Article updated on December 2nd, 2024 by Bob Ciura

Spreadsheet data updated daily

The Dividend Aristocrats are a select group of 66 S&P 500 stocks with 25+ years of consecutive dividend increases.

They are the ‘best of the best’ dividend growth stocks. The Dividend Aristocrats have a long history of outperforming the market.

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

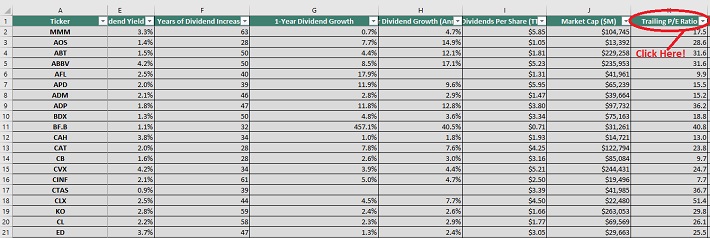

There are currently 66 Dividend Aristocrats. You can download an Excel spreadsheet of all 66 (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

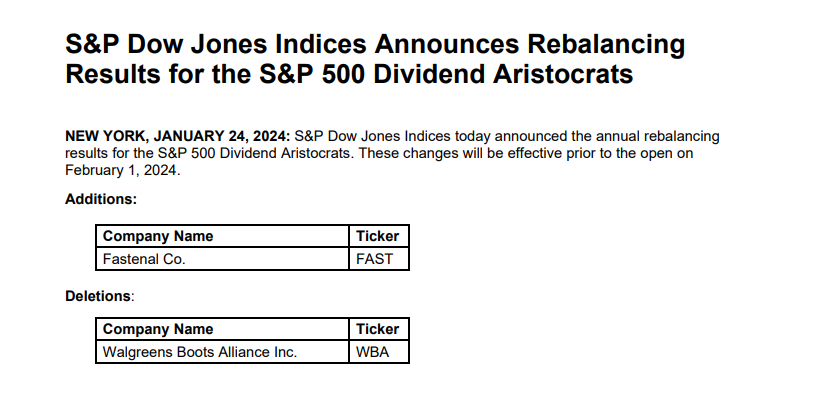

Note 1: On January 24th, 2024, Fastenal (FAST) was added to the list while Walgreens Boots Alliance (WBA) was removed, leaving 66 Dividend Aristocrats.

Source: S&P News Releases.

You can see detailed analysis on all 66 further below in this article, in our Dividend Aristocrats In Focus Series. Analysis includes valuation, growth, and competitive advantage(s).

Table of Contents

- How To Use The Dividend Aristocrats List To Find Dividend Investment Ideas

- Performance of the Dividend Aristocrats

- Sector Overview

- The 10 Best Dividend Aristocrats Now

- Dividend Aristocrats Analysis (The Dividend Aristocrats In Focus Series)

- Historical Dividend Aristocrats List (1989 – 2024)

- Frequently Asked Questions

- Final Thoughts

How to Use The Dividend Aristocrats List To Find Dividend Investment Ideas

The downloadable Dividend Aristocrats Excel Spreadsheet List above contains the following for each stock in the index:

- Price-to-earnings ratio

- Dividend yield

- Market capitalization

All Dividend Aristocrats are high-quality businesses based on their long dividend histories. A company cannot pay rising dividends for 25+ years without having a strong and durable competitive advantage.

But not all Dividend Aristocrats make equally good investments today. That’s where the spreadsheet in this article comes into play. You can use the Dividend Aristocrats spreadsheet to quickly find quality dividend investment ideas.

The list of all 66 Dividend Aristocrats is valuable because it gives you a concise list of all S&P 500 stocks with 25+ consecutive years of dividend increases (that also meet certain minimum size and liquidity requirements).

These are businesses that have both the desire and ability to pay shareholders rising dividends year-after-year. This is a rare combination.

Together, these two criteria are powerful – but they are not enough. Value must be considered as well.

The spreadsheet above allows you to sort by trailing price-to-earnings ratio so you can quickly find undervalued, high-quality dividend stocks.

Here’s how to use the Dividend Aristocrats list to quickly find high-quality dividend growth stocks potentially trading at a discount:

- Download the list

- Sort by ‘Trailing PE Ratio,’ smallest to largest

- Research the top stocks further

Here’s how to do this quickly in the spreadsheet:

Step 1: Download the list, and open it.

Step 2: Apply a filter function to each column in the spreadsheet.

Step 3: Click on the small gray down arrow next to ‘Trailing P/E Ratio’, and then sort smallest to largest.

Step 4: Review the highest ranked Dividend Aristocrats before investing. You can see detailed analysis on every Dividend Aristocrat found below in this article.

That’s it; you can follow the same procedure to sort by any other metric in the spreadsheet.

Performance Of The Dividend Aristocrats

In November 2024, the Dividend Aristocrats, as measured by the Dividend Aristocrats ETF (NOBL), registered a total return of 4.85%. It under-performed the SPDR S&P 500 ETF (SPY) for the month.

- NOBL generated returns of 4.85% in November 2024

- SPY generated returns of 5.96% in November 2024

Short-term performance is mostly noise. Performance should be measured over a minimum of 3 years, and preferably longer periods of time.

The Dividend Aristocrats Index has slightly under-performed the broader market index over the last decade, with a 10.71% total annual return for the Dividend Aristocrats and a 13.35% total annual return for the S&P 500 Index.

But the Dividend Aristocrats have exhibited lower risk than the benchmark, as measured by standard deviation.

Source: S&P Fact Sheet

Higher total returns with lower volatility is the ‘holy grail’ of investing. It is worth exploring the characteristics of the Dividend Aristocrats in detail to determine why they have performed so well.

Note that a good portion of the outperformance relative to the S&P 500 comes during recessions (2000 – 2002, 2008). Dividend Aristocrats have historically seen smaller drawdowns during recessions versus the S&P 500. This makes holding through recessions that much easier.

Case-in-point: In 2008 the Dividend Aristocrats Index declined 22%. That same year, the S&P 500 declined 38%.

Great businesses with strong competitive advantages tend to be able to generate stronger cash flows during recessions. This allows them to gain market share while weaker businesses fight to stay alive.

The Dividend Aristocrats Index has beaten the market over the last 28 years…

We believe dividend paying stocks outperform non-dividend paying stocks for three reasons:

- A company that pays dividends is likely to be generating earnings or cash flows so that it can pay dividends to shareholders. This excludes ‘pre-earnings’ start-ups and failing businesses. In short, it excludes the riskiest stocks.

- A business that pays consistent dividends must be more selective with the growth projects it takes on because a portion of its cash flows are being paid out as dividends. Scrutinizing over capital allocation decisions likely adds to shareholder value.

- Stocks that pay dividends are willing to reward shareholders with cash payments. This is a sign that management is shareholder friendly.

In our view, Dividend Aristocrats have historically outperformed the market and other dividend paying stocks because they are, on average, higher-quality businesses.

A high-quality business should outperform a mediocre business over a long period of time, all other things being equal.

For a business to increase its dividends for 25+ consecutive years, it must have or at least had in the very recent past a strong competitive advantage.

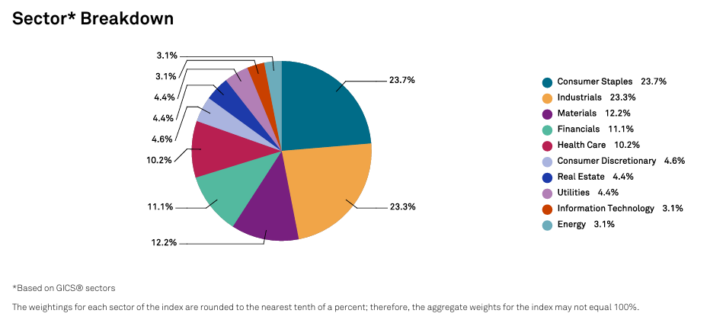

Sector Overview

A sector breakdown of the Dividend Aristocrats Index is shown below:

The Dividend Aristocrats Index is tilted toward Consumer Staples and Industrials relative to the S&P 500. These 2 sectors make up over 40% of the Dividend Aristocrats Index, but less than 20% of the S&P 500.

The Dividend Aristocrats Index is also significantly underweight the Information Technology sector, with a ~3% allocation compared with over 20% allocation within the S&P 500.

The Dividend Aristocrat Index is filled with stable ‘old economy’ blue chip consumer products businesses and manufacturers; the Coca-Cola’s (KO), and Johnson & Johnson’s (JNJ) of the investing world.

These ‘boring’ businesses aren’t likely to generate 20%+ earnings-per-share growth, but they also are very unlikely to see large earnings drawdowns as well.

The 10 Best Dividend Aristocrats Now

This research report examines the 10 best Dividend Aristocrats from our Sure Analysis Research Database with the highest 5-year forward expected total returns.

Dividend Aristocrat #10: J.M. Smucker (SJM)

- 5-year Expected Annual Returns: 9.7%

The J.M. Smucker company has grown into an international powerhouse of packaged food and beverage products including iconic names like Smucker’s, Jif and Folgers, along with various pet food brands.

Source: Investor Presentation

In late November, Smucker’s reported (11/26/24) results for the second quarter of fiscal 2025, which ends on April 30th, 2025. Currency-neutral, organic sales grew 2% over the prior year’s quarter, mostly thanks to material price hikes.

The strong volumes amid price hikes are testaments to the strength of the brands of the company. Adjusted earnings-per-share grew 7%, from $2.58 to $2.76, and exceeded the analysts’ estimates by $0.27.

Thanks to better-than-expected performance, Smucker’s slightly raised its guidance for fiscal 2025. It kept its guidance for growth of comparable sales intact at 8.5%-9.5% and raised its guidance for adjusted earnings-per-share to $9.70-$10.10.

Click here to download our most recent Sure Analysis report on SJM (preview of page 1 of 3 shown below):

Dividend Aristocrat #9: Brown-Forman (BF.B)

- 5-year Expected Annual Returns: 10.2%

Brown-Forman is an alcoholic beverage company that is based in Louisville. The company was founded in 1870. Brown

Forman produces and sells whiskey, vodka, tequila, champagne, and wine.

Its portfolio includes a range of mostly premium brands, such as Jack Daniel’s, Finlandia Vodka, Old Forester, and many others.

Brown-Forman reported revenues of $950 million for its first quarter (fiscal 2025) earnings results. Revenues were down by 9% compared to the previous year’s quarter.

Brown-Forman’s revenues came in below the analyst consensus, which caused a negative market reaction. The sales performance during the quarter was also weaker compared to the previous quarter, when Brown-Forman’s year-over-year performance had been slightly stronger.

In constant currencies, Brown-Forman experienced a revenue decline of 4% compared to the previous year’s quarter.

Brown-Forman’s earnings-per-share declined as well, as the company suffered from lower margins. Operating profit declined by 14% during the quarter.

Click here to download our most recent Sure Analysis report on BF.B (preview of page 1 of 3 shown below):

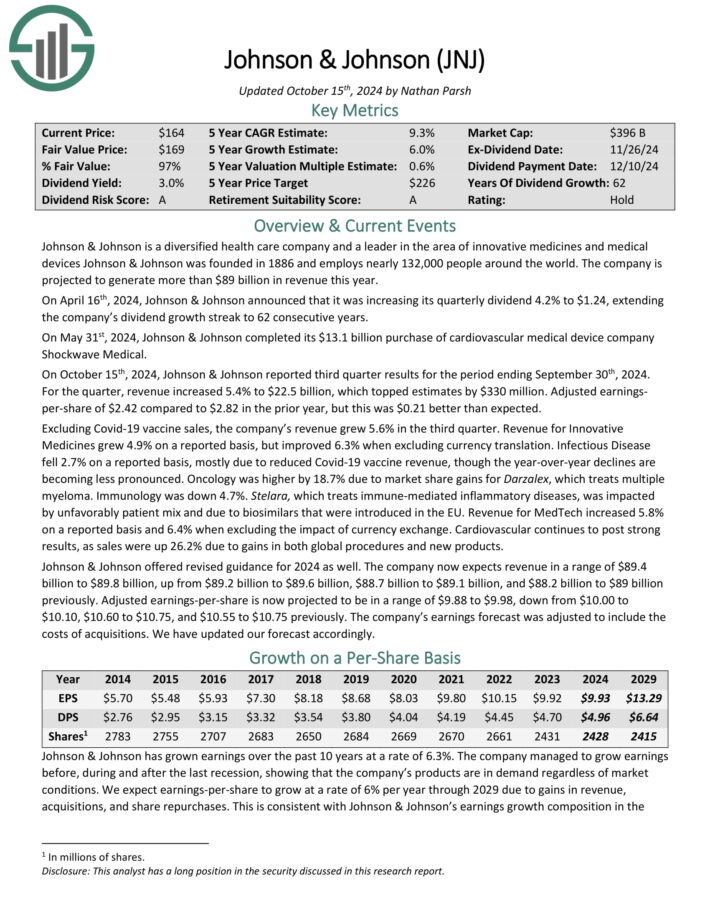

Dividend Aristocrat #8: Johnson & Johnson (JNJ)

- 5-year Expected Annual Returns: 10.5%

Johnson & Johnson was founded in 1886 and has transformed into one of the largest companies in the world. Johnson & Johnson is a mega-cap stock. The company generates annual sales above $99 billion.

Johnson & Johnson operates a diversified business model, allowing it to appeal to a wide variety of customers within the healthcare sector. J&J now operates two segments, pharmaceuticals and medical devices, after spinning off its consumer health franchises.

Johnson & Johnson reported third-quarter 2024 sales growth of 5.2%, reaching $22.5 billion, with operational growth of 6.3%.

Source: Investor Presentation

However, earnings per share (EPS) decreased by 34.3%, largely due to a one-time special charge and acquired in-process research and development (IPR&D).

Adjusted EPS fell 9.0% to $2.42, driven by the same IPR&D impact. The company made significant advancements, including approvals for treatments like TREMFYA and RYBREVANT, and the submission of a new general surgery robotic system, OTTAVA.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

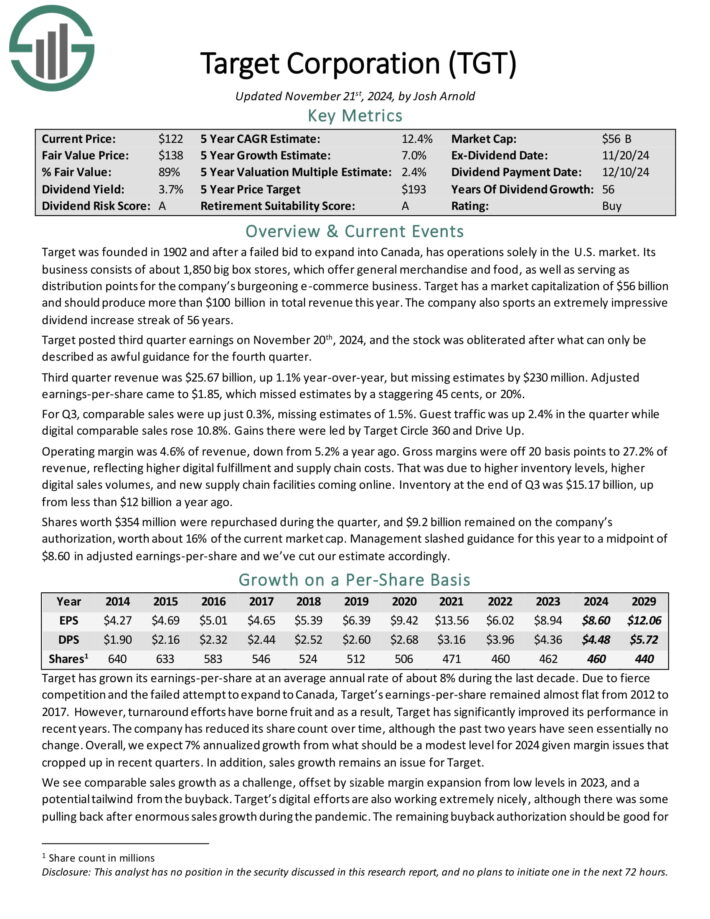

Dividend Aristocrat #7: Target Corporation (TGT)

- 5-year Expected Annual Returns: 10.7%

Target was founded in 1902 and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target posted second quarter earnings on August 21st, 2024, and results were quite strong, sending the stock jumping after the report. Adjusted earnings-per-share came to $2.57, which was 39 cents ahead of estimates. Revenue was up 2.7% year-over-year to $25.45 billion, which beat by $240 million.

Comparable sales were up 2% year-over-year, making up most of the total sales gain. Consensus was for a gain of 1.1%. Traffic was up 3% year-over-year with all six core merchandising categories seeing positive growth. Digital comparable sales were up 8.7%, once again driving growth.

Target has grown its dividend for more than five decades, making it a Dividend King. The company is investing heavily in its business in order to navigate through the changing landscape in the retail sector. The payout is now 47% of earnings for this year,

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

Dividend Aristocrat #6: Archer Daniels Midland (ADM)

- 5-year Expected Annual Returns: 11.0%

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. Archer-Daniels-Midland’s businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter results for Fiscal Year (FY) 2024 on November 18th, 2024. The company reported adjusted net earnings of $530 million and adjusted EPS of $1.09, both down from the prior year due to a $461 million non-cash charge related to its Wilmar equity investment.

Consolidated cash flows year-to-date reached $2.34 billion, reflecting strong operations despite market challenges.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

Dividend Aristocrat #5: Medtronic plc (MDT)

- 5-year Expected Annual Returns: 11.3%

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 90,000 employees.

Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. Medtronic has raised its dividend for 46 consecutive years.

In mid-November, Medtronic reported (11/19/24) results for the second quarter of fiscal 2025. Organic revenue grew 5% over the prior year’s quarter thanks to broad-based growth in all the four segments. Earnings-per-share grew 1%, from $1.25 to $1.26, and exceeded the analysts’ consensus by $0.01.

As Medtronic performed slightly better than expected in the second quarter, it marginally raised its guidance for fiscal 2025. It expects 4.75%-5.0% organic revenue growth and raised its guidance for earnings-per-share from $5.42-$5.50 to $5.44-$5.50.

Click here to download our most recent Sure Analysis report on MDT (preview of page 1 of 3 shown below):

