Updated on July 28th, 2023 by Bob Ciura

Income investors have faced a significant challenge in recent years. Generating suitable income to live off a dividend portfolio has not been easy, as the Federal Reserve kept interest rates low for many years. And, soaring stock prices caused the average dividend yield of the S&P 500 Index to sink to multi-decade lows.

Interest rates are rising again, but even so, the average dividend yield of the S&P 500 Index is just ~1.7%.

We recommend income investors focus on quality dividend stocks such as the Dividend Aristocrats, a group of 67 stocks in the S&P 500 Index which have raised their dividends for 25+ consecutive years.

There are currently 67 Dividend Aristocrats. You can download an Excel spreadsheet of all 67 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

At the same time, investors looking for high yields may not find the Dividend Aristocrats immediately attractive, as many of them have relatively low yields. Therefore, the task for income investors hoping to live off their dividends in retirement, is to find stocks that have a combination of a high yield and a high level of dividend safety.

With the proper research, investors can construct a portfolio that allows income investors to live off their dividends in retirement.

Table Of Contents

You can instantly jump to a section of the article by clicking the links below:

- Why Invest In Dividend Stocks For Retirement?

- What Retirees Must Avoid

- 10 Dividend Aristocrats Yielding Over 4%

- Final Thoughts

Why Invest In Dividend Stocks For Retirement?

There are a number of different asset classes that investors can gain exposure to, in the search for higher income. One of the most popular asset classes for retirees is fixed income, otherwise known as bonds. These are debt securities issued by corporations, governments and municipalities which pay investors periodic interest, as well as principal at maturity.

Bonds are certainly a worthwhile selection for income investors such as retirees, particularly for those with a higher level of risk aversion. Bonds generally carry a higher level of safety than stocks, as bondholders are paid before common stockholders.

At the same time, stocks have certain advantages of their own. For investors who are willing to accept a higher level of risk by investing in the stock market, the trade-off is that stocks could pay higher income over the long-run.

The reason is because many quality dividend stocks raise their dividend payouts on a regular basis. The Dividend Aristocrats have raised their dividends for at least 25 consecutive years, while the Dividend Kings have increased their payouts for over 50 years. Contrast this with bonds, which will pay a fixed level of interest to bondholders (which is why bonds are called fixed income).

Consider a hypothetical comparison of an investor who allocates $10,000 into a fixed income security paying 3% a year for 30 years. In year 30, the investor will receive the same 3% payout (equal to $300) as in year 1.

Now consider the case of a quality dividend growth stock that pays a 3% annual dividend on the same $10,000 investment. In year 1, the investor will receive $300. Now assume that the stock raises its dividend by 5% per year. In year 30, the stock would pay a dividend of nearly $1,300. And, the investor would receive an even higher payout in year 30 by reinvesting dividends each year along the way.

This is the concept of yield on cost. Taking the $1,300 annualized dividend payments and dividing by the initial investment of $10,000, this scenario results in a yield on cost of 13%.

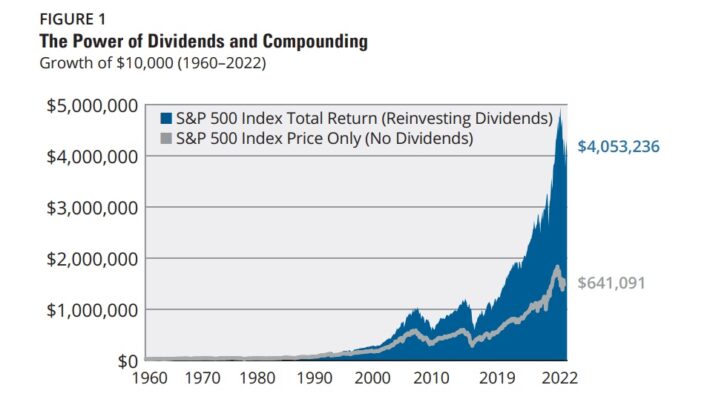

The power of dividends (and reinvesting dividends) is truly remarkable. According to a report from Hartford Funds, since 1960 approximately 84% of the total return of the S&P 500 Index was due to reinvested dividends and compounding.

Source: Hartford Funds

To be sure, retirees do not have 30 years to grow their income. But even without the benefit of a long investing time horizon, retirees can structure a quality portfolio of dividend-paying stocks that allows them to live off their dividends now.

If an investor allocates $10,000 to a portfolio of dividend stocks paying 4%, the year 1 income level would be $400. Using the same hypothetical example of 5% annual dividend growth, in 5 years the investor’s yield on cost would be an attractive 5.1%, resulting in a year 5 dividend payout of $510.

It’s fair to say that a retiree needs more than $510 in annual income to live on dividends. As a result, the typical portfolio size would need to be larger. But assuming an investor has a retirement portfolio of $500,000, a collection of dividend stocks paying 4% per year would result in a year 1 income level of $20,000.

And using the same dividend growth rate of 5% per year, this portfolio would generate dividend income of $25,525 in year 5 (again, this would be even higher if dividends are reinvested). This level of income would afford retirees a much better standard of living, especially when used in combination with Social Security benefits or other sources of income.

It is certainly not difficult finding quality dividend stocks that combine a 4% starting yield with 5% annual dividend growth. At the same time, investors must take precaution to avoid risky stocks with extremely high dividends. Stocks with elevated dividend yields above 5% are instantly appealing for income investors, but retirees must be careful with extreme-high yielders.

Such companies are often in fundamental distress, with collapsing share prices that have elevated their dividend yields to unsustainable levels. This is particularly true when it comes to certain segments of the stock market such as Business Development Companies or mortgage REITs.

