Originally published by Josh Arnold

Updated on August 31st, 2023

Kellogg Company (K) is perhaps one of the US’s most well-known consumer staples brands. The company’s ubiquitous cereals and snacks have dominated store shelves for many years, and it has afforded shareholders nice returns and a reliable dividend.

Kellogg has also raised its payout for 18 consecutive years, putting it on the list of blue-chip stocks which have raised their payouts for at least a decade consecutively.

You can download the full list of blue-chip stocks (along with important financial metrics such as dividend yields and price-to-earnings ratios) by clicking on the link below:

Kellogg’s has grown over time through organic market share gains and various acquisitions. While Kellogg is known for its cereals, it has plant-based food options and a massive snack business. This diversification has helped it weather recessions in the past.

However, Kellogg recently announced plans to split from a single conglomerate into two independent companies.

The question for investors is what to do with the shares of Kellogg with this separation looming. Below, we’ll examine the factors investors should consider.

Kellogg Spinoff Overview

Today, Kellogg is a highly diversified manufacturer of snacks, breakfast foods, and plant-based foods that operates globally. The company has dozens of popular brands in its portfolio that collectively help it generate about $15 billion in revenue. Kellogg’s trades with a market cap of $21 billion.

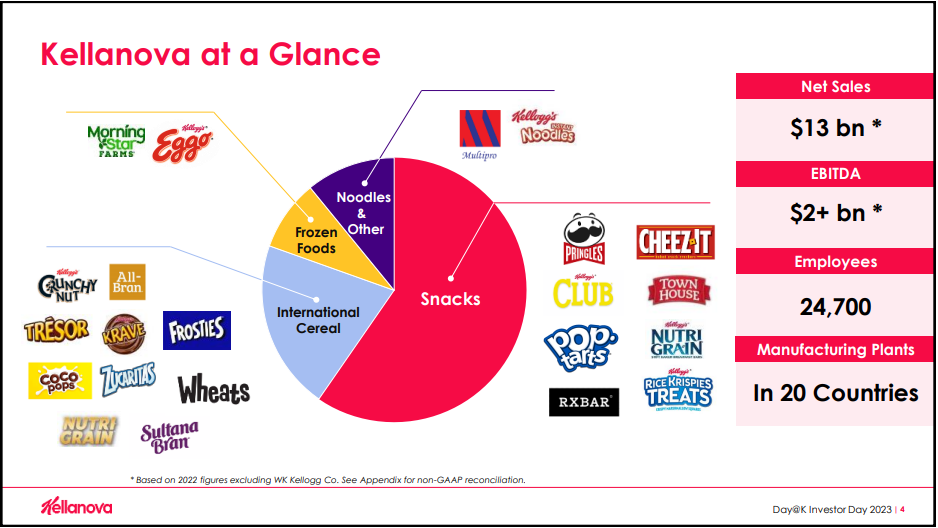

The company proposes a tax-free distribution of North American cereals business. Management plans to complete the spinoff in the fourth quarter of 2023. The North American cereals business will be known as WK Kellogg Co, while the remaining snacks-led business will be called Kellanova.

Source: Investor Presentation

Importantly for dividend investors, the company is looking into the dividend policies of the independent companies, and management promises a “strong aggregate dividend” between the three companies.

Generally, in this type of situation, we would expect the initial aggregate dividend of the independent companies to be at least equal to that of the pre-spinoff entity. Initial indications are that investors will see something similar in the case of Kellogg.

How Will The Spinoff Impact Future Growth?

The core of Kellogg today is the snack business, and that will remain intact post-spinoff. That business will have approximately $13.5 billion in 2024 revenue, and the company believes it will generate annual sales growth of 3%-5% and earnings-per-share growth of 7% to 9% annually.

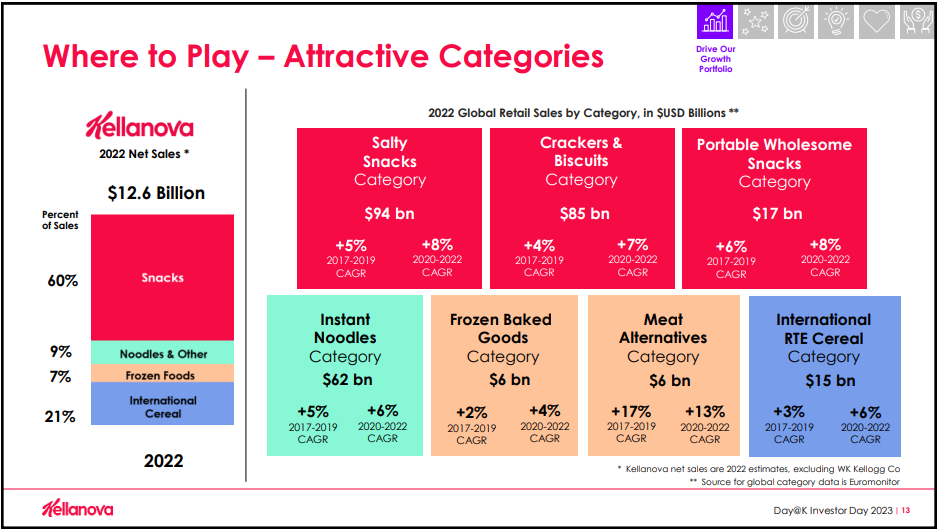

Kellanova’s businesses will be comprised of global snacking, international cereal and noodles, and North America frozen foods. The company believes these are attractive areas for long-term growth.

Source: Investor Presentation

Meanwhile, WK Kellogg will have a portfolio of very popular but lower-growth brands with projected 2024 revenue of $2.7 billion, focused on the U.S., Canada, and Caribbean cereal markets. Kellogg notes this business has a very strong market share, but that share is in a segment – breakfast cereals – that has seen declining overall demand over time.

Profit margins are high, however, and Kellogg believes the proposed dividend of this company will be attractive. Given its low-growth/high-profit model.

Kellogg expects both post-spinoff companies to pay dividends to shareholders, albeit at different levels. WK Kellogg Co expects to pay cash dividends, with a payout ratio of approximately 45% in 2024. At the same time, Kellanova’s payout ratio will be elevated initially, but is expected to reach the company’s longer-term target of a 50% payout ratio within the next few years.

Overall, Kellogg management envisions the aggregate dividend of the two post-separation companies remaining unchanged from the current level.

What Should Kellogg Shareholders Do?

The rationale behind breaking up conglomerates is generally the same; management of the conglomerate wants to hopefully unlock additional shareholder value by having more than one focused company rather than a bigger company with sometimes competing priorities.

In Kellogg’s case, the two proposed companies sell different products in different markets with different growth and profitability profiles. We see the rationale behind this decision to be sound, and it offers benefits over and above what has been achieved thus far with Kellogg as a single entity.

For instance, having two management teams instead of one will help focus effort on that particular business goal. For example, the cereals business will be focused on taking market share and operational efficiency. The snack business will take a more balanced approach of some growth and some margin expansion. In theory, these focused management teams should be more efficient at managing those businesses than as a conglomerate.

In addition, it gives shareholders the chance to choose what version of Kellogg they’d like to own. Today, shareholders can buy the conglomerate or nothing at all. Post-spinoff, if Kellogg shareholders are focused on income, for instance, they can sell the lower-yielding stock and reinvest in the higher-yielding stock.

Given this, we see sizable benefits for shareholders post-spinoff, and we think this is the best way for management to maximize value for shareholders.

After the spinoff is complete, what shareholders should do depends upon their particular goals. We think simply holding both companies will outperform what Kellogg was able to do on its own. A higher mix of WK Kellogg may be appropriate for income-focused investors, as this company is likely to have the higher yield due to its higher earnings power.

Part of the value of the spinoff is the choice afforded to investors, but we also think just holding both is a viable strategy.

Final Thoughts

Kellogg’s has been a strong income stock for many years. However, the nature of its business has meant that growth has slowed over time. The proposed spinoffs should, in our opinion, unlock additional value for shareholders by the end of next year.

Post-spinoff, we see two companies with distinct focuses on different brands and geographic markets. The overall dividend is likely to equal the current payout, so holding both stocks should not result in a dividend reduction.

We think there’s merit for all both post-spinoff companies and that simply holding through the spinoffs will yield favorable results.

Management has already made it clear that post-spinoff dividends are a priority, which is a positive sign for income investors. But on the whole, we take the spinoff proposal as a positive development that increases the stock’s attractiveness in the long run.

Additional Reading

The following Sure Dividend lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.