Updated on December 9th, 2024 by Bob Ciura

Income investors are always on the hunt for high-quality dividend stocks. There are many ways to measure high-quality stocks. One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

With this in mind, we created a downloadable list of over 130 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 66 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

While their length of dividend increases is the same, leading to some overlap, there are also some important differences between the Dividend Aristocrats and Dividend Champions.

As a result, the Dividend Champions list is much more expansive. There are many high-quality Dividend Champions that are not included on the Dividend Aristocrats list.

This article will discuss the Dividend Champions, and an analysis of our top 7 Dividend Champions now, ranked according to expected total returns in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

- Overview of Dividend Champions

- Top Dividend Champion #7: PepsiCo Inc. (PEP)

- Top Dividend Champion #6: Becton, Dickinson & Co. (BDX)

- Top Dividend Champion #5: PPG Industries (PPG)

- Top Dividend Champion #4: Sanofi SA (SNY)

- Top Dividend Champion #3: Sonoco Products (SON)

- Top Dividend Champion #2: SJW Group (SJW)

- Top Dividend Champion #1: Eversource Energy (ES)

Overview of Dividend Champions

The requirement to become a Dividend Champion is simple: 25+ years of consecutive annual dividend increases. The Dividend Aristocrats have the same requirement when it comes to number of years, but with a few additional requirements.

To be a Dividend Aristocrat, a company must also be included in the S&P 500 Index, must have a float-adjusted market cap of at least $3 billion, and must have an average daily value traded of at least $5 million.

These added requirements preclude many companies that possess a sufficient track record of annual dividend increases, but do not qualify based on market cap or liquidity reasons.

As a result, while there is some overlap between the Dividend Aristocrats and the Dividend Champions, there are also many Dividend Champions that are not Dividend Aristocrats.

Income investors might want to consider these stocks due to their impressive histories of annual dividend increases, so we have compiled them in the downloadable spreadsheet above.

In addition, we have ranked the top 7 Dividend Champions according to total expected annual returns over the next five years. Our top 7 Dividend Champions right now are ranked below.

The Top 7 Dividend Champions To Buy Right Now

The following 7 stocks represent Dividend Champions with at least 25 consecutive years of dividend increases, but they also have durable competitive advantages, long-term growth potential, and high expected total returns.

Stocks have been ranked by expected total annual return over the next five years, from lowest to highest.

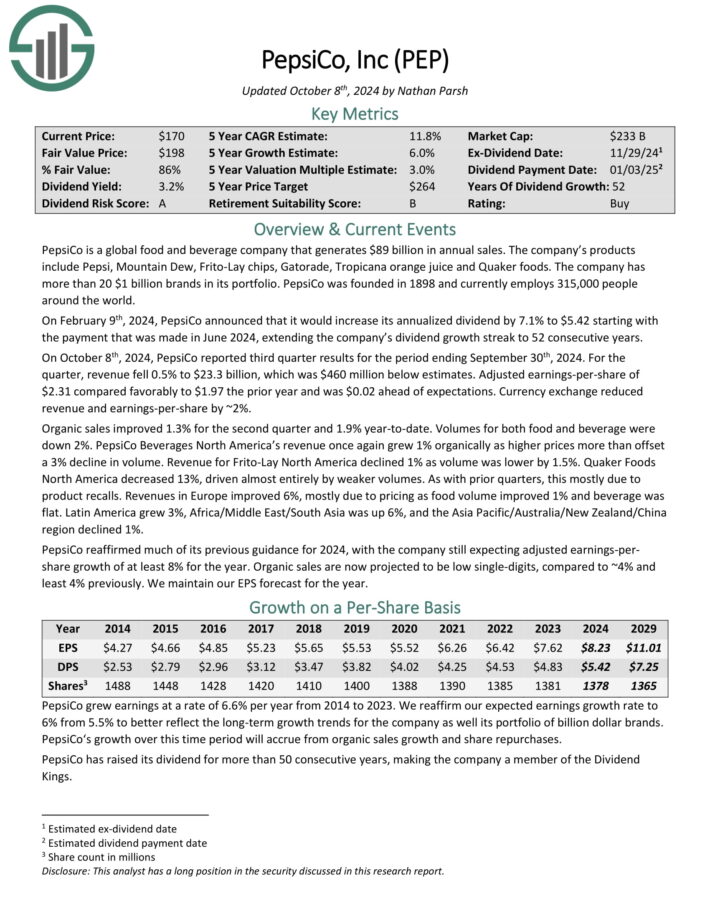

Top Dividend Champion #7: PepsiCo Inc. (PEP)

