Updated on April 17th, 2024 by Bob Ciura

The Dividend Aristocrats are some of the best dividend stocks an investor will find. These are companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

We believe the Dividend Aristocrats are among the highest-quality dividend growth stocks around. For this reason, we created a downloadable spreadsheet of all 68 Dividend Aristocrats, along with important metrics such as price-to-earnings ratios and dividend yields.

You can download the Excel sheet of all 68 Dividend Aristocrats by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Each year, we review all of the Dividend Aristocrats. The next stock in the series is an insurance broker giant, Brown & Brown Inc. (BRO). BRO might not be a familiar stock for most investors, but it has certainly earned its place on the list.

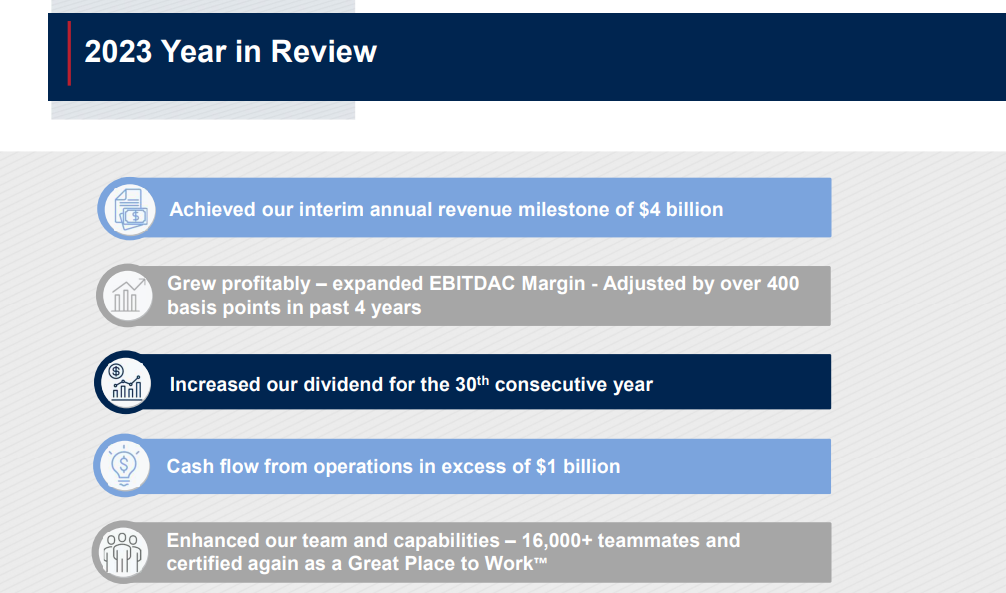

BRO has now increased its dividend for 30 consecutive years. This article will discuss the company’s business model, growth outlook, and whether we view it as a buy today.

Business Overview

Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.

The company employs about 14,500 people and generated about $3.6 billion in revenue last year. It operates through four segments: Retail, National Programs, Wholesale Brokerage, and Services.

The company has been diversifying its business segment throughout the years. Doing this allows the company to not be 100% dependent on one business segment. Thus, these segments have performed very well against their peers and have allowed BRO to achieve “best of breed” status in its industry.

Brown & Brown’s competitive advantage comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition strategy gives the company an enduring opportunity to continue growing its business for the foreseeable future.

Growth Prospects

Brown & Brown has a remarkable growth track record that includes a decade-long compound annual earnings growth rate of more than 14%. The company’s book value per common share has grown at a similar rate, expanding at ~11% per year over the last ten years.

The growth strategy is both simple and sustainable. Over the years, the company has actively acquired smaller insurance brokerage firms and integrated them into its larger operating base.

Brown & Brown posted fourth-quarter and full-year financial results on January 22nd, 2024, and results were quite strong once again. The company beat earnings-per-share by $0.05, coming in at $0.58 per share.

Revenue soared 14% higher year-over-year to $1.03 billion, and beat expectations by $45 million. Commissions and fees rose by 12.4% year-over-year, while organic revenue was up 7.7%, which excludes the impact of acquisitions and divestitures.

Income before taxes came to $355 million, up 83% year-over-year. Income before taxes margins rose to 34.6% from 21.5%. On an adjusted basis, operating income was $318 million, up 12% year-over-year. Adjusted operating margin fell slightly from 31.4% of revenue to 31.0%.

Source: Investor Presentation

We start 2024 with a strong growth estimate of $3.10 in earnings-per-share, as the company continues to see robust revenue growth that is also driving expanding margins.

We also expect BRO to generate 9% annual earnings-per-share growth over the next five years.

Competitive Advantages & Recession Performance

Brown & Brown’s competitive advantage comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition strategy gives the company an enduring opportunity to continue growing its business for the foreseeable future.

BRO is also modestly recession-resistant. For example, BRO’s competitive advantages allow it to maintain consistent profitability each year, even during recessions.

BRO’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $0.68

- 2008 earnings-per-share of $0.59 (13% decline)

- 2009 earnings-per-share of $0.54 (8% decline)

- 2010 earnings-per-share of $0.56 (4% increase)

Further, during the COVID-19 pandemic, earnings grew from $1.40 per share in 2019 to $1.67 per share in 2020. This represents an increase of 19% year-over-year.

Valuation & Expected Returns

Based on our expected EPS of $3.10 for 2024, BRO stock trades for a price-to-earnings ratio of 26.1, using today’s stock price of ~$81. BRO held an average price-to-earnings ratio of 23 over the past 10 years.

Today’s multiple is modestly above our fair P/E of 24, implying shares appear somewhat overvalued at their current price levels.

If the stock experiences a decline in the valuation multiple to our fair P/E of 24.0, annual shareholder returns would be reduced by 1.7% annually over the next five years.

Fortunately, earnings growth and dividends will positively impact future returns. First, we expect the company to grow earnings-per-share by 9% per year through 2029.

The stock also has a dividend yield of 0.6%. Putting it all together, a breakdown of our expected future returns is as follows:

- 9.0% expected earnings-per-share growth

- 0.6% dividend yield

- -1.7% multiple contraction

In this projection, total annualized shareholder returns could reach 7.9% through 2029. This is a satisfactory expected rate of return for this company, but one that is limited by the stock’s high valuation.

Final Thoughts

BRO has endured a number of challenges over the past decade, including the Great Recession of 2008-2009 and the coronavirus pandemic of 2020. And yet, it continued to raise its dividend each year. Very few companies have this ability, which makes this company a rare dividend growth stock.

BRO has a leadership position in its insurance industry and durable competitive advantages. These factors have the company positioned for growth in future years, making it highly likely that the company will continue to increase its dividend.

The company is a high-quality business and a dividend growth company, and while the stock is not necessarily overvalued, its rich multiple averts it from earning a buy rating from Sure Dividend at this time. Accordingly, we have assigned the stock a hold rating at its current price.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: