Updated on December 14th, 2023 by Bob Ciura

The book publishing industry is undergoing rapid changes. The business model that remained relatively unchanged for decades is rapidly moving toward new technologies such as e-books, while traditional books lose market share. The distribution channels through which the publishers sell books are shifting as well.

Amazon (AMZN), which started out as an online book store and expanded into many other product categories since, is the largest online book seller. Amazon is not only selling books, it has also moved into publishing books itself, which puts some pressure on traditional publishers.

These challenges were once again illustrated in 2023. Unit sales of print books fell 4.1% in the first nine months of the year.

In this article, we will look at the three biggest publicly traded book publishing stocks: Scholastic (SCHL), John-Wiley & Sons (WLY), and Pearson plc (PSO). All three of these companies pay dividends to shareholders, and are included in our list of all consumer discretionary stocks.

One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends. With this in mind, we created a downloadable list of all 150 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

The three stocks are ranked by estimated total annual returns over the coming five years. More data on each company is available through the Sure Analysis Research Database.

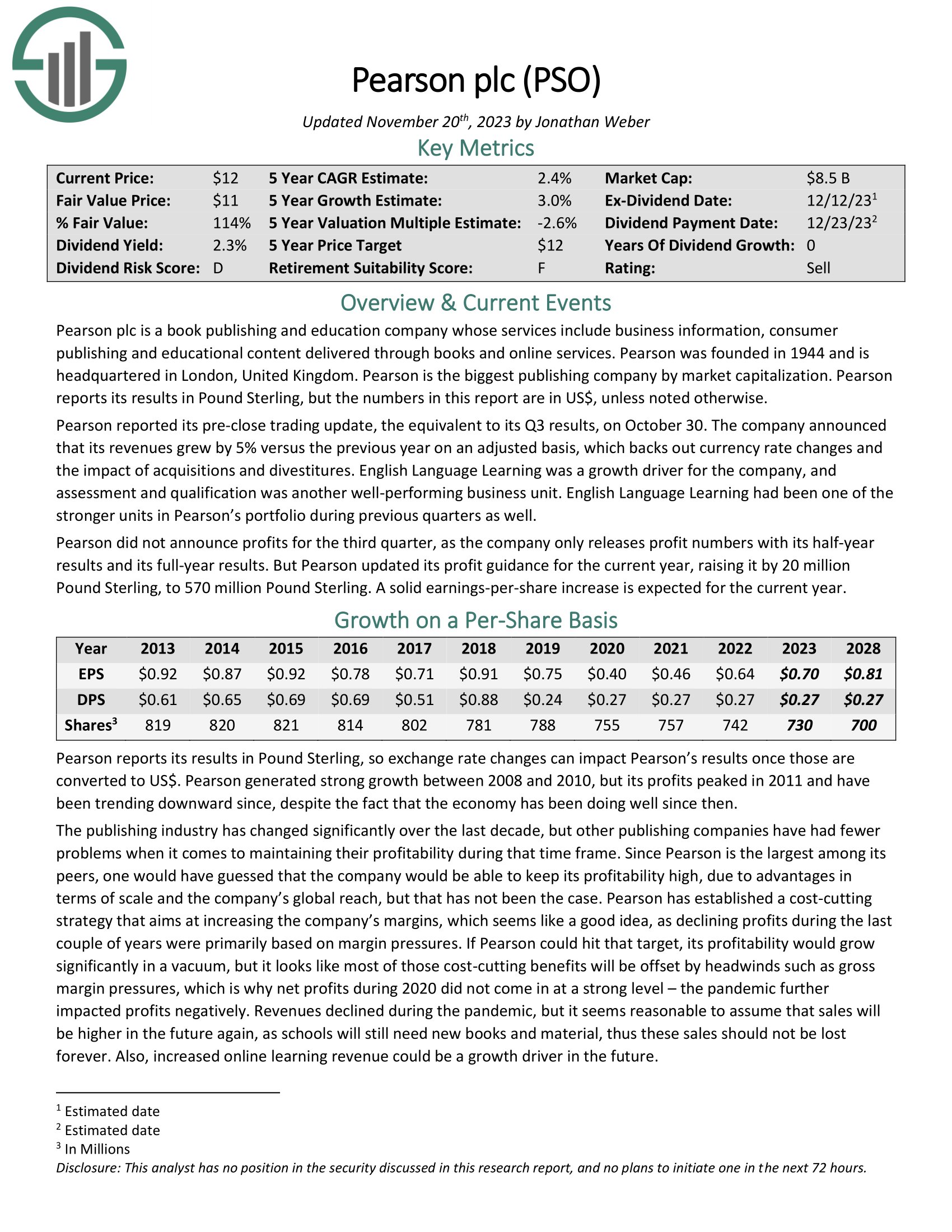

Book Publishing Stock #3: Pearson plc (PSO)

- 5-year expected annual returns: 3.1%

Pearson plc is the biggest book publishing company in the world, with annual sales of ~$3.4 billion and a market capitalization above $8 billion. Pearson is headquartered in the U.K., and the company was founded in 1944.

Pearson is active in consumer publishing, education content, and business information markets.

Pearson reported its pre-close trading update, the equivalent to its Q3 results, on October 30. The company announced that its revenues grew by 5% versus the previous year on an adjusted basis, which backs out currency rate changes and the impact of acquisitions and divestitures.

English Language Learning was a growth driver for the company, and assessment and qualification was another well-performing business unit.

Click here to download our most recent Sure Analysis report on Pearson (preview of page 1 of 3 shown below):

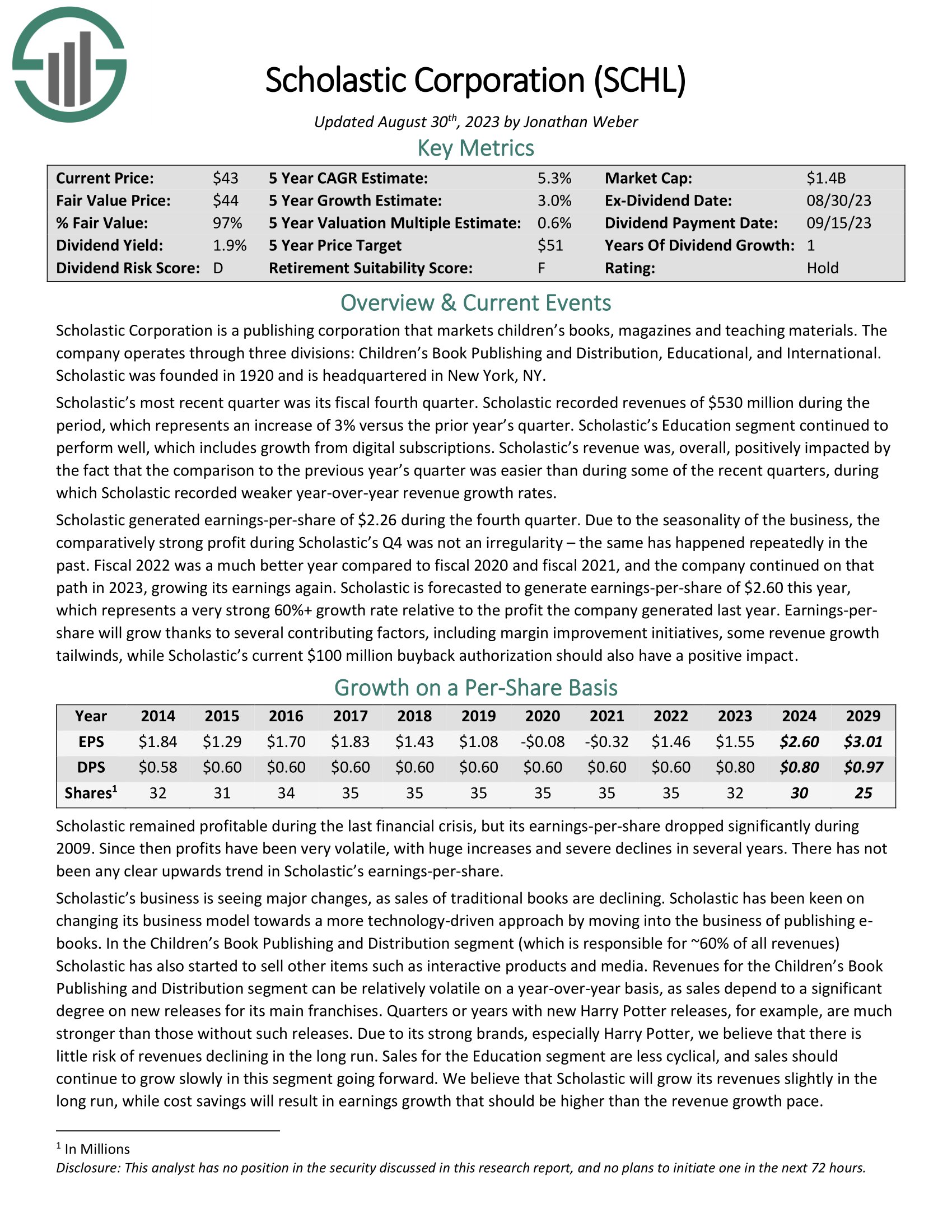

Book Publishing Stock #2: Scholastic (SCHL)

- 5-year expected annual returns: 6.8%

Scholastic Corporation is a publishing corporation that markets children’s books, magazines, and teaching materials. The company operates through three divisions: Children’s Book Publishing and Distribution, Educational, and International.

In the most recent quarter, revenue of $530 million increased 3% from the same quarter last year. Earnings-per-share came to $2.26 for the quarter. The company forecasts earnings-per-share of $2.60 this year, which represents a very strong 60%+ growth rate from the previous year. EPS growth will be derived from multiple factors, including margin expansion, revenue growth, and a boost from the current $100 million share buyback authorization.

Click here to download our most recent Sure Analysis report on Scholastic (preview of page 1 of 3 shown below):

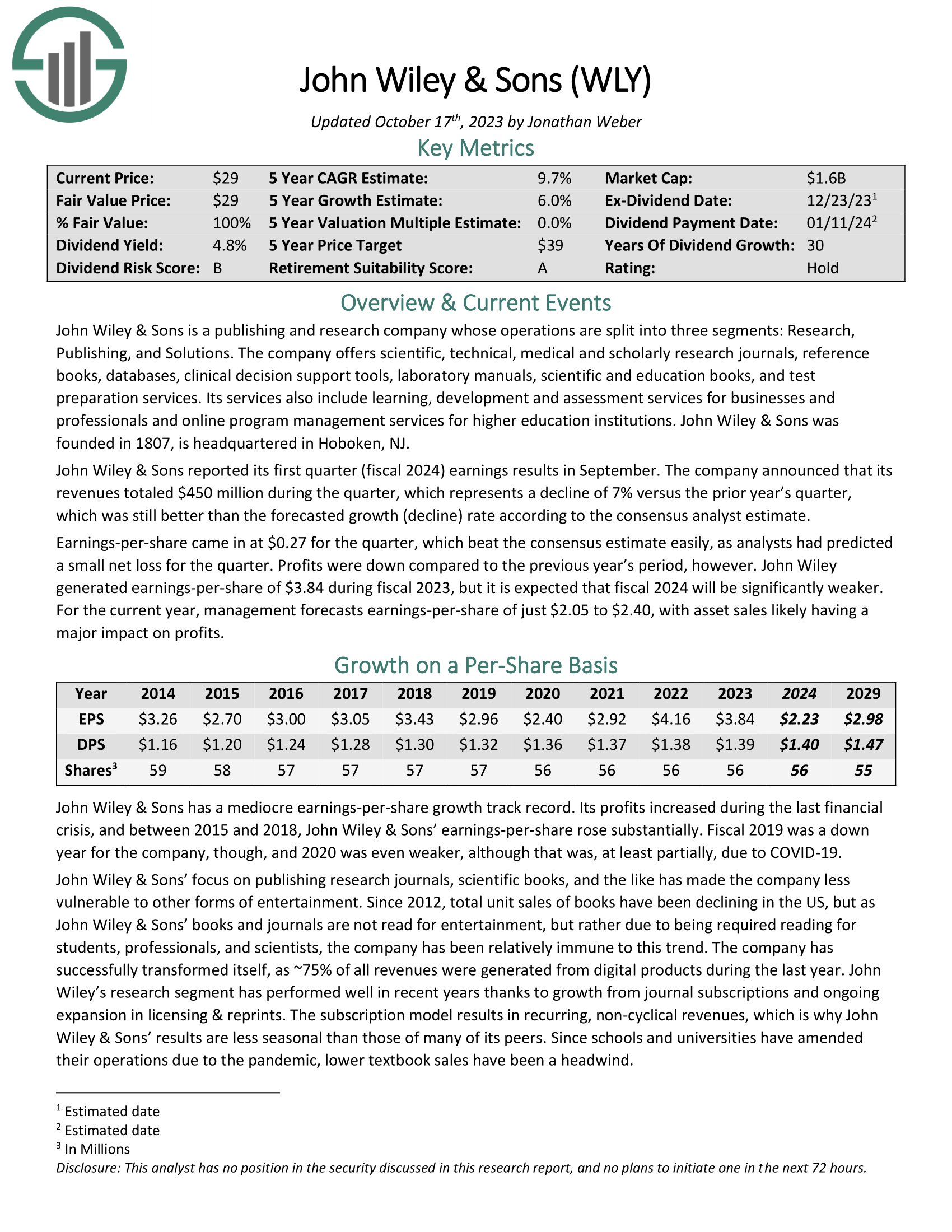

Book Publishing Stock #1: John Wiley & Sons (WLY)

- 5-year expected annual returns: 7.4%

John Wiley & Sons is a publishing company with a strong focus on the professional and scientific community. Its products include research journals (scientific, technical, medical and scholarly), reference books, manuals, databases, scientific and education books, test preparation services, and more.

The company also offers services such as development and assessment services for businesses and services for higher education institutions. John Wiley & Sons was founded in 1807.

John Wiley & Sons reported its first quarter (fiscal 2024) earnings results in September. Quarterly revenues totaled $450 million during the quarter, which represented a decline of 7% versus the same quarter last year. Earnings-per-share came in at $0.27 for the quarter, which beat the consensus estimate easily, as analysts had predicted a small net loss for the quarter.

For the current year, management forecasts earnings-per-share of $2.05 to $2.40. John Wiley has increased its dividend for 30 consecutive years. It is a Dividend Champion.

Click here to download our most recent Sure Analysis report on John Wiley & Sons (preview of page 1 of 3 shown below):

Final Thoughts

Book publishing stocks have experienced a number of challenges in recent years. Not only did the industry suffer from the coronavirus pandemic, but it was already dealing with the rise of e-readers and online education. Book publishing stocks have had to adapt to these challenges, with varying levels of success so far.

Because the industry remains in a challenged state heading into 2023, investors should be selective when it comes to book publishing stocks.

Due to the company’s earnings growth outlook, solid dividend yield, and reasonable valuation, we view John Wiley & Sons as the top book publishing stock today. That said, WLY stock earns a hold recommendation as its expected annual returns are below 10%.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks