Updated on February 22nd, 2023 by Samuel Smith

Real Estate Investment Trusts are popular investments among income investors and for obvious reasons.

They are required to pass along the vast majority of their earnings in order to retain a favorable tax structure, which often results in very high dividend yields across the asset class. You can see our full list of all 208 publicly-traded REITs here.

Chatham Lodging Trust (CLDT) had been a high-yielding REIT until 2020 when the company suspended its dividend due to the coronavirus pandemic. The company recently reinstated its monthly dividend at the $0.07 monthly level.

Chatham had been paying a monthly dividend prior to the suspension, making it one of the monthly dividend stocks we cover.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yields and payout ratios) by clicking on the link below:

Buying stocks with sustainable dividends is a major goal for income investors. As a result, investors must make sure high dividend payouts are sustainable over the long term. Chatham is working its way back, but the stock remains risky for income investors.

Business Overview

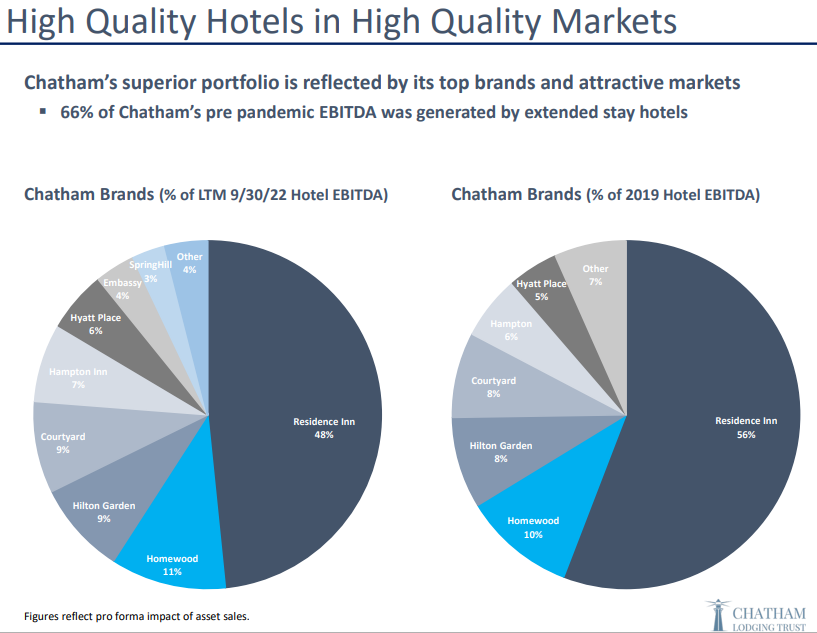

Chatham Lodging Trust manages and invests in upscale extended stay and premium branded hotel services in high-quality markets. As a result, it has the highest RevPAR of the three lodging REITs that are focused almost entirely on the limited-service segment and the most upside as business recovers.

Chatham operates under brand names like Hyatt, Residence Inn, and Hilton.

Source: Investor Presentation

On November 8th, 2022, Chatham Lodging Trust announced Q3 results. It reported revenue of $87.89M (+36.7% Y/Y), which beat analyst consensus estimates by $3.42M. Third quarter 2022 RevPAR of $150 compared favorably to $149 in the 2019 third quarter. It generated margins for all hotels owned during the quarter of 50.1 percent, up significantly from margins of 44.7 percent in the 2021 third quarter. For the comparable hotels, GOP margins rose a very strong 160 basis points to 50.5 percent compared to 48.9 percent for the 2019 third quarter. Adjusted EBITDA experienced a massive jump to $35.1 million from $19.6 million in the 2021 third quarter. Due to uncertainty surrounding the hotel industry, the company is not providing guidance at this time.

Growth Prospects

Multiple fronts are challenging Chatham’s growth. Not only did the hotel industry have to grapple with the pandemic in recent years, which caused many hotels to close for extended periods, but even before that, the industry was facing increasing competition from Airbnb (ABNB).

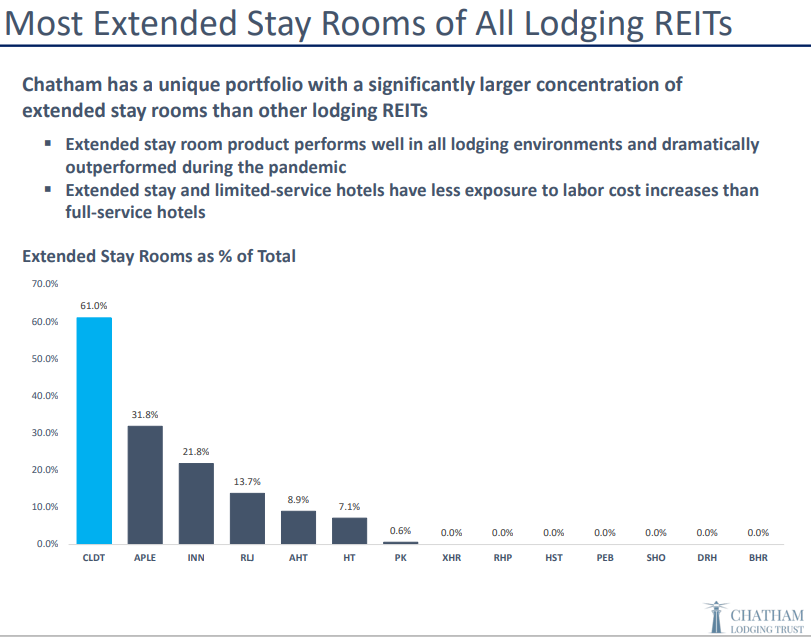

Still, Chatham is a well-run REIT. It is at the top of the pile among its competitors in terms of extended stay rooms as a percent of total rooms. Additionally, Chatham believes their same store operating margins will grow beyond pre-pandemic levels.

Select-service lodging provides higher margins than full-service, and Chatham focuses on the former in part for that very reason.

Source: Investor Presentation

Chatham’s focus on the best markets and brands in the select-service sector has boosted its RevPAR above some other REITs that focus on select-service properties.

This helps drive not only higher revenue, but better margins, as well as fixed costs are leveraged down. Using this strategy, Chatham drives better RevPAR than some competitors.

Chatham’s focus on the select-service model and its execution has been outstanding thus far. This should serve it well in the years to come in terms of growth, meaning Chatham’s future is bright. And the company is still investing in growth.

For example, Chatham has constructed a 170-room hotel in the Warner Center in Los Angeles, CA. This is the first ground-up development since the company’s inception. The hotel opened in January 2022. It is expected to generate one of the highest RevPARs in the Trust’s portfolio.

Competitive Advantage & Recession Performance

Chatham does not have any public information from the last recession. During recessionary periods, hotel REITs experience difficulty because their revenue is linked to consumers discretionary income. This means that Chatham would not be very resistant to recessions.

Chatham operates in large metropolitans, which generally attract a lot of consumers, but during the COVID-19 pandemic, almost all business travel halted. Business travel has yet to roar back in the way it was pre-pandemic, and it may not for a while still.

Due to the coronavirus pandemic, Chatham slashed the distribution for 2020 and 2021 but has since reinstated a monthly dividend.

Dividend Analysis

Chatham’s monthly dividend is a major draw for shareholders. With its 6.3% current annualized yield, it is a high-yielding REIT. Thus, Chatham may be an appealing stock if investors are looking for current income. Of course, investors should always monitor the quarterly results of high-yield stocks like Chatham to ensure the dividend remains safe.

One positive for the dividend is that Chatham has a reasonable level of leverage and well-balanced maturities, so it should not have to slash its dividend for the foreseeable future in order to preserve its balance sheet.

Chatham has a reasonable amount of maturities in 2023, which gives it some time to repair the balance sheet until it needs to refinance a much larger amount of mortgage debt coming due in 2024. Chatham has reduced its net debt by $323 million since 3/31/20, which equates to a 42% reduction in net debt over that period of time.

Final Thoughts

As a hotel REIT, Chatham was one of the hardest-hit REITs from the pandemic. While 2021 and 2022 were years of recovery following the pandemic, conditions continue to improve materially, and solid results are anticipated in 2023. Furthermore, Chatham recently resumed paying dividends to shareholders, which instantly makes the stock more appealing to income investors.

We believe Chatham will be able to sustain its attractive monthly dividend for the foreseeable future, although the longer-term outlook remains uncertain.

Overall, Chatham Lodging has a good reputation as a REIT with popular name brands, but the issues facing the hotel sector weigh very heavily on the company, especially if the economy slides into recession later this year.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more