Updated on January 25th, 2024 by Bob Ciura

Spreadsheet data updated daily

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

Their strength makes them appealing investments for comparatively safe, reliable dividends and capital appreciation versus less established stocks.

This research report has the following resources to help you invest in blue chip stocks:

Resource #1: The Blue Chip Stocks Spreadsheet List

This list contains important metrics, including: dividend yields, payout ratios, dividend growth rates, 52-week highs and lows, betas, and more. There are currently more than 400 securities in our blue chip stocks list.

We categorize blue chip stocks as companies that are members of 1 or more of the following 3 lists:

- Dividend Achievers (10+ years of rising dividends, in the NASDAQ)

- Dividend Aristocrats (25+ years of rising dividends, in the S&P 500)

- Dividend Kings (50+ years of rising dividends)

Resource #2: The 7 Best Blue Chip Stocks To Buy Now

See the top 7 best blue-chip stock buys now using expected total returns from the Sure Analysis Research Database. We use the following criteria for our rankings:

- Dividend Risk Score of “C” or better

- Rank highest to lowest by expected total returns

Resource #3: Other Blue Chip Stock Research

Find more compelling blue chip stock research from Sure Dividend.

The 7 Best Blue Chip Stocks To Buy Now

The 7 best blue chip stocks as ranked using data from the Sure Analysis Research Database (excluding REITs and MLPs) are analyzed in detail below.

We use the following criteria for our rankings:

- Dividend Risk Score of “C” or better

- Rank by expected total returns

The table of contents below allows for easy navigation.

- Blue-Chip Stock #7: Bristol-Myers Squibb (BMY)

- Blue-Chip Stock #6: Humana Inc. (HUM)

- Blue-Chip Stock #5: Lincoln National Corp. (LNC)

- Blue-Chip Stock #4: Archer Daniels Midland (ADM)

- Blue-Chip Stock #3: 3M Company (MMM)

- Blue-Chip Stock #2: Eversource Energy (ES)

- Blue-Chip Stock #1: Albemarle Corporation (ALB)

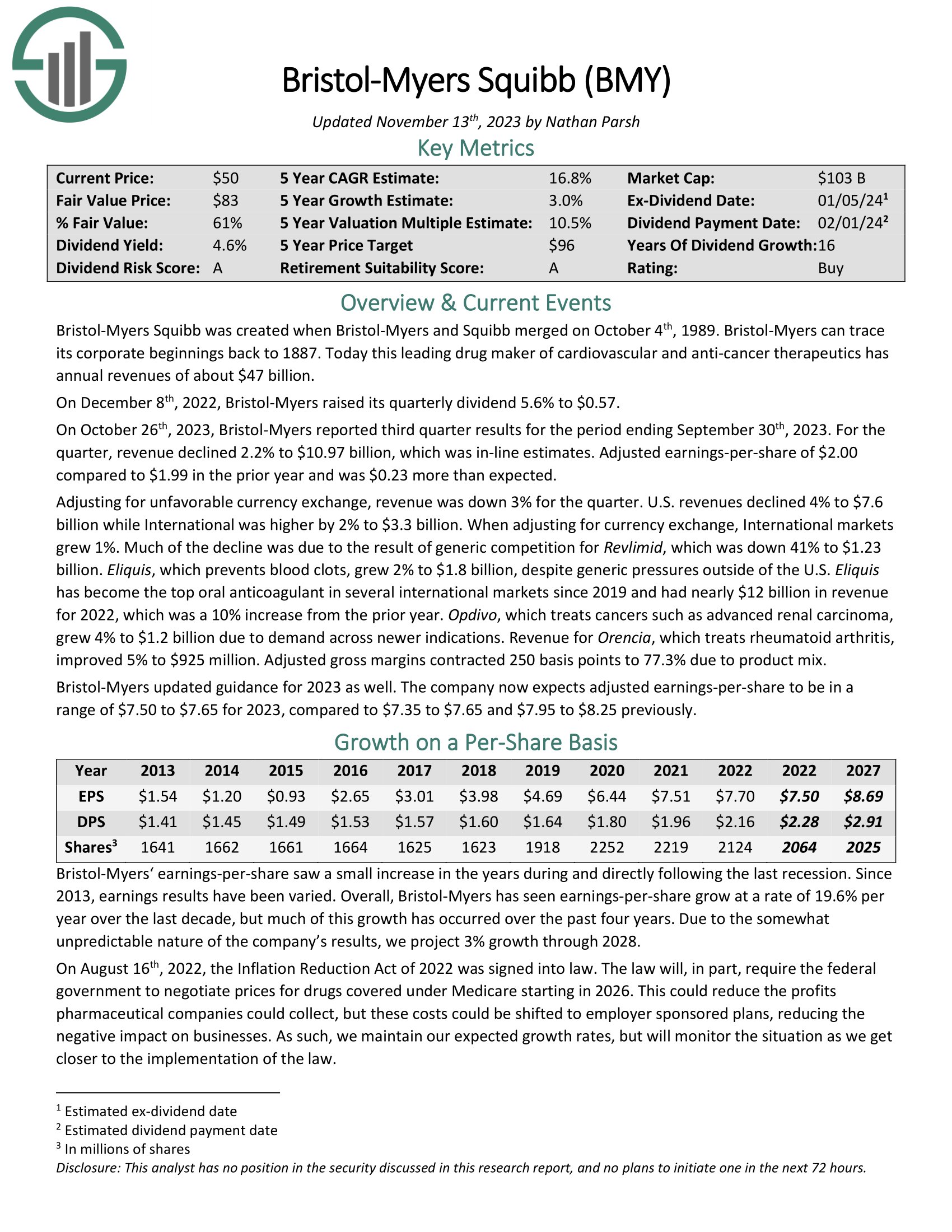

Blue-Chip Stock #7: Bristol-Myers Squibb (BMY)

- Dividend History: 17 years of consecutive increases

- Dividend Yield: 4.7%

- Expected Total Return: 16.9%

Bristol-Myers Squibb is a leading drug maker of cardiovascular and anti-cancer therapeutics with annual revenues of about $47 billion.

