Published on March 8th, 2023 by Samuel Smith

Real Estate Investment Trusts – or REITs – can be a fantastic source of yield, safety, and growth for dividend investors. For example, Generation Income Properties (GIPR) has an impressive 8.8% dividend yield.

Generation Income Properties also pays its dividends on a monthly basis, which is rare in a world where the vast majority of dividend stocks make quarterly payouts.

There are only 84 monthly dividend stocks that we currently cover. You can see our full list of monthly dividend stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

Generation Income Properties’ high dividend yield and monthly dividend payments make it an intriguing stock for dividend investors, even though the company IPO in 2019.

This article will analyze the investment prospects of Generation Income Properties.

Business Overview

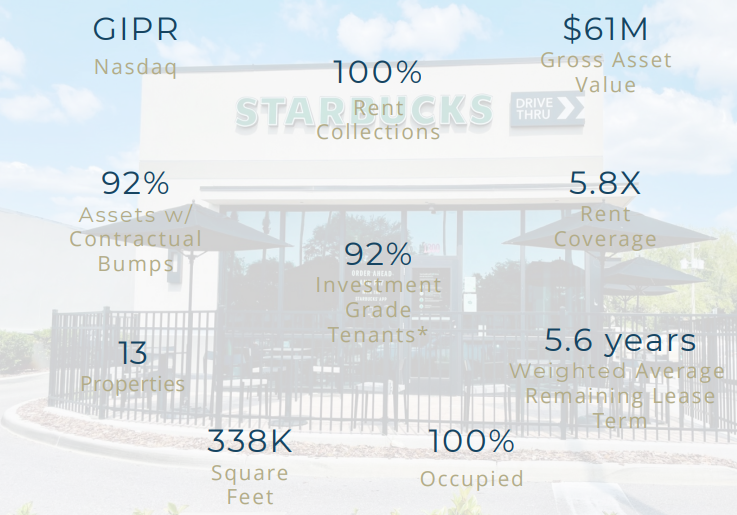

Generation Income Properties, founded in 2015, acquires and manages a diversified portfolio of primarily investment-grade, single-tenant retail, industrial, and office properties with a generational outlook in mind. The company focuses on the underlying real estate, the credit of the tenant, and opportunistic lease terms of less than ten years remaining.

The company looks for higher-density real estate markets which will help lead to higher real estate values. Also, by purchasing shorter lease terms for investment-grade credit tenant assets, GIP can provide above-market returns.

Source: Gipreit.com

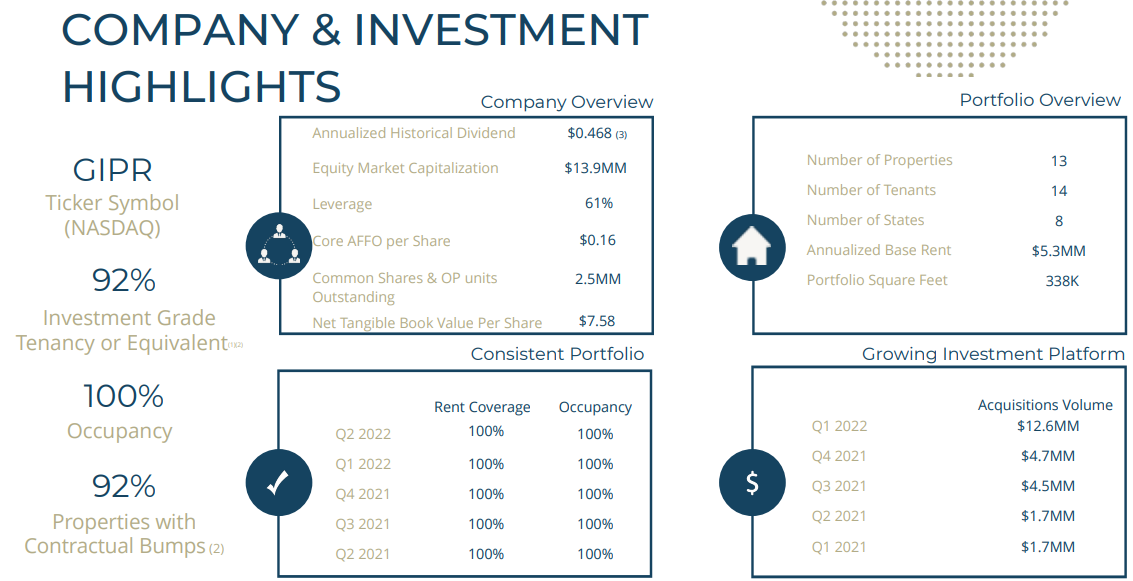

On November 14th, 2023, the company reported third-quarter results for Fiscal Year (FY)2022. GIPR incurred a net loss of $639 thousand, equivalent to a basic and diluted loss of ($0.28) per share. However, the company generated Core FFO of $326 thousand or $0.14 per basic and diluted share and Core AFFO of $358 thousand or $0.16 per basic and diluted share.

In his remarks about the quarter, CEO David Sobelman highlighted the company’s focus on maximizing internal growth and expanding their pipeline to better manage market uncertainty. He noted that the company is strategically positioned to take advantage of market imbalances and will opportunistically acquire assets when appropriate. Sobelman also expressed satisfaction with the company’s stable position, as evidenced by their 100% rent collection rate, fixed debt rates that are below current market interest rates, and the strong creditworthiness of their tenants.

As of September 30, 2022, roughly 85% of the company’s annualized base rent (“ABR”) came from tenants with investment-grade credit ratings of “BBB-” or higher from recognized credit rating agencies. The company’s top tenants include the General Service Administration, PRA Holdings, Inc., Pratt and Whitney, and Kohl’s, all of which have an ‘BB+’ credit rating or higher from S&P Global Ratings and contribute about 66% of the portfolio’s annualized base rent. Additionally, all of the company’s tenants have consistently paid rent since the company’s inception.

Moreover, approximately 92% of the portfolio’s annualized base rent provides for increases in contractual base rent during future years of the current term or lease renewal periods. The average ABR per square foot for the portfolio is $15.70.

Growth Prospects

Generation Income Properties has had impressive growth since forming before going public.

Source: Gipreit.com

The trust has grown steadily in portfolio size and revenue, but relatively high operating costs and dilution from share issuances have slowed shareholder returns. With higher costs and the dilution of share issuances, this combination will hurt the company’s future FFO per share growth.

Growth drivers for the company will come from its continuation of acquisitions, as it acquired four properties in 2021 and will continue growing in 2022. Also, the increase in rent from its current tenants through regular contractual rent hikes further drives growth. However, the company must better control its expenses in order to genuinely create shareholder value.

Dividend Analysis

For all of its growth concerns, Generation Income Properties dividend appears to be unsafe right now. The company already had to lower its distribution in Q4 in order to position the company to retain enough cash flow to be able to begin investing in growing the company. This was essential in order to try to improve economies of scale and make the company a more efficient entity. The company is expected to improve AFFO per share from $0.33 in 2022 to $0.44 in 2023, so it appears that it is at least headed in a positive direction.

Also, the company’s balance sheet is concerning. The company has a low EBITDA to an interest coverage ratio of 0.6, which signals that it needs to improve its operating efficiency if it can remain solvent over the long-term.

Final Thoughts

Generation Income Properties is a high dividend stock, and its monthly dividend payments make it attractive to income investors. However, several factors make us cautious about the company today, such as its lack of diversification within its property portfolio and its high level of debt.

With a risky dividend, we view the stock as unattractive for risk-averse income investors. Investors looking for a REIT that pays monthly dividends should look at other REITs with more favorable growth prospects, higher yields, and safer dividends.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more