Updated on April 23rd, 2023 by Felix Martinez

Are you looking for long-term investment opportunities that can provide a reliable stream of passive income for you and your family? If so, “forever” stocks may be worth considering. These are stocks that have proven reliable and durable over long periods while retaining the potential to continue providing passive income for generations to come.

This article will highlight 20 “forever” stocks coming from various industries, including technology, healthcare, and consumer goods, with solid track records of growth and stability. Their unique qualities, market-leading positions, and commitment to growing their dividends are quite likely to keep serving you and your family with rising passive income for the long-term future.

The downloadable Dividend Kings Spreadsheet List below contains the following for each stock in the index among other important investing metrics:

- Payout ratio

- Dividend yield

- Price-to-earnings ratio

You can see the full downloadable spreadsheet of all 48 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

What makes a stock a “forever” stock?

To more specifically define what makes a stock a “forever” stock in our book, here are a few attributes we considered when determining which stocks to include in our list:

Strong financials:

Our “forever” stock list includes companies with healthy balance sheets and the ability to post consistent profits during various economic environments. These companies are more likely to be able to continue paying and increasing their dividends in good times and bad.

Dividend history:

Our chosen stocks have an established history of consistently paying dividends and increasing them over time. This indicates that their management teams value their shareholders and are committed to returning value to them. Prolonged dividend growth track records also reinforce the previous point that these companies have already managed to grow their payouts in good and bad times. Our selected stocks feature at least 20 years of consecutive dividend hikes.

Dividend yield / Payout ratio:

While a company’s dividend yield is arbitrary when determining whether a stock is a generational holding, we have ensured that the stocks featured here pay out a meaningful, well-covered yield. While a high yield can be tempting, it’s essential to consider the dividend’s sustainability. We have selected companies that yield at least 1.5% and whose payouts comprise less than 80% of their underlying earnings.

Growth potential:

An established track record of solid financials and dividend growth alone would be insufficient for a “forever” stock unless its future growth prospects also remain robust. We have selected stocks with several growth catalysts and a clear plan for future growth. This is essential to ensure these companies can continue to grow their dividends and help your wealth compound over time rather comfortably.

Competitive advantages/moat:

A strong competitive advantage can help a company maintain its profitability and growth over the long term, making it more likely to continue paying dividends and increasing them over time. This is one of the critical criteria that can make a stock a “forever” stock – a company with a solid competitive advantage and can maintain its market position and profitability is more likely to continue providing passive income for generations to come.

This article will discuss the top 20 “forever stocks” that matches the above critera.

Table of Contents

- Forever Stock #20: ABM Industries Inc. (ABM)

- Forever Stock #19: Abbott Laboratories (ABT)

- Forever Stock #18: American States Water Co. (AWR)

- Forever Stock #17: Commerce Bancshares, Inc. (CBSH)

- Forever Stock #16: California Water Services Group (CWT)

- Forever Stock #15: Emerson Electric Co. (EMR)

- Forever Stock #14: Genuine Parts Co. (GPC)

- Forever Stock #13: Lowe’s Companies, Inc. (LOW)

- Forever Stock #12: Johnson & Johnson (JNJ)

- Forever Stock #11: PepsiCo, Inc. (PEP)

- Forever Stock #10: 3M Company (MMM)

- Forever Stock #9: Tennant Company (TNC)

- Forever Stock #8: Procter & Gamble (PG)

- Forever Stock #7: Qualcomm Incorporated (QCOM)

- Forever Stock #6: MDU Resources (MDU)

- Forever Stock #5: Black Hills Corporation (BKH)

- Forever Stock #4: Realty Income Corporation (O)

- Forever Stock #3: Target Corporation (TGT)

- Forever Stock #2: Enterprise Products Partners L.P. (EPD)

- Forever Stock #1: Medtronic plc (MDT)

Forever Stock #20: ABM Industries Inc. (ABM)

- Dividend yield: 2.1%

- Years of dividend growth: 55

ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking. The company employs about 124,000 people in over 350 offices throughout the United States and various international locations, primarily in Canada. ABM Industries has increased its dividend for 55 consecutive years, which makes the company a Dividend King. ABM Industries is headquartered in New York, NY.

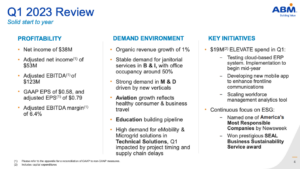

ABM Industries reported its first-quarter earnings results (fiscal 2023) in March. The company announced that its revenues totaled $1.99 billion during the quarter, below the analyst estimate, but was up 2.8% versus the previous year’s quarter. ABM Industries generated earnings-per-share of $0.79 during the first quarter, which beat the analyst consensus by $0.02. ABM Industries’ earnings-per-share decreased by 15.9% versus the previous year’s quarter. ABM Industries’ guidance for the current fiscal year, 2023, was announced. Earnings-per-share are expected to be $3.40 to $3.60 on an adjusted basis, with some synergies of the recent Able Services acquisition being built into that estimate.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on ABM Industries (preview of page 1 of 3 shown below):

Forever Stock #19: Abbott Laboratories (ABT)

- Dividend yield: 1.8%

- Years of dividend growth: 51

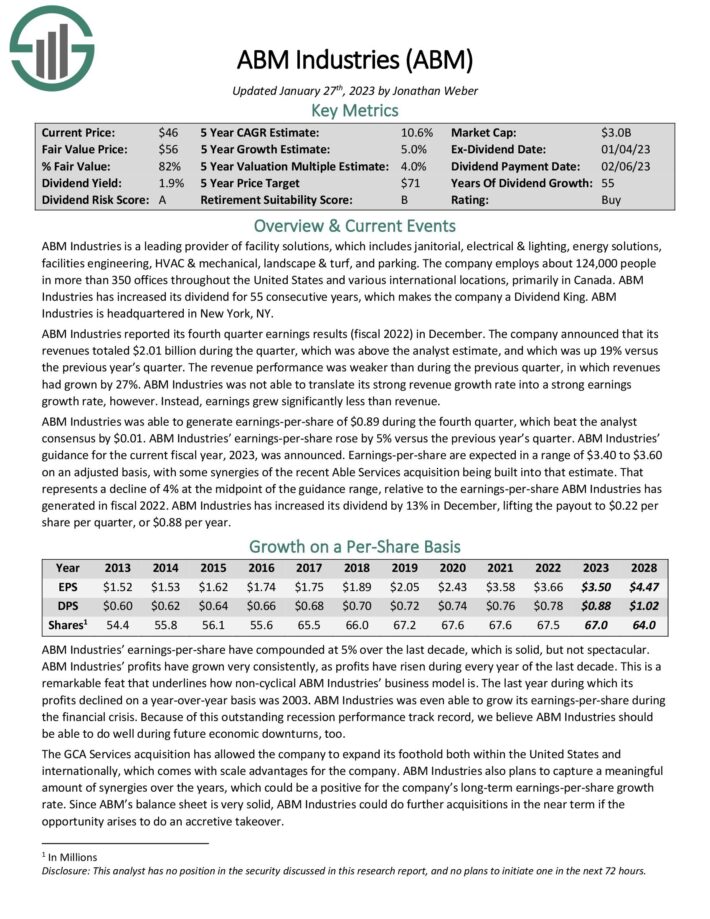

Abbott Laboratories, founded in 1888, is one of the world’s largest medical appliances & equipment manufacturers, comprised of four segments: Nutrition, Diagnostics, Established Pharmaceuticals, and Medical Devices. Abbott Laboratories provides products in over 160 countries and employs 113,000 people. The company generated $44 billion in sales and $9.4 billion in profit in 2022.

On April 19th, 2023, Abbott Laboratories reported earnings results for the first quarter for the period ending March 31st, 2023. For the quarter, the company generated $9.7 billion in sales (60% outside of the U.S.), representing an 18.5% decrease compared to the first quarter of 2022. Adjusted earnings-per-share of $1.03 compared unfavorably to $1.73 in the prior year. Revenue was $60 million better than expected, while adjusted earnings-per-share was $0.05 ahead of estimates.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Abbott Laboratories (preview of page 1 of 3 shown below):

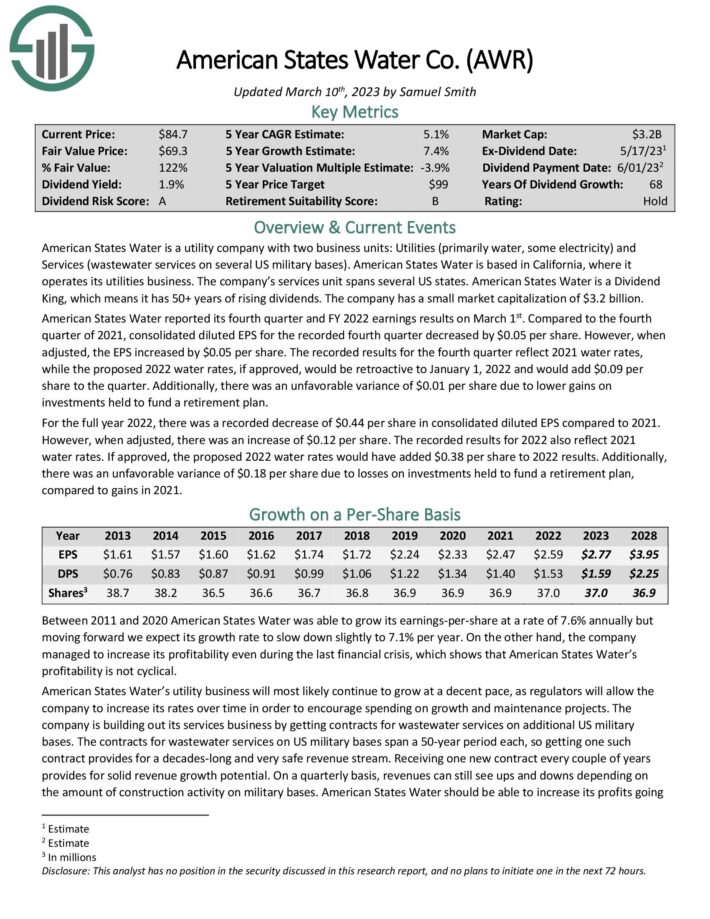

Forever Stock #18: American States Water Co. (AWR)

- Dividend yield: 1.7%

- Years of dividend growth: 68

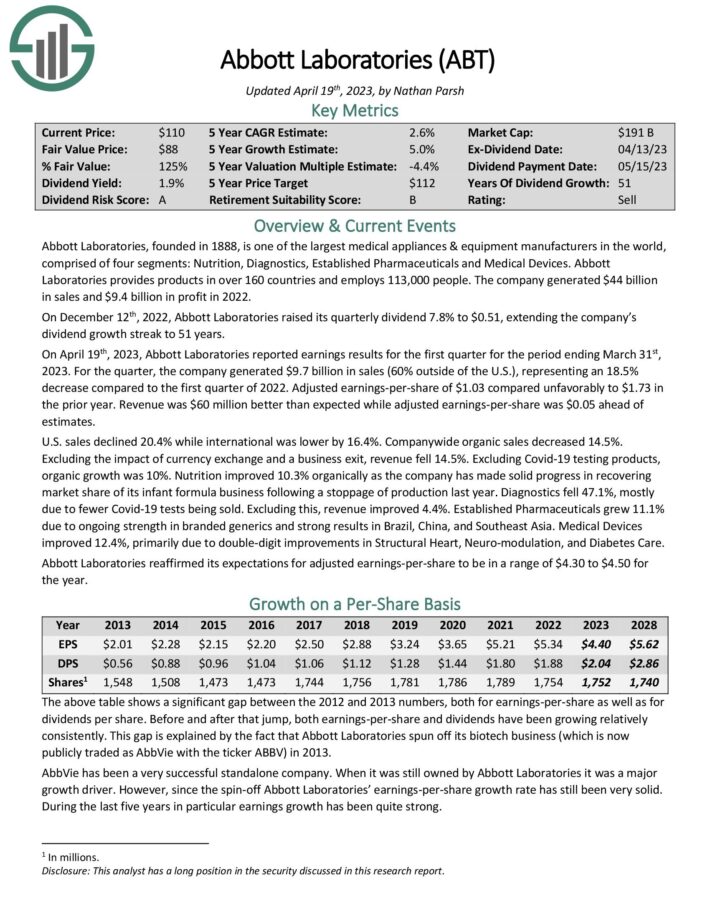

American States Water is a utility company with two business units: Utilities (primarily water, some electricity) and Services (wastewater services on several US military bases). American States Water is based in California, where it operates its utility business. The company’s services unit spans several US states. American States Water is a Dividend King, which means it has 50+ years of rising dividends. The company has a small market capitalization of $3.4 billion.

American States Water reported its fourth quarter and FY 2022 earnings results on March 1st. Compared to the fourth quarter of 2021, consolidated diluted EPS for the recorded the fourth quarter decreased by $0.05 per share. However, when adjusted, the EPS increased by $0.05 per share. The recorded results for the fourth quarter reflect 2021 water rates, while the proposed 2022 water rates would be retroactive to January 1, 2022, and would add $0.09 per share to the quarter. Additionally, there was an unfavorable variance of $0.01 per share due to lower gains on

investments held to fund a retirement plan.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on American States Water (preview of page 1 of 3 shown below):

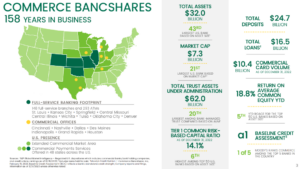

Forever Stock #17: Commerce Bancshares, Inc. (CBSH)

- Dividend yield: 2.0%

- Years of dividend growth: 54

Commerce Bancshares is a bank holding for Commerce Bank. It offers general banking services to its customers. Its services include retail and corporate banking, as well as asset management, investment banking, and other offerings. The company was founded in 1865 and operated branches in Colorado, Kansas, Missouri, Illinois, and Oklahoma. Commerce Bancshares is headquartered in Kansas City, Missouri.

Commerce Bancshares reported its first-quarter earnings results on April 18th, 2023. The company generated revenues of $389 million during the quarter, up 14.3% from the previous year’s quarter. During the quarter, Commerce Bancshares’ loan portfolio averaged $16.4 billion, up 3.3% sequentially. This improved from the previous trend, as loan demand had grown slower in previous quarters. Also, net income for the first quarter of 2023 amounted to $119.5 million, compared to $118.2 million in the first quarter of 2022 and $131.6 million in the prior quarter. Commerce Bancshares generated earnings-per-share of $0.95 during the first quarter, which was up 3.3% compared to the previous year’s quarter, with higher revenues offsetting the headwind from higher provisions for credit losses.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Commerce Bancshares (preview of page 1 of 3 shown below):

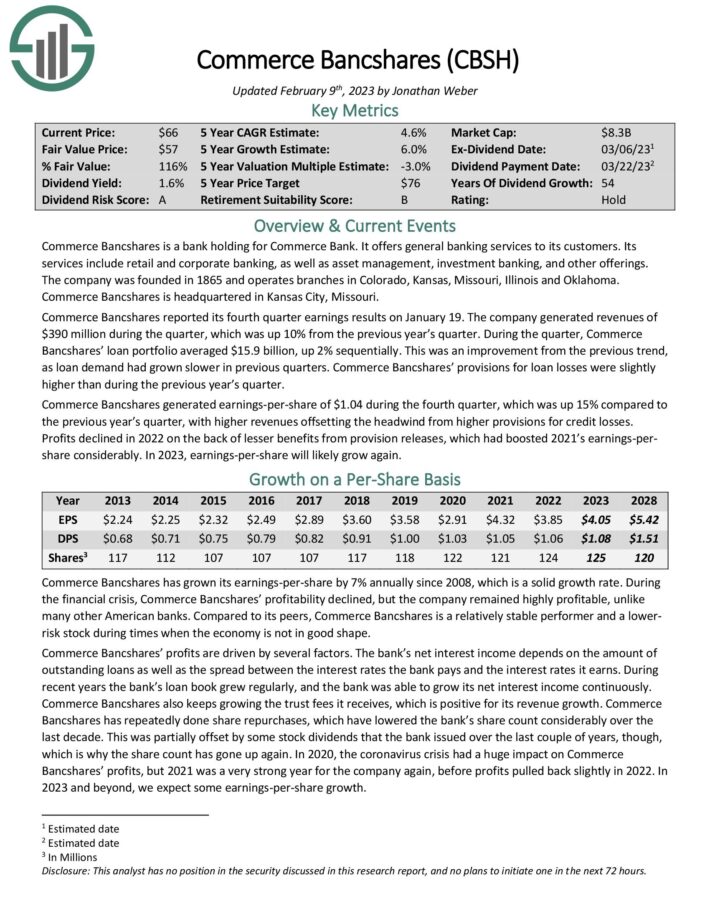

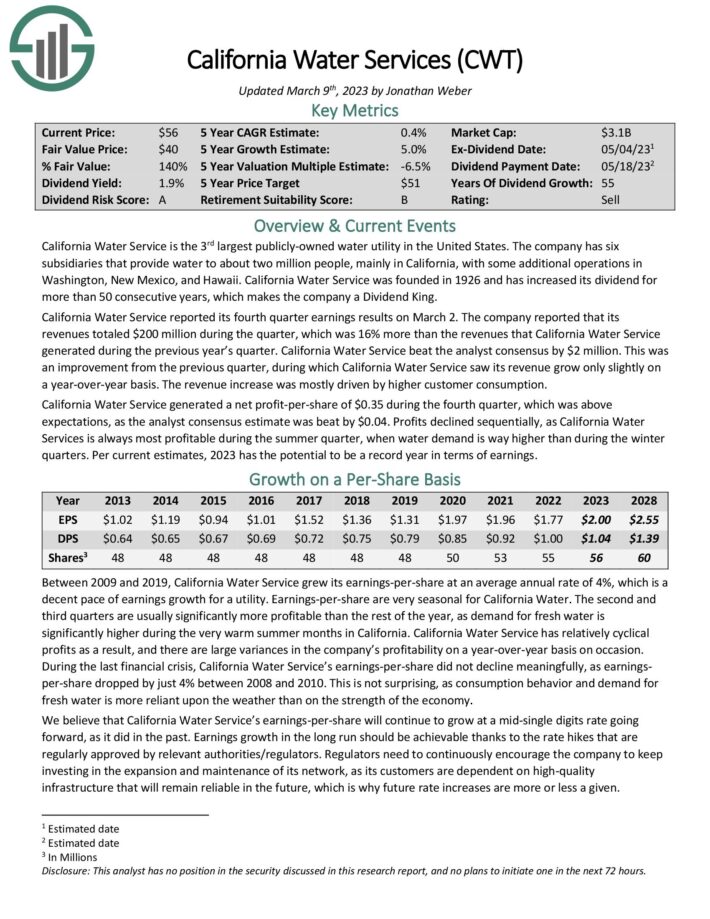

Forever Stock #16: California Water Service Group (CWT)

- Dividend yield: 1.8%

- Years of dividend growth: 55

California Water Service is the 3rd largest publicly-owned water utility in the United States. The company has six subsidiaries providing water to about two million people, mainly in California, with additional operations in Washington, New Mexico, and Hawaii. California Water Service was founded in 1926 and has increased its dividend for over 50 consecutive years, making the company a Dividend King.

California Water Service reported its first-quarter earnings results on March 2nd, 2023. The company reported that its revenues totaled $200 million during the quarter, 16% more than California Water Service’s revenues during the previous year’s quarter. California Water Service beat the analyst consensus by $2 million. This was an improvement from the previous quarter, during which California Water Service saw its revenue grow only slightly on a year-over-year basis. The revenue increase was driven mainly by higher customer consumption.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on California Water Service (preview of page 1 of 3 shown below):

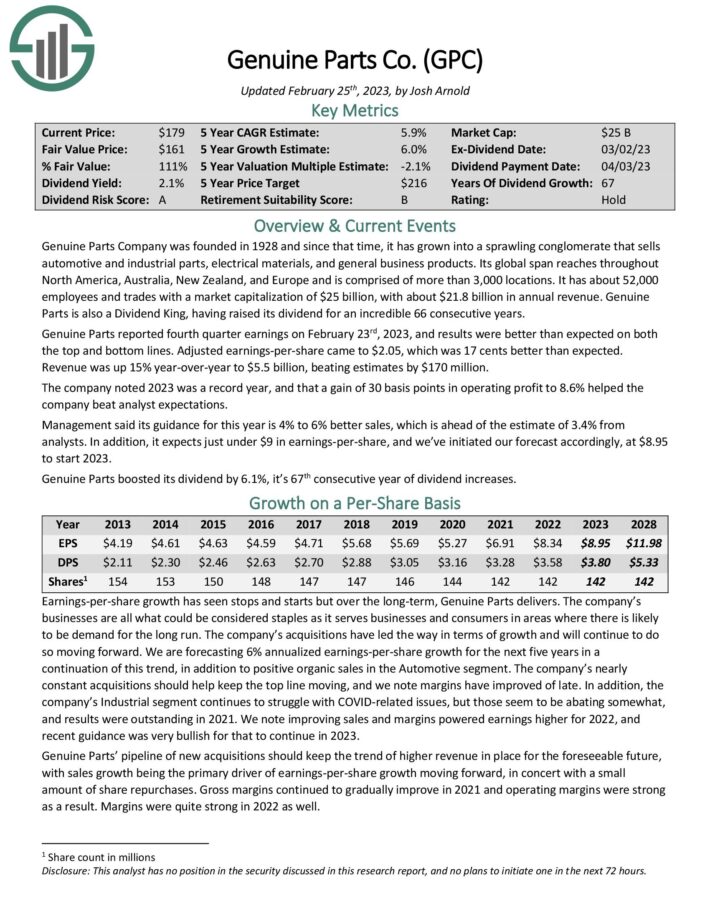

Forever Stock #15: Emerson Electric Co. (EMR)

- Dividend yield: 2.4%

- Years of dividend growth: 66

Emerson Electric was founded in Missouri in 1890. Since then, it has evolved through organic growth, as well as strategic acquisitions and divestitures, from a regional manufacturer of electric motors and fans into a $50 billion diversified global leader in technology and engineering. Its global customer base and diverse product and service offerings afford it about $15 billion in annual revenue. The company’s impressive 66-year dividend increase streak lands it on the prestigious Dividend Kings list.

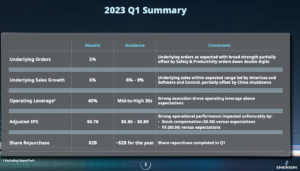

Emerson reported first-quarter earnings on February 8th, 2023, and the results were much weaker than expected. Adjusted earnings-per-share came to 78 cents, nine cents worse than expected. Revenue was $3.37 billion, 6.6% higher than the comparable period a year ago, but missed estimates by $60 million. Profit increased by 250% to $3.97 per share, or $2.33 billion, year-over-year. However, earnings from continuing operations plummeted from $1.25 per share to 56 cents.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Emerson Electric (preview of page 1 of 3 shown below):

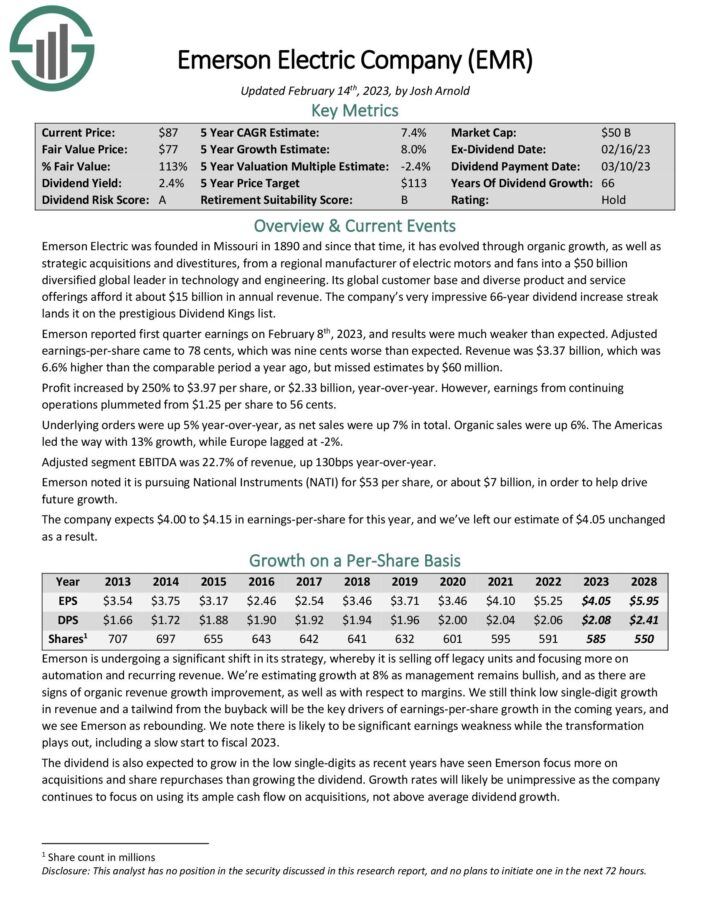

Forever Stock #14: Genuine Parts Co. (GPC)

- Dividend yield: 2.3%

- Years of dividend growth: 67

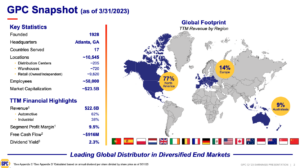

Genuine Parts Company was founded in 1928, and since that time, it has grown into a sprawling conglomerate that sells automotive and industrial parts, electrical materials, and general business products. Its global span reaches North America, Australia, New Zealand, and Europe, comprising more than 3,000 locations. It has about 52,000 employees and trades with a market capitalization of $25 billion, with about $23.4 billion in annual revenue. Genuine Parts is also a Dividend King, having raised its dividend for an incredible 67 consecutive years.

Genuine Parts reported first-quarter earnings on April 20th, 2023, and results were better than expected on the top and bottom lines. Adjusted earnings-per-share came to $2.14, which was 09 cents better than expected. Revenue was up 8.9% year-over-year to $5.8 billion, beating estimates by $120 million. The company noted 2022 was a record year and that a gain of 30 basis points in operating profit to 8.6% helped the company beat analyst expectations.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Genuine Parts Company (preview of page 1 of 3 shown below):

Forever Stock #13: Lowe’s Cos, Inc. (LOW)

- Dividend yield: 2.3%

- Years of dividend growth: 67

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). The company, which has a current market capitalization of $125.8 billion, was founded in 1946 and is headquartered in Mooresville, NC. Lowe’s operates or services more than 1,700 home improvement and hardware stores in the U.S. and Canada. Lowe’s trades under the ticker symbol LOW on the NYSE.

Lowe’s reported fourth quarter and full year 2022 results on March 1st, 2023. Total sales for the fourth quarter came in at $22.4 billion compared to $21.3 billion in the same quarter a year ago. Comparable sales decreased by 1.5%, while the U.S. home improvement comparable sales declined by 0.7%. Adjusted net earnings, which excludes the pre-tax transaction costs associated with the sale of the Canadian retail business, rose 28% year-over-year to $2.28 per share. For the full year, Lowe’s generated diluted EPS of $10.17, a 15% decrease compared to $12.04 in 2021.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Lowe’s Companies (preview of page 1 of 3 shown below):

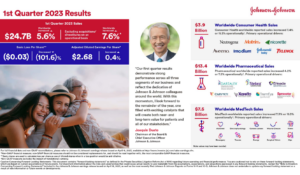

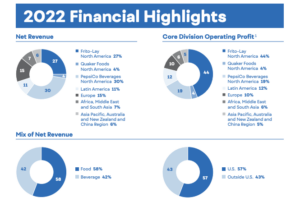

Forever Stock #12: Johnson & Johnson (JNJ)

- Dividend yield: 2.9%

- Years of dividend growth: 61

Johnson & Johnson is a diversified healthcare company and a leader in the area of pharmaceuticals (~49% of sales), medical devices (~34% of sales), and consumer products (~17% of sales). Johnson & Johnson was founded in 1886 and employed more than 141,000 people worldwide. The company is projected to generate approximately $98 to $99 billion in revenue this year.

On April 18th, 2023, Johnson & Johnson released first-quarter results for the period ending March 31st, 2023. For the quarter, revenue grew 5.6% to $24.7 billion, which was $1.1 billion better than expected. Adjusted earnings-per-share of $2.68 compared favorably to $2.67 in the prior year and was $0.18 more than anticipated.

Also on April 18th, 2023, Johnson & Johnson announced that it was increasing its quarterly dividend by 5.3% to $1.19, extending its dividend growth streak to 61 consecutive years.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Johnson & Johnson (preview of page 1 of 3 shown below):

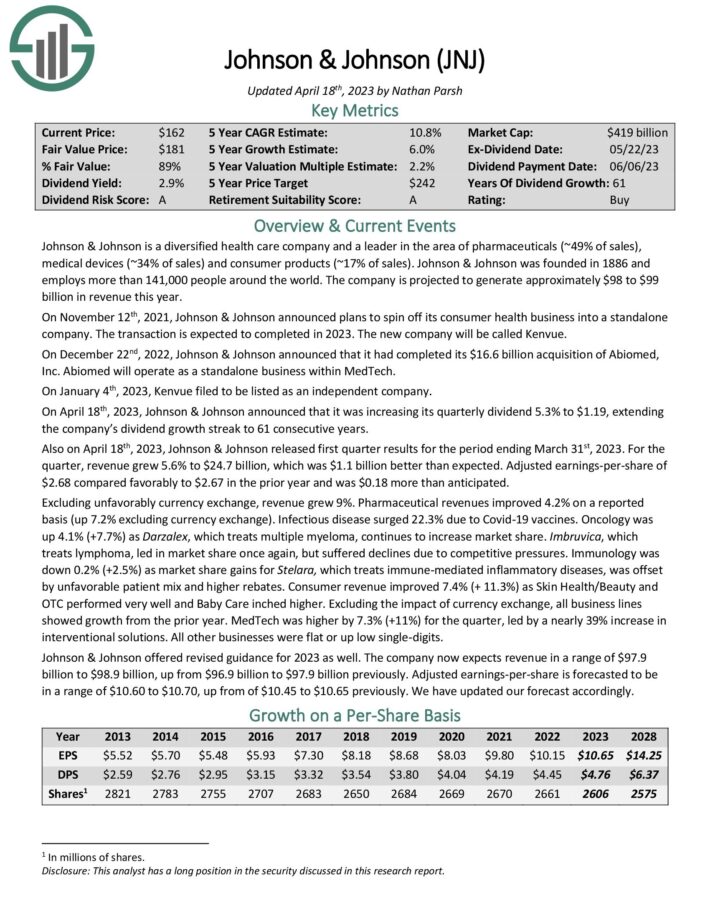

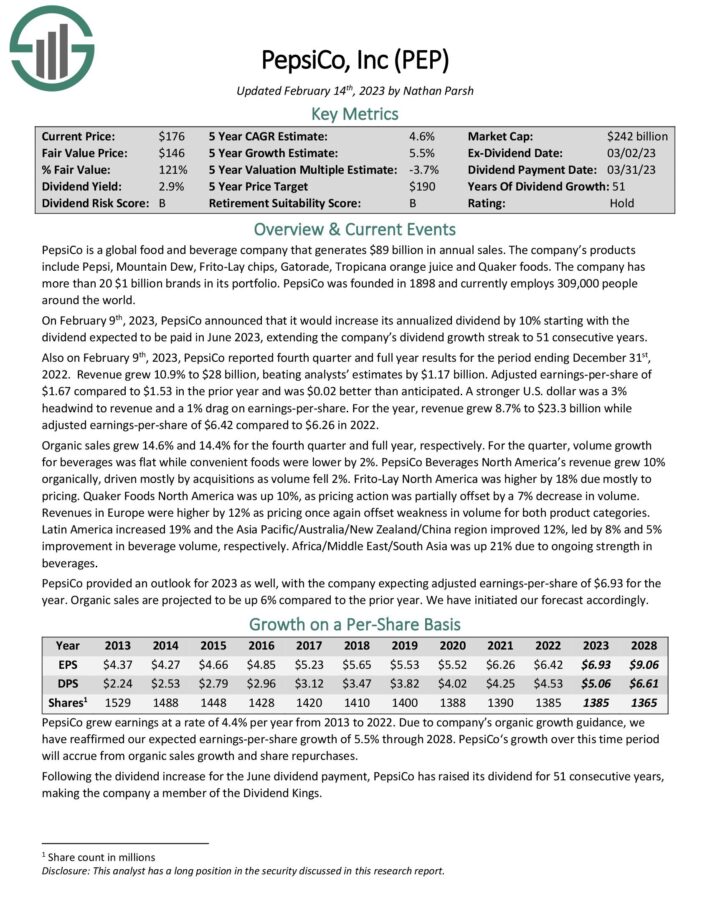

Forever Stock #11: PepsiCo, Inc. (PEP)

- Dividend yield: 2.5%

- Years of dividend growth: 51

PepsiCo is a global food and beverage company with about $80 billion in annual sales. The company has multiple competitive advantages, including its strong brands and a global scale. Specifically, PepsiCo has 23 individual brands that generate at least $1 billion in annual sales. Besides its strong brands tending to yield consistent sales as they are widely trusted amongst consumers, they secure optimal shelf space at retailers and provide PepsiCo with exceptional pricing power.

On February 9th, 2023, PepsiCo reported fourth-quarter and full-year results for the period ending December 31st, 2022. Revenue grew 10.9% to $28 billion, beating analysts’ estimates by $1.17 billion. The adjusted earnings-per-share of $1.67 compared to $1.53 in the prior year was $0.02 better than anticipated. A stronger U.S. dollar was a 3% headwind to revenue and a 1% drag on earnings-per-share. For the year, revenue grew 8.7% to $23.3 billion while adjusted earnings-per-share of $6.42 compared to $6.26 in 2022.

Also on February 9th, 2023, PepsiCo announced that it would increase its annualized dividend by 10%, starting with the dividend expected to be paid in June 2023, extending its dividend growth streak to 51 consecutive years.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on PepsiCo, Inc. (preview of page 1 of 3 shown below):

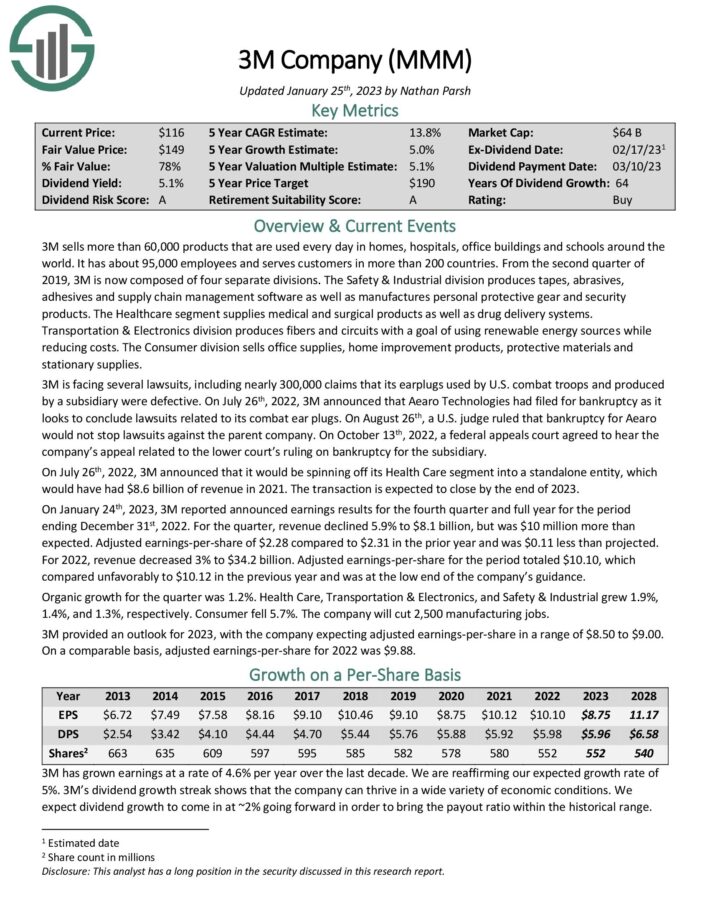

Forever Stock #10: 3M Co. (MMM)

- Dividend yield: 5.7%

- Years of dividend growth: 64

3M sells more than 60,000 products used daily in homes, hospitals, office buildings, and schools worldwide. It has about 95,000 employees and serves customers in more than 200 countries. From the second quarter of 2019, 3M comprises four separate divisions.

On January 24th, 2023, 3M reported announced earnings results for the fourth quarter and full year for the period ending December 31st, 2022. The quarter’s revenue declined 5.9% to $8.1 billion but was $10 million more than expected. The adjusted earnings-per-share of $2.28 compared to $2.31 in the prior year was $0.11 less than projected. For 2022, revenue decreased by 3% to $34.2 billion. Adjusted earnings-per-share for the period totaled $10.10, which compared unfavorably to $10.12 in the previous year and was at the low end of the company’s guidance.

On July 26th, 2022, 3M announced that it would be spinning off its Health Care segment into a standalone entity, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on 3M Company (preview of page 1 of 3 shown below):

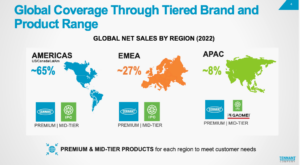

Forever Stock #9: Tennant Co. (TNC)

- Dividend yield: 1.6%

- Years of dividend growth: 52

Tennant Company is a machinery company that produces cleaning products and offers cleaning solutions to its customers. In the US, the company holds the market leadership position in its industry, but it also sells its products in more than 100 additional countries around the globe. Tennant was founded in 1870.

Tennant Company reported its fourth-quarter earnings results on February 23. The company announced that it generated revenues of $290 million during the quarter, which was 5% more than the top line number from the previous year’s quarter. This was a reversal from recent trends, as revenue had declined year-over-year during the previous quarter. Revenues also were up on a sequential basis during the period.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Tennant Company (preview of page 1 of 3 shown below):

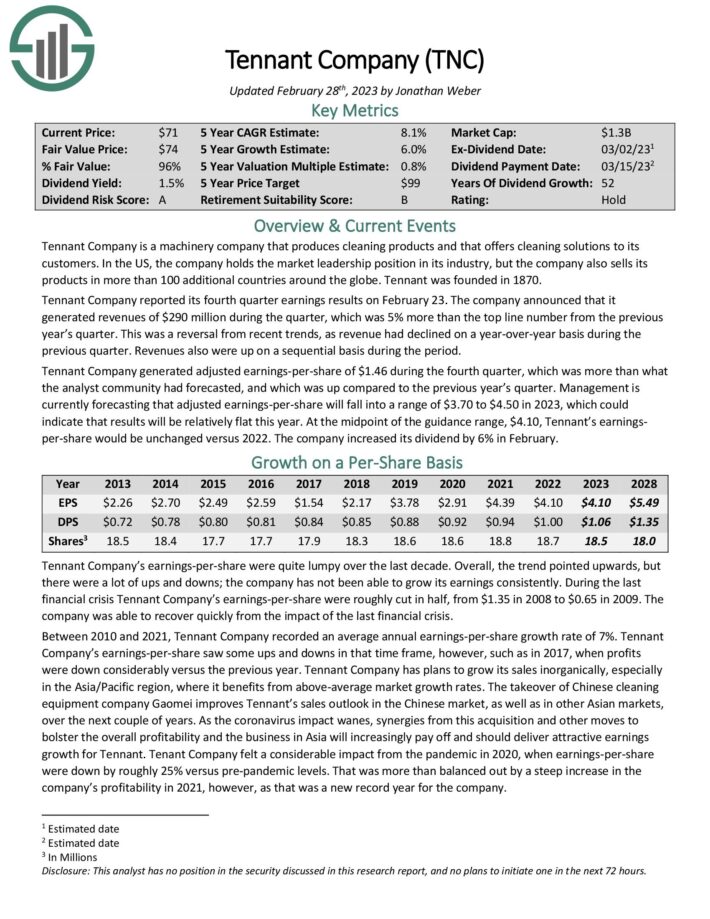

Forever Stock #8: Procter & Gamble Co. (PG)

- Dividend yield: 2.4%

- Years of dividend growth: 66

Founded in 1837 and headquartered in Cincinnati, Ohio, Procter & Gamble is a consumer products giant that sells its products in over 180 countries. Notable brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral-B, Scope, Olay, and many more. The $340 billion market capitalization company generated $80 billion in sales in fiscal 2022. Procter & Gamble has paid a dividend for 131 years and has grown its dividend for 66 consecutive years – one of the longest active streaks of any company.

In mid-April, Procter & Gamble reported (4/21/23) financial results for the third quarter of fiscal 2023 (its fiscal year ends June 30th). The company grew its organic sales by 7% over the prior year’s quarter, and its sales increased by 4%. Unfavorable foreign exchange had a four percent impact on net sales. Organic sales growth resulted from 10% price hikes, partly offset by a -3% volume decrease.

On April 12th , 2022, Procter & Gamble raised its dividend by 5.0%, from $0.8698 per quarter to $0.9133.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Procter & Gamble (preview of page 1 of 3 shown below):

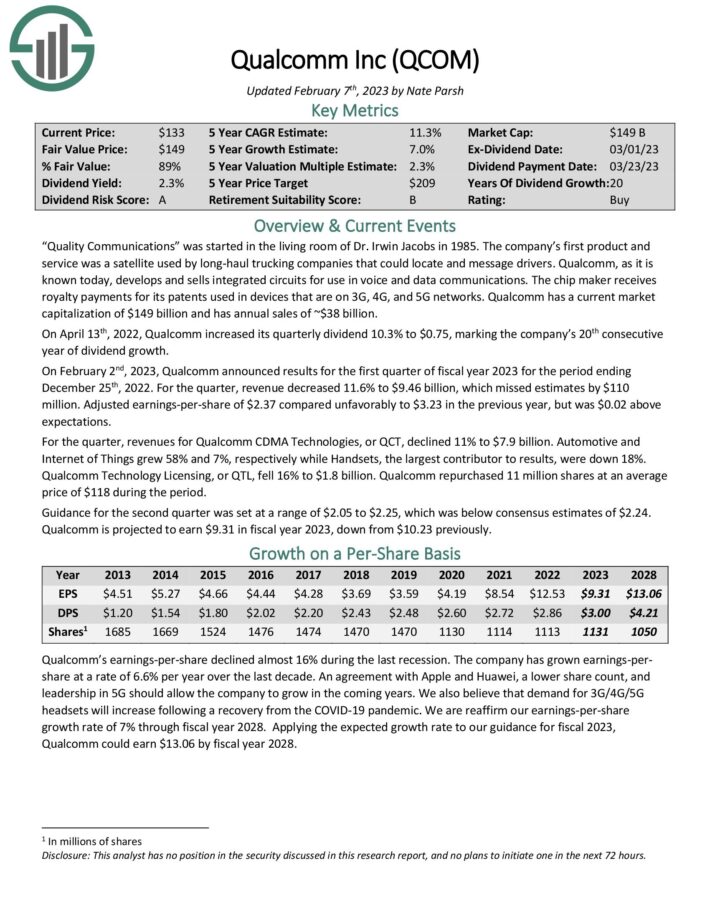

Forever Stock #7: QUALCOMM Incorporated (QCOM)

- Dividend yield: 2.7%

- Years of dividend growth: 20

Qualcomm, as it is known today, develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G, 4G, and 5G networks. Qualcomm’s current market capitalization of $131 billion generates annual sales of ~$44 billion.

While the semiconductor industry is cyclical, Qualcomm’s chips are essential for phone manufacturers to power their devices. Qualcomm’s technologies are critical for powering the telecommunications industry in general, and the company has enjoyed great traction lately due to the ongoing expansion of the 5G network.

On February 2nd, 2023, Qualcomm announced results for the first quarter of the fiscal year 2023 for the period ending December 25th, 2022. For the quarter, revenue decreased 11.6% to $9.46 billion, which missed estimates by $110 million. Adjusted earnings-per-share of $2.37 compared unfavorably to $3.23 in the previous year but was $0.02 above expectations.

On April 13th, 2022, Qualcomm increased its quarterly dividend by 10.3% to $0.75, marking its 20th consecutive year of dividend growth.

Source: Investor Presentation

Qualcomm has grown its dividend for 20 consecutive years, and based on its projected earnings for the year, its dividend payout ratio stands close to 32%.

Click here to download our most recent Sure Analysis report on QUALCOMM Incorporated (preview of page 1 of 3 shown below):

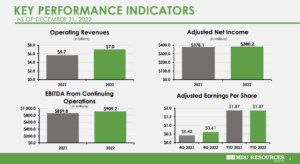

Forever Stock #6: MDU Resources (MDU)

- Dividend yield: 3.0%

- Years of dividend growth: 32

MDU Resources is a regulated energy delivery, transportation, and construction materials and services business. The company was founded in 1924, and since then, it has grown from a small electric utility in North Dakota to a market capitalization of $6.1 billion.

MDU reported the fourth quarter and full-year earnings on February 9th, 2023, and results were better than expected on both the top and bottom lines and by wide margins in both cases. Adjusted earnings-per-share came to 61 cents, which was eight cents better than estimates. Revenue soared 29% year-over-year to $1.86 billion and was $360 million ahead of expectations. On a dollar basis, adjusted earnings were $126 million, which was sharply higher than the $87 million in the year-ago period. On a per-share basis, it was up from 42 cents. MDU had an all-time high backlog at the end of the year of $3 billion in its construction businesses.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on MDU Resources (preview of page 1 of 3 shown below):

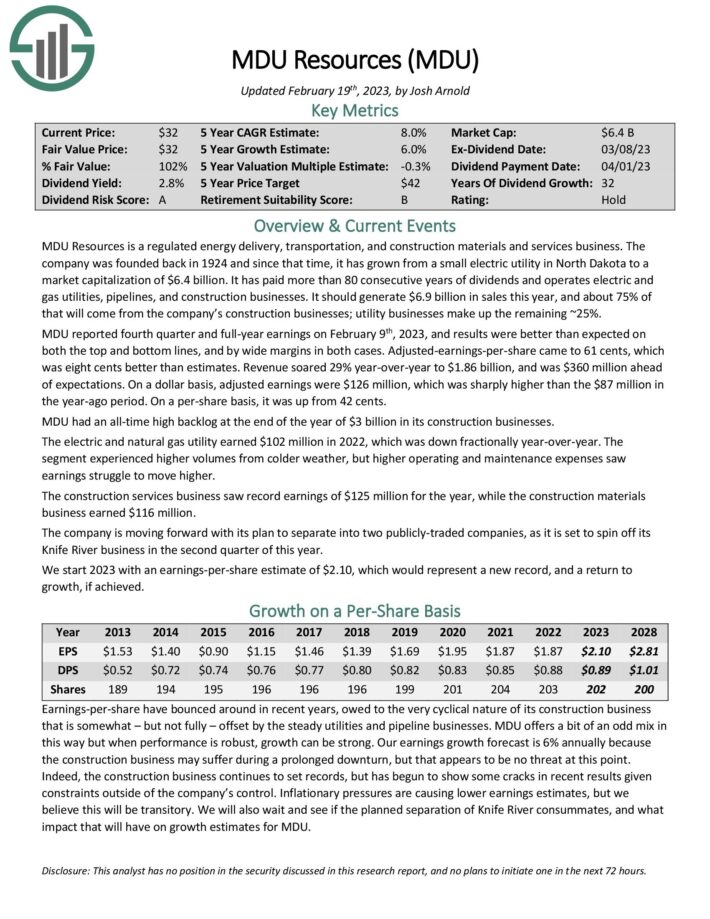

Forever Stock #5: Black Hills Corporation (BKH)

- Dividend yield: 3.8%

- Years of dividend growth: 52

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Black Hills was founded in 1941 and is headquartered in Rapid City, South Dakota. Black Hills Corporation has increased its dividend for over 50 years, making it a Dividend King thanks to five decades of dividend raises.

Black Hills Corporation reported its fourth-quarter earnings results on February 7. The company generated revenues of $790 million during the quarter, which was 41% more than the revenues that Black Hills Corporation was able to generate during the previous year’s quarter. Black Hills Corporation’s revenues were higher than the analyst community expected, beating the consensus estimate by a hefty $130 million. Black Hills Corporation generated earnings-per-share of $1.11 during the fourth quarter, which was above the consensus analyst estimate. Earnings-per-share were unchanged versus the previous year’s quarter.

Due to a modest dividend growth rate, Black Hills Corporation’s dividend payout ratio declined over the past decade. Today, the company pays out roughly 60% of its net profits through dividends.

Source: Investor Presentation

Demand for electricity and gas is not very cyclical, although it somewhat depends on weather conditions. Thus, Black Hills should remain profitable under most circumstances. Customers tend to stick with their provider because Black Hills operates a relatively stable business model. The company should also be able to weather future recessions well, which makes it an ideal generational stock for rising income.

Click here to download our most recent Sure Analysis report on Black Hills Corporation (preview of page 1 of 3 shown below):

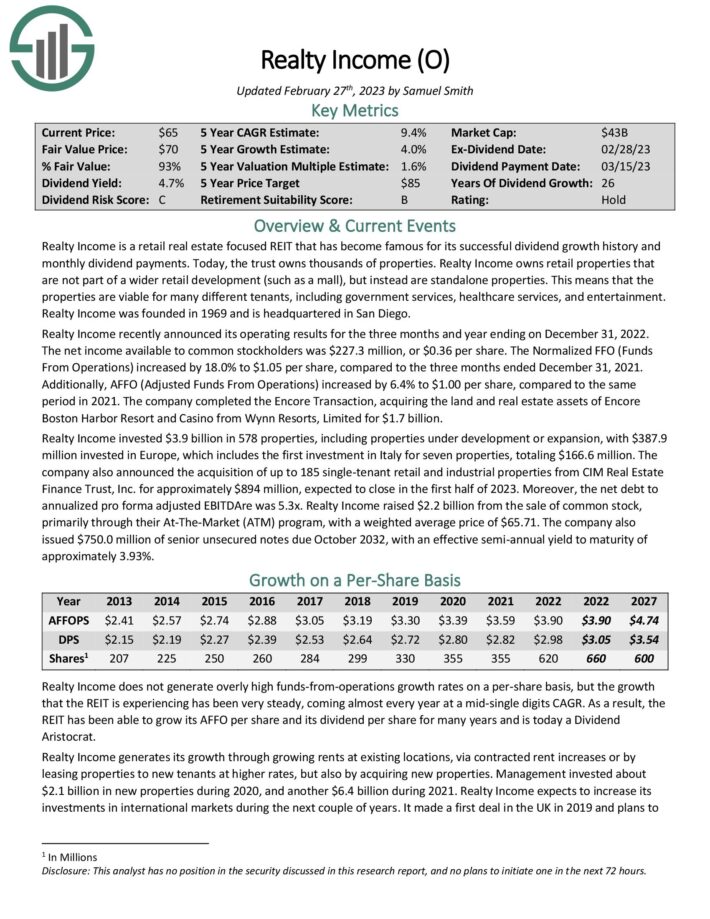

Forever Stock #4: Realty Income Corporation (O)

- Dividend yield: 4.9%

- Years of dividend growth: 26

Realty Income is a REIT that has become famous for its successful dividend growth history and monthly dividend payments. Today, the trust owns more than 4,000 properties that are not part of a more comprehensive retail development (such as a mall) but instead are stand-alone properties. This means its locations are viable for many tenants, including government services, healthcare services, and entertainment.

Realty Income recently announced its operating results for the three months and year ending on December 31, 2022. The net income available to common stockholders was $227.3 million, or $0.36 per share. The Normalized FFO (Funds From Operations) increased by 18.0% to $1.05 per share compared to the three months ended December 31, 2021. Additionally, AFFO (Adjusted Funds From Operations) increased by 6.4% to $1.00 per share compared to the same period in 2021. The company completed the Encore Transaction, acquiring the land and real estate assets of Encore Boston Harbor Resort and Casino from Wynn Resorts, Limited for $1.7 billion.

Realty Income has trademarked itself as “The Monthly Dividend Company”, boasting 632 monthly dividends declared and 101 consecutive quarterly increases.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Realty Income Corporation (preview of page 1 of 3 shown below):

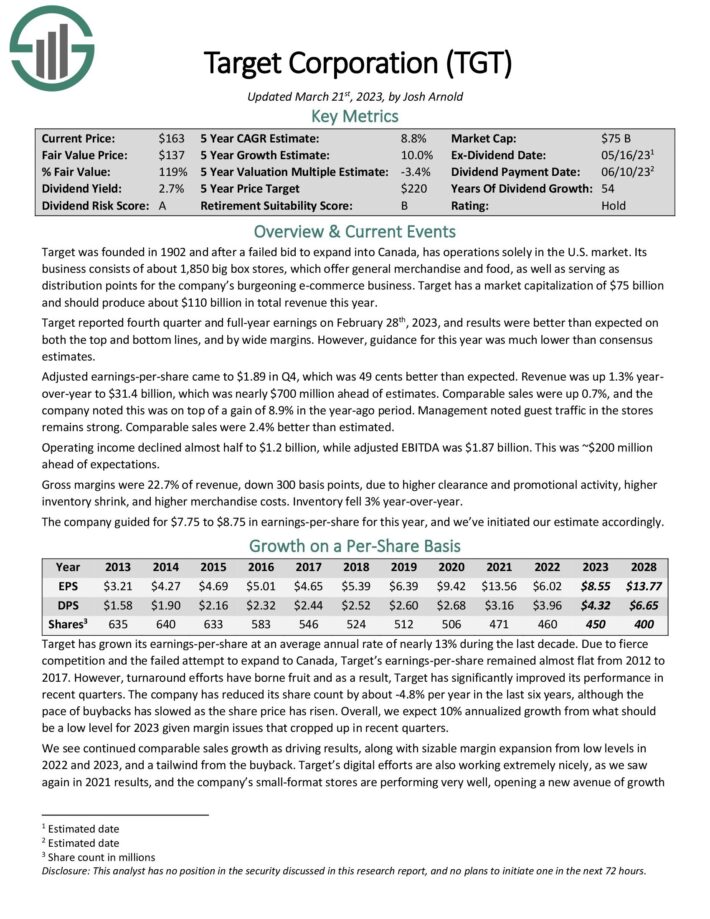

Forever Stock #3: Target Corporation (TGT)

- Dividend yield: 3.7%

- Years of dividend growth: 54

Target was founded in 1902 and, after a failed bid to expand into Canada, has operations solely in the U.S. market. Its business consists of about 2,000 big box stores offering general merchandise and food and serving as distribution points for its burgeoning e-commerce business. Target’s market capitalization of $74.7 billion should produce about $110 billion in total revenue this year.

Target reported fourth-quarter and full-year earnings on February 28th, 2023, and results were better than expected on both the top and bottom lines and by wide margins. However, guidance for this year was much lower than consensus estimates. Adjusted earnings-per-share reached $1.89 in Q4, which was 49 cents better than expected. Revenue was up 1.3% year over-year to $31.4 billion, which was nearly $700 million ahead of estimates. Comparable sales were up 0.7%, and the company noted this was on top of a gain of 8.9% in the year-ago period. Management noted guest traffic in the stores remains strong. Comparable sales were 2.4% better than estimated.

Source: Investor Infographic

Click here to download our most recent Sure Analysis report on Target Corporation (preview of page 1 of 3 shown below):

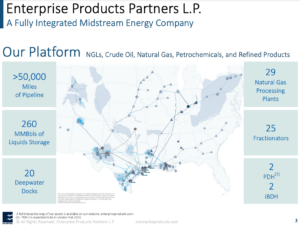

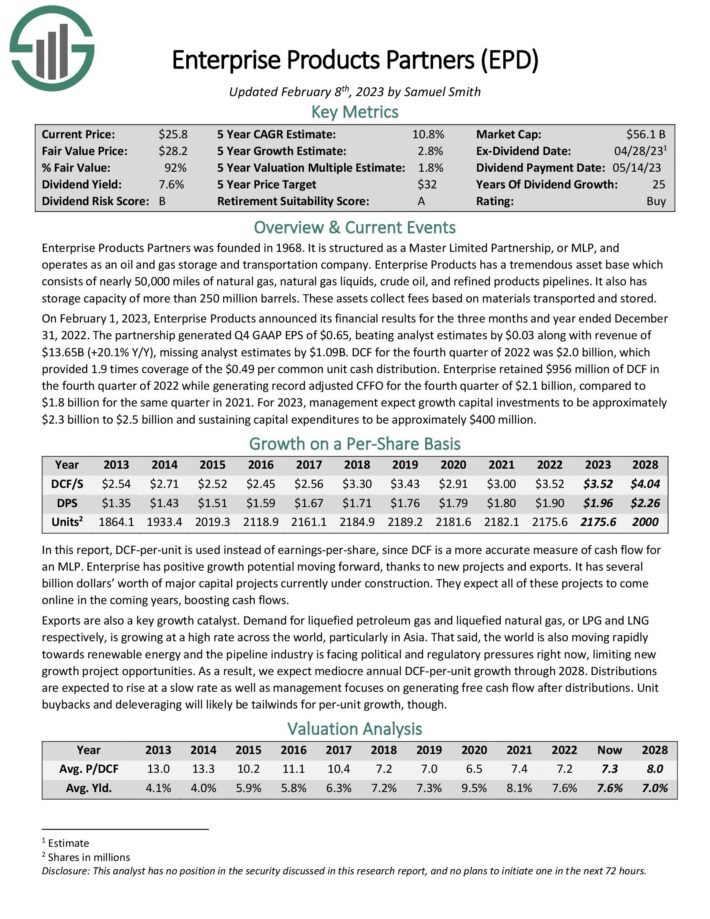

Forever Stock #2: Enterprise Products Partners L.P. (EPD)

- Dividend yield: 7.3%

- Years of dividend growth: 25

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company. Enterprise Products has a tremendous asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines. It also has a storage capacity of more than 250 million barrels. These assets collect fees based on materials transported and stored.

On February 1, 2023, Enterprise Products announced its financial results for the three months and year ending December 31, 2022. The partnership generated Q4 GAAP EPS of $0.65, beating analyst estimates by $0.03, and revenue of $13.65B (+20.1% Y/Y), missing analyst estimates by $1.09B. DCF for the fourth quarter of 2022 was $2.0 billion, which provided 1.9 times coverage of the $0.49 per common unit cash distribution. Enterprise retained $956 million of DCF in the fourth quarter of 2022 while generating record adjusted CFFO for the fourth quarter of $2.1 billion, compared to $1.8 billion for the same quarter in 2021.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Enterprise Products Partners L.P. (preview of page 1 of 3 shown below):

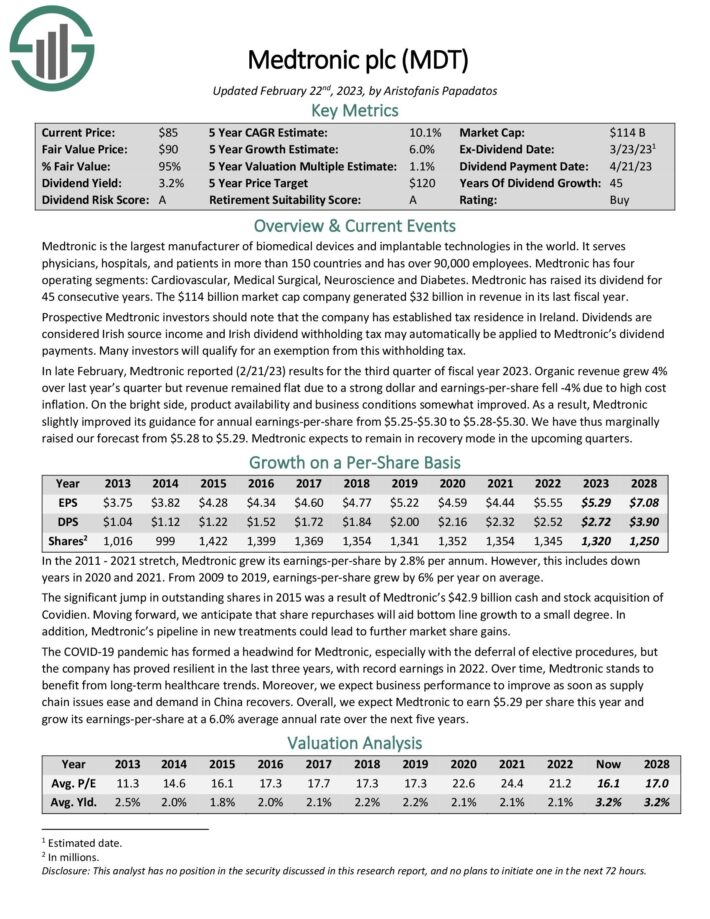

Forever Stock #1: Medtronic plc (MDT)

- Dividend yield: 3.2%

- Years of dividend growth: 45

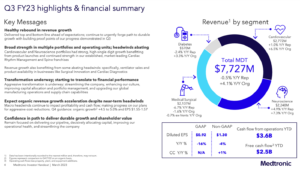

Medtronic is the world’s largest manufacturer of biomedical devices and implantable technologies. It serves physicians, hospitals, and patients in over 150 countries and has over 90,000 employees. Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience, and Diabetes. The $114 billion market cap company generated $32 billion in revenue in its last fiscal year.

In late February, Medtronic reported (2/21/23) results for the third quarter of the fiscal year 2023. Organic revenue grew 4% over last year’s quarter, but revenue remained flat due to a strong dollar, and earnings-per-share fell -4% due to high-cost inflation. On the bright side, product availability and business conditions somewhat improved. As a result, Medtronic slightly improved its guidance for annual earnings-per-share from $5.25-$5.30 to $5.28-$5.30. We have thus marginally raised our forecast from $5.28 to $5.29. Medtronic expects to remain in recovery mode in the upcoming quarters.

Source: Investor Presentation

Its growing financials, moat, and consistent focus on invocation have allowed the company to grow its dividend for 45 consecutive years. The dividend has grown by 16% per year on average over the last 45 years and by 8% per year on average over the last five years.

Click here to download our most recent Sure Analysis report on Medtronic plc (preview of page 1 of 3 shown below):

Final Thoughts

In conclusion, “forever” stocks, such as the 20 names we featured in this article, can be a great way to generate passive income and gradually grow your wealth over time. Forever stocks have proven to be dependable and enduring over long periods, and their growth catalysts should continue providing rising income for generations to come.

When selecting “forever” stocks for your portfolio, you must consider various factors, including solid financials, a history of consistently paying and increasing dividends, growth potential, and a solid competitive advantage or “moat.” We hope our list has provided some worthwhile ideas for long-term investment opportunities.

Further Reading

If you are interested in finding more blue-chip stocks, and other income investing opportunities, the following Sure Dividend resources will be of interest to you.

Blue Chip Stock Investing

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 10 Best Performing Blue Chip Stocks Over The Last 12 Months

- 10 Blue-Chip Tech Stocks For Growing Dividends

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more