- 5-year expected returns: 13.5%

PepsiCo is a global food and beverage company that generates $89 billion in annual sales. The company’s products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On October 8th, 2024, PepsiCo reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 0.5% to $23.3 billion, which was $460 million below estimates.

Adjusted earnings-per-share of $2.31 compared favorably to $1.97 the prior year and was $0.02 ahead of expectations. Currency exchange reduced revenue and earnings-per-share by ~2%.

Organic sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for both food and beverage were down 2%.

PepsiCo Beverages North America’s revenue once again grew 1% organically as higher prices more than offset a 3% decline in volume.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

Top Dividend Champion #6: Becton, Dickinson & Co. (BDX)

- 5-year expected returns: 14.2%

Becton, Dickinson & Co., or BD, is a global leader in the medical supply industry. The company was founded in 1897 and has 75,000 employees across 190 countries.

The company generates about $20 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S.

BDX reported results for the fourth quarter and fiscal year 2024, which ended September 30th, 2024. For the quarter, revenue grew 6.9% to $5.44 billion, which was $57 million more than expected.

On a currency neutral basis, revenue improved 7.4%. Adjusted earnings-per-share of $3.81 compared favorably to $3.42in the prior year and was $0.04 ahead of estimates.

For the fiscal year, revenue grew 4.2% to $20.2 billion while adjusted earnings-per-share of $13.14 compared to $12.21 in the prior year.

Click here to download our most recent Sure Analysis report on BDX (preview of page 1 of 3 shown below):

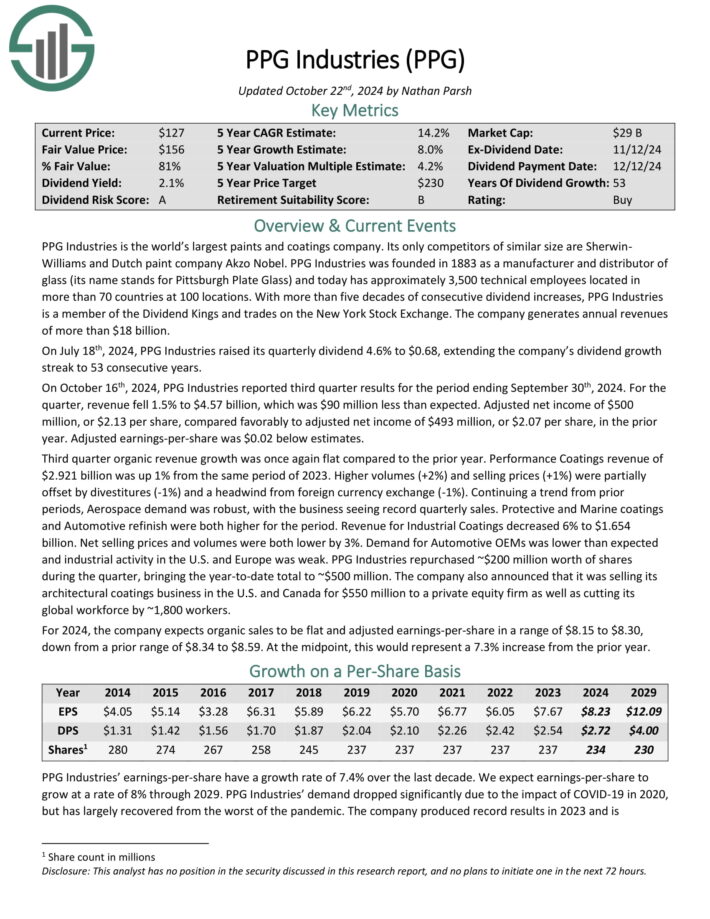

Top Dividend Champion #5: PPG Industries (PPG)

- 5-year expected returns: 14.4%

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

On October 16th, 2024, PPG Industries reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 1.5% to $4.57 billion, which was $90 million less than expected.