What Retirees Must Avoid

The most important thing for retirees investing in the stock market, is to avoid dividend cuts or eliminations. This happens when a company is no longer able to pay the dividend at the current rate, usually due to a drop in company revenue and earnings.

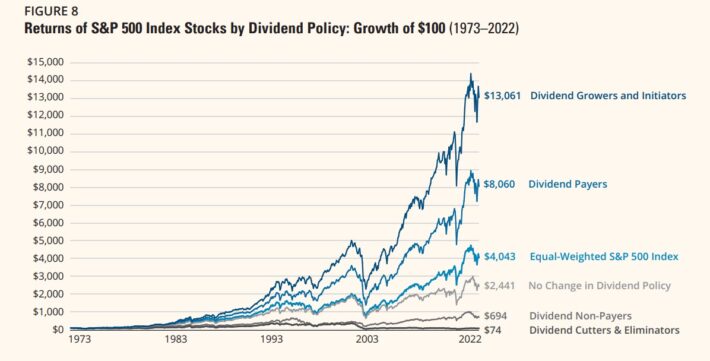

The following graphic shows the historical performance of stocks broken down into several groups, which are dividend growers and initiators; dividend payers; stocks with no change in their dividend policy; stocks that do not pay dividends; and stocks that either reduce or eliminate their dividends. These groups are juxtaposed with the performance of the broader S&P 500 Index:

Clearly, the best-performing group was dividend growth stocks, whereas dividend cutters and eliminators actually lost money for their investors over the ~50 year time frame.

This shows the importance of investing in quality companies that can grow their dividends over long run, and at the same time avoiding companies that cut or eliminate their dividends.

There are a number of different asset classes that investors can gain exposure to, in the search for higher income and sustainable dividends.

The following 10 Dividend Aristocrats have current yields of at least 4%, and can reasonably be expected to grow their dividends each year.

10 Dividend Aristocrats Yielding Over 4%

With all this in mind, the following 10 dividend stocks represent quality businesses with durable competitive advantages. These companies have proved the ability to grow their dividends each year, regardless of the overall economic climate.

They all have dividend yields above 4%, are members of the Dividend Aristocrats, and could be expected to raise their dividends for many years.

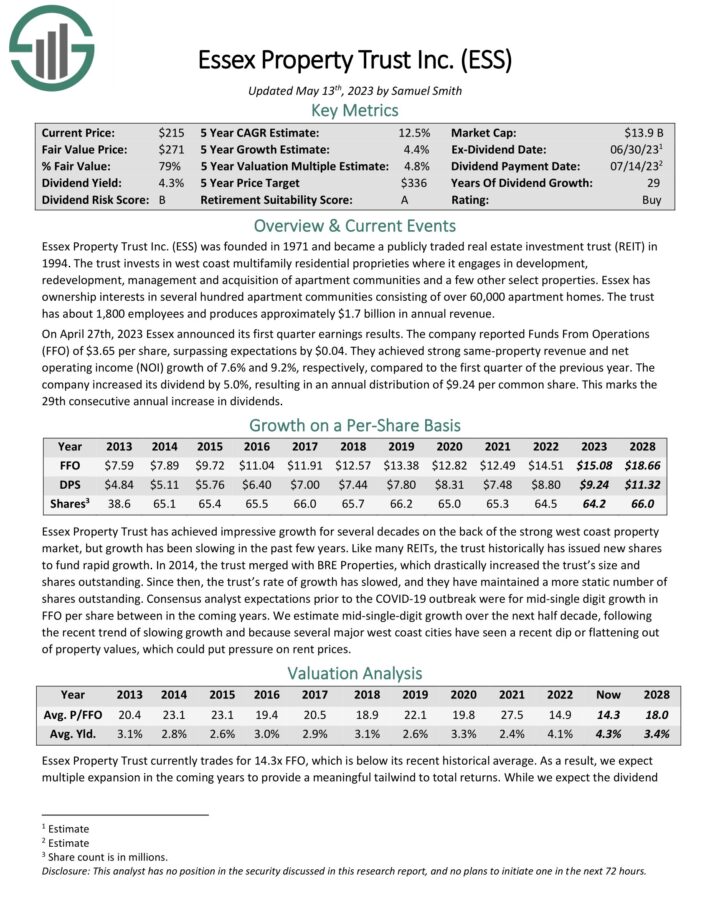

Essex Property Trust (ESS)

- Dividend Yield: 4.0%

Essex Property Trust was founded in 1971. The trust invests in west coast multifamily residential proprieties where it engages in development, redevelopment, management and acquisition of apartment communities and a few other select properties.

Essex has ownership interests in several hundred apartment communities consisting of over 60,000 apartment homes. The trust has about 1,800 employees and produces approximately $1.6 billion in annual revenue.

Source: Investor Presentation

On April 27th, 2023 Essex announced its first quarter earnings results. The company reported Funds From Operations (FFO) of $3.65 per share, surpassing expectations by $0.04. They achieved strong same-property revenue and net operating income (NOI) growth of 7.6% and 9.2%, respectively, compared to the first quarter of the previous year. The company increased its dividend by 5.0%, resulting in an annual distribution of $9.24 per common share. This marks the 29th consecutive annual increase in dividends.

Click here to download our most recent Sure Analysis report on ESS (preview of page 1 of 3 shown below):

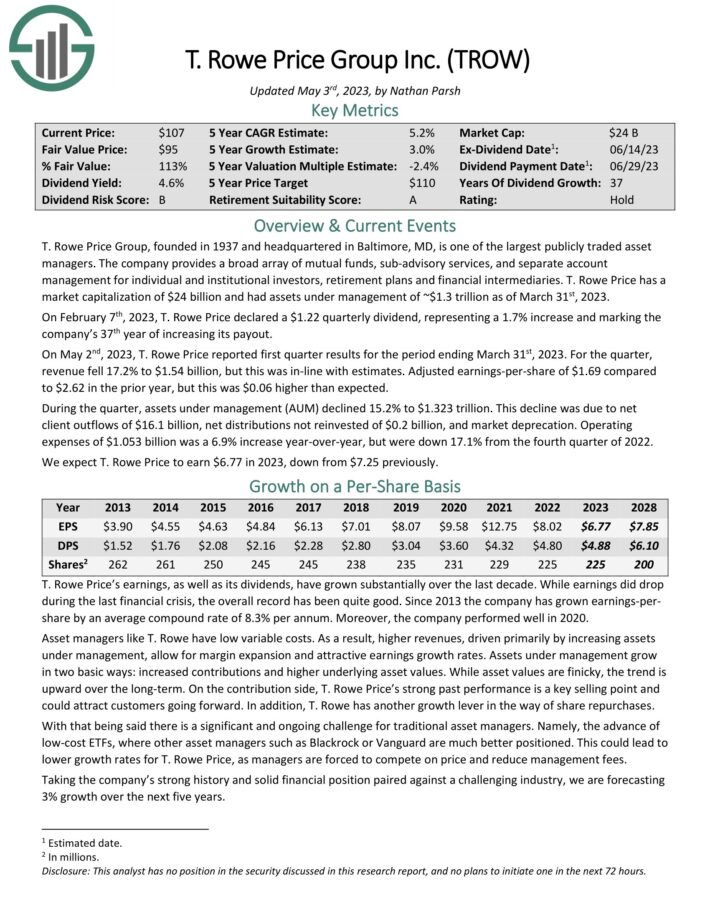

T.Rowe Price (TROW)

- Dividend Yield: 4.2%

T. Rowe Price Group, founded in 1937 and headquartered in Baltimore, MD, is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, sub-advisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries.

On February 7th, 2023, T. Rowe Price declared a $1.22 quarterly dividend, representing a 1.7% increase and marking the company’s 37th year of increasing its payout. On May 2nd, 2023, T. Rowe Price reported first quarter results for the period ending March 31st, 2023. For the quarter, revenue fell 17.2% to $1.54 billion, but this was in-line with estimates. Adjusted earnings-per-share of $1.69 compared to $2.62 in the prior year, but this was $0.06 higher than expected.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

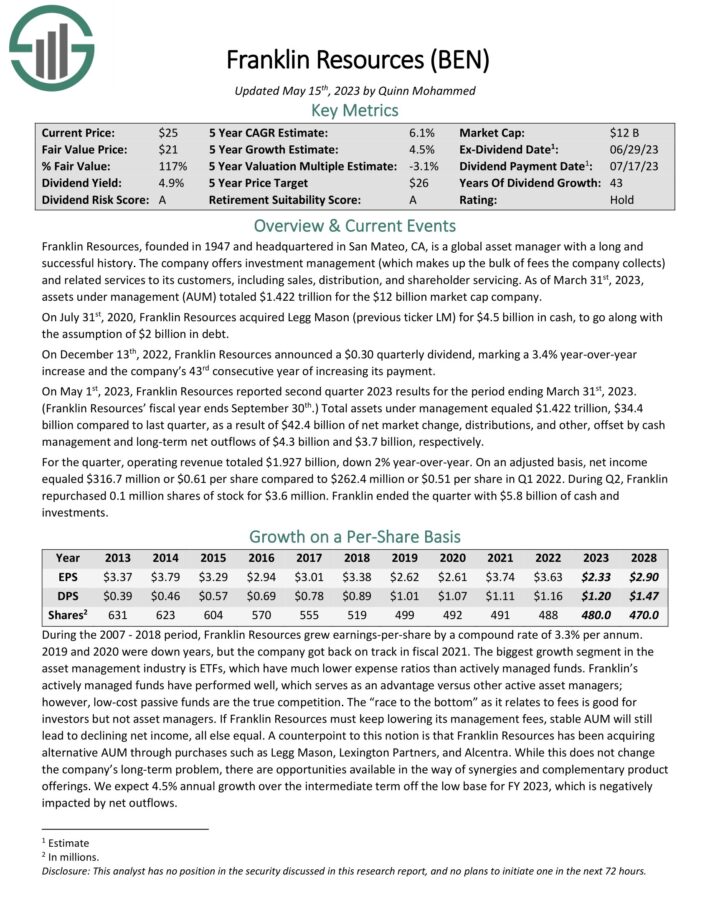

Franklin Resources (BEN)

- Dividend Yield: 4.2%

On December 13th, 2022, Franklin Resources announced a $0.30 quarterly dividend, marking a 3.4% year-over-year increase and the company’s 43rd consecutive year of increasing its payment.

On May 1st, 2023, Franklin Resources reported second quarter 2023 results for the period ending March 31st, 2023. (Franklin Resources’ fiscal year ends September 30th.) Total assets under management equaled $1.422 trillion, $34.4 billion compared to last quarter, as a result of $42.4 billion of net market change, distributions, and other, offset by cash management and long-term net outflows of $4.3 billion and $3.7 billion, respectively.

For the quarter, operating revenue totaled $1.927 billion, down 2% year-over-year. On an adjusted basis, net income equaled $316.7 million or $0.61 per share compared to $262.4 million or $0.51 per share in Q1 2022.

