Spreadsheet data updated daily

Top 5 List Updated on December 18th, 2023 by Bob Ciura

The communication services sector has a lot to offer investors, particularly those looking for higher investment income.

Many communication services stocks generate strong profits and cash flow, which allow them to pay high dividend yields to shareholders.

And, the major communication services stocks broadly have lower valuations than many other market sectors, making them appealing for value investors as well.

With this in mind, we created a list of communication services stocks.

You can download the list (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Keep reading this article to learn more about the benefits of investing in communication services stocks.

Table Of Contents

The following table of contents provides for easy navigation:

- How To Use The Communication Services Stocks List

- The Top 5 Communication Services Stocks Now

#5: Omnicom (OMC)

#4: Comcast Corporation (CMCSA)

#3: Twenty-First Century Fox (FOXA)

#2: Verizon Communications (VZ)

#1: AT&T Inc. (T) - Final Thoughts

How To Use The Communication Services Stocks List To Find Investment Ideas

Having an Excel database of all communication services stocks, combined with important investing metrics and ratios, is very useful.

This tool becomes even more powerful when combined with knowledge of how to use Microsoft Excel to find the best investment opportunities.

With that in mind, this section will provide a quick explanation of how you can instantly search for stocks with particular characteristics, using two screens as an example.

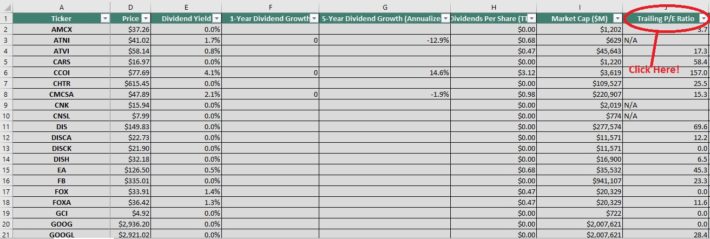

The first screen that we will implement is for stocks with price-to-earnings ratios below 15.

Screen 1: Low P/E Ratios

Step 1: Download the Communication Services Stocks Excel Spreadsheet List at the link above.

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter field to ‘Less Than’, and input ’15’ into the field beside it.

The remaining list of stocks contains stocks with price-to-earnings ratios less than 15.

The next section demonstrates how to screen for stocks with high dividend yields.

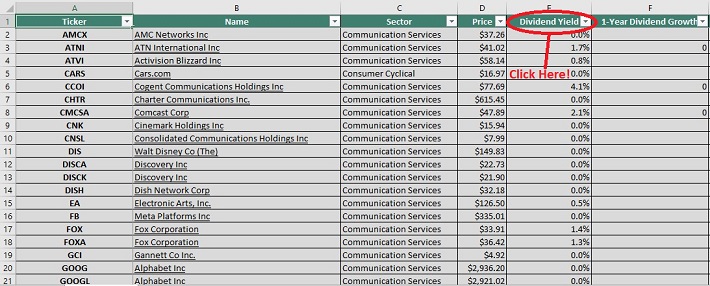

Screen 2: Communication Services Stocks With High Dividend Yields

Stocks are often categorized based on their dividend yields. This is the percentage of an investment that an investor will receive in dividend income.

We define high dividend yields as stocks with yields of 5% or more.

Screening for stocks with high dividend yields could provide interesting investment opportunities for more risk-averse, income-oriented investors.

Here’s how to use the Communication Services Stocks Excel Spreadsheet List to find such investment opportunities.

Step 1: Download the Communication Services Stocks Excel Spreadsheet List at the link above.

Step 2: Click on the filter icon for the ‘dividend yield’ column, as shown below.

Step 3: Change the filter setting to ‘Greater Than’ and input 0.03 into the column beside it. Note that 0.03 is equivalent to 3%.

The remaining stocks in this list are those with dividend yields above 3%. This narrowed investment universe is suitable for investors looking for low-risk, high-yield securities.

You now have a solid fundamental understanding of how to use the spreadsheet to its fullest potential. The remainder of this article will discuss the top 5 communication services stocks now.

The Top 5 Communication Services Stocks Now

The following section discusses our top five communication services stocks today, based on their expected annual returns over the next five years.

The rankings in this article are derived from our expected total return estimates from the Sure Analysis Research Database.

The five stocks with the highest projected five-year total returns are ranked in this article, from lowest to highest.

Related: Watch the video below to learn how to calculate expected total return for any stock.

Rankings are compiled based upon the combination of current dividend yield, expected change in valuation, as well as expected annual earnings-per-share growth.

This determines which communication services stocks offer the best total return potential for shareholders.

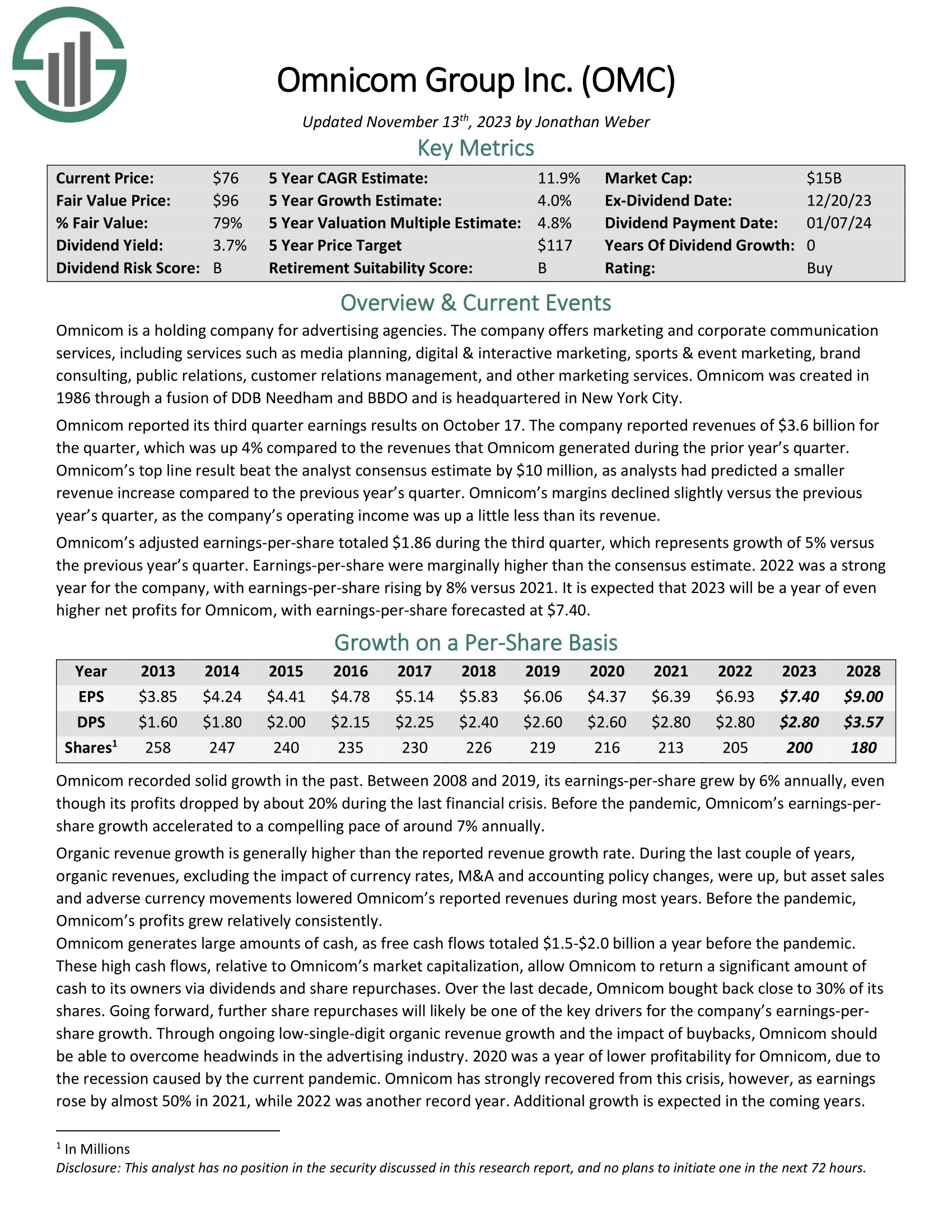

#5: Omnicom (OMC)

- 5-year expected annual returns: 8.9%

Omnicom is a holding company for advertising agencies. The company offers marketing and corporate communication services, including services such as media planning, digital & interactive marketing, sports & event marketing, brand consulting, public relations, customer relations management, and other marketing services.

Omnicom was created in 1986 through a fusion of DDB Needham and BBDO and is headquartered in New York City.

Omnicom reported its third quarter earnings results on October 17. The company reported revenues of $3.6 billion for the quarter, which was up 4% from the prior year’s quarter. Omnicom’s top line result beat the analyst consensus estimate by $10 million.

Omnicom’s adjusted earnings-per-share totaled $1.86 during the third quarter, which represents growth of 5% versus the previous year’s quarter.

Click here to download our most recent Sure Analysis report on OMC (preview of page 1 of 3 shown below):

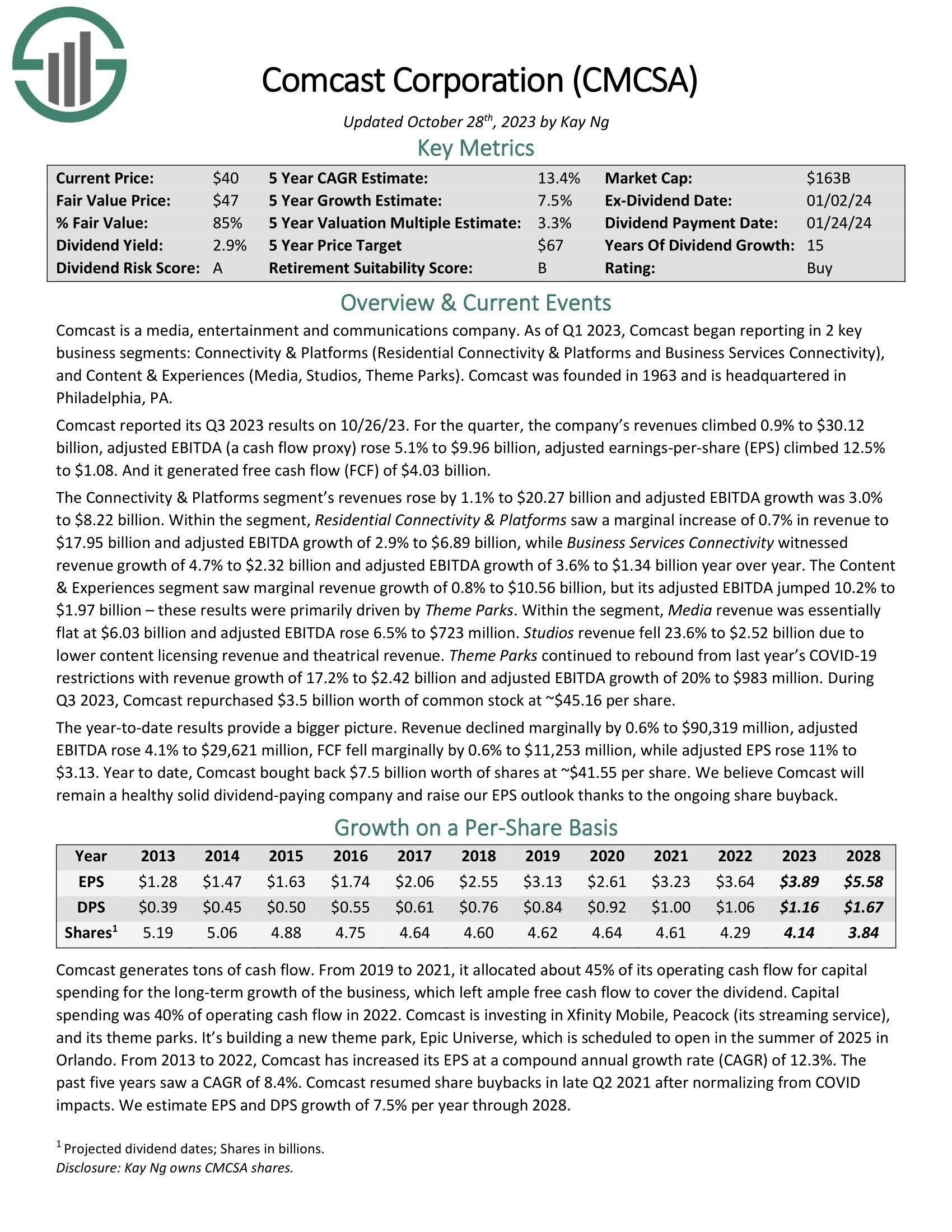

#4: Comcast Corporation (CMCSA)

