Updated on January 18th, 2023 by Nathan Parsh

During the COVID-19 pandemic, many businesses and industries were hit hard because of closures. One industry that was hit the hardest was the restaurant industry. Since everything is now open, some of these companies are starting to experience a real return to growth.

A good example of this is Cracker Barrel Old Country Store Inc. (CBRL). While not yet back to pre-pandemic numbers, the company business has improved. This company sports a high dividend yield as well.

CBRL is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We also cover a lot of other different high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Thus, for the following high-yield stocks in this series, we will review Cracker Barrel, with a dividend yield of 4.8%.

Business Overview

Cracker Barrel Old Country Store was established in 1969 as a restaurant concept that embraces America’s heritage. It sells home-style food at modest prices. It differentiates itself from competitors within the casual dining industry with unique menu offerings. For example, some of Cracker Barrel’s most popular menu items are its meatloaf and signature biscuits.

It also operates a gift shop. Cracker Barrel generates annual sales of approximately $3.3 billion and the stock trades with a market capitalization of $2.4 billion. The bulk of company sales comes from its restaurant operations, while the company also derives revenue from its in-store retail business.

The company owns and operates two unique brands. The primary and core brand is Cracker Barrel Old Country Store. The other Brand is Maple Street Biscuit Company, which was acquired in 2019. The company has 664 stores that welcome approximately 225 million guests in a typical year with travelers making up about 35%-40% of those visits. Restaurant sales contribute 80% of revenue, while the retail shop, which is integral to the Cracker Barrel brand, makes up 20% of revenue.

Source: Investor Presentation

On December 2nd, 2022, the company reported first-quarter results for fiscal year 2023. The company fiscal year ends at the end of July of each year. For the first quarter, the company’s total revenue increased by 14.4% compared to 2Q2019, which was pre-COVID-19. Total revenue increased 7% to $839.5 million year-over-year. Comparable store restaurant sales increased by 7.1% while similar store retail sales increased by 4.3%.

GAAP operating income for the first quarter was $23.6 million, or 2.8% of total revenue, and adjusted operating income was $30.0 million, or 3.6% of total revenue. GAAP net income was $17.1 million, or 2.0% of total revenue. Adjusted EBITDA was $54.8 million, or 6.5% of total revenue.

Adjusted operating income for the first quarter was $30 million, which was a 35% decline from the prior year that was caused by higher commodity and wage inflation. GAAP earnings per diluted share were $0.77, and adjusted earnings per diluted share were $0.99.

Growth Prospects

The company is currently in 45 states with the most footprint on the mid to east coast. This leaves the company with plenty of growth prospects to expand west. Management expects to open a net 66 to 71 stores this fiscal year. The company can also grow traffic with a frequency strategy of earning one more visit from current guests per year as well as attract new customers via new occasions and revenue sources.

Source: Investor Presentation

Another growth driver would be making the restaurants more appealing to the Gen z and Millennials without losing their core uniqueness. For example, Gen z and Millennials make up ~10% and ~20% of the company’s core guests, respectively. The Boomers and Matures make up 49% of the company’s core guests. This is concerning to investors as this age group gets older and older. This has the potential to hurt the company in the long run.

Acquiring others like restaurants would also help the company continue to grow. For example, the acquisition of Maple Street in 2019 complements the Cracker Barrel brand.

Competitive Advantages & Recession Performance

Cracker Barrel’s competitive advantage is its authentic experiential brand. The company has a unique culture of caring hospitality, which people of all ages love when they visit one of its restaurants. The company’s earnings performed very well during the Great Recession. However, the share price performance was very poor during this time. For example, in 2007, the share price was as high as $50.37 per share and as low as $11.64 per share in 2008. This was about a 56% decrease in share price in a little over a year and a half.

CBRL’s earnings-per-share throughout the Great Recession:

• 2007 earnings-per-share of $2.52

• 2008 earnings-per-share of $2.79 (11% increase)

• 2009 earnings-per-share of $2.89 (4% increase)

• 2010 earnings-per-share of $3.62 (25% increase)

As you see, the company did very well during the 2008-2009 Great Recession. Almost like the recession was not even there. But as we mentioned above, the share price performed miserably at the time.

On the bright side, those investors who held through the Great Recession did very well and were paid a growing dividend while waiting for a recovery.

Dividend Analysis

Before the COVID-19 pandemic, the company had a strong dividend growth history of nine consecutive years of dividend growth. The company had a nine-year dividend growth rate of 22.7%, which is outstanding. However, because of the COVID-19 pandemic, the company had to freeze its dividend. On May 25, 2021, CBRL announced a 23.1% dividend cut compared to its prior dividend.

The following quarter, the company increased its dividend by 30% and back to the levels before the COVID-19 pandemic. This is very promising. This shows that the management team believes that the company will make it through this and continue its growth as before.

It should be noted that the dividend has not increased since, but this is a better performance than most restaurant companies. The lack of a recent dividend raise is likely the prudent move as the payout ratio has climbed considerably higher as higher inflationary and wage pressures weigh on the business. The dividend looks safe going forward.

We expect the company will make $5.86 per share in earnings in FY2023. This will give us a dividend payout ratio of 89%. We also expect the company to continue to grow earnings by 4.5% for the next five years. Thus, in 2028, we anticipate that Cracker Barrel will make $7.30 per share, bringing down the dividend payout ratio to a slightly lower level of 80%.

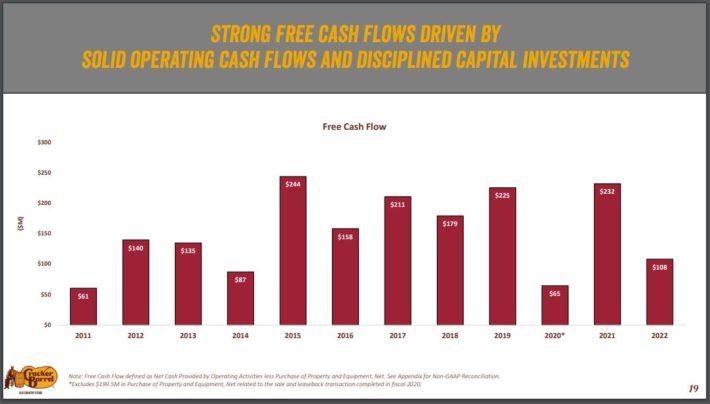

Free cash flow growth since the pandemic has been strong at times, but also inconsistent. Stabilizing growth in this area would go a long way towards protecting the dividend, if not raising it.

Source: Investor Presentation

Given the high payout ratio as well as a debt-to-equity ratio of just 1.0, we believe that the dividend could be at risk for being cut in the future if the overall business doesn’t improve.

Final Thoughts

Cracker Barrel is on its way towards recovering fully from the COVID-19 outbreak and related impacts. The ability to both reinstate and maintain the dividend is a testament to the brand, but the dividend could be hard to fund if Cracker Barrel sees a downturn in its business.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more