Published on January 5th, 2023 by Josh Arnold

When investors think of great dividend stocks, the well-known, larger names tend to come to mind. However, there are many strong income names that are on the smaller side in terms of market cap, and in this article, we’ll take a deeper look at one of them.

That stock is PetMed Express (PETS), a company with a market cap of under $400 million, but a very high yield and impressive 13-year streak of raising its payout. In fact, the 6.5% current yield is good enough to land PetMed Express on our list of high-yield stocks.

This list contains about 200 stocks with yields of at least 5%, meaning they all yield at least three times that of the S&P 500.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Below, we’ll analyze the prospects of PetMed Express as an investment opportunity today.

Business Overview

PetMed Express is a pet pharmacy business that is based in the US. The company provides prescription and non-prescription therapies and medications, health products, vitamins and supplements, food, and other products for dogs, cats, and horses. In addition, it sells hard goods such as beds, crates, and other related products. The company was founded in 1996, generates about $270 million in annual revenue, and trades with a market cap of $374 million.

Source: Investor presentation, page 4

The company reported second quarter earnings on November 7th, 2022, and results were quite weak. Total revenue was $65.4 million, which was down about 3% from the year-ago period. Adjusted EBITDA was $7.1 million, off from $9.8 million a year ago, a decline of 28%. The decline in adjusted EBITDA was worse than revenue due to deleveraging of operating costs, which resulted in lower profit margins. The company said revenue was stabilizing after multiple quarters of decline, which it attributed to the growth of its AutoShip & Save subscription program. That program accounted for 39% of total revenue in Q2, which was up from 34% in the prior quarter.

Net income was $3.9 million on an adjusted basis, or 18 cents per share. These were down from $6.3 million and 31 cents, respectively, in the comparable period a year ago. Following second quarter results, we now expect PetMed Express to generate 77 cents per share in adjusted earnings for this year, which would be a decline of roughly one-quarter from the year-ago period, should it come to fruition.

Growth Prospects

PetMed Express has had a somewhat spotty history when it comes to earnings growth. The company has seen what amount to boom and bust cycles in earnings, and it is firmly in the grip of a bust cycle today. Earnings-per-share peaked in 2019 at $1.84, but we expect well under half that value for this year’s earnings. Higher levels of competition, increased freight costs, and supply chain constraints have all contributed to the company’s declining earnings in the past handful of years.

However, we do not expect these headwinds to persist forever, and believe the current level of earnings is one the company can grow from in the years to come. In fact, we see 5% projected earnings-per-share growth from fiscal 2023’s level of 77 cents. This growth could accrue from a combination of higher revenue and higher profit margins. As revenue increases, it will leverage down the company’s operating costs, which will help boost profit margins.

We see fiscal 2023 as the near-term bottom for revenue, which should help boost earnings-per-share in the years to come. We note the supply chain and logistics headwinds are wildcards, and the timing of when those headwinds are alleviated will help determine the path for earnings. However, we are optimistic that estimates have fallen enough at this point.

Competitive Advantages

The business PetMed Express operates in is highly competitive, and given competitors all sell the same products, it is somewhat commoditized. That means entrants in the pet supply business struggle to create advantages, and PetMed Express is no different. In fact, we do not believe the company has much of an advantage over peers, which is evidenced by its inability to sustainably grow revenue and earnings in recent years.

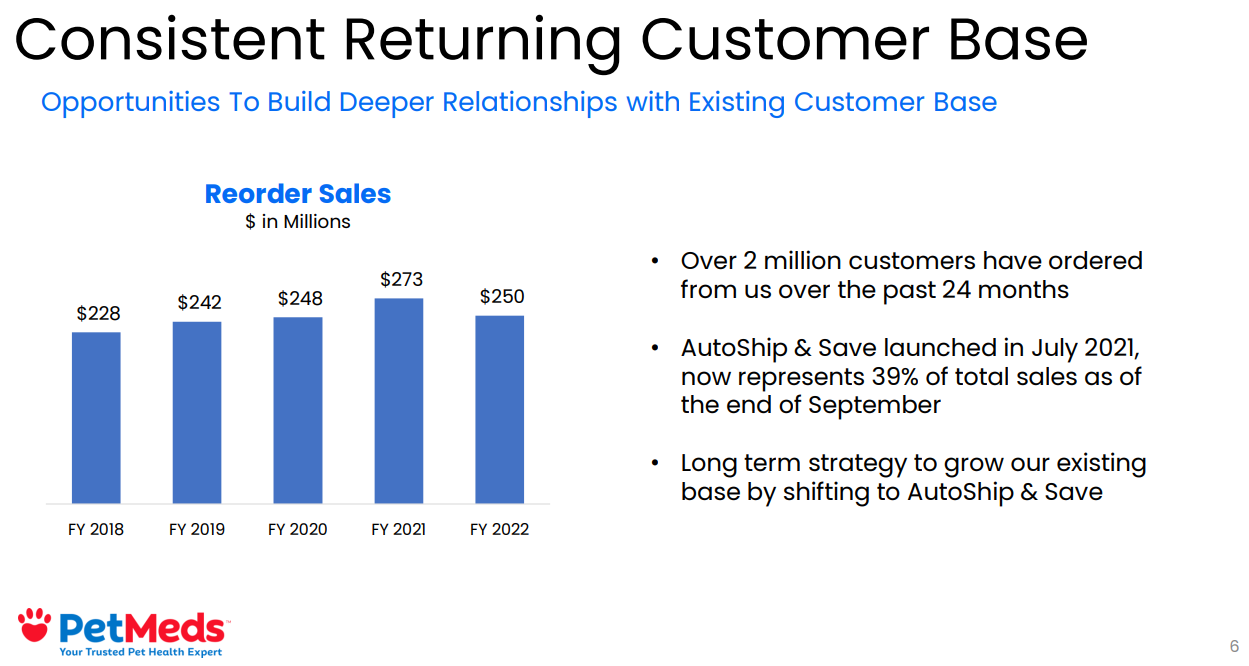

Source: Investor presentation, page 6

The company is attempting to create brand loyalty with its AutoShip subscription program, and that is working to an extent. The company believes over two million customers have ordered from PetMed in the past two years, and that nearly all of its revenue comes from repeat customers. Should the AutoShip & Save program continue to take revenue share, PetMed Express may have a more sustainable revenue base and the advantages that would come along with that. However, with low barriers to entry and many competitors, we hesitate to say the company has, or will have, a sustainable advantage.

Dividend Analysis

PetMed Express has paid a dividend each quarter since it initiated the payout in 2009. Since then, the company has continued to raise its dividend, and has an impressive 13-year streak of dividend increases. The payout has been stagnant at 30 cents per share on a quarterly basis since the spring of 2021, so the company will need to raise the dividend soon to keep its streak alive. Even so, given the company’s small size and cyclical industry, its dividend history is quite attractive.

The issue today is that the payout ratio is well in excess of 100% of earnings, as the dividend run rate is $1.20 against $0.77 in projected earnings-per-share. That equates to 155% of earnings, which is obviously unsustainable long-term. While we expect earnings to rebound from current levels, we have concerns about the company’s ability to continue to pay its current dividend, let alone raise it.

The good news is that PetMed Express has almost $100 million of net cash on its balance sheet, and no long-term debt. With the dividend costing about $25 million per year, it could theoretically pay the shortfall in the dividend not covered by earnings for several years with cash currently on the balance sheet. We do not find this to be an attractive strategy, but it is an option, and may help the company defend its dividend while it waits for earnings to rebound.

The current yield is also outstanding at 6.5%, which is about four times that of the S&P 500, so on a pure income basis, PetMed Express is quite good. We currently forecast modest 2% growth in the payout in the years to come, as we believe the management team will do whatever it can to defend the payout.

Final Thoughts

PetMed Express is offering investors an extremely high yield of 6.5% today, which is not only four times that of the broader market, but is also very high by the stock’s historical standards. We see that yield as quite attractive, and believe the management team will do whatever it can to defend the dividend. However, we note that earnings are well below the dividend, and we therefore have concerns about its ability to do so.

The stock is down more than 60% in the last five years, against a gain of about 40% for the S&P 500, so the stock has been a poor performer as well. We see modest growth coming from this year’s very low earnings base, but not enough to warrant the risk of owning this stock.

PetMed Express is highly speculative, and we believe the risk of a dividend cut is too high for our liking.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more