Updated on December 4th, 2024 by Bob Ciura

Spreadsheet data updated daily

Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually.

This research report focuses on all 76 individual monthly paying securities. It includes the following resources.

Resource #1: The Monthly Dividend Stock Spreadsheet List

This list contains important metrics, including: dividend yields, payout ratios, dividend growth rates, 52-week highs and lows, betas, and more.

Note: We strive to maintain an accurate list of all monthly dividend payers. There’s no universal source we are aware of for monthly dividend stocks; we curate this list manually. If you know of any stocks that pay monthly dividends that are not on our list, please email support@suredividend.com.

Resource #2: The Monthly Dividend Stocks In Focus Series

The Monthly Dividend Stocks In Focus series is where we analyze all monthly paying dividend stocks. This resource links to stand-alone analysis on each of these securities.

Resource #3: The 10 Best Monthly Dividend Stocks

This research report analyzes the 10 best monthly dividend stocks as ranked by expected total return.

Resource #4: Other Monthly Dividend Stock Research

– Monthly dividend stock performance

– Why monthly dividends matter

– The dangers of investing in monthly dividend stocks

– Final thoughts and other income investing resources

The Monthly Dividend Stocks In Focus Series

You can see detailed analysis on the individual monthly dividend securities we cover by clicking the links below:

- Agree Realty (ADC)

- AGNC Investment (AGNC)

- Atrium Mortgage Investment Corporation (AMIVF)

- Apple Hospitality REIT, Inc. (APLE)

- ARMOUR Residential REIT (ARR)

- A&W Revenue Royalties Income Fund (AWRRF)

- Banco Bradesco S.A. (BBD)

- Diversified Royalty Corp. (BEVFF)

- Boston Pizza Royalties Income Fund (BPZZF)

- Bridgemarq Real Estate Services (BREUF)

- BSR Real Estate Investment Trust (BSRTF)

- Canadian Apartment Properties REIT (CDPYF)

- ChemTrade Logistics Income Fund (CGIFF)

- Choice Properties REIT (PPRQF)

- Cross Timbers Royalty Trust (CRT)

- CT Real Estate Investment Trust (CTRRF)

- SmartCentres Real Estate Investment Trust (CWYUF)

- Dream Industrial REIT (DREUF)

- Dream Office REIT (DRETF)

- Dynex Capital (DX)

- Ellington Residential Mortgage REIT (EARN)

- Ellington Financial (EFC)

- EPR Properties (EPR)

- Exchange Income Corporation (EIFZF)

- Extendicare Inc. (EXETF)

- Flagship Communities REIT (MHCUF)

- First National Financial Corporation (FNLIF)

- Freehold Royalties Ltd. (FRHLF)

- Firm Capital Property Trust (FRMUF)

- Fortitude Gold (FTCO)

- Gladstone Capital Corporation (GLAD)

- Gladstone Commercial Corporation (GOOD)

- Gladstone Investment Corporation (GAIN)

- Gladstone Land Corporation (LAND)

- Global Water Resources (GWRS)

- Granite Real Estate Investment Trust (GRP.U)

- H&R Real Estate Investment Trust (HRUFF)

- Horizon Technology Finance (HRZN)

- Hugoton Royalty Trust (HGTXU)

- Itaú Unibanco (ITUB)

- The Keg Royalties Income Fund (KRIUF)

- LTC Properties (LTC)

- Sienna Senior Living (LWSCF)

- Main Street Capital (MAIN)

- Modiv Inc. (MDV)

- Mullen Group Ltd. (MLLGF)

- Northland Power Inc. (NPIFF)

- NorthWest Healthcare Properties REIT (NWHUF)

- Orchid Island Capital (ORC)

- Oxford Square Capital (OXSQ)

- Permian Basin Royalty Trust (PBT)

- Phillips Edison & Company (PECO)

- Pennant Park Floating Rate (PFLT)

- Peyto Exploration & Development Corp. (PEYUF)

- Pine Cliff Energy Ltd. (PIFYF)

