Article updated on April 3rd, 2024 by Bob Ciura

Spreadsheet data updated daily

High dividend stocks are stocks with a dividend yield well in excess of the market average dividend yield of ~1.4%.

The resources in this report focus on truly high yielding securities, often with dividend yields multiples higher than the market average.

Resource #1: The High Dividend Stocks List Spreadsheet

Note: The spreadsheet uses the Wilshire 5000 as the universe of securities from which to select, plus a few additional securities we screen for with 5%+ dividend yields.

The free high dividend stocks list spreadsheet has our full list of ~230 individual securities (stocks, REITs, MLPs, etc.) with 5%+ dividend yields.

The high dividend stocks spreadsheet has important metrics to help you find compelling ultra high yield income investing ideas. These metrics include:

- Market cap

- Payout ratio

- Dividend yield

- Trailing P/E ratio

- Annualized 5-year dividend growth rate

Resource #2: The 7 Best High Yield Stocks Now

This resource analyzes the 7 best high-yield stocks in detail. The criteria we use to rank high dividend securities in this resource are:

- Is in the 870+ income security Sure Analysis Research Database

- Rank based on dividend yield, from highest to lowest

- Dividend Risk Scores of C or better

- Based in the U.S.

Additionally, a maximum of three stocks are allowed for any single sector to ensure diversification.

Resource #3: The High Dividend 50 Series

The High Dividend 50 Series is where we analyze the 50 highest-yielding securities in the Sure Analysis Research Database. The series consists of 50 stand-alone analysis reports on these securities.

Resource #4: More High-Yield Investing Research

– How to calculate your income per month based on dividend yield

– The risks of high-yield investing

– Other high dividend research

The 7 Best High Yield Stocks Now

This resource analyzes the 7 best high yielding securities in the Sure Analysis Research Database as ranked by the following criteria:

- Rank based on dividend yield, from highest to lowest

- Dividend Risk Scores of C or better

- Based in the U.S.

Note: Ranking data is from the current edition of the Sure Analysis spreadsheet.

Additionally, a maximum of three stocks are allowed for any single market sector to ensure diversification.

It’s difficult to define ‘best’. Here, we are using ‘best’ in terms of highest yields with reasonable and better dividend safety.

A tremendous amount of research goes into finding these 7 high yield securities. We analyze more than 850 income securities every quarter in the Sure Analysis Research Database. This is real analysis done by our analyst team, not a quick computer screen.

“So I think it was just looking at different companies and I always thought if you looked at 10 companies, you’d find one that’s interesting, if you’d look at 20, you’d find two, or if you look at 100 you’ll find 10. The person that turns over the most rocks wins the game. I’ve also found this to be true in my personal investing.”

– Investing legend Peter Lynch

Click here to download a PDF report for just one of the 850+ income securities we cover in Sure Analysis to get an idea of the level of work that goes into finding compelling income investments for our audience.

The 7 best high yield securities are listed in order by dividend yield below, from lowest to highest.

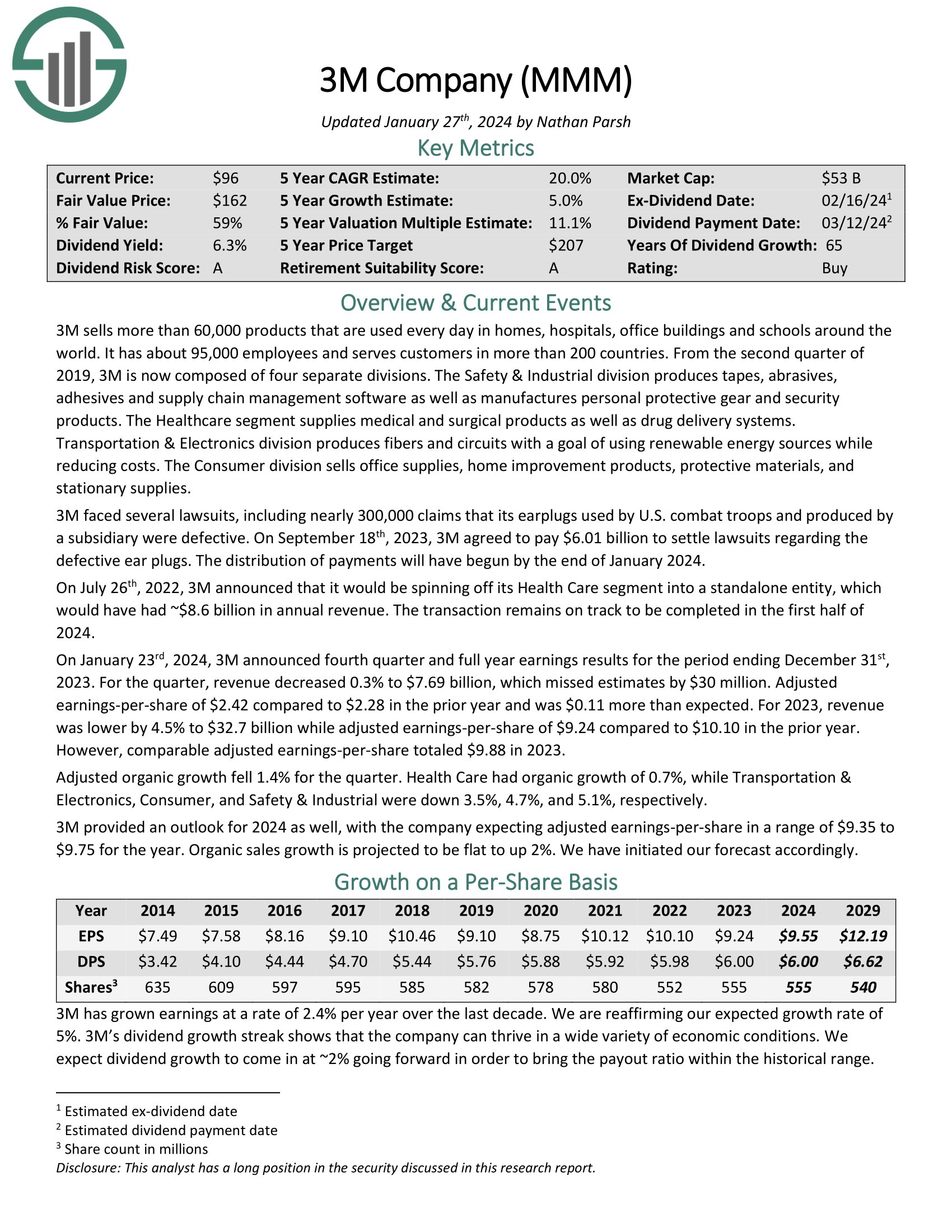

- High Dividend Stock #7: 3M Company (MMM)

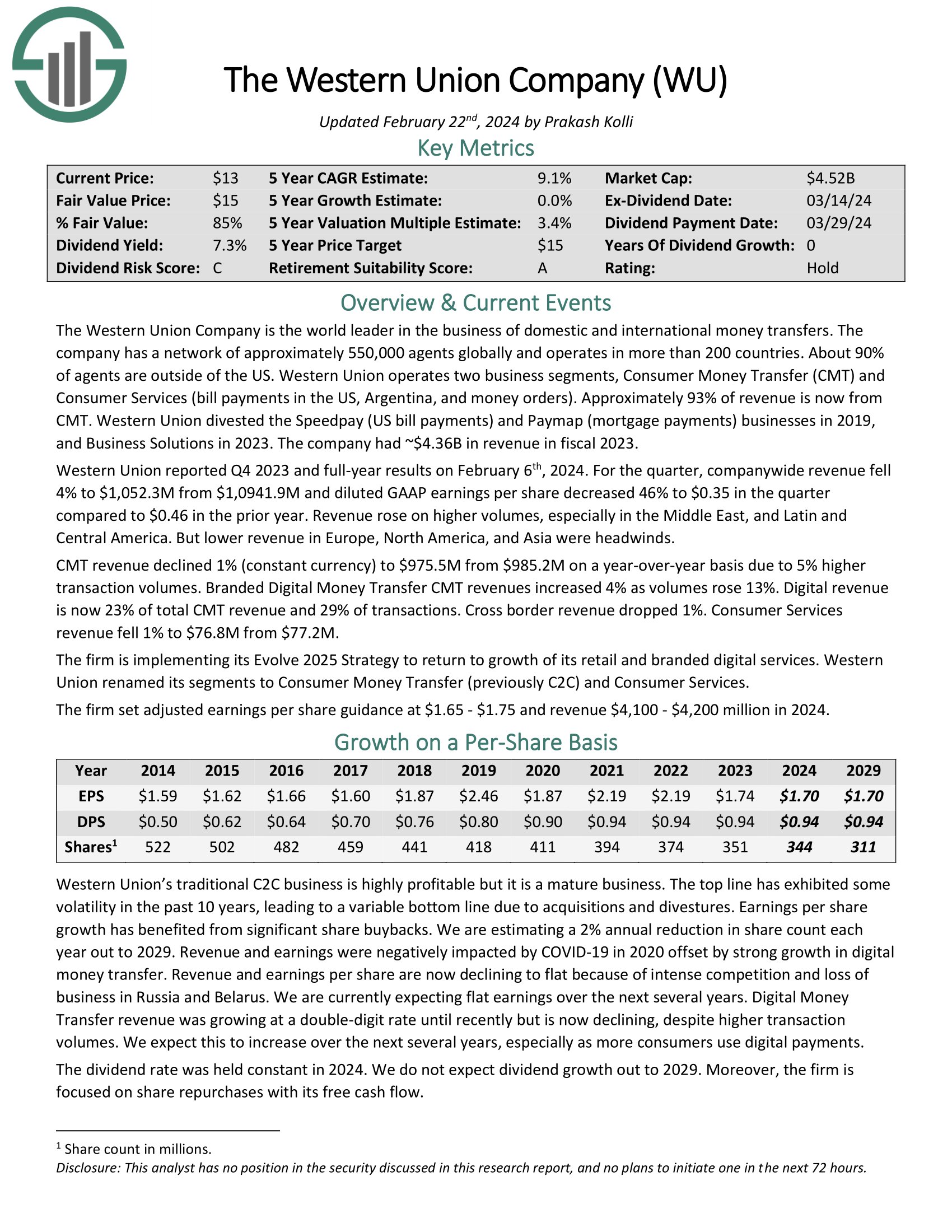

- High Dividend Stock #6: Western Union (WU)

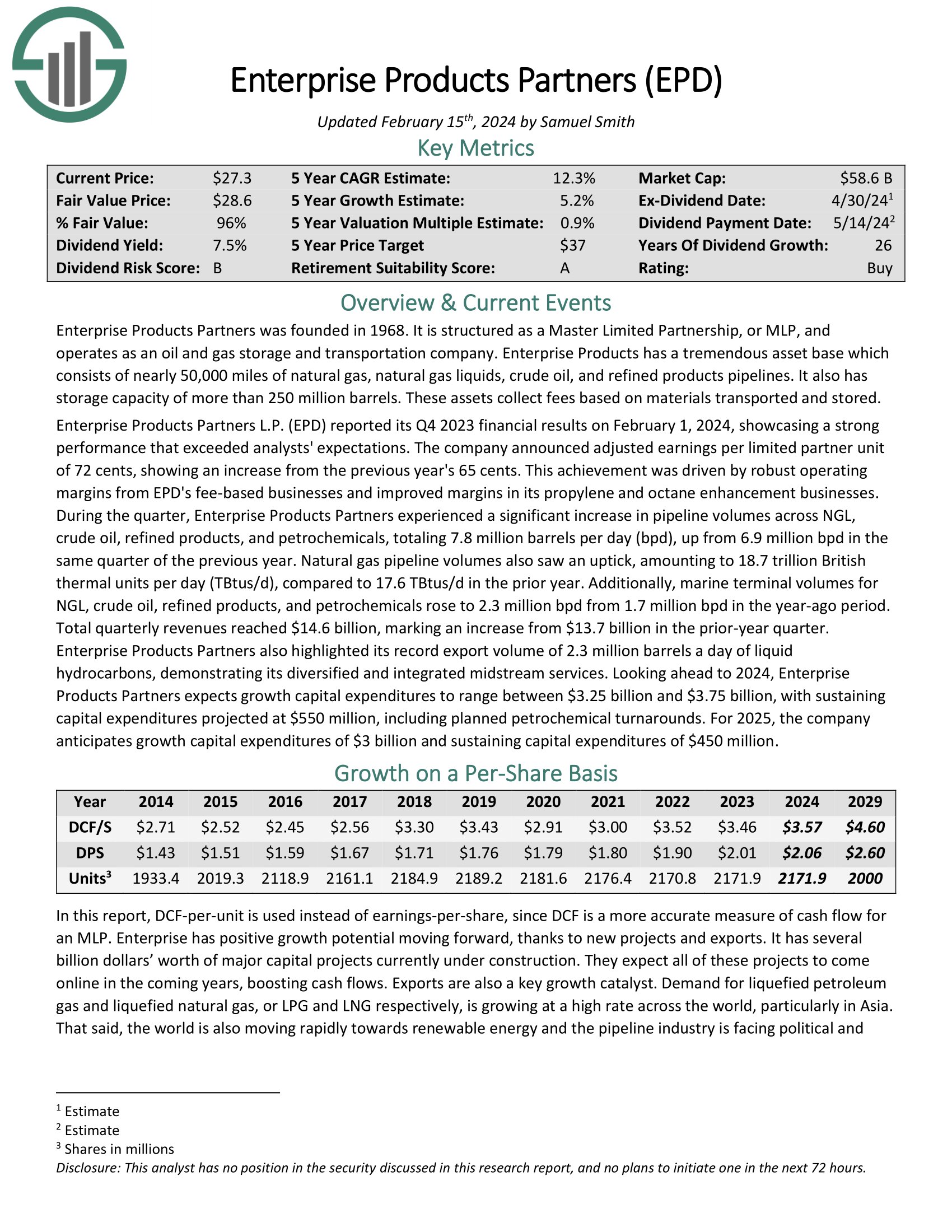

- High Dividend Stock #5: Enterprise Products Partners (EPD)

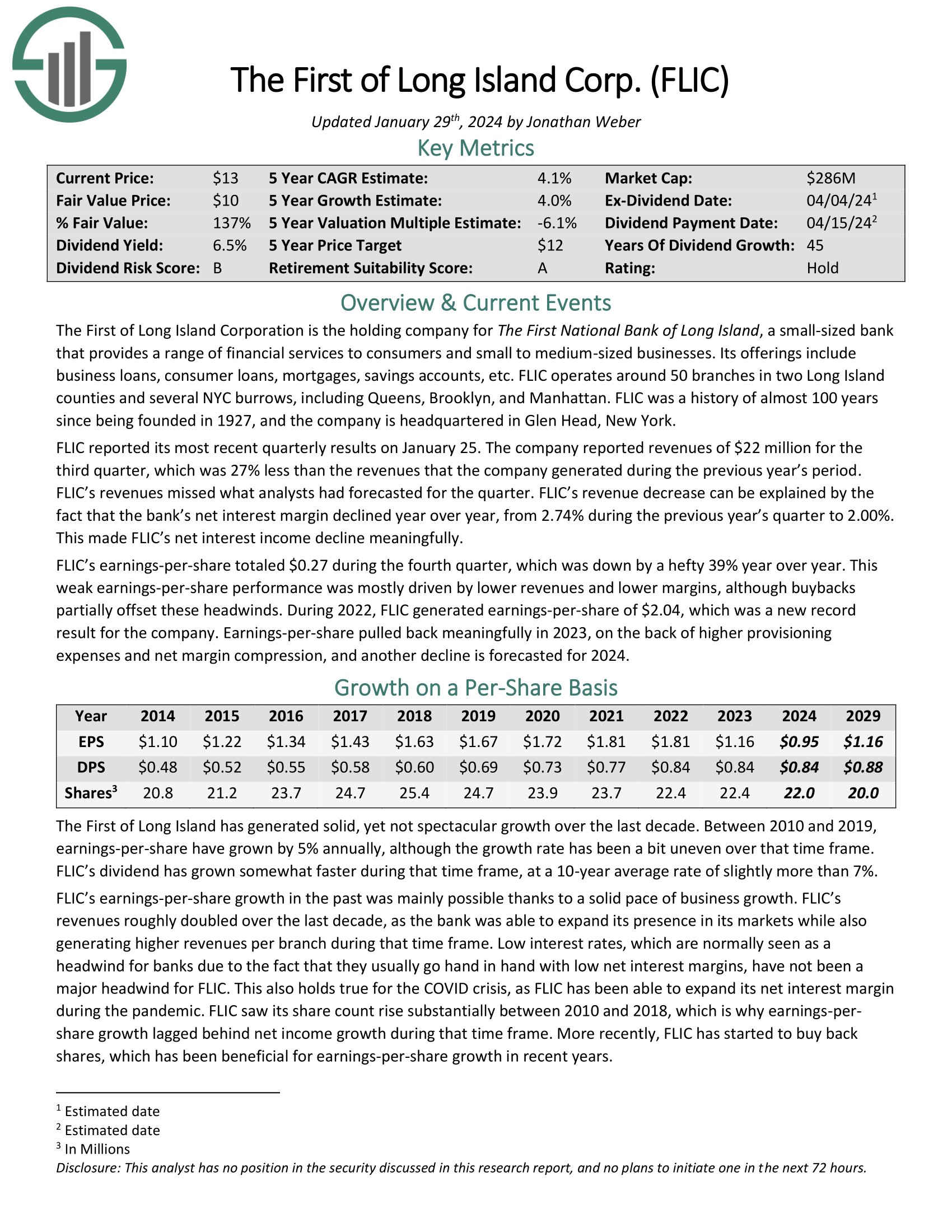

- High Dividend Stock #4: First of Long Island Corp. (FLIC)

- High Dividend Stock #3: MPLX LP (MPLX)

- High Dividend Stock #2: Universal Health Realty Income Trust (UHT)

- High Dividend Stock #1: Altria Group (MO)

High Dividend Stock #7: 3M Company (MMM)

- Dividend Yield: 6.5%

- Dividend Risk Score: A

3M is an industrial manufacturer that sells more than 60,000 products used daily in homes, hospitals, office buildings, and schools worldwide. It has about 95,000 employees and serves customers in more than 200 countries.

On January 23rd, 2024, 3M announced fourth quarter and full year earnings results for the period ending December 31st, 2023. For the quarter, revenue decreased 0.3% to $7.69 billion, which missed estimates by $30 million. Adjusted earnings-per-share of $2.42 compared to $2.28 in the prior year and was $0.11 more than expected.

For 2023, revenue was lower by 4.5% to $32.7 billion while adjusted earnings-per-share of $9.24 compared to $10.10 in the prior year. However, comparable adjusted earnings-per-share totaled $9.88 in 2023.

Click here to download our most recent Sure Analysis report on 3M Company (preview of page 1 of 3 shown below):

High Dividend Stock #6: Western Union (WU)

- Dividend Yield: 6.8%

- Dividend Risk Score: C

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries. About 90% of agents are outside of the US. Western Union operates two business segments, Consumer-to-Consumer (C2C) and Other (bill payments in the US and Argentina).

Western Union reported Q4 2023 and full-year results on February 6th, 2024. For the quarter, company-wide revenue fell 4% to $1,052.3M from $1,0941.9M and diluted GAAP earnings per share decreased 46% to $0.35 in the quarter compared to $0.46 in the prior year. Revenue rose on higher volumes, especially in the Middle East, and Latin and Central America. But lower revenue in Europe, North America, and Asia were headwinds.

CMT revenue declined 1% (constant currency) to $975.5M from $985.2M on a year-over-year basis due to 5% higher transaction volumes. Branded Digital Money Transfer CMT revenues increased 4% as volumes rose 13%. Digital revenue is now 23% of total CMT revenue and 29% of transactions. Cross border revenue dropped 1%. Consumer Services revenue fell 1% to $76.8M from $77.2M.

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

High Dividend Stock #5: Enterprise Products Partners (EPD)

- Dividend Yield: 6.9%

- Dividend Risk Score: B

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company. Enterprise Products has a tremendous asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines. It also has storage capacity of more than 250 million barrels. These assets collect fees based on materials transported and stored.

Enterprise Products Partners L.P. (EPD) reported its Q4 2023 financial results on February 1, 2024. The company announced adjusted earnings per limited partner unit of 72 cents, an increase from the previous year’s 65 cents.

During the quarter, Enterprise Products Partners experienced a significant increase in pipeline volumes across NGL, crude oil, refined products, and petrochemicals, totaling 7.8 million barrels per day (bpd), up from 6.9 million bpd in the same quarter of the previous year.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

High Dividend Stock #4: First of Long Island Corp. (FLIC)

- Dividend Yield: 7.8%

- Dividend Risk Score: B

The First of Long Island Corporation is the holding company for The First National Bank of Long Island, a small bank that provides a range of financial services to consumers and small to medium-sized businesses. Its offerings include business loans, consumer loans, mortgages, savings accounts, etc. FLIC operates around 50 branches in two Long Island counties and several NYC burrows, including Queens, Brooklyn, and Manhattan.

FLIC reported its most recent quarterly results on January 25. The company reported revenues of $22 million for the third quarter, which was 27% less than the revenues that the company generated during the previous year’s period. The bank’s net interest margin declined year over year, from 2.74% during the previous year’s quarter to 2.00%.

FLIC’s earnings-per-share totaled $0.27 during the fourth quarter, which was down by 39% year over year. This weak earnings-per-share performance was mostly driven by lower revenues and lower margins, although buybacks partially offset these headwinds.

Click here to download our most recent Sure Analysis report on FLIC (preview of page 1 of 3 shown below):

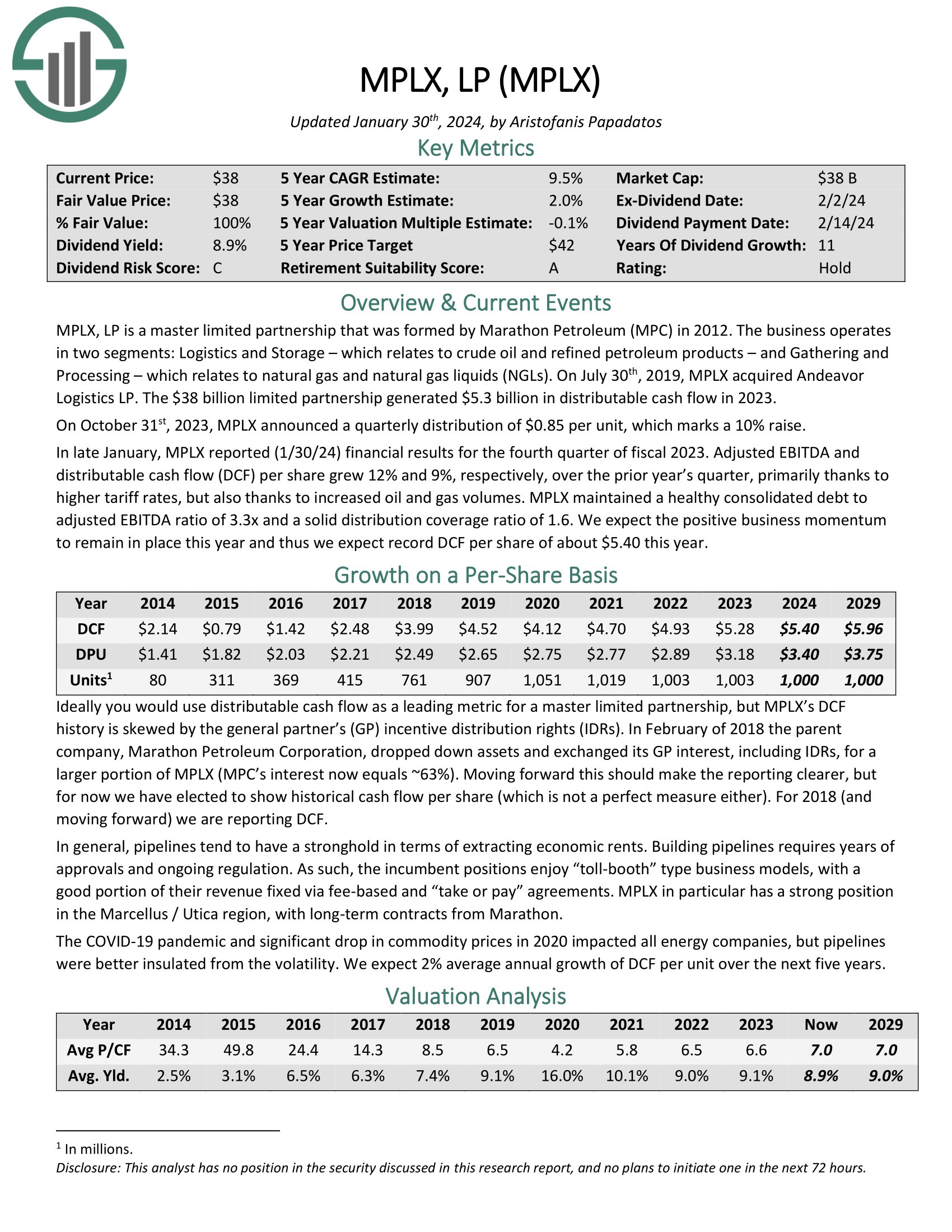

High Dividend Stock #3: MPLX LP (MPLX)

- Dividend Yield: 8.6%

- Dividend Risk Score: C

MPLX LP is a Master Limited Partnership that was formed by the Marathon Petroleum Corporation (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The business operates in two segments:

- Logistics and Storage, which relates to crude oil and refined petroleum products

- Gathering and Processing, which relates to natural gas and natural gas liquids (NGLs).

In late January, MPLX reported (1/30/24) financial results for the fourth quarter of fiscal 2023. Adjusted EBITDA and distributable cash flow (DCF) per share grew 12% and 9%, respectively, over the prior year’s quarter, primarily thanks to higher tariff rates, but also thanks to increased oil and gas volumes.

MPLX maintained a healthy consolidated debt to adjusted EBITDA ratio of 3.3x and a solid distribution coverage ratio of 1.6.

Click here to download our most recent Sure Analysis report on MPLX (preview of page 1 of 3 shown below):

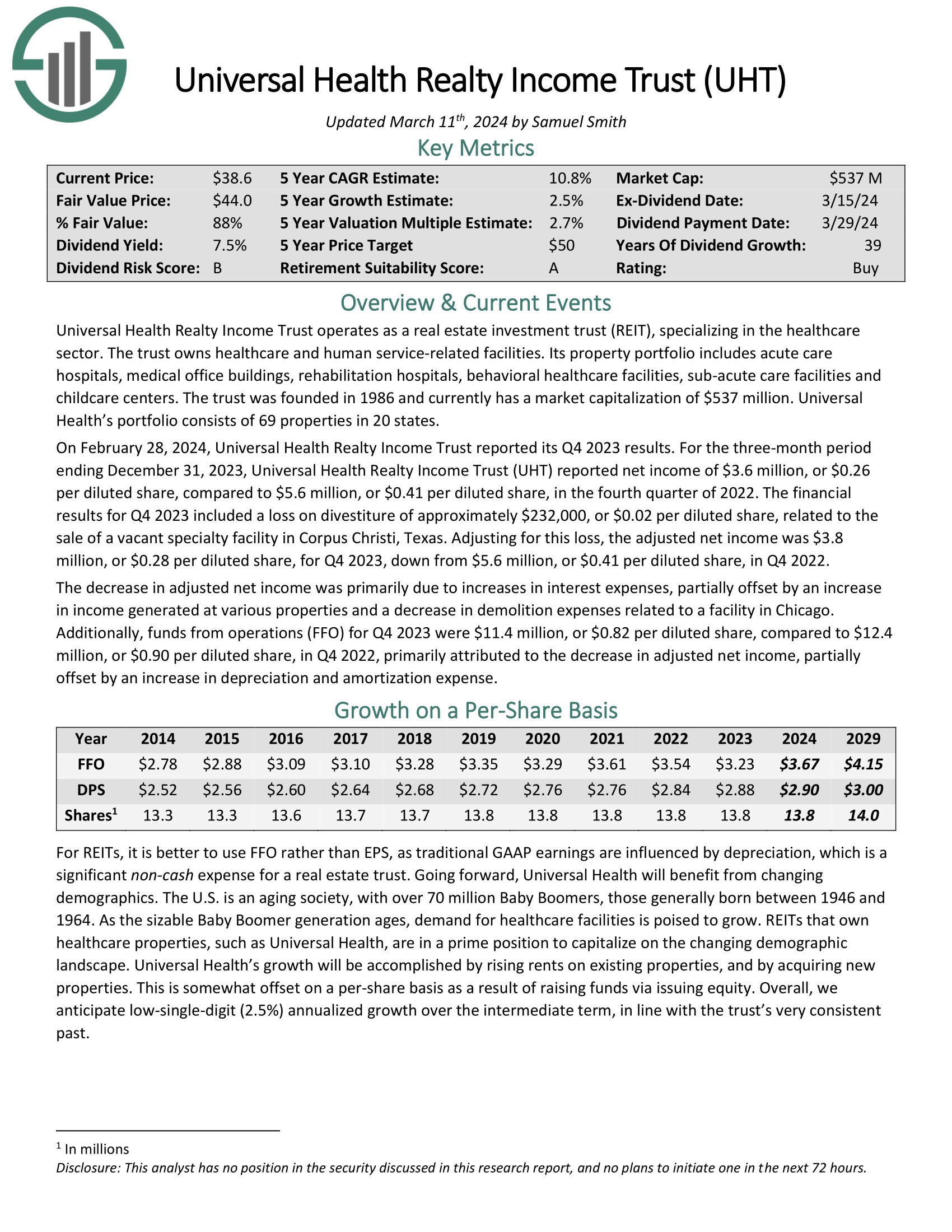

High Dividend Stock #2: Universal Health Realty Income Trust (UHT)

- Dividend Yield: 8.3%

- Dividend Risk Score: B

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities. Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers.

On February 28, 2024, Universal Health Realty Income Trust reported its Q4 2023 results. For the quarter, UHT reported net income $0.26 per diluted share, compared to $0.41 per diluted share, in the fourth quarter of 2022.

The financial results for Q4 2023 included a loss on divestiture of approximately $232,000, or $0.02 per diluted share, related to the sale of a vacant specialty facility in Corpus Christi, Texas. Adjusting for this loss, the adjusted net income was $3.8 million, or $0.28 per diluted share, for Q4 2023, down from $5.6 million, or $0.41 per diluted share, in Q4 2022.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

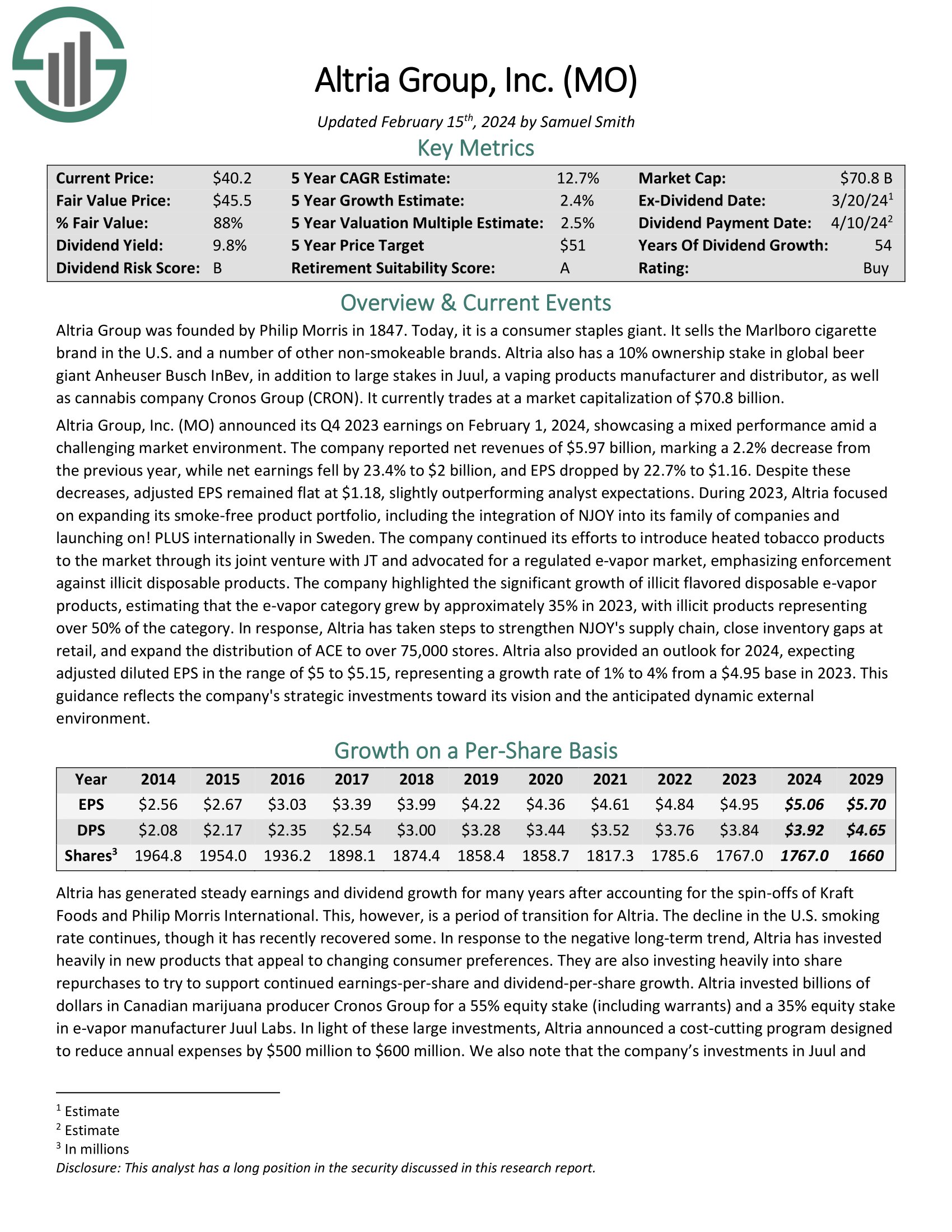

High Dividend Stock #1: Altria Group (MO)

- Dividend Yield: 9.1%

- Dividend Risk Score: B

Altria Group was founded by Philip Morris in 1847. Today, it is a consumer staples giant. It sells the Marlboro cigarette brand in the U.S. and a number of other non-smokeable brands, including Skoal and Copenhagen.

Altria has increased its dividend for over 50 years, placing it on the exclusive Dividend Kings list. This is a rare business longevity achievement that speaks to the staying power of the company’s brands, even with the gradual decline in smoking in the U.S.

Altria announced its Q4 2023 earnings on February 1, 2024. The company reported net revenues of $5.97 billion, marking a 2.2% decrease from the previous year, while net earnings fell by 23.4% to $2 billion, and EPS dropped by 22.7% to $1.16. Despite these decreases, adjusted EPS remained flat at $1.18, slightly outperforming analyst expectations.

Altria also provided an outlook for 2024, expecting adjusted diluted EPS in the range of $5 to $5.15, representing a growth rate of 1% to 4% from a $4.95 base in 2023.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

The High Dividend 50 Series

The High Dividend 50 Series is analysis on the 50 highest-yielding Sure Analysis Research Database stocks, excluding royalty trusts, BDCs, REITs, and MLPs.

Click on a company’s name to view the high dividend 50 series article for that company. A link to the specific Sure Analysis Research Database report page for each security is included as well.

More High-Yield Investing Resources

How To Calculate Your Monthly Income Based On Dividend Yield

A common question for income investors is “how much money can I expect to receive per month from my investment?”

To find your monthly income, follow these steps:

- Find your investment’s dividend yield

Note: Dividend yield can be calculated as dividends per share divided by share price - Multiply it by the current value of your holding

Note: If you haven’t yet invested, multiply dividend yield by the amount you plan to invest - Divide this number by 12 to find monthly income

To find the monthly income from your entire portfolio, repeat the above calculation for each of your holdings and add them together.

You can also use this formula backwards to find the dividend yield you need from your investments to make a certain amount of monthly dividend income.

The example below assumes you want to know what dividend yield you need on a $240,000 investment to generate $1,000/month in dividend income.

- Multiply $1,000 by 12 to find annual income target of $12,000

- Divide $12,000 by your investment amount of $240,000 to find your target yield of 5.0%

In practice most dividend stocks pay dividends quarterly, so you would actually receive 3x the monthly amount quarterly instead of receiving a payment every month. However, some stocks do actually pay monthly dividends. You can see our monthly dividend stocks list here.

The Risks Of High-Yield Investing

Investing in high-yield stocks is a great way to generate income. But it is not without risks.

First, stock prices fluctuate. Investors need to understand their risk tolerance before investing in high dividend stocks. Share price fluctuations means that your investment can (and almost certainly will) decline in value, at least temporarily (and possibly permanently) do to market volatility.

Second, businesses grow and decline. Investing in a stock gives you fractional ownership in the underlying business. Some businesses grow over time. These businesses are likely to pay higher dividends over time. The Dividend Champions are an excellent example of this; each has paid rising dividends for 25+ consecutive years.

What’s dangerous is when a business declines. Dividends are paid out of a company’s cash flows. If the business sees its cash flows decline, or worse is losing money, it may reduce or eliminate its dividend. Business decline is a real risk with high yield investing. Business declines often coincide with and or accelerate during recessions.

A company’s payout ratio gives a good gauge of how much ‘room’ a company has to pay its dividend. The payout ratio is calculated as dividends divided by income. The lower the payout ratio, the better, because dividends have more earnings coverage.

A company with a payout ratio over 100% is paying out more in dividends than it is making in profits, a long-term unsustainable situation. A company with a payout ratio of 50% is making double in income what it is paying out in dividends, so it has ‘room’ for earnings to decline significantly without reducing its dividend.

Third, management teams can change their dividend policies. Even if a company isn’t declining, the company’s management team may change priorities and reduce or eliminate its dividend. In practice, this typically occurs if a company has a high level of debt and wants to focus on debt reduction. But it could in theory happen to any dividend paying stock.

The risks of high yield investing can be reduced (but not eliminated) by investing in higher quality businesses in a diversified portfolio of 20 or more stocks. This reduces both business decline risk (by investing in high quality businesses) and the shock to your portfolio if any one stock does reduce or eliminate its dividend (through diversification).

Other High Dividend Research

The free spreadsheet of 5%+ dividend yield stocks in this article gives you more than 200 high yield income securities to review. You can download it below.

Investors should continue to monitor each stock to make sure their fundamentals and growth remain on track, particularly among stocks with extremely high dividend yields.

See the resources below to generate additional compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500