Spreadsheet data updated daily

Spreadsheet and Top 5 List Updated on November 20th, 2024 by Bob Ciura

The communication services sector has a lot to offer investors, particularly those looking for higher investment income.

Many communication services stocks generate strong profits and cash flow, which allow them to pay high dividend yields to shareholders.

And, the major communication services stocks broadly have lower valuations than many other market sectors, making them appealing for value investors as well.

With this in mind, we created a list of 45 communication services stocks.

You can download the list (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Keep reading this article to learn more about the benefits of investing in communication services stocks.

Table Of Contents

The following table of contents provides for easy navigation:

- How To Use The Communication Services Stocks List

- The Top 5 Communication Services Stocks Now

#5: Omnicom Group (OMC)

#4: Verizon Communications (VZ)

#3: Interpublic Group of Companies (IPG)

#2: Comcast Corporation (CMCSA)

#1: Alphabet Inc. (GOOG)(GOOGL) - Final Thoughts

How To Use The Communication Services Stocks List To Find Investment Ideas

Having an Excel database of all communication services stocks, combined with important investing metrics and ratios, is very useful.

This tool becomes even more powerful when combined with knowledge of how to use Microsoft Excel to find the best investment opportunities.

With that in mind, this section will provide a quick explanation of how you can instantly search for stocks with particular characteristics, using two screens as an example.

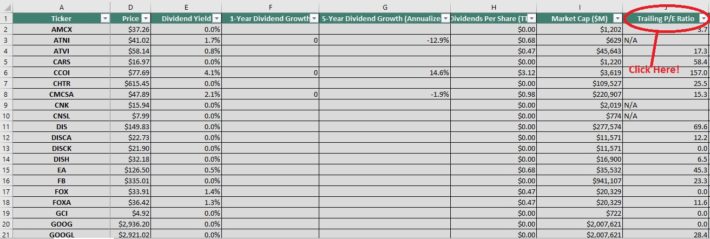

The first screen that we will implement is for stocks with price-to-earnings ratios below 15.

Screen 1: Low P/E Ratios

Step 1: Download the Communication Services Stocks Excel Spreadsheet List at the link above.

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter field to ‘Less Than’, and input ’15’ into the field beside it.

The remaining list of stocks contains stocks with price-to-earnings ratios less than 15.

The next section demonstrates how to screen for stocks with high dividend yields.

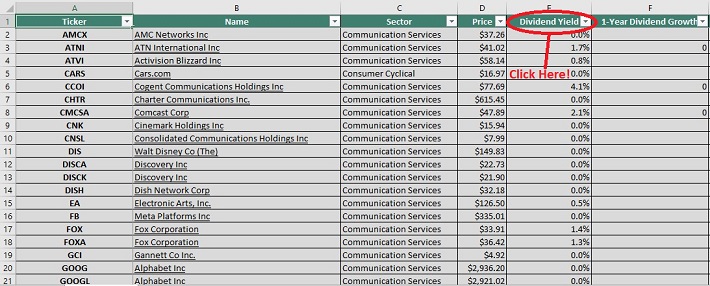

Screen 2: Communication Services Stocks With High Dividend Yields

Stocks are often categorized based on their dividend yields. This is the percentage of an investment that an investor will receive in dividend income.

We define high dividend yields as stocks with yields of 5% or more.

Screening for stocks with high dividend yields could provide interesting investment opportunities for more risk-averse, income-oriented investors.

Here’s how to use the Communication Services Stocks Excel Spreadsheet List to find such investment opportunities.

Step 1: Download the Communication Services Stocks Excel Spreadsheet List at the link above.

Step 2: Click on the filter icon for the ‘dividend yield’ column, as shown below.

Step 3: Change the filter setting to ‘Greater Than’ and input 0.03 into the column beside it. Note that 0.03 is equivalent to 3%.

The remaining stocks in this list are those with dividend yields above 3%. This narrowed investment universe is suitable for investors looking for low-risk, high-yield securities.

You now have a solid fundamental understanding of how to use the spreadsheet to its fullest potential. The remainder of this article will discuss the top 5 communication services stocks now.

The Top 5 Communication Services Stocks Now

The following section discusses our top five communication services stocks today, based on their expected annual returns over the next five years.

The rankings in this article are derived from our expected total return estimates from the Sure Analysis Research Database.

The five stocks with the highest projected five-year total returns are ranked in this article, from lowest to highest.

Related: Watch the video below to learn how to calculate expected total return for any stock.

Rankings are compiled based upon the combination of current dividend yield, expected change in valuation, as well as expected annual earnings-per-share growth.

This determines which communication services stocks offer the best total return potential for shareholders.

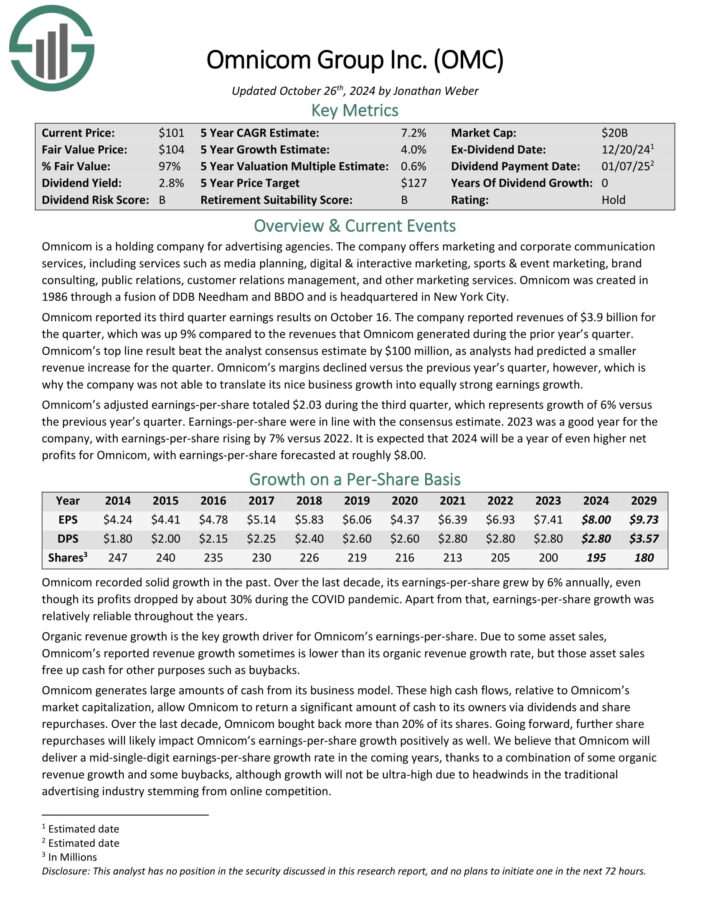

#5: Omnicom Group (OMC)

- 5-year expected annual returns: 7.8%

Omnicom is a holding company for advertising agencies. The company offers marketing and corporate communication services, including services such as media planning, digital & interactive marketing, sports & event marketing, brand consulting, public relations, customer relations management, and other marketing services.

Omnicom was created in 1986 through a fusion of DDB Needham and BBDO and is headquartered in New York City.

Omnicom reported its third quarter earnings results on October 16. The company reported revenues of $3.9 billion for the quarter, which was up 9% year-over-year.

Source: Investor Presentation

Omnicom’s top line result beat the analyst consensus estimate by $100 million, as analysts had predicted a smaller revenue increase for the quarter.

Omnicom’s margins declined versus the previous year’s quarter, however, which is why the company was not able to translate its nice business growth into equally strong earnings growth.

Omnicom’s adjusted earnings-per-share totaled $2.03 during the third quarter, which represents growth of 6% versus the previous year’s quarter. Earnings-per-share were in line with the consensus estimate.

Click here to download our most recent Sure Analysis report on OMC (preview of page 1 of 3 shown below):

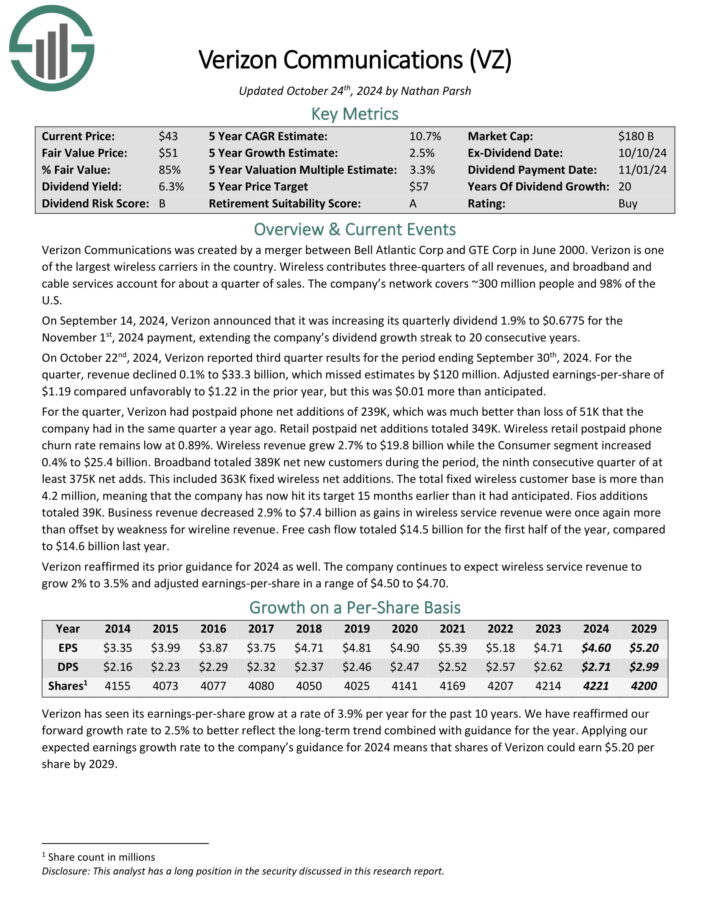

#4: Verizon Communications (VZ)

- 5-year expected annual returns: 11.4%

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless carriers in the country.

Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On October 22nd, 2024, Verizon reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue declined 0.1% to $33.3 billion, which missed estimates by $120 million.

Source: Investor Presentation

Adjusted earnings-per-share of $1.19 compared unfavorably to $1.22 in the prior year, but this was $0.01 more than anticipated.

For the quarter, Verizon had postpaid phone net additions of 239K, which was much better than loss of 51K that the company had in the same quarter a year ago. Retail postpaid net additions totaled 349K.

Wireless retail postpaid phone churn rate remains low at 0.89%. Wireless revenue grew 2.7% to $19.8 billion while the Consumer segment increased 0.4% to $25.4 billion.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

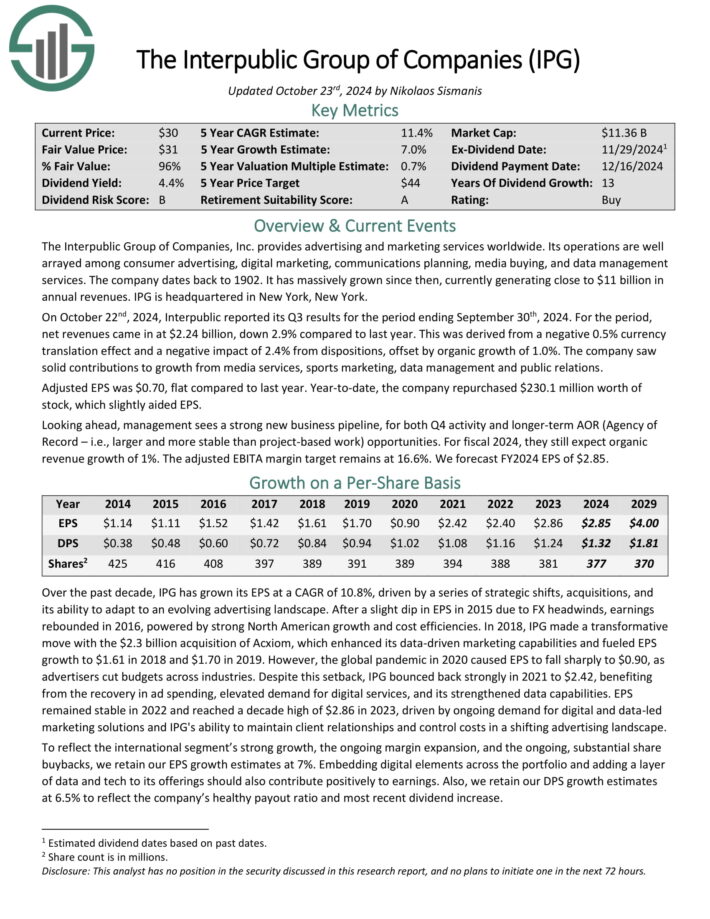

#3: Interpublic Group of Companies (IPG)

- 5-year expected annual returns: 13.2%

The Interpublic Group of Companies, Inc. provides advertising and marketing services worldwide. Its operations are well arrayed among consumer advertising, digital marketing, communications planning, media buying, and data management services. The company dates back to 1902.

On October 22nd, 2024, Interpublic reported its Q3 results for the period ending September 30th, 2024. For the period, net revenues came in at $2.24 billion, down 2.9% compared to last year. This was derived from a negative 0.5% currency translation effect and a negative impact of 2.4% from dispositions, offset by organic growth of 1.0%.

The company saw solid contributions to growth from media services, sports marketing, data management and public relations.

Adjusted EPS was $0.70, flat compared to last year. Year-to-date, the company repurchased $230.1 million worth of stock, which slightly aided EPS.

Click here to download our most recent Sure Analysis report on IPG (preview of page 1 of 3 shown below):

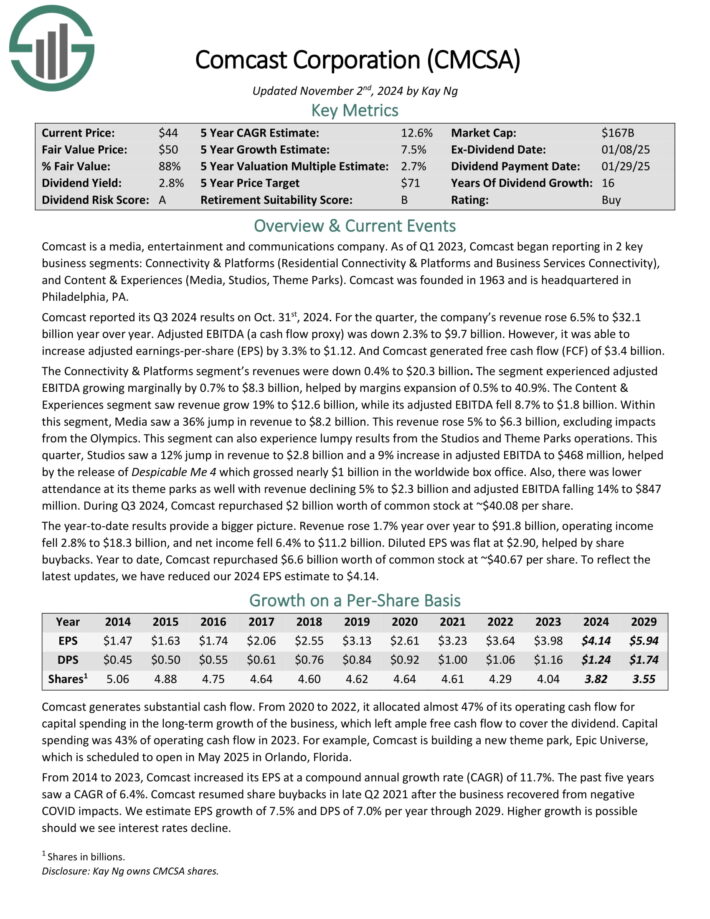

#2: Comcast Corporation (CMCSA)

- 5-year expected annual return: 13.4%

Comcast is a media, entertainment and communications company. Its business units include Cable Communications (High–Speed Internet, Video, Business Services, Voice, Advertising, Wireless), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Entertainment), and Sky, a leading entertainment company in Europe.

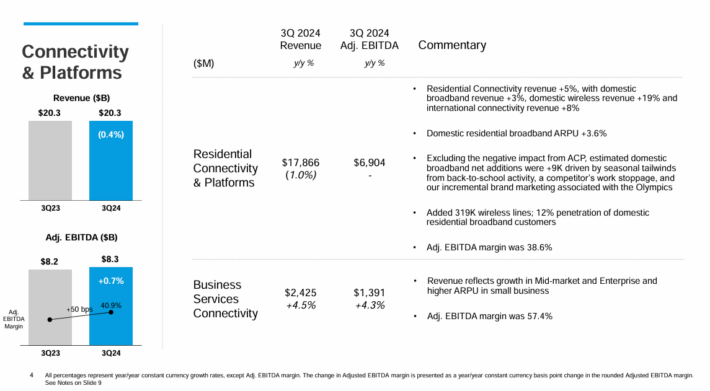

Comcast reported its Q3 2024 results on Oct. 31st, 2024. For the quarter, the company’s revenue rose 6.5% to $32.1 billion year over year. Adjusted EBITDA (a cash flow proxy) was down 2.3% to $9.7 billion.

Source: Investor Presentation

However, it was able to increase adjusted earnings-per-share (EPS) by 3.3% to $1.12. And Comcast generated free cash flow (FCF) of $3.4 billion. The Connectivity & Platforms segment’s revenues were down 0.4% to $20.3 billion.

The segment experienced adjusted EBITDA growing marginally by 0.7% to $8.3 billion, helped by margins expansion of 0.5% to 40.9%. The Content & Experiences segment saw revenue grow 19% to $12.6 billion, while its adjusted EBITDA fell 8.7% to $1.8 billion.

Click here to download our most recent Sure Analysis report on Comcast (preview of page 1 of 3 shown below):

#1: Alphabet Inc. (GOOG)(GOOGL)

Alphabet is a technology conglomerate that operates several businesses such as Google search, Android, Chrome, YouTube, Nest, Gmail, Maps, and many more. Alphabet is a leader in many of the areas of technology that it operates. On October 29th, 2024, Alphabet reported third quarter results for the period ending September 30th, 2024.

As had been the case for several quarters, the company delivered better than expected results. Revenue grew 15.1% to $88.3 billion for the period and beat analysts’ estimates by $2.05 billion. Adjusted earnings-per-share of $2.12 compared very favorably to $1.55 in the prior year and was $0.27 above expectations.

Once again, nearly every aspect of Alphabet’s business performed well during the quarter. Revenue for Google Search, the largest contributor to results, increased more than 12% to $49.4 billion. YouTube ads grew 12.2% to $8.9 billion while Google Network declined 1.6% to $7.5 billion. Google subscriptions, platforms, and devices were up almost 28% to $10.7 billion.

Click here to download our most recent Sure Analysis report on GOOGL (preview of page 1 of 3 shown below):

Final Thoughts

The communication services sector is attractive for long-term investment. Demand for various communication services such as Internet and wireless remains high, and is not likely to slow down any time soon.

The sector is also appealing for income investors, due to the high-yielding telecom stocks.

If you’re willing to explore ideas outside of the communication services sector, the following databases contain some of the most high-quality dividend stocks around:

- The Dividend Aristocrats: dividend stocks with 25+ years of consecutive dividend increases.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: Considered the best-of-the-best when it comes to dividend history, the Dividend Kings are an elite group of dividend stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: dividend stocks that are on the Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings list.

If you’re looking for other sector-specific stocks, the following Sure Dividend databases will be useful:

- The Complete List Of Utility Stocks

- The Complete List Of Healthcare Stocks

- The Complete List Of Consumer Staples Stocks

- The Complete List Of Consumer Discretionary Stocks

- The Complete List Of Financials Stocks

- The Complete List Of Technology Stocks

- The Complete List Of Real Estate Stocks

- The Complete List Of Energy Stocks

- The Complete List Of Materials Stocks

- The Complete List Of Industrial Stocks