- 5-year expected annual return: 10.9%

Comcast is a media, entertainment and communications company. Its business units include Cable Communications (High–Speed Internet, Video, Business Services, Voice, Advertising, Wireless), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Entertainment), and Sky, a leading entertainment company in Europe.

Comcast reported its Q3 2023 results on 10/26/23. For the quarter, the company’s revenues climbed 0.9% to $30.12 billion, adjusted EBITDA (a cash flow proxy) rose 5.1% to $9.96 billion, adjusted earnings-per-share (EPS) climbed 12.5% to $1.08. And it generated free cash flow (FCF) of $4.03 billion. The Connectivity & Platforms segment’s revenues rose by 1.1% to $20.27 billion and adjusted EBITDA growth was 3.0% to $8.22 billion.

Click here to download our most recent Sure Analysis report on Comcast (preview of page 1 of 3 shown below):

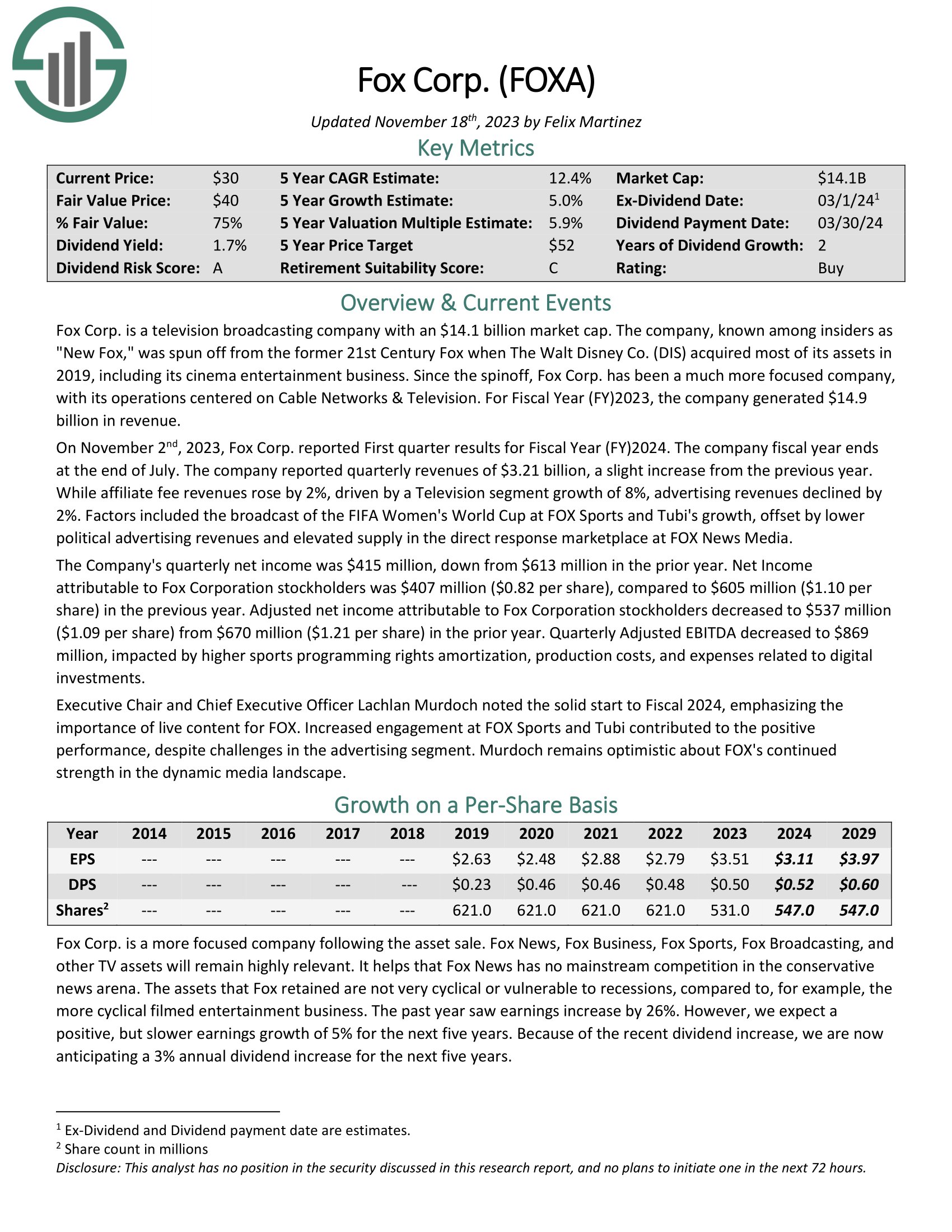

#3: Twenty-First Century Fox (FOXA)

- 5-year expected annual returns: 12.6%

Fox Corp. is a television broadcasting company that was spun off from the former 21st Century Fox when The Walt Disney Co. (DIS) acquired most of its assets in 2019, including its cinema entertainment business.

Since the spinoff, Fox Corp. has been a much more focused company, with its operations centered on cable networks and television. For the fiscal year (FY) 2022, the company generated $13.97 billion in revenue.

On November 2nd, 2023, Fox Corp. reported First quarter results for Fiscal Year (FY) 2024. The company fiscal year ends at the end of July. The company reported quarterly revenues of $3.21 billion, a slight increase from the previous year.

While affiliate fee revenues rose by 2%, driven by a Television segment growth of 8%, advertising revenues declined by 2%. Factors included the broadcast of the FIFA Women’s World Cup at FOX Sports and Tubi’s growth, offset by lower political advertising revenues and elevated supply in the direct response marketplace at FOX News Media.

Click here to download our most recent Sure Analysis report on Twenty-First Century Fox (preview of page 1 of 3 shown below):

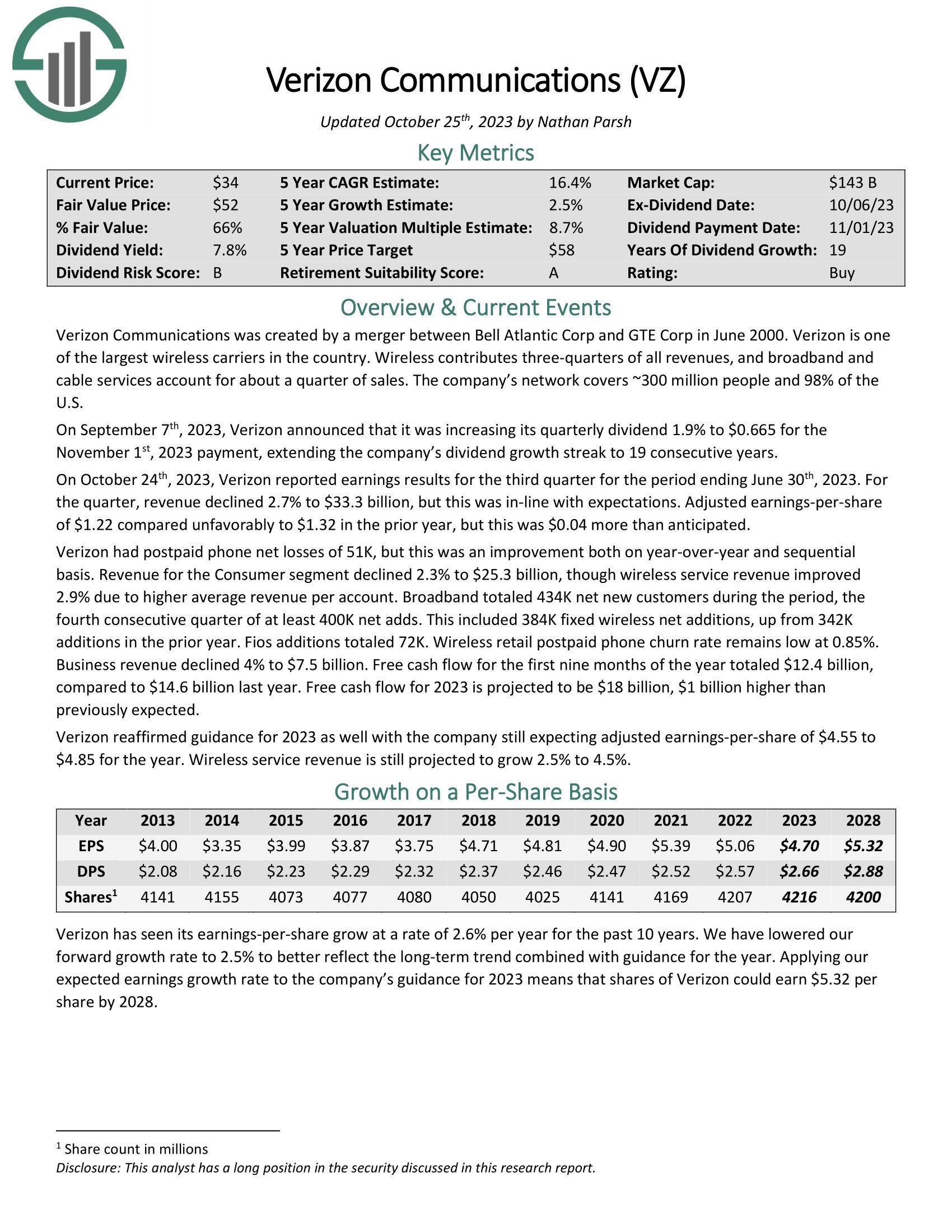

#2: Verizon Communications (VZ)

- 5-year expected annual returns: 14.3%

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On September 7th, 2023, Verizon announced that it was increasing its quarterly dividend 1.9% to $0.665 for the November 1st, 2023 payment, extending the company’s dividend growth streak to 19 consecutive years. On October 24th, 2023, Verizon reported earnings results for the third quarter for the period ending June 30th, 2023. For the quarter, revenue declined 2.7% to $33.3 billion, but this was in-line with expectations. Adjusted earnings-per-share of $1.22 compared unfavorably to $1.32 in the prior year, but this was $0.04 more than anticipated.

Verizon had postpaid phone net losses of 51K, but this was an improvement both on year-over-year and sequential basis. Revenue for the Consumer segment declined 2.3% to $25.3 billion, though wireless service revenue improved 2.9% due to higher average revenue per account. Broadband totaled 434K net new customers during the period, the fourth consecutive quarter of at least 400K net adds.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

