Updated on April 26th, 2024 by Bob Ciura

Each year, we review all of the Dividend Aristocrats. Attaining membership to this group is difficult: companies must be of a certain size, belong to the S&P 500 Index, and (most importantly) have at least 25 consecutive years of dividend growth.

There are just 68 Dividend Aristocrats, proving the exclusivity of the list.

You can download an Excel spreadsheet of all 68 Dividend Aristocrats, including important financial metrics such as P/E ratios and dividend yields, by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Albemarle Corporation (ALB) joined this exclusive list in 2020. The company is reaping strong growth from continued demand for lithium. It is poised to continue growing for many years, as demand for lithium is only set to rise in the years ahead.

This article will review the investment prospects of Albemarle.

Business Overview

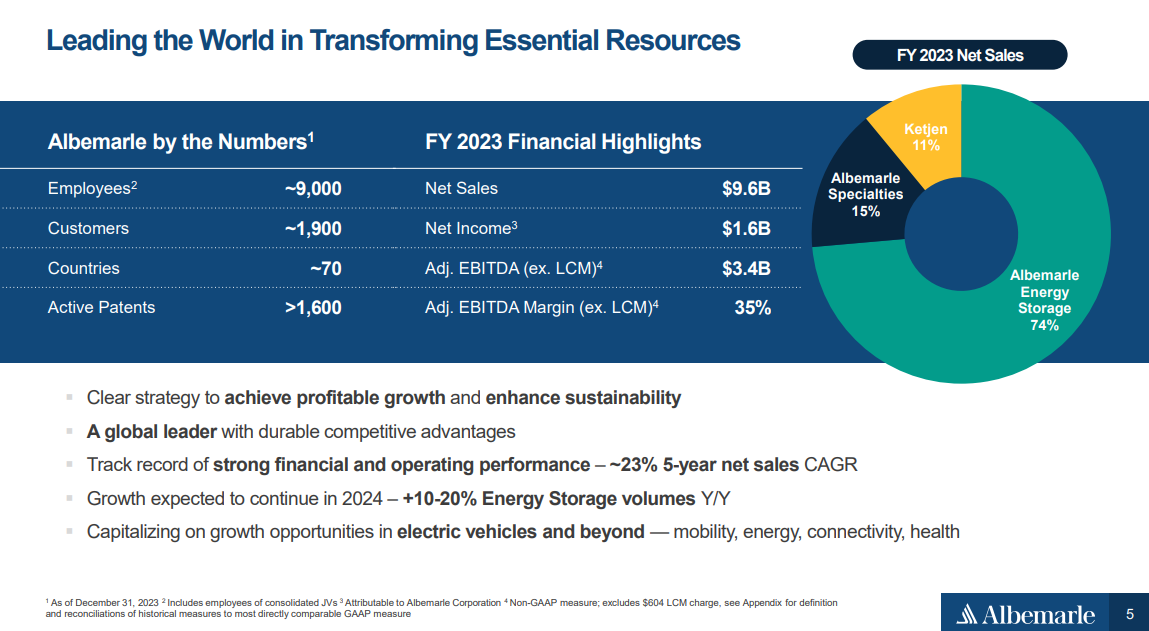

Albemarle is the largest producer of lithium and second-largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile.

The company has two joint ventures in Australia that also produce lithium. Albemarle’s Chile assets offer a very low-cost source of lithium. The company operates in nearly 100 countries.

Beginning January 1st, 2023, the company reorganized into the following segments: Energy Storage, Specialties, and Ketjen.

Albemarle produces annual sales approaching $10 billion.

Source: Investor Presentation

On February 14th, 2024, Albemarle announced fourth-quarter and full-year 2023 results. For the quarter, revenue declined 9.9% to $2.36 billion, but beat estimates by $180 million. Adjusted earnings-per-share of $1.85 compared very unfavorably to $9.60 in the prior year, but was $0.74 above expectations.

For the year, revenue grew 31% to a new record $9.6 billion while adjusted earnings-per-share of $22.25 compared to $22.84 in 2022. Results were once again negatively impacted by lower prices for lithium. For the quarter, revenue for Energy Storage decreased 15.4% to $1.68 billion. Volume growth of 35% was offset by lower prices.

Revenues for Specialties were lower by 16.1% to $339.6 million as volumes decreased 2% and realized prices declined 15%. Ketjen sales of $260.7 million were a 45% improvement from the prior year as volume increase 37% and pricing added 7%.

Albemarle provided an outlook for 2024 as well, with the company expecting revenue in a range of $5.5 billion to $6.2 billion. The decline in revenue will be due to lower prices for lithium.

Growth Prospects

A major reason that results are expected to be well above prior numbers is that Albemarle stands to benefit from the increased sales of electric vehicles, as the company’s lithium is used to provide the batteries.

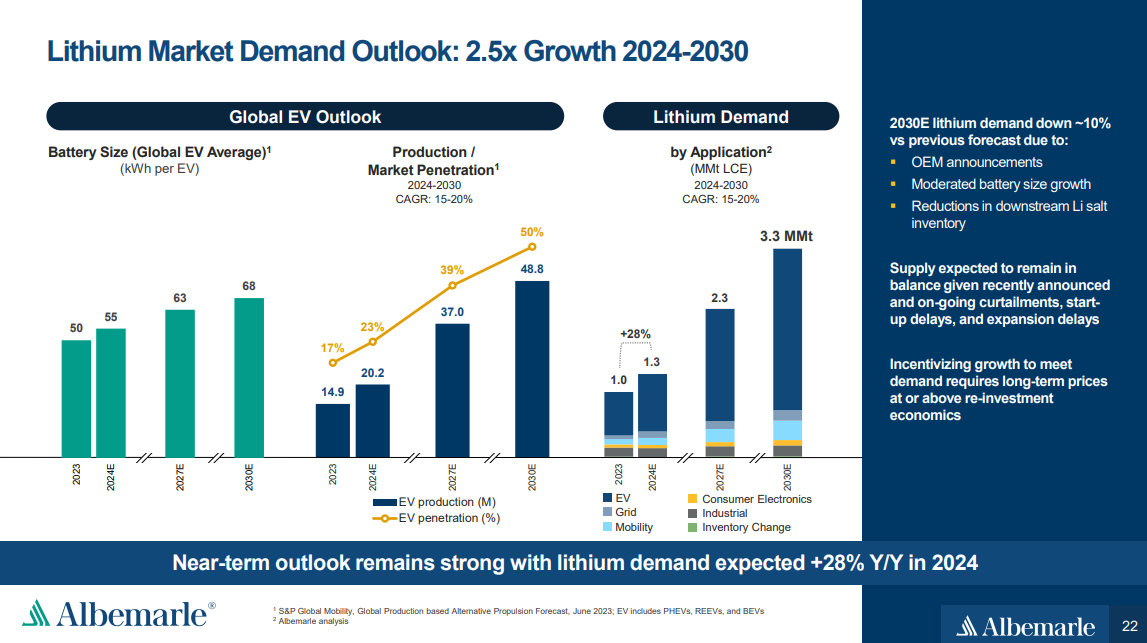

Lithium is expected to be a growth segment over the next five years due to increasing demand for a wide range of applications, including electric vehicles and consumer electronics.

Source: Investor Presentation

Energy storage is expected to spike in the coming years as more consumers purchase electric vehicles. Electric vehicles are projected to account for 22.0% of all new car sales by 2025, up from just 4.6% in 2020. Battery size is also expected to grow.

With this growth will come a significant increase in demand for lithium.

We believe that the company can grow earnings-per-share at a rate of 7.5% annually for the next five years due to its leadership positions in the areas of lithium and bromine.

Competitive Advantages & Recession Performance

Despite being among global leaders in multiple businesses, Albemarle isn’t content to rest on its previous success. The company has been active in acquiring businesses that strengthen its market share.

Albemarle is not a recession-proof company. Listed below are the company’s earnings-per-share during and after the last recession:

- 2007 earnings-per-share of $2.41

- 2008 earnings-per-share of $2.40 (0.4% decrease)

- 2009 earnings-per-share of $1.94 (19% increase)

- 2010 earnings-per-share of $3.51 (45% increase)

The specialty chemical business is heavily reliant on demand from customers. Lower demand results in lower pricing, which negatively impacts Albemarle’s performance. It is likely that the company would face a similar type of slowdown during the next recession.

That said, the company has durable competitive advantages. A key competitive advantage is that it ranks as the largest producer of lithium in the world. The metal is used in batteries for electric cars, pharmaceuticals, airplanes, mining, and other applications.

Albemarle is also a top producer of Bromine, which is used in the electronics, construction, and automotive industries. The company possesses a size and scale that others cannot match.

Investors interested in investing in Albemarle should understand that ownership of the stock comes with risks due to the volatile nature of its industry.

Valuation & Expected Returns

Using our expected earnings-per-share of $5.55 for the year, ALB shares have a price-to-earnings ratio of 21.1. Over the last decade, Albemarle has traded with an average price-to-earnings ratio of 23.

We have lowered our multiple target to 18x earnings, to account for the volatility of lithium prices. If the stock were to trade with this target by 2029, then valuation would be a 3.0% tailwind to annual returns over this time period.

In addition, the dividend yield of 1.4% will add to shareholder returns. The dividend payout is very well-covered, as the projected payout ratio for the year is just 29%.

The company has been successful at prudently managing its dividend, given the nature of its business. Albemarle has raised its dividend for 28 consecutive years.

EPS growth will be another driver of returns. We expect 7.5% annual EPS growth for ALB in the next five years.

Therefore, we project that Albemarle will provide a total annual return of 5.9% over the next five years, stemming from 7.5% earnings growth, a starting yield of 1.4%, and a 3% annual decline from a contracting valuation multiple.

Final Thoughts

Reaching Dividend Aristocrat status is no small feat. Albemarle is the dominant player in the lithium industry, and has taken steps to further improve its competitive position.

The company benefits from low-cost mines and its leadership position in multiple categories.

Albemarle is far from recession-proof and has experienced some earnings declines over the last decade, but this makes the company’s dividend growth track record even more impressive.

While the company can experience volatility, we rate shares of Albemarle as a hold.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: