Published on April 6th, 2023 by Nikolaos Sismanis

Different investors may have different interpretations of the term “blue chip,” but in general, it refers to companies that are considered top dogs in their respective industries.

For us, a stock earns the title of “blue chip” when it features at least a decade of consistent dividend growth. It’s not a small accomplishment, as it demonstrates that the company’s business model is likely to withstand tough economic times while continuing to deliver steady growth.

As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks, which you can download by clicking below:

In this article, we are looking at blue chip companies within the tech sector. The sector isn’t typically praised for its dividend growth prospects, as only 18 companies feature a dividend growth track record of 10+ years.

Still, these companies have demonstrated their commitment to growing shareholder returns over a commendable period of time.

To highlight these industry leaders, we’ve compiled a list of the top 10 tech sector blue chip companies based on their track record of dividend growth, ranked in ascending order.

Table of Contents

- Blue Chip Tech Stock #10: Oracle Corporation (ORCL)

- Blue Chip Tech Stock #9: Cisco Systems, Inc. (CSCO)

- Blue Chip Tech Stock #8: Broadridge Financial Solutions, Inc. (BR)

- Blue Chip Tech Stock #7: Texas Instruments Incorporated (TXN)

- Blue Chip Tech Stock #6: Analog Devices, Inc. (ADI)

- Blue Chip Tech Stock #5: QUALCOMM Incorporated (QCOM)

- Blue Chip Tech Stock #4: Microsoft Corporation (MSFT)

- Blue Chip Tech Stock #3: Microchip Technology Incorporated (MCHP)

- Blue Chip Tech Stock #2: International Business Machines Corporation (IBM)

- Blue Chip Tech Stock #1: Jack Henry & Associates, Inc. (JKHY)

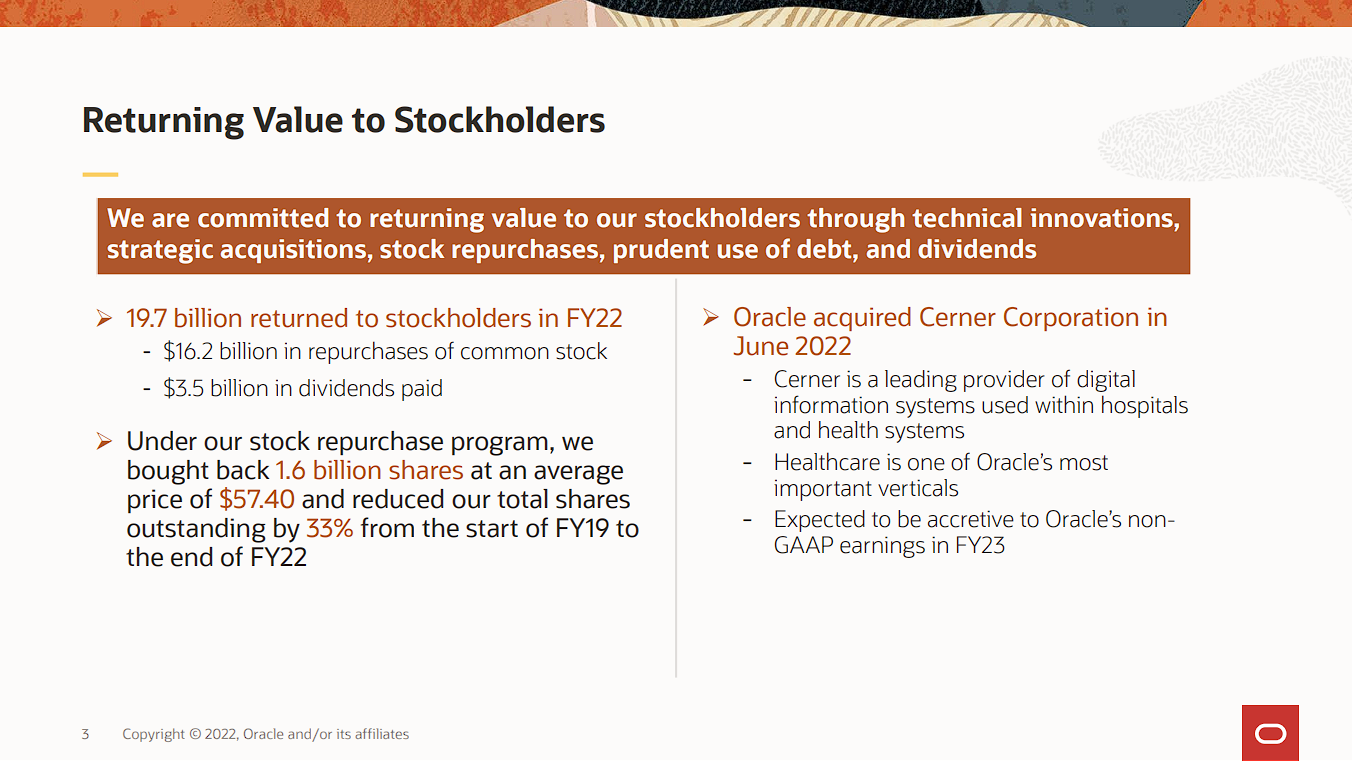

Blue Chip Tech Stock #10: Oracle Corporation (ORCL)

- Years of Dividend Growth: 13

- Dividend Yield: 1.7%

Oracle is an information technology company that provides software, hardware, and services. Its offerings include applications, platforms, and infrastructure technologies (cloud software), hardware products such as servers, hardware-related software products (e.g., operating systems), and services such as consultation & education. Oracle was founded in 1977 and is headquartered in Redwood City, CA.

