This is a guest contribution by Dividend Power

Monthly dividend stocks pay a dividend each month to their shareholders. According to Sure Dividend, there are currently 80 monthly dividend stocks.

In the United States, companies usually pay dividends quarterly. But many real estate investment trusts (REITs), business development companies (BDCs), and oil and gas energy trusts pay monthly dividends. In most cases, these companies are mandated to distribute at least 90% of the income.

The advantage of monthly dividend stocks is they pay a consistent income, allowing a retiree to meet expenses. Regular dividends or bonds do not allow for this level of consistency.

For this reason, Sure Dividend created a list of 80 monthly dividend stocks. You can download the full list of monthly dividend stocks by clicking on the link below:

This list contains important metrics, including: dividend yields, payout ratios, dividend growth rates, 52-week highs and lows, betas, and more.

However, the disadvantage to monthly dividend stocks is that the payout ratios are elevated, and the rate can vary month-to-month. Further, REITs, BDCs, and energy trusts are prone to cutting or omitting dividends, especially during economic stress, like the COVID-19 pandemic or the Great Recession.

We pick three monthly dividend equities using three criteria: at least five years of dividend growth, a dividend yield of at least 4%, and a market capitalization of $1+ billion. Our top three choices are:

- Realty Income (O)

- Stag Industrial (STAG)

- Main Street Capital (MAIN)

#1: Realty Income (O)

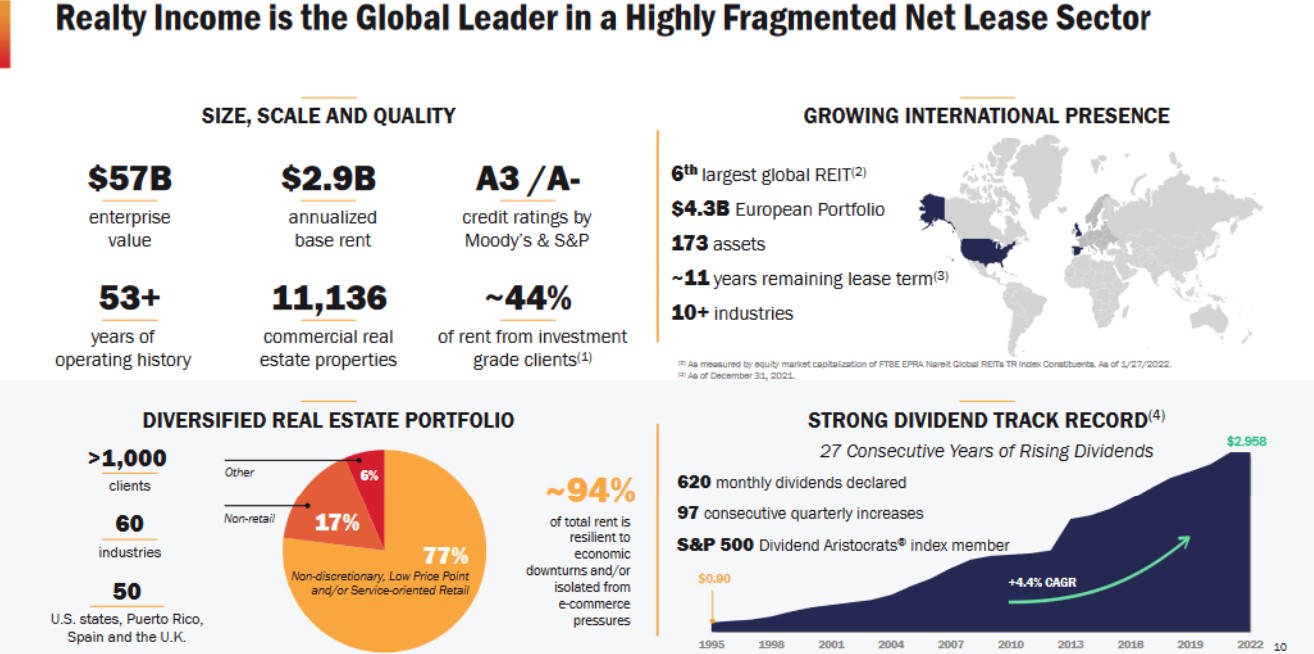

A monthly dividend payer list is incomplete without Realty Income (O). It is a well-known net lease REIT with nearly $40 billion in market capitalization. Also, it has a 50+ year history, pointing to its staying power.

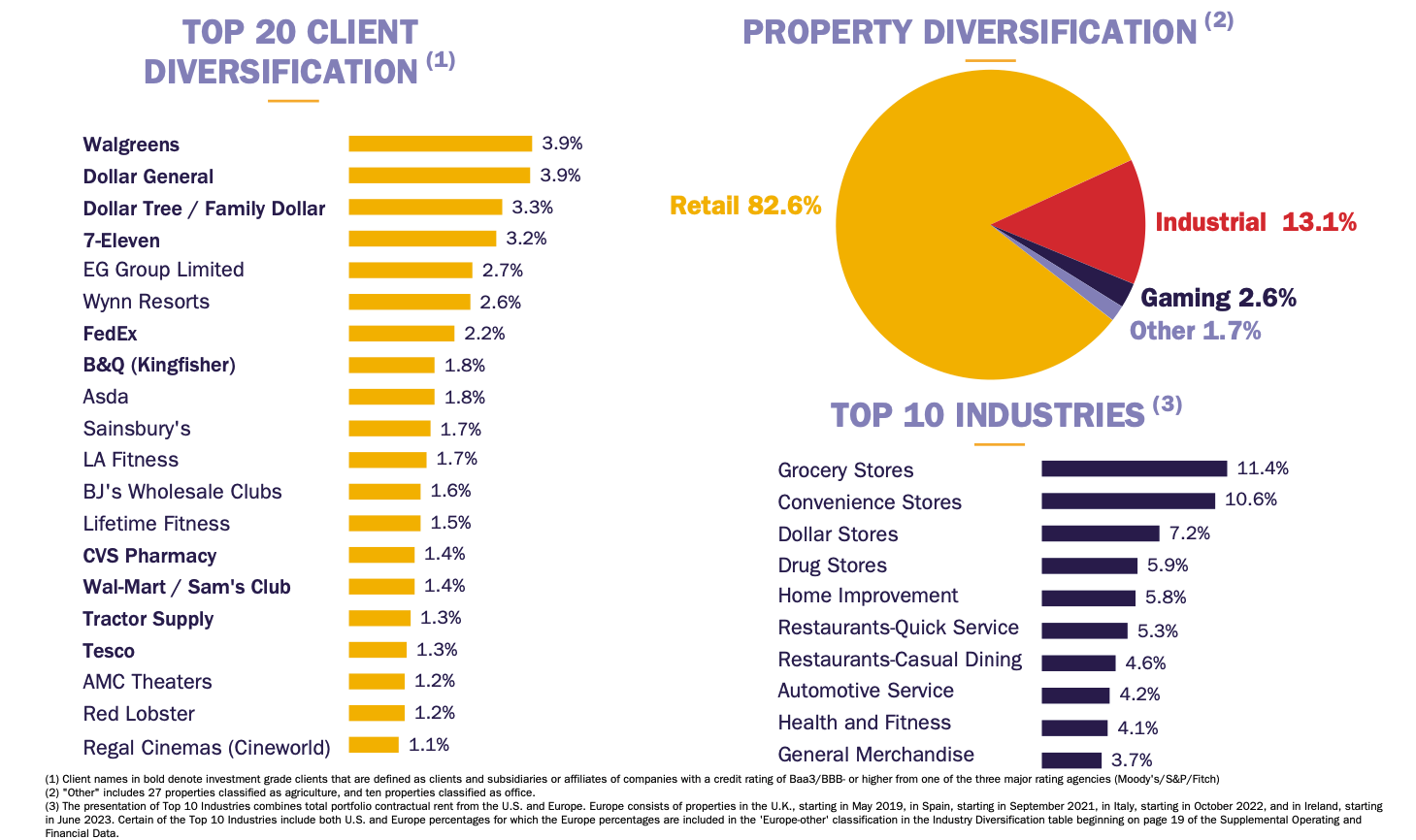

Realty Income was founded in San Diego in 1969. It has grown into a giant with properties in all 50 states, the United Kingdom, Ireland, Spain, and Italy. Currently, the Trust is the 7th largest globally, with 13,282 properties leased to 1,324 clients in 85 industries. The top three industries are grocery, convenience, and dollar stores.

Also, no single client represents more than 4% of revenue, reducing risk. The five largest clients by revenue are Walgreens (3.9%), Dollar General (3.9%), Dollar Tree / Family Dollar (3.3%), 7-Eleven (3.2%) and EG Group Limited (2.7%).

Source: Investor Presentation

At the end of Q3 2023, Realty Income had a 98.8% occupancy rate compared to a 98.2% median. It has developed properties and picked stable clients. In addition, Realty Income operates under a triple-net lease structure, dramatically reducing inflationary risks.

From a growth perspective, the REIT is well-positioned. It uses long-term leases, and the average remaining duration is ~10 years. The fixed rent typically increases annually, and variable rent can rise if the client’s sales grow. In addition, Realty Income is an acquisitive firm, acquiring VEREIT in 2021 and Spirit Realty Capital in 2023.

Because of its long history and consistency, Realty Income is often a preferred monthly dividend payer for portfolios. It has paid a dividend for 640 months in a row or 54 years. The 104 quarterly increases in 29 years place it on the Dividend Aristocrats and Dividend Champions lists. Over this time, the dividend has grown at an average rate of 4.3%. The bottom line is no other monthly dividend stock has this type of record.

Source: Realty Income Investor Relations

Realty Income’s dividend streaks come with excellent safety. The stock has a low beta of 0.5 versus the S&P 500 Index, meaning volatility is reduced. Next, the earnings per share have been positive in 26 of the past 27 years, and adjusted funds from operations (AFFO) have climbed 5.0% CAGR since 1996. Hence, the dividend is supported by operational growth. Lastly, the balance sheet is excellent, with an A3 / A- upper medium investment grade credit rating from Moody’s and S&P Global.

Income investors will like the 5.69% forward dividend yield, more than one percentage point above the 5-year average. Currently, the stock is undervalued based on the historical price-to-AFFO range. We view the REIT as a long-term buy.

#2: Stag Industrial (STAG)

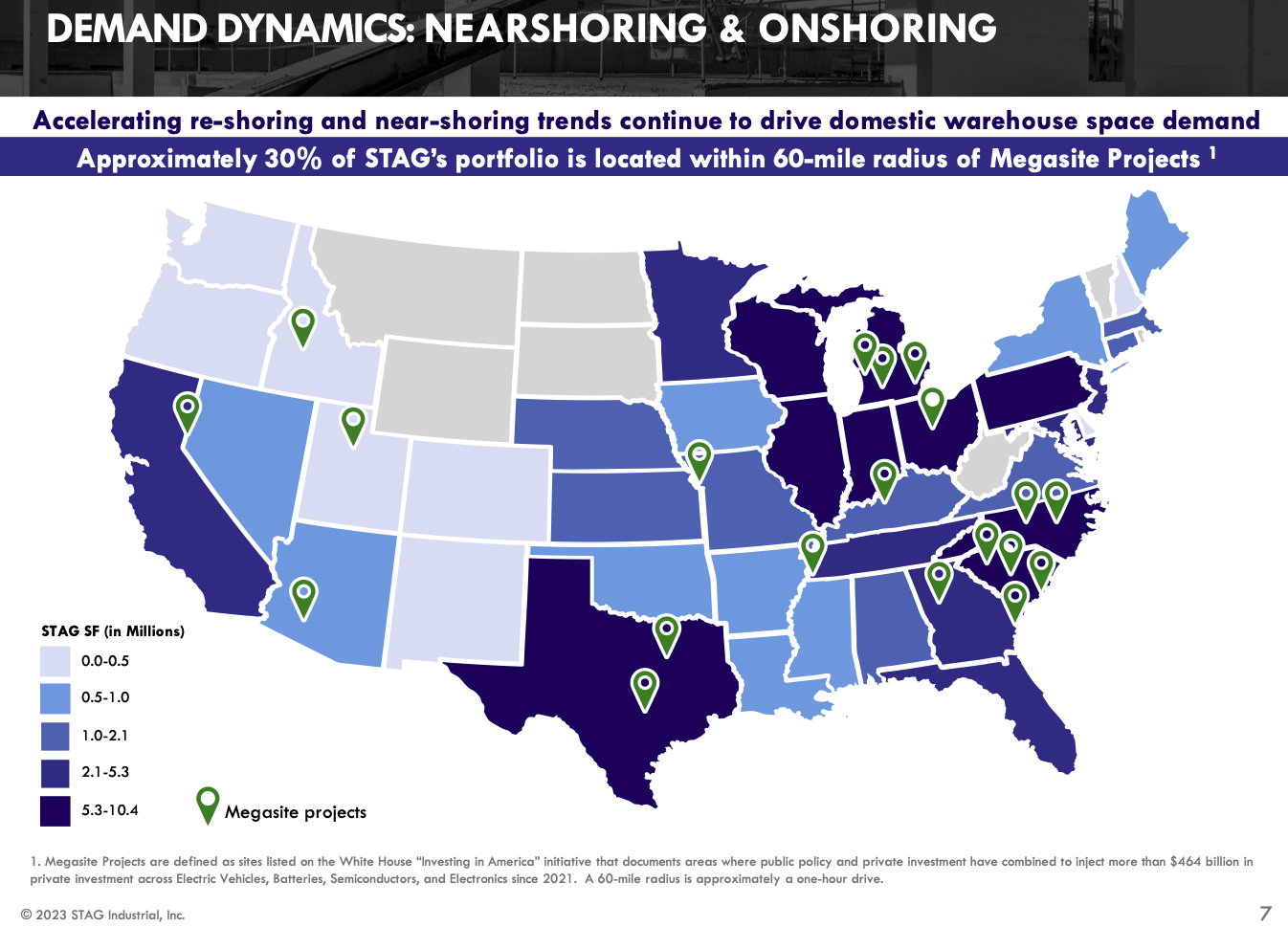

Stag Industrial (STAG) is a unique REIT focusing only on single-tenant, large industrial properties in the United States. The Trust owns about 568 properties with 112 million square feet in 41 states. It mainly rents the properties to one or two tenants, occupying most or all of the building.

Source: STAG Investor Relations

This strategy presents a risk because a building is either occupied or empty. However, STAG has deep expertise and performs quantitative and qualitative analyses to limit losses. Consequently, 53% of the tenants are publicly rated, and nearly one-third of the tenants are investment grade. Moreover, at the end of Q3 2023, the portfolio’s occupancy rate was 97.6%.

STAG grows by developing new properties or acquiring older ones and redeveloping them. The growth drivers are e-commerce near-shoring, and onshoring of industrial and distribution activities. For redevelopment, the Trust acquires vacant properties and adds value. It also expands existing real estate in the portfolio. The strategy seemingly works because STAG’s rent growth exceeds that of the markets. Further, STAG has many years of growth ahead because it commands less than 1% of the total market.

STAG is carrying a 4.1% dividend yield. However, this value is less than the 5-year average. After snowballing early, the growth rate has slowed to 0.8% on average in the trailing 5-years. The low rate of increase has caused the payout ratio to decline to more reasonable levels. Still, the REIT is now a Dividend Contender and did not cut dividends during the pandemic bear market. The balance sheet is conservative, with 87%+ fixed rate debt and the remainder at variable rates. The credit rating agencies give STAG a ‘Baa3,’ lower-medium investment-grade score.

STAG is fairly valued now, trading at a P/AFFO of 15.8X within the 5-year and 10-year ranges. Investors should keep track of this Trust and wait for a good entry point.

#3: Main Street Capital (MAIN)

Most BDCs are volatile because of the risks. The dividend also fluctuates because net interest income (NII) varies. However, Main Street Capital (MAIN) is one BDC that stands out because of its consistency and history.