The company generates annual revenue of about $18.2 billion.

Source: Investor Presentation

Adjusted net income of $500 million, or $2.13 per share, compared favorably to adjusted net income of $493 million, or $2.07 per share, in the prior year. Adjusted earnings-per-share was $0.02 below estimates.

Third quarter organic revenue growth was once again flat compared to the prior year. Performance Coatings revenue of $2.921 billion was up 1% from the same period of 2023. Higher volumes (+2%) and selling prices (+1%) were partially offset by divestitures (-1%) and a headwind from foreign currency exchange (-1%).

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

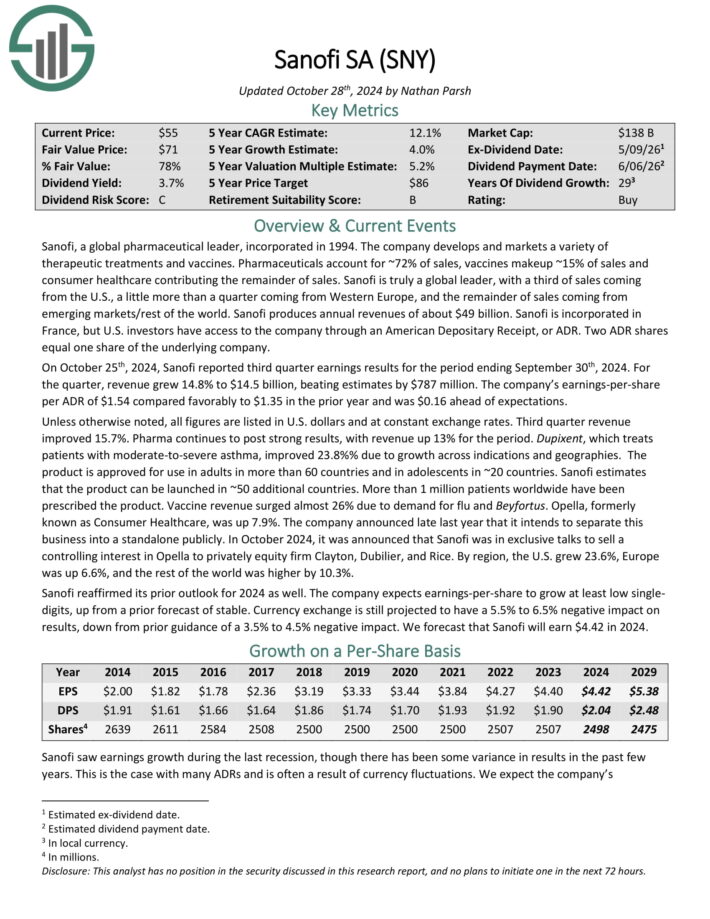

Top Dividend Champion #4: Sanofi SA (SNY)

- 5-year expected returns: 15.1%

Sanofi, a global pharmaceutical leader, incorporated in 1994. The company develops and markets a variety of therapeutic treatments and vaccines. Pharmaceuticals account for ~72% of sales, vaccines makeup ~15% of sales and consumer healthcare contributing the remainder of sales.

On October 25th, 2024, Sanofi reported third quarter earnings results for the period ending September 30th, 2024. For the quarter, revenue grew 14.8% to $14.5 billion, beating estimates by $787 million. The company’s earnings-per-share per ADR of $1.54 compared favorably to $1.35 in the prior year and was $0.16 ahead of expectations.

Unless otherwise noted, all figures are listed in U.S. dollars and at constant exchange rates. Third quarter revenue improved 15.7%. Pharma continues to post strong results, with revenue up 13% for the period. Dupixent, which treats patients with moderate-to-severe asthma, improved 23.8%% due to growth across indications and geographies.

The product is approved for use in adults in more than 60 countries and in adolescents in ~20 countries. Sanofi estimates that the product can be launched in ~50 additional countries.

Click here to download our most recent Sure Analysis report on SNY (preview of page 1 of 3 shown below):

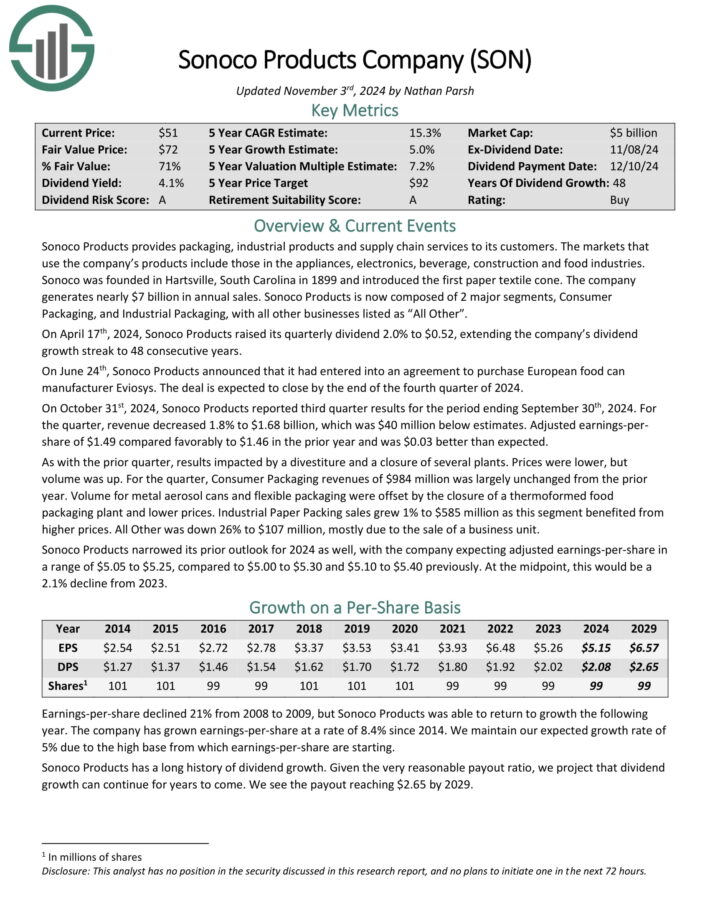

Top Dividend Champion #3: Sonoco Products (SON)

- 5-year expected returns: 15.2%

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates nearly $7 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

Source: Investor Presentation

On October 31st, 2024, Sonoco Products reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue decreased 1.8% to $1.68 billion, which was $40 million below estimates. Adjusted earnings-per share of $1.49 compared favorably to $1.46 in the prior year and was $0.03 better than expected.

As with the prior quarter, results impacted by a divestiture and a closure of several plants. Prices were lower, but volume was up. For the quarter, Consumer Packaging revenues of $984 million was largely unchanged from the prior year.

Volume for metal aerosol cans and flexible packaging were offset by the closure of a thermoformed food packaging plant and lower prices. Industrial Paper Packing sales grew 1% to $585 million as this segment benefited from higher prices.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

