Data updated daily

Constituents updated annually

The consumer staples sector is home to some of the most well-known dividend growth stocks in the world.

There is also a wide body of evidence that suggests that the consumer staples sector outperforms over long periods of time.

With that in mind, we’ve compiled a database of all consumer staples stocks, which you can access below:

The list of stocks was derived from a few major consumer staples ETFs:

- Consumer Staples Select Sector SPDR ETF (XLP)

- Invesco Dynamic Food & Beverage ETF (PBJ)

- Invesco S&P Small Cap Consumer Staples ETF (PSCC)

Keep reading this article to learn more about the merits of investing in consumer staples stocks.

Table of Contents

This article provides our full list of all consumer staples stocks, a tutorial on how to use the spreadsheets to create screens of consumer staples stocks, and the top 7 consumer staples stocks now.

The top 7 list was derived from the expected returns of each stock. We calculate expected returns based on a projection of earnings-per-share growth, dividend yields, and changes in the valuation multiple. The 7 consumer staples stocks are ranked by 5-year expected returns, from lowest to highest.

The table of contents below allows for easy navigation:

- How To Use The Consumer Staples Stocks List To Find Investment Ideas

- Why Invest In Consumer Staples Stocks?

- Consumer Staples Stock #7: Newell Brands (NWL)

- Consumer Staples Stock #6: Balchem Corporation (BCPC)

- Consumer Staples Stock #5: Conagra Brands (CAG)

- Consumer Staples Stock #4: Altria Group (MO)

- Consumer Staples Stock #3: Target Corporation (TGT)

- Consumer Staples Stock #2: Walgreens Boots Alliance (WBA)

- Consumer Staples Stock #1: NuSkin Enterprises (NUS)

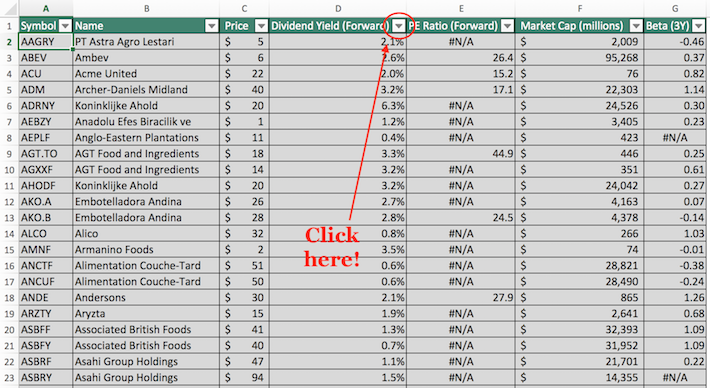

How To Use The Consumer Staples Stocks List To Find Investment Ideas

Having an Excel document containing each dividend-paying consumer staples stocks is very useful.

This tool becomes even more potent when combined with a solid, fundamental knowledge of how to manipulate data with Microsoft Excel. Quantitative investing screeners allow investors to remove many of the cognitive biases that impair long-term investing returns.

With that in mind, this section will provide a step-by-step explanation of how to use the dividend-paying consumer staples stocks list to find the best consumer staples investment ideas by using simple screening techniques.

The first screen that we will implement is for stocks with price-to-earnings ratios below 25,

Screen 1: Avoiding Overvalued Stocks

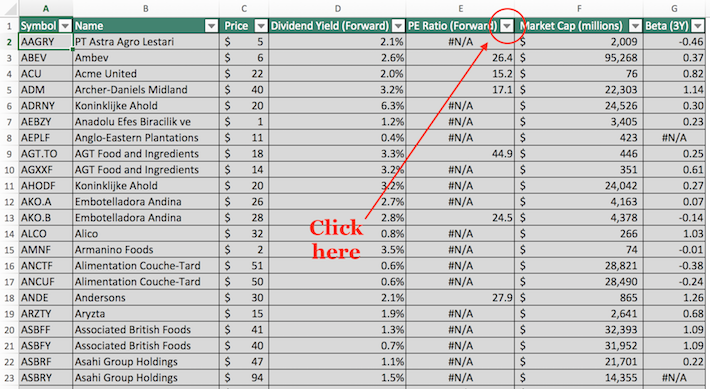

Step 1: Download your free spreadsheet of all 71 consumer staples stocks here.

