Updated on January 19th, 2024 by Bob Ciura

As a business owner, selling products that have high profit margins along with strong brand awareness and an exceptionally loyal customer base is strongly desirable. This allows for predictable revenue and high levels of profits over time.

The tobacco industry fits this model, despite declines over time in the number of customers that use its products. Tobacco stocks are particularly attractive to income investors thanks to their generous dividends and defensive characteristics during economic downturns. Tobacco stocks produce a lot of cash, but have very little capital expenditure needs, creating what could be considered perfect income stocks.

You can download a spreadsheet with all our tobacco stocks (along with important financial metrics such as dividend yields and price-to-earnings ratios) using the link below:

Tobacco stocks are widely prized by income investors thanks to their high dividend yields, stable payouts and dividend increase streaks. However, declining customer counts and usage rates are weighing on the group.

This article will analyze the prospects of 6 of the largest tobacco stocks. Rankings are in order of projected total returns from worst to best.

Table of Contents

You can instantly jump to any individual stock analysis by clicking on the links below:

- Industry Overview: Declining Smoking Rates

- Imperial Brands plc (IMBBY)

- Philip Morris International (PM)

- Vector Group (VGR)

- Universal Corp. (UVV)

- British American Tobacco (BTI)

- Altria Group (MO)

But first, we’ll take a look at the tobacco industry’s primary concern, which is declining tobacco usage.

Industry Overview: Declining Smoking Rates

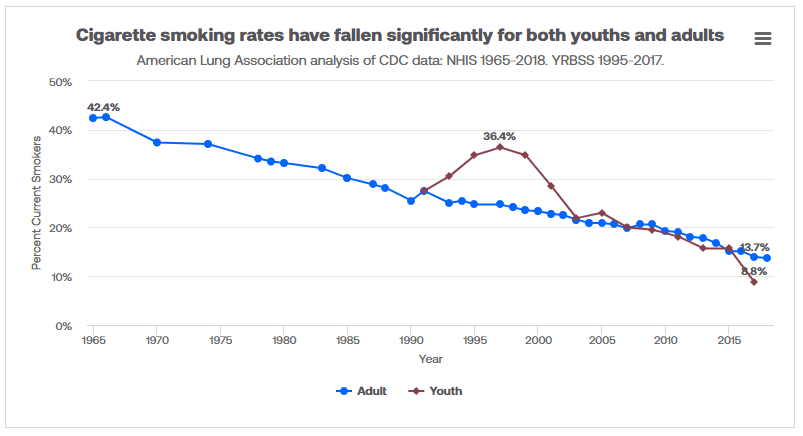

The percent of the U.S. population that smokes is in a continuous decline, and has been for decades.

Source: American Lung Association

The percent of the U.S. smoking adult population has steadily declined from 42% in 1965 to just 14% as of 2018. The declines among the youth population have been even bigger. Young people now have a smoking rate of about one in eleven. This sort of decline in an industry’s customer group generally spells trouble for the companies that operate within it.

Other forms of tobacco usage have seen similar rates of decline, including smokeless tobacco. This has been the case with every demographic group, so it is widespread among all of the companies’ potential customers.

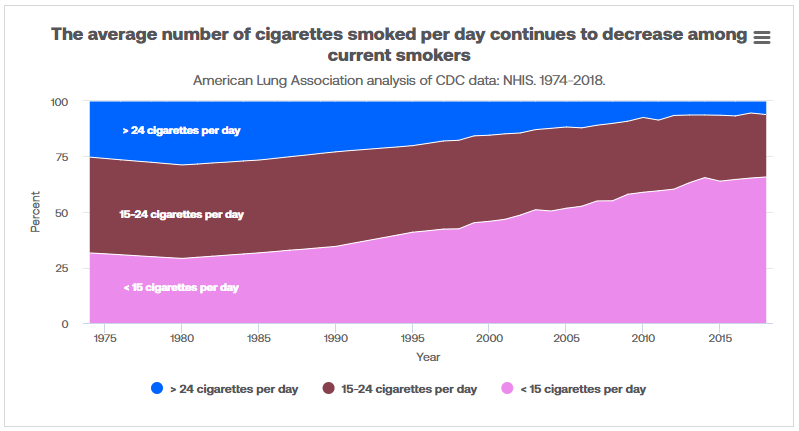

Not only are fewer people smoking, but the ones that do are smoking less than they used to.