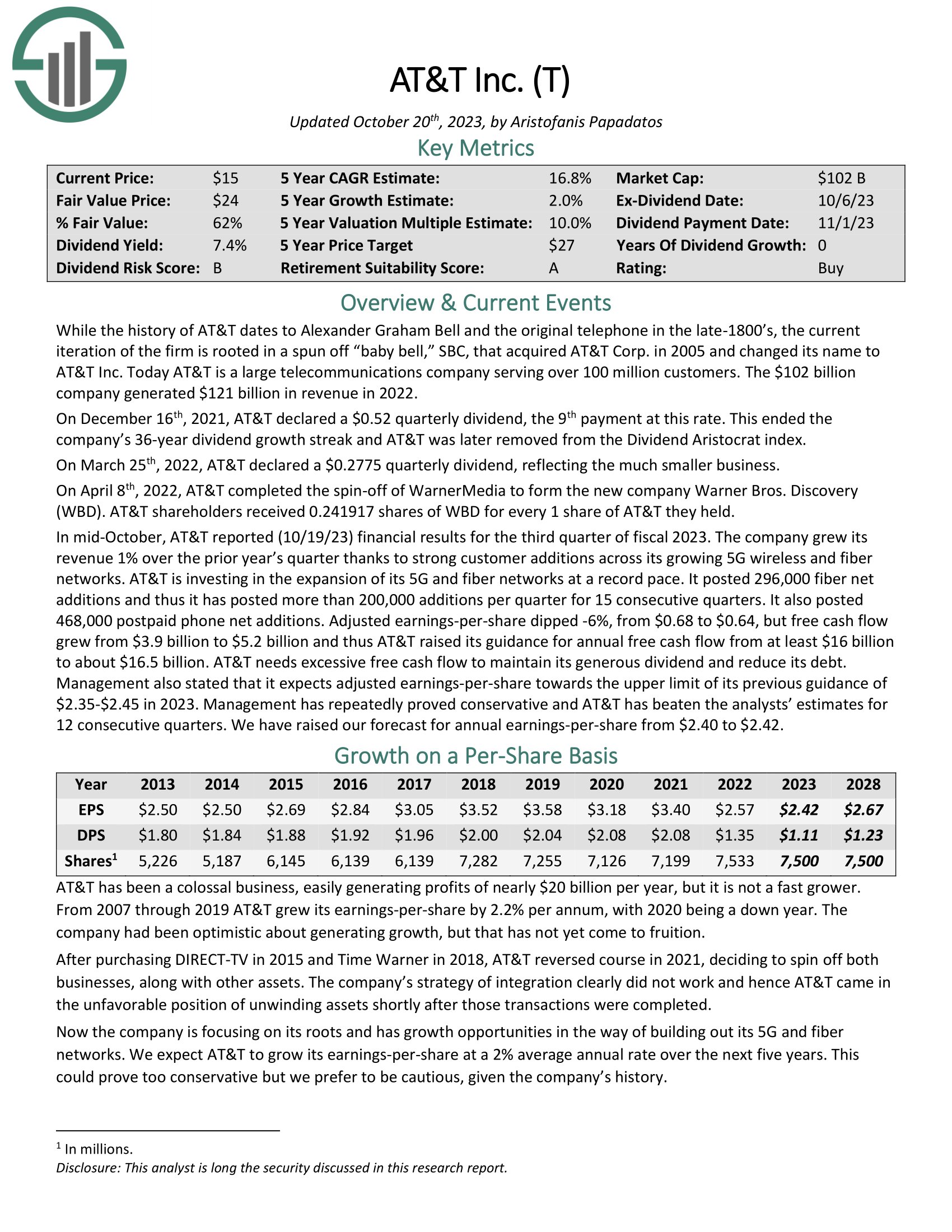

#1: AT&T Inc. (T)

AT&T is a large telecommunications company serving over 100 million customers. The company generated $121 billion in revenue in 2022.

On April 8th, 2022, AT&T completed the spin-off of WarnerMedia to form the new company Warner Bros. Discovery (WBD). AT&T shareholders received 0.241917 shares of WBD for every 1 share of AT&T they held.

In mid-October, AT&T reported (10/19/23) financial results for the third quarter of fiscal 2023. The company grew its revenue 1% over the prior year’s quarter thanks to strong customer additions across its growing 5G wireless and fiber networks. AT&T is investing in the expansion of its 5G and fiber networks at a record pace. It posted 296,000 fiber net additions and thus it has posted more than 200,000 additions per quarter for 15 consecutive quarters. It also posted 468,000 postpaid phone net additions.

Adjusted earnings-per-share dipped -6%, from $0.68 to $0.64, but free cash flow grew from $3.9 billion to $5.2 billion and thus AT&T raised its guidance for annual free cash flow from at least $16 billion to about $16.5 billion.

Click here to download our most recent Sure Analysis report on AT&T (preview of page 1 of 3 shown below):

Final Thoughts

The communication services sector is attractive for long-term investment. Demand for various communication services such as Internet and wireless remains high, and is not likely to slow down any time soon.

The sector is also appealing for income investors, due to the high-yielding telecom stocks.

If you’re willing to explore ideas outside of the communication services sector, the following databases contain some of the most high-quality dividend stocks around:

- The Dividend Aristocrats: dividend stocks with 25+ years of consecutive dividend increases.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: Considered the best-of-the-best when it comes to dividend history, the Dividend Kings are an elite group of dividend stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: dividend stocks that are on the Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings list.

If you’re looking for other sector-specific stocks, the following Sure Dividend databases will be useful:

- The Complete List Of Utility Stocks

- The Complete List Of Healthcare Stocks

- The Complete List Of Consumer Staples Stocks

- The Complete List Of Consumer Discretionary Stocks

- The Complete List Of Financials Stocks

- The Complete List Of Technology Stocks

- The Complete List Of Real Estate Stocks

- The Complete List Of Energy Stocks

- The Complete List Of Materials Stocks

- The Complete List Of Industrial Stocks