Step 2: Click on the filter icon at the top of the price-to-earnings ratio column, as shown below.

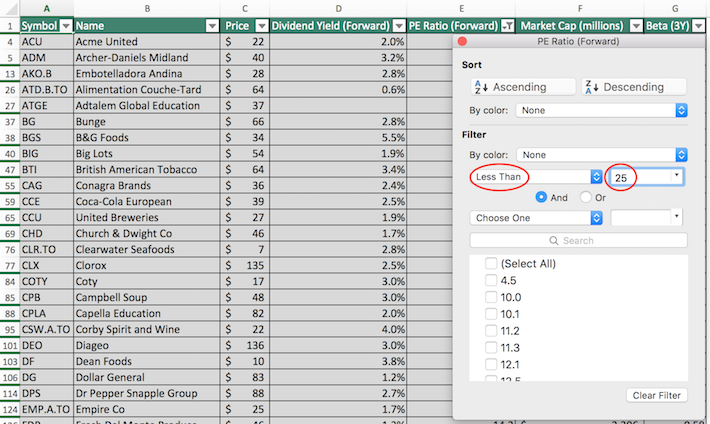

Step 3: Change the filter setting to “Less Than” and input 25 into the field beside it, as shown below.

The remaining stocks in the spreadsheet are consumer staples with price-to-earnings ratio less than 25.

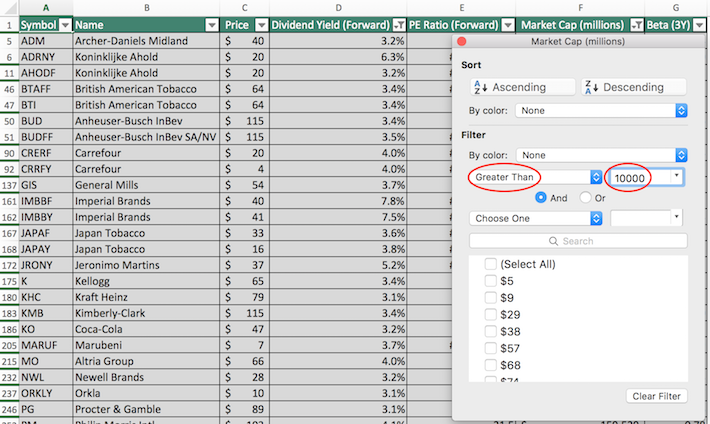

The next screen that we’ll implement is for ‘blue chip stocks’ – those with dividend yields above 3% and market capitalizations above $10 billion.

Screen 2: Blue Chip Stocks

Step 1:Download your free spreadsheet of all 71 consumer staples stocks here.

Step 2: We’ll first filter by dividend yield and then by market capitalization. Importantly, order doesn’t matter – you could also filter by market capitalization and then dividend yield and the screen would output the same results.

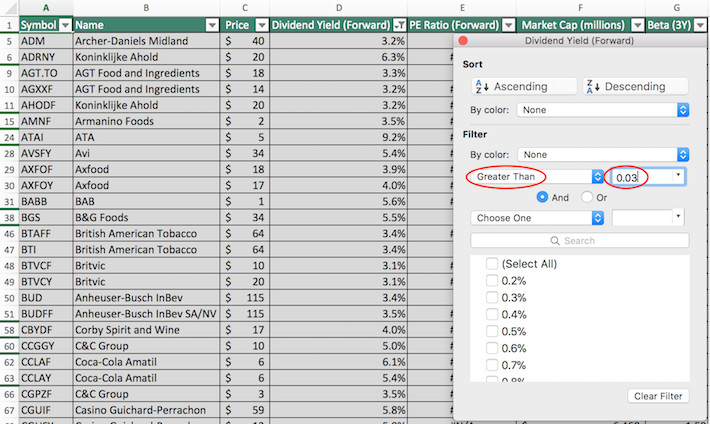

To filter by dividend yield, click the filter icon at the top of the dividend yield icon, as shown above.

