Published on March 5th, 2023 by Nikolaos Sismanis

Business Development Companies, or BDCs, have become popular among income investors. That is because BDCs, as an alternative asset class, offer very high dividend yields, thanks in part to a favorable tax structure. The companies generally achieve extremely high yields on their investments, which they pass along to shareholders in the form of distributions.

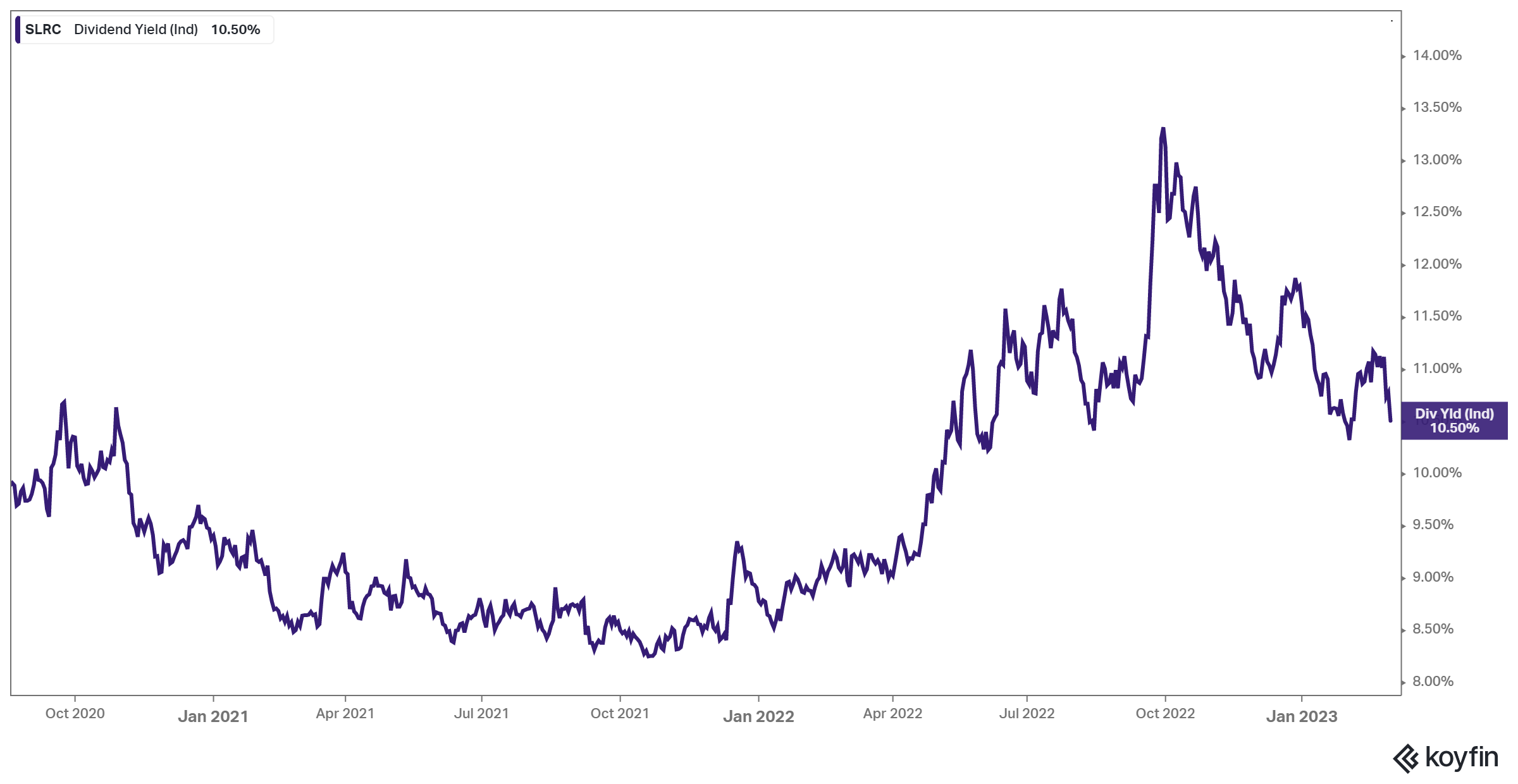

For example, SLR Investment Corp. (SLRC) is a BDC with a current dividend yield of 10.5%. Not only does SLRC have a very high yield, more than six times that of the S&P 500 Index, but it also pays its dividend each month rather than once per quarter. This allows investors even faster compounding, with more frequent dividend payments.

SLR Investment Corp. is one of a select few stocks that pays its dividend each month rather than each quarter. SLRC is one of 84 monthly dividend stocks.

We have compiled a full list of 84 monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

SLRC stock has a combination of a high yield and monthly payouts, which on the surface, is very attractive for income investors. But of course, investors should assess the quality of SLRC’s business, its future growth potential, and the sustainability of the dividend before buying shares.

This article will discuss SLRC’s business model and whether the high dividend yield is too good to be true.

Business Overview

SLR Investment Corp. is a Business Development Company that primarily invests in U.S. middle-market companies. The company has five core business units which include cash flow, asset-based, life science lending, equipment finance, and corporate leasing.

The trust’s debt investments primarily consist of cash flow senior secured loans, including first lien and second lien debt instruments. It also offers asset-based loans including senior secured loans collateralized on a first lien basis by current assets.

The company trades on the NASDAQ under the ticker symbol SLRC. SLRC is externally managed by SLR Capital Partners, an independent investment advisor founded in 2006. SLR has a team of roughly 300 employees which includes over 130 origination and investment professionals in over twelve offices across the U.S.

As of April 1st, 2022, SLR Investment Corp. completed its previously announced merger with SLR Senior Investment Corp. (previous ticker SUNS). SUNS was merged into SLR, which is the surviving company. Following the merger, legacy SLRC shareholders own approximately 77% of the company, and previous SUNS shareholders now own 23% of the combined company.

Additionally, SLR Capital Partners lowered the annual base management fee payable by SLRC from 1.75% to 1.50% on gross assets and retained the annual base management fee. SLRC is keeping its target leverage ratio at 0.90x – 1.25x debt-to-equity.

As of December 31st, 2022, SLR Investment’s portfolio consisted of 139 companies with exposures of 30.8% in senior secured loans, 30.0% in asset-based senior secured loans, 23.7% in equipment senior secured financings, and 15.5% in life science senior secured loans. SLR Investment Corp. generates around $180 million in total investment income annually and is based in New York, New York.

The BDC reported its fourth quarter and full year 2022 (for the period ending December 31st) results on February 28th. The company generated a net investment income of $76.4 million in 2022, an increase of 25% compared to the prior year’s quarter.

Net investment income-per-share (NIIPS) totaled $1.48 for the full year, up 3.5% from $1.44 per share in the prior year. The lower growth on a per-share basis was due to the additional shares the company issued during the year to fund its portfolio expansion and complete its merger with SUNS.

SLR Investment Corp.’s net asset value per share totaled $18.83 at the end of 2022, which was down 8.0% from the end of 2021.

Growth Prospects

SLR Investment Corp has produced volatile results in the last decade. The pandemic negatively affected the company, but they were somewhat shielded with such a diverse portfolio.

In the near term, the company will benefit from the recently completed merger with SLR Senior Investment Corp., as SLR Investment Corp. will receive a reduction of the base management fee, cost savings through synergies, and opportunities to reduce borrowing costs and increase the combined company’s net interest margin.

The company will continue to grow its comprehensive investment portfolio. And with such a large allocation to floating rate investments, the company should also benefit from the significant interest rate increases which are anticipated in 2022 and beyond. On December 31st, 2022, the weighted average asset yield of SLR’s $2.9 billion investment portfolio of 12.2% was strong.

Growth of the portfolio and the weighted average asset yield would lead to an increase in net investment income, from which the company can continue paying the dividend. That said, we remain wary of the fact that in the absence of a notable increase in net investment income, payouts could keep exceeding what the company makes.

On the bright side, the company, especially for a business development company, has not issued a significant number of shares in the last decade. This is beneficial to shareholders because their equity in SLRC is not diluted with more outstanding shares available on the market.

SLR Capital has a direct origination platform to direct the company to proprietary investment opportunities, which applies a private equity approach to its underwriting process and includes in-depth due diligence and structuring of the investment terms. With the proprietary platform, SLR Investment Corp. should capitalize on further portfolio opportunities.

Dividend Analysis

One reason why BDCs like SLRC can pay high dividends is because of a favorable tax structure. SLRC qualifies as a regulated investment company. As such, it generally is not subject to income taxes so long as it distributes taxable income to shareholders.

SLRC is a very attractive stock for dividend investors. It currently pays a monthly dividend of $0.1367 per share. On an annualized basis, the $1.64 per-share dividend represents a 10.5% current dividend yield.

The company has paid quarterly dividends from mid-2010 up to April 2022. SLRC paid a $0.60 quarterly dividend from 2010 until halfway through 2013, when the dividend was slashed by one-third to $0.40. In the first quarter of 2018, SLR Investment Corp. increased its quarterly dividend by a penny to $0.41, which it has continued to pay until now.

The new monthly dividend of $0.1367 per share is equivalent to the prior quarterly dividend of $0.41. However, it is now paid more frequently, which allows for slightly faster compounding.

Currently, we forecast that SLRC is likely to produce about $1.60 in net investment income in 2023. At this rate, the company would be paying out more than 100% of net investment income in the form of dividends. This means the dividend is not safe and may be cut in the future.

Additionally, in 2021 and 2022, the company paid out $1.64 in dividends while it earned $1.40 and $1.44, respectively. As a result, it appears the dividend has been on shaky grounds for some years now. The massive dividend yield of 10.5% could indicate that shareholders are leery of an upcoming cut.

Final Thoughts

SLR Investment Corp. recently made a massive acquisition and folded SLR Senior Investment Corp. into its company. Legacy SLRC shareholders now own 77% of the combined company, with the previous SUNS shareholders owning 23% of the SLR Investment Corp.

While this will provide the company with a reduced management fee from their investment advisor, SLR Capital Partners, cost savings, and opportunities to reduce borrowing costs and improve net interest margin, the dividend remains questionable.

The current massive 10.5% yield may be an indication that shareholders are wary of an upcoming dividend cut. Indeed, the company has paid out more than 100% of net investment income in the recent prior years and may do so again in 2023.

As long as SLR Investment Corp. over-distributes, the company’s NAV/share could also be on track for consistent deterioration. Thus, make sure you are aware of the risks attached to the stock before considering allocating capital to it.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more