Updated on December 4th, 2024 by Bob Ciura

There are many was to measure the quality of a dividend stock. One way is the length of a company’s dividend history.

In general, stocks that have raised their dividends for multiple years in a row have demonstrated that they are committed to rewarding investors with steadily rising dividends.

One lesser-known group of dividend growth stocks is the list of Dividend Challengers, which have raised their dividends for 5-9 years in a row.

While 5 years is not the longest history of dividend growth, it does demonstrate a history of returning cash to shareholders with dividends.

It also represents a company with a profitable business model, durable competitive advantages, and a positive growth outlook.

With this in mind, we created a downloadable list of 189 Dividend Challengers.

You can download your free copy of the Dividend Challengers list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 66 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

Dividend growth investors should also familiarize themselves with the Dividend Challengers, which could be Dividend Aristocrats in the making.

This article will discuss an overview of Dividend Challengers, and why investors should consider quality dividend growth stocks.

Additional information regarding dividend stocks in our coverage universe can be found in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

- Overview of Dividend Challengers

- Example Of A Dividend Challenger: Equinix Inc. (EQIX)

- Final Thoughts

Overview of Dividend Challengers

The requirement to become a Dividend Challenger is simple: 5-9 consecutive years of dividend growth.

This is not exactly a high hurdle to clear, but it does separate dividend growth stocks from the companies that have held their dividends steady for many years.

Companies that do not raise their dividends each year are often unable to do so because the underlying business is struggling.

While there are no proven precursors to a dividend cut, one potential red flag is when a stock freezes its dividend, particularly if that stock had previously held a long track record of hiking its dividend payout each year.

When business conditions deteriorate, companies often see their revenue and earnings-per-share decline. This could happen for a number of reasons, including a recession, escalating competition, or perhaps an unexpected event such as a geopolitical conflict or natural disaster.

In any event, a company with falling revenue and earnings-per-share will likely not be able to raise its dividend.

Depending on how things go from there, the company in question might be able to return to dividend growth if its fundamentals improve.

On the other hand, if conditions worsen, the next step could be a dividend cut or suspension. A dividend freeze might be the first step in this process.

For this reason, investors should pay attention if a dividend growth stock goes longer than a year without raising its payout.

Example Of A Dividend Challenger: Constellation Brands (STZ)

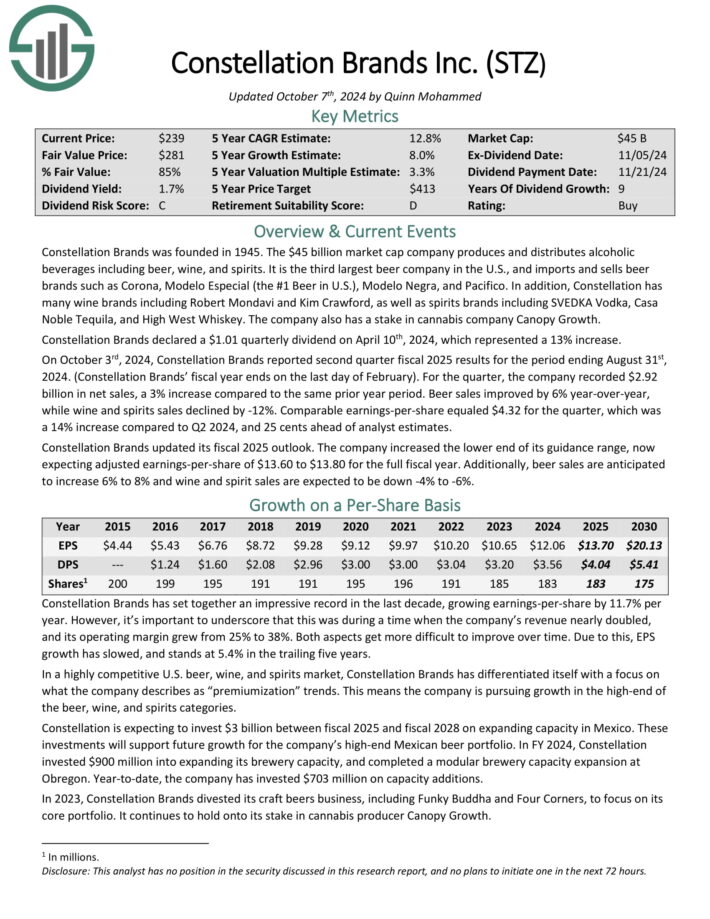

Constellation Brands was founded in 1945, and today, it produces and distributes beer, wine, and spirits. It has over 100 brands in its portfolio, including beer brands such as Corona.

In addition, Constellation’s wine brands include Robert Mondavi and Clos du Bois. Its liquor brands include SVEDKA Vodka, Casa Noble Tequila, and High West Whiskey.

One of the biggest reasons for Constellation Brands’ impressive growth in recent years, is its focus on the premium segment, which continues to grow.

On October 3rd, 2024, Constellation Brands reported second quarter fiscal 2025 results for the period ending August 31st, 2024. (Constellation Brands’ fiscal year ends on the last day of February).

Source: Investor Presentation

For the quarter, the company recorded $2.92 billion in net sales, a 3% increase compared to the same prior year period.

Beer sales improved by 6% year-over-year, while wine and spirits sales declined by -12%. Comparable earnings-per share equaled $4.32 for the quarter, which was a 14% increase compared to Q2 2024, and 25 cents ahead of analyst estimates.

Click here to download our most recent Sure Analysis report on STZ (preview of page 1 of 3 shown below):

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend stocks.

In order for a company to raise its dividend for at least 5 years, it must have durable competitive advantages, recession resistance, and a management team that is dedicated to increasing dividends.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Aristocrats List: a group of elite S&P 500 stocks with 25+ years of consecutive dividend increases.

- The Dividend Achievers List is comprised of ~400 NASDAQ stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The High Yield Monthly Dividend Stocks List: the 20 monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: