividend Yield of 15.1%

Apollo Commercial Real Estate Finance was founded in 2009. A REIT invests in debt securities, such as senior mortgages, mezzanine loans, and other commercial real estate-related debt. The investments of Apollo are placed in the U.S. and Europe and are collateralized by the underlying estate properties.

ACREFI Management, an indirect subsidiary of Apollo Global Management, externally manages Apollo. Investors should be aware that externally managed REITs are in principle characterized by higher risk than internally managed REITs, as the incentives of the management of the former are not always aligned with the interests of the unitholders. This is an important risk factor to consider before purchasing Apollo.

Apollo is currently offering a nearly 10-year high dividend yield of 15.1% but there are good reasons behind the high yield. The REIT has exhibited a volatile performance record throughout the last decade and has proved highly vulnerable to recessions. It is also negatively affected by the negative yield curve of interest rates. In addition, the REIT has a payout ratio of 86%, leaving a minimum safety margin for the dividend. Overall, Apollo is likely to perform well whenever the economy recovers from its latest slowdown but it is highly vulnerable to recessions and the prevailing environment of high interest rates.

Click here to download our most recent Sure Analysis report on Apollo Commercial Real Estate Finance (ARI) (preview of page 1 of 3 shown below):

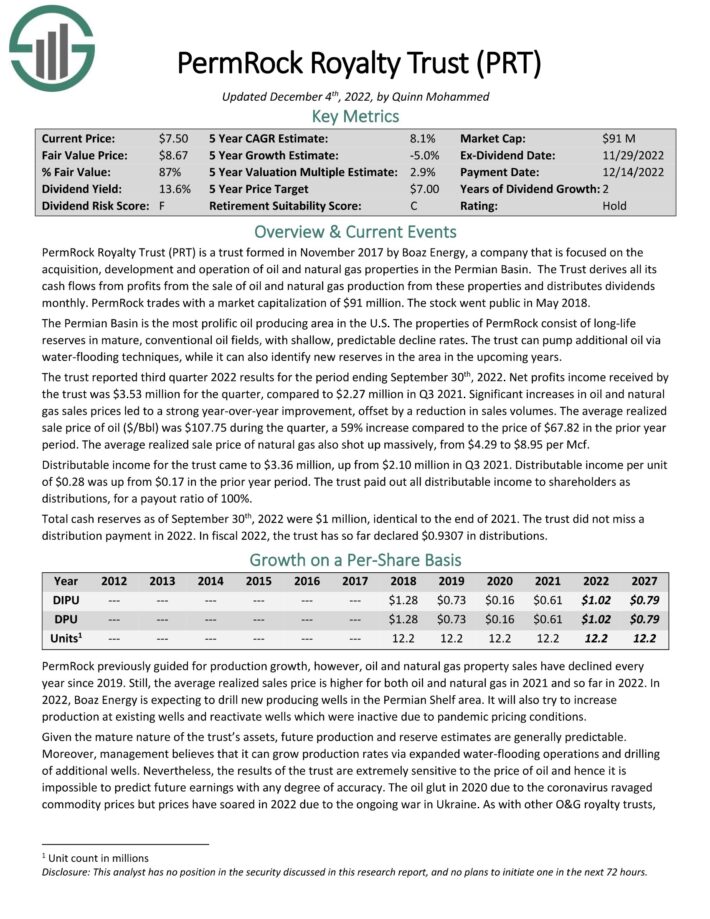

Low-Priced High Dividend Stock #6: PermRock Royalty Trust (PRT) – Dividend Yield of 14.9%

PermRock Royalty Trust is a trust formed in November 2017 by Boaz Energy, a company that is focused on the acquisition, development, and operation of oil and natural gas properties in the Permian Basin. The trust derives all its cash flows from profits from the sale of oil and natural gas production from these properties and distributes dividends on a monthly basis.

The Permian Basin is the most prolific oil producing area in the U.S. The properties of PermRock consist of long-life reserves in mature, conventional oil fields, with shallow, predictable decline rates. The trust can pump additional oil via water-flooding techniques in order to make the most out of its properties, while it can also identify new reserves in the area in the upcoming years.

