Article updated on December 3rd, 2024 by Bob Ciura

Spreadsheet data updated daily

High dividend stocks are stocks with a dividend yield well in excess of the market average dividend yield of ~1.3%.

The resources in this report focus on truly high yielding securities, often with dividend yields multiples higher than the market average.

Resource #1: The High Dividend Stocks List Spreadsheet

Note: The spreadsheet uses the Wilshire 5000 as the universe of securities from which to select, plus a few additional securities we screen for with 5%+ dividend yields.

The free high dividend stocks list spreadsheet has our full list of ~140 individual securities (stocks, REITs, MLPs, etc.) with 5%+ dividend yields.

The high dividend stocks spreadsheet has important metrics to help you find compelling ultra high yield income investing ideas. These metrics include:

- Market cap

- Payout ratio

- Dividend yield

- Trailing P/E ratio

- Annualized 5-year dividend growth rate

Resource #2: The 7 Best High Yield Stocks Now

This resource analyzes the 7 best high-yield stocks in detail. The criteria we use to rank high dividend securities in this resource are:

- Is in the 870+ income security Sure Analysis Research Database

- Rank based on dividend yield, from highest to lowest

- Dividend Risk Scores of C or better

- Based in the U.S.

Additionally, a maximum of three stocks are allowed for any single sector to ensure diversification.

Resource #3: The High Dividend 50 Series

The High Dividend 50 Series is where we analyze the 50 highest-yielding securities in the Sure Analysis Research Database. The series consists of 50 stand-alone analysis reports on these securities.

Resource #4: More High-Yield Investing Research

– How to calculate your income per month based on dividend yield

– The risks of high-yield investing

– Other high dividend research

The 7 Best High Yield Stocks Now

This resource analyzes the 7 best high yielding securities in the Sure Analysis Research Database as ranked by the following criteria:

- Rank based on dividend yield, from highest to lowest

- Dividend Risk Scores of C or better

- Based in the U.S.

Note: Ranking data is from the current edition of the Sure Analysis spreadsheet.

Additionally, a maximum of three stocks are allowed for any single market sector to ensure diversification.

It’s difficult to define ‘best’. Here, we are using ‘best’ in terms of highest yields with reasonable and better dividend safety.

A tremendous amount of research goes into finding these 7 high yield securities. We analyze more than 850 income securities every quarter in the Sure Analysis Research Database. This is real analysis done by our analyst team, not a quick computer screen.

“So I think it was just looking at different companies and I always thought if you looked at 10 companies, you’d find one that’s interesting, if you’d look at 20, you’d find two, or if you look at 100 you’ll find 10. The person that turns over the most rocks wins the game. I’ve also found this to be true in my personal investing.”

– Investing legend Peter Lynch

Click here to download a PDF report for just one of the 850+ income securities we cover in Sure Analysis to get an idea of the level of work that goes into finding compelling income investments for our audience.

The 7 best high yield securities are listed in order by dividend yield below, from lowest to highest.

- High Dividend Stock #7: Verizon Communications (VZ)

- High Dividend Stock #6: Enterprise Products Partners LP (EPD)

- High Dividend Stock #5: Whirlpool Corp. (WHR)

- High Dividend Stock #4: Universal Health Realty Income Trust (UHT)

- High Dividend Stock #3: Altria Group (MO)

- High Dividend Stock #2: MPLX LP (MPLX)

- High Dividend Stock #1: Western Union (WU)

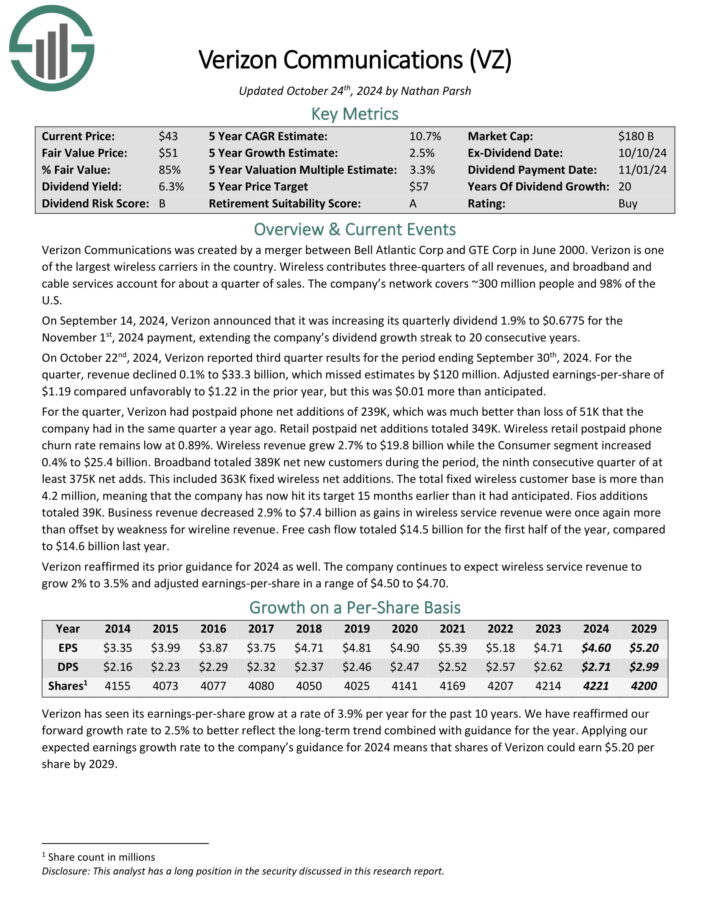

High Dividend Stock #7: Verizon Communications (VZ)

- Dividend Yield: 6.2%

- Dividend Risk Score: B

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless carriers in the country.

Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On October 22nd, 2024, Verizon reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue declined 0.1% to $33.3 billion, which missed estimates by $120 million.

Source: Investor Presentation

Adjusted earnings-per-share of $1.19 compared unfavorably to $1.22 in the prior year, but this was $0.01 more than anticipated.

For the quarter, Verizon had postpaid phone net additions of 239K, which was much better than loss of 51K that the company had in the same quarter a year ago. Retail postpaid net additions totaled 349K.

Wireless retail postpaid phone churn rate remains low at 0.89%. Wireless revenue grew 2.7% to $19.8 billion while the Consumer segment increased 0.4% to $25.4 billion.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

