Published on April 3rd, 2023 by Jonathan Weber

Dividend stocks are great for retirees and other investors that live off the income their portfolio generates. But dividend stocks are also interesting for investors that do not live off their dividends.

In this article, we will showcase 20 of the best high-yielding income stocks with strong total return outlooks that could be compelling investments in the current year and beyond.

Additionally, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with 5%+ dividend yields.

Why Dividend Stocks Are Attractive

Dividend stocks generate income that can be used to pay for one’s living expenses. But apart from that, income stocks can also be of value to other investors, due to several reasons.

First, dividends provide an important boost to a company’s total returns over time. Studies show that more than 30% of a company’s total return is driven by dividends over a longer period of time. For individual high-yielding stocks, the total return contribution is even larger.

Stocks that pay high dividends do not need to see their share prices expand as much as a non-dividend-paying stock in order to achieve the same total return.

Second, dividend stocks, and especially resilient dividend stocks that continue to pay dividends during tough times, can ease investor concerns during recessions, bear markets, and so on. While their share prices might dip temporarily, investors will at least still benefit from a steady income stream, which can help investors avoid costly mistakes such as selling stocks during bear markets, thereby locking in gains.

Third, when companies have a track record of paying out dividends, that has a disciplining effect on management. Management teams will be less likely to pursue strategies that aren’t generating shareholder value, such as empire building, and will instead focus on generating reliable cash flow that can be paid out to the company’s owners.

The 20 Best High-Yielders With Strong Total Returns Today

This is the list of the top 20 stocks in our coverage universe that provide attractive total returns of at least 10% per year (according to our models), and that also have solid risk ratings. The stocks in this list are sorted from the highest to lowest dividend yields.

Table of Contents

- Best High Yield Stock #1: City Office REIT, Inc. (CIO)

- Best High Yield Stock #2: MPLX, LP (MPLX)

- Best High Yield Stock #3: The Western Union Company (WU)

- Best High Yield Stock #4: Lincoln National Corp (LNC)

- Best High Yield Stock #5: Altria Group, Inc. (MO)

- Best High Yield Stock #6: British American Tobacco (BTI)

- Best High Yield Stock #7: TransAlta Renewables Inc. (TRSWF)

- Best High Yield Stock #8: Magellan Midstream Partners (MMP)

- Best High Yield Stock #9: Enterprise Products Partners (EPD)

- Best High Yield Stock #10: Enbridge Inc. (ENB)

- Best High Yield Stock #11: Verizon Communications (VZ)

- Best High Yield Stock #12: SK Telecom (SKM)

- Best High Yield Stock #13: The Bank of Nova Scotia (BNS)

- Best High Yield Stock #14: Canadian Imperial Bank of Commerce (CM)

- Best High Yield Stock #15: The First of Long Island Corp. (FLIC)

- Best High Yield Stock #16: Lazard Ltd. (LAZ)

- Best High Yield Stock #17: Great-West Lifeco Inc. (GWLIF)

- Best High Yield Stock #18: Universal Health Realty Income Trust (UHT)

- Best High Yield Stock #19: Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI)

- Best High Yield Stock #20: 3M Company (MMM)

1: City Office REIT (CIO)

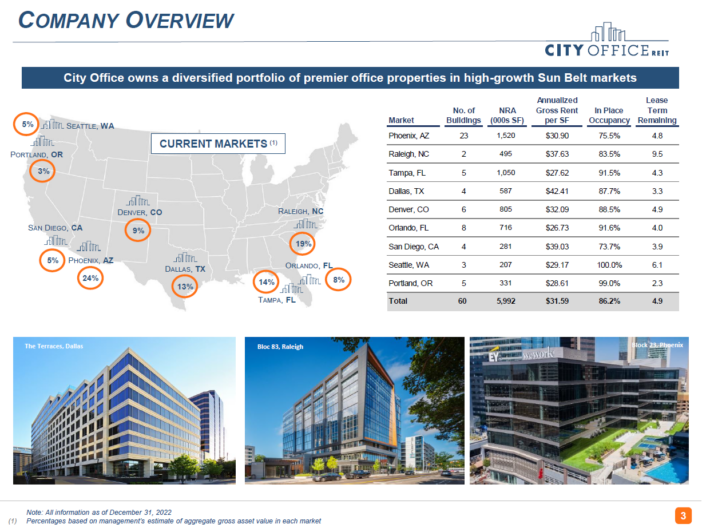

City Office REIT (CIO), as the name suggests, is a real estate investment trust that invests primarily in office properties. City Office is focused on markets in the South and the West of the United States, mainly in “18-hour” cities.

Source: City Office REIT

While office real estate has been under pressure in recent years due to the work-from-home environment, City Office mostly owns high-quality office buildings, which is why it is impacted less than many of its peers.

The company was able to grow its funds from operations-per-share in both 2021 and 2022, which was a strong feat. While rising interest rates are forecasted to be a headwind in the current year, City Office should continue to cover the dividend easily, as we are forecasting a payout ratio of 61% for the company’s current dividend of $0.80 per share per year.

City Office currently trades with a very strong dividend yield of 12.8%, which is very strong. Since we are also forecasting some minor funds from operations growth over the coming years, and since we believe that City Office has upside potential towards what we deem fair value, the expected total return is north of 20% per year over the coming five years.

Click here to download our most recent Sure Analysis report on Office Properties (CIO) (preview of page 1 of 3 shown below):

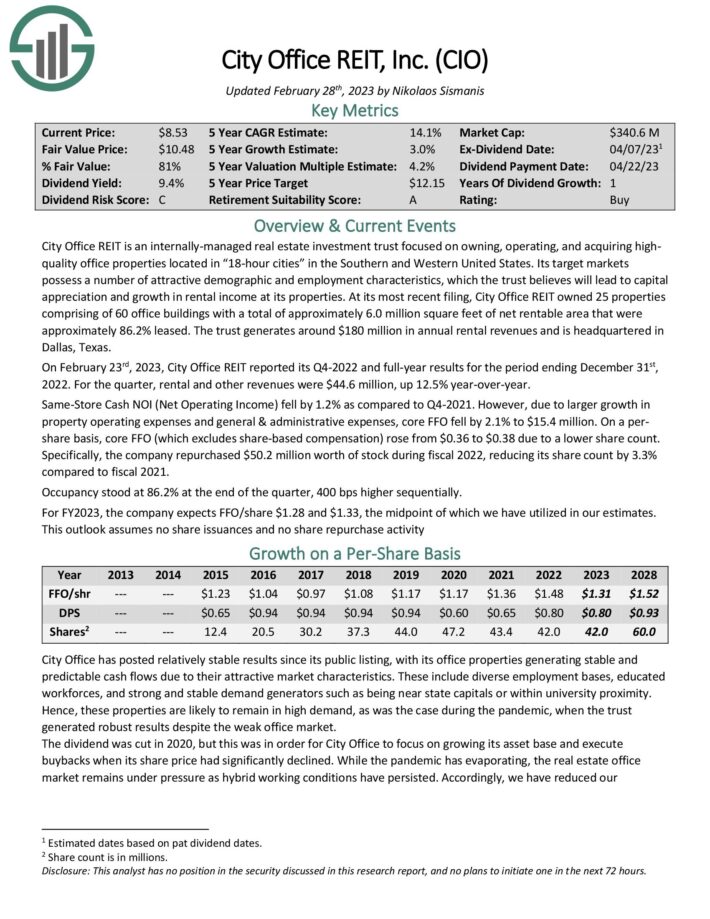

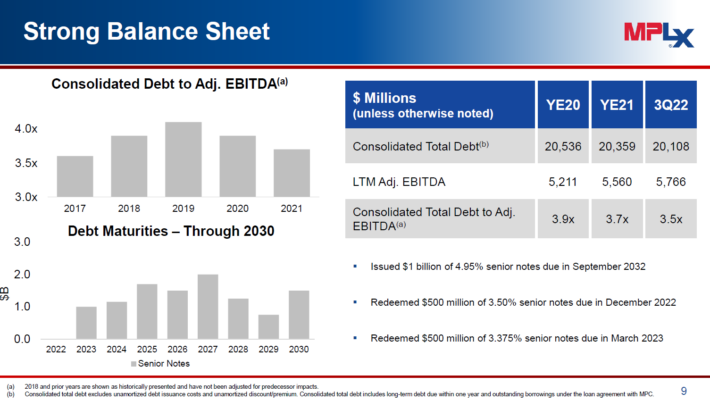

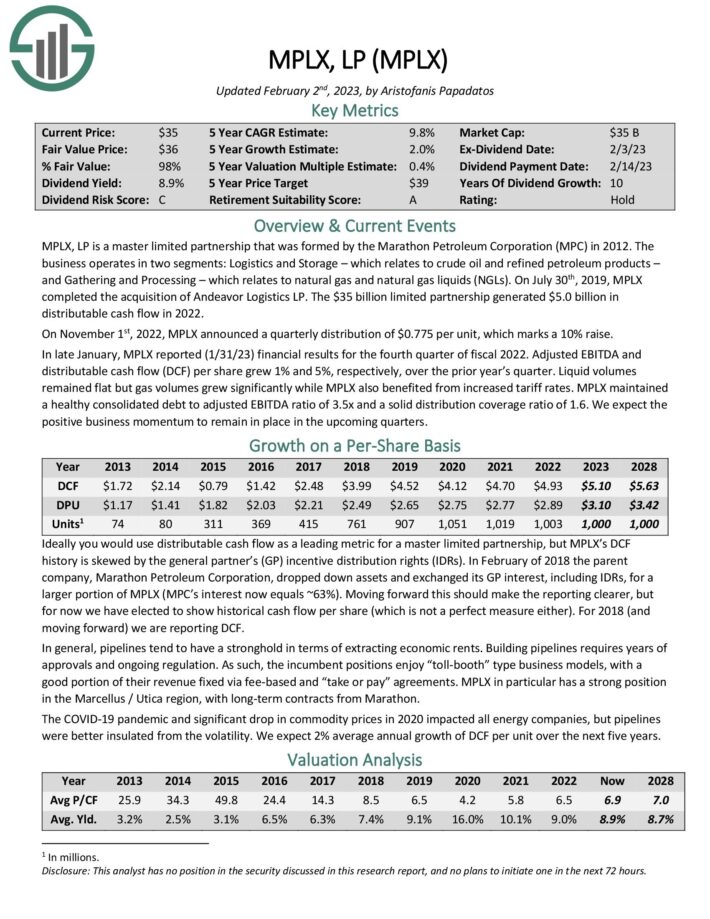

2: MPLX (MPLX)

MPLX is an energy midstream company that owns pipelines for the transportation of commodities such as natural gas. On top of that, MPLX also owns gathering and storage assets.