PermRock thrived in 2022 thanks to the Ukrainian crisis, which triggered an impressive rally of oil and gas prices to 13-year highs. The trust is currently offering an exceptionally high dividend yield of 14.9%, which is likely to attract some income-oriented investors.

However, investors should be aware of the dramatic cycles of the prices of oil and gas. As a pure upstream player, PermRock is highly vulnerable to the cycles of its industry. It is also important to note that the trust’s oil and gas sales have declined every year since 2019. As it seems that we have just passed the peak of this oil and gas industry cycle, PermRock has excessive downward risk going forward. Therefore, only the investors who have conviction for higher oil and gas prices in the upcoming years should consider purchasing the stock.

Click here to download our most recent Sure Analysis report on PermRock Royalty Trust (PRT) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #7: Ares Commercial Real Estate Corporation (ACRE) – Dividend Yield of 14.7%

Ares Commercial Real Estate Corporation is a specialty finance company primarily engaged in originating and investing in commercial real estate loans and related investments. The company is externally managed by a publicly traded Ares Management Corporation subsidiary, a leading global alternative asset manager. As mentioned above, externally managed companies have a higher inherent risk than internally managed companies, as the interests of management is not always aligned with the interests of unitholders.

The company’s loan portfolio, which is almost fully composed of senior loans, comprises 60 market loans across eight asset types, with an outstanding principal balance of $2.3 billion. Approximately 70% of the loans are tied to multifamily, office, and industrial properties.

The stock of Ares Commercial Real Estate has plunged 41% over the last 12 months, and thus the stock is currently offering a nearly 10-year high dividend yield of 14.7%. However, there are good reasons behind the abnormally high yield. The company is highly vulnerable to the current investing environment of rising interest rates. It has also proved vulnerable to recessions. Given its choppy performance record and an excessive payout ratio of 91%, its dividend is far from safe.

Click here to download our most recent Sure Analysis report on Ares Commercial Real Estate Corporation (ACRE) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #8: AGNC Investment Corporation (AGNC) – Dividend Yield of 14.6%

Founded in 2008, AGNC Investment Corporation is a mortgage REIT that invests primarily in agency mortgage-backed securities (MBS) on a leveraged basis. The company’s asset portfolio consists of residential mortgage pass-through securities, collateralized mortgage obligations (CMO) and non-agency MBS. Most of its investments are fixed-rate agency MBS, with a 30-year maturity period.

AGNC greatly benefited from the nearly all-time low interest rates that prevailed over the last decade. However, due to the surge of inflation to a 40-year high, the Fed has been raising interest rates aggressively since early last year. This is a strong headwind for the performance of AGNC, which suffers from any unexpected rise in interest rates.

Moreover, the company has exhibited unreliable business performance over the last decade, with extremely volatile results. Due to the headwinds facing its business, AGNC is currently trading at an exceptionally low price-to-earnings ratio of 4.1 and is offering a nearly 10-year high dividend yield of 14.6%, with a healthy payout ratio of 60%. While AGNC is characterized by unreliable performance, the stock seems to have been sold off to the extreme due to negative market sentiment. As a result, AGNC is likely to highly reward patient investors off its current depressed stock price.

Click here to download our most recent Sure Analysis report on AGNC Investment Corporation (AGNC) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #9: Piedmont Office Realty Trust (PDM) – Dividend Yield of 12.4%

Piedmont Office Realty Trust owns, manages, develops, redevelops, and operates high-quality office properties located primarily in sub-markets within seven major Eastern U.S. office markets. The company derives most of its revenues from U.S. government entities, business services companies, and financial institutions in the Sunbelt region. Piedmont Office Realty Trust is fully integrated and self-managed.

While office leases tend to be fairly stable, the pandemic and the resultant work-from-home trend could result in a permanent paradigm shift, adversely affecting the REIT business. On the other hand, Piedmont Office Realty Trust has exhibited a consistent performance record, as it has grown its FFO per unit in 8 of the last 9 years. This is an admirable achievement, as this period includes the coronavirus crisis. Nevertheless, investors should be aware that this is a slow-growth REIT, which has grown its FFO per unit by only 3.6% per year on average over the last nine years.

