Updated on October 17th, 2024 by Felix Martinez

The Keg Royalties Income Fund (KRIUF) has two appealing investment characteristics:

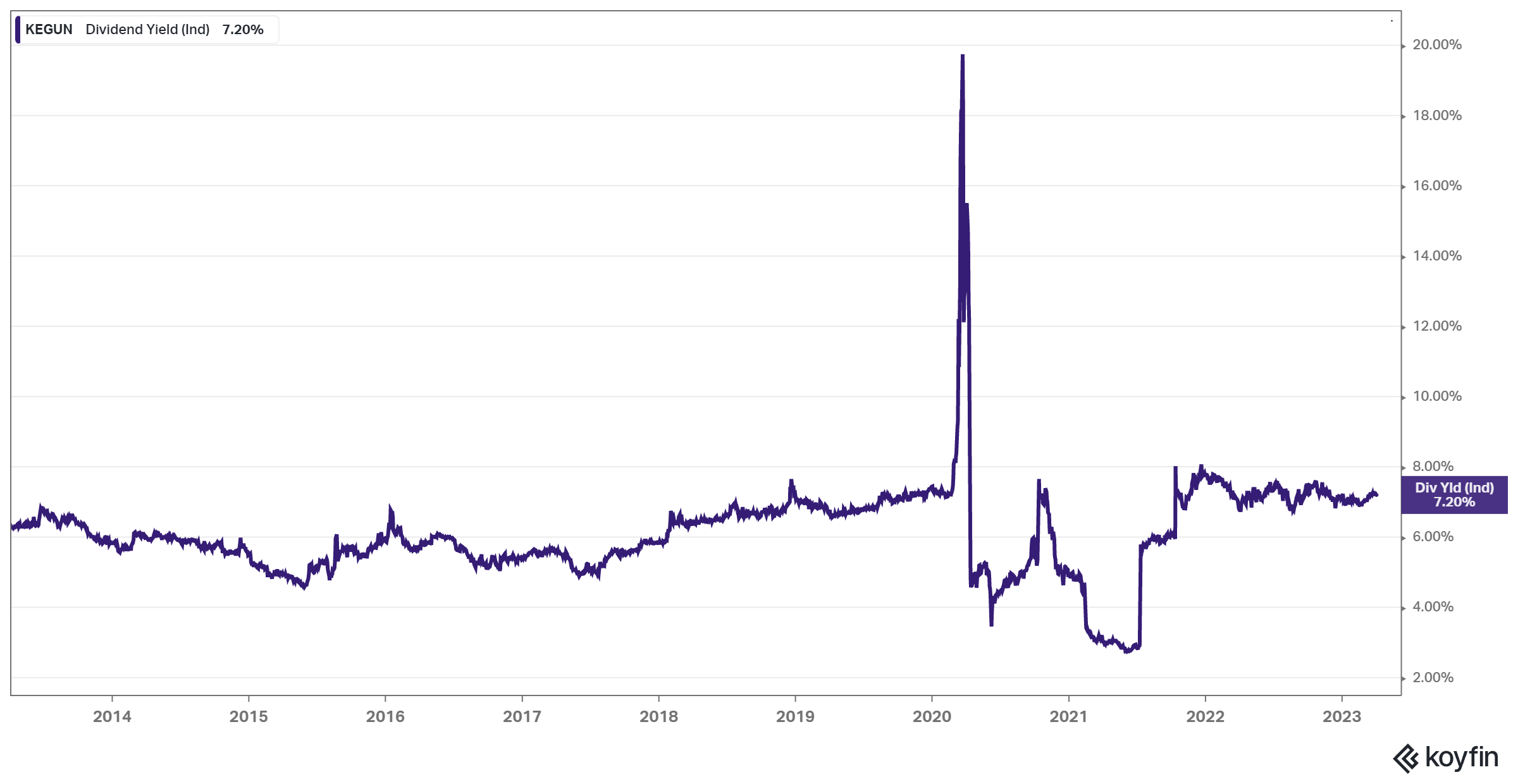

#1: It is a high-yield stock based on its 7.5% dividend yield.

Related: List of 5%+ yielding stocks.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

The combination of a high dividend yield and a monthly dividend render The Keg Royalties Income Fund appealing to income-oriented investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about The Keg Royalties Income Fund.

Business Overview

The Keg Royalties Income Fund is a limited-purpose fund that owns the Keg trademarks and related property purchased from Keg Restaurants Ltd (KRL). Keg Restaurants has built a premier steakhouse brand in Canada and an established presence in the United States.

The fund owns the rights to the brand and has granted KRL an exclusive license to use the Keg Rights in exchange for a monthly royalty payment equal to 4% of the gross sales of Keg restaurants.

In return for adding restaurants to the fund’s royalty pool, KRL receives the right to acquire units in the fund. KRL’s effective ownership of the fund has grown from 10.00% at the time of the IPO in 2002 to over 33.%% as of the end of 2023. Hence, the interests of the two entities are well-aligned.

The Keg Royalties Income Fund stands out as a “top-line” fund, with its revenue stemming predominantly from KRL’s restaurant sales and only minor operating and financing expenses curbing its net income. Additionally, the fund benefits from a secondary source of income – a $57.0 million Keg Loan, which generates interest income at a rate of 7.5% per annum, paid monthly.

This unique structure shields the fund from the fluctuating earnings and expenses associated with actually running the restaurants. As a result, the fund enjoys protection from inflation and a relatively predictable stream of royalties and interest, among other benefits.

Growth Prospects

Similar to other royalty funds of its type that we have analyzed, like the Boston Pizza Royalty Income Fund and the A&W Revenue Royalties Income Fund, the fund’s growth prospects and overall performance hinge on just two key factors. The first is the number of franchised restaurants in its royalty pool, while the second is the rate of growth in same-restaurant sales.

For context, at the start 0f 2004, the fund had 86 Keg restaurants in its royalty pool. By the end of 2007 and 2013, this number had grown to 95 and 102, respectively. Since then, activity in the royalty pool has been rather stagnant. At the end of 2020 and 2021, the fund had 106 restaurants in its pool, while by the end of 2023, it had added one more to its count of 105.

We expect very few annual additions to the fund’s royalty pool, as it appears the brand has reached peak scaling potential. In comparison to the Boston Pizza and A&W Royalty Funds, which primarily focus on fast-food brands and offer more significant growth potential, Keg’s high-end dining experience is more tailored to a smaller and more specialized demographic, resulting in a more contained expansion capability.

That said, growing same-restaurant sales still poses a growth catalyst for the fund. In 2019, before the COVID-19 pandemic, there were 105 Keg restaurants in the fund’s royalty pool, generating about C$623.7 million in gross sales, or C$5.94 million per restaurant.

As a result, the last six months, the fund recorded about C$14.257 million (red box) in royalty, which is exactly 4% of the underlying gross restaurant sales in the royalty pool. It also recorded an additional $2.177 million in interest income from its 7.5%-yielding loan, as mentioned earlier. You can also see the distributions paid to KRL corresponding to its ownership in the fund and other advancements paid for upcoming restaurant openings.

Source: Annual Report

Future price increases in line with inflation should slowly but gradually add to the fund’s royalty-eligible gross sales generated by KRL. Of course, foot traffic in the company’s restaurants and/or restaurant openings and closings could sway results, either.

The company reported its financial results for the second quarter and the first half of 2024, showing mixed performance. Royalty Pool Sales increased by 2.3% in the second quarter to $175.2 million, but decreased by 1.8% year-to-date, totaling $356.4 million. Similarly, Keg Restaurants Ltd.’s (KRL) average sales per operating week saw a 2.3% rise in the quarter, but dropped by 1.2% for the year. Despite a decline in guest visits, same-store sales were up 1.7% in the quarter but down 1.9% year-to-date.

Royalty income for the quarter increased by 2.3% to $7.0 million, though it fell 1.8% year-to-date. Distributable cash, a key indicator of financial health, decreased by 4.3% to $0.282 per Fund unit for the quarter but rose by 8.9% year-to-date. The Fund paid out a special cash distribution of $0.08 per unit in January 2024, contributing to a payout ratio of 100.8% for the quarter and 82.1% year-to-date.

Despite these fluctuations, the Fund remains financially stable, with $2 million in cash and a positive working capital balance of $3.7 million. Management remains optimistic, attributing the positive quarter results to operational efficiencies and a strong guest experience. KRL plans to focus on marketing efforts and enhancing guest demand through the remainder of 2024.

Dividend Analysis

Aligned with the fund’s aim to distribute all its profits to unitholders, the payout ratio has consistently hovered around the 100% mark. In 2023, it stood at 87%, while in 2021, it was 121.5%, owing to the fund’s decision to disburse extra cash that had been held back in 2020 due to the pandemic, which had resulted in a payout ratio of just 85.9% at the time. Still, since its inception, management estimates that 99.78% of distributable cash has been distributed.

Investors should not expect distribution increases or distribution “cuts”, but instead expect that each year’s total distributions per unit will vary based on the underlying gross sales of Keg-licensed restaurants.

We see limited distribution growth prospects moving forward, in line with our rationale regarding the fund’s overall growth. Apart from higher pricing over the years, we can see the fund generating more or less stagnant earnings and thus paying out rather stagnant distributions.

The current monthly distribution of C$0.09 translates to an annualized rate of C$1.08 (or US$0.78), implying a yield of 7.5%. This yield is rather substantial, but it also reflects investors’ expectations for limited dividend growth prospects.

Source: Koyfin

It’s worth highlighting that the management’s approach appears to involve dividing the quarterly or yearly distributions into equal sums by forecasting the forthcoming cash flows, thereby creating a uniform distribution rate and ensuring consistency in payouts month after month.

Final Thoughts

The Keg Royalties Income Fund offers a hefty dividend yield, which, along with the highly attractive frequency of its monthly payouts, makes it a compelling pick for income-oriented investors.

Its frictionless revenue model, which is directly tied to the restaurant’s gross sales in its royalty pool, offers protection from inflation and a dependable stream of profits, regardless of each individual restaurant’s profitability.

Provided that the Keg brand does not significantly change, we anticipate the company will continue to generate a stable stream of monthly distributions through reliable royalty and interest income.

However, compared to other trusts of this type we have analyzed, we anticipate that the scope for distribution growth is relatively restricted due to the paucity of new restaurant openings and the possible saturation of the brand.

Consequently, investors should prepare for the bulk of their returns to come from the dividend. Taking this into account, we believe the fund will not achieve annualized returns exceeding the mid-to-high single digits, which is in line with its current dividend yield.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more