Updated on March 8th, 2023 by Aristofanis Papadatos

Whitestone REIT (WSR) has three appealing investment characteristics:

#1: It is a REIT so it has a favorable tax structure and pays out the majority of its earnings as dividends.

Related: List of publicly traded REITs

#2: It is a high yield stock based on its 5.1% dividend yield.

Related: List of 5%+ yielding stocks

#3: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Whitestone REIT’s trifecta of favorable tax status as a REIT, a high yield, and a monthly dividend make it appealing to individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Whitestone REIT.

Business Overview

Whitestone is a commercial REIT that acquires, owns, manages, develops, and redevelops properties it believes to be e-commerce resistant in metropolitan areas with high rates of population growth. The REIT currently owns 57 properties with about 5.1 million square feet of gross leasable area.

Its properties are located primarily in the southern United States, in areas with favorable demographics, such as income and economic growth. The trust’s properties are located primarily in Phoenix and Houston, with smaller allocations to other major cities in Texas.

The company’s acquisition criteria include community-centered properties that are visibly located in developing and diverse areas. Properties are typically in the 50,000-200,000 square foot range, and from $5 million to $180 million in cost.

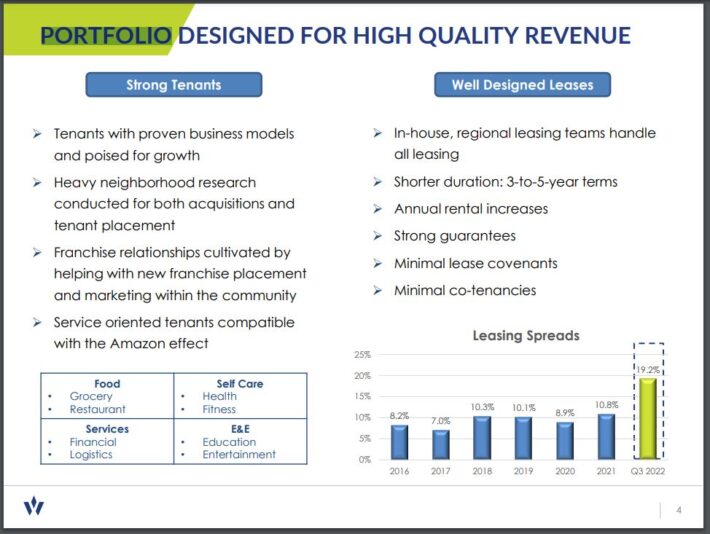

Whitestone believes its investment properties are “e-commerce resistant” because they are go-to destinations that provide necessary goods.

Source: Investor Presentation

Moreover, the company believes these are products and services that are not readily available online. In fact, Whitestone sees itself as the least susceptible to online replacement among its peer group.

Its properties are located in densely-populated, high-income areas, which are experiencing strong growth. Its portfolio is highly diversified, with about 1,500 tenants. The top 5 industries are restaurant & food service (23% of annual base rent), grocery (9%), financial services (9%), salons (8%), and medical & dental (8%).

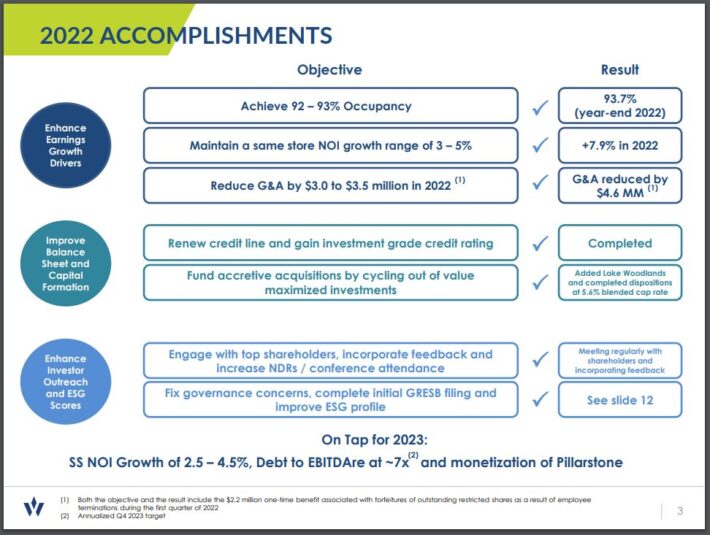

Whitestone reported its fourth-quarter results on 2/28/23. For the quarter, the REIT witnessed an all-time high occupancy rate of 93.7% versus 91.3% in the prior year’s quarter. Whitestone grew its revenue by 4.8% and its funds from operations (“FFO”) per share by 9.5%, from $0.21 to 0.23. Same-store net operating income (“SSNOI”) rose 7.1% while rental rate growth was 23.5%, up from 14.9% a year ago, driven by a jump in rental rate growth in renewal leases (23.2% vs. 15.7% a year ago) and new leases (24.3% vs. 11.2% a year ago).

Whitestone provided lackluster guidance for 2023, expecting 2.5%-4.5% growth of same-store net operating income and FFO per share of $0.95-$0.99. The REIT forecasts an ending occupancy of about 94% and potentially higher bad debt of 0.75%-1.50% of revenue (versus 0.83% in 2022). It also forecasts general and administrative expense to rise by about 8% and interest expense to rise roughly 19% due to much higher interest rates. We expect Whitestone to post FFO per share of $0.97 in 2023.

Growth Prospects

Whitestone’s growth strategy is centered around:

- Investing in locations with solid population growth

- Acquiring properties that are mismanaged, overleveraged, or in foreclosure or receivership

- Enhancing value property

From 2012 through 2015 Whitestone acquired 2.465 million square feet of gross leasable area. From 2016 through 2019 Whitestone acquired 0.778 million square feet of gross leasable area.

The decline in acquisitions is due in part to a focus on deleveraging. The leverage ratio (Net Debt to EBITDA) of the REIT is currently standing at 7.0, which is excessive.

Source: Investor Presentation

With further deleveraging anticipated, it is likely that Whitestone will maintain its modest acquisition pace.

Management believes that post-pandemic investments in acquisitions, re-development, and development projects can drive returns of at least 10%. We would first like to see the same-store net operating income remain positive, which will likely be helped by a more supportive macro environment.

We are also concerned over the impact of the high debt load on the results of the REIT. Due to the aggressive interest rate hikes implemented by the Fed, Whitestone saw its interest expense grow 11% in 2022, with further growth expected in the upcoming years, as the REIT will be forced to refinance its debt at much higher interest rates.

For now, we expect Whitestone to grow its FFO per share by 3% per year on average over the next five years. Whitestone’s current focus on deleveraging coupled with a distribution growth history that was flat for nearly a decade (before the onset of the pandemic) means growth expectations are low for Whitestone.

Dividend & Valuation Analysis

As a retail REIT, Whitestone was not spared from the coronavirus pandemic of 2020. As a result of the steep economic impact of the pandemic, Whitestone REIT reduced its monthly dividend by 63% in April 2020, from $0.095 to $0.035.

The reduction was expected. Whitestone’s distribution had remained higher than its FFO every year between 2013 and 2019. A reduction during COVID-19 was both prudent and necessary. As the pandemic has subsided, Whitestone’s financial position has improved, which has allowed the company to raise its monthly dividend modestly to $0.04, where it currently stands.

The distribution looks secure going forward. We expect Whitestone to maintain a dividend payout ratio of 49% for 2023, based on our projected FFO-per-share of $0.97 for the full year. A dividend payout ratio below 50% is highly unusual for REITs, and likely implies a high level of dividend safety.

With such a low payout ratio, we believe the distribution will almost certainly increase from its current low base over the next several years. Whitestone currently has a 5.1% yield. Additional distribution growth would only enhance investors’ yield on cost.

Another appealing factor is valuation. The REIT is currently trading for just 9.8 times its fiscal 2023 expected FFO-per-share. This multiple is much lower than the 5-year average of 11.4 of the stock.

But with years of stagnation on a per unit basis and a recent distribution reduction, we conservatively forecast a fair value price to FFO of 11.0 for Whitestone. Therefore, if the valuation multiple were to expand from 9.8 to 11.0 over the next five years, this would lift shareholder returns by 2.3% per year on average.

Adding in the 3% annual FFO-per-share growth, potential shareholder returns could reach 10.0% per year through 2028. This is a tempting expected rate of return, which makes Whitestone an appealing stock for value and income investors, albeit with an elevated level of risk.

Final Thoughts

With a 5.1% distribution yield, positive EPS growth expectations, and potential valuation multiple returns, Whitestone offers investors an expected total annual return of 10.0% over the next five years.

And this is without any increase in the distribution over the next five years. We believe distribution increases are likely in the medium term because the payout ratio of Whitestone is abnormally low for a REIT.

The security has shown it can continue to pay shareholders at this distribution rate even during COVID-19. The monthly dividends are a bonus for investors looking for income. In addition, the cheap valuation should appeal to value investors.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more