Piedmont Office Realty Trust is currently offering a 10-year high dividend yield of 12.4%, with a solid payout ratio of 45%. However, the REIT has a material debt load, and hence its interest expense is likely to increase significantly due to the adverse environment of rising interest rates. In 2022, the interest expense of Piedmont Office Realty Trust grew 27%, and thus it consumed 77% of operating income. Overall, the dividend is not safe, particularly if interest rates remain high beyond this year.

On the other hand, the stock is now trading at a 10-year low price-to-FFO ratio of 3.7. Whenever inflation and interest rates revert to normal levels, Piedmont Office Realty Trust is likely to highly reward investors off its current depressed price.

Click here to download our most recent Sure Analysis report on Piedmont Office Realty Trust (PDM) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #10: Prospect Capital Corporation (PSEC) – Dividend Yield of 10.3%

Prospect Capital Corporation provides private debt and private equity to middle-market companies in the U.S. The company focuses on direct lending to owner-operated companies as well as sponsor-backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Business development companies (BDCs) face cut-throat competition from their peers and hence they do not enjoy any sort of competitive advantage. Prospect is not an exception. It is also important to note that Prospect has hardly extended its balance sheet over the last decade. As a result, it does not enjoy the advantages that result from a great scale.

Moreover, Prospect has grown its net investment income during the last decade but has failed to grow its net investment income per share due to the hefty issuance of new shares. Since 2012, its share count has nearly doubled, and thus its net investment income per share has decreased 55%, from $1.67 in 2012 to $0.75 in 2022. As a result, the stock has dramatically underperformed the S&P 500 during the last decade (-36% vs. +156%).

Due to its poor performance record, Prospect has reduced its dividend, from $1.22 in 2012 to $0.72 now. It is also important to note that the stock has paid the same dividend for five consecutive years. Given also the current payout ratio of 92%, it is evident that the 10.3% dividend of the stock has a thin margin of safety.

Click here to download our most recent Sure Analysis report on Prospect Capital Corporation (PSEC) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #11: Ladder Capital (LADR) – Dividend Yield of 9.9%

Ladder Capital is a commercial real estate finance company structured as an internally managed REIT. Ladder Capital originates and invests in a portfolio of commercial real estate and real estate-related assets, diversified by region and property type. The company capitalizes on loans and securities related to commercial real estate. It was founded in October 2008, it completed its IPO in February 2014 and received REIT status at the beginning of 2015.

The competitive advantage of Ladder Capital is its experienced management team. The interests of management are aligned with those of the shareholders, as directors own a significant portion of the company. Ladder Capital was not a public company at the time of the Great Recession but it can be reasonably assumed to be highly vulnerable to recessions. In the coronavirus crisis, the REIT incurred a 62.5% plunge in its earnings per share and slashed its dividend by 31%.

Despite the dividend cut, the stock is still offering an exceptionally high dividend yield of 9.9%. It also has a decent payout ratio of 72%. However, due to its material debt load, its unreliable business performance, and its vulnerability to the prevailing environment of rising interest rates, its dividend is far from safe. Therefore, the stock is suitable only for the investors who are confident that interest rates will begin to normalize the latest in 2024.

Click here to download our most recent Sure Analysis report on Ladder Capital (LADR) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #12: Gladstone Capital (GLAD) – Dividend Yield of 9.8%

Gladstone Capital is a business development company that primarily invests in small and medium businesses. These investments are made via a variety of equity (10% of portfolio) and debt instruments (90% of portfolio), generally with very high yields. Loan size typically ranges from $7 million to $30 million and has terms of up to seven years. The company’s stated purpose is to generate income it can distribute to its shareholders. The company pays its distributions on a monthly basis.

Like any other BDC, Gladstone has no competitive advantages as it operates in a highly competitive environment. It is also dependent upon funding costs and the spreads it can earn on its debt and equity investments. Gladstone is vulnerable to recessions, as some borrowers will likely face liquidity issues during rough economic periods. Indeed, Gladstone cut its dividend during the Great Recession and has not restored it yet.

Gladstone is currently facing strong business headwinds, namely an adverse environment of high interest rates and an economy that has greatly decelerated and may even fall into a recession. As a result, the stock has come under pressure, and thus it is currently offering a nearly 10-year high dividend yield of 9.8%. As BDCs distribute most of their earnings in the form of dividends, the payout ratio of 86% is reasonable for a BDC. However, the high payout ratio of Gladstone and its sensitivity to recessions result in a vulnerable dividend. Nevertheless, thanks to its consistent performance record, Gladstone is fairly attractive from a long-term perspective.