Step 3: To filter for dividend yields greater than 3%, change the filter setting to ‘Greater Than’, and input 0.03 into the field beside it.

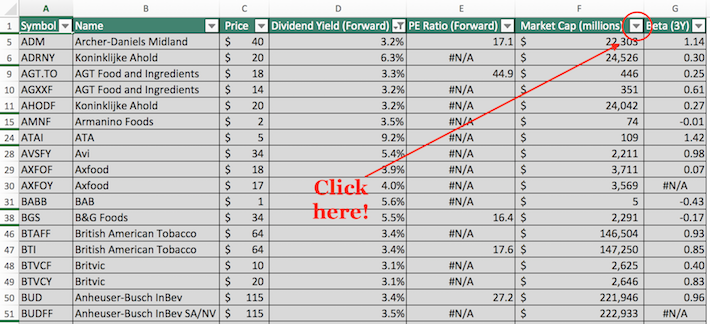

Step 4: Next we’ll execute the screen for market capitalization. Close of out of the previous window (by clicking exit, not by clicking ‘clear filter’ at the bottom of the filter window). Then, click the filter icon at the top of the market capitalization column, as shown below.

Step 5: Change the filter setting to ‘Greater Than’ and input 10000 into the field beside it. Notice that since market capitalization is measured in millions of dollars in this spreadsheet, then filtering for stocks with market capitalizations above ‘$10,000 million’ is equivalent for screening for securities with market capitalizations above $10 billion.

The remaining stocks in this spreadsheet are those with dividend yields above 3% and market capitalizations above $10 billion.

You now have a solid understanding of how to use the dividend-paying consumer staples stocks spreadsheet to find compelling investment ideas. The next section will provide a summary of why the consumer staples sector merits an allocation in your investment portfolio.

Why Invest In Consumer Staples Stocks?

Consumer staples stocks are an appealing investment category for a number of reasons.

First of all, consumer staples stocks are very recession-resistant by definition. Consumer staples companies make products or deliver services that are considered to be ‘staples’ – in other words, consumers can’t do without them.

Food stocks within the consumer staples sector are an excellent example of this. Consumers are likely to buy more food products during recessions as they cut back on dining out to conserve funds during difficult economic times.

Alcohol stocks are another example. People tend to drink at least the same amount (if not more) when times get tough.

This means that consumer staples stocks tend to hold up very well during periods of economic turmoil. This can be seen by studying the sector’s performance during the 2007-2009 financial crisis.

During 2008, for example, the consumer staples sector returned -15%. While this seems bad on the surface, it is actually very good on a relative basis. Here’s the performance of some other sectors during the same calendar year:

- Financials: -55%

- Materials: -44%

- Technology: -41%

Clearly, the performance of the consumer staples sector beat these other industries by a wide margin despite being negative itself. In fact, consumer staples was the single best performing sector during calendar year 2008.

The consumer staples sector stands up well during times of recessions, implying that the sector presents less risk than many of its counterparts.

Amazingly, the sector’s long-term performance has also been one of the best. The sector has demonstrated a remarkable ability to generate consistently high returns on invested capital, avoiding the mean reversion experienced by many other highly profitable industries.

While traditional academic theory tells us that investors must assume extra risk to generate incremental returns, the outperformance of the recession-resistant consumer staples sector tells us that this isn’t true in practice. The sector’s combination of high returns and low risk make it a uniquely appealing sector for conservative total return investors.

