Article updated on October 23rd, 2024 by Bob Ciura

Constituents updated annually

The healthcare sector is home to some of the most popular dividend stocks in our investment universe.

The importance of healthcare in the lives of many consumers makes this sector one of the most stable and recession-resistant in the entire stock market, and allows well-managed healthcare companies to raise their dividends year in and year out.

Clearly, this sector holds appeal for dividend growth investors.

To that end, we’ve compiled a list of all 314 healthcare stocks (along with important investing metrics like price-to-earnings ratios and dividend yields) which you can download below:

The healthcare stocks list was derived from the following major sector ETFs:

- Health Care Select Sector SPDR ETF (XLV)

- Invesco S&P SmallCap Health Care ETF (PSCH)

- iShares Biotechnology ETF (IBB)

Keep reading this article to learn more about the merits of investing in healthcare stocks.

How To Use The Healthcare Stocks List To Find Investment Ideas

The fundamental appeal of the healthcare sector makes an Excel database of all healthcare stocks very useful.

This tool becomes significantly more powerful when combined with an elementary knowledge of how to use Microsoft Excel to filter for securities with particular financial characteristics.

This section will show you how to apply two useful investment screens to the Healthcare Stocks Excel sheet using a step-by-step picture-based methodology.

The end goal is to help you find the best dividend healthcare stocks that meet your specific investing criteria.

The first filter will search for dividend-paying healthcare stocks with price-to-earnings ratios less than 20.

Screen 1: Low Price-To-Earnings Ratios

Step 1: Download the Healthcare Stocks Excel Spreadsheet List at the link above.

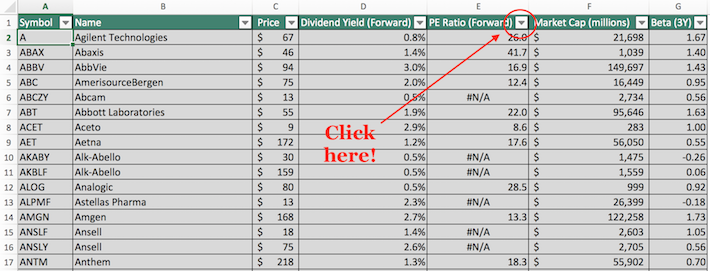

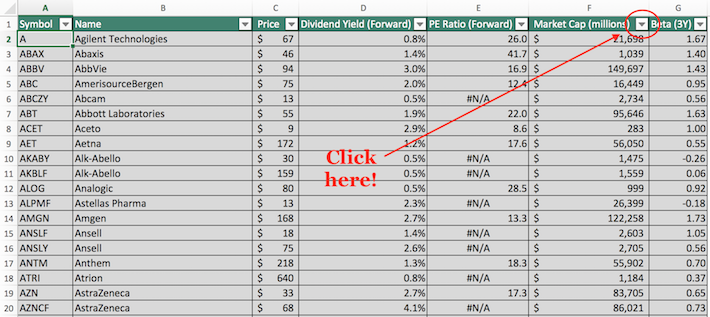

Step 2: Click on the filter icon at the top of the price-to-earnings ratio column, as shown below.

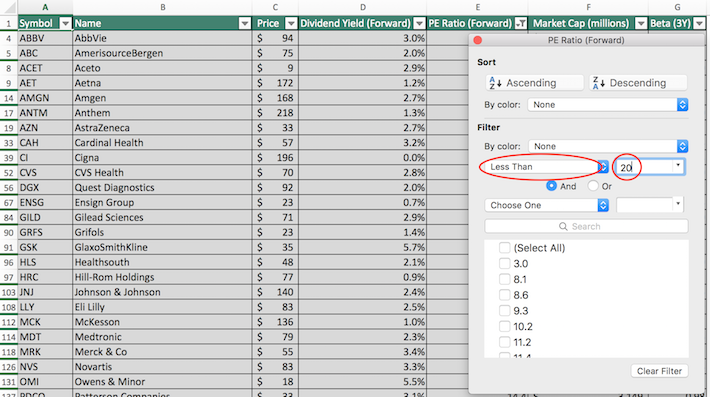

Step 3: Change the filter setting to ‘Less Than’ and input ’20’ into the field beside it.

The remaining stocks are dividend payers within the healthcare sector that are trading at earnings multiples less than 20.

Moving on, the next example will show how to filter for dividend-paying healthcare stocks with dividend yields above 3% and market capitalizations above $10 billion. We’ll call this the ‘blue chip stocks’ screener.

Screen 2: Blue Chip Stocks

Step 1: Download the Healthcare Stocks Excel Spreadsheet List at the link above.

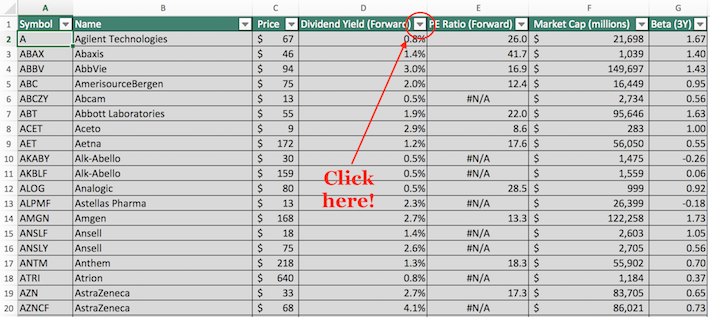

Step 2: Click on the filter icon at the top of the dividend yield column, as shown below.

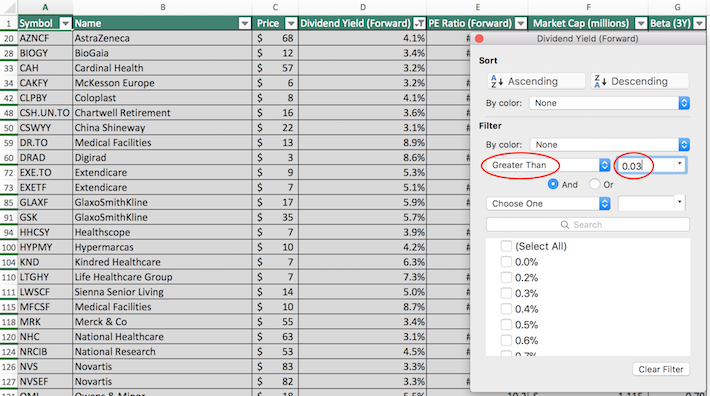

Step 3: Change the filter setting to ‘Greater Than’ and input 0.03 into the field beside it. Note that we need to input 0.03, not just 3 – this would filter for dividend yields greater than 300%, not 3% as we desire.

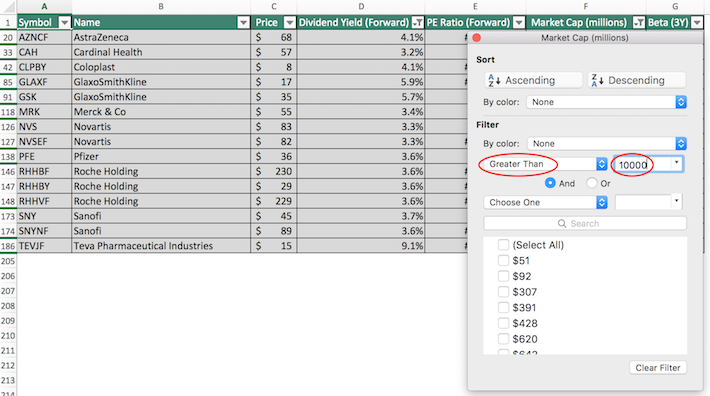

Step 4: Close out of that filter window by clicking on the exit button (not by clicking on the ‘clear filter’ button at the bottom of the window). Then, click on the filter button at the top of the market capitalization column, as shown below.

Step 5: Change the filter setting to ‘Greater Than’ and input 10000 into the field beside it. Notice that since market capitalization is measured in millions in this Excel document, filtering for a market capitalization above ‘$10,000 million’ is equivalent to $10 billion.

The remaining stocks in this Excel document are dividend-paying healthcare stocks with market capitalizations above $10 billion and high yields above 3%.

You now have a solid understanding of how to make the most of this powerful Excel document. The remainder of this article will discuss why healthcare stocks deserve an allocation in your investment portfolio.

Why Invest In Healthcare Stocks

There are a number of fundamental reasons why healthcare stocks are appealing for self-directed investors. First of all, healthcare stocks are extraordinarily recession-resistant.

This makes sense. Consumers are far less likely to reduce their healthcare expenditures than they are for more discretionary expenses like communications, clothing, or even utilities.

The only sector that comes close to healthcare in terms of recession resiliency is the consumer staples sector.

The observable consequence of the necessity-based business models of healthcare companies is that their stock prices tend to stand up well during periods of recessions.

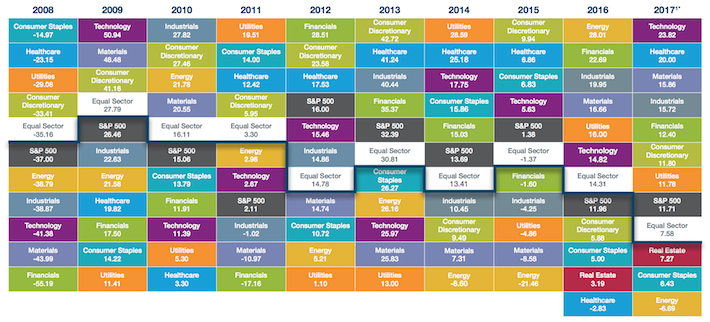

As the following heat map displays, the healthcare sector was the second-best-performing sector in 2008, during the worst year of the Great Recession.

Source: SPDR

The image above shows that the sector is often among the market’s best performers, even during recessions, as the healthcare sector ranked in the top 3 best performing sectors in 7 of the 10 years shown above.

Healthcare companies are also prone to having strong, regulatory-based competitive advantages due to their strong relationships with the U.S. Food and Drug Administration (FDA).

Unlike other sectors (particularly the technology sector), healthcare startups are unlikely to disrupt existing players within the industry. This makes the entrenched positioning of existing sector participants even more powerful.

Investors should keep in mind that not all healthcare companies are created equal. Like all sectors, it has various subsectors, including:

- Medical devices – Medtronic (MDT) is an example

- Pure-play pharmaceutical companies – AbbVie (ABBV) is an example

- Healthcare distributors – Cardinal Health (CAH) is an example

- Healthcare conglomerates – Johnson & Johnson (JNJ) is the best example

For those interested in gaining exposure to the healthcare sector, each subsector mentioned above merits investment on its own to achieve appropriate levels of diversification.

Final Thoughts

The Dividend Healthcare Stocks Excel List is an excellent place to find high-quality dividend stocks suitable for long-term investment, largely due to our ability to screen it for particular quantitative characteristics.

If you’re interested in finding other compelling investment opportunities outside of the healthcare space, the following Sure Dividend databases will prove very useful:

- The Dividend Aristocrats: S&P 500 Index stocks with 25+ years of consecutive dividend increases

- The Dividend Kings: dividend stocks with 50+ years of consecutive dividend increases

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases

- The Blue Chip Stocks List: dividend stocks that are on either the Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings lists

We can also turn to the portfolios of the world’s greatest investors for investment ideas. With that in mind, there is no better investor than Warren Buffett.