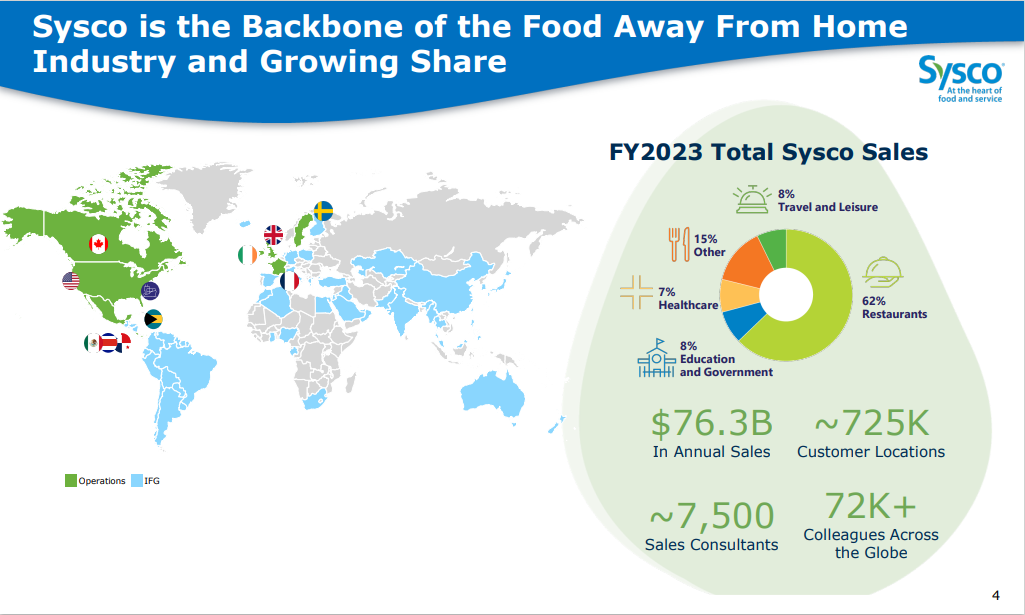

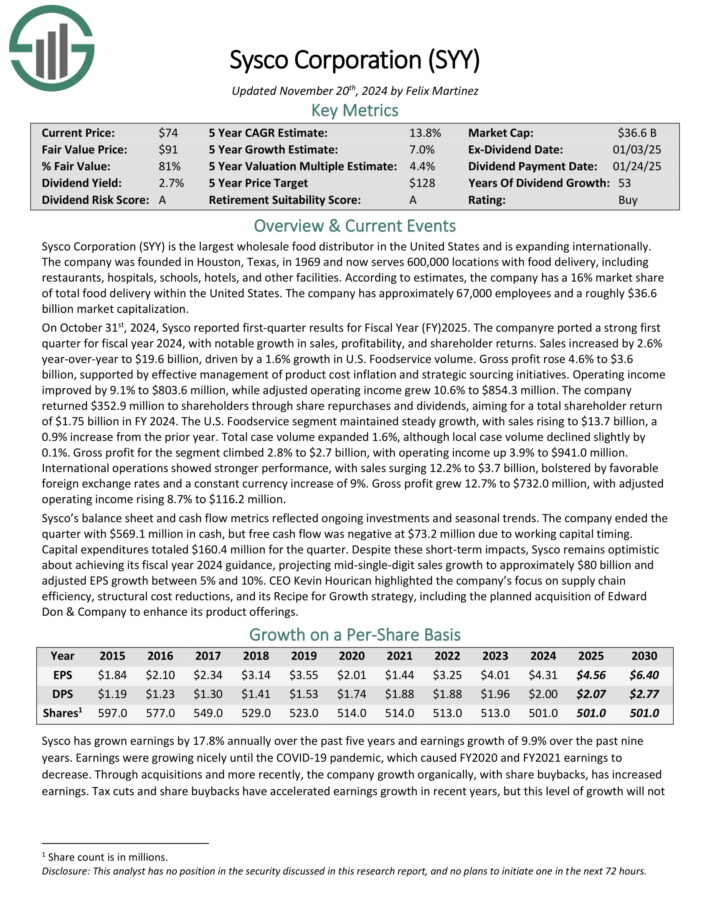

Dividend Aristocrat #4: Sysco Corporation (SYY)

- 5-year Expected Annual Returns: 12.7%

Sysco Corporation is the largest wholesale food distributor in the United States. The company serves 600,000 locations with food delivery, including restaurants, hospitals, schools, hotels, and other facilities.

Source: Investor Presentation

On October 31st, 2024, Sysco reported first-quarter results for Fiscal Year (FY) 2025. Quarterly sales increased by 2.6% year-over-year to $19.6 billion, driven by a 1.6% growth in U.S. Foodservice volume.

Gross profit rose 4.6% to $3.6 billion, supported by effective management of product cost inflation and strategic sourcing initiatives.

Operating income improved by 9.1% to $803.6 million, while adjusted operating income grew 10.6% to $854.3 million.

The company returned $352.9 million to shareholders through share repurchases and dividends, aiming for a total shareholder return of $1.75 billion in FY 2024.

Click here to download our most recent Sure Analysis report on SYY (preview of page 1 of 3 shown below):

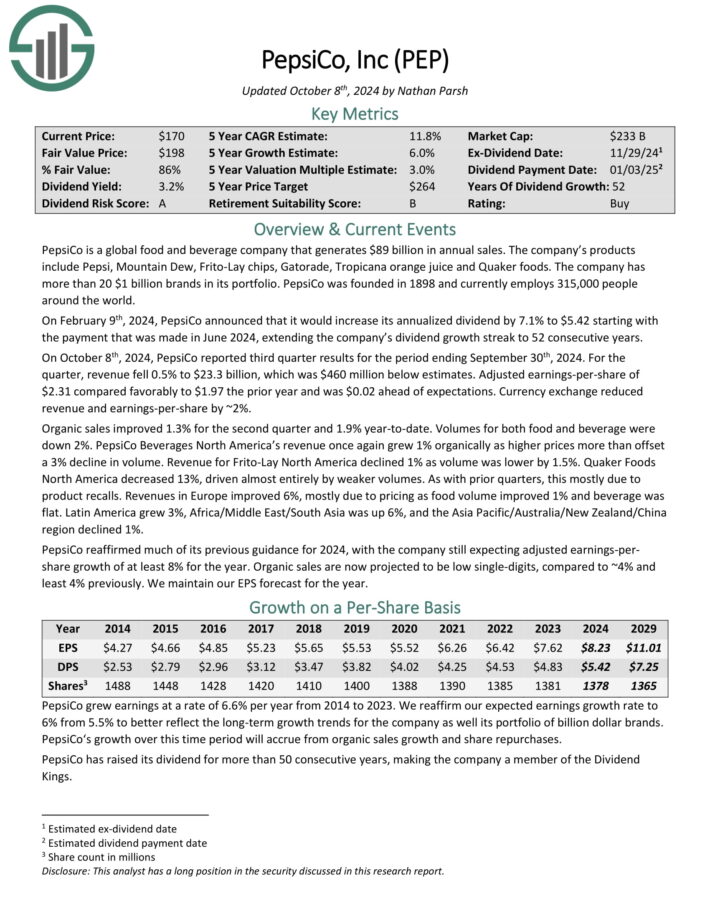

Dividend Aristocrat #3: PepsiCo Inc. (PEP)

- 5-year Expected Annual Returns: 12.7%

PepsiCo is a global food and beverage company that generates $89 billion in annual sales. The company’s products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On October 8th, 2024, PepsiCo reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 0.5% to $23.3 billion, which was $460 million below estimates.

Adjusted earnings-per-share of $2.31 compared favorably to $1.97 the prior year and was $0.02 ahead of expectations. Currency exchange reduced revenue and earnings-per-share by ~2%.

Organic sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for both food and beverage were down 2%.

PepsiCo Beverages North America’s revenue once again grew 1% organically as higher prices more than offset a 3% decline in volume.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

Dividend Aristocrat #2: Becton, Dickinson & Co. (BDX)

- 5-year Expected Annual Returns: 14.0%

Becton, Dickinson & Co., or BD, is a global leader in the medical supply industry. The company was founded in 1897 and has 75,000 employees across 190 countries.

The company generates about $20 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S.

BDX reported results for the fourth quarter and fiscal year 2024, which ended September 30th, 2024. For the quarter, revenue grew 6.9% to $5.44 billion, which was $57 million more than expected.

On a currency neutral basis, revenue improved 7.4%. Adjusted earnings-per-share of $3.81 compared favorably to $3.42in the prior year and was $0.04 ahead of estimates.

For the fiscal year, revenue grew 4.2% to $20.2 billion while adjusted earnings-per-share of $13.14 compared to $12.21 in the prior year.

Click here to download our most recent Sure Analysis report on BDX (preview of page 1 of 3 shown below):

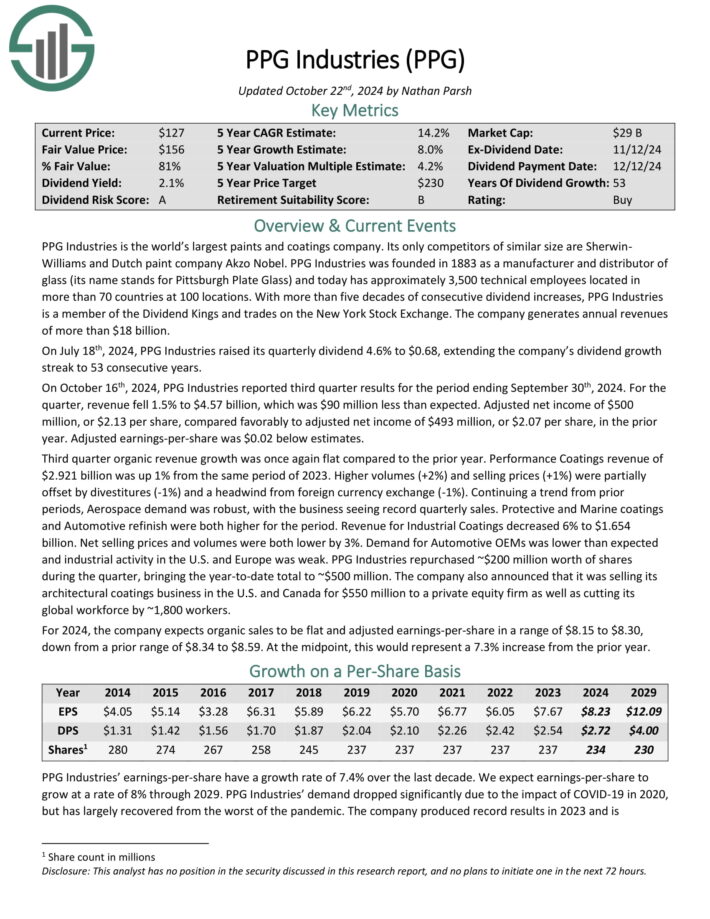

Dividend Aristocrat #1: PPG Industries (PPG)

- 5-year Expected Annual Returns: 14.7%

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

On October 16th, 2024, PPG Industries reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 1.5% to $4.57 billion, which was $90 million less than expected.

The company generates annual revenue of about $18.2 billion.

Source: Investor Presentation

Adjusted net income of $500 million, or $2.13 per share, compared favorably to adjusted net income of $493 million, or $2.07 per share, in the prior year. Adjusted earnings-per-share was $0.02 below estimates.

Third quarter organic revenue growth was once again flat compared to the prior year. Performance Coatings revenue of $2.921 billion was up 1% from the same period of 2023. Higher volumes (+2%) and selling prices (+1%) were partially offset by divestitures (-1%) and a headwind from foreign currency exchange (-1%).

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

The Dividend Aristocrats In Focus Analysis Series

You can see analysis on every single Dividend Aristocrat below. Each is sorted by GICS sectors and listed in alphabetical order by name. The newest Sure Analysis Research Database report for each security is included as well.

Consumer Staples

- Archer-Daniels-Midland (ADM) | [See newest Sure Analysis report]

- Amcor (AMCR) | [See newest Sure Analysis report]

- Brown-Forman (BF-B) | [See newest Sure Analysis report]

- Colgate-Palmolive (CL) | [See newest Sure Analysis report]

- Church & Dwight (CHD) | [See newest Sure Analysis report]

- Clorox (CLX) | [See newest Sure Analysis report]

- Coca-Cola (KO) | [See newest Sure Analysis report]

- Hormel Foods (HRL) | [See newest Sure Analysis report]

- J.M. Smucker (SJM) | [See newest Sure Analysis report]

- Kimberly-Clark (KMB) | [See newest Sure Analysis report]

- McCormick & Company (MKC) | [See newest Sure Analysis report]

- PepsiCo (PEP) | [See newest Sure Analysis report]

- Procter & Gamble (PG) [See newest Sure Analysis report]

- Sysco Corporation (SYY) [See newest Sure Analysis report]

- Walmart (WMT) | [See newest Sure Analysis report]

Industrials

- Automatic Data Processing (ADP) | [See newest Sure Analysis report]

- A.O. Smith (AOS) | [See newest Sure Analysis report]

- C.H. Robinson Worldwide (CHRW) | [See newest Sure Analysis report]

- Cintas (CTAS) | [See newest Sure Analysis report]

- Dover (DOV) | [See newest Sure Analysis report]

- Emerson Electric (EMR) | [See newest Sure Analysis report]

- Expeditors International (EXPD) | [See newest Sure Analysis report]

- Fastenal Co. (FAST) | [See newest Sure Analysis report]

- Illinois Tool Works (ITW) | [See newest Sure Analysis report]

- Nordson Corporation (NDSN) | [See newest Sure Analysis report]

- Pentair (PNR) | [See newest Sure Analysis report]

- Roper Technologies (ROP) | [See newest Sure Analysis report]

- Stanley Black & Decker (SWK) | [See newest Sure Analysis report]

- W.W. Grainger (GWW) | [See newest Sure Analysis report]

- General Dynamics (GD) | [See newest Sure Analysis report]

- Caterpillar (CAT) | [See newest Sure Analysis report]

Health Care

- Abbott Laboratories (ABT) | [See newest Sure Analysis report]

- AbbVie (ABBV) | [See newest Sure Analysis report]

- Becton, Dickinson & Company (BDX) | [See newest Sure Analysis report]

- Cardinal Health (CAH) | [See newest Sure Analysis report]

- Johnson & Johnson (JNJ) | [See newest Sure Analysis report]

- Kenvue Inc. (KVUE) | [See newest Sure Analysis report]

- Medtronic (MDT) | [See newest Sure Analysis report]

- West Pharmaceutical Services (WST) | [See newest Sure Analysis report]

Consumer Discretionary

- Genuine Parts Company (GPC) | [See newest Sure Analysis report]

- Lowe’s Companies (LOW) | [See newest Sure Analysis report]

- McDonald’s (MCD) | [See newest Sure Analysis report]

- Target (TGT) | [See newest Sure Analysis report]

Financials

- Aflac (AFL) | [See newest Sure Analysis report]

- Brown & Brown (BRO) | [See newest Sure Analysis report]

- Cincinnati Financial (CINF) | [See newest Sure Analysis report]

- Franklin Resources (BEN) | [See newest Sure Analysis report]

- S&P Global (SPGI) | [See newest Sure Analysis report]

- T. Rowe Price Group (TROW) | [See newest Sure Analysis report]

- Chubb (CB) | [See newest Sure Analysis report]

Materials

- Air Products and Chemicals (APD) | [See newest Sure Analysis report]

- Albemarle (ALB) | [See newest Sure Analysis report]

- Ecolab (ECL) | [See newest Sure Analysis report]

- PPG Industries (PPG) | [See newest Sure Analysis report]

- Sherwin-Williams (SHW) | [See newest Sure Analysis report]

- Nucor (NUE) | [See newest Sure Analysis report]

- Linde (LIN) | [See newest Sure Analysis report]

Energy

- Chevron (CVX) | [See newest Sure Analysis report]

- Exxon Mobil (XOM) | [See newest Sure Analysis report]

Information Technology

Real Estate

- Essex Property Trust (ESS) | [See newest Sure Analysis report]

- Federal Realty Investment Trust (FRT) | [See newest Sure Analysis report]

- Realty Income (O) | [See newest Sure Analysis report]

Utilities

- Atmos Energy (ATO) | [See newest Sure Analysis report]

- Consolidated Edison (ED) | [See newest Sure Analysis report]

- NextEra Energy (NEE) | [See newest Sure Analysis report]

