Updated on March 25h, 2024 by Bob Ciura

Every year, Sure Dividend reviews the Dividend Aristocrats, which we consider to be some of the best stocks for investors seeking to build long-term wealth.

Companies who have attained Dividend Aristocrat status have met the following criteria:

- Are a member of the S&P 500 index.

- Have at least 25 consecutive years of dividend increases.

- Meet certain size and liquidity requirements.

Membership in this group is very exclusive, as there are just 68 stocks on the Dividend Aristocrats list.

We have compiled a list of all 68 Dividend Aristocrats, along with important financial metrics such as price-to-earnings ratios and dividend yields. You can download the full list by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

NextEra Energy, Inc. (NEE) is a Dividend Aristocrat since 2021 when it managed to hit the 25-year dividend growth goal. It has since continued to increase its dividend each year since.

This article will discuss NextEra Energy’s business model, growth prospects, and valuation to determine whether it is an attractive stock for income investors right now.

Business Overview

With a market capitalization of ~$130 billion, NextEra Energy has grown into one of the largest utility companies in the world since its founding in 1925.

While the company has nuclear power plants in Iowa, New Hampshire, and Wisconsin, it is in Florida where it has the vast majority of its business. The company consists of three operating segments: Florida Power & Light, NextEra Energy Resources, and Gulf Power. The Florida Power & Light and Gulf Power segments are rate-regulated electric utilities that serves about 5.8 million customer accounts in Florida.

NEE generates roughly 80% of its revenues from FPL. NextEra Energy is one of the largest generators of wind and solar energy in the world.

NextEra Energy reported its Q4 and full-year 2023 financial results on 01/25/24. The utility continues to deliver stable results, but the stock valuation has come down. For the quarter, the company reported revenues of $6.9 billion (up 11.6% year over year), translating to adjusted earnings of $1.1 billion (up 5.5% year over year). On a per-share basis, adjusted earnings climbed 2% to $0.52.

For the full year, the company generated revenues of $28.1 billion (up 34%) and adjusted earnings of $6.4 billion (up 12% year over year). Adjusted earnings per share were $3.17 (up 9.3%), exceeding the top end — $3.13 — of management’s estimate.

Particularly, FPL added about 1,200 MW of cost-effective rate base solar projects, while NEER added 9,000 MW worth of new renewables and storage projects, bringing its backlog to over 20 GW.

Growth Prospects

NextEra Energy benefits from several key factors that should enable the company to continue to grow. Its utility business is well-positioned to capture new customers as it resides in one of the largest states in the country.

Florida’s population also continues to grow, which should provide the company with the potential to increase its customer count, which should benefit its revenue growth in the future.

NextEra is also located in a state that is very constructive in its regulation of utilities. This allows the company to recover its investments in new projects quickly.

For example, Florida Power & Light, along with Gulf Power, notified regulators that it would seek annual base rate increases of more than $600 million in 2023, with further base rate increases being seen in 2024 and beyond.

The company’s enormous customer base allows it to make massive investments without resulting in extremely high base rate increases.

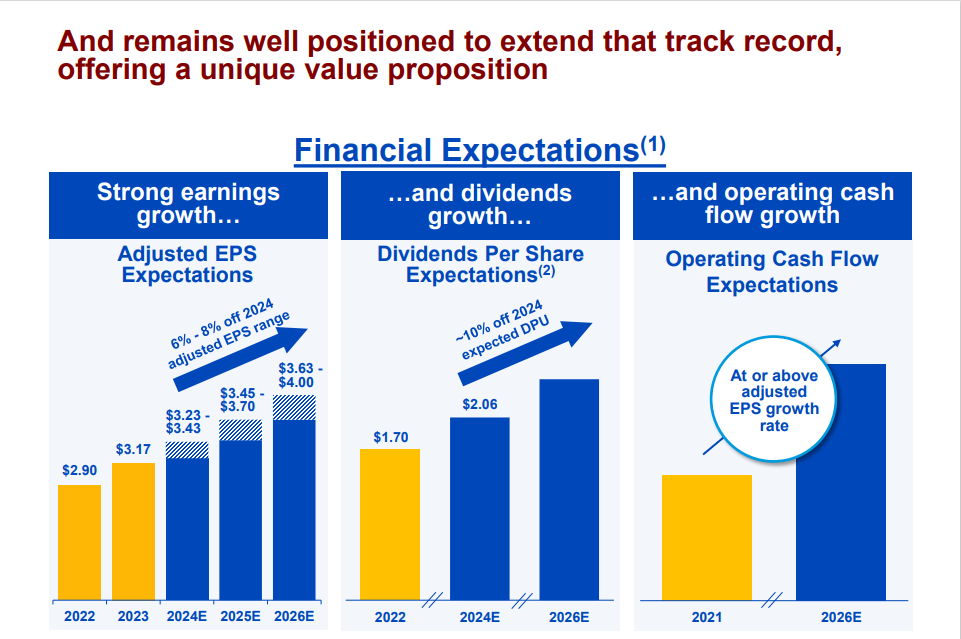

Overall, NEE sees strong growth up ahead.

Source: Investor Presentation

But what really sets NextEra Energy apart from most of its peers is the company’s renewable energy business. This business is growing at a much faster pace than the company’s other segments.

NEER commissioned ~5.6 GW of renewable and storage projects in 2023. At the end of 2023, its backlog stood

at ~20 GW. The company will bring a large portion of that online over the next two to three years, and investors can expect further investments in renewable energy assets in the long run.

NEE management initiated its 2024 adjusted EPS guidance range at $3.23-$3.43. We expect the company to grow its adjusted EPS by 7% per year over the next five years.

Competitive Advantages & Recession Performance

Size and scale are NextEra’s biggest competitive advantages. No other company in the world can claim a larger renewable energy business than NextEra. A very large (and growing) customer base is an additional advantage.

The company regularly expands its massive scale via acquisitions, such as its 2019 purchase of Gulf Power from Southern Company, for $6.5 billion. These acquisitions usually are immediately accretive for NextEra’s earnings-per-share, which creates significant value for shareholders, especially when additional synergies are captured over time.

Utility stocks are often viewed as reliable investments given the steadiness of their revenues and earnings. This makes these stocks especially attractive to investors in uncertain times.

NextEra Energy is no different and performed very well during the last recession. Listed below are the company’s earnings-per-share before, during, and after the last recession:

- 2006 earnings-per-share: $0.81

- 2007 earnings-per-share: $0.82 (1.2% increase)

- 2008 earnings-per-share: $1.02 (24.4% increase)

- 2009 earnings-per-share: $0.99 (2.9% decrease)

- 2010 earnings-per-share: $1.19 (20.2% increase)

NextEra Energy did suffer a slight drop in earnings-per-share in 2009, but overall, saw its bottom line grow quite a lot in the 2006-2010 time frame.

At the same time, the company’s dividend continued to grow each year.

Valuation & Expected Returns

Based on expected adjusted earnings-per-share for 2024 of $3.33, NEE stock has a price-to-earnings ratio of 18.7 at current prices. We think a multiple of about 21 is fair given the current higher interest rate environment.

Shareholders could see valuation changes increase the expected total returns by 2.3% per year through 2029 if the stock were to trade with our target price-to-earnings ratio.

Earnings growth and dividend yield will also contribute to total returns. We believe that the company’s extensive renewable portfolio, in addition to its growth prospects and competitive advantages, will allow NextEra to grow at a rate of 7% per year over the next five years.

Lastly, NEE stock currently yields 3.3%.

Annual returns will consist of the following:

- 7% earnings-per-share growth

- 3.3% dividend yield

- 2.3% P/E multiple expansion

In total, we expect that NextEra Energy will offer an annual return of 12.6% over the coming five years, which is attractive.

Final Thoughts

There are a high number of positives that investors should find in NextEra Energy. The company’s size, ability to thrive in recessionary times, and its long dividend history are just three items we find attractive about the company.

NextEra Energy is also located in a state that we believe to be very constructive for approving rate base increases. Florida’s population also continues to grow, which should provide additional customers.

The company also is adept at making solid additions to its core business through acquisitions. We expect that this will also be the case in future years as NextEra augments its organic growth with strategic additions.

Lastly, NextEra’s leadership position in the renewable energy space cannot be overstated. The company has a very large backlog that should provide for ample growth in the coming years.

With expected annual returns above 10%, NEE stock gets a buy rating.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List: considered to be the best-of-the-best among dividend growth stocks, the Dividend Kings are a group of exceptional dividend stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: contains stocks on either the Dividend Achievers, Dividend Aristocrats, or Dividend Kings list.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: