Updated on January 19th, 2023, by Quinn Mohammed

After a strong 36-year streak of dividend increases, AT&T paid the same dividend in 2021 as it did in 2020. This marked the end of its dividend increase streak, and the company then slashed its dividend 47% following the spinoff of its media business in mid-2022.

Despite the dividend cut in 2022, the company today has a high yield of 5.7% at its recent share price. This high yield could help soften the challenges inflation is posing to current investment portfolios.

AT&T is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the telecom behemoth AT&T Inc. (T).

Business Overview

AT&T is a leading telecommunications company, providing a wide range of services, including wireless, broadband, and television. The company is made up of two operating segments.

First, AT&T Communications provides communications and entertainment services through mobile and broadband. The segment serves more than 100 million U.S. customers and nearly 3 million business customers. In 2021, this segment generated $114.7 billion in revenue.

Second is the AT&T Latin America segment, which provides mobile service to consumers and businesses in Mexico. The Latin America segment generated $5.4 billion in revenue in 2021. However, to note, is that the company sold off the Vrio video operations in mid-November 2021, which was responsible for $2.7 billion of the $5.4 billion in that time period.

AT&T is a large-cap stock with a market capitalization of $140 billion. The company generated steady profits and strong cash flow for many years.

On April 8th, 2022, AT&T completed the spin-off of WarnerMedia to form the new company Warner Bros. Discovery (WBD). AT&T shareholders received 0.241917 shares of WBD for every 1 share of AT&T they held.

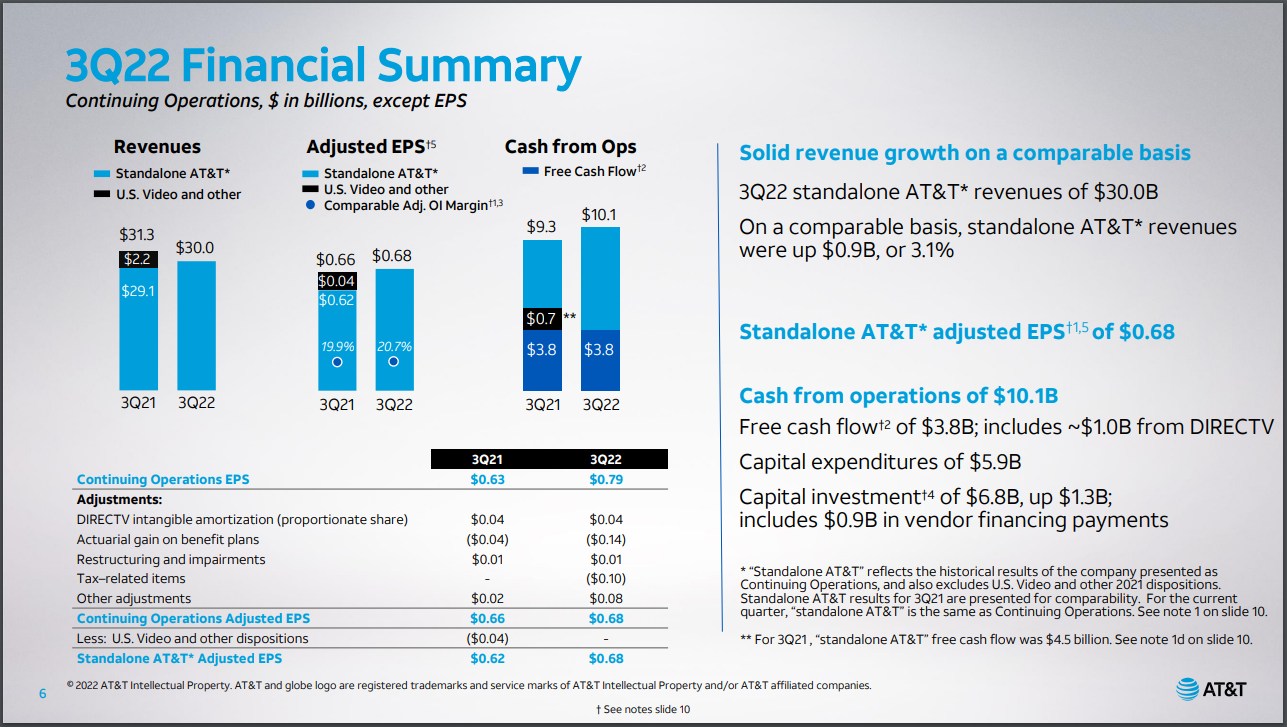

On October 20th, 2022, AT&T reported Q3 2022 results. For the quarter, the company generated $30.0 billion in revenue from continuing operations, down -4.1% from $31.3 billion in Q3 2021, as a result of the U.S. Video separation in July 2021. On an adjusted basis, earnings-per-share equaled $0.68 compared to $0.66 in the year ago quarter.

Source: Investor Presentation

AT&T’s net debt equaled $131.1 billion, and the company’s net debt-to-EBITDA ratio was 3.22x at the end of the third quarter.

AT&T also provided a 2022 outlook. The company expects adjusted earnings-per-share of at least $2.50 in the full year.

Growth Prospects

AT&T is a massive business, and as the law of large numbers dictates, the company grows very slowly.

The company took on loads of debt to fund acquisitions, such as DirecTV in 2015 and Time Warner in 2018, in addition to other bolt-on acquisitions. Paying down this significant accumulated debt took its toll on the company and prevented it from investing as much as it otherwise would have been able to into its main business, telecommunications.