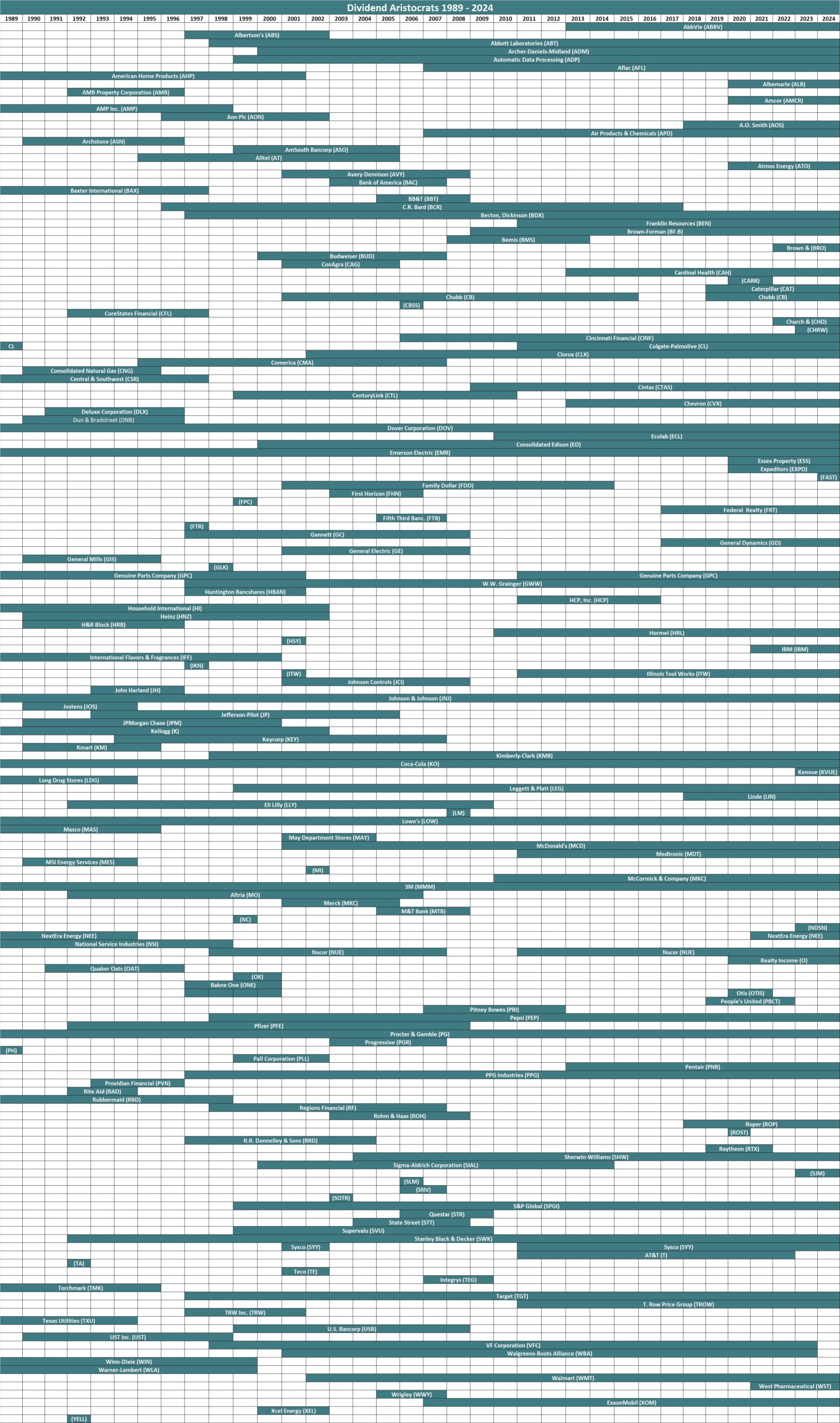

Historical Dividend Aristocrats List

(1989 – 2024)

The image below shows the history of the Dividend Aristocrats Index from 1989 through 2023:

Note: CL, GPC, and NUE were all removed and re-added to the Dividend Aristocrats Index through the historical period analyzed above. We are unsure as to why. Companies created via a spin-off (like AbbVie) can be Dividend Aristocrats with less than 25 years of rising dividends if the parent company was a Dividend Aristocrat.

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet and image below is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

[memberful_if_does_not_have_active_subscription] [/memberful_if_does_not_have_active_subscription] [memberful_if_has_active_subscription] [/memberful_if_has_active_subscription]This information was compiled from the following sources:

- 1989 – 1991: Dividend Growth Investor

- 1992 – 2015: NOBL Index Historical Constituents

- 2016: Sure Dividend update

- 2017 – 2024: Data from S&P press releases

Frequently Asked Questions

This section will address some of most common questions investors have regarding the Dividend Aristocrats.

1. What is the highest-paying Dividend Aristocrat?

Answer: Franklin Resources (BEN) currently yields 6.0%.

2. What is the difference between the Dividend Aristocrats and the Dividend Kings?

Answer: The Dividend Aristocrats must be constituents of the S&P 500 Index, have raised their dividends for at least 25 consecutive years, and satisfy a number of liquidity requirements.

The Dividend Kings only need to have raised their dividends for at least 50 consecutive years.

3. Is there an ETF that tracks the Dividend Aristocrats?

Answer: Yes, the Dividend Aristocrats ETF (NOBL) is an exchange-traded fund that specifically holds the Dividend Aristocrats.

4. What is the difference between the Dividend Aristocrats and the Dividend Champions?

Answer: The Dividend Aristocrats and Dividend Champions share one requirement, which is that a company must have raised its dividend for at least 25 consecutive years.

But like the Dividend Kings, the Dividend Champions do not need to be in the S&P 500 Index, nor satisfy the various liquidity requirements.

5. Which Dividend Aristocrat has the longest active streak of annual dividend increases?

Currently, there are 3 Dividend Aristocrats tied at 67 years: Procter & Gamble, Genuine Parts, and Dover Corporation.

6. What is the average dividend yield of the Dividend Aristocrats?

Right now, the average dividend yield of the Dividend Aristocrats is 2.0%.

7. Are the Dividend Aristocrats safe investments?

While there are never any guarantees when it comes to the stock market, we believe the Dividend Aristocrats are among the safest dividend stocks when it comes to the sustainability of their dividend payouts.

The Dividend Aristocrats have durable competitive advantages that allow them to raise their dividends each year, even during a recession.

Other Dividend Lists & Final Thoughts

The Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

There is nothing magical about the Dividend Aristocrats. They are ‘just’ a collection of high-quality shareholder friendly stocks that have strong competitive advantages.

Purchasing these types of stocks at fair or better prices and holding for the long-run will likely result in favorable long-term performance.