Source: American Lung Association

The number of people smoking at least 15 cigarettes a day has plummeted in the past few decades. Today, the overwhelming majority of smokers use fewer than 15 cigarettes daily. In other words, there are fewer customers for the industry. And, the ones that remain are using fewer products. This has negatively impacted demand from two directions. This has led to much lower volumes of total cigarettes sold, producing a declining total to be split up among the various companies selling cigarettes.

An increasing number of U.S. states have significantly raised the tax on cigarettes to reduce their budget deficits, and to reduce the potential appeal of smoking for consumers. Given the propensity of localities to use tax increases on cigarettes, the situation will likely only get worse for tobacco stocks.

In addition, pricing increases have the impact of reducing usage further. Demand will almost certainly continue to decline as taxes and prices rise. Indeed, health organizations like the American Lung Association actively encourage localities to raise taxes on cigarettes and other tobacco products to discourage usage.

To make matters worse for tobacco companies, most of the world’s smoking population rate looks much the same as the above chart. It has become abundantly clear that consumers around the world are eschewing tobacco products for health concerns.

These negative trends have kept many investors away from tobacco stocks. However, tobacco stocks can still generate solid total returns given that they tend to offer respectable dividend yields. The key behind an investment in tobacco stocks is the inelastic demand for cigarettes relative to their price due to the addictive nature of these products.

Tobacco companies have been able to raise their prices to help offset declining smoking rates. As a result, they have exceptional growth records. In addition, population growth partly offsets the effect of the declining percent of smokers. However, investors must keep in mind that the total volumes for the industry are in fairly steep decline, and all indications are that this is irreversible.

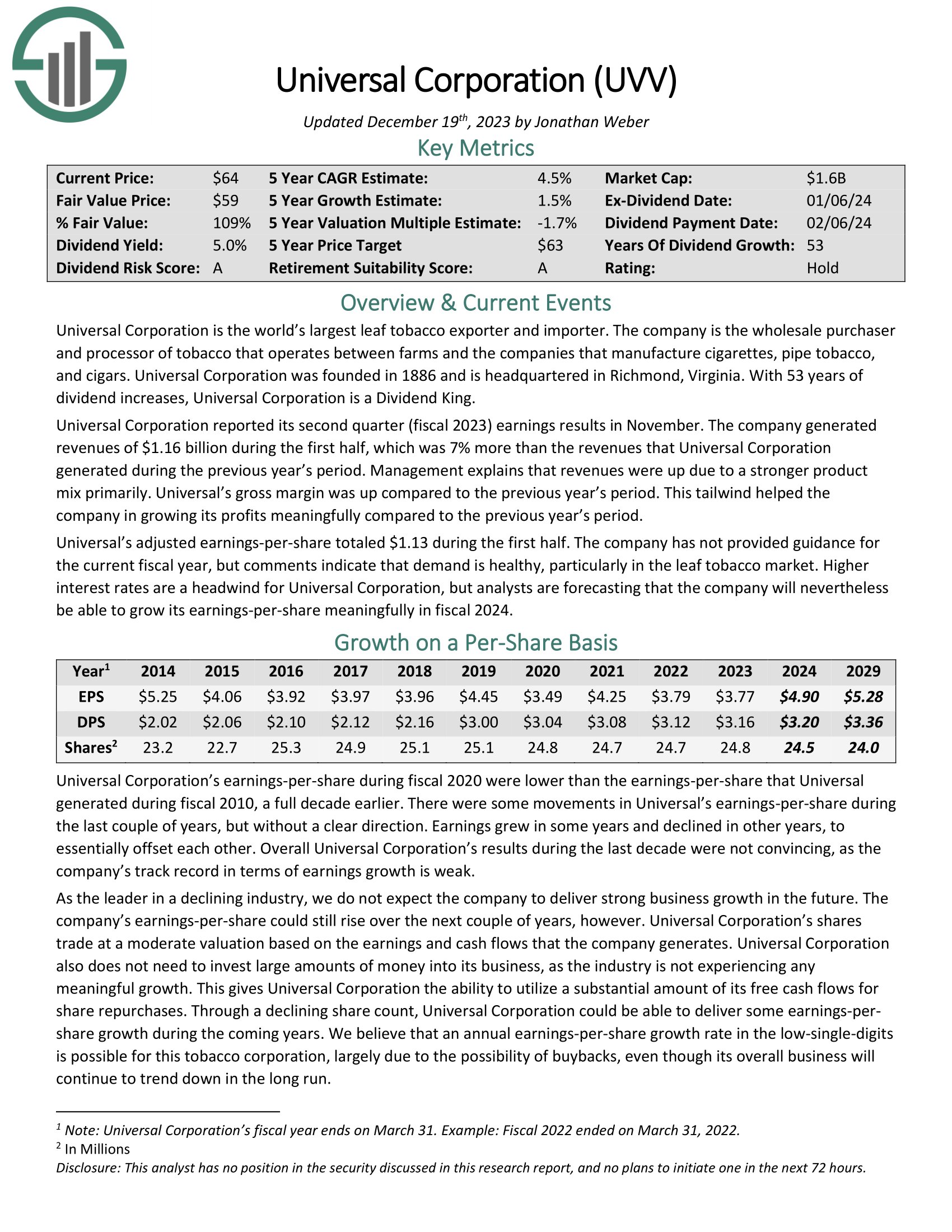

Tobacco Stock #6: Universal Corporation (UVV)

- 5-year expected returns: 6.5%

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates as an intermediary between tobacco farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal also has an ingredients business that is separate from the core leaf segment.

Universal also does not need to invest large amounts of money into its business, which gives it the ability to utilize a substantial amount of its free cash flows for share repurchases and dividends.

And, for its part Universal is attempting a transition to a producer of fruits, vegetables, and ingredients which the company hopes will diversify its business and provide renewed growth. Universal acquired FruitSmart, an independent specialty fruit and vegetable ingredient processor. FruitSmart supplies juices, concentrates, blends, purees, fibers, seed and seed powders, and other products to food, beverage and flavor companies around the world.

It also acquired Silva International, a privately-held dehydrated vegetable, fruit, and herb processing company. Silva procures over 60 types of dehydrated vegetables, fruits, and herbs from over 20 countries.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

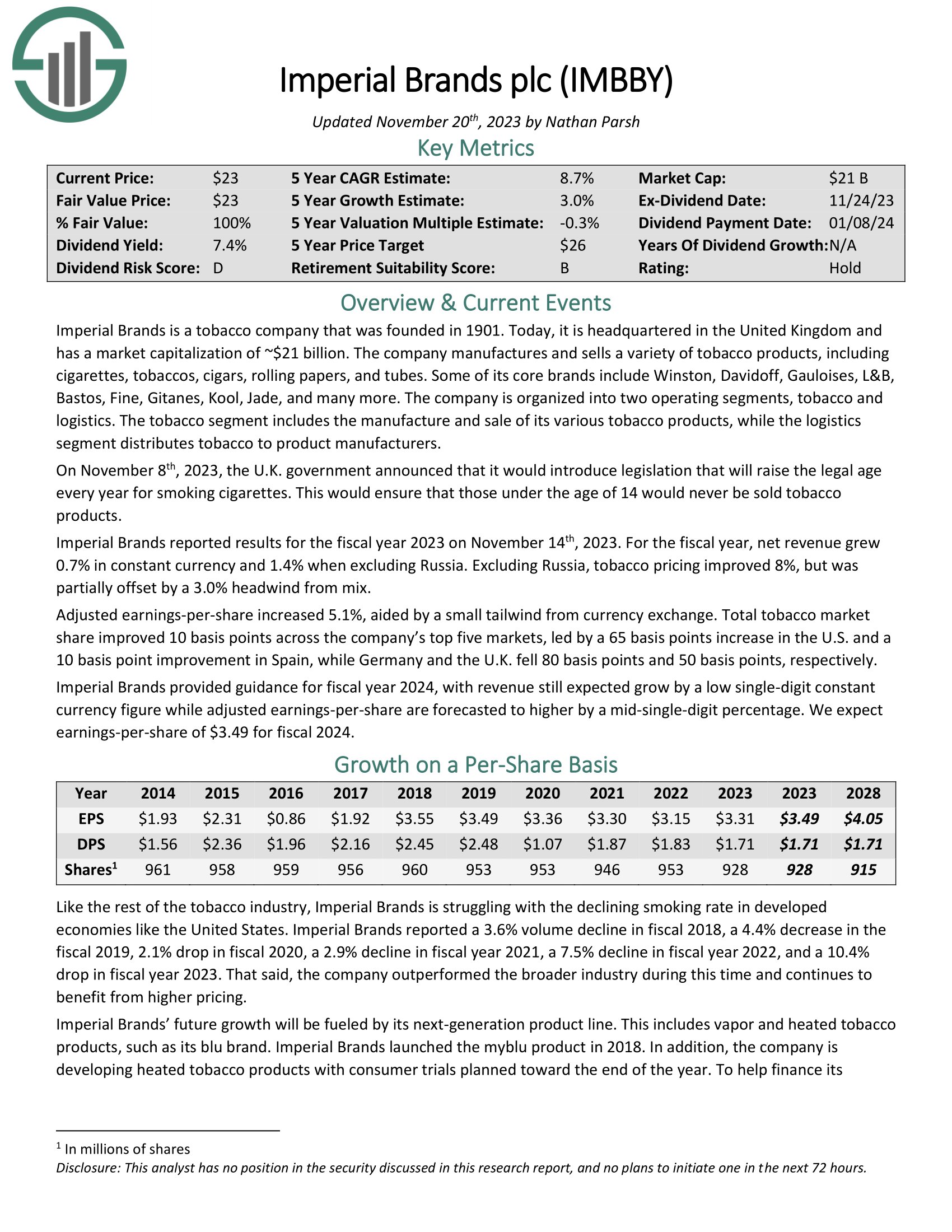

Tobacco Stock #5: Imperial Brands plc (IMBBY)

- 5-year expected returns: 7.8%

The next stock on our list is Imperial Brands, a British tobacco product conglomerate that was founded in 1901. Today, the company is a market leader in a variety of locations around the globe and produces just over $10 billion in annual revenue.

Imperial Brands reported results for the fiscal year 2023 on November 14th, 2023. For the fiscal year, net revenue grew 0.7% in constant currency and 1.4% when excluding Russia. Excluding Russia, tobacco pricing improved 8%, but was partially offset by a 3.0% headwind from mix.

Adjusted earnings-per-share increased 5.1%, aided by a small tailwind from currency exchange. Total tobacco market share improved 10 basis points across the company’s top five markets, led by a 65 basis points increase in the U.S. and a 10 basis point improvement in Spain, while Germany and the U.K. fell 80 basis points and 50 basis points, respectively.

Click here to download our most recent Sure Analysis report on IMBBY (preview of page 1 of 3 shown below):