- Primaris REIT (PMREF)

- Paramount Resources Ltd. (PRMRF)

- PermRock Royalty Trust (PRT)

- Prospect Capital Corporation (PSEC)

- Permianville Royalty Trust (PVL)

- Pizza Pizza Royalty Corp. (PZRIF)

- Realty Income (O)

- RioCan Real Estate Investment Trust (RIOCF)

- Richards Packaging Income Fund (RPKIF)

- Sabine Royalty Trust (SBR)

- Stellus Capital Investment Corp. (SCM)

- Savaria Corp. (SISXF)

- San Juan Basin Royalty Trust (SJT)

- SL Green Realty Corp. (SLG)

- Whitecap Resources Inc. (SPGYF)

- Slate Grocery REIT (SRRTF)

- Stag Industrial (STAG)

- Timbercreek Financial Corp. (TBCRF)

- Tamarack Valley Energy (TNEYF)

- U.S. Global Investors (GROW)

- Whitestone REIT (WSR)

The 10 Best Monthly Dividend Stocks

This research report examines the 10 monthly dividend stocks from our Sure Analysis Research Database with the highest 5-year forward expected total returns.

We currently cover nearly 80 monthly dividend stocks every quarter in the Sure Analysis Research Database.

Use the table below to quickly jump to analysis on any of the top 10 best monthly dividend stocks as ranked by expected total returns.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- Monthly Dividend Stock #10: STAG Industrial (STAG)

- Monthly Dividend Stock #9: Gladstone Land Corporation (LAND)

- Monthly Dividend Stock #8: Apple Hospitality REIT (APLE)

- Monthly Dividend Stock #7: Ellington Financial (EFC)

- Monthly Dividend Stock #6: AGNC Investment Corporation (AGNC)

- Monthly Dividend Stock #5: EPR Properties (EPR)

- Monthly Dividend Stock #4: Oxford Square Capital (OXSQ)

- Monthly Dividend Stock #3: Horizon Technology Finance (HRZN)

- Monthly Dividend Stock #2: Ellington Credit Co. (EARN)

- Monthly Dividend Stock #1: Itau Unibanco (ITUB)

Monthly Dividend Stock #10: STAG Industrial (STAG)

- 5-Year Expected Total Return: 8.7%

- Dividend Yield: 4.0%

STAG Industrial is an owner and operator of industrial real estate. It is focused on single-tenant industrial properties and has ~560 buildings across 41 states in the United States.

The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant.

Source: Investor Presentation

However, STAG Industrial executes a deep quantitative and qualitative analysis on its tenants. As a result, it has incurred credit losses that have been less than 0.1% of its revenues since its IPO.

In late October, STAG Industrial reported (10/29/24) financial results for the third quarter of fiscal 2024. Core FFO per share grew 2% over the prior year’s quarter, from $0.59 to $0.60, in line with the analysts’ consensus, thanks to the sustained strength of the REIT’s tenants and hikes in rent rates.

Net operating income grew 5% over the prior year’s quarter even though the occupancy rate remained flat at 97.1%.

Click here to download our most recent Sure Analysis report on STAG Industrial Inc. (STAG) (preview of page 1 of 3 shown below):

Monthly Dividend Stock #9: Gladstone Land Corporation (LAND)

- 5-Year Expected Total Return: 9.4%

- Dividend Yield: 4.7%

Gladstone Land Corporation is a real estate investment trust, or REIT, that specializes in the owning and operating of farmland in the U.S. The trust owns about 160 farms, comprising more than 110,000 acres of farmable land.

Gladstone’s business is made up of three different options available to farmers, all of which are done on a triple-net basis. The trust offers long-term sale leaseback transactions, traditional leases of farmland, and outright purchases of farm properties. Gladstone’s portfolio has an appraised value of over $1.5 billion.

Gladstone posted third quarter earnings on November 6th, 2024, and results were slightly better than expected.

Adjusted funds-from-operations, or FFO, was $4.5 million, or 13 cents per share. That was down from $5.4 million, or 15 cents per share, in the year-ago period.

Total cash lease revenues declined, driven by lower fixed base cash rents, partially offset by additional participation rents.

Fixed base cash rents were down primarily from the sale of a large farm in Florida in the first quarter of this year. In addition, Gladstone saw lower rent renewal rates on certain properties.

Cash flow from operations was $1.4 million lower year-over-year, largely due to payment of certain cash allowances for three specific leases.

Click here to download our most recent Sure Analysis report on LAND (preview of page 1 of 3 shown below):

Monthly Dividend Stock #8: Apple Hospitality REIT (APLE)

- 5-Year Expected Total Return: 9.8%

- Dividend Yield: 5.9%

Apple Hospitality REIT is a hotel REIT that owns a portfolio of hotels with tens of thousands of rooms located across dozens of states.

It franchises its properties out to leading brands, including Marriott-branded hotels, Hilton-branded hotels, and Hyatt-branded hotels.

As of December 31, 2023, Apple Hospitality owned 225 hotels with a total of 29,900 guest rooms across 88 markets in 38 states.

Source: Investor Presentation

Apple Hospitality REIT, Inc. (APLE) reported its second-quarter 2024 financial results, demonstrating solid performance across key metrics.

The company posted earnings per share (EPS) of $0.31, beating estimates by $0.01, and generated revenue of $390.08 million, representing a 7.87% year-over-year increase and surpassing expectations by $2.57 million.

For the second quarter, Apple Hospitality recorded net income of $73.9 million, an increase of 13.2% compared to the same period in 2023, with a net income per share of $0.31, up 6.9%.

The company’s operating income for Q2 was $93.5 million, up 12.6%, and the operating margin improved by 100 basis points to 24%.

Click here to download our most recent Sure Analysis report on APLE (preview of page 1 of 3 shown below):

Monthly Dividend Stock #7: Ellington Financial (EFC)

- 5-Year Expected Total Return: 9.8%

- Dividend Yield: 12.7%

Ellington Financial Inc. acquires and manages mortgage, consumer, corporate, and other related financial assets in the United States.

The company acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Source: Investor Presentation

Additionally, it manages RMBS, for which the U.S. government guarantees the principal and interest payments. It also provides collateralized loan obligations, mortgage–related and non–mortgage–related derivatives, equity investments in mortgage originators and other strategic investments.

On November 6th, 2024, Ellington Financial reported its Q3 results for the period ending September 30th, 2024. Due to the nature company’s business model, Ellington doesn’t report any revenues. Instead, it records only income. For the quarter, gross interest income came in at $101.7 million, up 2.5% quarter-over-quarter.

Adjusted (previously referred to as “core”) EPS came in at $0.40, seven cents higher versus Q2-2024. The rise was driven in part by a sizeable contribution from Ellington’s proprietary reverse mortgage strategy, offset by a higher share count. Ellington’s book value per share fell from $13.92 to $13.66 during the last three months.

Click here to download our most recent Sure Analysis report on Ellington Financial (EFC) (preview of page 1 of 3 shown below):

Monthly Dividend Stock #6: AGNC Investment Corp. (AGNC)

- 5-Year Expected Total Return: 11.0%

- Dividend Yield: 15.2%

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

AGNC Investment Corp. reported strong financial results for the third quarter ended September 30, 2024. The company achieved a comprehensive income of $0.63 per common share, driven by a net income of $0.39 and other comprehensive income of $0.24 from marked-to-market investments.

Net spread and dollar roll income contributed $0.43 per share. The tangible net book value increased by $0.42 per share to $8.82, reflecting a 5.0% growth from the previous quarter.

AGNC declared dividends of $0.36 per share, resulting in a 9.3% economic return on tangible common equity, which includes both dividends and the increase in net book value.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

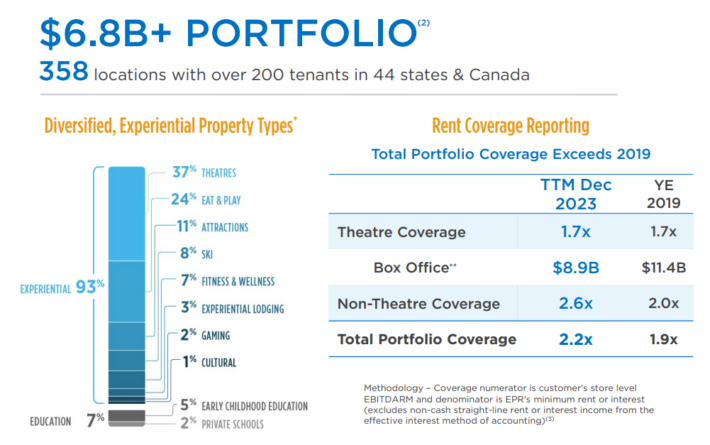

Monthly Dividend Stock #5: EPR Properties (EPR)

- 5-Year Expected Total Return: 11.1%

- Dividend Yield: 7.6%

EPR Properties is a specialty real estate investment trust, or REIT, that invests in properties in specific market segments that require industry knowledge to operate effectively.

It selects properties it believes have strong return potential in Entertainment, Recreation, and Education. The portfolio includes about $7 billion in investments across 350+ locations in 44 states, including over 200 tenants.

Source: Investor Presentation

EPR posted third quarter earnings on October 30th, 2024, and results were better than expected on both the top and bottom lines. Funds-from-operations came to $1.29, which was two cents ahead of estimates. FFO was down from $1.47 per share a year ago. On a dollar basis, FFO fell from $113 million to just over $100 million.

Revenue was off almost 5% year-over-year to $180.5 million, which was $21.5 million ahead of expectations. For the nine months, revenue was off from $534 million to $521 million.

Click here to download our most recent Sure Analysis report on EPR (preview of page 1 of 3 shown below):

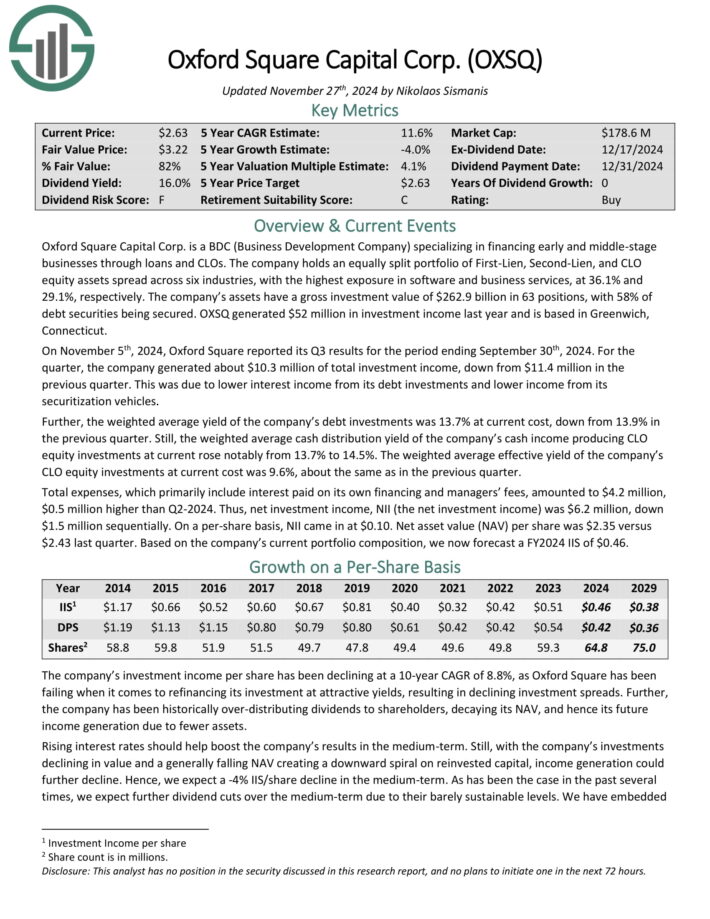

Monthly Dividend Stock #4: Oxford Square Capital (OXSQ)

- 5-Year Expected Total Return: 11.5%

- Dividend Yield: 15.9%

Oxford Square Capital Corp. is a BDC specializing in financing early and middle–stage businesses through loans and CLOs.

The company holds an equally split portfolio of First–Lien, Second–Lien, and CLO equity assets spread across multiple industries, with the highest exposure in software and business services.

Source: Investor Presentation

On November 5th, 2024, Oxford Square reported its Q3 results for the period ending September 30th, 2024. For the quarter, the company generated about $10.3 million of total investment income, down from $11.4 million in the previous quarter.

This was due to lower interest income from its debt investments and lower income from its securitization vehicles.

Further, the weighted average yield of the company’s debt investments was 13.7% at current cost, down from 13.9% in the previous quarter.

Still, the weighted average cash distribution yield of the company’s cash income producing CLO equity investments at current rose notably from 13.7% to 14.5%.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

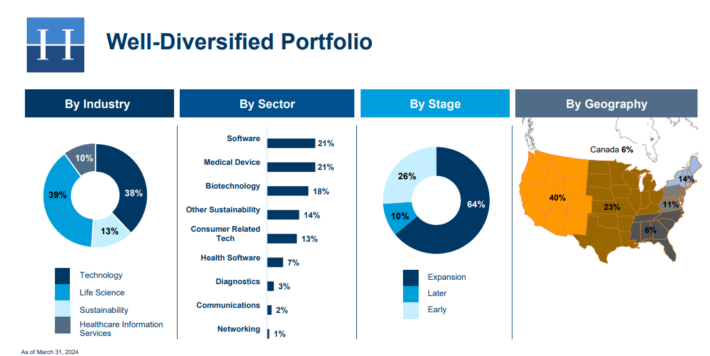

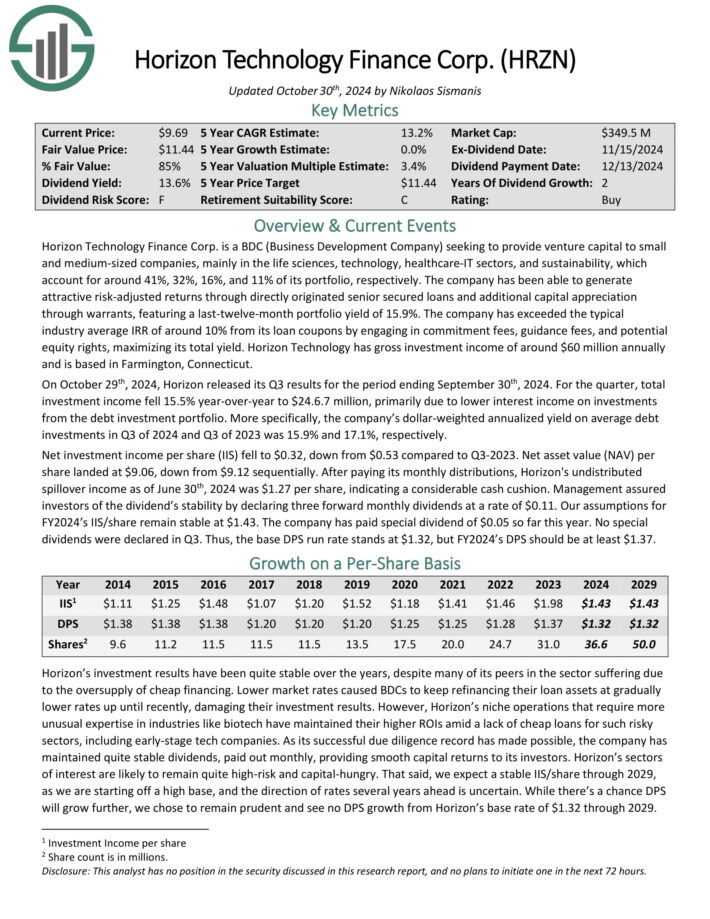

Monthly Dividend Stock #3: Horizon Technology Finance (HRZN)

- 5-Year Expected Total Return: 14.0%

- Dividend Yield: 14.1%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Source: Investor Presentation

On October 29th, 2024, Horizon released its Q3 results for the period ending September 30th, 2024. For the quarter, total investment income fell 15.5% year-over-year to $24.6.7 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q3 of 2024 and Q3 of 2023 was 15.9% and 17.1%, respectively.

Net investment income per share (IIS) fell to $0.32, down from $0.53 compared to Q3-2023. Net asset value (NAV) per share landed at $9.06, down from $9.12 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of June 30th, 2024 was $1.27 per share, indicating a considerable cash cushion.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

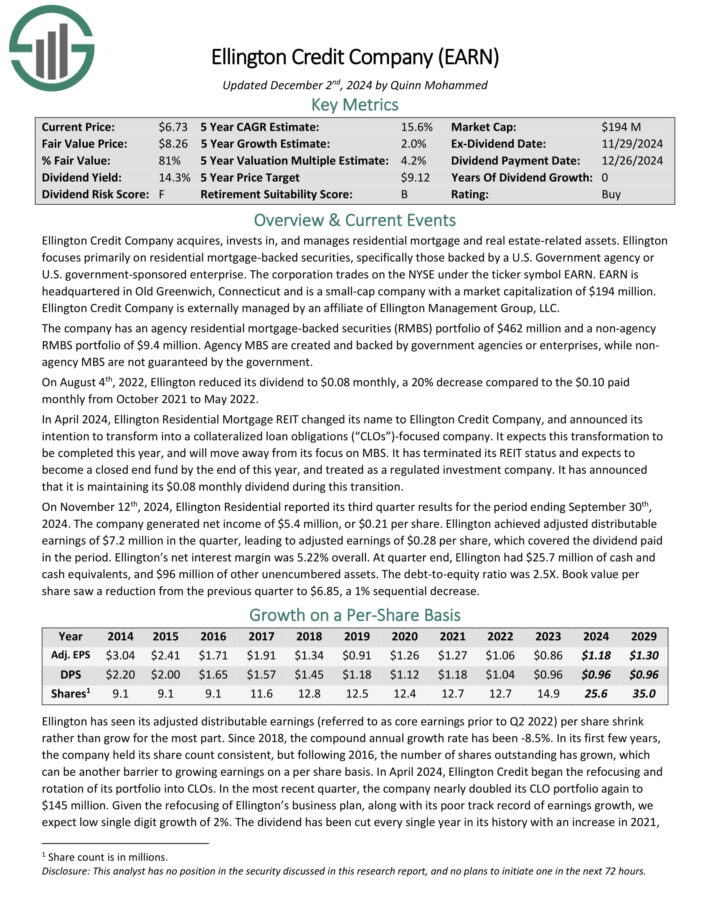

Monthly Dividend Stock #2: Ellington Credit Co. (EARN)

- 5-Year Expected Total Return: 15.7%

- Dividend Yield: 14.3%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On November 12th, 2024, Ellington Residential reported its third quarter results for the period ending September 30th, 2024. The company generated net income of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million in the quarter, leading to adjusted earnings of $0.28 per share, which covered the dividend paid in the period.

Net interest margin was 5.22% overall. At quarter end, Ellington had $25.7 million of cash and cash equivalents, and $96 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

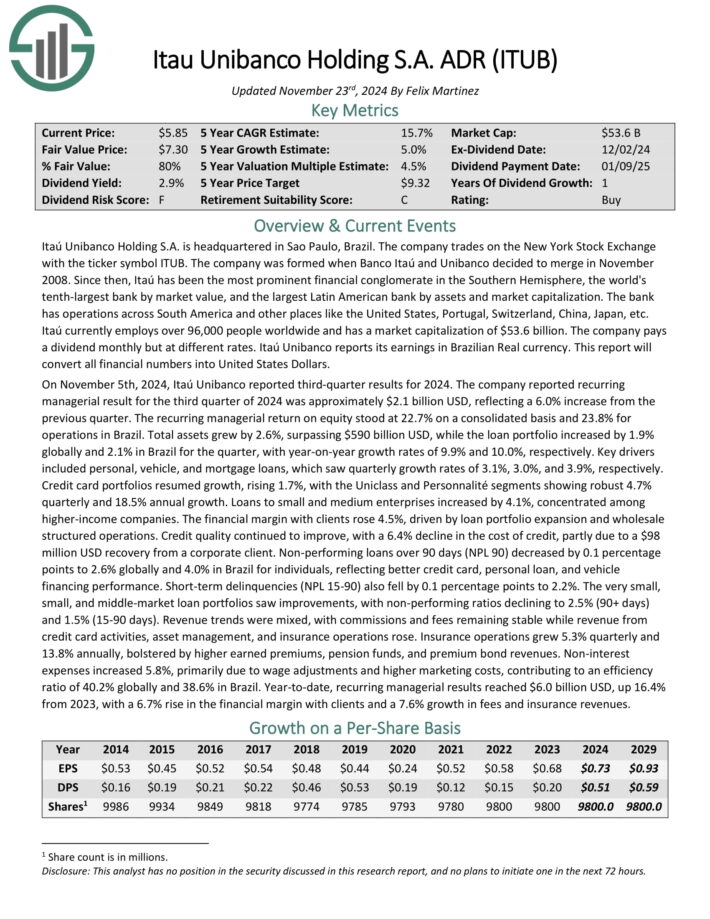

Monthly Dividend Stock #1: Itau Unibanco (ITUB)

- 5-Year Expected Total Return: 17.7%

- Dividend Yield: 9.5%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

On November 5th, 2024, Itaú Unibanco reported third-quarter results for 2024. The company reported recurring managerial result for the third quarter of 2024 was approximately $2.1 billion USD, reflecting a 6.0% increase from the previous quarter.

The recurring managerial return on equity stood at 22.7% on a consolidated basis and 23.8% for operations in Brazil. Total assets grew by 2.6%, surpassing $590 billion USD, while the loan portfolio increased by 1.9% globally and 2.1% in Brazil for the quarter, with year-on-year growth rates of 9.9% and 10.0%, respectively.

Key drivers included personal, vehicle, and mortgage loans, which saw quarterly growth rates of 3.1%, 3.0%, and 3.9%, respectively.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

Other Monthly Dividend Stock Resources

Each separate monthly dividend stock has its own unique characteristics. The resources below will give you a better understanding of monthly dividend stock investing.

The following research reports will help you generate more monthly dividend stock investment ideas.

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

Monthly Dividend Stock Performance

In November 2024, a basket of the monthly dividend stocks above generated total returns of 3.2%. For comparison, the Russell 2000 ETF (IWM) generated returns of 11.1% for the month.

Notes: Data for performance is from Ycharts. Canadian company performance may be in the company’s home currency.

Monthly dividend stocks under-performed the Russell 2000 last month. We will update our performance section monthly to track future monthly dividend stock returns.

In November 2024, the 3 best-performing monthly dividend stocks (including dividends) were:

- Bank Bradesco (BBD), up 13.6%

- Itau Unibanco (ITUB) , up 11.4%

- Dream Office REIT (DRETF), up 9.7%

The 3 worst-performing monthly dividend stocks (including dividends) in the month were:

- Gladstone Capital (GLAD), down 15.8%

- Paramount Resources (PRMRF), down 17.3%

- Permian Basin Royalty Trust (PBT), down 25.7%

Why Monthly Dividends Matter

Monthly dividend payments are beneficial for one group of investors in particular; retirees who rely on dividend stocks for income.

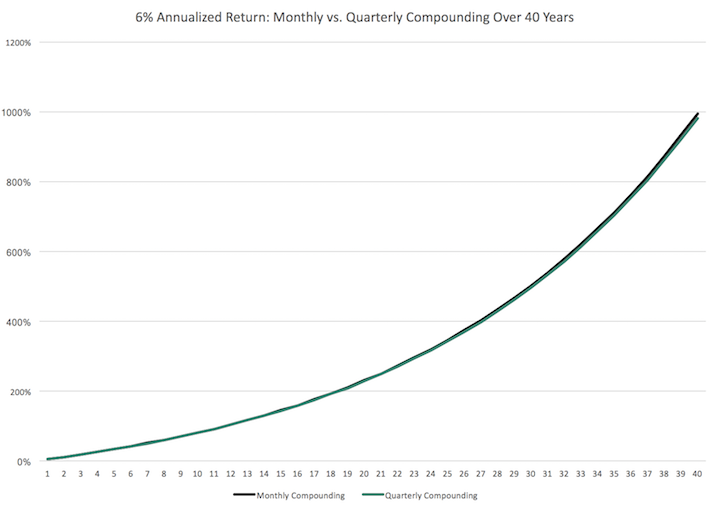

With that said, monthly dividend stocks are better under all circumstances (everything else being equal), because they allow for returns to be compounded on a more frequent basis. More frequent compounding results in better total returns, particularly over long periods of time.

Consider the following performance comparison:

Over the long run, monthly compounding generates slightly higher returns over quarterly compounding. Every little bit helps.

With that said, it might not be practical to manually re-invest dividend payments on a monthly basis. It is more feasible to combine monthly dividend stocks with a dividend reinvestment plan to dollar cost average into your favorite dividend stocks.

The last benefit of monthly dividend stocks is that they allow investors to have – on average – more cash on hand to make opportunistic purchases. A monthly dividend payment is more likely to put cash in your account when you need it versus a quarterly dividend.

Case-in-point: Investors who bought a broad basket of stocks at the bottom of the 2008-2009 financial crisis are likely sitting on triple-digit total returns from those purchases today.

The Dangers of Investing In Monthly Dividend Stocks

Monthly dividend stocks have characteristics that make them appealing to do-it-yourself investors looking for a steady stream of income. Typically, these are retirees and people planning for retirement.

Investors should note many monthly dividend stocks are highly speculative. On average, monthly dividend stocks tend to have elevated payout ratios. An elevated payout ratio means there’s less margin for error to continue paying the dividend if business results suffer a temporary (or permanent) decline.

As a result, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession.

Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. This can lead management teams to aggressively leverage their balance sheet, fueling growth with debt. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction.

With that said, there are a handful of high-quality monthly dividend payers around. Chief among them is Realty Income (O). Realty Income has paid increasing dividends (on an annual basis) every year since 1994.

The Realty Income example shows that there are high-quality monthly dividend payers around, but they are the exception rather than the norm. We suggest investors do ample due diligence before buying into any monthly dividend payer.

Final Thoughts & Other Income Investing Resources

Financial freedom is achieved when your passive investment income exceeds your expenses. But the sequence and timing of your passive income investment payments can matter.

Monthly payments make matching portfolio income with expenses easier. Most personal expenses recur monthly whereas most dividend stocks pay quarterly. Investing in monthly dividend stocks matches the frequency of portfolio income payments with the normal frequency of personal expenses.

Additionally, many monthly dividend payers offer investors high yields. The combination of a monthly dividend payment and a high yield should be especially appealing to income investors.

But not all monthly dividend payers offer the safety that income investors need. A monthly dividend is better than a quarterly dividend, but not if that monthly dividend is reduced soon after you invest. The high payout ratios and shorter histories of most monthly dividend securities mean they tend to have elevated risk levels.

Because of this, we advise investors to look for high-quality monthly dividend payers with reasonable payout ratios, trading at fair or better prices.

Additionally, see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- High Dividend Stocks: 5%+ dividend yields