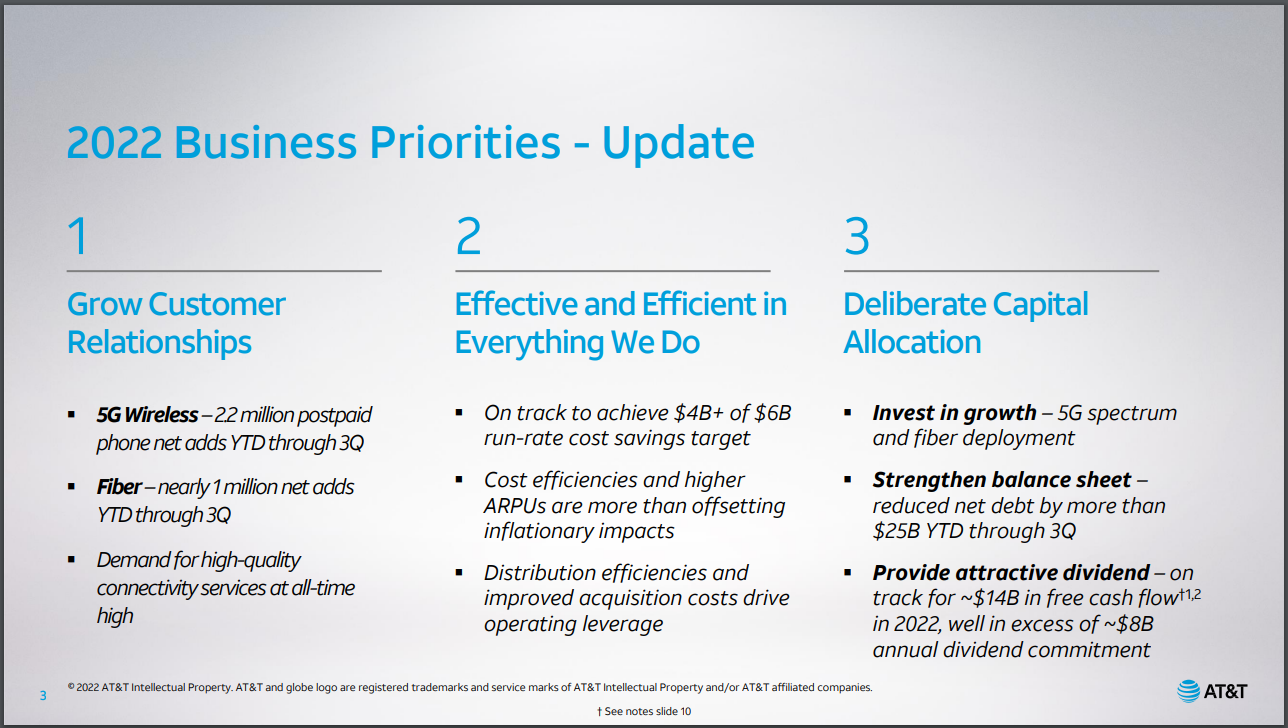

Source: Investor Presentation

AT&T expects to spend tremendously on capital investments in the next couple of years on its telecom business. In 2022 and 2023 each, the company anticipates capital investments in excess of $20 billion. Starting in 2024, however, these investments should diminish as the company moves past its peak years for capital investment in 5G and fiber.

AT&T, following the spinoff, is now a simpler and more focused company, with the goal of becoming America’s best broadband provider. This title would be appointed based on its network with fiber at its foundation. Through its fiber expansion plans the company expects to support more than 30 million fiber locations by the end of 2025.

The company will strengthen the balance sheet by reducing its net debt with its free cash flow after dividends. AT&T continues to believe it can reduce the net debt to adjusted EBITDA ratio to 2.5x by the end of 2023. After having separated its media business, AT&T’s renewed focus on telecom will benefit from the fact that it no longer needs to invest in wireless network infrastructure and media assets at the same time.

For 2022 and 2023, the company is anticipating low-to-mid single-digit revenue growth, as it adjusts to the new makeup of the company. Growth will come from an increase in wireless service revenues and broadband revenue. Additionally, the company is on track to achieve more than $4 billion out of the $6 billion run-rate cost savings target by the end of 2022, which in effect will fuel growth in adjusted EBITDA in the coming years.

Competitive Advantages & Recession Performance

AT&T has a competitive advantage with its entrenched position in various important industries. The company also operates a recession-resistant business. AT&T enjoys steady demand, as most consumers require their broadband and wireless service, even during recessions.

AT&T’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share: $2.76

- 2008 earnings-per-share: $2.16

- 2009 earnings-per-share: $2.12

- 2010 earnings-per-share: $2.29

AT&T experienced some earnings decline during the Great Recession, but the company remained highly profitable. This allowed it to continue growing its dividend throughout the time period and beyond. AT&T eclipsed its pre-recession earnings level, but it took until 2016. Still, the company paid a dividend that was well covered throughout the last decade.

In the COVID-19 pandemic year of 2020, the business held up quite well. While many businesses faced tremendous challenges due to the pandemic, AT&T generated strong cash flow and had a payout ratio below 70%. In the current economic downturn as a result of high inflation and increasing interest rates, AT&T’s dividend appears to be rock solid.

Dividend Analysis

Following the Time Warner acquisition, AT&T faced difficulties in growing its dividend meaningfully. After 36 years of consecutive dividend increases, AT&T kept its dividend steady and lost its Dividend Aristocrat status in 2021. Then in 2022, AT&T utilized the spinoff as a way to reduce its dividend payment to shareholders. In turn, this afforded the company the funds for its massive capital investment plans.

Following the spinoff, AT&T’s new annual dividend is $1.11. At the current share price, AT&T is yielding about 5.7%. Based on the company’s forecasted adjusted EPS of $2.55, the company would be paying out only 44% of 2022 earnings as dividends.

With the lower payout, AT&T may return to increasing the dividends once its new structure has been digested.

Final Thoughts

AT&T should benefit from its renewed focus on its main telecom business following the spin off its media assets and its reduced dividend. Its slimmed down business and improved efficiency should allow it to improve the balance sheet and continue to make massive capital investments in its expansion.

Despite the dividend reduction, AT&T sports a high dividend yield of 5.7% today. Furthermore, this dividend appears to be ultra safe with a dividend payout ratio of only 44% forecast for 2022.

Unfortunately, the spin-off cost the company its Dividend Aristocrat status. Following the digestion of the new business structure, though, AT&T may reinstate its annual dividend increases.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more