For the 2023 third quarter, revenue declined 2.2% to $10.97 billion, which was in-line estimates. Adjusted earnings-per-share of $2.00 compared to $1.99 in the prior year and was $0.23 more than expected.

Adjusting for unfavorable currency exchange, revenue was down 3% for the quarter. U.S. revenues declined 4% to $7.6 billion while International was higher by 2% to $3.3 billion. When adjusting for currency exchange, International markets grew 1%.

Much of the decline was due to the result of generic competition for Revlimid, which was down 41% to $1.23 billion. Eliquis, which prevents blood clots, grew 2% to $1.8 billion.

Click here to download our most recent Sure Analysis report on BMY (preview of page 1 of 3 shown below):

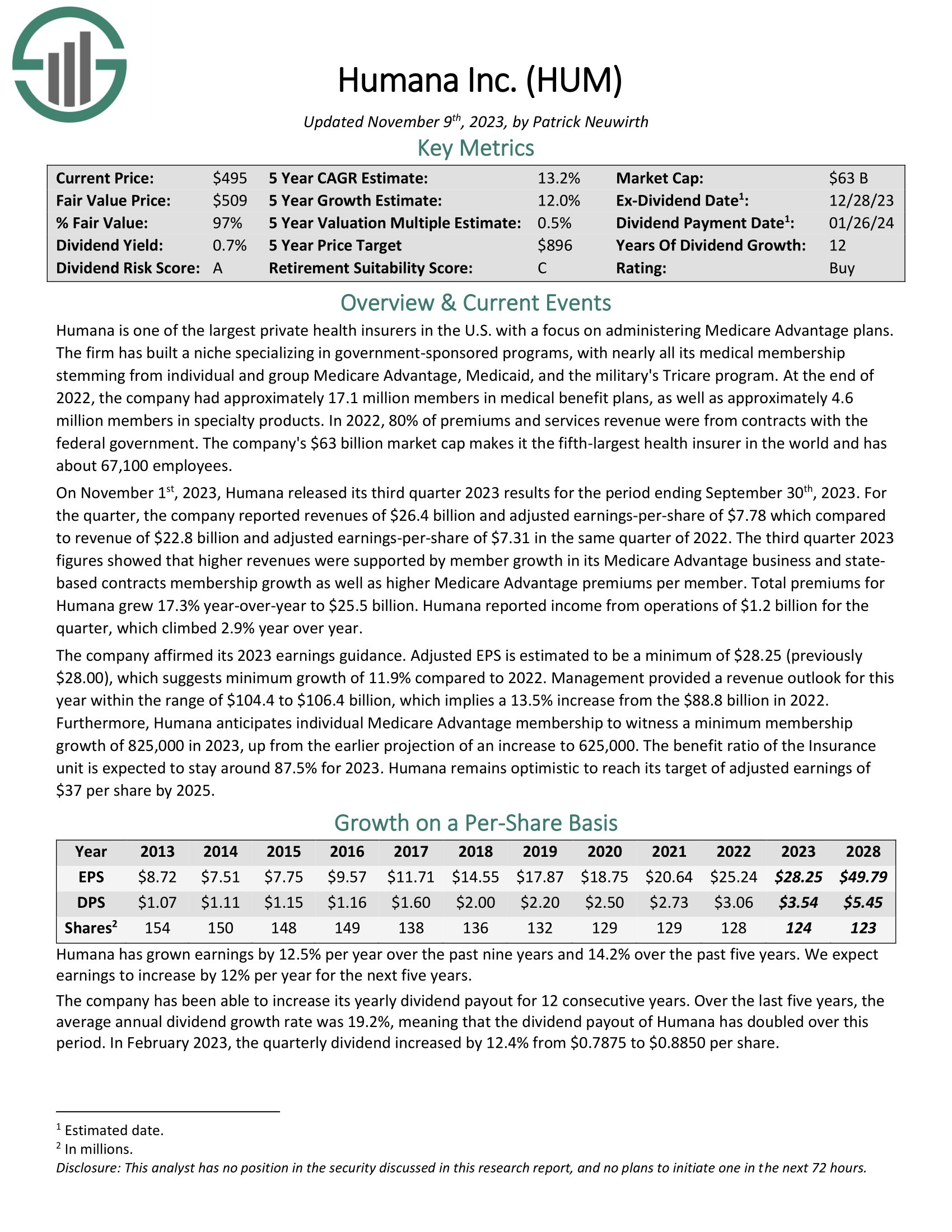

Blue-Chip Stock #6: Humana Inc. (HUM)

- Dividend History: 12 years of consecutive increases

- Dividend Yield: 1%

- Expected Total Return: 18.0%

Humana is one of the largest private health insurers in the U.S. with a focus on administering Medicare Advantage plans. The firm has built a niche specializing in government-sponsored programs, with nearly all its medical membership stemming from individual and group Medicare Advantage, Medicaid, and the military’s Tricare program.

At the end of 2022, the company had approximately 17.1 million members in medical benefit plans, as well as approximately 4.6 million members in specialty products. In 2022, 80% of premiums and services revenue were from contracts with the federal government.

The company has been able to increase its yearly dividend payout for 12 consecutive years. Over the last five years, the average annual dividend growth rate was 19.2%, meaning that the dividend payout of Humana has doubled over this period. In February 2023, the quarterly dividend increased by 12.4% from $0.7875 to $0.8850 per share.

Click here to download our most recent Sure Analysis report on HUM (preview of page 1 of 3 shown below):

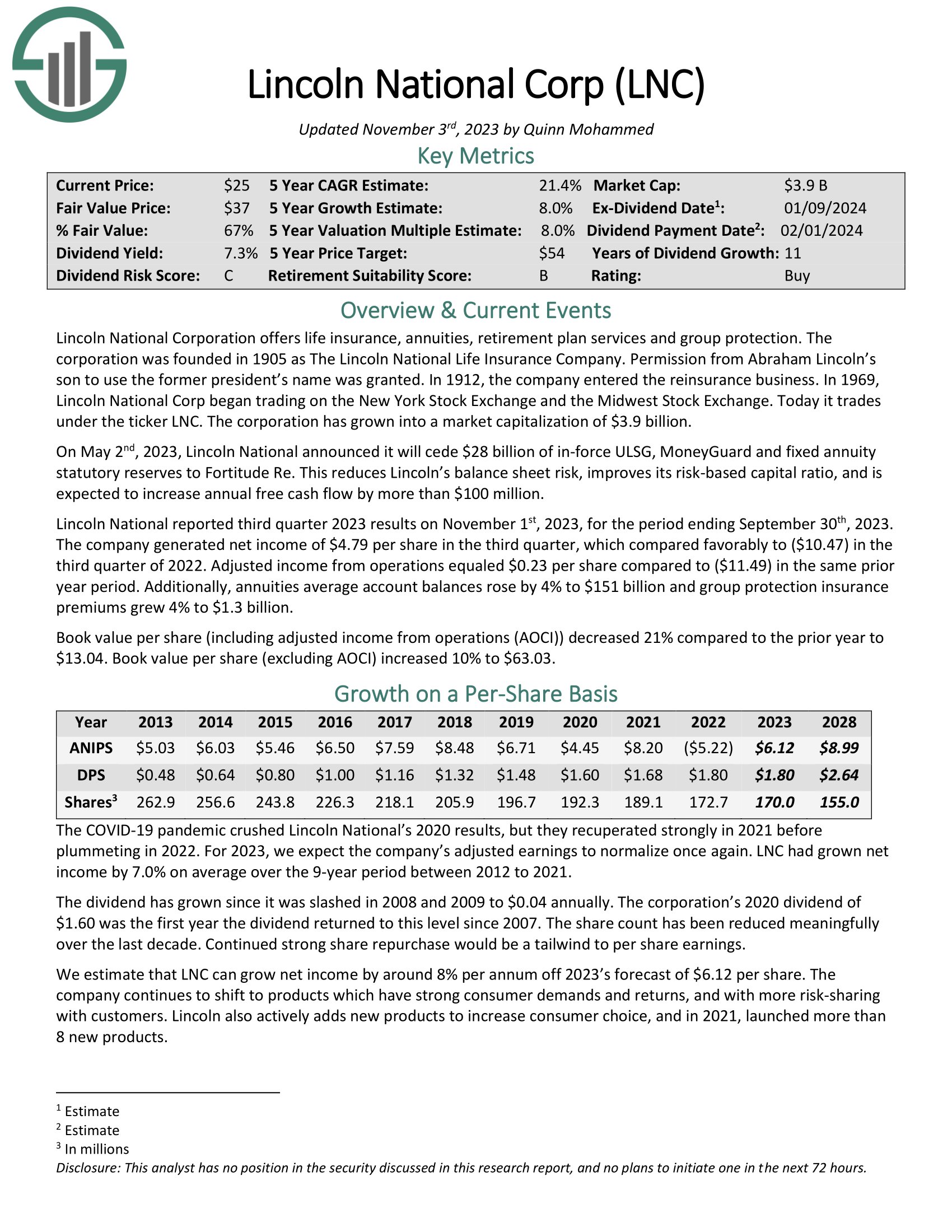

Blue-Chip Stock #5: Lincoln National Corp. (LNC)

- Dividend History: 11 years of consecutive increases

- Dividend Yield: 6.5%

- Expected Total Return: 18.7%

Lincoln National Corporation offers life insurance, annuities, retirement plan services and group protection. The corporation was founded in 1905.

Lincoln National reported third quarter 2023 results on November 1st, 2023, for the period ending September 30th, 2023. The company generated net income of $4.79 per share in the third quarter, which compared favorably to ($10.47) in the third quarter of 2022.

Adjusted income from operations equaled $0.23 per share compared to ($11.49) in the same prior year period. Additionally, annuities average account balances rose by 4% to $151 billion and group protection insurance premiums grew 4% to $1.3 billion.

Click here to download our most recent Sure Analysis report on LNC (preview of page 1 of 3 shown below):

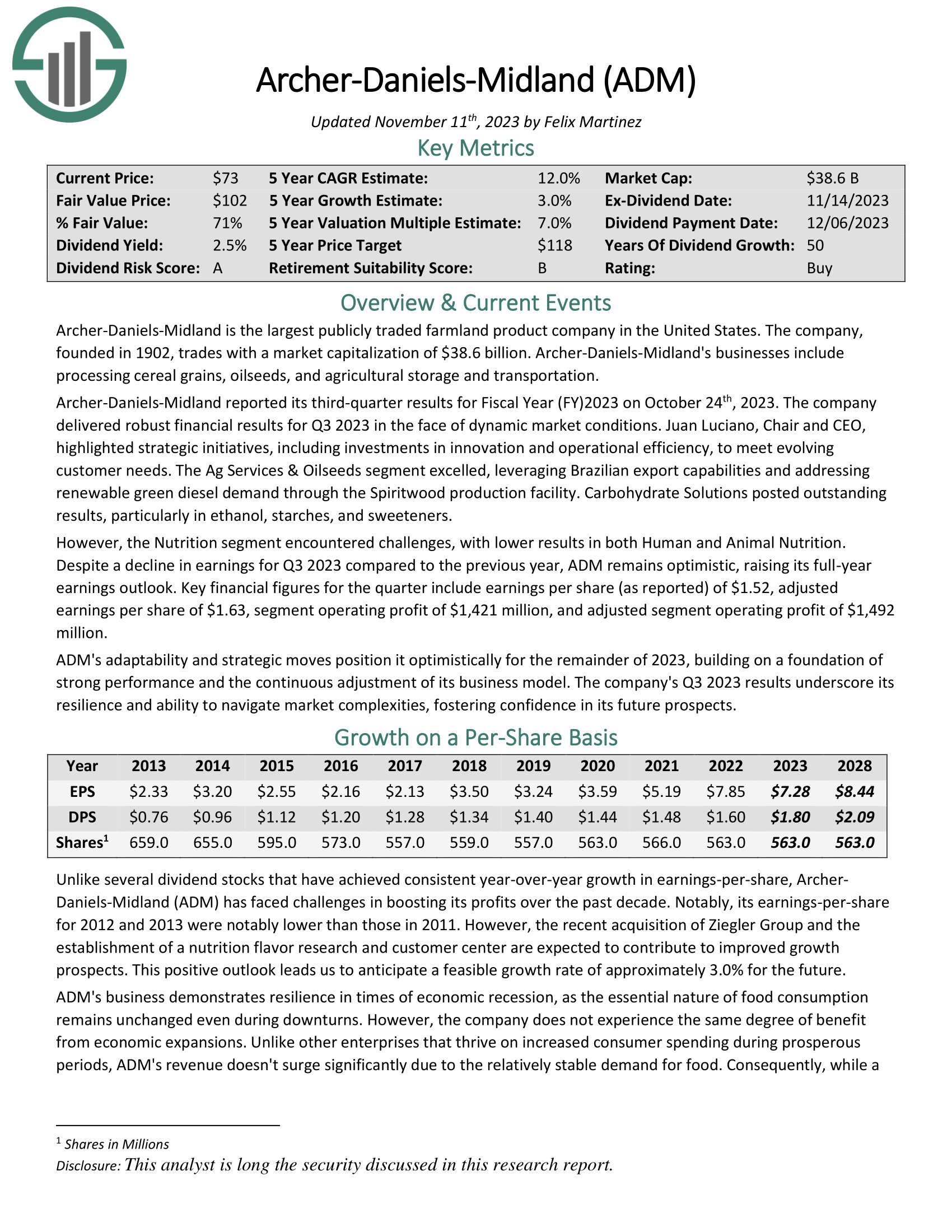

Blue-Chip Stock #4: Archer Daniels-Midland (ADM)

- Dividend History: 50 years of consecutive increases

- Dividend Yield: 3.5%

- Expected Total Return: 19.5%

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. The company, founded in 1902, trades with a market capitalization of $38.6 billion. Archer-Daniels-Midland’s businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter results for Fiscal Year (FY) 2023 on October 24th, 2023. The company delivered robust financial results for Q3 2023 in the face of dynamic market conditions. Juan Luciano, Chair and CEO, highlighted strategic initiatives, including investments in innovation and operational efficiency, to meet evolving customer needs.

The Ag Services & Oilseeds segment excelled, leveraging Brazilian export capabilities and addressing renewable green diesel demand through the Spiritwood production facility. Carbohydrate Solutions posted outstanding results, particularly in ethanol, starches, and sweeteners.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

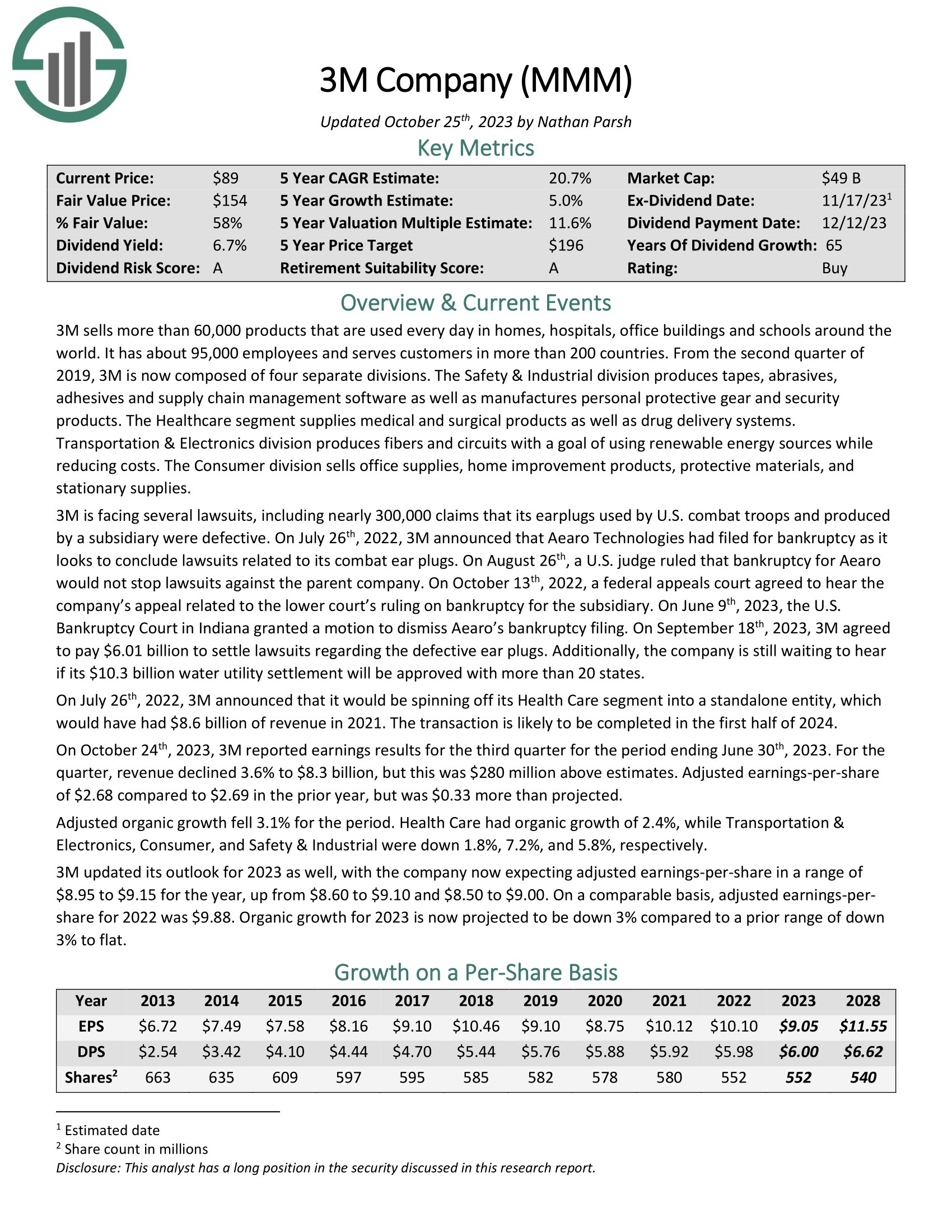

Blue-Chip Stock #3: 3M Company (MMM)

- Dividend History: 65 years of consecutive increases

- Dividend Yield: 6.4%

- Expected Total Return: 19.6%

3M is an industrial manufacturer that sells more than 60,000 products used daily in homes, hospitals, office buildings, and schools worldwide. It has about 95,000 employees and serves customers in more than 200 countries.

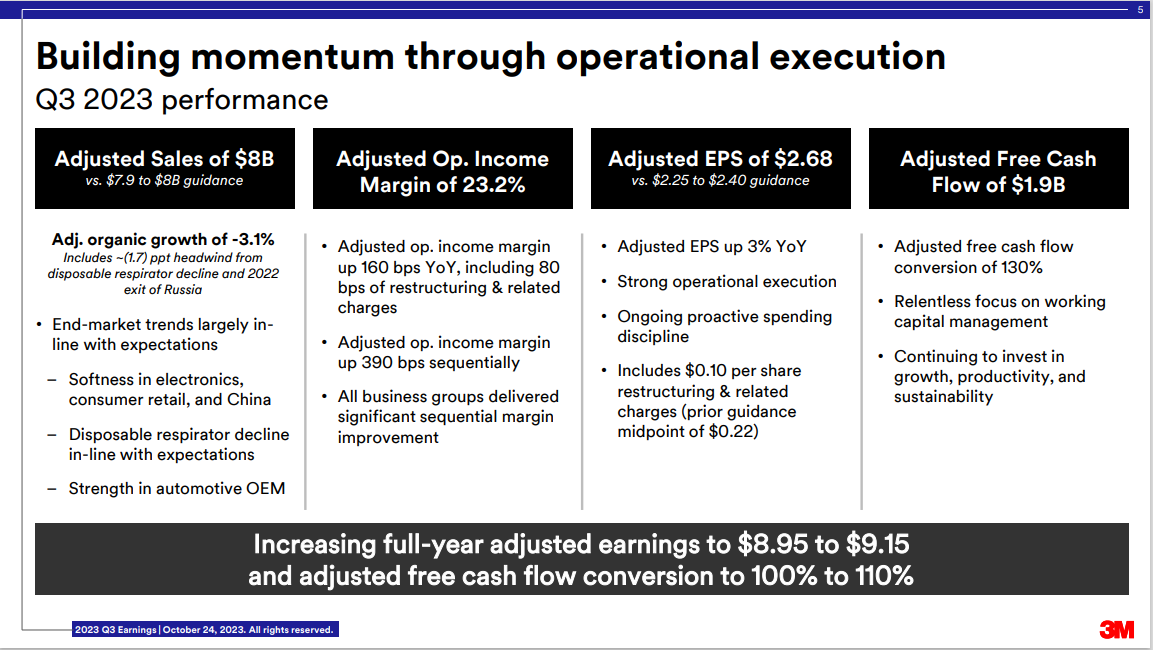

On October 24th, 2023, 3M reported earnings results for the third quarter.

Source: Investor Presentation

For the quarter, revenue declined 3.6% to $8.3 billion, but this was $280 million above estimates. Adjusted earnings-per share of $2.68 compared to $2.69 in the prior year, but was $0.33 more than projected.

Adjusted organic growth fell 3.1% for the period. Health Care had organic growth of 2.4%, while Transportation & Electronics, Consumer, and Safety & Industrial were down 1.8%, 7.2%, and 5.8%, respectively.

Click here to download our most recent Sure Analysis report on 3M Company (preview of page 1 of 3 shown below):

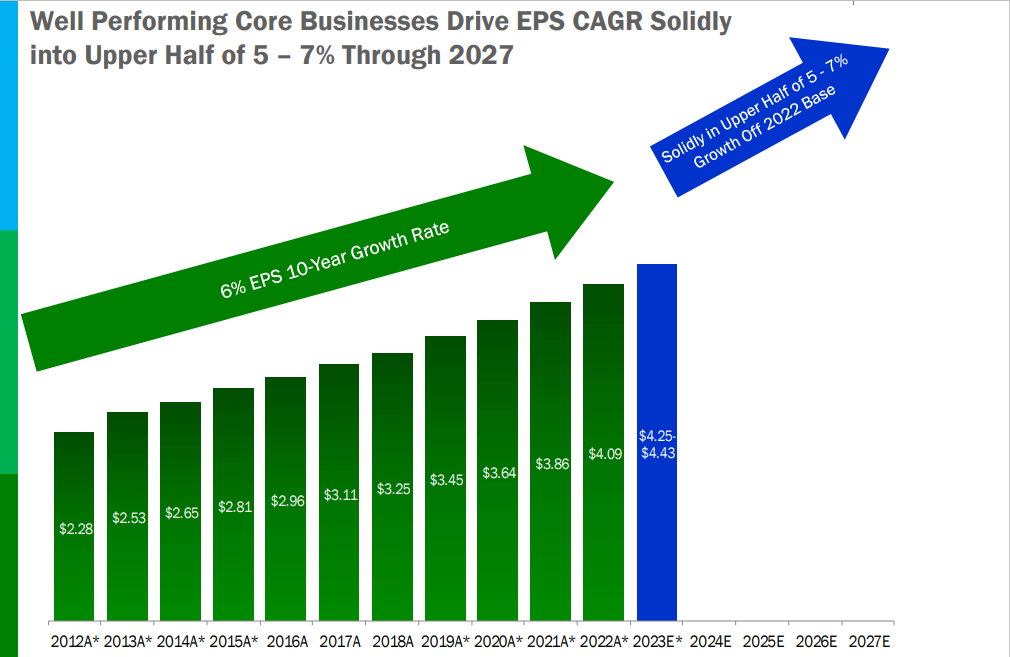

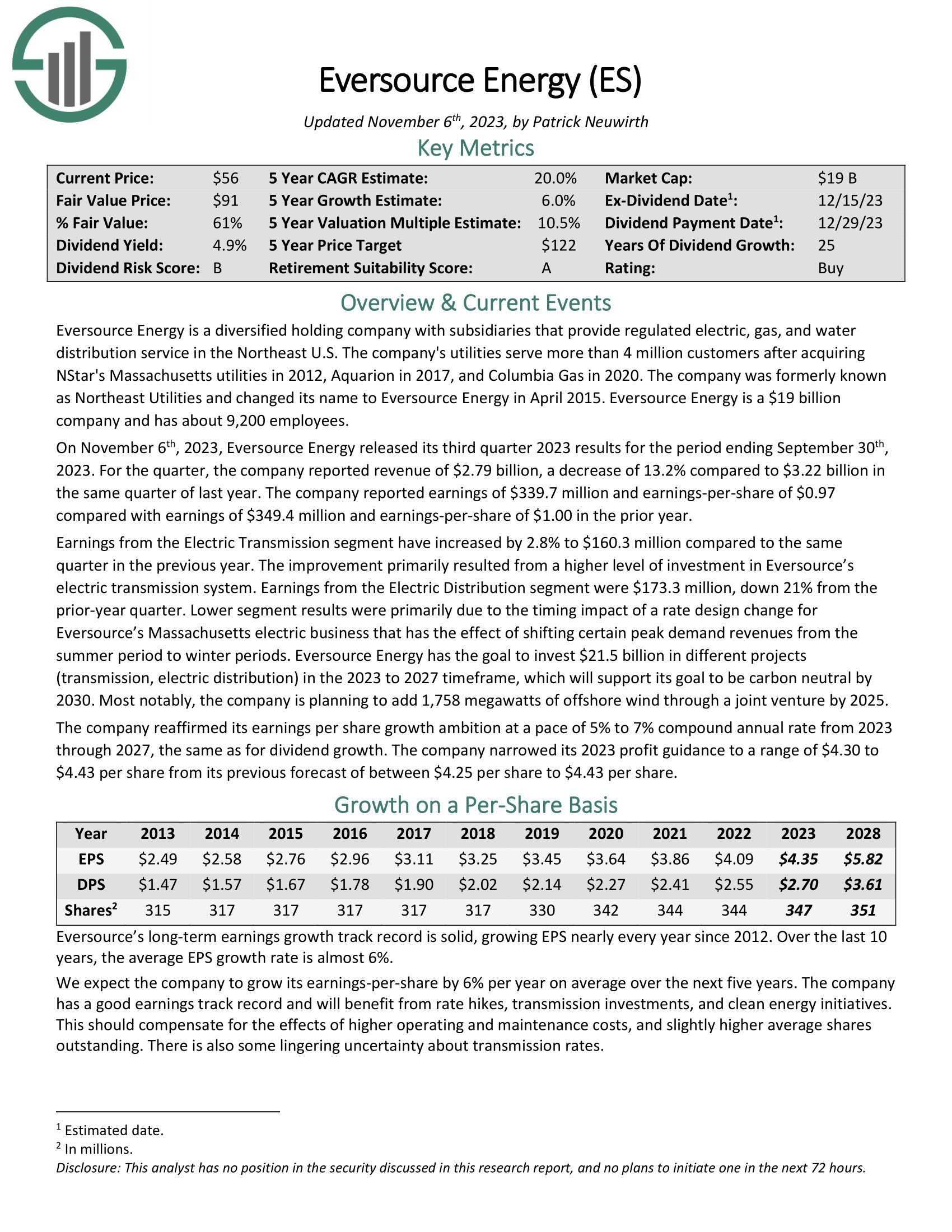

Blue-Chip Stock #2: Eversource Energy (ES)

- Dividend History: 25 years of consecutive increases

- Dividend Yield: 5.0%

- Expected Total Return: 21.0%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S. The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has a long history of generating steady growth over time.

Source: Investor Presentation

On November 6th, 2023, Eversource Energy released its third quarter 2023 results for the period ending September 30th, 2023. For the quarter, the company reported revenue of $2.79 billion, a decrease of 13.2% compared to $3.22 billion in the same quarter of last year. The company reported earnings of $339.7 million and earnings-per-share of $0.97 compared with earnings of $349.4 million and earnings-per-share of $1.00 in the prior year.

The company reported earnings of $15 million and earnings-per-share of $0.04 compared with earnings of $292 million and earnings-per-share of $0.84 in the prior year.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

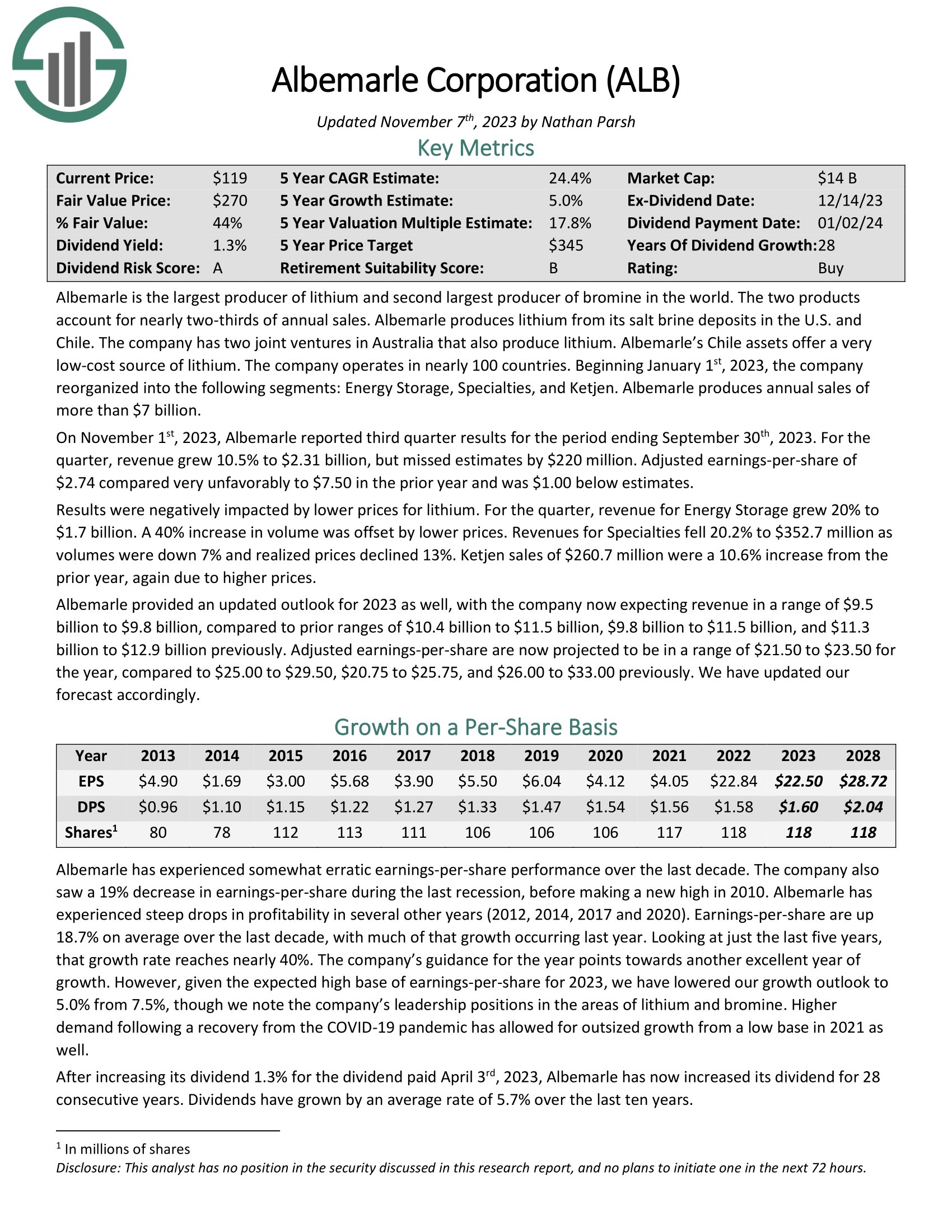

Blue-Chip Stock #1: Albemarle Corporation (ALB)

- Dividend History: 28 years of consecutive increases

- Dividend Yield: 1.0%

- Expected Total Return: 33.0%

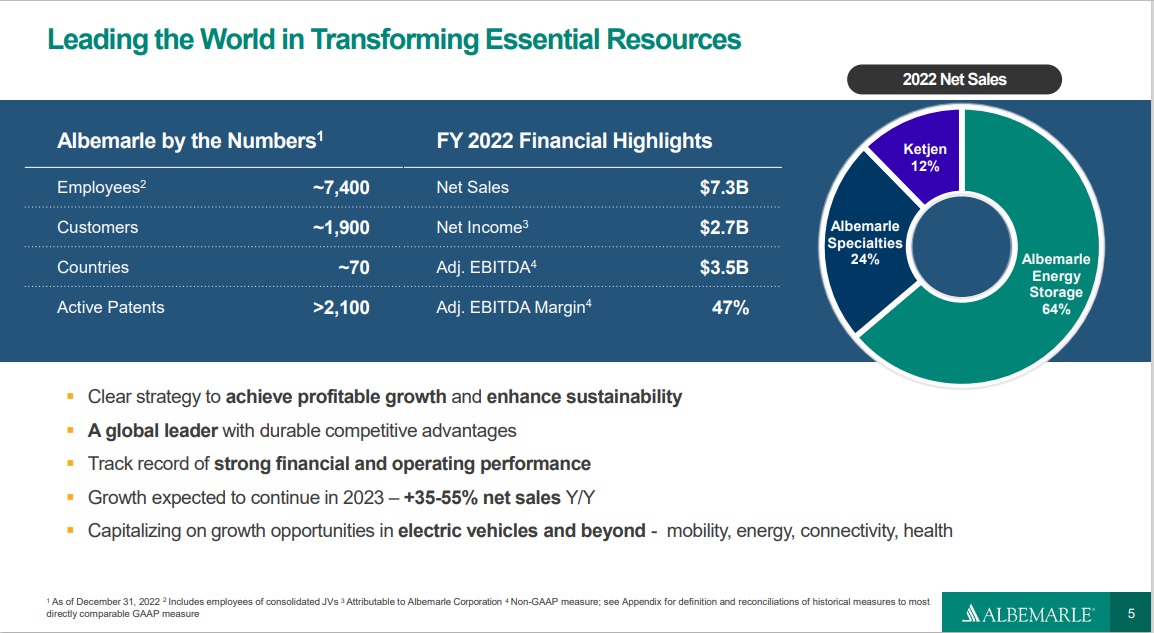

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile. The company has two joint ventures in Australia that also produce lithium.

Related: 2023 Lithium Stocks List

Source: Investor Presentation

On November 1st, 2023, Albemarle reported third quarter results for the period ending September 30th, 2023. For the quarter, revenue grew 10.5% to $2.31 billion, but missed estimates by $220 million. Adjusted earnings-per-share of $2.74 compared very unfavorably to $7.50 in the prior year and was $1.00 below estimates.

Results were negatively impacted by lower prices for lithium. For the quarter, revenue for Energy Storage grew 20% to $1.7 billion. A 40% increase in volume was offset by lower prices. Revenues for Specialties fell 20.2% to $352.7 million as volumes were down 7% and realized prices declined 13%. Ketjen sales of $260.7 million were a 10.6% increase from the prior year, again due to higher prices.

Click here to download our most recent Sure Analysis report on Albemarle (preview of page 1 of 3 shown below):

Other Blue Chip Stock Resources

Blue chip stocks tend to have many or all of the following characteristics:

- Market leaders

- Popular / well-known

- Large-cap market capitalization

- Long history of paying rising dividends

- Consistent profitability even during recessions

That’s why they can make excellent investments for the long-run. And their strength and reliability make them compelling investments for investors of all experience levels, from beginners to experts.

This article featured several resources for finding compelling blue chip stock investments:

- The Blue Chip Stocks List (see below)

The resources below will give you a better understanding of blue chip investing, long-term investing, and dividend growth investing.

Blue Chip Stock Investing

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 20 ‘Forever’ Blue-Chip Stocks For Long-Term Investing

Dividend Growth Investing

- Dividend Kings: 50+ Consecutive years of dividend increases

- Dividend Champions: 25+ Consecutive years of dividend increases

- The Best DRIP Stocks: The top 15 Dividend Champions with no-fee dividend reinvestment plans