Click here to download our most recent Sure Analysis report on Gladstone Capital (GLAD) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #13: Global Medical REIT (GMRE) – Dividend Yield of 9.7%

Global Medical REIT is a net-lease medical office REIT that acquires specialized healthcare facilities, which it leases to national healthcare systems and industry-leading physician groups. The portfolio of the REIT consists of gross investments in real estate worth around $1.5 billion. The asset portfolio includes 189 facilities with an aggregate of 4.9 million leasable square feet and an aggregate of $114.5 million worth of annualized base rent.

Global Medical REIT has rapidly grown its healthcare property portfolio, enjoying robust cash flows and high-quality tenants. The solid occupancy and the extended average lease period of the company render it resilient even under adverse economic conditions. In 2020, which was marked by the fierce recession caused by the pandemic, Global Medical REIT posted record FFO per unit. We expect the REIT to continue growing its FFO per unit thanks to acquisitions and annual rent escalations.

Just like most REITs, Global Medical REIT has been hurt by rising interest rates, which have significantly increased the interest expense of the REIT. Due to this headwind, the stock of Global Medical REIT has slumped 46% over the last 12 months, and thus it is now trading at an exceptionally low price-to-FFO ratio of 9.6 and is offering a 9.7% dividend yield. The trust has a payout ratio of 91%, so its dividend is not safe. On the other hand, given its manageable amount of debt, Global Medical REIT is likely to endure the adverse economic environment and recover whenever interest rates normalize. Thanks to its cheap valuation, the stock is attractive for patient investors, who can remain focused in the long run.

Click here to download our most recent Sure Analysis report on Global Medical REIT (GMRE) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #14: Kronos Worldwide (KRO) – Dividend Yield of 8.6%

Kronos Worldwide is a chemicals company. It generates virtually all of its revenues from the sales of titanium dioxide (TiO2) pigments. These pigments are used for giving brightness and color to products such as paints, cosmetics, and plastics. Kronos went public in 2003 and it remains a subsidiary of Valhi (VHI), which owns 50% of Kronos’ outstanding stock.

Investors should be aware that the stock of Kronos has limited trading volume and modest outstanding stock float. It is thus hard to establish a large position in the stock. In addition, this is a pure commodity business, in which cycles are inevitable. As a result, Kronos has exhibited a highly volatile performance record.

The TiO2 business is a highly cyclical one, as it is tied to end markets such as housing. Due to the adverse environment of high interest rates, the housing market is likely to significantly decelerate in the upcoming quarters. Consequently, Kronos, which incurred a 29% decline in its earnings per share last year, is poised to incur a further decrease in its earnings per share this year. This helps explain the 42% plunge in the stock over the last 12 months.

Due to its stock price decline, Kronos is offering a 10-year high dividend yield of 8.6%. However, the payout ratio is 152% and hence it is excessive. Therefore, despite its strong balance sheet, the company may cut its dividend at some point.

Due to the dramatic cycles of its business, Kronos is an ideal candidate to purchase when its business prospects seem gloomy. Its business is currently in a downcycle but we recommend waiting for a much lower entry point, as we expect business conditions to deteriorate in the near future.

Click here to download our most recent Sure Analysis report on Kronos Worldwide (KRO) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #15: Telephone & Data Systems (TDS) – Dividend Yield of 7.5%

Telephone & Data Systems is a telecommunications company that provides customers with cellular and landline services, wireless products, cable, broadband, and voice services across the U.S. The Cellular Division accounts for more than 75% of total operating revenue. Telephone & Data Systems started in 1969 as a collection of 10 rural telephone companies and has grown to a company with a market capitalization of $1.1 billion and more than $5.4 billion in annual revenues.

Telephone & Data Systems has an 82% stake in U.S. Cellular and essentially relies on this stake to achieve growth. The strong dependence of Telephone & Data Systems on U.S. Cellular results in an extremely volatile and unreliable performance. The company has grown fast in some years but it has greatly decelerated in the last two years. It incurred losses last year and is poised to incur further losses this year. This is the key behind the 47% slump of the stock over the last 12 months.

Due to its slump, Telephone & Data Systems currently offers a 10-year high dividend yield of 7.5%. However, earnings do not cover its dividend, as the company is poised to incur losses this year. Given also its inconsistent business performance, the stock is highly speculative.

Click here to download our most recent Sure Analysis report on Telephone & Data Systems (TDS) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #16: Macerich (MAC) – Dividend Yield of 7.0%

Macerich is one of the leading owners, operators, and developers of major retail real estate. The company is incorporated as a REIT and owns 51 million square feet of real estate consisting primarily of interests in 47 regional shopping centers. Macerich has a significant presence in the West Coast, Arizona, Chicago, and the Metro New York to Washington, DC corridor.

Macerich has been facing a strong secular headwind, namely the shift of consumers from brick-and-mortar shopping to online purchases. As a result, the REIT has been unable to generate meaningful growth in FFO per unit over the last 14 years. Recent years have been particularly challenging as the revenue of the company has declined.

U.S. retailers closed 12,200 stores in 2020 and 5,079 stores in 2021. Even in 2019, before the pandemic, more than 9,300 stores were shut down. Fewer than half of U.S. malls are expected to survive the ongoing business disruption. The rent per square foot of Macerich is still growing but it is misleading, as vacancy rates have increased. The REIT is doing its best to reduce its exposure to vulnerable retailers but it still has a long way to go to achieve this. In 2019, UBS estimated that about 75,000 U.S. stores will close if the market share of online sales rises from 16% to 25%. The market share of online sales currently stands at 20%.

Macerich was struggling before the pandemic, as it was trying to redevelop the properties it had recaptured from Sears. Even worse, the REIT has been hurt by the pandemic. Due to this downturn, Macerich cut its quarterly dividend twice in 2020, for an 80% total dividend cut. In reference to the pandemic, the worse seems to be behind Macerich but the REIT still has to tackle great challenges.

Macerich is offering a 7.0% dividend yield with a healthy payout ratio of 38%. However, the stock is unattractive due to its business’s secular decline. Investors should always avoid companies whose business model is under attack. This rule applies to Macerich.

Click here to download our most recent Sure Analysis report on Macerich (MAC) (preview of page 1 of 3 shown below):

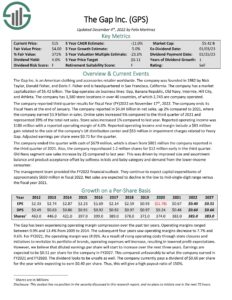

Low-Priced High Dividend Stock #17: The Gap (GPS) – Dividend Yield of 6.6%

The Gap is an American clothing and accessories retailer with 3,380 store locations in over 40 countries, of which 2,743 stores are company operated. The company was founded in 1982 and operates six business lines: Gap, Banana Republic, Old Navy, Intermix, Hill City, and Athleta.

Despite the popularity of its brands, Gap has incurred a collapse in its earnings over the last decade due to cut-throat competition. During this period, its sales have decreased modestly, but its operating margins have become extremely thin due to heated competition. As a result, the company has switched from earnings per share of $2.33 in 2012 to a loss per share of -$0.40 last year.

Even worse, The Gap is currently facing an extremely adverse business environment due to the surge of inflation to sky-high levels. Its operating costs have greatly increased, while high inflation has also taken its toll on consumer spending, as it has reduced the real purchasing power of consumers. It is thus natural that the stock has plunged 39% over the last 12 months.

The Gap is currently offering a 10-year high dividend yield of 6.6%, but its payout ratio is extreme, at 150%. Given also the current business headwinds and the challenges that were facing the company even before the surge of inflation, the prospects of the company are poor. If The Gap experiences a recovery in its business, the stock will probably rally, but it is highly risky and speculative, and hence it should be avoided. Its vast underperformance over the last 5 years (-70% vs. +56% of the S&P 500) is a testament to the excessive risk of the stock.

Click here to download our most recent Sure Analysis report on The Gap (GPS) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #18: Clipper Realty (CLPR) – Dividend Yield of 6.6%

Clipper Realty is a REIT that was founded by the merger of four pre-existing real estate companies. The founders have retained about 2/3 of the ownership and votes, as they have never sold a share, thereby causing some corporate governance concerns. On the bright side, this ownership reassures investors that the insiders are heavily incentivized to enhance shareholder returns. Clipper Realty owns commercial real estate across New York City.

Clipper Realty has been adversely affected by the work-from-home trend caused by the pandemic, though the trust has proved less vulnerable to this trend than other REITs, such as SL Green Realty (SLG). As a result, Clipper Realty has almost fully recovered from the pandemic.

Moreover, the stock currently offers a 6.6% dividend yield, with a decent payout ratio of 72%. Nevertheless, investors should note that Clipper Realty has an extremely weak balance sheet. Its interest expense exceeds its operating income, while its net debt stands at $1.2 billion. As this amount is 5 times the stock’s market capitalization, it is undoubtedly excessive. It is thus evident that Clipper Realty is vulnerable to rising interest rates. While the REIT is offering an above average dividend yield, we advise investors to avoid highly indebted companies due to their asymmetric risk in the event of an unforeseen downturn.

Click here to download our most recent Sure Analysis report on Clipper Realty (CLPR) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #19: RPT Realty (RPT) – Dividend Yield of 6.2%

RPT Realty is a REIT that owns and operates a national portfolio of open-air shopping destinations principally located in the top U.S. markets. The portfolio of the company currently consists of 44 wholly-owned shopping centers, 13 shopping centers owned through its grocery anchored joint venture, and 48 retail properties owned through its net lease joint venture. The REIT currently has a 93.8% occupancy rate.

RPT Realty is facing the same secular threat as Macerich: the secular decline of traditional retail stores. Due to this decline, RPT Realty has incurred a slow but steady decline in its FFO per unit over the last decade. As if the shift in consumer trends were not enough, RPT Realty was also hurt by the coronavirus crisis in the last three years. The company is currently recovering from the pandemic, but it has lackluster growth prospects ahead due to the secular decline of traditional retailers.

RPT Realty is currently offering a 6.2% dividend yield with a healthy payout ratio of 57%. However, the REIT has a material debt load, with its interest expense currently exceeding its operating income. Given also the secular threat facing its business, RPT Realty has an elevated amount of risk.

Click here to download our most recent Sure Analysis report on RPT Realty (RPT) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #20: Whitestone REIT (WSR) – Dividend Yield of 5.4%

Whitestone is a retail REIT that owns 57 properties with about 5.1 million square feet of gross leasable area, primarily in top U.S. markets in Texas and Arizona. Its tenant base is highly diversified with 1,477 tenants and no tenant exceeding 2.2% of total revenue. The REIT aims to rent its properties to financially strong tenants and service-oriented businesses, including grocery, restaurant, health and fitness, financial services, logistics services, education and entertainment, in neighborhoods with high disposable income.

The properties of Whitestone are located primarily in the southern U.S., in areas with favorable demographics, such as income and economic growth. The trust’s properties are located primarily in Phoenix and Houston, with smaller allocations to other major cities in Texas.

From 2012 through 2015, Whitestone acquired 2.465 million square feet of gross leasable area. From 2016 through 2019 Whitestone acquired 0.778 million square feet of gross leasable area. The decline in acquisitions is due in part to a focus on deleveraging. The leverage ratio (Net Debt to EBITDA) of the REIT is currently standing at 7.0, which is excessive. Due to the high leverage ratio and rising interest rates, the interest expense of Whitestone grew 11% in 2022 and is likely to rise further this year.

Whitestone is currently offering a 5.4% dividend yield, with a solid payout ratio of 49%. It is also trading at a nearly 10-year low price-to-FFO ratio of 9.3. Despite its high debt load, Whitestone seems attractive right now thanks to its cheap valuation, its well covered dividend, and its resilient business model.

Click here to download our most recent Sure Analysis report on Whitestone REIT (WSR) (preview of page 1 of 3 shown below):

Final Thoughts

When a stock offers an exceptionally high dividend yield, it usually signals that its dividend is at the risk of being cut. This rule certainly applies to most of the above stocks.

Nevertheless, some of the above stocks are highly attractive now thanks to their cheap valuation and still-high yield even after a potential reasonable dividend cut.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more