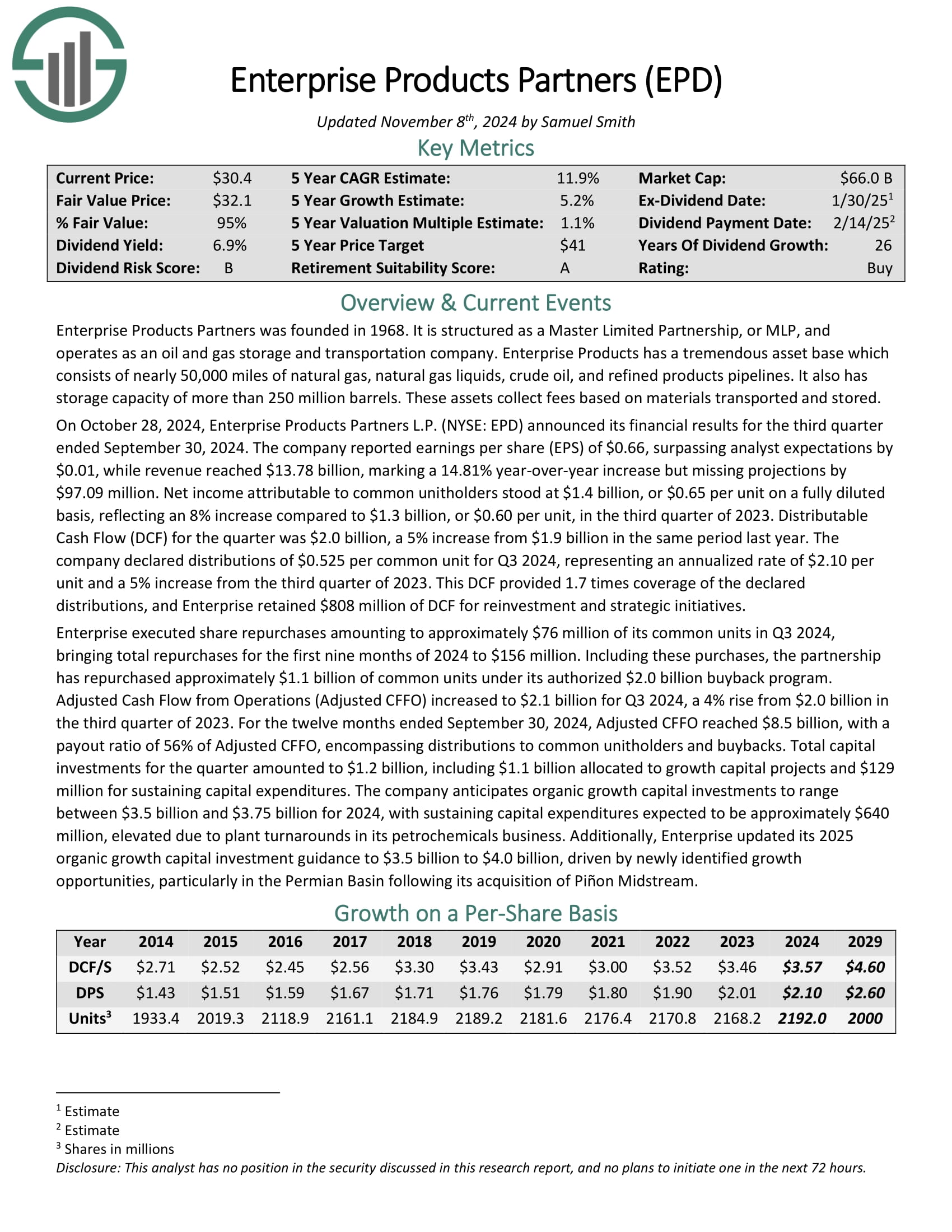

High Dividend Stock #6: Enterprise Products Partners (EPD)

- Dividend Yield: 6.2%

- Dividend Risk Score: B

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of more than 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 300 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

On October 28, 2024, Enterprise Products Partners announced its financial results for the third quarter ended September 30, 2024. Revenue reached $13.78 billion, marking a 14.81% year-over-year increase.

Distributable Cash Flow (DCF) for the quarter was $2.0 billion, a 5% increase from $1.9 billion in the same period last year.

The company declared distributions of $0.525 per common unit for Q3 2024, representing an annualized rate of $2.10 per unit and a 5% increase from the third quarter of 2023.

DCF provided 1.7 times coverage of the declared distributions.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

High Dividend Stock #5: Whirlpool Corp. (WHR)

- Dividend Yield: 6.3%

- Dividend Risk Score: C

Whirlpool Corporation is a leading home appliance company with well-known brands like Whirlpool, KitchenAid, and Maytag.

Roughly half of the company’s sales are in North America, but Whirlpool does business around the world under twelve principal brand names.

On October 23rd, 2024, Whirpool reported third quarter 2024 results. Sales for the quarter totaled $3.99 billion, down 18.9% from third quarter 2023. Ongoing earnings per diluted share was $3.43 for the quarter, 37% lower than the previous year’s $5.45 per share.

Whirlpool reaffirmed its 2024 guidance, seeing ongoing earnings-per-share coming in at a midpoint of $12.00 on revenue of $16.9 billion.

Additionally, Whirlpool expects cash provided by operating activities to total roughly $1.05 billion, with $500 million in free cash flow.

Click here to download our most recent Sure Analysis report on WHR (preview of page 1 of 3 shown below):

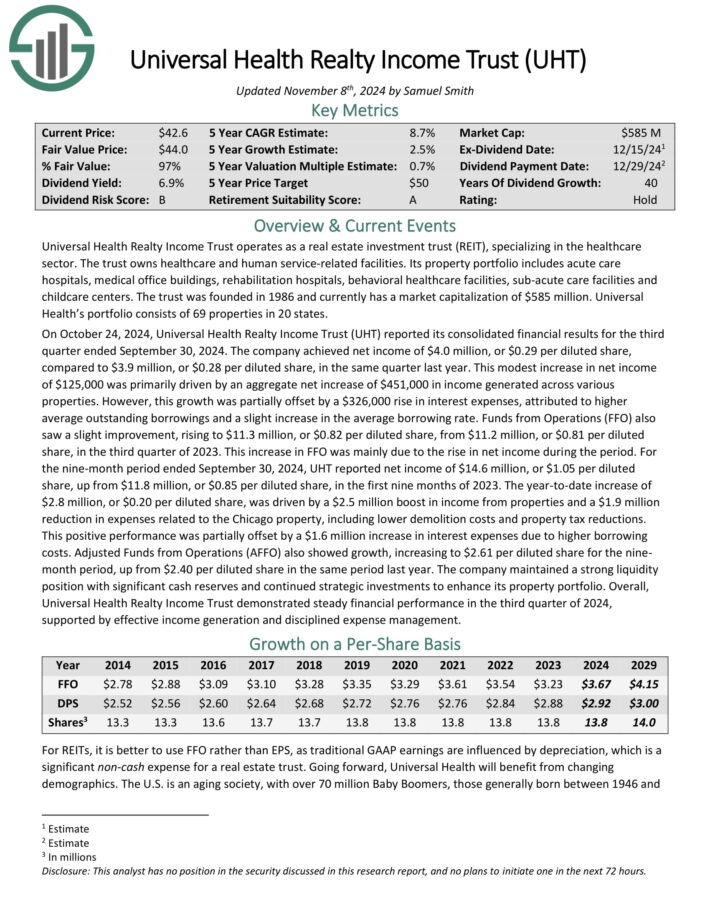

High Dividend Stock #4: Universal Health Realty Income Trust (UHT)

- Dividend Yield: 7.3%

- Dividend Risk Score: B

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities.

Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers. Universal Health’s portfolio consists of 69 properties in 20 states.

On October 24, 2024, UHT reported its third quarter results. Funds from Operations (FFO) saw a slight improvement, rising to $11.3 million, or $0.82 per diluted share, from $11.2 million, or $0.81 per diluted share, in the third quarter of 2023. This increase in FFO was mainly due to the rise in net income during the period.

The company maintained a strong liquidity position with significant cash reserves and continued strategic investments to enhance its property portfolio.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

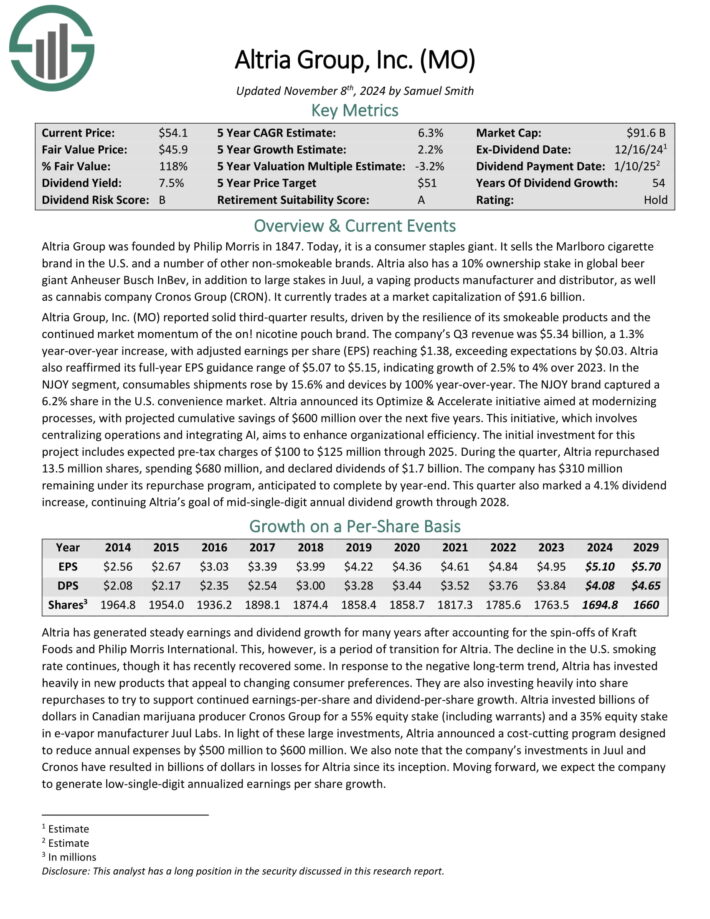

High Dividend Stock #3: Altria Group (MO)

- Dividend Yield: 7.1%

- Dividend Risk Score: B

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

Altria reported solid third-quarter results, driven by the resilience of its smokeable products and the continued market momentum of the on! nicotine pouch brand.

Source: Investor Presentation

The company’s Q3 revenue was $5.34 billion, a 1.3% year-over-year increase, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria also reaffirmed its full-year EPS guidance range of $5.07 to $5.15, indicating growth of 2.5% to 4% over 2023.

During the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The company has $310 million remaining under its repurchase program, anticipated to complete by year-end.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

High Dividend Stock #2: MPLX LP (MPLX)

- Dividend Yield: 7.5%

- Dividend Risk Score: C

MPLX LP is a Master Limited Partnership that was formed by the Marathon Petroleum Corporation (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The business operates in two segments:

- Logistics and Storage, which relates to crude oil and refined petroleum products

- Gathering and Processing, which relates to natural gas and natural gas liquids (NGLs)

In early November, MPLX reported (11/5/24) financial results for the third quarter of fiscal 2024.

Source: Investor Presentation

Adjusted EBITDA and distributable cash flow (DCF) per share grew 7% and 5%, respectively, over the prior year’s quarter, primarily thanks to higher tariff rates and increased gas volumes.

MPLX maintained a healthy consolidated debt to adjusted EBITDA ratio of 3.4x and a solid distribution coverage ratio of 1.5x.

Click here to download our most recent Sure Analysis report on MPLX (preview of page 1 of 3 shown below):

High Dividend Stock #1: Western Union (WU)

- Dividend Yield: 8.5%

- Dividend Risk Score: C

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries.

About 90% of agents are outside of the US. Western Union operates two business segments, Consumer-to-Consumer (C2C) and Other (bill payments in the US and Argentina).

Western Union reported Q3 2024 results on October 23rd, 2024. Company-wide revenue decreased 6% and diluted GAAP earnings per share increased 70% to $0.78 in the quarter compared to $0.46 in the prior year.

Source: Investor Presentation

Revenue fell on challenges in Iraq despite higher retail, branded digital transactions, and Consumer Services volumes. Volumes are generally higher, but revenue is flat to declining in most geographies.

CMT revenue fell 9% on a year-over-year basis even with 3% higher transaction volumes. Branded Digital Money Transfer CMT revenues increased 9% as volumes rose 15%.

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

The High Dividend 50 Series

The High Dividend 50 Series is analysis on the 50 highest-yielding Sure Analysis Research Database stocks, excluding royalty trusts, BDCs, REITs, and MLPs.

Click on a company’s name to view the high dividend 50 series article for that company. A link to the specific Sure Analysis Research Database report page for each security is included as well.

More High-Yield Investing Resources

How To Calculate Your Monthly Income Based On Dividend Yield

A common question for income investors is “how much money can I expect to receive per month from my investment?”

To find your monthly income, follow these steps:

- Find your investment’s dividend yield

Note: Dividend yield can be calculated as dividends per share divided by share price - Multiply it by the current value of your holding

Note: If you haven’t yet invested, multiply dividend yield by the amount you plan to invest - Divide this number by 12 to find monthly income

To find the monthly income from your entire portfolio, repeat the above calculation for each of your holdings and add them together.

You can also use this formula backwards to find the dividend yield you need from your investments to make a certain amount of monthly dividend income.

The example below assumes you want to know what dividend yield you need on a $240,000 investment to generate $1,000/month in dividend income.

- Multiply $1,000 by 12 to find annual income target of $12,000

- Divide $12,000 by your investment amount of $240,000 to find your target yield of 5.0%

In practice most dividend stocks pay dividends quarterly, so you would actually receive 3x the monthly amount quarterly instead of receiving a payment every month. However, some stocks do actually pay monthly dividends.

You can see our monthly dividend stocks list here.

The Risks Of High-Yield Investing

Investing in high-yield stocks is a great way to generate income. But it is not without risks.

First, stock prices fluctuate. Investors need to understand their risk tolerance before investing in high dividend stocks. Share price fluctuations means that your investment can (and almost certainly will) decline in value, at least temporarily (and possibly permanently) do to market volatility.

Second, businesses grow and decline. Investing in a stock gives you fractional ownership in the underlying business. Some businesses grow over time. These businesses are likely to pay higher dividends over time.

The Dividend Champions are an excellent example of this; each has paid rising dividends for 25+ consecutive years.

What’s dangerous is when a business declines. Dividends are paid out of a company’s cash flows. If the business sees its cash flows decline, or worse is losing money, it may reduce or eliminate its dividend. Business decline is a real risk with high yield investing. Business declines often coincide with and or accelerate during recessions.

A company’s payout ratio gives a good gauge of how much ‘room’ a company has to pay its dividend. The payout ratio is calculated as dividends divided by income. The lower the payout ratio, the better, because dividends have more earnings coverage.

A company with a payout ratio over 100% is paying out more in dividends than it is making in profits, a long-term unsustainable situation.

For example, a company with a payout ratio of 50% is making double in income what it is paying out in dividends, so it has ‘room’ for earnings to decline significantly without reducing its dividend.

Third, management teams can change their dividend policies. Even if a company isn’t declining, the company’s management team may change priorities and reduce or eliminate its dividend.

In practice, this typically occurs if a company has a high level of debt and wants to focus on debt reduction. But it could in theory happen to any dividend paying stock.

The risks of high yield investing can be reduced (but not eliminated) by investing in higher quality businesses in a diversified portfolio of 20 or more stocks. This reduces both business decline risk (by investing in high quality businesses) and the shock to your portfolio if any one stock does reduce or eliminate its dividend (through diversification).

Other High Dividend Research

The free spreadsheet of 5%+ dividend yield stocks in this article gives you more than 140 high yield income securities to review. You can download it below:

Investors should continue to monitor each stock to make sure their fundamentals and growth remain on track, particularly among stocks with extremely high dividend yields.

See the resources below to generate additional compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500