Updated on February 28th, 2024 by Nikolaos Sismanis

To invest in great businesses, you have to find them first. Carl Icahn is an expert at this, with an equity investment portfolio worth more than $10.9 billion as of the end of the 2023 fourth quarter.

Carl Icahn’s portfolio is filled with quality stocks. You can ‘cheat’ from Carl Icahn stocks to find picks for your portfolio. That’s because institutional investors are required to periodically show their holdings in a 13F filing.

You can see all 13 Carl Icahn stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Notes: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

This article analyzes Carl Icahn’s 13 stocks based on the information disclosed in his Q4 2023 13F filing.

Table of Contents

You can skip to a specific section with the table of contents below. Stocks are listed by percentage of the total portfolio, from highest to lowest.

- Carl Icahn & Dividend Stocks

- #1: Icahn Enterprises LP (IEP)

- #2: CVR Energy Inc. (CVI)

- #3: Southwest Gas Holdings (SWX)

- #4: Bausch Health Companies (BHC)

- #5: FirstEnergy Corp. (FE)

- #6: Dana Incorporated (DAN)

- #7: Conduent Inc. (CNDT)

- #8: American Electric Power Company Inc.

- #9: Illumina, Inc. (ILMN)

- #10: Sandridge Energy (SD)

- #11: International Flavors & Fragrances (IFF)

- #12: Bausch & Lomb Corporation (BLCO)

- #12: Newell Brands (NWL)

- Final Thoughts

Carl Icahn & Dividend Stocks

Carl Icahn has grown his wealth by investing in and acquiring businesses with strong competitive advantages, trading at fair or better prices.

Most investors know Carl Icahn looks for attractive stocks, but few know the degree to which he invests in dividend stocks:

- 10 out of the 13 Carl Icahn stocks pay dividends

- His top 5 holdings have an average dividend yield of 3.7% (and make up 94% of his portfolio)

- His investment firm, Icahn Enterprises, is structured as an MLP and pays its investors a massive double-digit yield.

Keep reading this article to see Carl Icahn’s 13 stock selections analyzed in greater detail.

#1: Icahn Enterprises L.P. (IEP)

Dividend Yield: 18.6%

Percent of Carl Icahn’s Portfolio: 64.1%

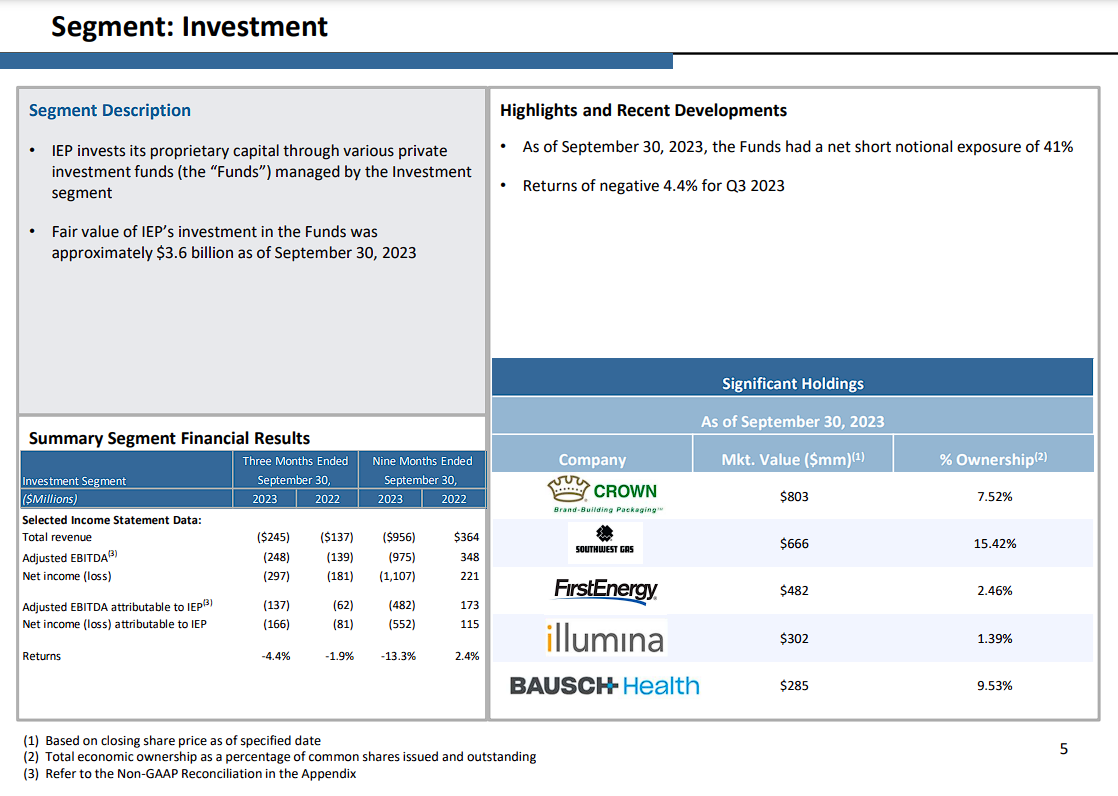

Icahn Enterprises L.P. operates in investment, energy, automotive, food packaging, metals, real estate, and home fashion businesses in the United States and Internationally. The company’s Investment segment focuses on finding undervalued companies to allocate capital through its various private investment funds.

The company has yet to report its Q4 results.

Source: Investor Presentation

Carl Icahn owns 100% of Icahn Enterprises GP, the general partner of Icahn Enterprises and Icahn Enterprises Holdings, and approximately 89% of Icahn Enterprises’ outstanding shares.

On August 4th, 2023, Icahn Enterprises slashed its distribution by 50% to a quarterly rate of $1.00.

On November 3rd, 2023, the partnership reported its Q3 results for the period ending September 30th, 2023. For the quarter, revenues came in at $3.0 billion, 12% lower year-over-year, while the loss per unit was $0.01, versus a loss per unit of $0.37 in Q3-2022. Lower revenues were due to Icahn’s investments recording weaker results compared to last year.

The company employs a complex accounting method by realizing revenues through its investment funds, not its subsidiaries’ actual sales. Consequently, the company posts net losses in operating activities and only profits from its “investment activities” segment of its cash flows.

The company does not specifically report investment income per share. The partnership’s distribution cut may have proven Hindenburg’s earlier short report, which argued that the stock is trading at an “inflated” valuation against NAV, to be right.

Click here to download our most recent Sure Analysis report on IEP (preview of page 1 of 3 shown below):

#2: CVR Energy Inc. (CVI)

Dividend Yield: 5.3%

Percent of Carl Icahn’s Portfolio: 20.1%

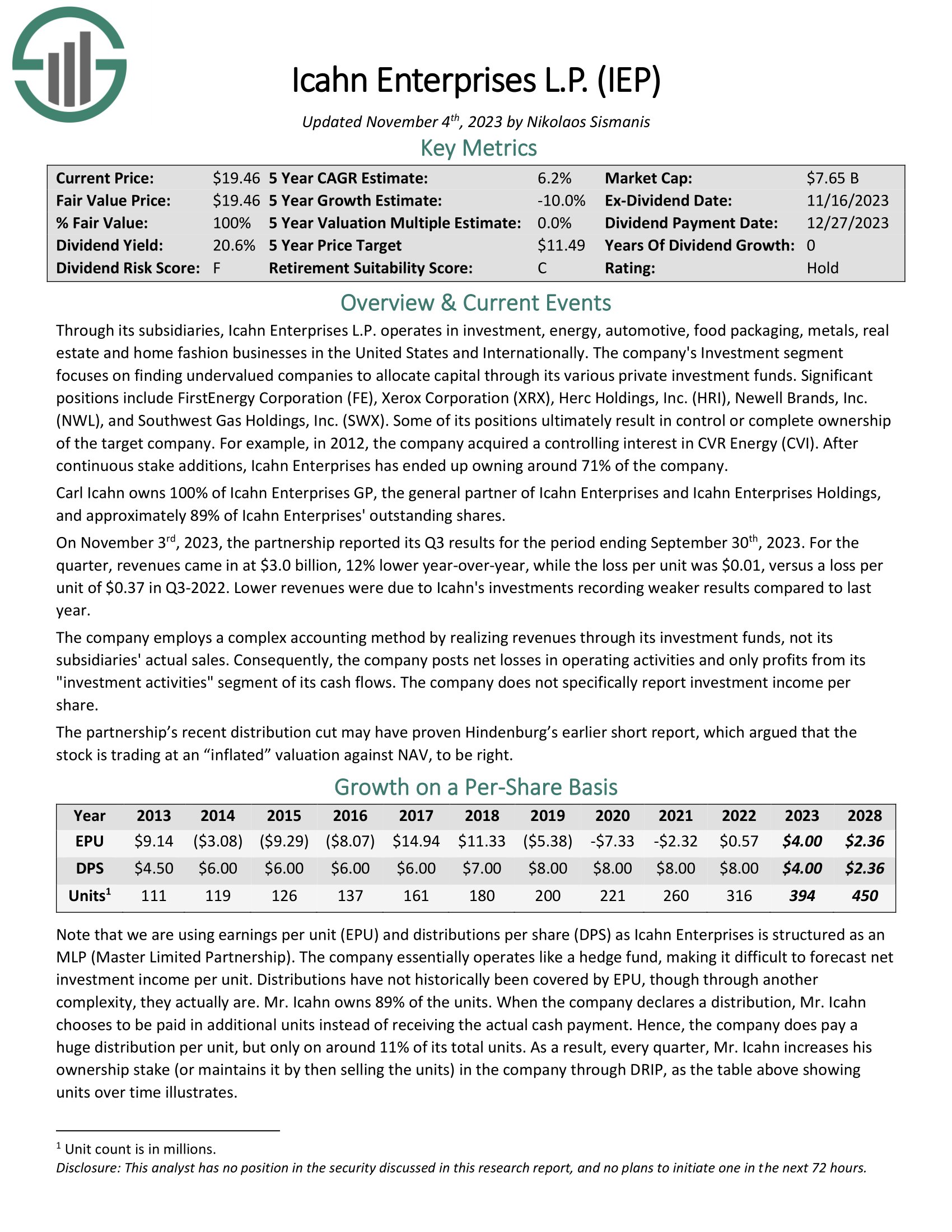

CVR Energy is a diversified holding company primarily engaged in the renewable fuels and petroleum refining and marketing businesses, as well as in the nitrogen fertilizer manufacturing business through its interest in CVR Partners, LP. CVR Energy subsidiaries serve as the general partner and own 37% of the common units of CVR Partners.

Source: Investor Presentation

For Q4, the company reported net income of $91 million, $0.91 per diluted share, on net sales of $2.2 billion, compared to the fourth quarter 2022 net income attributable to CVR Energy stockholders of $112 million, or $1.11 per diluted share, on net sales of $2.7 billion.

Adjusted earnings for the fourth quarter of 2023 was $0.65 per diluted share compared to adjusted earnings of $1.68 per diluted share in the fourth quarter of 2022.

Fourth quarter 2023 EBITDA was $204 million, compared to fourth quarter 2022 EBITDA of $313 million. Adjusted EBITDA for the fourth quarter of 2023 was $170 million, compared to adjusted EBITDA of $388 million in the fourth quarter of 2022.

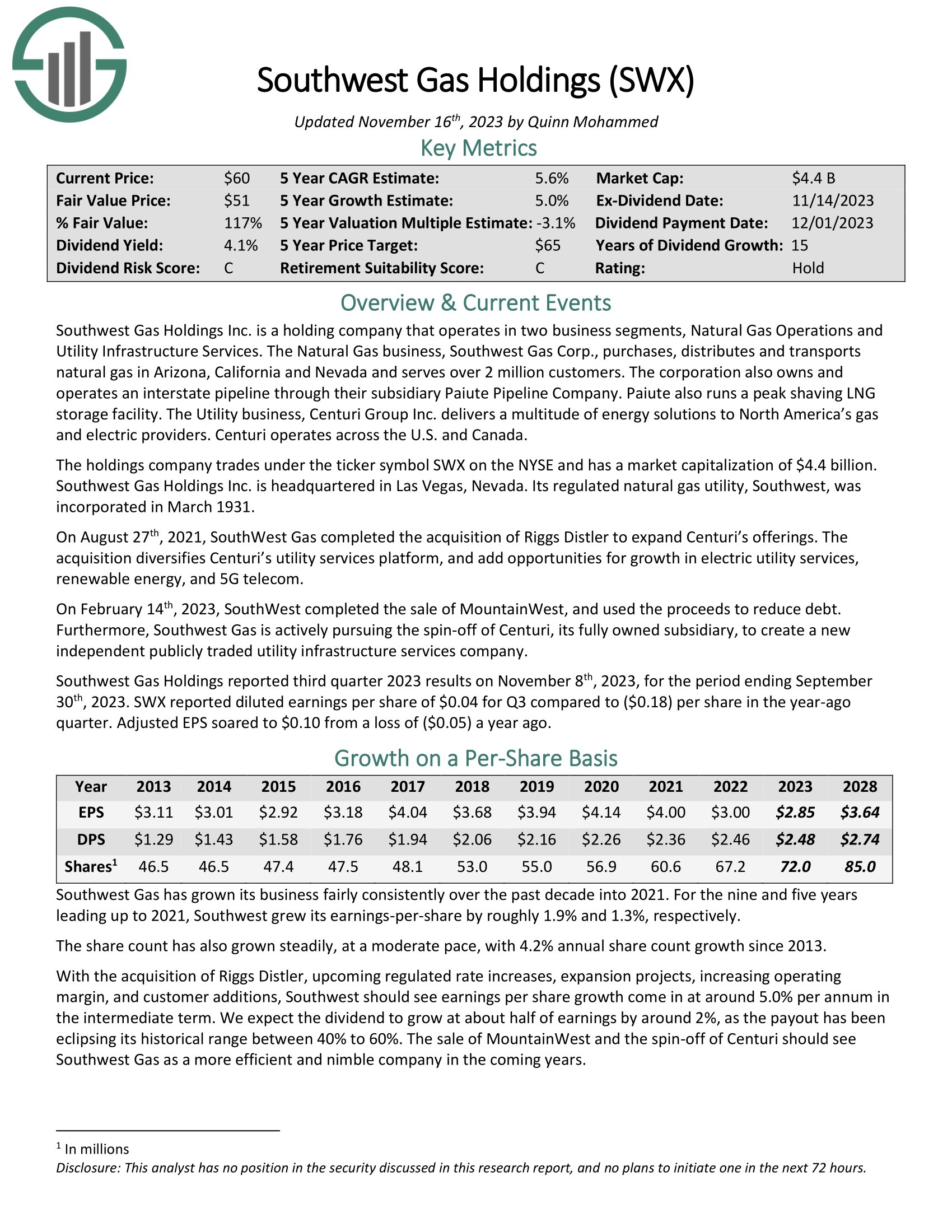

#3: Southwest Gas Holdings (SWX)

Dividend Yield: 4.1%

Percent of Carl Icahn’s Portfolio: 5.5%

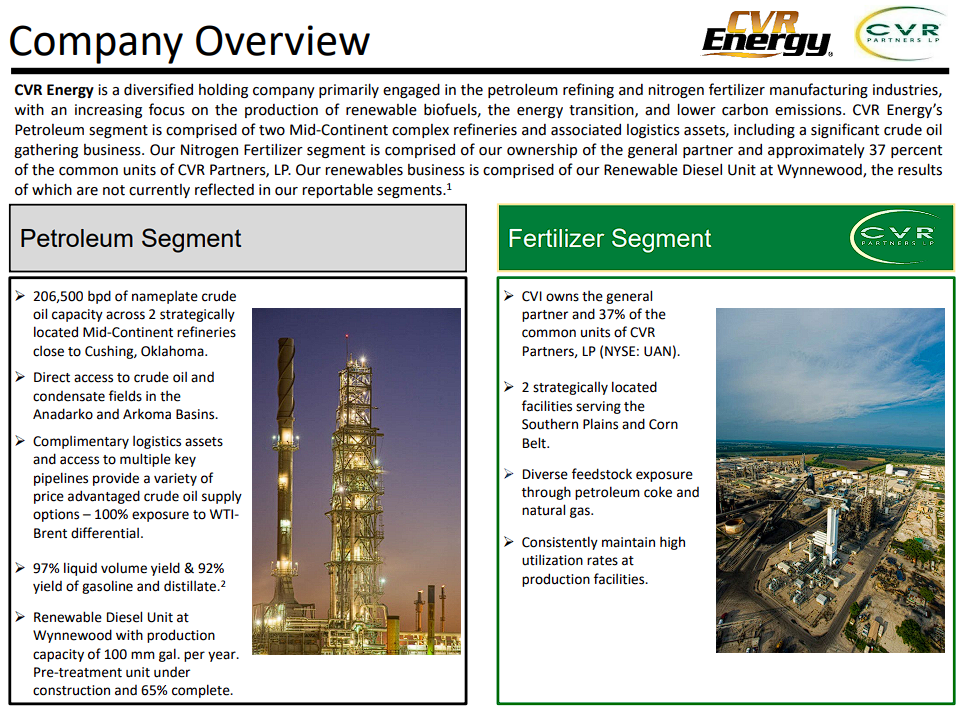

Southwest Gas Holdings Inc. is a holding company that operates in two business segments: Natural Gas Operations and Utility Infrastructure Services. The Natural Gas business, Southwest Gas Corp., purchases, distributes, and transports natural gas in Arizona, California, and Nevada and serves over 2 million customers.

The corporation also owns and operates an interstate pipeline through its subsidiary, Paiute Pipeline Company. Paiute also runs a peak-shaving LNG storage facility. The Utility business, Centuri Group Inc., delivers a multitude of energy solutions to North America’s gas and electric providers. Centuri operates across the U.S. and Canada.

The company has yet to post its Q4 results.

Source: Investor Presentation

On February 14th, 2023, SouthWest completed the sale of MountainWest and used the proceeds to reduce debt. Furthermore, Southwest Gas is actively pursuing the spin-off of Centuri, its fully owned subsidiary, to create a new independent publicly traded utility infrastructure services company. The spin-off is expected to occur in the fourth quarter of 2023 or the first quarter of 2024.

Southwest Gas Holdings reported third quarter 2023 results on November 8th, 2023, for the period ending September 30th, 2023. SWX reported diluted earnings per share of $0.04 for Q3 compared to ($0.18) per share in the year-ago quarter. Adjusted EPS soared to $0.10 from a loss of ($0.05) a year ago.

Click here to download our most recent Sure Analysis report on SWX (preview of page 1 of 3 shown below):

#4: Bausch Health Companies (BHC)

Dividend Yield: N/A (Bausch Health does not currently pay a quarterly dividend)

Percent of Carl Icahn’s Portfolio: 2.5%

Bausch Health Companies was formerly known as Valeant Pharmaceuticals and changed its name to Bausch Health Companies Inc. in July 2018. Bausch Health manufactures and markets a range of pharmaceutical, medical device, and over-the-counter (OTC) products, primarily in the therapeutic areas of eye health, gastroenterology, and dermatology.

The company operates through five segments: Salix, International, Solta Medical, Diversified Products, and Bausch + Lomb. The Salix segment provides gastroenterology products in the U.S., while the International segment offers Solta products, branded and generic pharmaceutical products, OTC products, medical device products, and Bausch + Lomb products in Canada, Europe, Asia, Latin America, Africa, and the Middle East.

The Solta Medical segment offers medical devices. The Diversified Products segment offers pharmaceutical products in the areas of neurology and other therapeutic classes, as well as generic, dermatological, and dentistry products in the United States.

Lastly, the Bausch + Lomb segment offers products with a focus on vision care and surgical and ophthalmic pharmaceutical products.

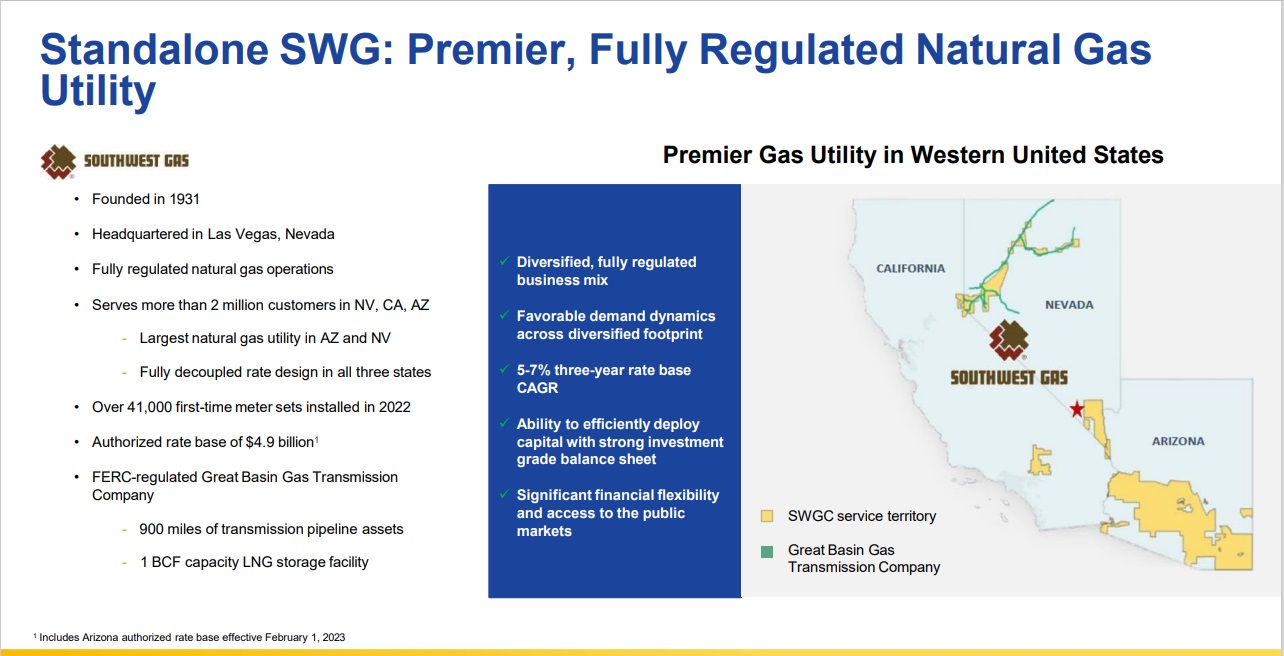

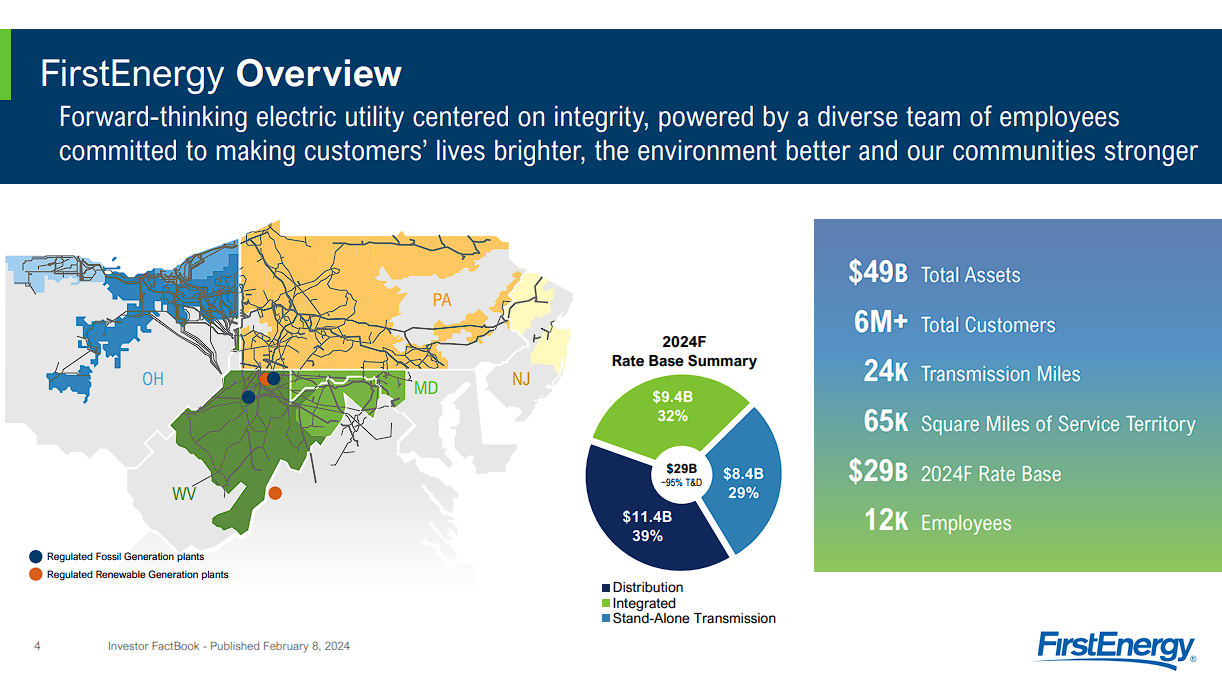

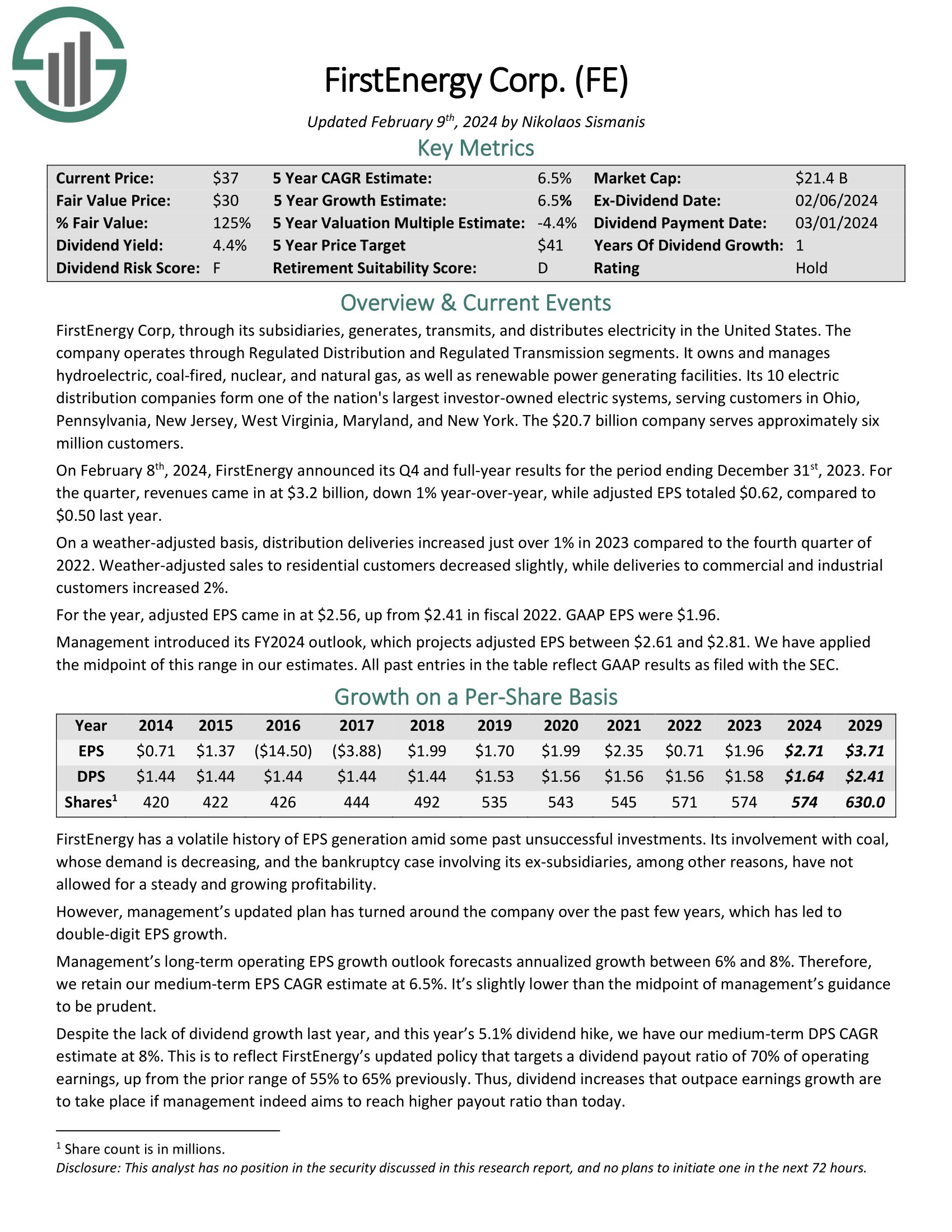

#5: FirstEnergy Corp. (FE)

Dividend Yield: 4.2%

Percent of Carl Icahn’s Portfolio: 1.9%

FirstEnergy Corp, through its subsidiaries, generates, transmits, and distributes electricity in the United States. The company operates through Regulated Distribution and Regulated Transmission segments. It owns and manages hydroelectric, coal-fired, nuclear, and natural gas facilities, as well as renewable power-generating facilities.

Its ten electric distribution companies form one of the nation’s largest investor-owned electric systems, serving customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York. The $21.4 billion company serves approximately six million customers.

Source: Investor FactBook

On February 8th, 2024, FirstEnergy announced its Q4 and full-year results for the period ending December 31st, 2023.

For the quarter, revenues came in at $3.2 billion, down 1% year-over-year, while adjusted EPS totaled $0.62, compared to $0.50 last year.

On a weather-adjusted basis, distribution deliveries increased just over 1% in 2023 compared to the fourth quarter of 2022. Weather-adjusted sales to residential customers decreased slightly, while deliveries to commercial and industrial customers increased by 2%.

For the year, adjusted EPS came in at $2.56, up from $2.41 in fiscal 2022. GAAP EPS was $1.96.

Click here to download our most recent Sure Analysis report on FE (preview of page 1 of 3 shown below):

#6: Dana Inc. (DAN)

Dividend Yield: 2.9%

Percent of Carl Icahn’s Portfolio: 1.6%

Dana Incorporated provides power-conveyance and energy-management solutions for vehicles and machinery in North America, Europe, South America, and the Asia Pacific. It operates in four segments: Light Vehicle Drive Systems, Commercial Vehicle Drive and Motion Systems, Off-Highway Drive and Motion Systems, and Power Technologies.

Sales for the fourth quarter of 2023 totaled $2.5 billion, compared with $2.6 billion in the same period of 2022. Lower sales in 2023 were driven by the impact of the UAW strike on our Light Vehicle Driveline segment, which was partially offset by cost-recovery actions and conversion of the sales backlog.

Source: Investor Presentation

Adjusted EBITDA for the fourth quarter of 2023 was $156 million, compared with $176 million for the same period in 2022. Strong efficiency improvements partially offset the margin impact of the UAW strike and higher spending on development for electric vehicle products.

#7: Conduent Inc. (CNDT)

Dividend Yield: N/A (Conduent does not currently pay a quarterly dividend)

Percent of Carl Icahn’s Portfolio: 1.1%

Conduent Inc. is a business process services and solutions company headquartered in Florham Park, New Jersey, USA. Established in 2017 as a spin-off from Xerox Corporation, Conduent specializes in providing a diverse range of services, including business process outsourcing, digital platforms, and technology solutions.

With a focus on industries such as healthcare, transportation, government, and financial services, the company offers services such as transaction processing, customer experience management, and automation. Conduent plays a crucial role in facilitating efficient business operations and digital interactions for its clients across various sectors.

Adjusted revenue for Q4 was $953 million, and $3.7 billion for the full year. Adjusted EBITDA was $103 million and $378 million for Q4 and full year, respectively, and the company’s adjusted EBITDA margin was 10.8% and 10.2%, respectively.

Management projects that 2024 is going to be difficult. They also expect that there will be a lot of divestiture activity.

#8: American Electric Power Company, Inc. (AEP)

Dividend Yield: 4.2%

Percent of Carl Icahn’s Portfolio: 0.5%

American Electric Power Company, Inc. (AEP) holds a significant position within the expansive landscape of the U.S. energy sector. As one of the foremost electric utility companies, AEP extends its services across 11 states, impacting the lives and businesses of millions.

Operating comprehensively in the electricity supply chain, AEP is involved in the generation, transmission, and distribution of power. The company’s diversified portfolio encompasses coal, natural gas, renewables, and nuclear power, reflecting adaptability to evolving energy dynamics.

Notably, AEP has strategically prioritized sustainability, which is evident in its investments in renewable energy projects such as wind and solar.

On November 2, 2023, American Electric Power (AEP) reported its third-quarter earnings for 2023. The company announced GAAP earnings of $954 million, or $1.83 per share, compared to $684 million, or $1.33 per share, in the third quarter of 2022.

Operating earnings for the third quarter of 2023 were $924 million or $1.77 per share, an increase from $831 million or $1.62 per share in the same period last year.

AEP’s CEO, Julie Sloat, attributed the earnings growth to the company’s long-term strategy of investing in a modern, reliable energy system that meets customer needs while maintaining affordable electricity rates.

This achievement was realized despite challenges such as high-interest rates, inflation, and unfavorable weather conditions.

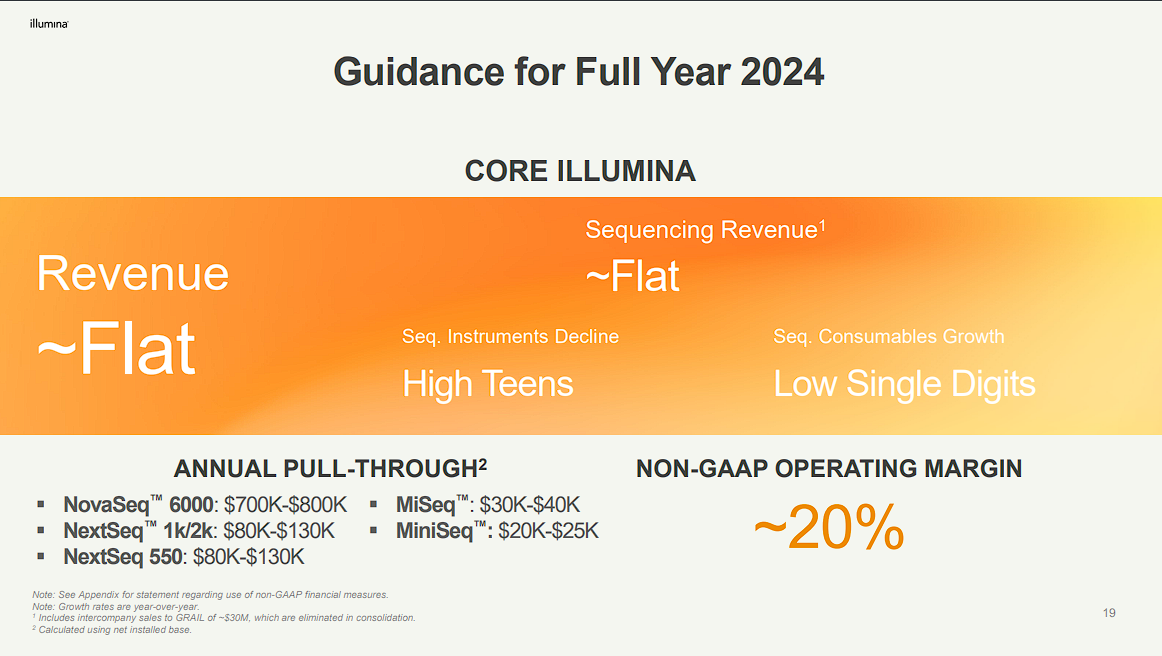

#9: Illumina, Inc. (ILMN)

Dividend Yield: N/A (Conduent does not currently pay a quarterly dividend)

Percent of Carl Icahn’s Portfolio: 0.5%

Illumina is an esteemed company dedicated to genetic sequencing and associated technologies. Renowned as a foremost provider of cutting-edge DNA sequencing platforms and services, Illumina holds a pivotal position in the realm of genomics and personalized medicine.

By harnessing its exceptional sequencing systems, Illumina has played a vital role in propelling genomics research to new heights. Their contributions span a wide range of fields, including genome-wide association studies, cancer genomics, investigations into infectious diseases, and explorations of reproductive health. Illumina’s revolutionary technologies have not only enabled remarkable discoveries but have also deepened our comprehension of intricate biological processes.

Illumina delivered higher-than-expected consolidated revenue of approximately $1.12 billion in the fourth quarter.

- America’s revenue, which is more than half of the business, was flat year-on-year.

- Europe revenue was up 17% year-on-year on a relatively easy prior year comparable.

- EMEA revenue declined 1%, although that included a ten percentage point impact from sanctions in Russia.

- Greater China’s revenue was down 13% year-over-year, reflecting continued geopolitical challenges local competition, and mid-throughput.

Non-GAAP net income was $22 million or $0.14 per diluted share, which included dilution from GRAIL’s.

For fiscal 2024, management expects results to be very similar to 2023. While some macro headlines are encouraging, the company hasn’t yet seen that translate to increased investment in its industry and, therefore, has not reflected in management’s guidance.

Source: Investor Presentation

#10: Sandridge Energy Inc. (SD)

Dividend Yield: 1.4%

Percent of Carl Icahn’s Portfolio: 0.5%

Headquartered in Oklahoma City, SandRidge Energy operates as an independent player in the realm of oil and natural gas exploration and production.

The company has strategically positioned itself with a notable focus on the Mid-Continent region of the United States, establishing a reputation for proficiency in exploring and developing oil and gas reserves. The company has an interest in 1,471 gross-producing wells.

Financially, SD has maintained strong margins over the last 12 months, primarily influenced by favorable commodity prices. Projections indicate a potential 2024 EPS of $4.87, reflecting a conservative outlook considering lower anticipated oil prices and higher interest rates. The forward P/E ratio stands close to 3, a notable discount compared to the sector median of 9.6.

That said, this valuation reflects the risks associated with commodity price volatility, regulatory challenges, and the rise of renewable investments.

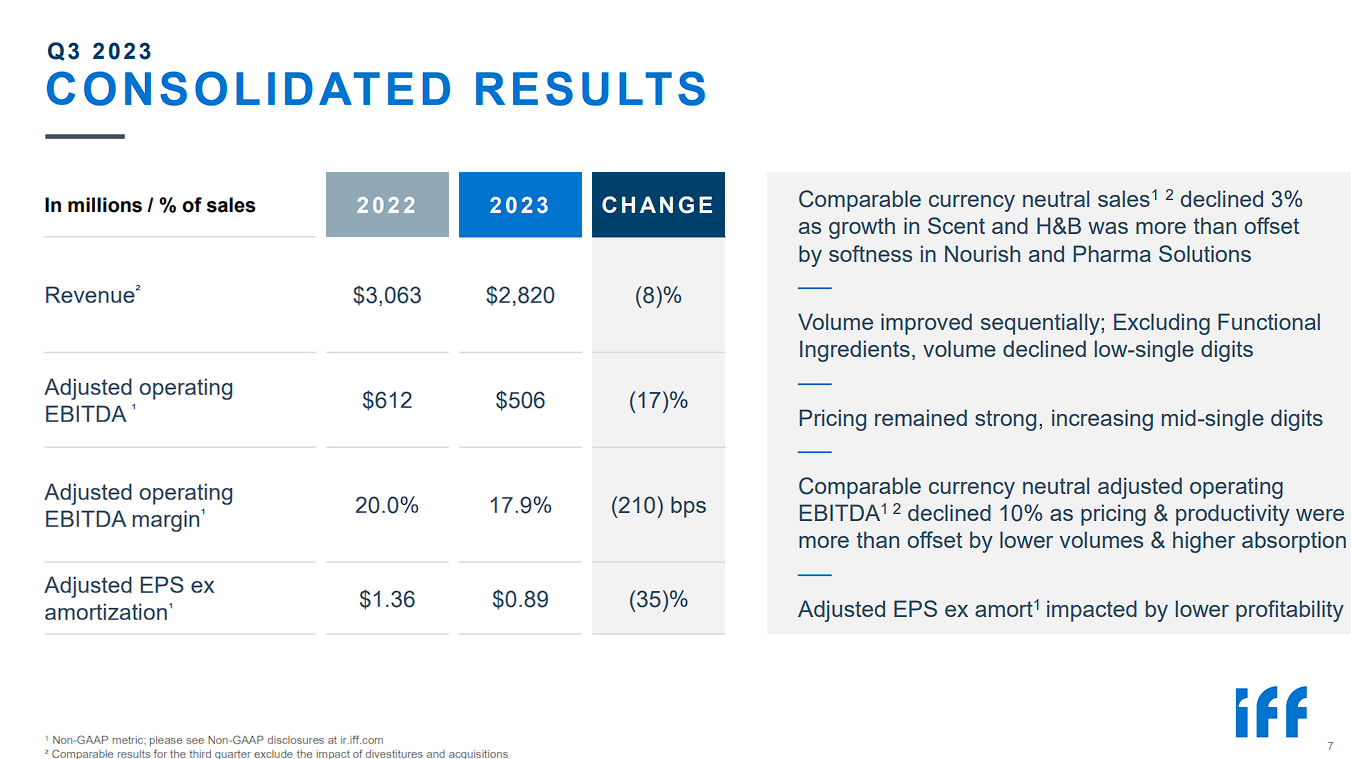

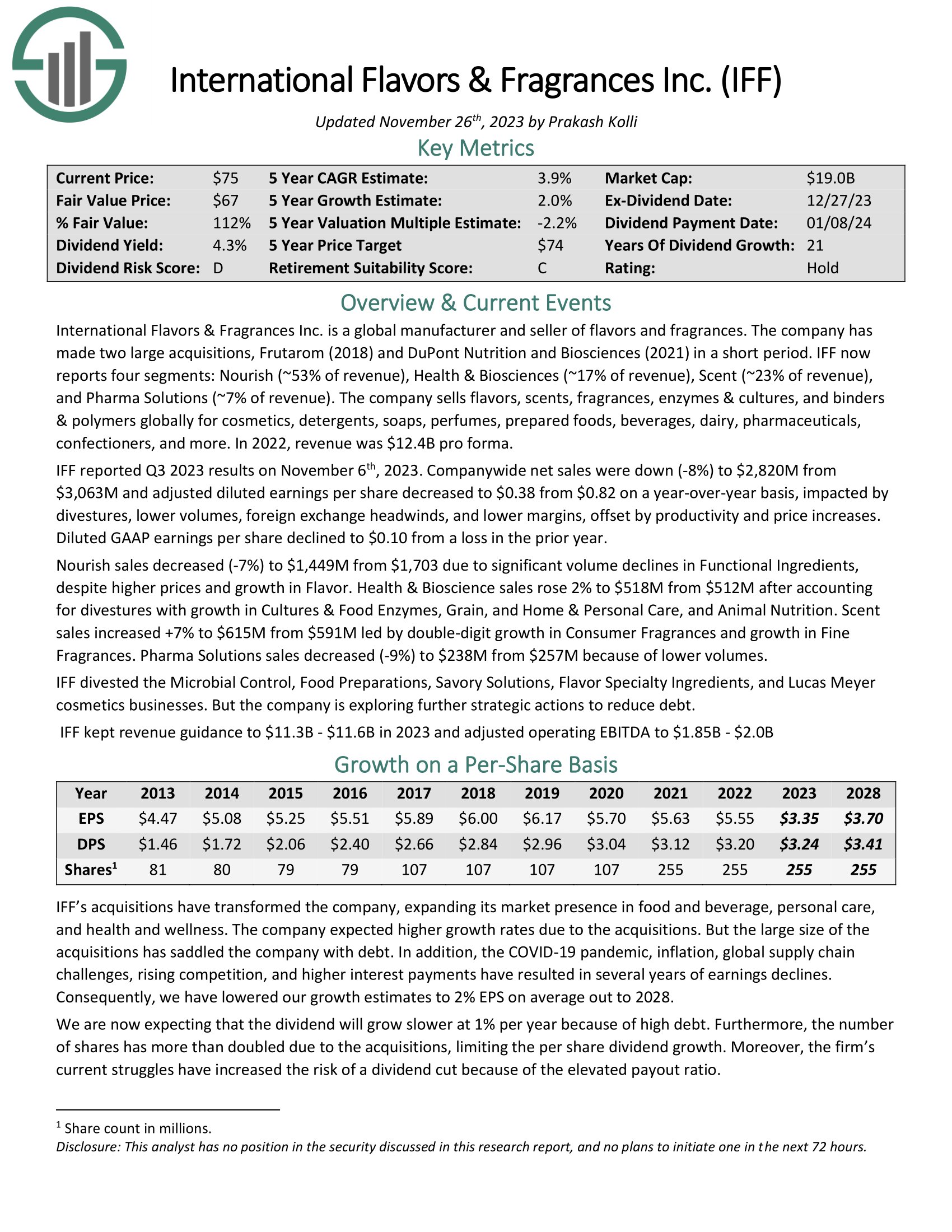

#11: International Flavors & Fragrances (IFF)

Dividend Yield: 3.9%

Percent of Carl Icahn’s Portfolio: 0.4%

International Flavors & Fragrances Inc. is a global manufacturer and seller of flavors and fragrances. The company has made two large acquisitions, Frutarom (2018) and DuPont Nutrition and Biosciences, in a short period. IFF now reports four segments: Nourish (~53% of revenue), Health & Biosciences (~17% of revenue), Scent (~23% of revenue), and Pharma Solutions (~7% of revenue).

The company sells flavors, scents, fragrances, enzymes & cultures, and binders & polymers globally for cosmetics, detergents, soaps, perfumes, prepared foods, beverages, dairy, pharmaceuticals, confectioners, and more. In 2022, revenue was $12.4B pro forma.

Source: Investor Presentation

IFF reported Q2 2023 results on August 7th, 2023. Companywide net sales were down (-11%) to $2,929M from $3,307M and adjusted diluted earnings per share decreased to $0.86 from $1.54 on a year-over-year basis, impacted by divestitures, foreign exchange headwinds, lower volumes because of destocking, and lower margins, offset by price increases. Diluted GAAP earnings per share declined to $0.11 from $0.43 because of lower sales and margins.

Nourish sales decreased (9%) to $1,564M from $1,818 due to significant declines in Ingredients, despite higher prices. Health and bioscience sales fell (3%) to $522M from $665M after accounting for divestitures with growth in Cultures and food Enzymes, Grain, and Home and Personal Care offset weakness in Health.

Scent sales increased +5% to $592M from $580M led by double-digit growth in Consumer Fragrances and growth in Fine Fragrances. Pharma Solutions sales increased +3% to $251M from $244M led by growth in Core Pharma.

IFF divested the Microbial Control, Food Preparations, Savory Solutions, and Flavor Specialty Ingredients businesses. However, the company is exploring further strategic actions for the Cosmetic Ingredients and Lucas Meyer Cosmetics units.

IFF lowered revenue guidance to $11.3B – $11.6B in 2023 and adjusted operating EBITDA to $1.85B – $2.0B

Click here to download our most recent Sure Analysis report on IFF (preview of page 1 of 3 shown below):

#12: Bausch & Lomb Corporation (BLCO)

Dividend Yield: N/A

Percent of Carl Icahn’s Portfolio: 0.4%

Bausch + Lomb Corporation operates as an eye health company worldwide. It operates through three segments: Vision Care, Ophthalmic Pharmaceuticals, and Surgical. The Vision Care segment provides contact lenses and contact lens care products.

The Ophthalmic Pharmaceuticals segment offers proprietary and generic pharmaceutical products for post-operative treatments, as well as for the treatment of eye conditions such as glaucoma and retinal diseases.

The Surgical segment provides medical device equipment, consumables, and technologies. Bausch + Lomb Corporation was spun off from Bausch Health Companies.

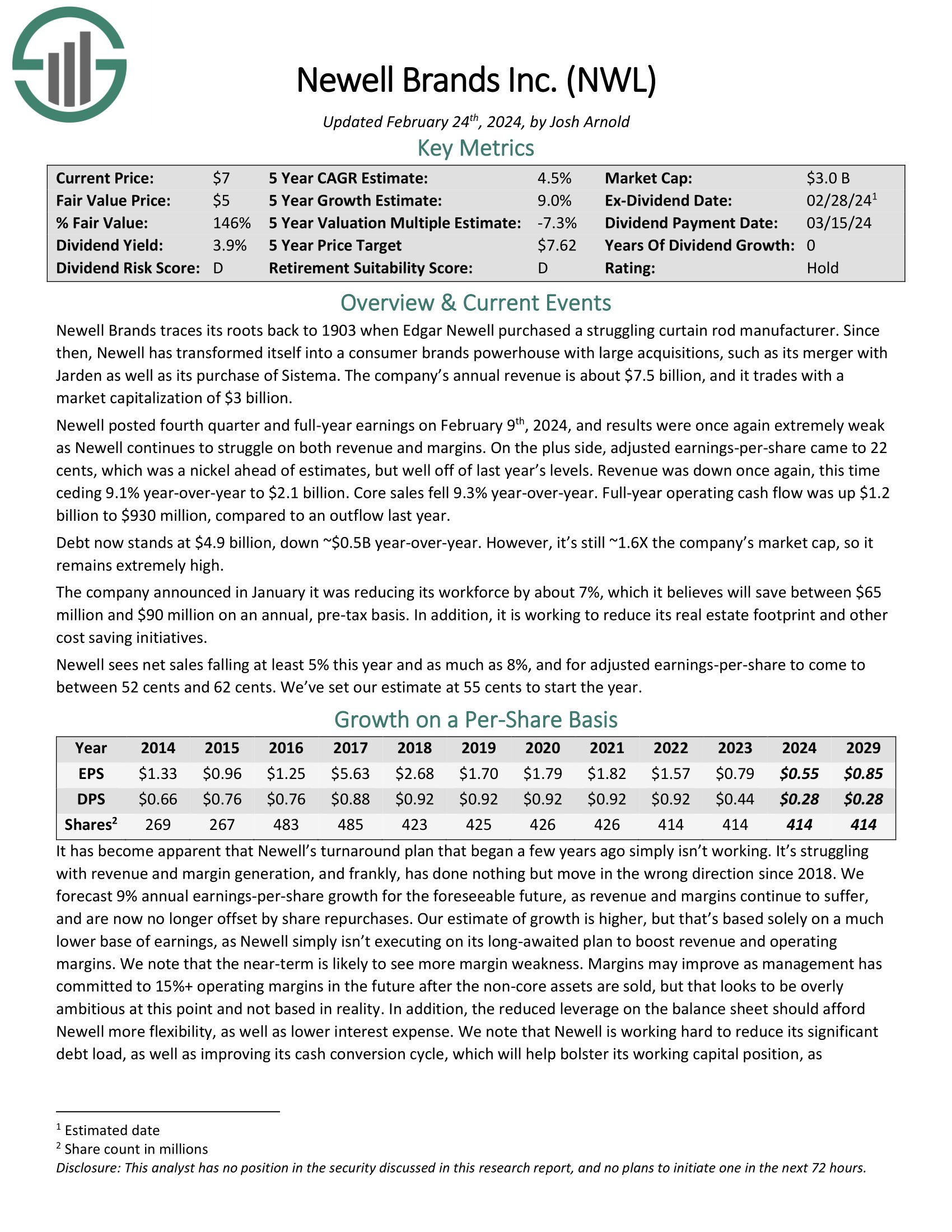

#13: Newell Brands (NWL)

Dividend Yield: 5.4%

Percent of Carl Icahn’s Portfolio: 0.4%

Newell has transformed itself into a consumer brands powerhouse with large acquisitions, such as its merger with Jarden as well as its purchase of Sistema. The company’s annual revenue is over $8 billion, and it has a diversified product portfolio.

Source: Investor Presentation

Newell posted third-quarter earnings on October 27th, 2023, and results were somewhat mixed once again, as we’ve become accustomed to from the constantly-transitioning company. Adjusted earnings-per-share came to 39 cents, which was an impressive 16 cents better than expected.

Revenue, however, was off 9.3% year-over-year to $2.04 billion and was $80 million light of estimates. Core sales declined 9.2%, and the company saw a slight headwind from category exits, as well as a small tailwind from forex exchange.

Adjusted gross margin was 31.3% of revenue, up from 29.6% a year ago. The company saw benefits from its cost-saving and productivity program, as well as higher realized selling prices. That helped offset fixed cost deleveraging, as well as higher restructuring charges.

Adjusted operating income was $167 million, or 8.2% of sales. This was lower than $234 million, or 10.4% of revenue, a year ago. Newell continues to struggle mightily when it comes to generating both revenue and margins, and projected earnings of just 75 cents per share for this year will be the lowest in more than a decade for Newell.

Click here to download our most recent Sure Analysis report on Newell (preview of page 1 of 3 shown below):

Final Thoughts

You can see more high-quality dividend stocks in the following Sure Dividend databases:

- The Dividend Kings List: Dividend Stocks With 50+ Years of Rising Dividends

- The Dividend Aristocrats List: 25+ Years of Rising Dividends

- The 20 Highest Yielding Dividend Aristocrats Now

- Blue Chips List: Stocks With 10+ Years of Rising Dividends

Alternatively, another great place to look for high-quality business is inside the portfolios of other highly successful investors.

To that end, Sure Dividend has created the following stock databases:

You might also be looking to create a highly customized dividend income stream to pay for life’s expenses.

The following two lists provide useful information on high dividend stocks and stocks that pay monthly dividends:

- The Best High Dividend Stocks: Stocks With 5%+ Dividend Yields

- The Best Monthly Dividend Stocks: All 84 Stocks That Pay Monthly Dividends

Lastly, you can see the articles below for analysis on other major investment firms/asset managers: