Updated on October 31st, 2024 by Bob Ciura

Spreadsheet data updated daily

Utility stocks can make excellent investments for long-term dividend growth investors.

Durable, regulatory-based competitive advantages allow these companies to consistently raise their rates over time. In turn, this allows them to raise their dividend payments year in and year out.

Even better, many utility stocks have above-average dividend yields, providing a compelling combination of income now and growth later for long-term investors.

Because of these favorable industry characteristics, we’ve compiled a list of utility stocks. The list is derived from the major utility sector exchange-traded funds JXI and XLU.

You can download the list of all utility stocks (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Keep reading this article to learn more about the benefits of investing in utility stocks.

Table Of Contents

The following table of contents provides for easy navigation:

- How To Use The Utility Stocks List

- Why Utility Dividend Stocks Make Attractive Investments

- The Top 10 Utility Stocks Now

- Top Utility Stock #10: National Grid plc (NGG)

- Top Utility Stock #9: Ameren Corp. (AEE)

- Top Utility Stock #8: RGC Resources (RGCO)

- Top Utility Stock #7: Artesian Resources Corp. (ARTNA)

- Top Utility Stock #6: Evergy Inc. (EVRG)

- Top Utility Stock #5: NorthWestern Energy Group (NWE)

- Top Utility Stock #4: Portland General Electric (POR)

- Top Utility Stock #3: SJW Group (SJW)

- Top Utility Stock #2: AES Corp. (AES)

- Top Utility Stock #1: Eversource Energy (ES)

How To Use The Utility Dividend Stocks List To Find Investment Ideas

Having an Excel database of all the dividend-paying utility stocks combined with important investing metrics and ratios is very useful.

This tool becomes even more powerful when combined with knowledge of how to use Microsoft Excel to find the best investment opportunities.

With that in mind, this section will provide a quick explanation of how you can instantly search for utility stocks with particular characteristics, using two screens as an example.

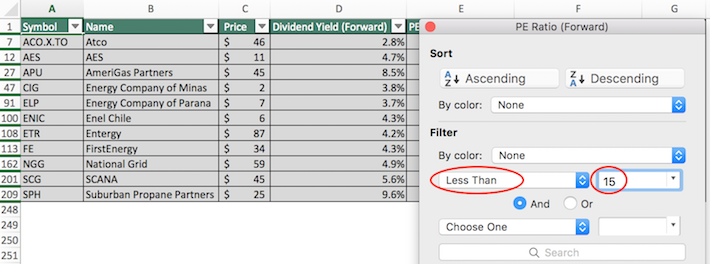

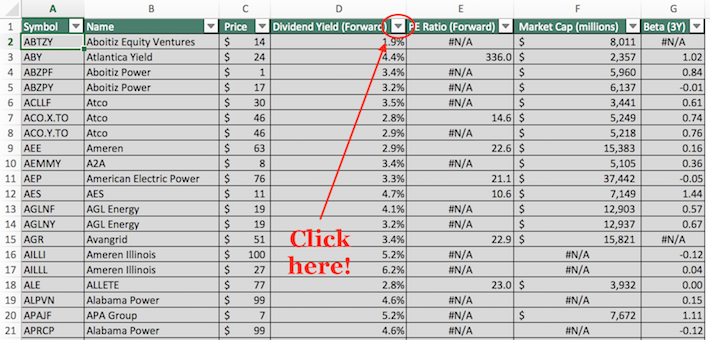

The first screen that we will implement is for utility stocks with price-to-earnings ratios below 15.

Screen 1: Low P/E Ratios

Step 1: Download the Utility Dividend Stocks Excel Spreadsheet List at the link above.

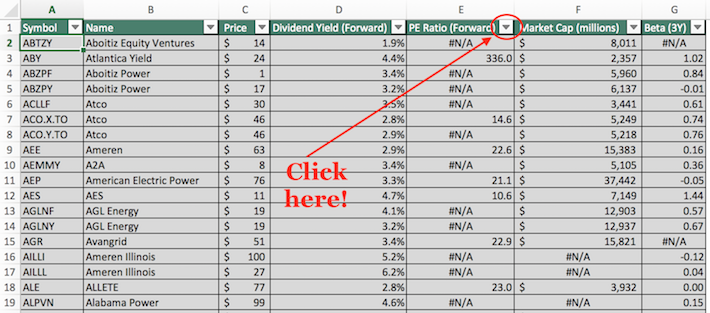

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter field to “Less Than” and input “15” into the field beside it.

The remaining list of stocks contains dividend-paying utility stocks with price-to-earnings ratios less than 15. As you can see, there are relatively few securities (at the time of this writing) that meet this strict valuation cutoff.

The next section demonstrates how to screen for large-cap stocks with high dividend yields.

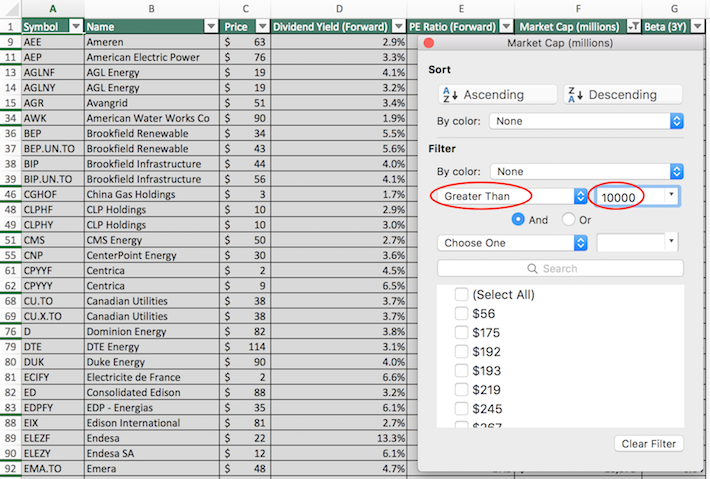

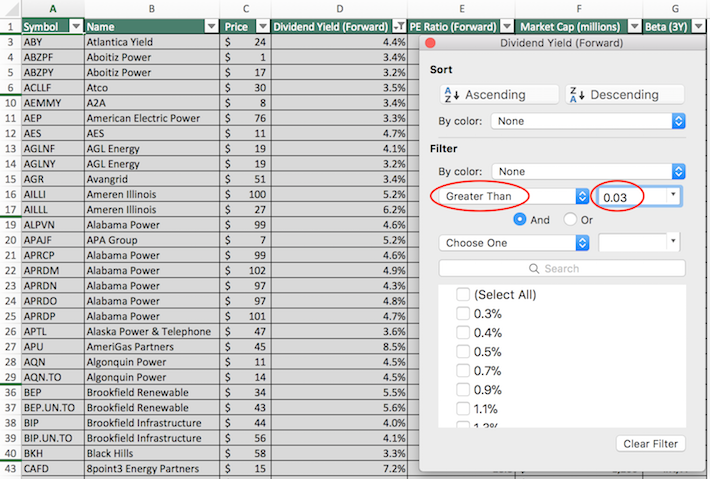

Screen 2: Large-Cap Stocks With High Dividend Yields

Businesses are often categorized based on their market capitalization. Market capitalization is calculated as stock price multiplied by the number of shares outstanding and gives a marked-to-market perception of what people think a business is worth on average.

Large-cap stocks are loosely defined as businesses with a market capitalization above $10 billion and are perceived as lower risk than their smaller counterparts. Accordingly, screening for large-cap stocks with high dividend yields could provide interesting investment opportunities for conservative, income-oriented investors.

Here’s how to use the Utility Dividend Stocks Excel Spreadsheet List to find such investment opportunities.

Step 1: Download the Utility Dividend Stocks Excel Spreadsheet List at the link above.

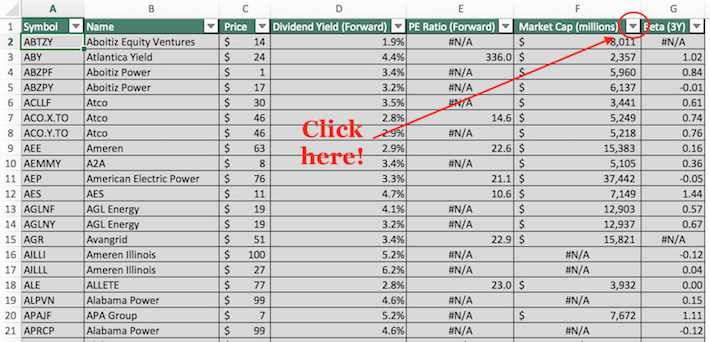

Step 2: Click the filter icon at the top of the Market Cap column, as shown below.

Step 3: Change the filter setting to “Greater Than”, and input 10000 into the field beside it. Note that since market capitalization is measured in millions of dollars in this Excel sheet, filtering for stocks with market capitalizations greater than “$10,000 millions” is equivalent for screening for those with market capitalizations exceeding $10 billion.

Step 4: Close that filter window (by exiting it, not by clicking ‘clear filter’) and click on the filter icon for the “dividend yield” column, as shown below.

Step 5: Change the filter setting to “Greater Than” and input 0.03 into the column beside it. Note that 0.03 is equivalent to 3%.

The remaining stocks in this list are those with market capitalizations above $10 billion and dividend yields above 3%. This narrowed investment universe is suitable for investors looking for low-risk, high-yield securities.

You now have a solid fundamental understanding of how to use the Utility Dividend Stocks Excel Spreadsheet List to its fullest potential. The remainder of this article will discuss the characteristics that make the utility sector attractive for dividend growth investors.

Why Utility Dividend Stocks Make Attractive Investments

The word “utility” describes a wide variety of business models but is usually used as a reference to electric utilities — companies that engage in the generation, transmission, and distribution of electricity.

Other types of utilities include propane utilities and water utilities.

So why do these businesses make for attractive investments?

Utilities usually conduct business in highly regulated markets, complying with rules set by federal, state, and municipal governments.

While this sounds highly unattractive on the surface, what it means in practice is that utilities are basically legal monopolies.

The strict regulatory environment that utility businesses operate in creates a strong and durable competitive advantage for existing industry participants.

For this reason, electric utilities are among the most popular stocks for long-term dividend growth investors — especially because they tend to offer above-average dividend yields.

Indeed, the regulatory-based competitive advantages available to utility stocks give them the consistency to raise their dividends regularly.

Simply put, utility stocks are some of the most dependable dividend stocks around.

To provide a few examples, the following utility stocks have exceptionally long streaks of consecutive dividend increases:

- Consolidated Edison (ED) — more than 25 years of consecutive dividend increases

- American States Water (AWR) — a water utility — more than 50 years of consecutive dividend increases

- SJW Group (SJW) — another water utility — more than 50 years of consecutive dividend increases

The long streak of consecutive dividend increases is possible only because of their unique industry-specific competitive advantages.

Clearly, the utility sector is very stable. People are going to need electricity and water in ever-increasing amounts for the foreseeable future.

One characteristic that does not describe utility stocks is high growth. One of the regulatory constraints imposed upon utility companies is the pace at which they can increase the fees paid by their customers.

These rate increases are usually in the low-single-digits, which provides a cap on the revenue growth experienced by these companies.

Utility stocks typically don’t offer strong total returns, but there are exceptions.

The Top 10 Utility Stocks Now

Taking all of the above into consideration, the following section discusses our top 10 list of North American utility stocks today, based on their expected annual returns over the next five years.

The rankings in this article are derived from our expected total return estimates from the Sure Analysis Research Database.

The 10 utility stocks with the highest projected five-year total returns are ranked in this article, from lowest to highest.

Related: Watch the video below to learn how to calculate expected total return for any stock.

Rankings are compiled based upon the combination of current dividend yield, expected change in valuation, as well as expected annual earnings-per-share growth.

This determines which utility stocks offer the best total return potential for shareholders.

Top Utility Stock #10: National Grid plc (NGG)

- 5-year expected annual returns: 10.6%

National Grid plc is a diversified electricity and natural gas utility with operations in the UK and US. In the UK, National Grid owns and operates the electric and natural gas transmission network. In the US, the company serves 7.1 million electricity and natural gas customers in Massachusetts and New York.

National Grid reported fiscal full year results on May 23rd, 2024. Company-wide operating profit rose 6% and earnings per share climbed 6% to $1.00 from $0.94. Operating profits rose due to contributions from a strong performance from U.S. regulated assets and UK Electricity Distribution but offset by weaker performance in other segments.

The utility continues to make large investments in renewables in the Northeast US and UK focusing on wind power, solar, and storage. It also is investing in large transmission and distribution projects in the US and UK. NGG plans to invest ~$60B through 2029 to drive ~10% asset and 6% to 8% EPS growth.

Click here to download our most recent Sure Analysis report on NGG (preview of page 1 of 3 shown below):

Top Utility Stock #9: Ameren Corporation (AEE)

- 5-year expected annual returns: 10.9%

Ameren Corporation owns rate-regulated generation, transmission, and distribution networks that deliver electricity and natural gas in Missouri and Illinois. The company serves 2.4 million electricity customers and more than 900,000 natural gas customers.

It primarily generates electricity through coal, nuclear, and natural gas, as well as renewable sources, such as hydroelectric, wind, methane gas, and solar.

On August 1st, 2024, Ameren Corporation released its second quarter results for the period ending June 30th, 2024. For the quarter, the company reported net income of $258 million and $0.97 earnings per diluted share, compared to the same quarter a year ago net income of $237 million and $0.90 earnings per diluted share.

The reported earnings increased by 7.8% year-over-year, driven by earnings on increased infrastructure investments, new Ameren Missouri electric service rates, and higher electric retail sales.

Click here to download our most recent Sure Analysis report on AEE (preview of page 1 of 3 shown below):

Top Utility Stock #8: RGC Resources Inc. (RGCO)

- 5-year expected annual returns: 11.2%

RGC Resources, Inc. operates as a distributor and seller of natural gas to industrial, commercial, and residential customers through its subsidiaries: Roanoke Gas, Midstream, and Diversified Energy. Residential customers are the company’s largest customer segment, accounting for ~58% of the total revenues, followed by commercial customers at 34%.

The company operates in three segments: Gas Utility, the key revenue generator; Investment in Affiliates; and Parent & Other. The company was founded in 1883 and generates just under $100 million in annual revenue.

On August 6th, 2024, RGC Resources announced its Q3 2024 results. The company posted non-GAAP EPS of $0.02, missing the market’s estimate by $0.05, and total revenues of $14.5 million, which were up 5.84% year over year. The decrease was primarily owing to higher personnel and professional costs, inflationary pressures, and reduced noncash earnings from its investment in the MVP as it transitioned to operational status.

RGC Resources, Inc. reported net income for the first nine months of fiscal 2024 increased 13% to $11.6 million, or $1.15 per share, from $10.3 million, or $1.04 per share in the prior year period.

Click here to download our most recent Sure Analysis report on RGCO (preview of page 1 of 3 shown below):

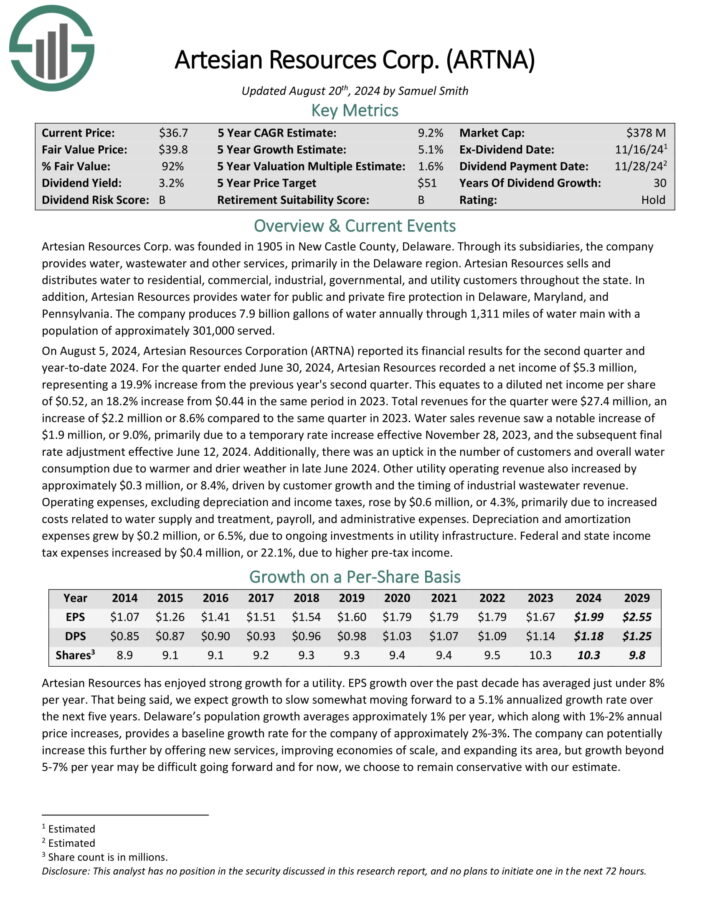

Top Utility Stock #7: Artesian Resources (ARTNA)

- 5-year expected annual returns: 11.2%

Artesian Resources Corp. was founded in 1905 in New Castle County, Delaware. Through its subsidiaries, the company provides water, wastewater and other services, primarily in the Delaware region.

Artesian Resources sells and distributes water to residential, commercial, industrial, governmental, and utility customers throughout the state.

In addition, Artesian Resources provides water for public and private fire protection in Delaware, Maryland, and Pennsylvania. The company produces 7.9 billion gallons of water annually through 1,311 miles of water main with a population of approximately 301,000 served.

On August 5, 2024, Artesian Resources Corporation (ARTNA) reported its financial results for the second quarter and year-to-date 2024. For the quarter ended June 30, 2024, Artesian Resources recorded a net income of $5.3 million, representing a 19.9% increase from the previous year’s second quarter.

This equates to a diluted net income per share of $0.52, an 18.2% increase from $0.44 in the same period in 2023. Total revenues for the quarter were $27.4 million, an increase of $2.2 million or 8.6% compared to the same quarter in 2023.

Click here to download our most recent Sure Analysis report on ARTNA (preview of page 1 of 3 shown below):

Top Utility Stock #6: Evergy Inc. (EVRG)

- 5-year expected annual returns: 15.3%

Evergy is an electric utility holding company incorporated in 2017 and headquartered in Kansas City, Missouri.

Through its subsidiaries Evergy Kansas, Evergy Metro and Evergy Missouri West, the company serves approximately 1.4 million residential customers, nearly 200,000 commercial customers and 6,900 industrial customers and municipalities in Kansas and Missouri.

In early August, Evergy reported (8/9/24) financial results for the second quarter of fiscal 2024. The company benefited from warmer-than-normal weather, rate hikes and higher transmission margin, partly offset by higher interest expense, operating & maintenance costs and depreciation. As a result, its adjusted earnings-per-share grew 11% over the prior year’s quarter, from $0.81 to $0.90, and beat the analysts’ consensus by $0.01.

EVRG expects adjusted earnings-per-share of $3.73-$3.93 and reiterated its long-term guidance for 4%-6% adjusted earnings-per-share growth.

Click here to download our most recent Sure Analysis report on Evergy Inc. (preview of page 1 of 3 shown below):

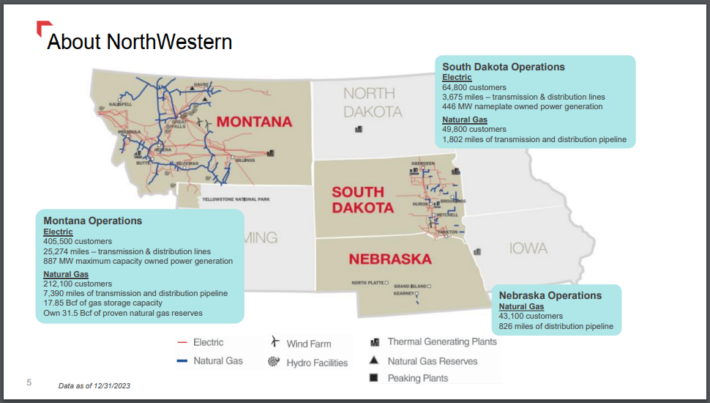

Top Utility Stock #5: NorthWestern Corp. (NWE)

- 5-year expected annual returns: 12.3%

NorthWestern Corp. is a Sioux Falls, South Dakota based electricity and gas utility. It has 1,570 employees, and primarily serves the states of South Dakota and Montana.

Source: Investor Relations

The company has been dramatically overhauling its energy generation fleet. While NorthWestern long relied on coal for the majority of its power production, that has now shifted with wind, solar, and hydroelectric accounting for approximately 55% of total combined power generation today.

On July 30th, 2024, NorthWestern announced its Q2 2024 earnings. The results were slightly ahead of expectations. Earnings-per-share of $0.53 increased from $0.35 year-over-year, and topped the consensus outlook by five cents. Revenues rose 10% year-over-year to $320 million.

On July 29th, 2024, the company announced the acquisition of the Energy West natural gas utility distribution system, adding 33,000 additional customers in Montana to its broader business.

Click here to download our most recent Sure Analysis report on NWE (preview of page 1 of 3 shown below):

Top Utility Stock #4: Portland General Electric Company (POR)

- 5-year expected annual returns: 11.9%

Portland General Electric is an electric utility based in Portland, Oregon, providing electricity to more than 930,000 customers in 51 cities. The company owns or contracts more than 3.5 gigawatts of energy generation, between gas, coal, wind & solar, and hydro.

On April 19th, 2024, Portland General Electric announced a 5% increase in the quarterly dividend to $0.50 per share. Portland General reported second quarter 2024 results on July 26th, 2024. The company reported net income of $72 million for the quarter, equal to $0.69 per diluted share on a GAAP basis, compared to $0.39 in Q2 2023.

Retail energy deliveries in H1 2024 decreased 1.5% compared to the same prior year period, but wholesale energy deliveries soared 55%. As a result, total energy deliveries grew 9.4%.

Leadership reaffirmed its 2024 full year guidance for adjusted earnings per share of $3.08 at the midpoint based on a series of assumptions, most notably a 2.5% increase in annual energy deliveries.

Click here to download our most recent Sure Analysis report on Portland General Electric Company (preview of page 1 of 3 shown below):

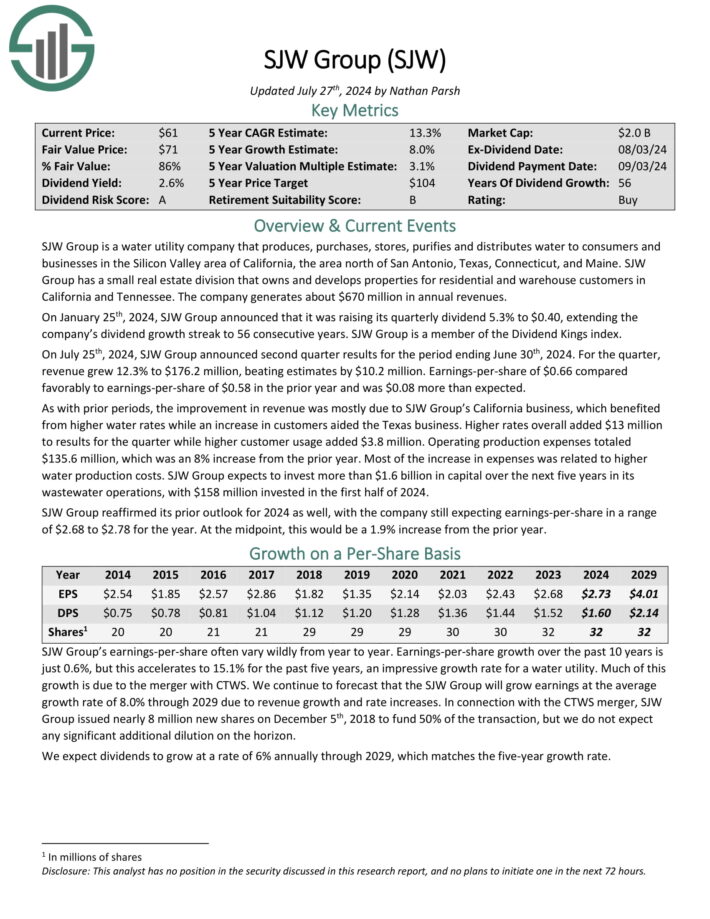

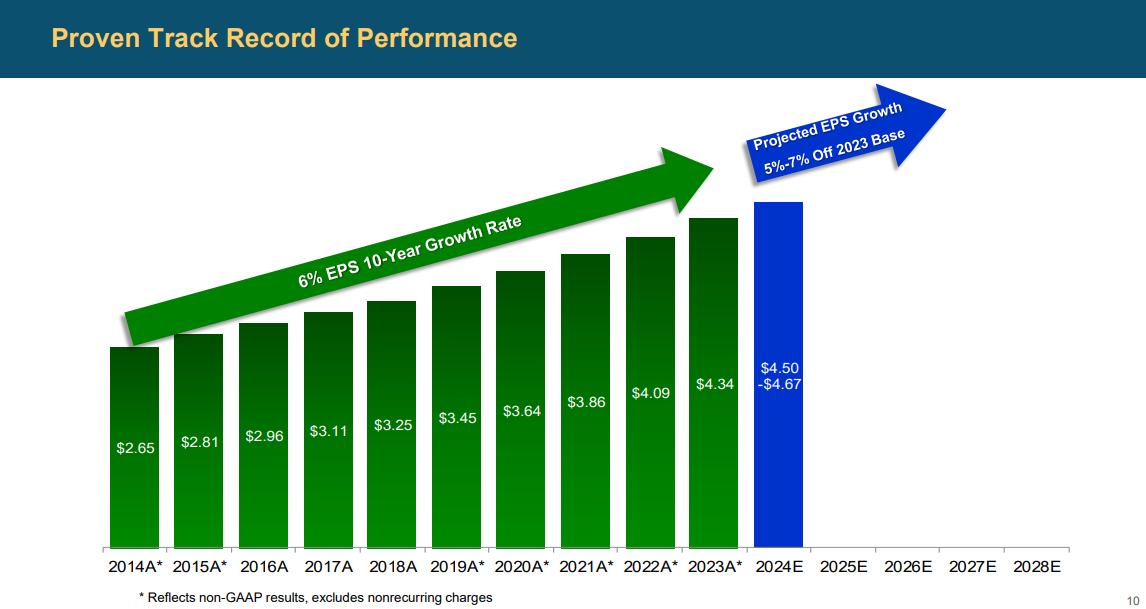

Top Utility Stock #3: SJW Group (SJW)

- 5-year expected annual returns: 15.5%

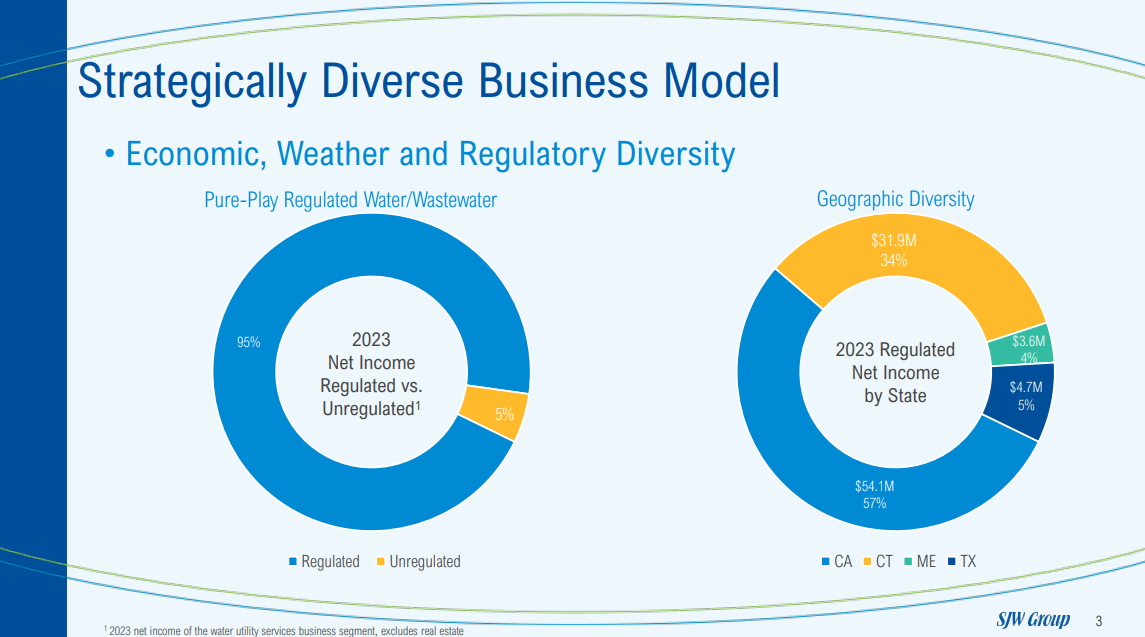

SJW Group is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

Source: Investor Presentation

On July 25th, 2024, SJW Group announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 12.3% to $176.2 million, beating estimates by $10.2 million.

Earnings-per-share of $0.66 compared favorably to earnings-per-share of $0.58 in the prior year and was $0.08 more than expected. Higher rates overall added $13 million to results for the quarter while higher customer usage added $3.8 million.

Click here to download our most recent Sure Analysis report on SJW (preview of page 1 of 3 shown below):

Top Utility Stock #2: AES Corp. (AES)

- 5-year expected annual returns: 15.2%

The AES (Applied Energy Services) Corporation was founded in 1981 as an energy consulting company. The corporation now has businesses in 14 countries and a portfolio of approximately 100 power plants and wind and solar farms.

AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel. The company has nearly 35,000 Gross MW in operation. In 2023, AES produced nearly $13 billion in revenues.

AES Corporation reported second quarter results on August 1st, 2024, for the period ending June 30th, 2024. Adjusted EPS soared 81% to $0.38 for Q2 2024.

The company constructed and acquired 1.6 GW of renewable energy year-to-date, and is on course to add 3.6 GW of new projects online in 2024. Leadership expects to achieve the high end of its 2024 guidance for adjusted EPS of $1.87 to $1.97 for the full fiscal year.

Additionally, the company reaffirms its expectation it can grow EPS on average 7% to 9% through 2025 from a base year of 2020. It also still expects annual EPS growth of 7% to 9% from 2023 through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

Top Utility Stock #1: Eversource Energy (ES)

- 5-year expected annual returns: 17.3%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On July 31st, 2024, Eversource Energy released its second-quarter 2024 results for the period ending June 30th, 2024. For the quarter, the company reported earnings of $335.3 million, a substantial increase from $15.4 million in the same quarter of last year, which had been impacted by an impairment charge.

The company reported earnings-per-share of $0.95 compared with earnings-per-share of $0.04 in the prior year.

Earnings from the Electric Transmission segment increased to $189.0 million, up from $161.0 million in the prior year, primarily due to a higher level of investment in Eversource’s electric transmission system, which is necessary to address system capacity growth and deliver clean energy resources for the region.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

Final Thoughts

The utility sector is a great place to find high-quality dividend stocks suitable for long-term investment.

It is not, however, the only place to find attractive investments.

If you’re willing to venture outside of the utility industry for investment opportunities, the following Sure Dividend databases are very useful:

- The Dividend Aristocrats: dividend growth stocks with 25+ years of consecutive dividend increases

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

- The Complete List Of Technology Stocks

- The Complete List Of Communication Services Stocks

- The Complete List Of Consumer Staples Stocks

- The Complete List Of Consumer Discretionary Stocks

- The Complete List Of Healthcare Stocks

- The Complete List Of Financial Stocks

- The Complete List Of Real Estate Stocks

- The Complete List Of Energy Stocks

- The Complete List Of Materials Stocks

- The Complete List Of Industrial Stocks