Source: MPLX presentation

While prices for natural gas and other energy commodities can be very volatile, the profits and cash flows that MPLX generates are not volatile, as the company mostly has fee-based contracts in place that insulate it from commodity price movements.

This business model explains how MPLX has managed to generate consistent cash flows even during the pandemic when many energy companies ran into problems and had to cut their dividends. MPLX saw its cash flows decline by 8% in 2020, but in 2021, they already hit a new record high.

In 2022, MPLX, again, hit new record cash flows, and the forecast for the current year is even better. The dividend of $3.10 per year is easily covered by the company’s strong cash flows, as the payout ratio is 60%.

With a dividend yield of 9.0%, some growth potential, and upside potential towards our fair value estimate, MPLX should be able to deliver attractive total returns going forward.

Click here to download our most recent Sure Analysis report on Office Properties (MPLX) (preview of page 1 of 3 shown below):

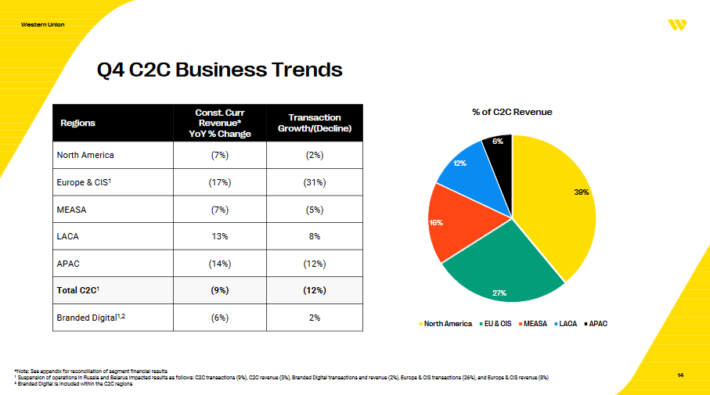

3: Western Union (WU)

Western Union is a leading money transfer services provider, both nationally and internationally. The company operates with a network of more than 500,000 agents across more than 200 countries, resulting in peer-leading geographic penetration. Most of the company’s revenues are generated in the consumer-to-consumer money transfer business.

Source: Western Union presentation

Western Union has not experienced significant growth over the last decade, and we believe that the same will hold true over the coming years. But Western Union still could be an attractive investment.

At current prices, shares offer a dividend yield of 8.5%, and with a 59% payout ratio, there is room for future dividend increases. The dividend cut risk also seems low due to the strong coverage ratio.

Primarily thanks to its high dividend yield, but also thanks to some upside potential towards fair value, we believe that total returns will be attractive going forward, at around 12% per year.

Click here to download our most recent Sure Analysis report on Office Properties (WU) (preview of page 1 of 3 shown below):

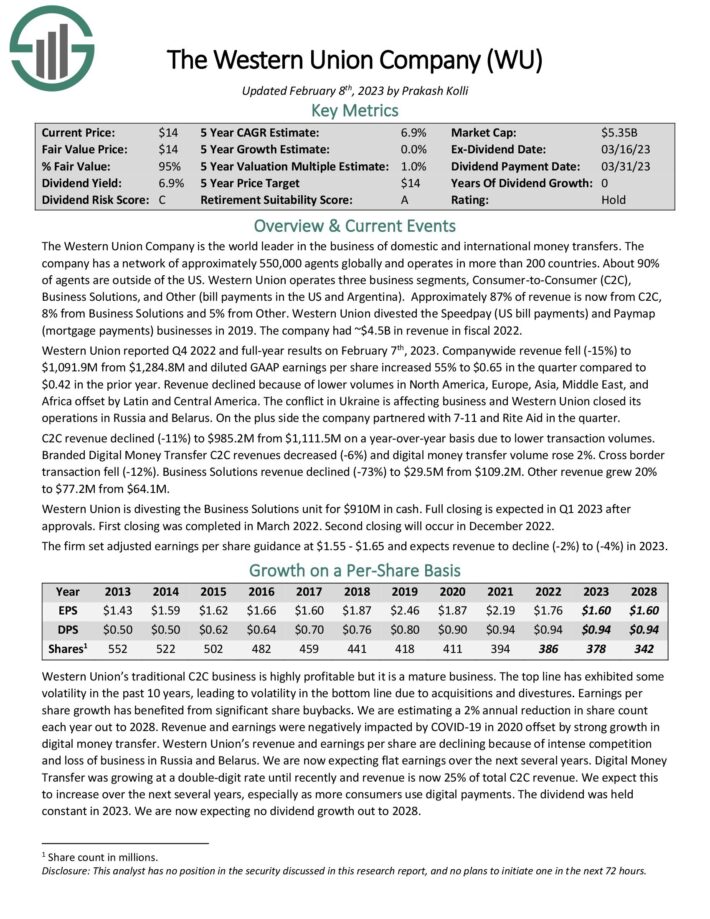

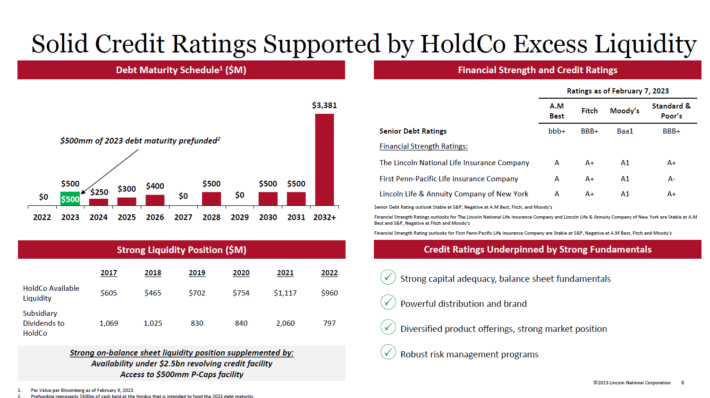

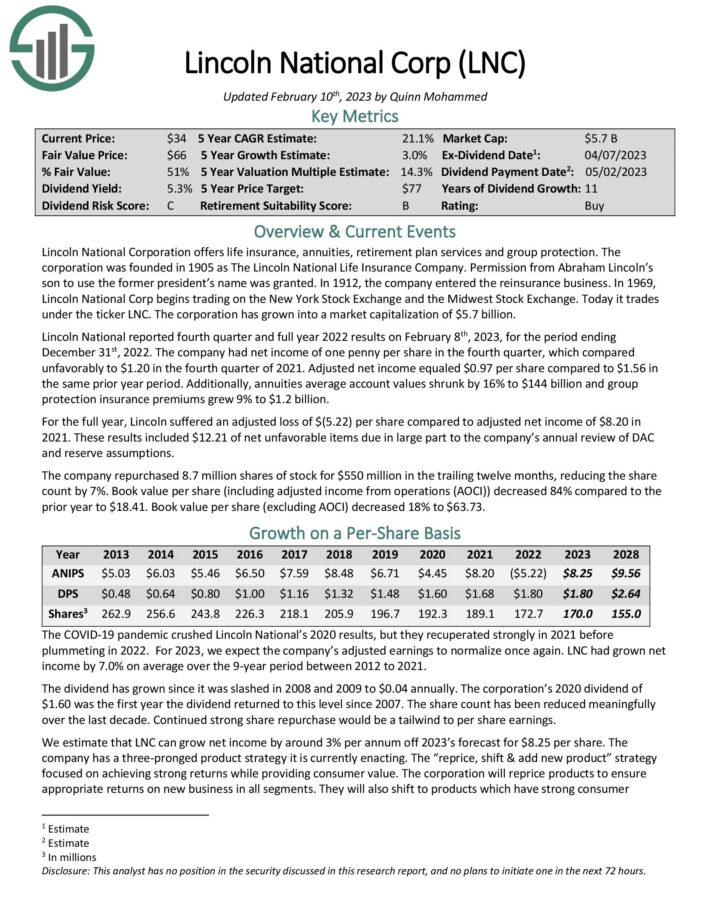

4: Lincoln National (LNC)

Lincoln National is an insurance company that offers retirement plan services, life insurance, and similar products to its customers. Lincoln National was founded more than 100 years ago, in 1905.

Source: Lincoln National presentation

The company reported net losses in 2022, but that was primarily driven by unrealized and realized losses in its investment portfolio, which, in turn, were caused by the market turmoil we have seen in bond and equity markets.

Underlying business performance has been solid, and it is expected that profitability will be strong this year as well. At the same time, Lincoln National trades at a very inexpensive valuation, iin part due to the sell-off among financial stocks in early 2023.

At current prices, Lincoln National trades with a dividend yield of 8.2%. The dividend is well-covered with a payout ratio of just above 20%, based on the consensus earnings-per-share estimate for the current year.

Between this high dividend yield and substantial multiple expansion tailwinds, we believe that total returns could be very attractive over the coming years, as Lincoln National is currently priced for disaster.

Click here to download our most recent Sure Analysis report on Office Properties (LNC) (preview of page 1 of 3 shown below):

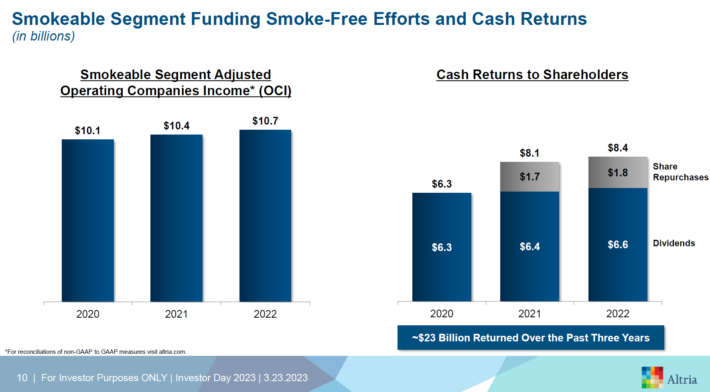

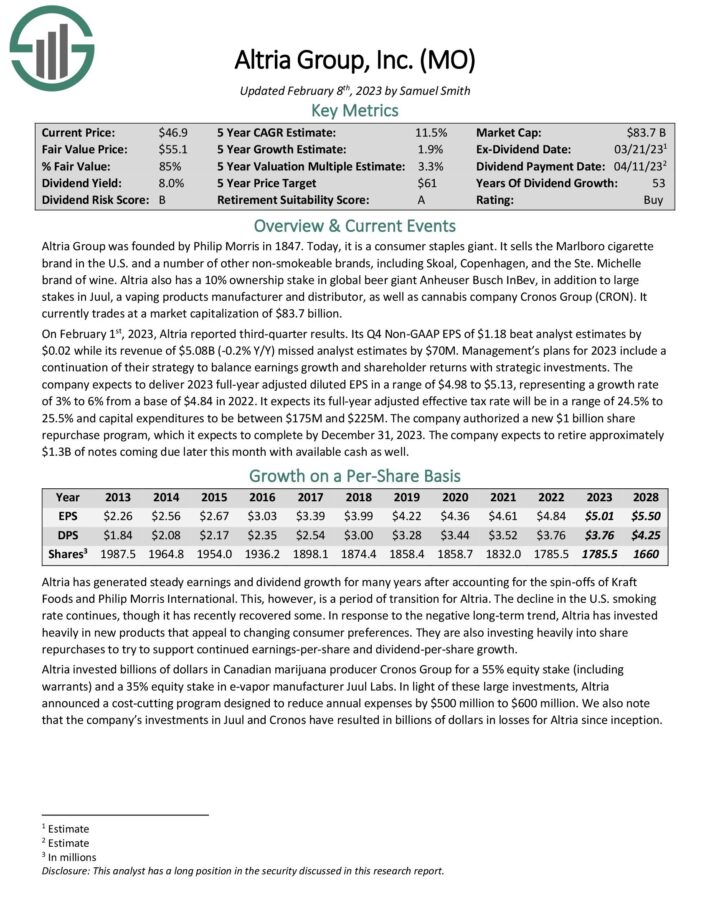

5: Altria Group (MO)

Altria is a tobacco company that primarily sells cigarettes, including under the iconic Marlboro brand. Altria owns non-smokable tobacco products as well, and it also holds a stake in beer company Anheuser-Busch InBev.

Source: Altria presentation

While cigarette demand in the United States has been declining for many years, the company was able to still grow its revenue and profit as Altria has continually increased the price of the cigarettes it sells. Earnings growth has been very consistent in the past, and Altria is forecasting that it will grow its earnings-per-share by another 4% this year.

Altria’s dividend is covered with a payout ratio of around 80%, and since cash flows and earnings have been very resilient, there is little dividend cut risk. The dividend yield, at current prices, is 8.5%.

Between the high dividend yield, some earnings growth in the coming years, and multiple expansion tailwinds, we believe that there is a good chance that Altria will deliver attractive total returns in the low-teens range over the coming five years.

Click here to download our most recent Sure Analysis report on Office Properties (MO) (preview of page 1 of 3 shown below):

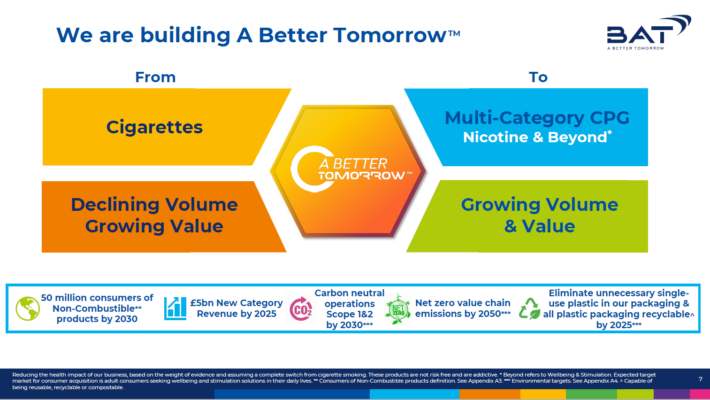

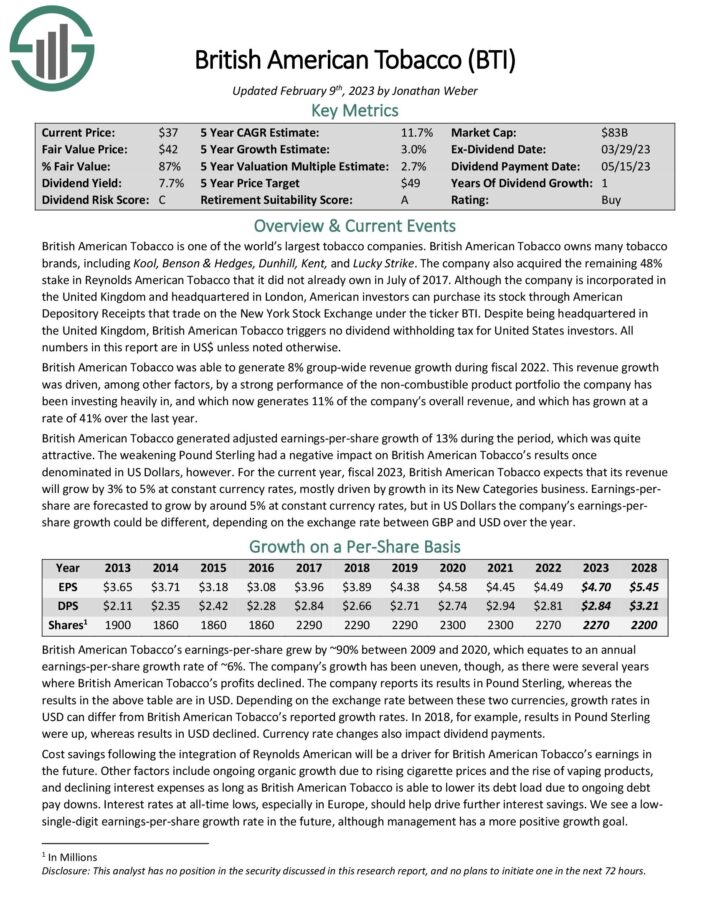

6: British American Tobacco (BTI)

British American Tobacco is, as the name suggests, another tobacco company. It is less focused on the US market, relative to its peer Altria.

Source: British American Tobacco presentation

British American Tobacco’s earnings growth has not been as consistent as that of Altria, but the company nevertheless delivered solid earnings-per-share increases over the last decade. We also forecast that buybacks and organic growth, primarily in the smokeless products category, will result in attractive earnings growth in the future.

At current prices, British American Tobacco’s dividend yield is 8.0% and the dividend is well-covered with a payout ratio of 60%. We do believe that the dividend cut risk is pretty slim.

Between the high yield, some earnings growth, and some multiple expansion tailwinds, British American Tobacco should be able to deliver total returns well north of 10% per year going forward.

Click here to download our most recent Sure Analysis report on Office Properties (BTI) (preview of page 1 of 3 shown below):

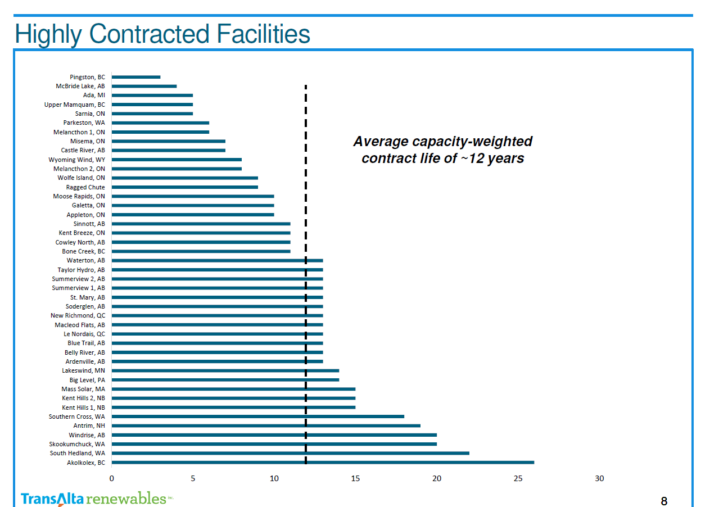

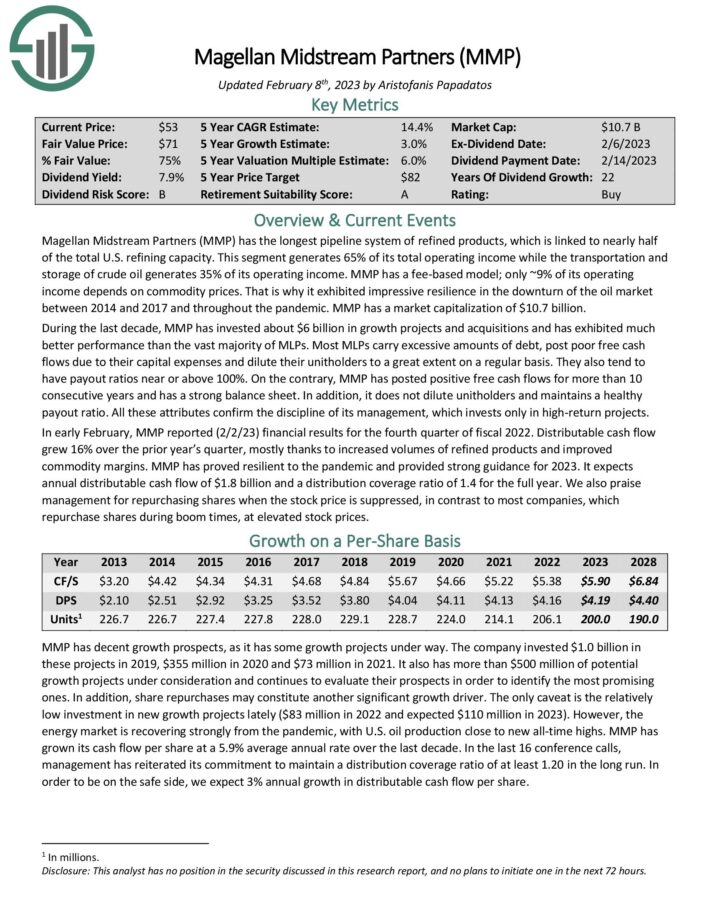

7: TransAlta Renewables Inc. (TRSWF)

TransAlta Renewables Inc. is a Canada-based renewable power generation company. Its assets include wind parks, hydropower assets, but also natural gas power plants. Its history dates back more than 100 years.

Source: TransAlta Renewables presentation

TransAlta Renewables has not delivered a lot of cash flow growth over the last decade, at least on a per-share basis, as business-wide cash flow growth was mostly offset by a rising share count. We do not forecast much per-share cash flow growth going forward, as we deem a low single-digit growth rate likely.

Still, TransAlta Renewables has a compelling total return outlook, as the dividend yields 7.9% already, and we believe that the company currently trades well below fair value. As multiple expansion should result in a substantial total return tailwind going forward, mid-teens annual returns seem realistic.

Click here to download our most recent Sure Analysis report on Office Properties (TRSWF) (preview of page 1 of 3 shown below):

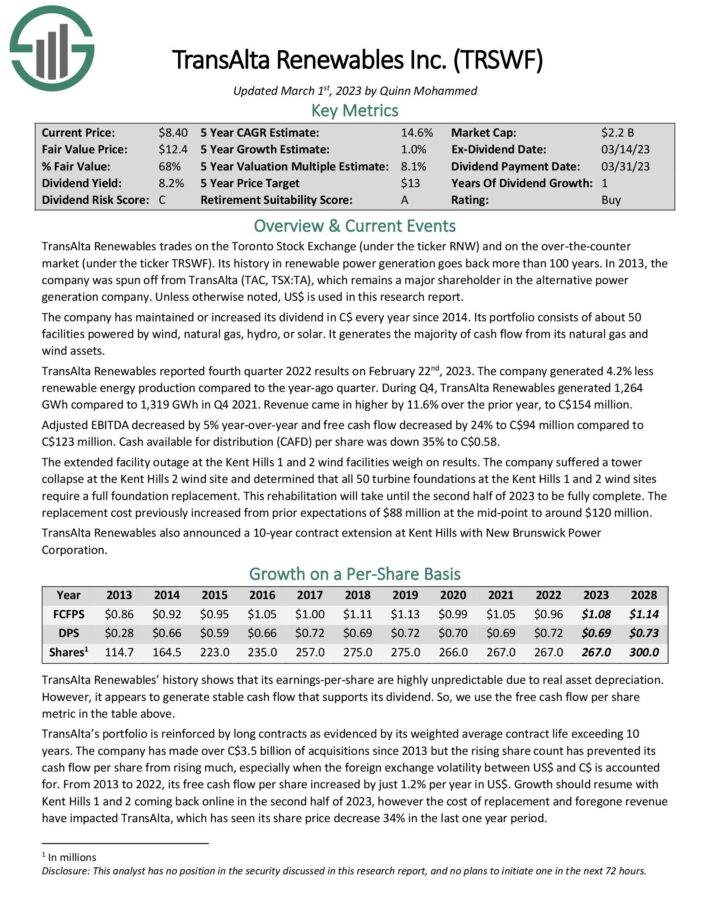

8: Magellan Midstream Partners (MMP)

Magellan Midstream Partners is an energy midstream company, but unlike MPLX, it’s not natural gas-focused, but refined products-focused. Its pipeline network is the largest of its kind and connects to nearly half of the overall US refining capacity.

Source: Magellan Midstream Partners presentation

Like other midstream companies, it utilizes fee-based contracts to a large degree, which is why results have been resilient versus macro shocks and commodity price declines in the past. In 2020, Magellan Midstream’s cash flows declined, but they still covered the dividend easily.

We do not forecast a lot of growth, but between fee increases and some growth spending, Magellan Midstream Partners should be able to deliver some growth going forward.

The stock yields 7.7% at current prices and the payout ratio is 71%. Since the company has increased its dividend for more than 20 years in a row throughout all kinds of macro shocks, we believe that the dividend cut risk is low.

With a high dividend yield and some share price upside potential due to multiple expansion and business growth, Magellan Midstream should be able to deliver total returns of well above 10% from here.

Click here to download our most recent Sure Analysis report on Office Properties (MMP) (preview of page 1 of 3 shown below):

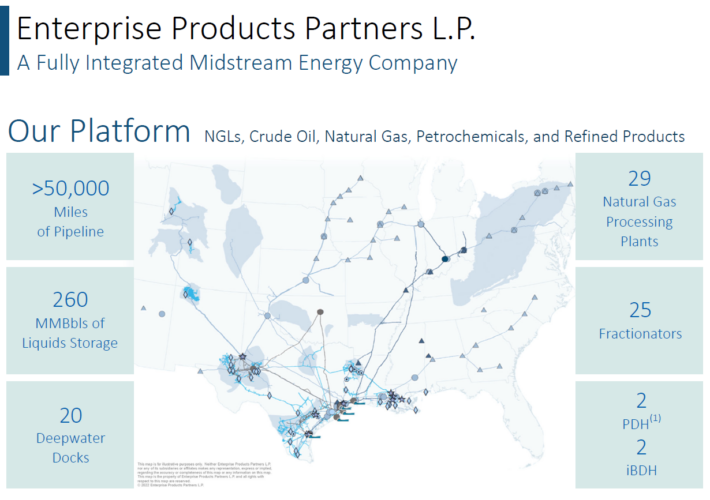

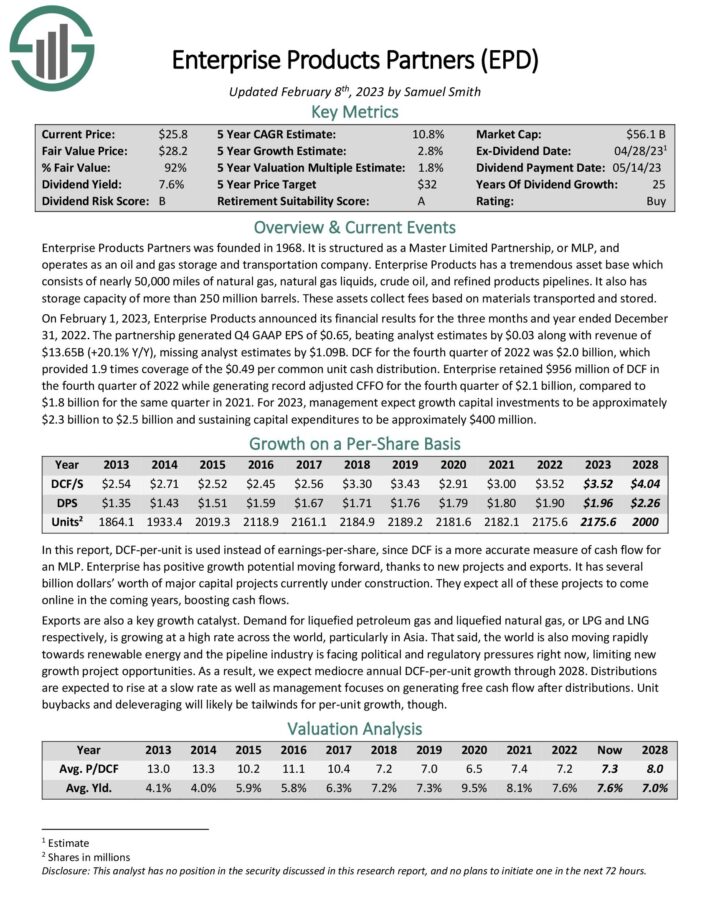

9: Enterprise Products Partners (EPD)

Enterprise Products Partners is another energy midstream company. It is one of the largest in the industry, being active across natural gas and natural gas liquids, crude oil, refined products, and so on.

Source: Enterprise Products Partners presentation

Enterprise Products has one of the strongest balance sheets in the industry, and its diversification, both geographically and across different sub-segments, makes it very resilient.

The company currently offers a dividend yield of 7.6%, and the dividend looks very reliable, due to a 56% payout ratio and 25 years of uninterrupted dividend increases.

We forecast some cash flow-per-share growth going forward and also see the valuation expand to some degree, which, combined with the high yield, should result in attractive total returns for investors.

Click here to download our most recent Sure Analysis report on Office Properties (EPD) (preview of page 1 of 3 shown below):

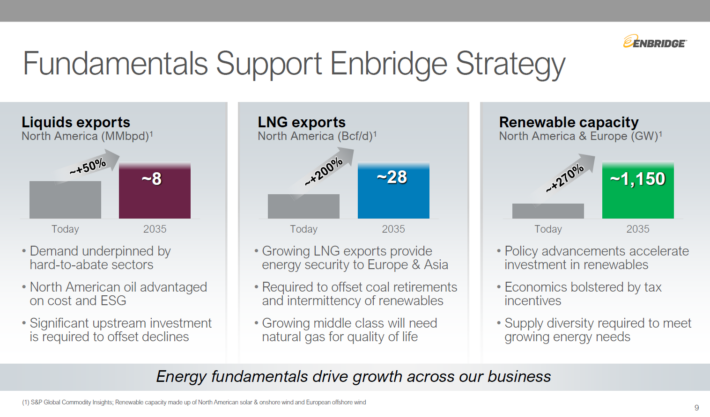

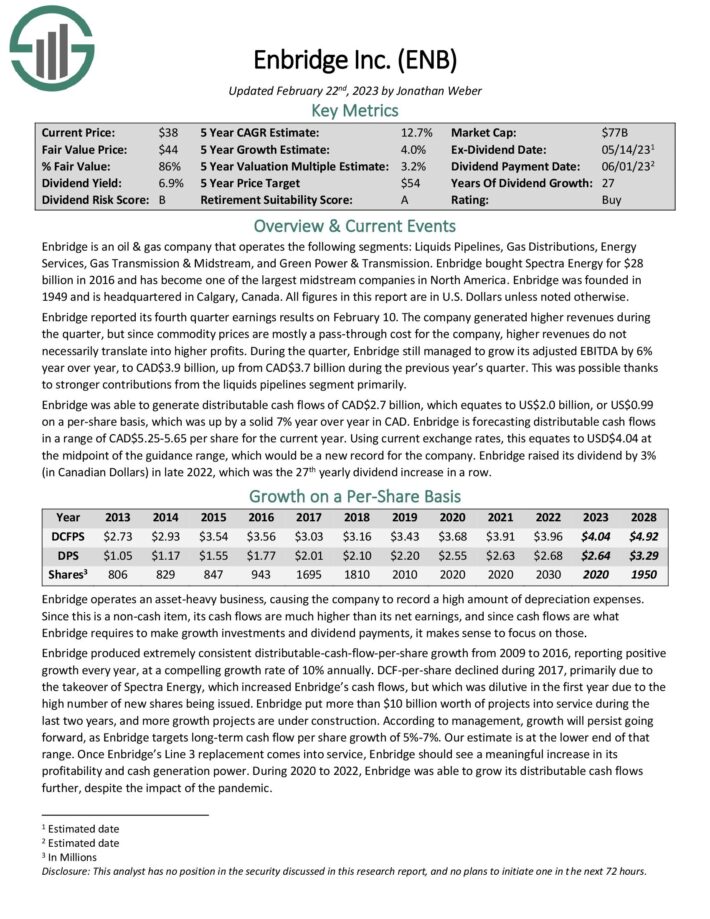

10: Enbridge (ENB)

Canada-based Enbridge is an energy midstream company as well. It owns large pipelines that transport crude oil and other commodities, including from Canada to the US. Enbridge also owns renewable energy assets such as wind parks, however, making it somewhat unique among energy midstream companies.

Source: Enbridge presentation

Enbridge has delivered consistent cash flow-per-share growth over the last decade, and we expect more of the same going forward, as the company works through its growth project backlog while organic growth from existing assets should also have a positive impact on future cash flows.

Enbridge currently trades with a dividend yield of 7.2%. The dividend looks safe, due to Enbridge’s 27-year dividend growth track record and, at 65%, the payout ratio is far from high.

Total returns should be well in the double-digits, thanks primarily to the high dividend yield, but some cash flow growth and multiple expansion will be beneficial as well.

Click here to download our most recent Sure Analysis report on Office Properties (ENB) (preview of page 1 of 3 shown below):

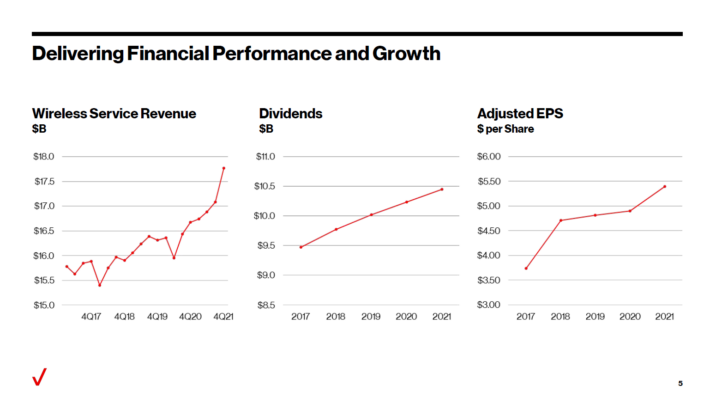

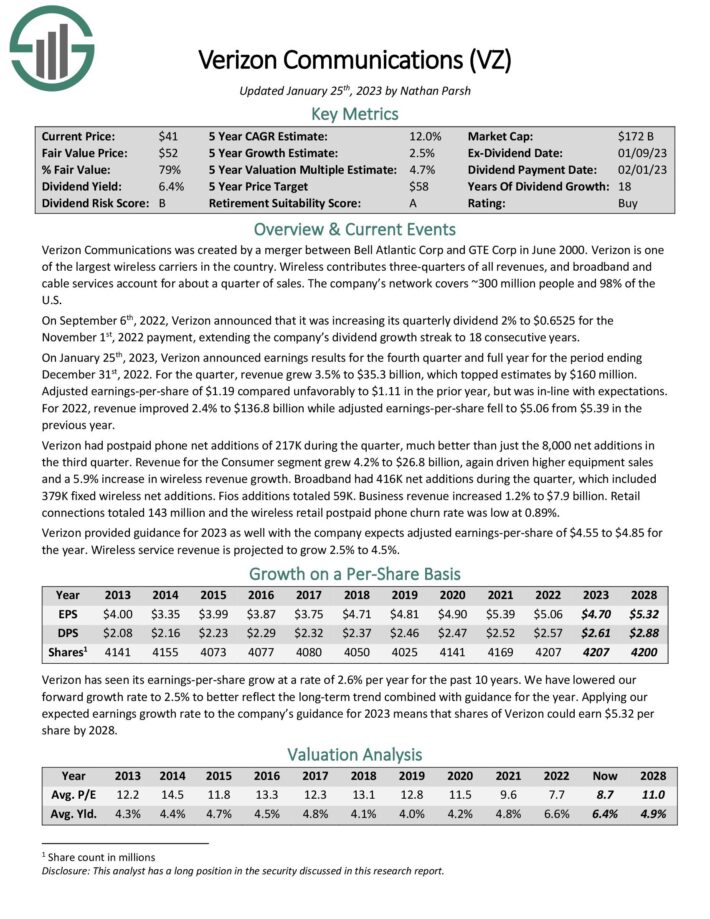

11: Verizon Communications (VZ)

Verizon is a telecommunications company that offers wireless services as well as broadband and cable services to its customers. Wireless services contribute about three-quarters of the company’s revenues and are thus the most important unit by far. Its network covers 98% of the United States.

Source: Verizon presentation

Verizon has not delivered a lot of earnings growth over the last decade, and it will likely not turn into a high-growth company going forward. Still, between rate increases and margin expansion efforts, we believe that a low single-digit earnings-per-share growth rate will be achieved.

At current prices, Verizon trades with a dividend yield of 6.8%. That’s one of the highest dividend yields Verizon has traded with in recent memory, as its dividend yield mostly was in the 4% to 5% range over the last decade. With a payout ratio of 56%, there is little reason to worry about a dividend cut.

Verizon should experience serious multiple expansion tailwinds going forward, as shares trade well below our fair value estimate right now. In combination with some earnings-per-share growth and the high dividend yield, that should allow for a low-teens total return over the coming five years.

Click here to download our most recent Sure Analysis report on Office Properties (VZ) (preview of page 1 of 3 shown below):

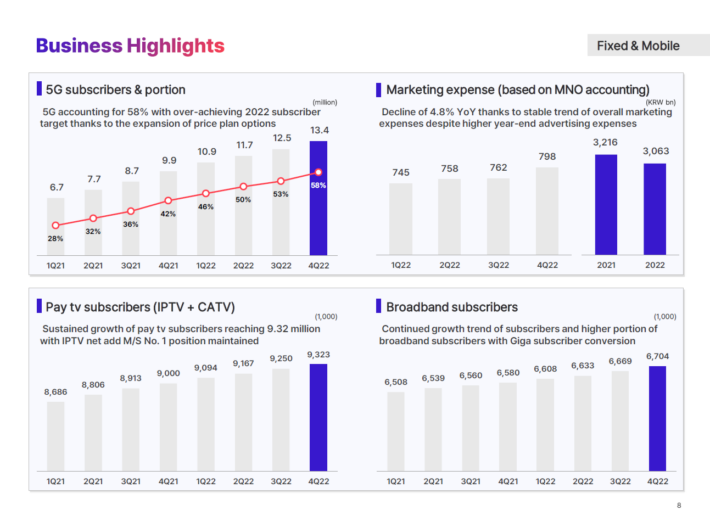

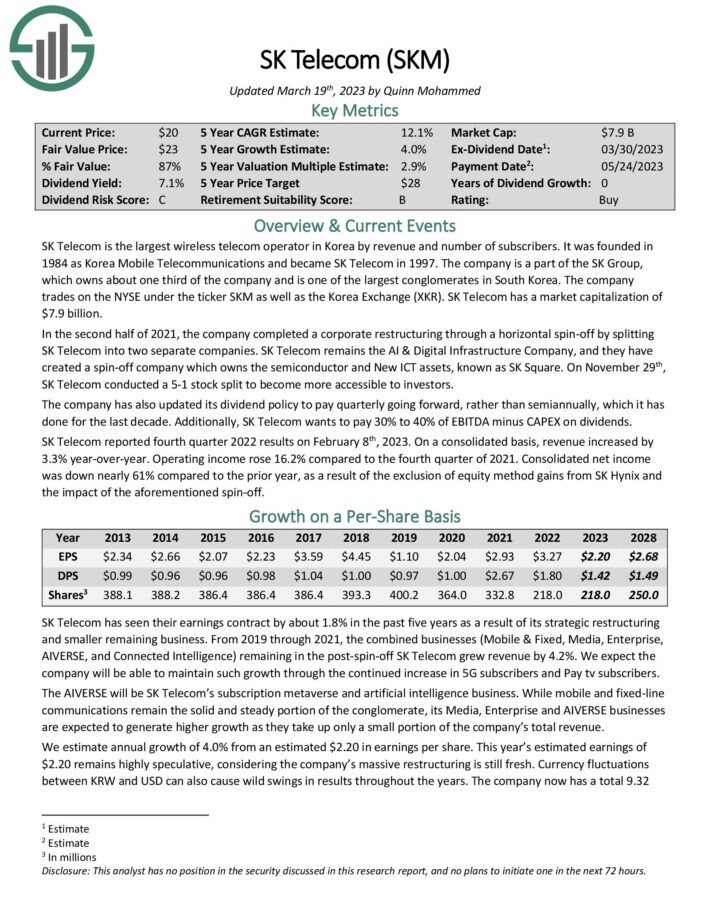

12: SK Telecom (SKM)

SK Telecom is South Korea’s largest wireless telecom operator, both in terms of revenue generation as well as when it comes to its customer count.

Source: SK Telecom presentation

Like other telecom companies, SK Telecom is not a high-growth player, but its business is relatively resilient, which is a good thing during recessions and other macro crises.

SK Telecom has increased its dividend substantially over the last decade, which was primarily possible thanks to an increase in the company’s dividend payout ratio. While the dividend payout ratio isn’t especially high, at 64%, the company will likely not increase the payout ratio drastically from the current level. Future dividend growth could thus be lower relative to the past.

At current prices, SK Telecom trades with a dividend yield of 6.8%. We believe that the dividend will be the primary driver of SK Telecom’s future total returns, although earnings-per-share growth and multiple expansion will add to the company’s total returns going forward. All in all, we believe total returns should be north of 10%.

Click here to download our most recent Sure Analysis report on Office Properties (SKM) (preview of page 1 of 3 shown below):

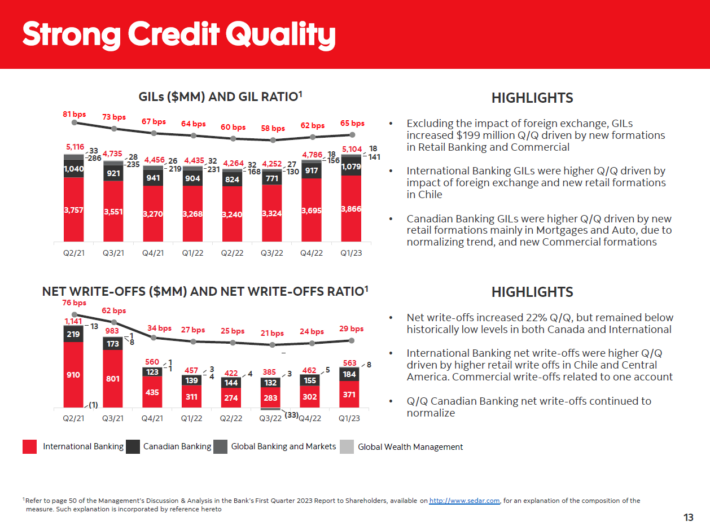

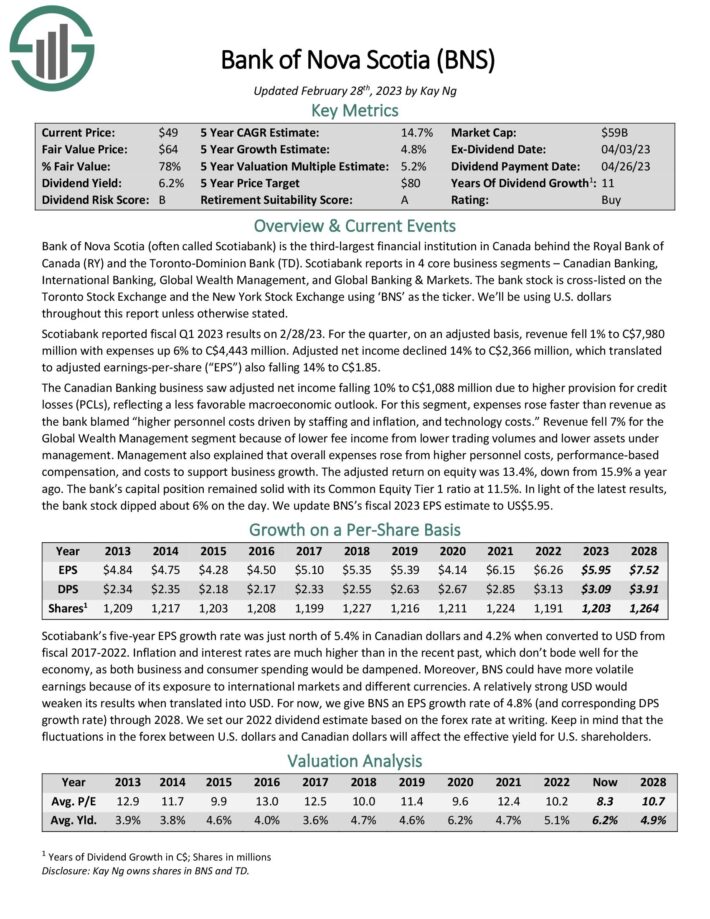

13: The Bank of Nova Scotia (BNS)

The Bank of Nova Scotia is a major Canadian bank. Behind Royal Bank of Canada (RY) and Toronto-Dominion (TD), it is the country’s third-largest financial institution.

Source: The Bank of Nova Scotia presentation

Bank of Nova Scotia has delivered solid earnings-per-share growth in the past, via a combination of underlying business growth, such as higher loans and higher service fees, and share repurchases. Combined, these factors allowed for earnings-per-share growth of around 5% per year, and we believe that a similar earnings growth rate is realistic for the future, too.

The company offers a dividend that yields 6.3% at current prices, with the dividend being well-covered with a dividend payout ratio of 56% based on this year’s expected earnings.

Between this dividend yield, the expected earnings growth from Bank of Nova Scotia, and some multiple expansion potential, we believe that the company can deliver total returns of well above 10% going forward.

Click here to download our most recent Sure Analysis report on Office Properties (BNS) (preview of page 1 of 3 shown below):

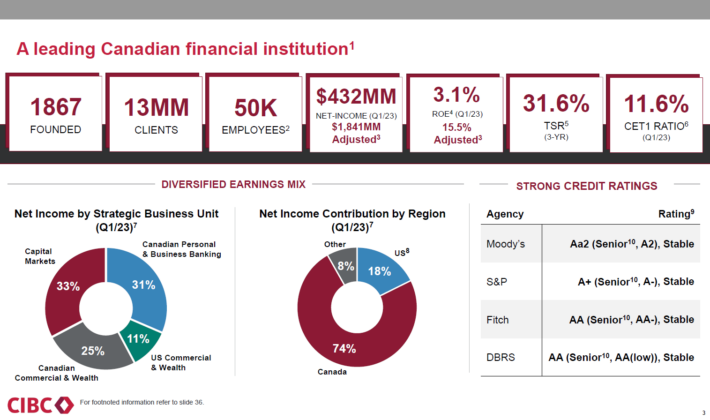

14: Canadian Imperial Bank of Commerce (CM)

Canadian Imperial Bank of Commerce is another large Canadian bank, although somewhat smaller than The Bank of Nova Scotia. Canadian Imperial Bank of Commerce offers typical banking products and services to individuals, small businesses, but also larger corporations.

Source: Canadian Imperial Bank of Commerce presentation

Canadian Imperial Bank of Commerce has delivered solid earnings growth prior to 2022, but last year, profits pulled back, partially due to lower asset management revenues. This should be reversible, however, as asset management fees will expand again once equity and bond markets recover from last year’s rout.

Canadian Imperial Bank of Commerce trades with a dividend yield of 6.2% right now, which is attractive. The dividend is very well-covered, as the dividend payout ratio stands at just 49%, which makes the dividend very safe.

The dividend yield provides a solid base for Canadian Imperial Bank of Commerce’s total returns, but earnings growth and multiple expansion add to that, which is why we believe that total returns will be well above 10% over the coming five years.

Click here to download our most recent Sure Analysis report on Office Properties (CM) (preview of page 1 of 3 shown below):

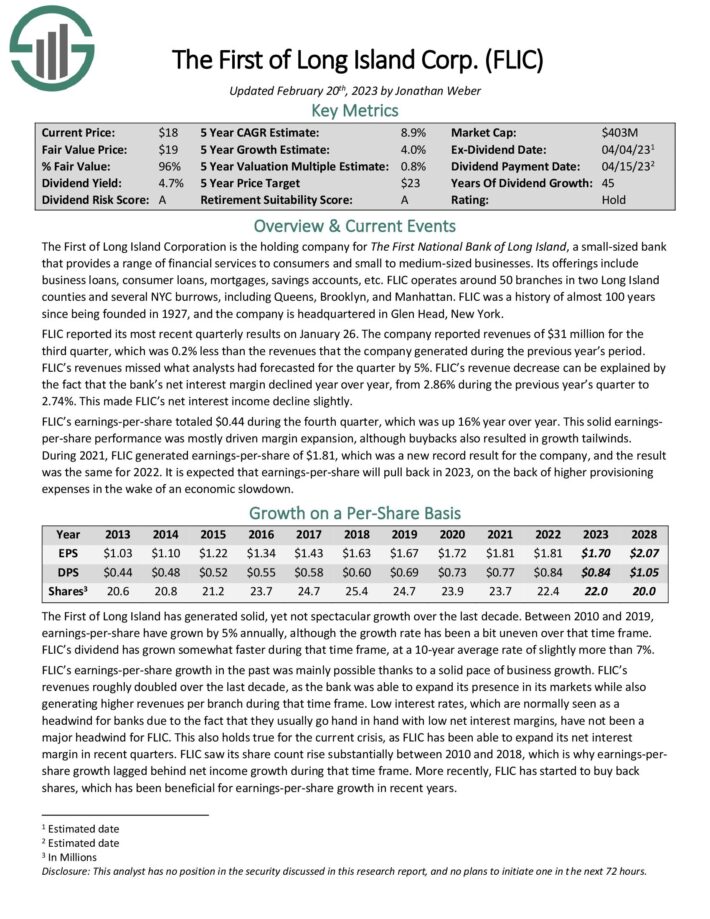

15: The First of Long Island (FLIC)

The First of Long Island is a small bank that is active in two Long Island counties and some New York City burrows. The First of Long Island operates just around 50 branches, but has a long and successful history. This includes a highly compelling 45-year dividend growth track record, showcasing the bank has managed to remain profitable and resilient during all kinds of macro environments.

Source: The First of Long Island presentation

The First of Long Island has achieved earnings growth in the 5% range over the last decade, and future profit growth will likely be at a comparable level, we believe.

The First of Long Island has seen its dividend yield climb to 6.2% as shares have pulled back so far in 2023. The dividend is well-covered, thanks to a dividend payout ratio of just 49%.

With its compelling dividend yield, some earnings growth potential, and some multiple expansion tailwinds, it can be expected that First of Long Island will generate total returns in the mid-teens range going forward.

Click here to download our most recent Sure Analysis report on Office Properties (FLIC) (preview of page 1 of 3 shown below):

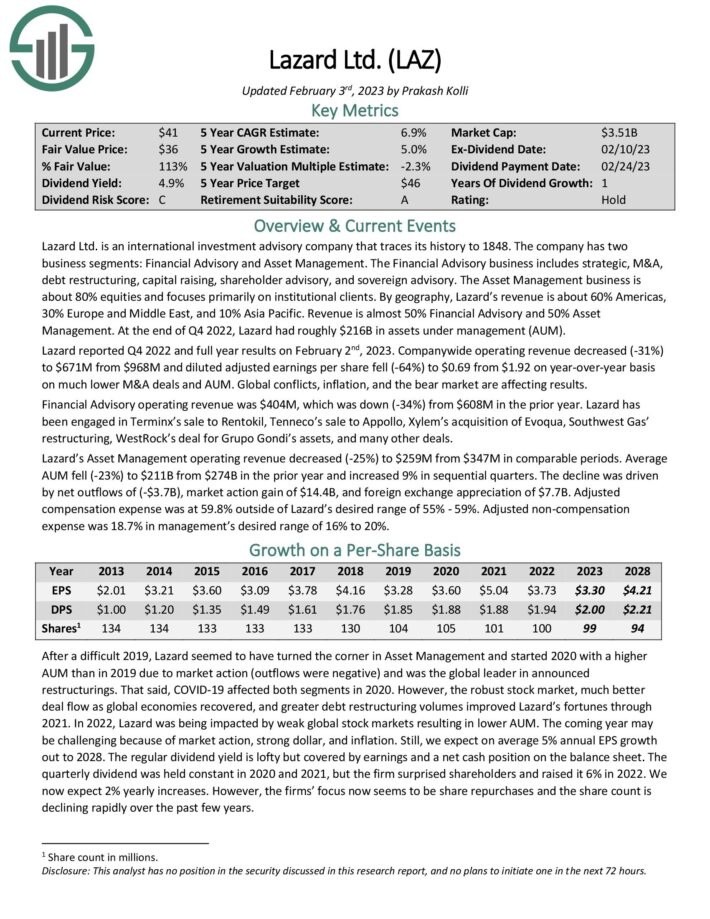

16: Lazard Ltd (LAZ)

Lazard Ltd is an internationally active investment advisor company that has a history dating back to the first half of the 19th century. Lazard, which is headquartered in Bermuda, offers M&A, capital raising, debt restructuring and related services, while also operating an asset management arm that is focused on equities.

Source: Lazard presentation

Lazard has grown its earnings at a mid-single-digit pace over the last decade, although there were some ups and downs, depending on factors such as market activity when it comes to IPOs, large M&A deals, and so on. It can thus be expected that Lazard’s results will remain somewhat cyclical in the future, too, as Lazard will remain dependent on market activity for some of its business arms.

Still, the dividend looks relatively safe, as the payout ratio, based on this year’s forecasted earnings, is just 61% — despite 2023 likely being a weaker year, relative to the last two years, when IPO and M&A markets were more active.

Lazard offers a dividend yield of 6.2% at current prices. When we also account for expected earnings growth in the mid-single digits, total returns should be north of 10% a year going forward, although multiple expansion likely won’t be a significant tailwind here.

Click here to download our most recent Sure Analysis report on Office Properties (LAZ) (preview of page 1 of 3 shown below):

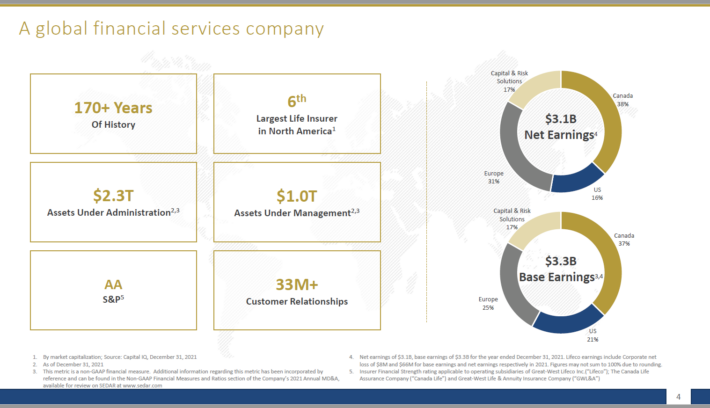

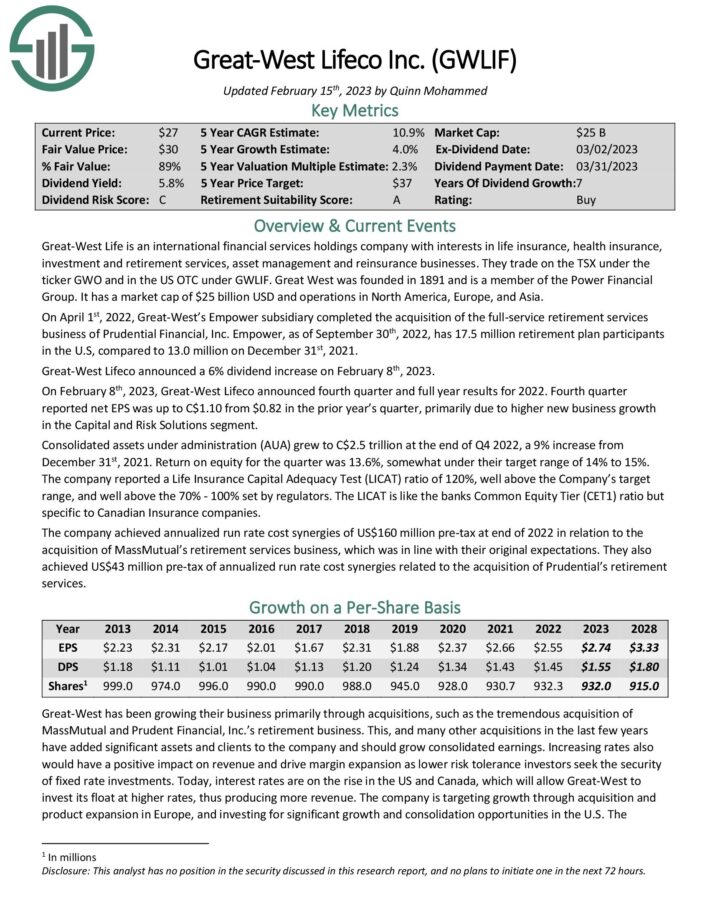

17: Great-West Lifeco Inc. (GWLIF)

Great-West Lifeco Inc. is a financial services holding company that holds interests in different assets, including life insurance, health insurance, asset management, and reinsurance businesses. Great-West Lifeco is headquartered in Winnipeg, Canada, and was founded more than 130 years ago.

Source: Great-West Lifeco presentation

Great-West Lifeco has generated earnings growth in the low single-digits over the last decade, and we believe that a low to mid-single-digit earnings-per-share growth rate is realistic for the future as well, thanks to a combination of organic business growth and share repurchases that lower the company’s share count over time.

Great-West Lifeco pays out around US$1.55 per year in dividends, which translates into a dividend yield of 5.9%. The dividend is pretty safe, we believe, as the dividend payout ratio is just

Source: Great-West Lifeco presentation

56%, and Great-West Lifeco’s earnings have been relatively resilient versus economic downturns in the past.

Between its solid dividend yield of almost 6%, some earnings growth, and some valuation upside, we believe that Great-West Lifeco could generate total returns in the 12% range going forward.

Click here to download our most recent Sure Analysis report on Office Properties (GWLIF) (preview of page 1 of 3 shown below):

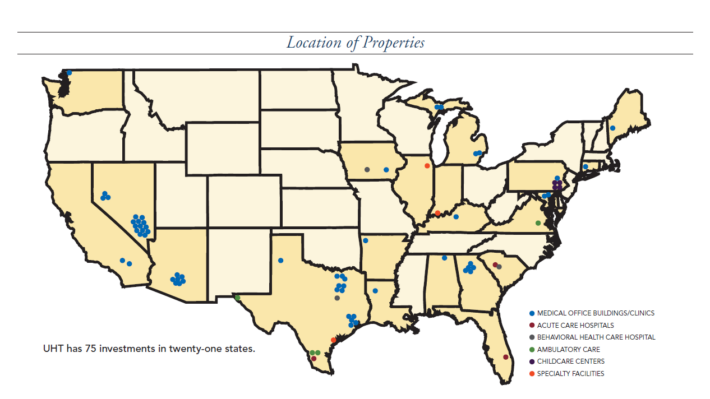

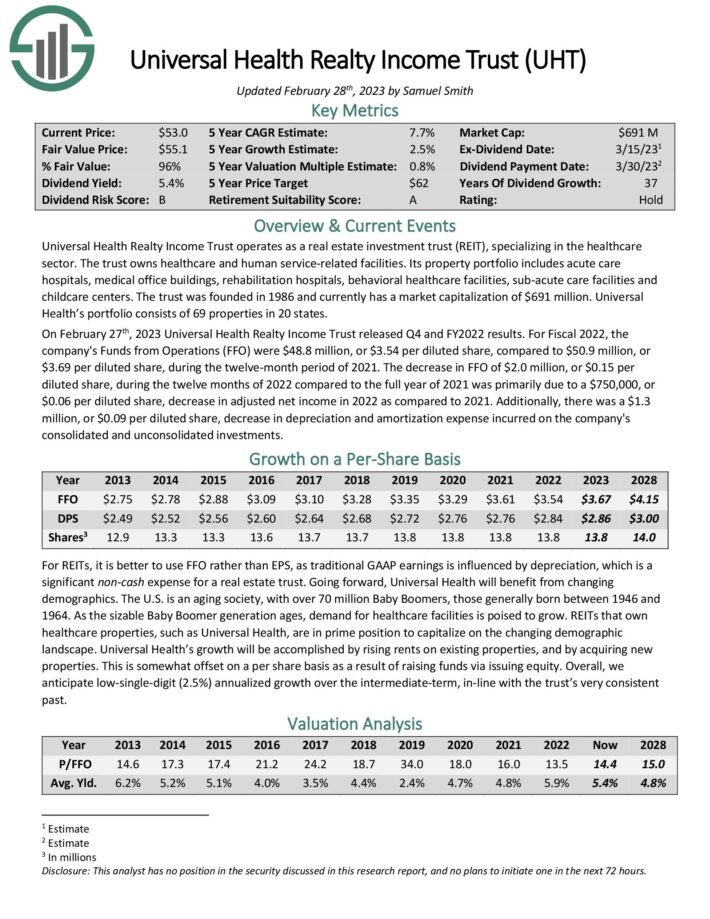

18: Universal Health Realty Income Trust (UHT)

Universal Health Realty Income Trust is a real estate income trust that is specialized in the healthcare sector. Universal Health Realty Income Trust owns acute care hospitals, medical office buildings, behavioral healthcare facilities, and so on.

Source. Universal Health Realty Income Trust presentation

Demand for healthcare is growing steadily in the US, primarily due to demographic change, as aging populations have increased healthcare needs. The longer-term growth outlook is thus solid for Universal Health Realty Income Trust, although the company won’t turn into a high-growth company. Over the last decade, FFO-per-share grew by roughly 3% per year, and future growth should be comparable to that, we believe.

Universal Health Realty Income Trust offers a dividend yield of 5.8% at current prices. The payout ratio at 76% is higher compared to most firms on this list. But since cash flows are expected to grow in the long run, and because the business is resilient versus recessions and other macro shocks, we still think that the dividend is relatively safe at the current level.

Between its dividend yield of close to 6%, the expected FFO growth, and some multiple expansion tailwinds, Universal Health Realty Income Trust should be able to deliver total returns of a little more than 10% per year going forward.

Click here to download our most recent Sure Analysis report on Office Properties (UHT) (preview of page 1 of 3 shown below):

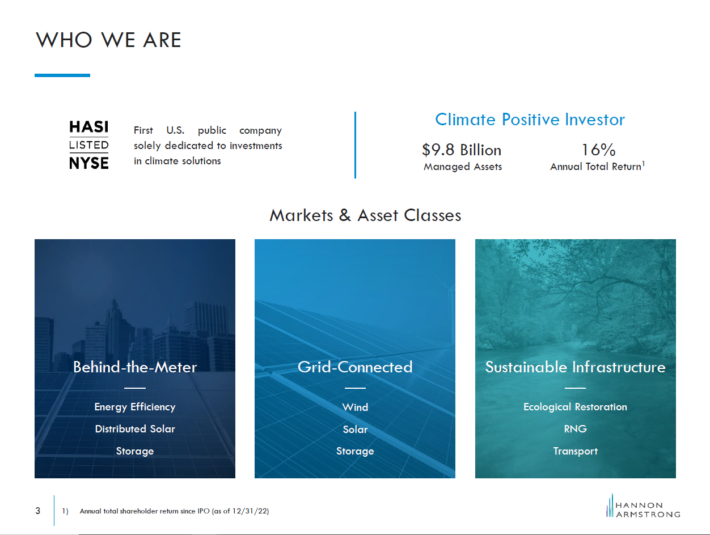

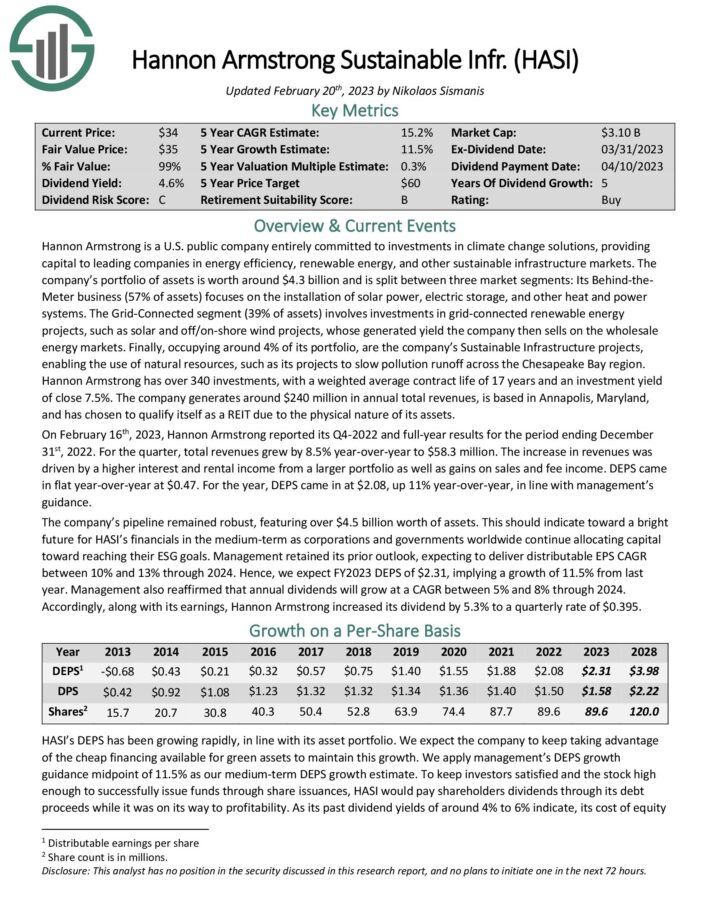

19: Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI)

Hannon Armstrong Sustainable Infrastructure Capital, Inc. is a company that is focused on providing capital for businesses in the energy efficiency, renewable energy, and sustainable infrastructure industries.

Source. Hannon Armstrong Sustainable Infrastructure Capital presentation

The industries Hannon Armstrong provides capital for are growing, in part due to massive public investments and incentives by governments and regulators. There thus is ample market growth for Hannon Armstrong to target.

The company has grown its profits by a lot over the last decade, although growth will likely slow down to some extent, as maintaining a high growth rate becomes harder the larger a company becomes. Still, we believe that Hannon Armstrong will grow its profits at a low double-digit pace over the coming five years, which is a strong growth rate for an income stock.

Hannon Armstrong’s current annual dividend of $1.58 per share translates into a dividend yield of 5.7%, which, in combination with the high expected earnings growth, makes Hannon Armstrong interesting for dividend growth investors. The dividend looks sufficiently safe thanks to a dividend payout ratio of 68%. When we consider the fact that profits will likely increase significantly over the coming years, then the company’s dividend coverage greatly improves.

Between its solid dividend yield and high earnings growth, Hannon Armstrong should deliver compelling total returns over the coming years, making the company attractive as a dividend growth or total return pick.

Click here to download our most recent Sure Analysis report on Office Properties (HASI) (preview of page 1 of 3 shown below):

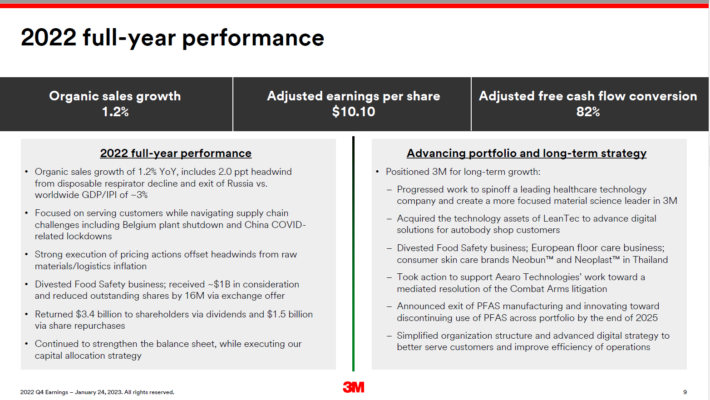

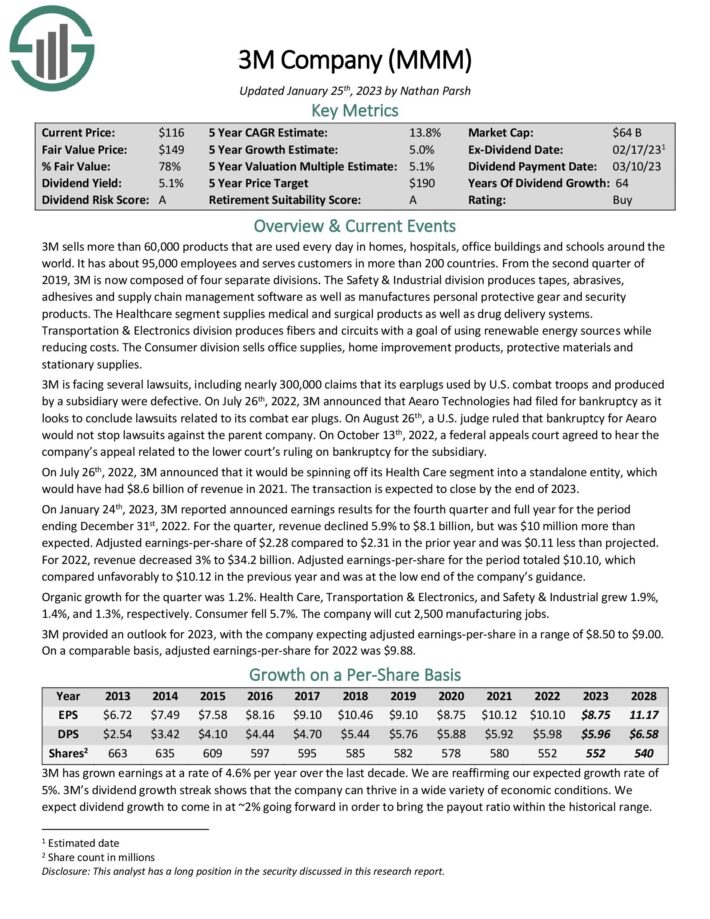

20: 3M Company (MMM)

3M is a diversified industrial company that sells a huge range of more than 60,000 different products, from personal safety equipment to adhesives, to a wide range of customers in more than 200 countries.

Source: 3M presentation

3M is a Dividend King, having raised its dividend for a hefty 64 years in a row. Thanks to its very diversified business, across different end markets and geographic markets, 3M has been relatively resilient versus past recessions, which includes the pandemic, during which 3M remained highly profitable.

The company has seen its shares decline over the last year, which has lifted its dividend yield to 5.7%, which is an unusually high dividend yield for 3M. Over the last decade, the dividend yield was in the 2% to 4% range most of the time.

The dividend is reasonably well-covered, as the forecasted dividend payout ratio for the current year is 69%. 3M’s very long and successful dividend growth track record is also reassuring for investors.

Between the dividend, some earnings growth, and some multiple expansion tailwinds, we are forecasting that 3M will deliver total returns in the mid-teens range over the coming five years.

Click here to download our most recent Sure Analysis report on Office Properties (MMM) (preview of page 1 of 3 shown below):

Final Thoughts

All of the above stocks offer strong business models that provide for relatively safe dividend yields. In addition, each name is projected to return at least 10% annually over the next five years, making them possible candidates for income and total return investors alike.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more