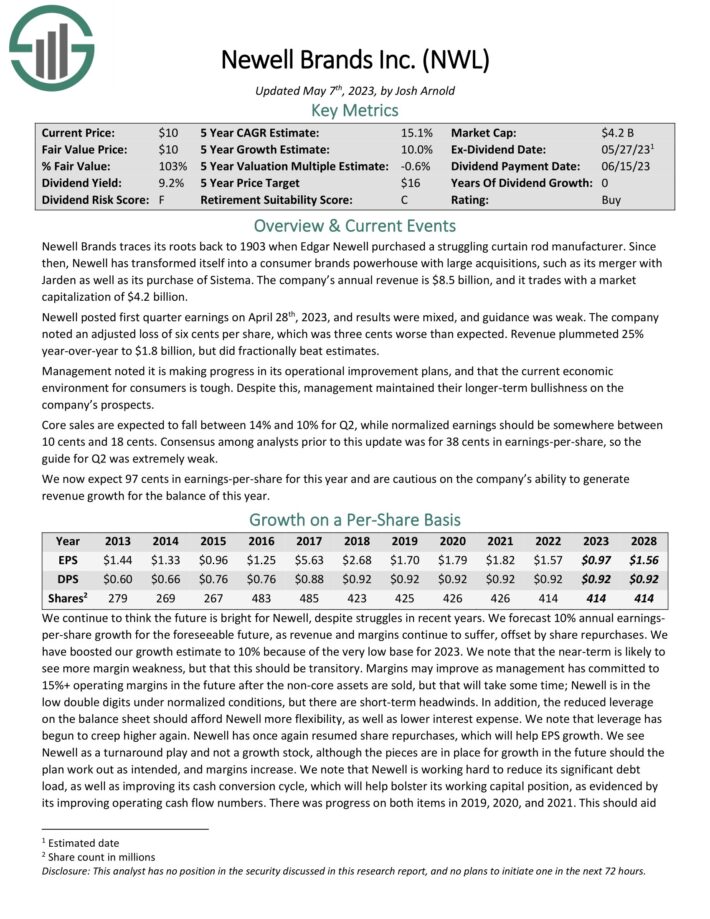

Consumer Staples Stock #7: Newell Brands (NWL)

- Expected Annual Returns: 11.8%

Newell Brands’ annual revenue is $8.5 billion. Newell posted first quarter earnings on April 28th, 2023, and results were mixed, and guidance was weak. The company noted an adjusted loss of six cents per share, which was three cents worse than expected. Revenue plummeted 25% year-over-year to $1.8 billion, but did fractionally beat estimates.

Management noted it is making progress in its operational improvement plans, and that the current economic environment for consumers is tough. Despite this, management maintained their longer-term bullishness on the company’s prospects. Core sales are expected to fall between 14% and 10% for Q2, while normalized earnings should be somewhere between 10 cents and 18 cents.

Click here to download our most recent Sure Analysis report on NWL (preview of page 1 of 3 shown below):

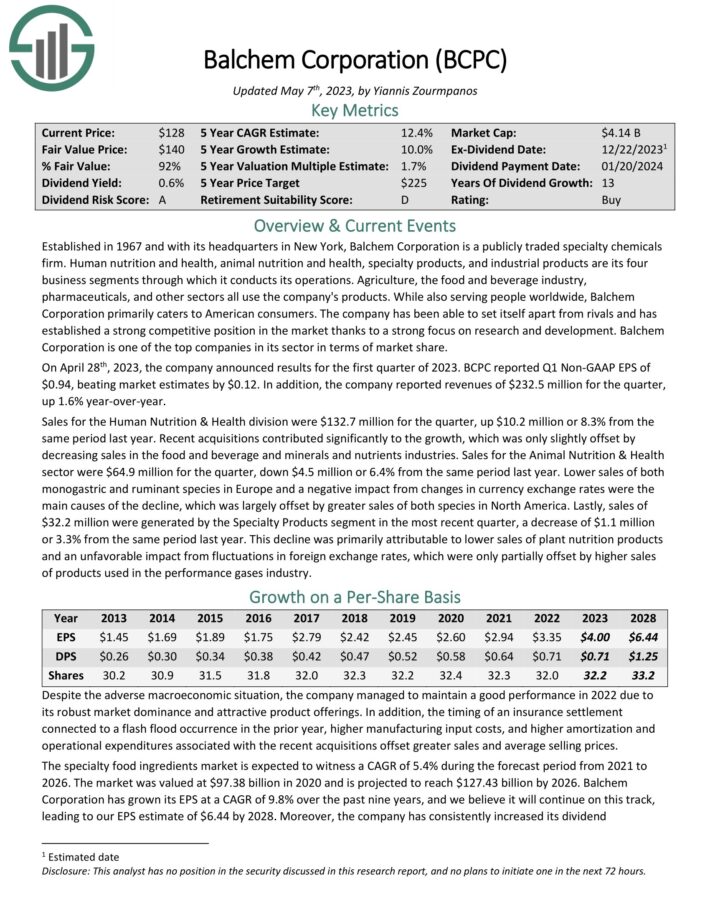

Consumer Staples Stock #6: Balchem Corporation (BCPC)

- Expected Annual Returns: 11.9%

Balchem Corporation is a publicly traded specialty chemicals firm. Human nutrition and health, animal nutrition and health, specialty products, and industrial products are its four business segments through which it conducts its operations. Agriculture, the food and beverage industry, pharmaceuticals, and other sectors all use the company’s products.

The company has been able to set itself apart from rivals and has established a strong competitive position in the market thanks to a strong focus on research and development. Balchem Corporation is one of the top companies in its sector in terms of market share.

On April 28th, 2023, the company announced results for the first quarter of 2023. BCPC reported Q1 Non-GAAP EPS of $0.94, beating market estimates by $0.12. In addition, the company reported revenues of $232.5 million for the quarter, up 1.6% year-over-year.

Click here to download our most recent Sure Analysis report on BCPC (preview of page 1 of 3 shown below):

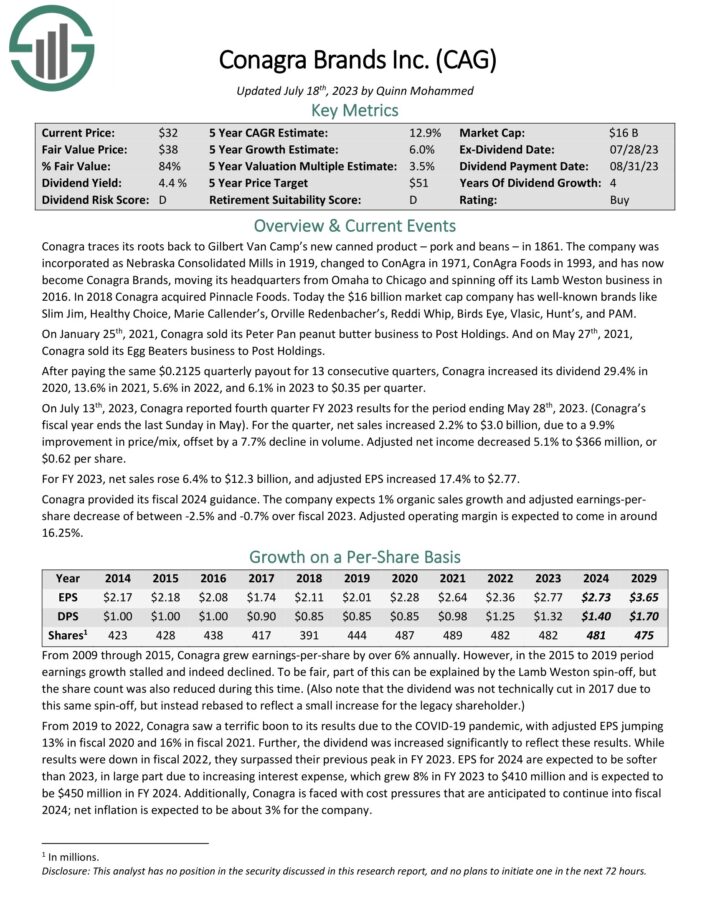

Consumer Staples Stock #5: Conagra Brands (CAG)

- Expected Annual Returns: 12.0%

Conagra is a food company with well-known brands like Slim Jim, Healthy Choice, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

On July 13th, 2023, Conagra reported fourth quarter FY 2023 results for the period ending May 28th, 2023. (Conagra’s fiscal year ends the last Sunday in May). For the quarter, net sales increased 2.2% to $3.0 billion, due to a 9.9% improvement in price/mix, offset by a 7.7% decline in volume. Adjusted net income decreased 5.1% to $366 million, or $0.62 per share. For FY 2023, net sales rose 6.4% to $12.3 billion, and adjusted EPS increased 17.4% to $2.77.