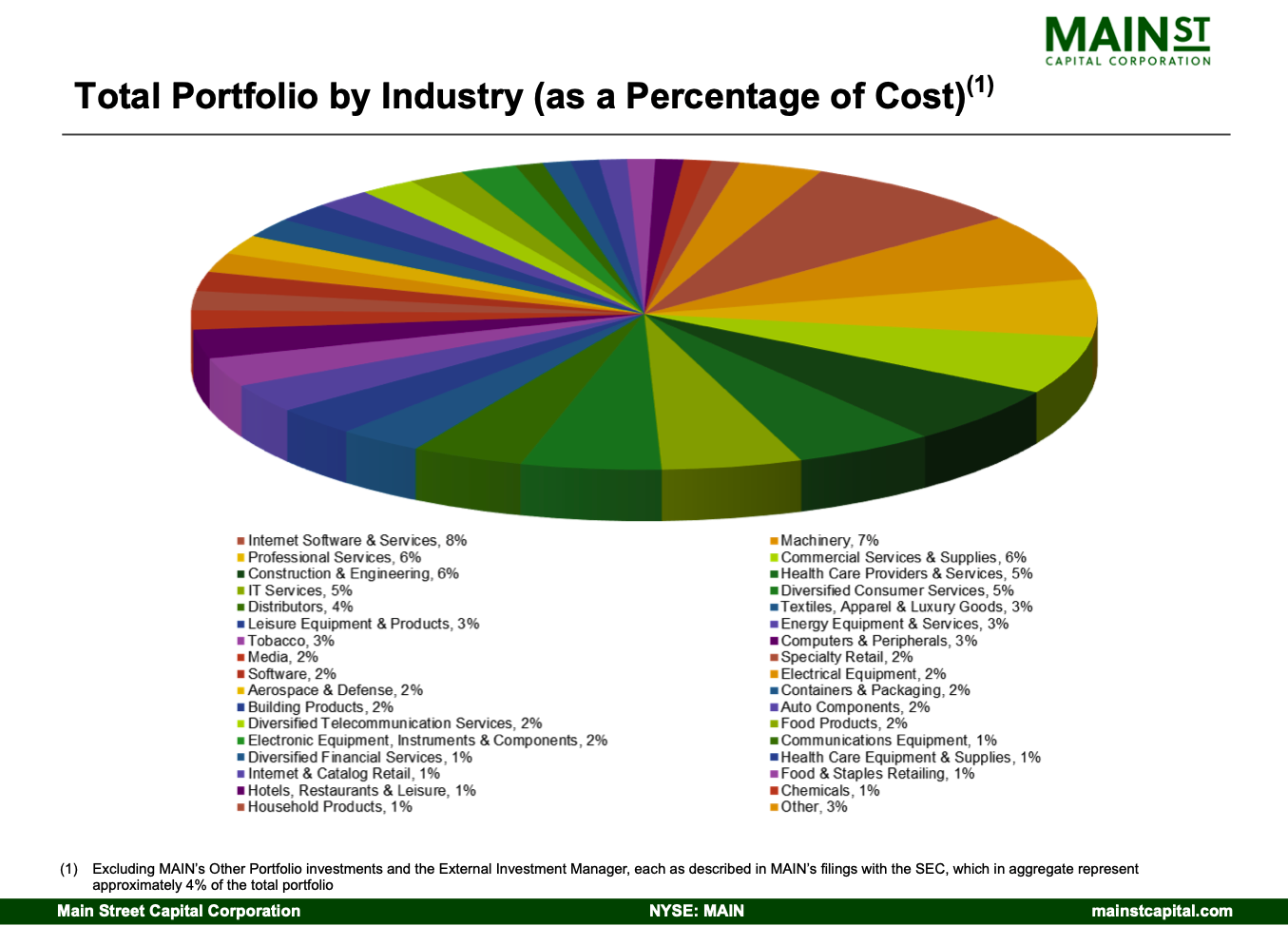

The firm traces its history to the mid-1990s and conducted an IPO in 2007. It provides equity capital to lower middle-market companies and debt capital to middle-market companies. Main Street Capital provides financing to businesses with annual revenues ranging from $10 to $150 million. The companies are typically owned by private equity.

The BDC currently has 195 portfolio companies with 79 lower middle markets, 89 private loans, and 27 middle markets. Main Street Capital has over $6.8 billion under management, with an average investment of $18.7 million. These investments are diversified across industries, with no single industry representing more than 8% of the portfolio.

Source: Main Street Capital Investor Relations

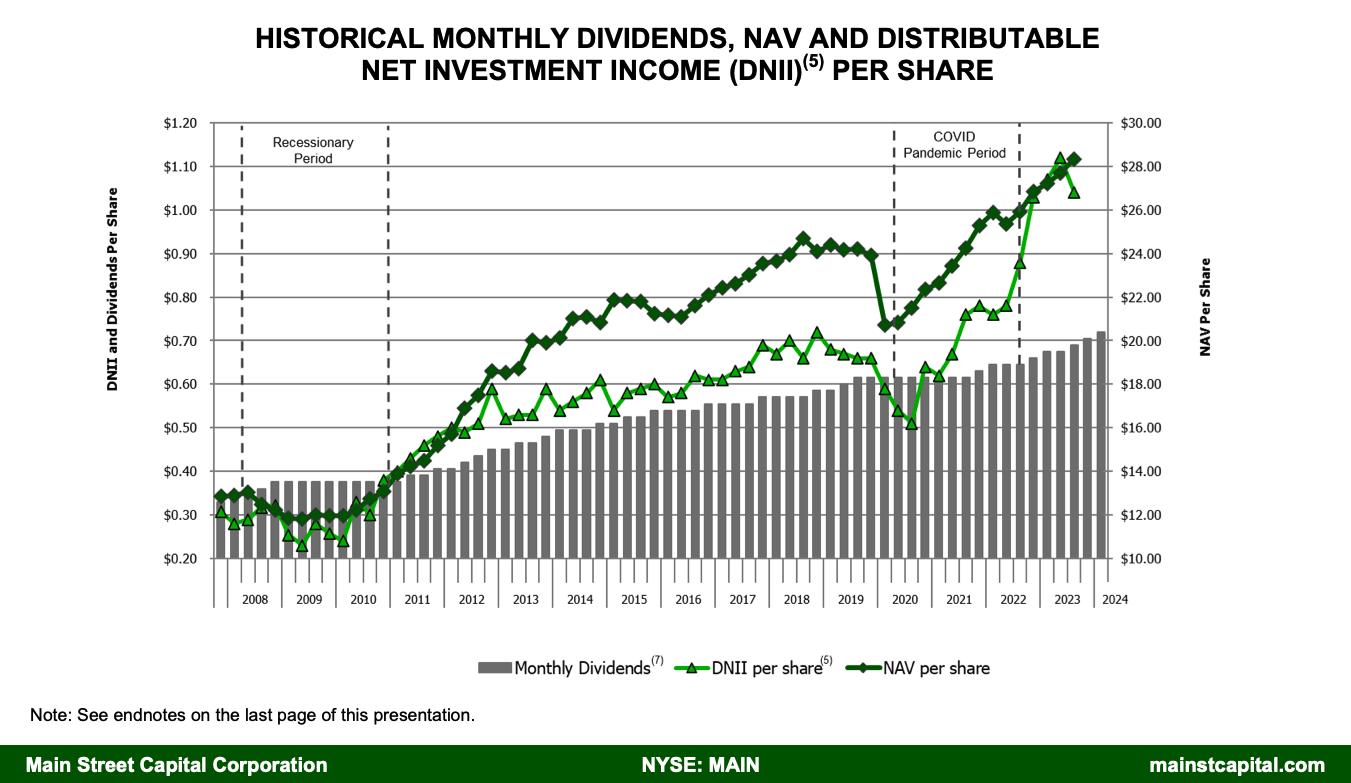

Long-term success has continuously allowed Main Street Capital to pay dividends since the IPO. Notably, it has never been decreased, although it has been held constant for stretches. Since the IPO, the dividend has grown 118%. Supplemental dividends are also paid in most years.

Source: Main Street Capital Investor Relations

The dividend has grown at a ~4.2% CAGR in the last decade and about 3% CAGR in the trailing 5-years. The BDC has grown the regular dividend for 13 consecutive years, making it a Dividend Contender. The firm’s latest dividend increase announcement was in November 2023.

Investors will like the forward yield of ~6.8%. Main Street Capital is undervalued at a P/E ratio of 10.2X, below the 5-year and 1-year ranges.

Author Bio: Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 2.5% out of over 26,000+ financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.