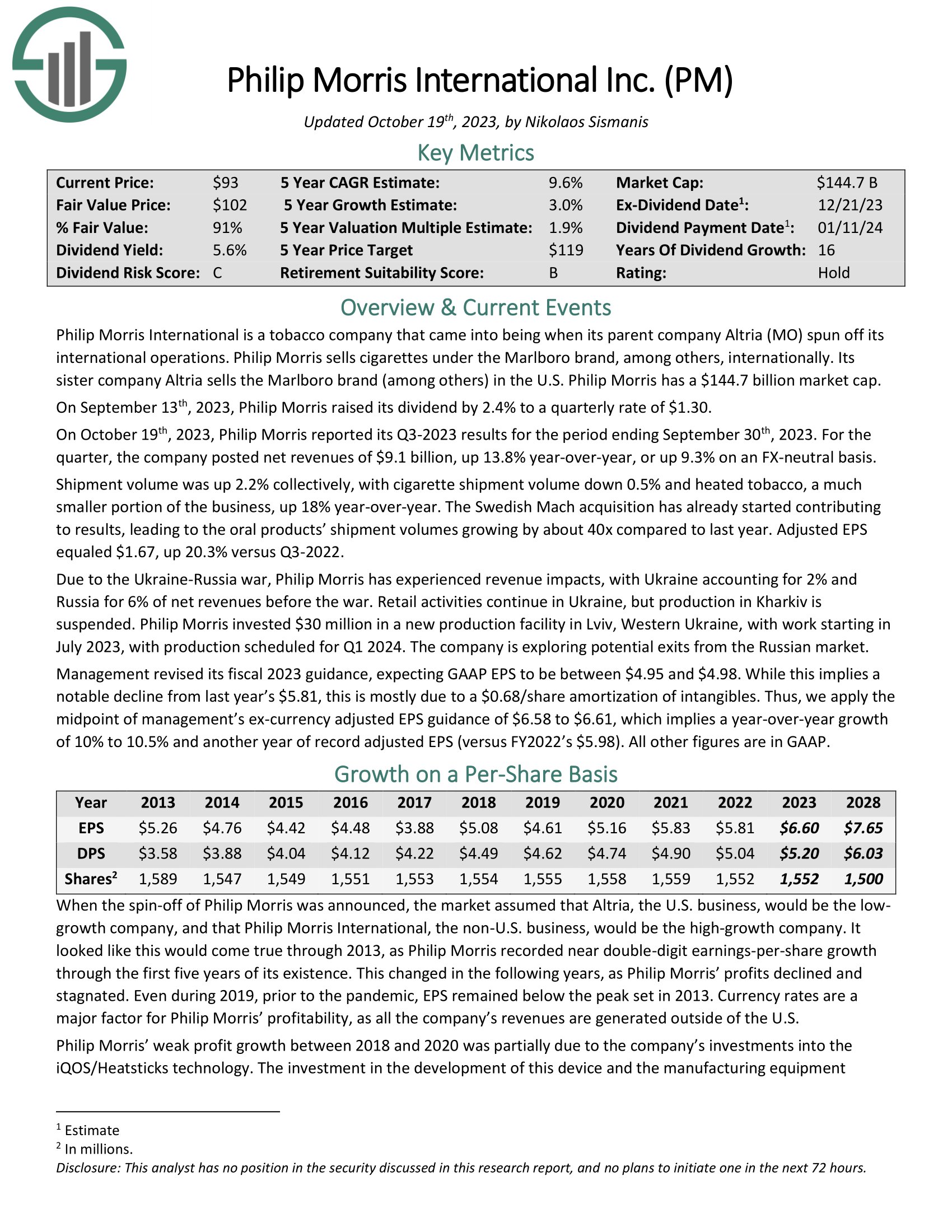

Tobacco Stock #4: Philip Morris International (PM)

- 5-year expected returns: 9.5%

Philip Morris International was spun off from Altria in 2008, and is charged with the production and distribution of Altria’s products outside of the United States. This distribution includes the exceedingly valuable Marlboro brand.

On October 19th, 2023, Philip Morris reported its Q3-2023 results for the period ending September 30th, 2023. For the quarter, the company posted net revenues of $9.1 billion, up 13.8% year-over-year, or up 9.3% on an FX-neutral basis. Shipment volume was up 2.2% collectively, with cigarette shipment volume down 0.5% and heated tobacco, a much smaller portion of the business, up 18% year-over-year.

The Swedish Mach acquisition has already started contributing to results, leading to the oral products’ shipment volumes growing by about 40x compared to last year. Adjusted EPS equaled $1.67, up 20.3% versus Q3-2022.

Philip Morris has raised its dividend for 16 consecutive years and for more than 50 years when including the time the company was part of Altria. Shares yield 5.5%, which helps to compensate for the low growth rate of just 2.8% over the last five years.

Click here to download our most recent Sure Analysis report on Philip Morris International (PM) (preview of page 1 of 3 shown below):

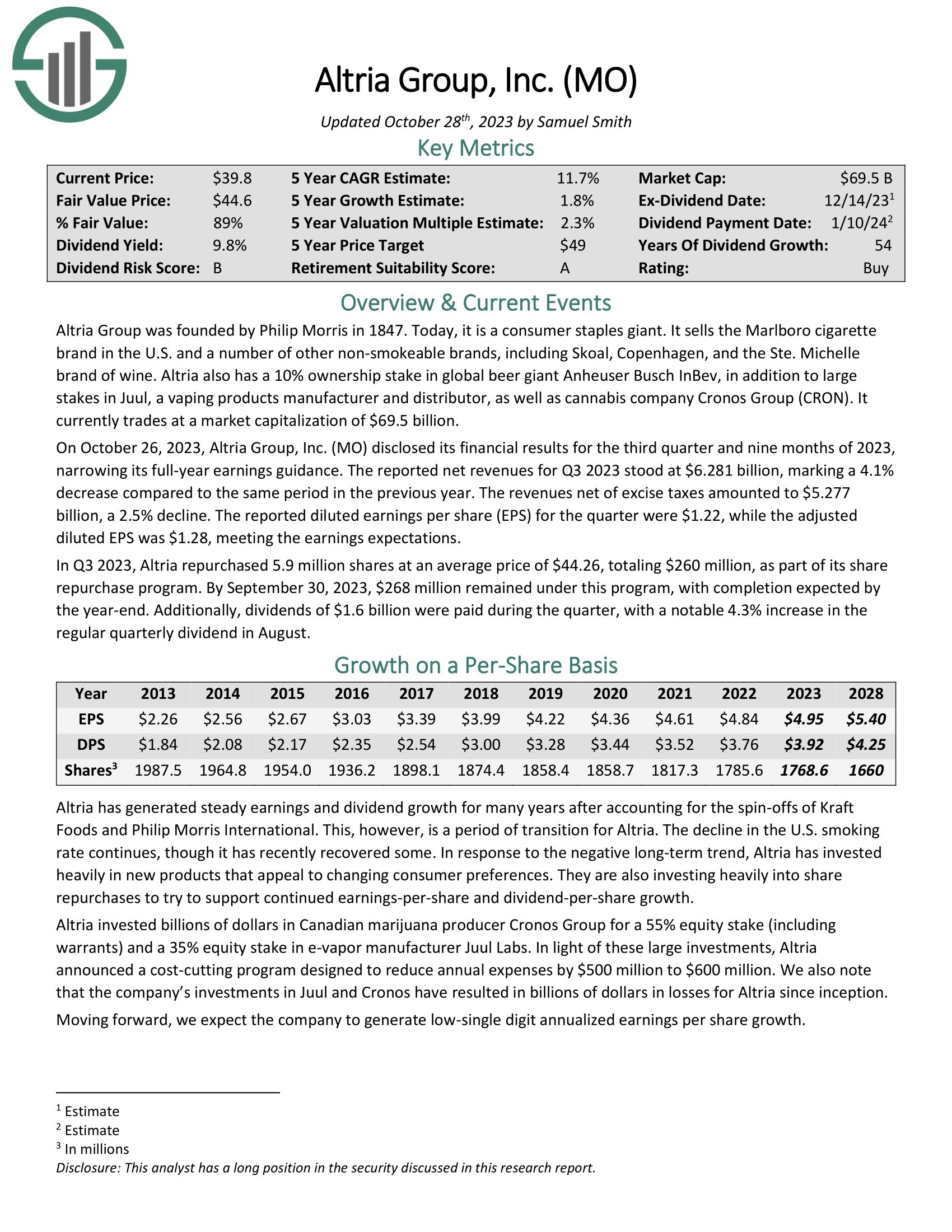

Tobacco Stock #3: Altria Group (MO)

- 5-year expected returns: 11.4%

Altria Group was founded by Philip Morris in 1847 and today has grown into a consumer staples giant. While it is primarily known for its tobacco products, it is significantly involved in the beer business due to its 10% stake in global beer giant Anheuser-Busch InBev.

The Marlboro brand holds over 42% retail market share in the U.S.

On October 26, 2023, Altria Group, Inc. (MO) disclosed its financial results for the third quarter and nine months of 2023, narrowing its full-year earnings guidance. The reported net revenues for Q3 2023 stood at $6.281 billion, marking a 4.1% decrease compared to the same period in the previous year.

The revenues net of excise taxes amounted to $5.277 billion, a 2.5% decline. The reported diluted earnings per share (EPS) for the quarter were $1.22, while the adjusted diluted EPS was $1.28, meeting the earnings expectations.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

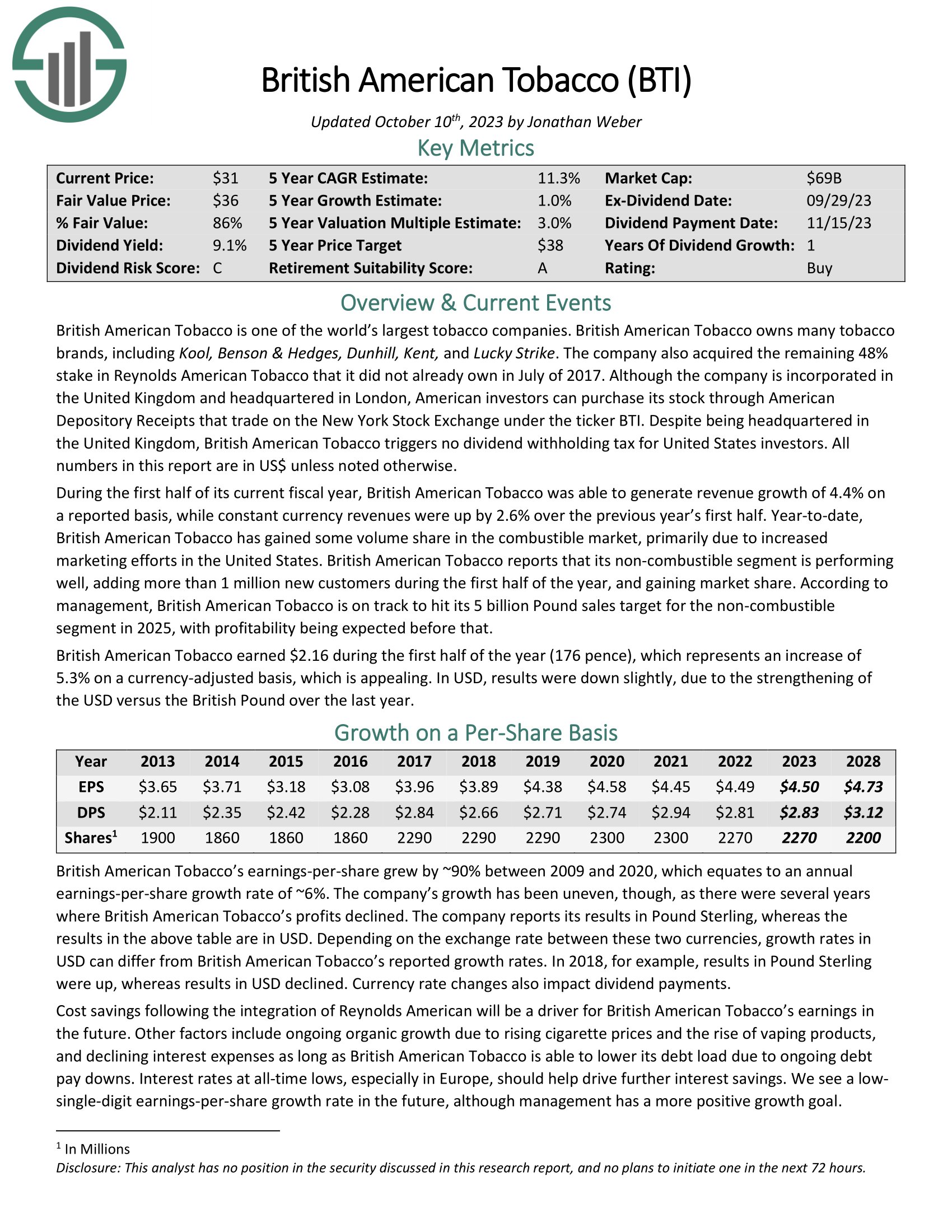

Tobacco Stock #2: British American Tobacco (BTI)

- 5-year expected returns: 12.5%

British American Tobacco is one of the largest tobacco companies in the world, with a market capitalization of $91 billion. British American Tobacco owns the following tobacco brands, among others: Kool, Benson & Hedges, Dunhill, Kent, and Lucky Strike.

During the first half of its current fiscal year, British American Tobacco was able to generate revenue growth of 4.4% on a reported basis, while constant currency revenues were up by 2.6% over the previous year’s first half.

Year-to-date, British American Tobacco has gained some volume share in the combustible market, primarily due to increased marketing efforts in the United States. British American Tobacco reports that its non-combustible segment is performing well, adding more than 1 million new customers during the first half of the year, and gaining market share.

According to management, British American Tobacco is on track to hit its 5 billion Pound sales target for the non-combustible segment in 2025, with profitability being expected before that.

Click here to download our most recent Sure Analysis report on BTI (preview of page 1 of 3 shown below):

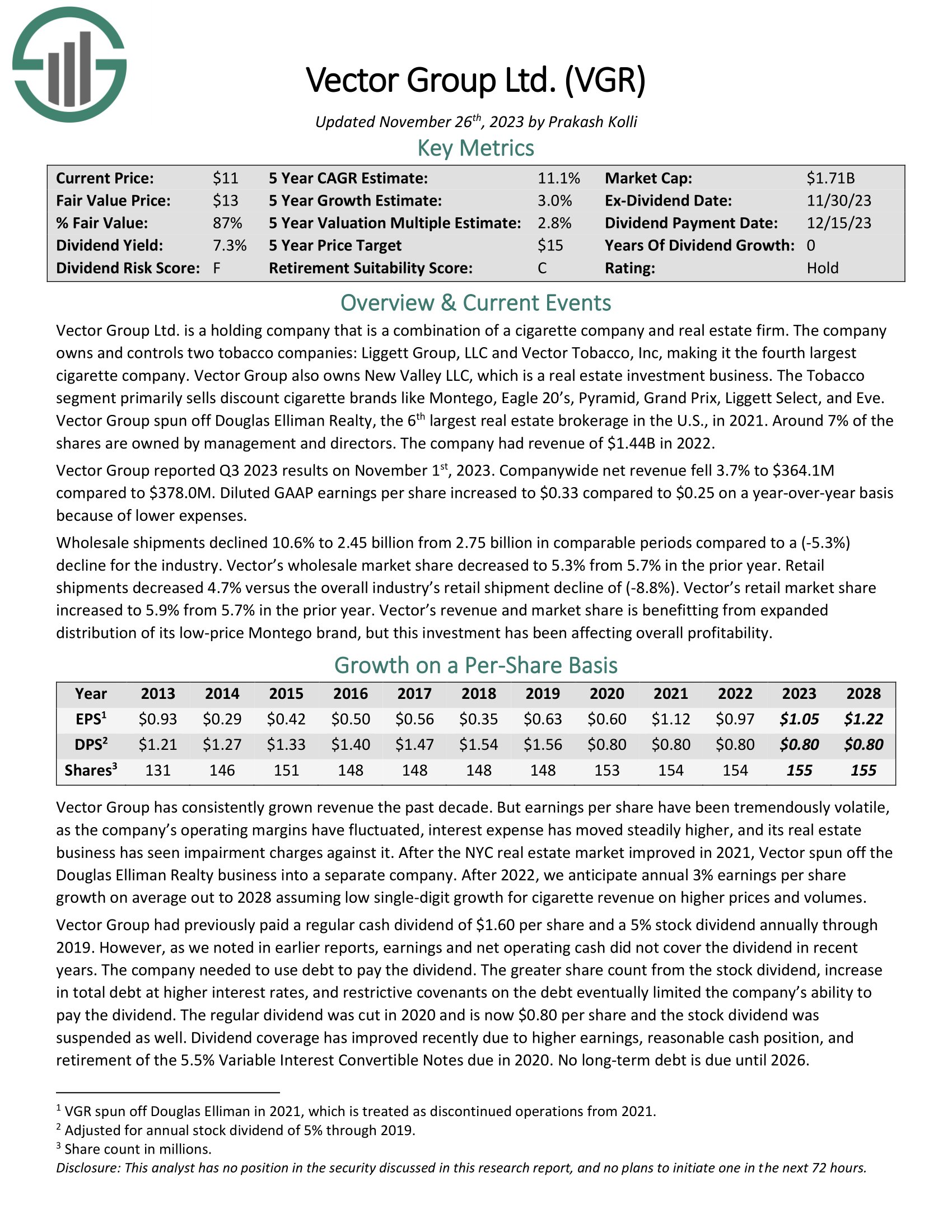

Tobacco Stock #1: Vector Group (VGR)

- 5-year expected returns: 13.1%

Vector Group is an unusual combination of a real estate investment firm and a tobacco company. The latter was founded in 1873 and continues to operate today as the Liggett Group, while the real estate business came later. Vector generates over $1.2 billion in annual revenue.

Unlike some of the others we’ve looked at, Vector is making no attempt to diversify away from cigarettes. Its stated goal is to continue to increase market share of its Liggett brand and maximize long-term profitability in that market.

Vector Group has exhibited a volatile performance record and has failed to grow its earnings-per-share meaningfully over the last decade.

Vector Group had previously paid a rising cash dividend and a 5% stock dividend annually through 2019. But its earnings and net operating cash have not covered the dividend in recent years, so the company needed to borrow and use debt to pay the dividend.

The regular dividend was cut for 2020 and is now $0.80 per share, and the stock dividend was suspended as well.

Related: 3 Reasons Why Companies Cut Their Dividends (With Examples)

Click here to download our most recent Sure Analysis report on VGR (preview of page 1 of 3 shown below):

Final Thoughts

Tobacco stocks as a group have had a difficult time in the past couple of years. Regulatory and consumer preference changes continue to plague the group. But valuations are relatively low, dividend yields are high, and most companies are diversifying away from tobacco. Vector Group now offers the best total projected annual returns, but all of these companies offer high dividend yields.

We see Altria, British American Tobacco, and Vector as offering the best total returns. And, all offer sizable dividend yields. Dividend sustainability varies by stock in this group, but overall, there is a lot for income investors to like when it comes to these 6 tobacco stocks.

Further Reading

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Aristocrats List: a group of elite S&P 500 stocks with 25+ years of consecutive dividend increases.

- The Highest Yielding Dividend Aristocrats: the 20 Dividend Aristocrats with the highest dividend yields right now.

- The Dividend Champions List: a broader group of stocks with 25+ years of consecutive dividend increases, without the S&P 500 Index inclusion requirement.

- The Dividend Challengers List: stocks with 5-9 years of consecutive dividend increases.

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Blue Chip Stocks List: contains stocks on either the Dividend Achievers, Dividend Aristocrats, or Dividend Kings list.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Highest Yielding Monthly Dividend Stocks: the 20 monthly dividend stocks with the highest dividend yields right now.