Click here to download our most recent Sure Analysis report on CAG (preview of page 1 of 3 shown below):

Consumer Staples Stock #4: Altria Group (MO)

- Expected Annual Returns: 12.1%

Altria Group was founded by Philip Morris in 1847 and today has grown into a consumer staples giant. While it is primarily known for its tobacco products, it is significantly involved in the beer business due to its 10% stake in global beer giant Anheuser-Busch InBev.

Related: The Best Tobacco Stocks Now, Ranked In Order

The Marlboro brand holds over 42% retail market share in the U.S.

On April 27th, 2023, Altria reported first-quarter results. Its adjusted diluted earnings per share came in at $1.18, up 5.4% year-over-year, while its net revenues declined by 2.9% year-over-year. Management reaffirmed its 2023 full year guidance range of adjusted diluted earnings per share of between $4.98 and $5.13, reflecting a potential growth range of 3-6% year-over-year.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

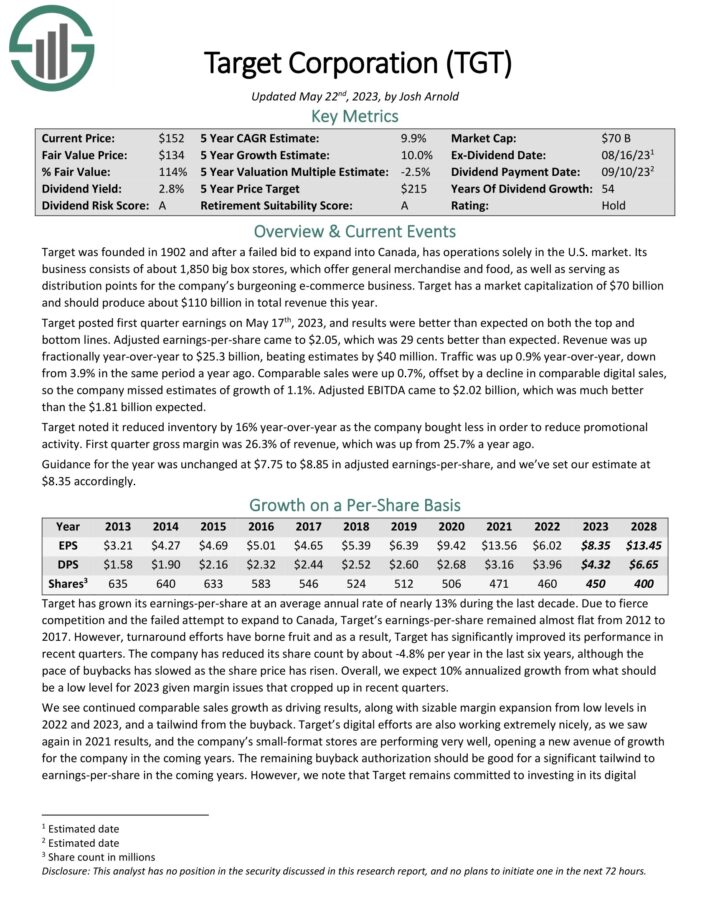

Consumer Staples Stock #3: Target Corporation (TGT)

- Expected Annual Returns: 12.7%

Target is a discount retail operations solely in the U.S. market. Its business consists of about 2,000 big box stores offering general merchandise and food and serving as distribution points for its burgeoning e-commerce business. Target should produce about $110 billion in total revenue this year.

Target reported fourth-quarter and full-year earnings on February 28th, 2023, and results were better than expected on both the top and bottom lines and by wide margins.

Source: Investor Infographic

Target posted first quarter earnings on May 17th, 2023, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.05, which was 29 cents better than expected. Revenue was up fractionally year-over-year to $25.3 billion, beating estimates by $40 million.

Traffic was up 0.9% year-over-year, down from 3.9% in the same period a year ago. Comparable sales were up 0.7%, offset by a decline in comparable digital sales, so the company missed estimates of growth of 1.1%. Adjusted EBITDA came to $2.02 billion, which was much better than the $1.81 billion expected.

Click here to download our most recent Sure Analysis report on Target Corporation (preview of page 1 of 3 shown below):

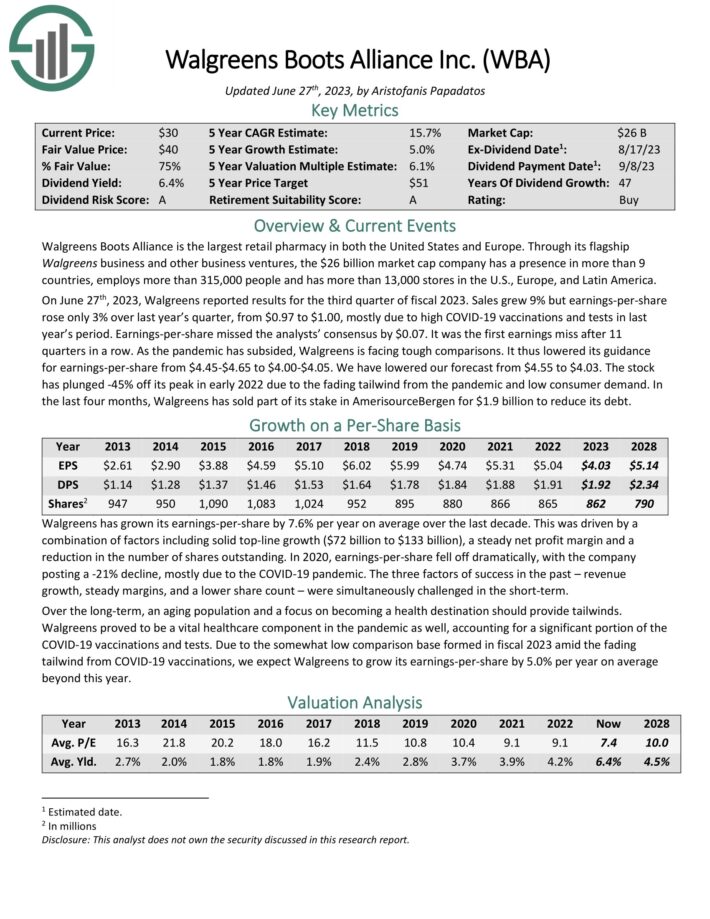

Consumer Staples Stock #2: Walgreens Boots Alliance (WBA)

- Expected Annual Returns: 15.2%

Walgreens Boots Alliance is the largest retail pharmacy in the United States and Europe. The company has a presence in more than nine countries through its flagship Walgreens business and other business ventures.

Source: Investor Presentation

On June 27th, 2023, Walgreens reported results for the third quarter of fiscal 2023. Sales grew 9% but earnings-per-share rose only 3% over last year’s quarter, from $0.97 to $1.00, mostly due to high COVID-19 vaccinations and tests in last year’s period. Earnings-per-share missed the analysts’ consensus by $0.07.

It was the first earnings miss after 11 quarters in a row. As the pandemic has subsided, Walgreens is facing tough comparisons. It lowered its guidance for earnings-per-share from $4.45-$4.65 to $4.00-$4.05.

Click here to download our most recent Sure Analysis report on Walgreens Boots Alliance (preview of page 1 of 3 shown below):

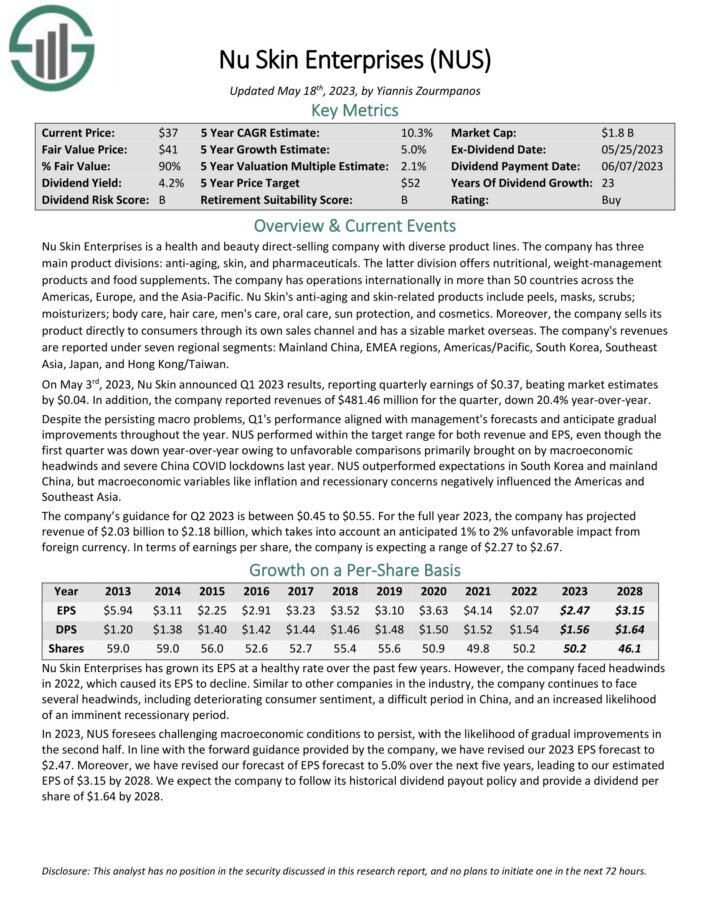

Consumer Staples Stock #1: NuSkin Enterprises (NUS)

- Expected Annual Returns: 16.1%

Nu Skin Enterprises is a health and beauty direct-selling company with diverse product lines. The company has three main product divisions: anti-aging, skin, and pharmaceuticals. The latter division offers nutritional, weight management products and food supplements. The company has operations internationally in more than 50 countries across the Americas, Europe, and the Asia-Pacific.

Nu Skin’s anti-aging and skin-related products include peels, masks, scrubs; moisturizers; body care, hair care, men’s care, oral care, sun protection, and cosmetics. Moreover, the company sells its product directly to consumers through its own sales channel and has a sizable market overseas.

On May 3rd, 2023, Nu Skin announced Q1 2023 results, reporting quarterly earnings of $0.37, beating market estimates by $0.04. In addition, the company reported revenues of $481.46 million for the quarter, down 20.4% year-over-year. Despite the persisting macro problems, Q1’s performance aligned with management’s forecasts and anticipate gradual improvements throughout the year.

The company’s guidance for Q2 2023 is between $0.45 to $0.55. For the full year 2023, the company has projected revenue of $2.03 billion to $2.18 billion, which takes into account an anticipated 1% to 2% unfavorable impact from foreign currency. In terms of earnings per share, the company is expecting a range of $2.27 to $2.67.

Click here to download our most recent Sure Analysis report on NUS (preview of page 1 of 3 shown below):

Final Thoughts

The consumer staples sector is an intriguing place to looks for high-quality dividend investment ideas.

If you’re willing to look outside of this sector while hunting for investment opportunities, the following stock databases are highly useful:

- The Dividend Aristocrats List: S&P 500 Index stocks with 25+ years of consecutive dividend increases

- The Dividend Achievers List: dividend stocks with 10+ years of consecutive dividend increases

- The Dividend Kings List: dividend stocks with 50+ years of consecutive dividend increases

Investing is a unique craft because we have the ability to ‘cheat’ off the moves of the world’s greatest investors.

Large, institutional investment managers with more than $100 million in assets under management are required to disclose their portfolio holdings on a quarterly basis through a regulatory filing called a 13F.

With this in mind, there is no better investor than Berkshire Hathaway’s Warren Buffett. We provide a detailed quarterly analysis on Warren Buffett’s stock portfolio, which you can access below:

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

- The Complete List Of Utility Stocks

- The Complete List Of Communication Services Stocks

- The Complete List Of Healthcare Stocks

- The Complete List Of Consumer Discretionary Stocks

- The Complete List Of Financials Stocks

- The Complete List Of Technology Stocks

- The Complete List Of Real Estate Stocks

- The Complete List Of Energy Stocks

- The Complete List Of Materials Stocks

- The Complete List Of Industrial Stocks