During the first half of the previous decade, investors were concerned about Oracle’s prospects. The company was lagging due to a shift in the tech industry towards cloud-based solutions, which Oracle was perceived to be slow to adopt. Furthermore, Oracle’s business model of licensing its software was considered rather outdated as an increasing number of companies were migrating towards a subscription-based model.

However, in recent years, Oracle has transformed into a cloud powerhouse. The company has made significant investments in cloud-based infrastructure and services, which now include a wide range of offerings. They include infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS), positioning Oracle as a respectable competitor to established cloud giants such as Amazon and Microsoft.

Oracle’s success in the cloud, combined with robust performance in its legacy divisions, has resulted in the company growing its earnings-per-share by a CAGR of 12.3% over the past five years.

Source: Investor Presentation

Besides Oracle’s notable dividend growth history, the company also features a tremendous track record of share buybacks. In fact, buybacks have been the preferred avenue for management to return cash to shareholders, having reduced its share count by nearly 55% since 1997.

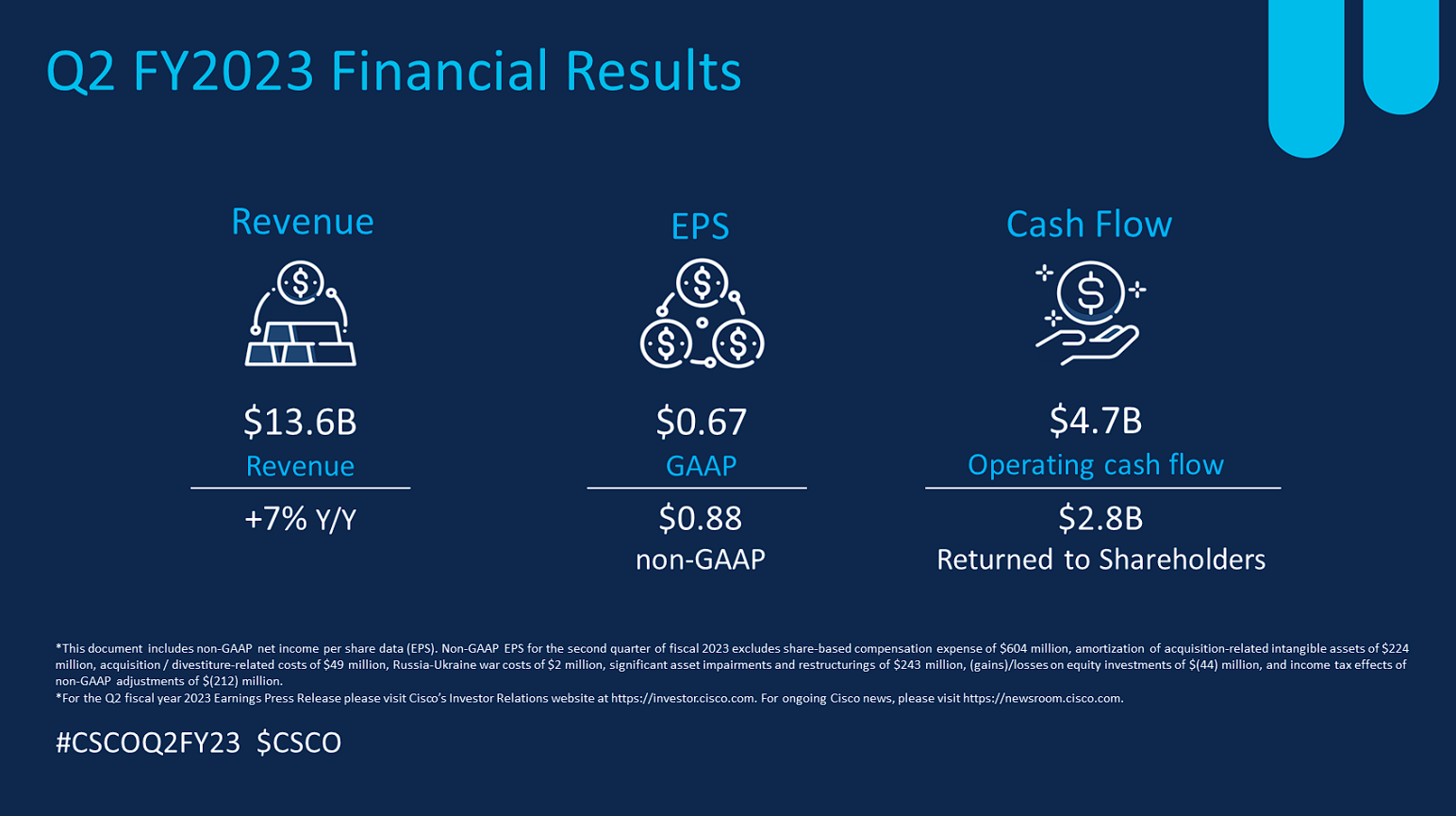

Blue Chip Tech Stock #9: Cisco Systems, Inc. (CSCO)

- Years of Dividend Growth: 13

- Dividend Yield: 3.0%

Cisco Systems is the global leader in high-performance computer networking systems. The company’s routers and switches allow networks around the world to connect to each other through the internet. Cisco also offers data center, cloud, and security products. The company went public on February 16th, 1990. Today, Cisco employs more than 83,300 people and generates about $51.6 billion in annual revenues.

The company has generated solid results in recent years, powered by the consistently growing demand for network devices, Internet of Things (IoT) tech, and cybersecurity solutions. Even though Cisco is a very mature company with a long operating history, it dominates this industry to this date.

Between 2013 and 2022, Cisco’s earnings have grown at a CAGR of 5.8% per year. The company’s dividend has also grown at a very satisfactory CAGR of 18.3% over the past decade.

Source: Investor Relations

We believe that the company has the capacity to grow its earnings-per-share by about 6% per year, powered by a combination of improving margins and share repurchases.

We also see the dividend growing at a similar rate. It’s lower than its past-decade average, as we remain mindful of growing competition in the space. Specifically, Arista Networks (ANET) has been gradually capturing market share in high-speed networking products lately, which could threaten Cisco’s dominance in the space in the coming years.

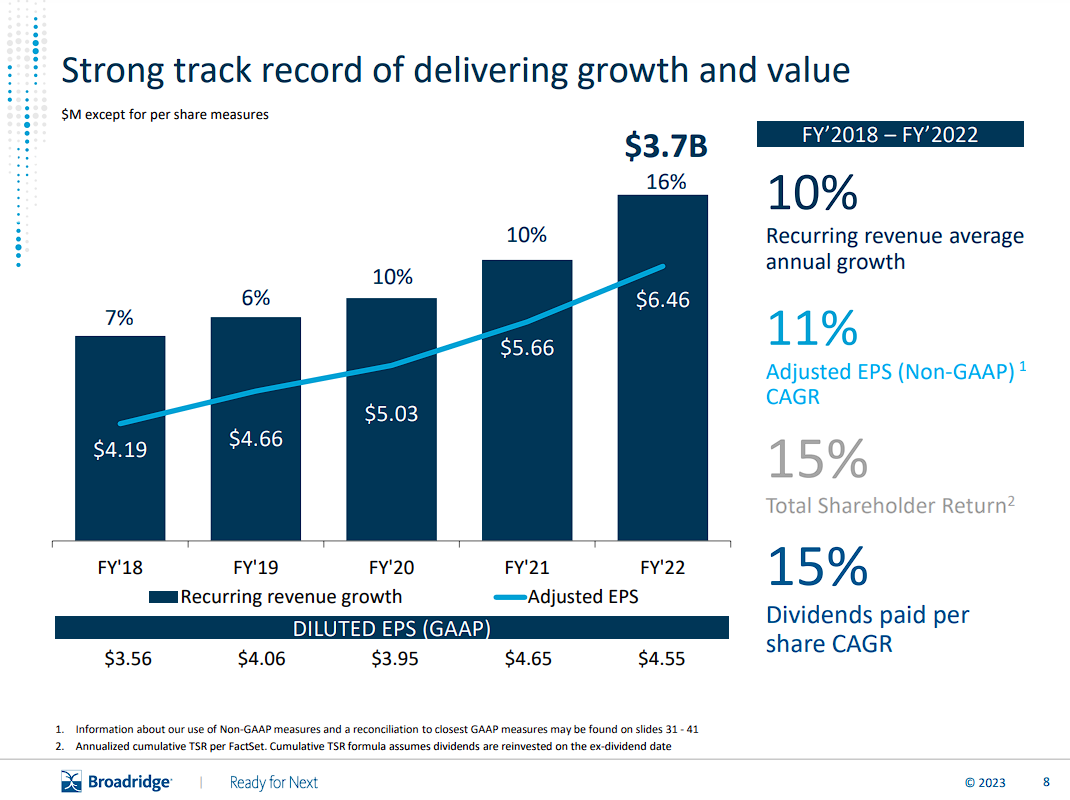

Blue Chip Tech Stock #8: Broadridge Financial Solutions, Inc. (BR)

- Years of Dividend Growth: 16

- Dividend Yield: 2.1%

Broadridge Financial Solutions, Inc. is a company that specializes in providing technology-based solutions and investor communications services to the financial services industry. It was once a part of Automatic Data Processing, Inc. (NYSE: ADP) as its brokerage service division since 1962 before becoming an independent company in 2007.

Broadridge is responsible for processing a staggering number of trades involving trillions of dollars on a daily basis. Moreover, the company’s investor communications reach an impressive 75% of North American households, and it manages shareholder voting in around 120 countries.

Broadridge has also made strides in the blockchain industry by securing a patent for proxy processing and repurchase agreements. The company has a global presence and serves clients from various parts of the world, but the bulk of its customers are in the United States, Canada, and the United Kingdom.

Broadridge has grown earnings-per-share on average by 16% over the past decade and 15% in the past five years. The company has increased its dividend for 16 consecutive years.

Source: Investor Presentation

Its growth is currently being driven by long-term trends that we expect to continue on in the near term. These include accelerating digitization and the democratization of investing, as more and more people enter the world of financial markets.

Investments in the company’s products (such as VSM offering) and technology platforms (such as Wealth and Global Post-Trade Management) should further fuel growth and increase customer retention. Additionally, acquisitions, such as the recent acquisition of Itiviti, will allow the corporation to increase the value it can offer to clients and expand its geographic reach.

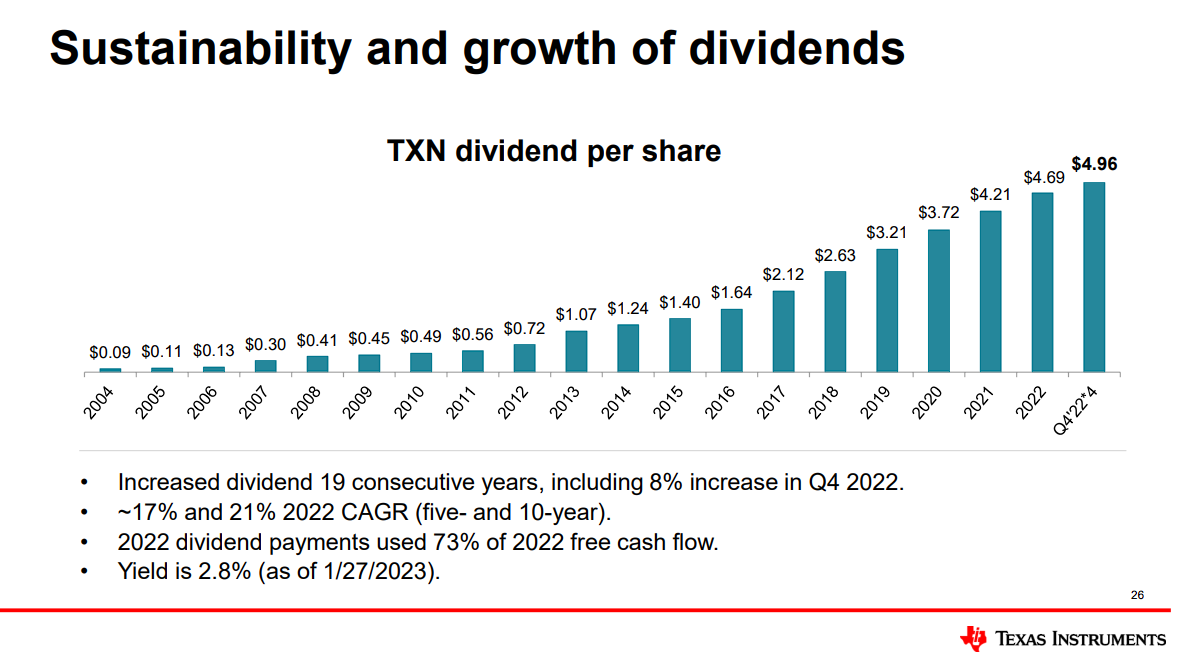

Blue Chip Tech Stock #7: Texas Instruments Incorporated (TXN)

- Years of Dividend Growth: 19

- Dividend Yield: 2.8%

Texas Instruments is a semiconductor company that operates two business units: Analog and Embedded Processing. Its products include semiconductors that measure sound, temperature, and other physical data and convert them to digital signals, as well as semiconductors that are designed to handle specific tasks and applications. Texas Instruments was founded in 1930 and is headquartered in Dallas, TX.

Texas Instruments’ earnings can be subject to cyclical patterns, as demand for semiconductors is closely correlated to the overall health of the economy. Still, the company has shown vital signs of resilience over the years, returning stronger following temporary headwinds.

For instance, despite recording a decline in earnings during the financial crisis, the company still managed to grow its earnings-per-share by approximately 12% annually from 2008 to 2020. Additionally, Texas Instruments maintained its profitability during the crisis while also continuing to offer a well-covered dividend.

Although the company’s revenue growth has been somewhat stagnant over the past eight quarters, we expect to rebound in the future, fueled by increasing demand for processors, as well as long-term tailwinds such as the rise of Industry 4.0 and automation.

The company features one of the most commendable dividend growth track records in the tech sector. It boasts 19 years of connective dividend increases. In fact, since 2004, the dividend has grown at an impressive CAGR of 25%.

Source: Investor Presentation

Over the same period, the company has created substantial shareholder value through stock buybacks. The company has demonstrated a strong dedication to this strategy, as evidenced by its impressive 47% reduction in share count since 2004.

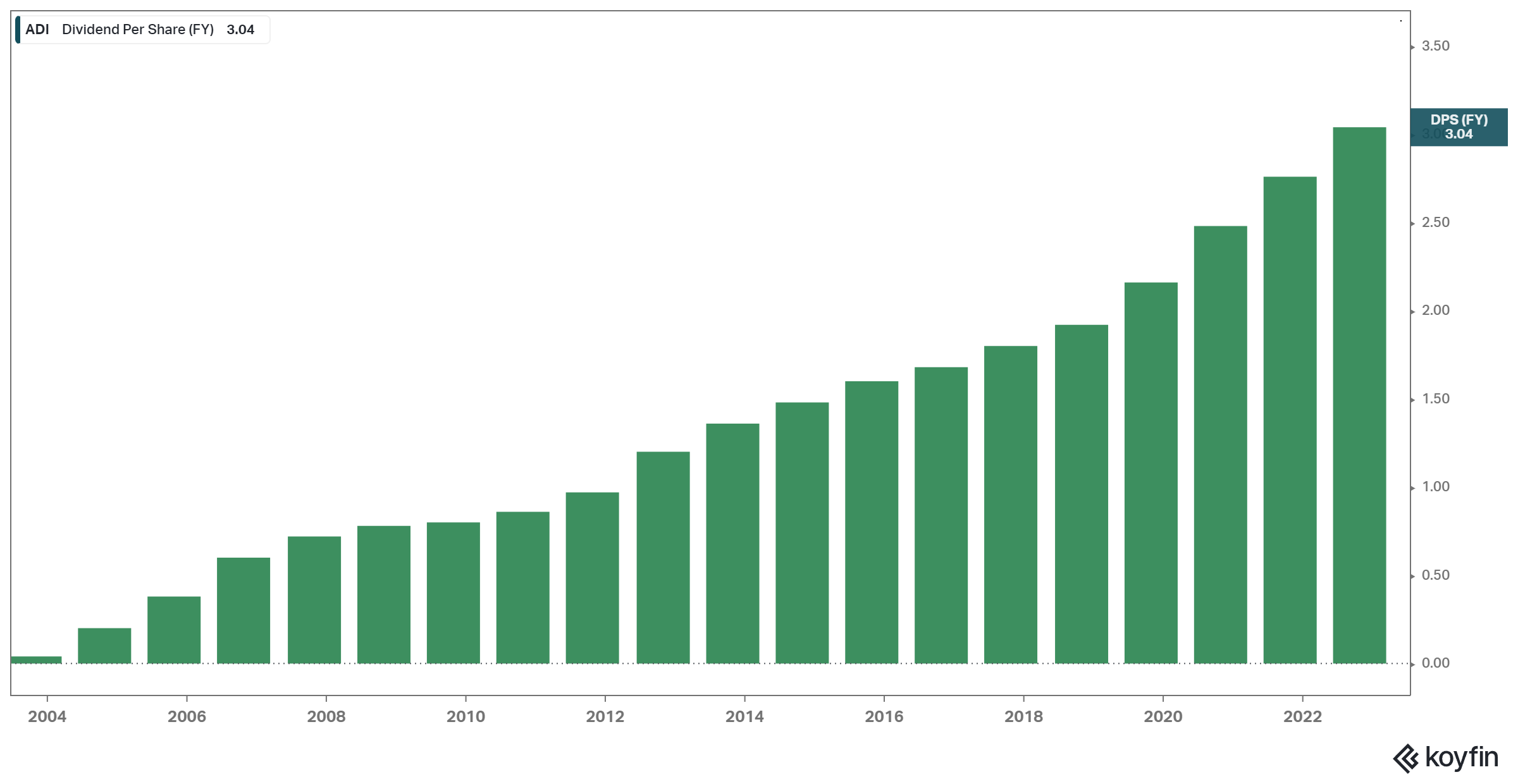

Blue Chip Tech Stock #6: Analog Devices, Inc. (ADI)

- Years of Dividend Growth: 19

- Dividend Yield: 1.8%

Analog Devices (ADI) makes integrated circuits that are sold to OEMs (original equipment manufacturers) to be incorporated into equipment and systems for communications, computer, instrumentation, industrial, military/aerospace, and consumer electronics applications. ADI was founded in 1965. Today, it generates about $12 billion in annual revenues.

Over the past five and nine years, Analog Devices has managed to grow its earnings-per-share at an average rate of 15.4% and 18.1% per annum, respectively. Moving forward, the company is targeting a long-term annual revenue growth rate of 7 to 10% annually. This growth is expected as the company solidifies its position in its leading markets and benefit from secular trends like Industry 4.0. This includes implementing machine learning into factory production, data centers, and augmented and virtual reality.

Regarding its dividend, the company has increased its payouts for 19 consecutive years. It has seen it grow at 9.6% and 9.1% annually over the past five and nine years, respectively.

Source: Koyfin

Currently, Analog Devices pays a quarterly dividend of $0.86, yielding 1.8%. Over the medium term, we expect dividends to grow in line with earnings-per-share at 9% annually. This implies a 2028 dividend estimate of $5.29.

Blue Chip Tech Stock #5: QUALCOMM Incorporated (QCOM)

- Years of Dividend Growth: 20

- Dividend Yield: 2.4%

In 1985, Dr. Irwin Jacobs founded “Quality Communications” in his very own living room. The company’s initial offering was a groundbreaking satellite system, which allowed long-haul trucking firms to communicate with and locate their drivers.

Today, known as “Qualcomm,” the company has evolved into a leading developer and distributor of integrated circuits for both voice and data transmissions. Thanks to its extensive patent portfolio, Qualcomm receives royalties from devices operating on cutting-edge 3G, 4G, and 5G networks.

With an impressive current market capitalization of $137.2 billion and annual sales of approximately $44 billion, Qualcomm has firmly established itself as a dominant force in the technology sector.

Throughout the last decade, Qualcomm has remained at the forefront of wireless communication advancements and played a significant role in pioneering the fundamental technologies that propel the industry forward. Consequently, the company’s earnings-per-share have seen an average growth rate of 6.6% over this period. Looking ahead, Qualcomm is poised to continue reaping the rewards of secular trends, including the global implementation of 5G networks.

Qualcomm has also shown notable commitment to growing shareholder returns, including increasing its dividend for 20 consecutive years. Impressively, the company boasts $110 billion in aggregate shareholder returns throughout its history.

Source: Investor Presentation

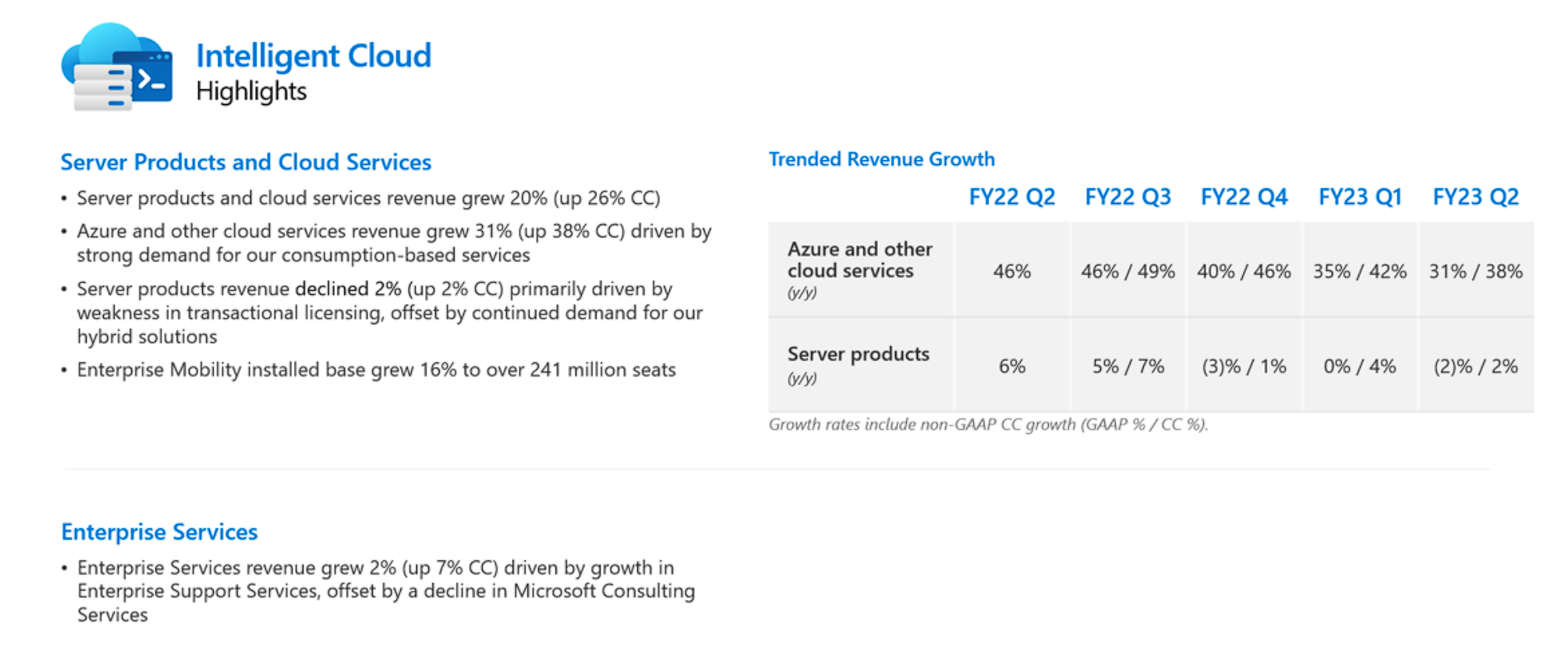

Blue Chip Tech Stock #4: Microsoft Corporation (MSFT)

- Years of Dividend Growth: 21

- Dividend Yield: 1.0%

Microsoft is an ever-lasting growth powerhouse in tech whose diversified portfolio of essential products and services continues to generate growing cash flows. In line with most enterprise software companies these days, Microsoft’s growth has slowed down as global economic growth has also taken a toll.

That said, the company remains highly profitable while returning substantial amounts of cash back to its shareholders. The company’s latest advancements in AI, including the upcoming integration of ChatGPT with its Bing search engine, should also be a growth catalyst that’s worth investors’ attention moving forward.

In the meantime, Azure, Microsoft’s high-growth cloud platform, continues to expand at a very impressive pace. Specifically, Azure’s revenues grew 31% in Microsoft’s most recent quarter (fiscal Q2), or 38% in constant currency, which is utterly remarkable. It reflects strong global corporate spending in the cloud despite a tough macro environment.

Source: Investor Presentation

Microsoft has rewarded shareholders with growing dividends for 21 consecutive years. Despite such a mature dividend growth track record, payouts continue to grow at a rather satisfactory pace, with Microsoft’s most recent dividend hike being by 10% to an annual rate of $2.72. With a modest yield of only 1.0%, it’s evident that investors are valuing the stock for its notable growth potential in the future.

We expect that the markets that Microsoft serves will continue to grow rapidly in the coming years. The company also has the potential to keep expanding its margins, especially given that Azure is a high-margin product. Therefore, we forecast that Microsoft’s earnings-per-share will grow, on average, by 10% over the medium term.

Blue Chip Tech Stock #3: Microchip Technology Incorporated (MCHP)

- Years of Dividend Growth: 22

- Dividend Yield: 1.8%

Microchip Technology develops, manufactures, and sells smart, connected, and secure embedded control solutions used for a wide variety of applications. These include disruptive growth trends such as 5G, artificial intelligence, Internet of Things (IoT), and autonomous driving, amongst others, in key end markets such as automotive, aerospace and defense, and communications.

The company’s strategic focus is that these solutions are cost-effective and offer high performance, with a wide voltage range operation, at extremely low power usage. Microchip Technology generates around $6 billion in annual revenues and is based in Chandler, Arizona.

Despite achieving relatively consistent revenue growth, Microchip Technology has struggled to meaningfully increase its earnings-per-share over the past decade. This is mainly due to a surge in operating and R&D expenses, as well as increased financial expenses. However, the company’s management has focused on expanding margins and leveraging the high demand for chips, resulting in a snowballing of adjusted earnings-per-share in recent quarters.

The company is currently attempting to bolster its production capacity to address its burgeoning delivery backlog. For this reason, we anticipate a medium-term earnings-per-share growth of approximately 12%.

Regarding its dividend, Microchip has incrementally increased its dividend for 21 years. That said, its increases have often been quite marginal, notably between 2014-2021.

Source: Investor Presentation

Nevertheless, we expect that Microchip will increase its dividend by an average rate of about 18% per annum in the coming years. This reflects the recent dividend growth acceleration as well as management’s goal, which aims to increase the dividend by around 9% moving forward sequentially (between quarters).

Blue Chip Tech Stock #2: International Business Machines Corporation (IBM)

- Years of Dividend Growth: 27

- Dividend Yield: 5.0%

IBM is an internationally renowned information technology giant offering comprehensive solutions for software, hardware, and services. They specialize in managing critical systems for large multinational organizations and governments, providing end-to-end solutions that cover the entire spectrum of needs.

Despite spinning off their managed infrastructure business, Kyndryl, in November 2021, IBM remains one of the world’s largest IT services companies with a focus on four key business segments: Software, Consulting, Infrastructure, and Financing. In 2022, IBM recorded impressive annual revenue of approximately $60.5 billion.

Although IBM’s primary operations have been profitable, the company has had a hard time achieving growth in recent years. This is mainly because the IT industry shifted towards the cloud and SaaS services, a space that IBM was slow to prioritize.

Still, even though IBM was late to the party, the company recognized the importance of cloud and SaaS and is now directing its efforts towards becoming a significant hybrid cloud player. This is evidenced by its acquisition of Red Hat and several other smaller companies, which have already started bearing fruits.

Specifically, in fiscal 2022, IBM posted revenues of $60.5 billion, up 6% year-over-year (or up 12% at constant currency), with its hybrid cloud revenues landing at $22.4 billion, up 11% year-over-year (or 17% at constant currency).

Source: Investor Presentation

Regardless, we remain wary of IBM’s profitability and dividend prospects. On the one hand, IBM boasts a tremendous track record of 27 consecutive annual dividend increases, which means IBM is one of the elite constituents of the Dividend Aristocrats Index. On the other hand, the company currently generates earnings-per-share at levels that are well below those of about a decade ago.

This has resulted in its payout ratio climbing over time. It currently stands at 69% based on our projections for earnings-per-share of $9.50 for fiscal 2023. Hence, we expect the company to prioritize deleveraging and growing its cloud platforms in an attempt to improve its bottom line. In light of this, we believe that any future dividend increases will likely be marginal, consistent with recent trends where the company has only raised dividends by less than 1%.

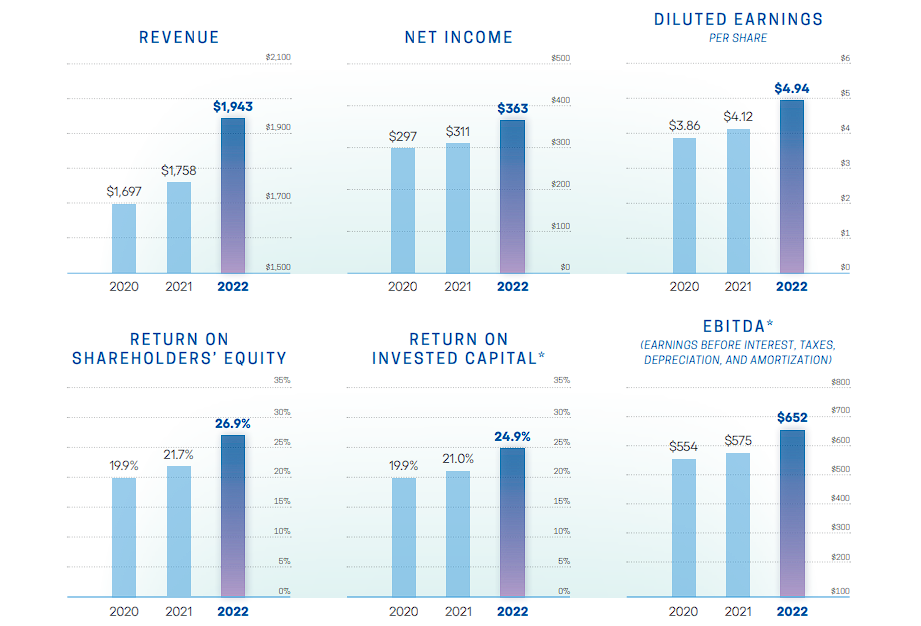

Blue Chip Tech Stock #1: Jack Henry & Associates, Inc. (JKHY)

- Years of Dividend Growth: 33

- Dividend Yield: 1.4%

Jack Henry & Associates is a business software & services company that is headquartered in Missouri. It was founded in 1976. The company provides information technology services to the financial services industry, including to more than 1,300 banks as well as other companies, such as insurance corporations.

When it comes to growing its earnings, Jack Henry & Associates has a proven track record of success. Since 2010, the company has experienced an impressive 12% annual growth in earnings-per-share, largely due to a blend of rising revenues and expanding margins.

This outcome isn’t surprising, as Jack Henry & Associates benefits from a robust operating leverage that is fueled by a high proportion of fixed costs. It implies that as revenue increases, the company can achieve margin expansion, which has been the case for most years.

Although Jack Henry & Associates has faced some headwinds in recent times, such as product mix changes that have limited margin growth, we believe that the company’s long-term outlook is bright. As the company continues to leverage its solid operational foundation, we anticipate that its profits will continue to outpace revenue growth.

Source: Annual Report

Regarding its dividend, Jack Henry & Associates features the lengthiest growth track record amongst all tech stocks in our coverage universe. The company has increased its dividends annually for 33 consecutive years, solidifying its position as a reliable and consistent performer.

Not only has Jack Henry & Associates sustained this impressive growth streak, but it has also managed to do so at a remarkable pace, with an average dividend growth rate of 15.8% over the past decade. We expect the company to continue growing its payouts at a rapid pace, with its payout ratio standing at a comfortable 43%.

Final Thoughts

Overall, investors can find fruitful investment opportunities amongst blue chip stocks, as these companies tend to feature a long history of financial stability and strong market position, amongst other attractive characteristics.

The tech sector is short of blue-chip opportunities, with less than 20 companies fitting our criterion, which requires at least ten years of consecutive dividend increases. Still, the names featured in this article have a proven track record of consistently growing shareholder returns.

That said, we note that when considering blue chip stocks for your portfolio, it is vital to evaluate various critical factors. Conducting a thorough analysis of a company’s financial health, assessing the existence of a robust competitive advantage or “moat,” and identifying any potential risks that could endanger the business are key starting points. We strongly advise taking these measures into account and not blindly investing in a stock solely based on its “blue-chip” status.

We hope that our list has provided some worthwhile ideas for long-term investment opportunities.

If you are interested in finding more blue-chip stocks, and other income investing opportunities, the following Sure Dividend resources will be of interest to you.

Blue Chip Stock Investing

- 20 ‘Forever’ Blue-Chip Stocks For Long-Term Investing

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 10 Best Performing Blue Chip Stocks Over The Last 12 Months

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more