Click here to download our most recent Sure Analysis report on Franklin Resources (preview of page 1 of 3 shown below):

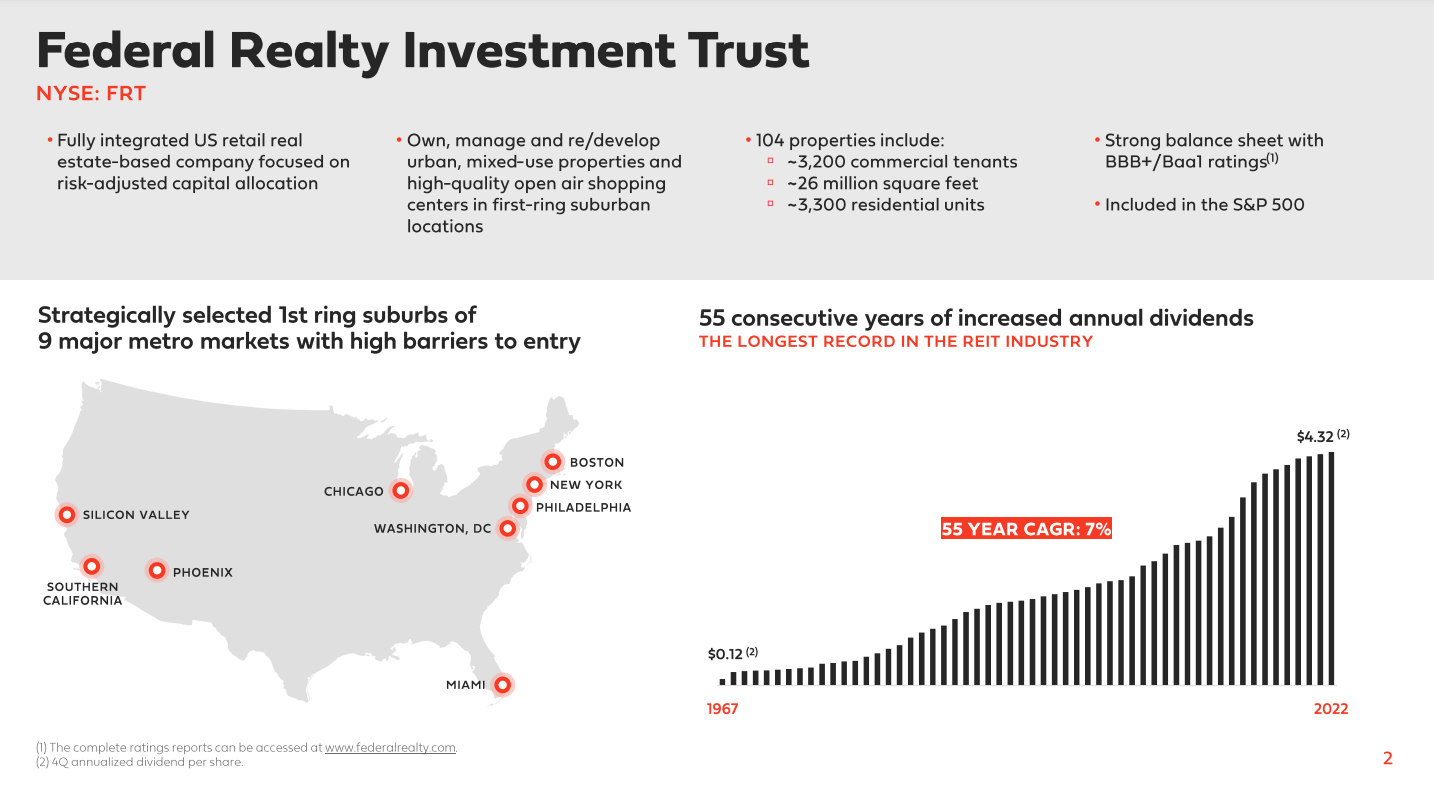

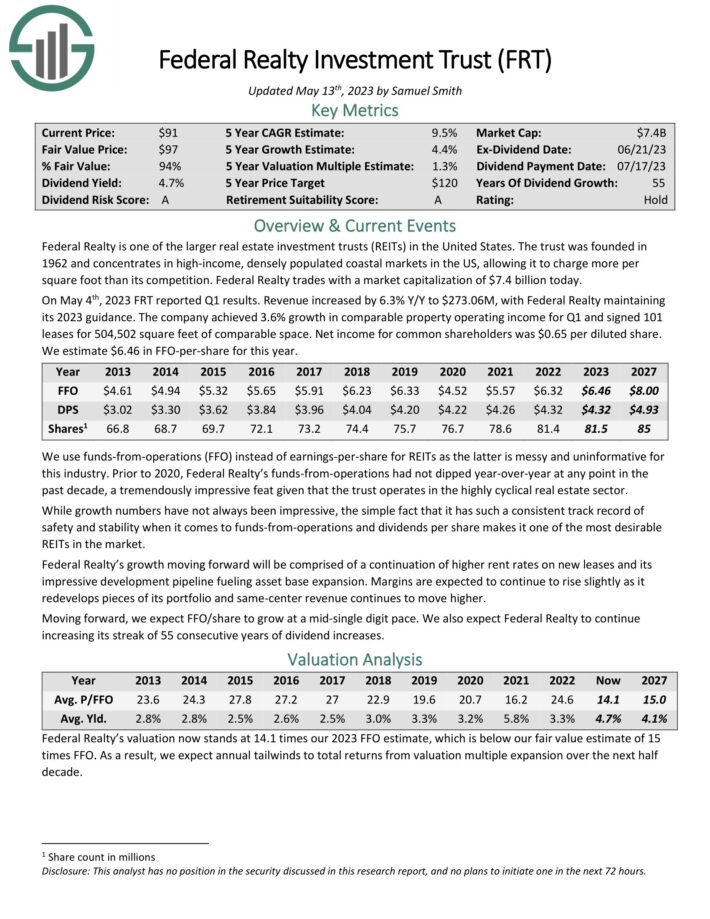

Federal Realty Investment Trust (FRT)

Federal Realty was founded in 1962. As a Real Estate Investment Trust, Federal Realty’s business model is to own and rent out real estate properties. It uses a significant portion of its rental income, as well as external financing, to acquire new properties. This helps create a “snow-ball” effect of rising income over time.

Federal Realty primarily owns shopping centers. However, it also operates in redevelopment of multi-purpose properties including retail, apartments, and condominiums. The portfolio is highly diversified in terms of tenant base.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

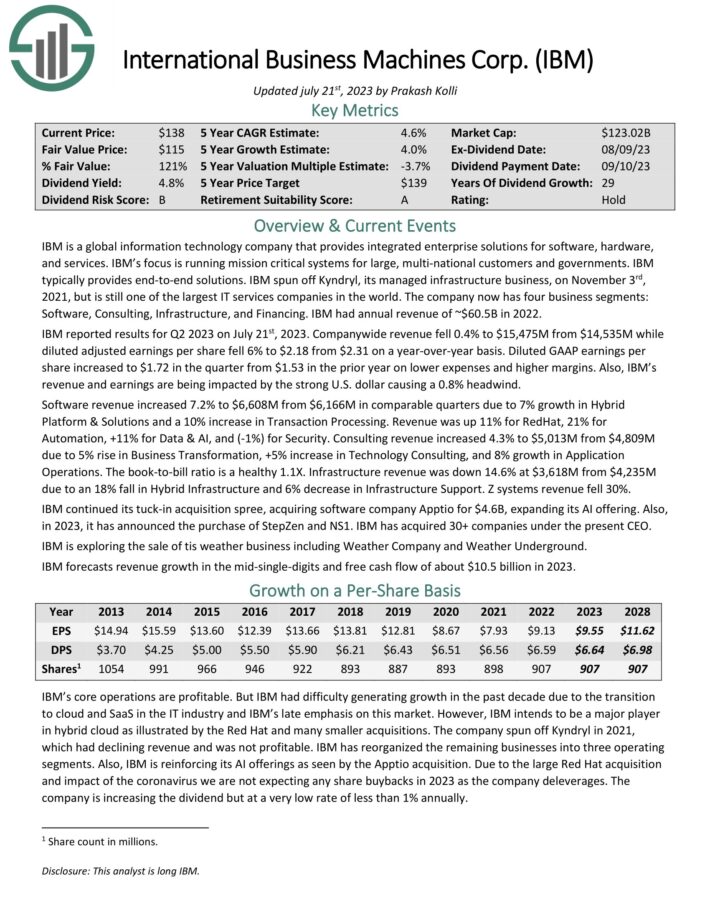

International Business Machines (IBM)

- Dividend Yield: 4.6%

IBM is a global information technology company that provides integrated enterprise solutions for software, hardware, and services. IBM’s focus is running mission-critical systems for large, multi-national customers and governments. IBM typically provides end-to-end solutions. The company now has four business segments: Software, Consulting, Infrastructure, and Financing. IBM had annual revenue of ~$60.5 in 2022.

IBM reported results for Q2 2023 on July 21st, 2023. Companywide revenue fell 0.4% to $15,475M from $14,535M while diluted adjusted earnings per share fell 6% to $2.18 from $2.31 on a year-over-year basis. Diluted GAAP earnings per share increased to $1.72 in the quarter from $1.53 in the prior year on lower expenses and higher margins.

Click here to download our most recent Sure Analysis report on International Business Machines (IBM) (preview of page 1 of 3 shown below):

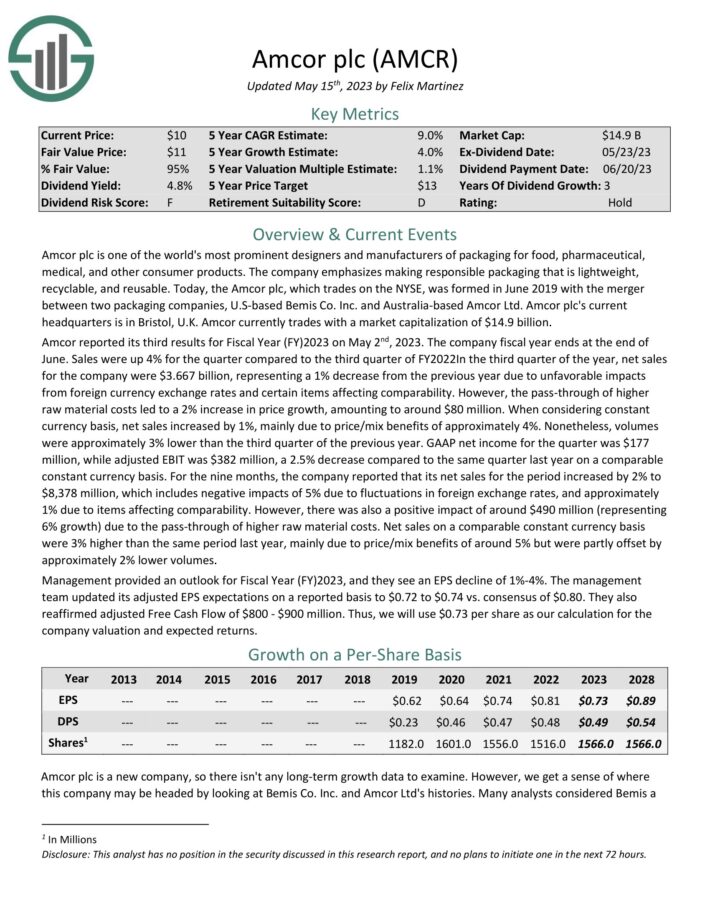

Amcor (AMCR)

- Dividend Yield: 4.8%

Amcor is one of the world’s most prominent designers and manufacturers of packaging for food, pharmaceutical, medical, and other consumer products. The company is headquartered in the U.K.

Amcor reported its third results for Fiscal Year (FY)2023 on May 2nd, 2023. The company fiscal year ends at the end of June. Sales were up 4% for the quarter compared to the third quarter of FY2022In the third quarter of the year, net sales for the company were $3.667 billion, representing a 1% decrease from the previous year due to unfavorable impacts from foreign currency exchange rates and certain items affecting comparability.

Click here to download our most recent Sure Analysis report on Amcor (preview of page 1 of 3 shown below):

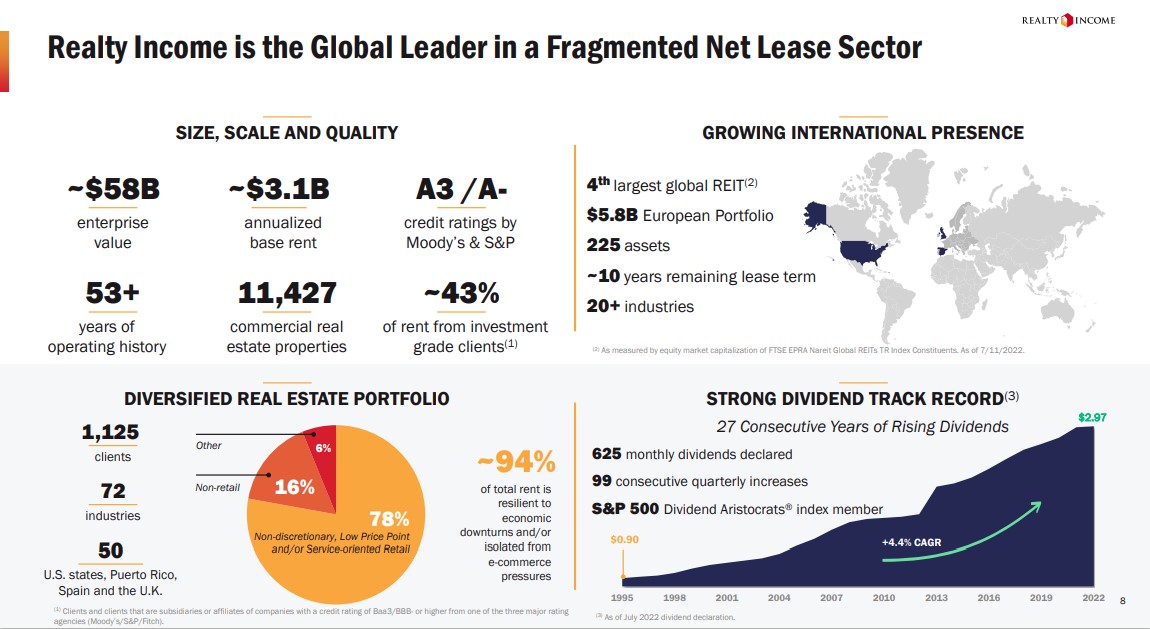

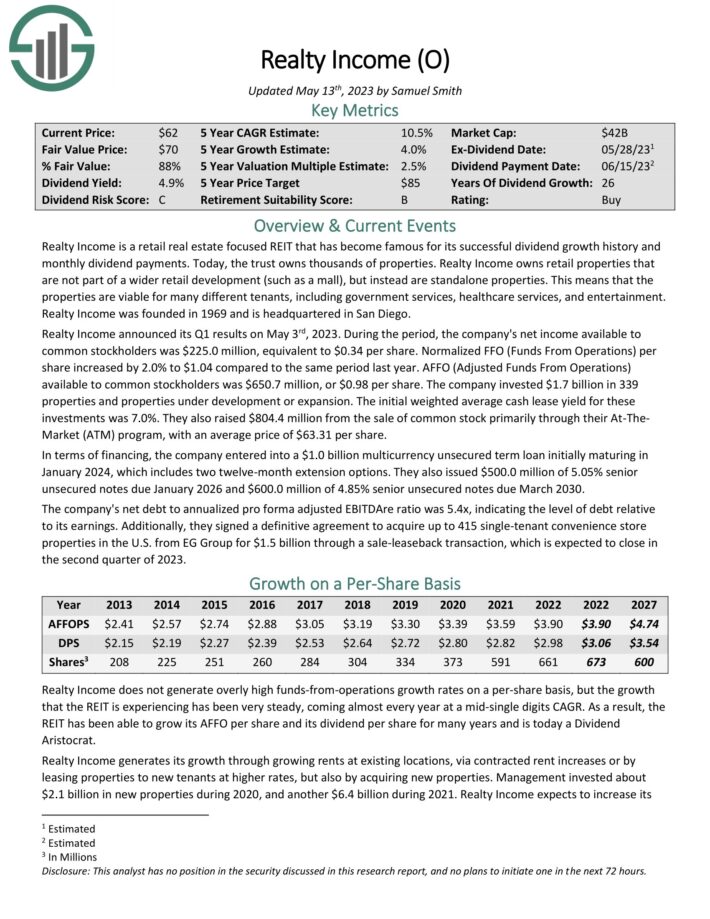

Realty Income (O)

- Dividend Yield: 5.0%

Realty Income is a retail-focused Real Estate Investment Trust (otherwise known as a REIT) that owns more than 6,500 properties. It owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Source: Investor Presentation

The company’s long history of dividend payments and increases is due to its high-quality business model and diversified property portfolio.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

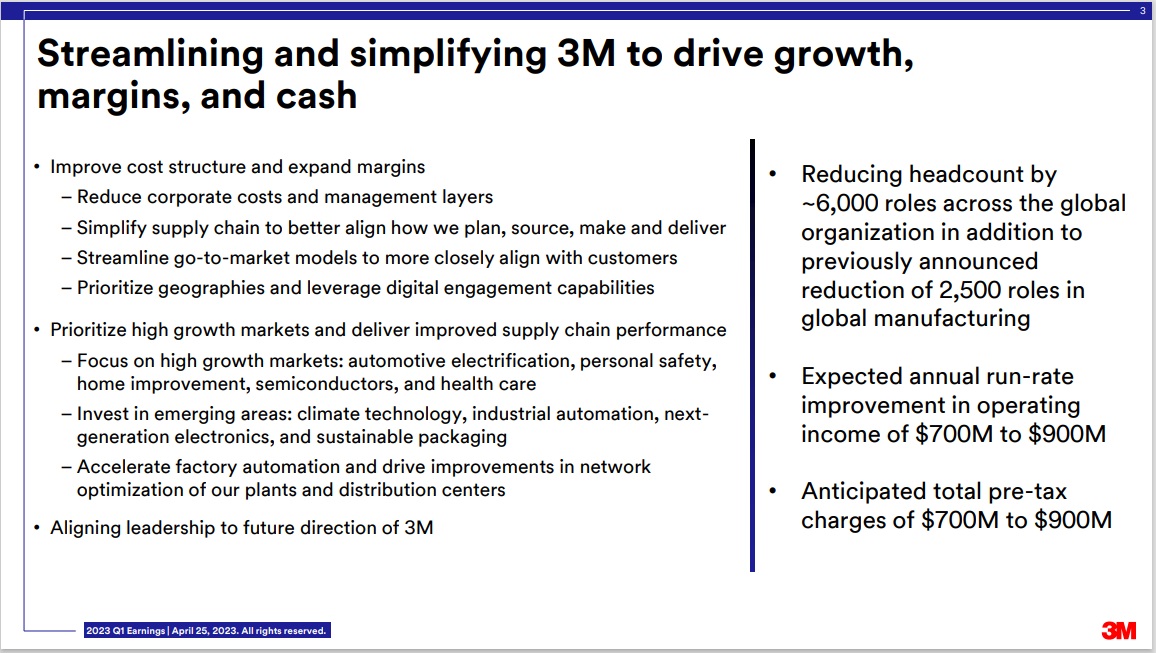

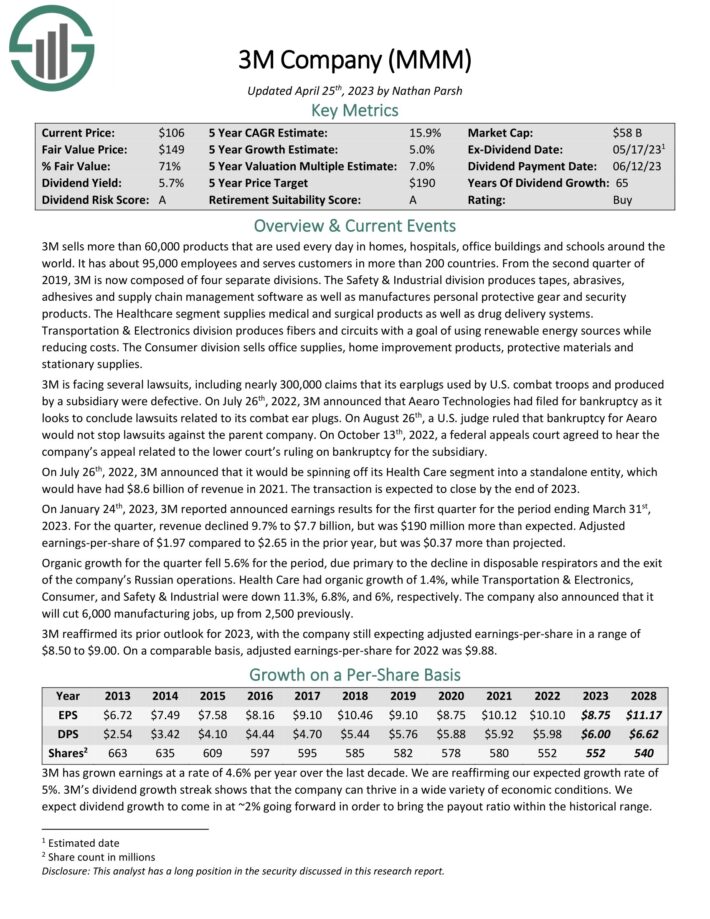

3M Company (MMM)

- Dividend Yield: 5.4%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries.

3M is now composed of four separate divisions: Safety & Industrial, Healthcare, Transportation & Electronics, and Consumer. The company also announced that it would be spinning off its Health Care segment into a standalone entity, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

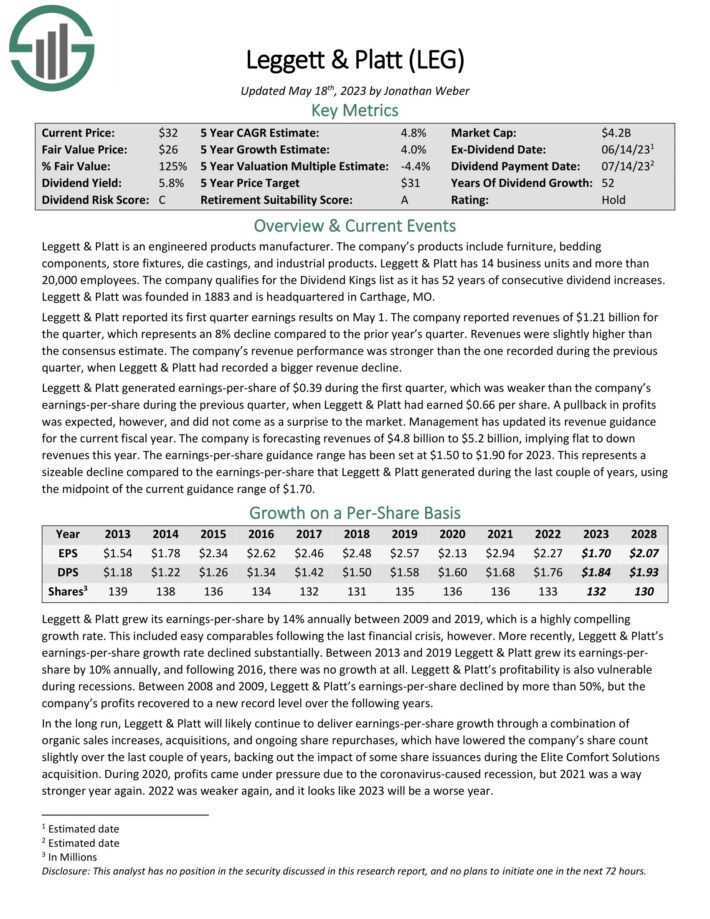

Leggett & Platt (LEG)

- Dividend Yield: 6.2%

Leggett & Platt is an engineered products manufacturer. The company’s products include furniture, bedding components, store fixtures, die castings, and industrial products. Leggett & Platt has 14 business units and more than 20,000 employees.

Leggett & Platt reported its first quarter earnings results on May 1. The company reported revenues of $1.21 billion for the quarter, which represents an 8% decline compared to the prior year’s quarter. Revenues were slightly higher than the consensus estimate. The company’s revenue performance was stronger than the one recorded during the previous quarter, when Leggett & Platt had recorded a bigger revenue decline.

Click here to download our most recent Sure Analysis report on Leggett & Platt (preview of page 1 of 3 shown below):

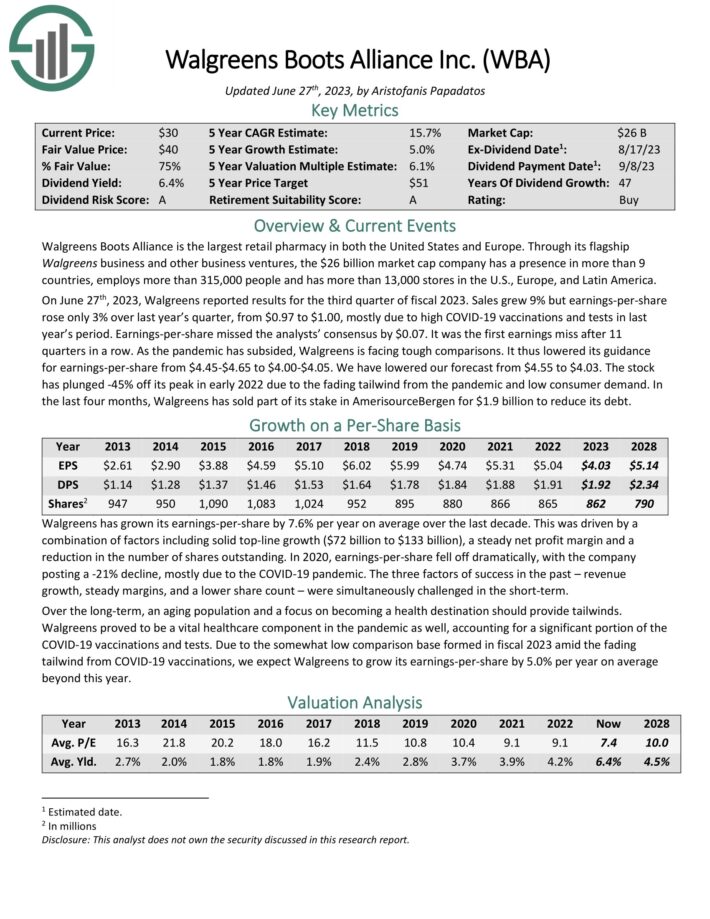

Walgreens Boots Alliance (WBA)

- Dividend Yield: 6.3%

Walgreens Boots Alliance is the largest retail pharmacy in the United States and Europe. The company has a presence in more than nine countries through its flagship Walgreens business and other business ventures.

Source: Investor Presentation

On June 27th, 2023, Walgreens reported results for the third quarter of fiscal 2023. Sales grew 9% but earnings-per-share rose only 3% over last year’s quarter, from $0.97 to $1.00, mostly due to high COVID-19 vaccinations and tests in last year’s period. Earnings-per-share missed the analysts’ consensus by $0.07.

It was the first earnings miss after 11 quarters in a row. As the pandemic has subsided, Walgreens is facing tough comparisons. It lowered its guidance for earnings-per-share from $4.45-$4.65 to $4.00-$4.05.

Click here to download our most recent Sure Analysis report on Walgreens Boots Alliance (preview of page 1 of 3 shown below):

Final Thoughts

Retirees have had a challenge producing satisfactory income over the past decade, due to historically low interest rates which have brought down yields across fixed income and the stock market.

But investors can still generate investment income by buying shares of quality dividend-paying stocks with yields above 4%. And, the best dividend stocks such as the Dividend Aristocrats, can grow their dividends each year. Importantly, dividend growth helps protect investors’ purchasing power against inflation, whereas most bonds do not offer inflation protection.

The 10 dividend stocks on this list can be the foundation of a quality income-producing portfolio, allowing retirees to live on their dividends.

Other Dividend Lists

The Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 50 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.