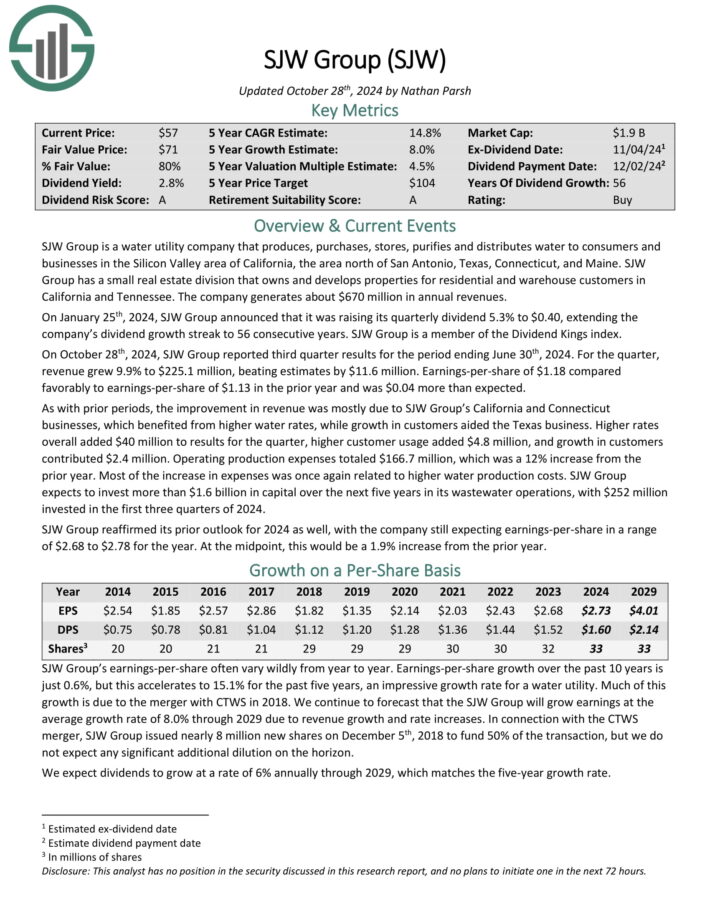

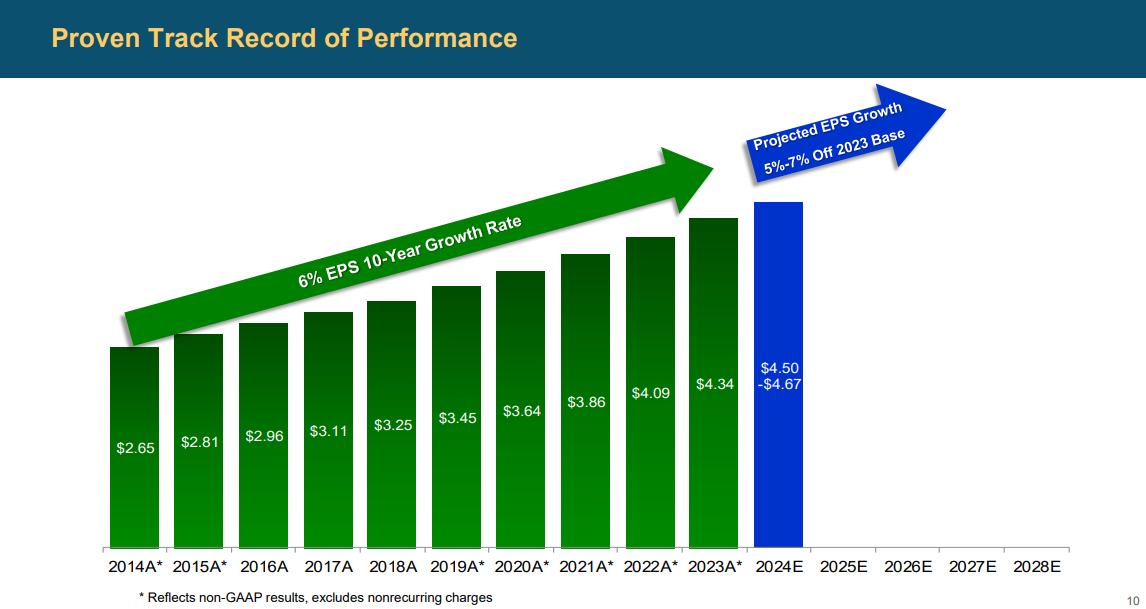

Top Dividend Champion #2: SJW Group (SJW)

- 5-year expected returns: 16.6%

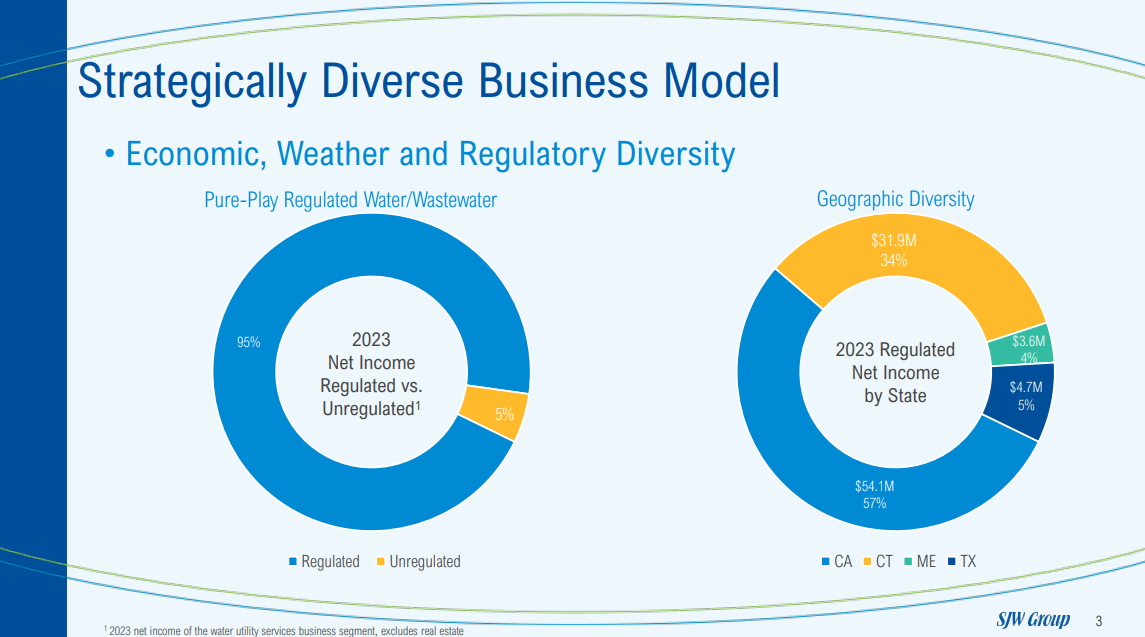

SJW Group is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

Source: Investor Presentation

On October 28th, 2024, SJW Group reported third quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 compared favorably to earnings-per-share of $1.13 in the prior year and was $0.04 more than expected.

As with prior periods, the improvement in revenue was mostly due to SJW Group’s California and Connecticut businesses, which benefited from higher water rates, while growth in customers aided the Texas business.

Higher rates overall added $40 million to results for the quarter, higher customer usage added $4.8 million, and growth in customers contributed $2.4 million. Operating production expenses totaled $166.7 million, which was a 12% increase from the prior year.

Click here to download our most recent Sure Analysis report on SJW (preview of page 1 of 3 shown below):

Top Dividend Champion #1: Eversource Energy (ES)

- 5-year expected returns: 18.4%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On November 4th, 2024, Eversource Energy released its third-quarter 2024 results for the period ending September 30th, 2024.

For the quarter, the company reported a net loss of $(118.1) million, a sharp decline from earnings of $339.7 million in the same quarter of last year, which reflects the impact of the company’s exit from offshore wind investments.

The company reported a loss per share of $(0.33), compared with earnings-per-share of $0.97 in the prior year. Earnings from the Electric Transmission segment increased to $174.9 million, up from $160.3 million in the prior year, primarily due to a higher level of investment in Eversource’s electric transmission system.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend stocks.

In order for a company to raise its dividend for at least 25 years, it must have durable competitive advantages, highly profitable businesses, and leadership positions in their respective industries.

They also have long-term growth potential and the ability to navigate recessions while continuing to raise their dividends.

The top 7 Dividend Champions presented in this article have long histories of dividend growth, and the combination of high dividend yields, low valuations, and future earnings growth potential make them attractive buys right now.

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.