Updated on May 31st, 2024

It isn’t surprising that we favor stocks that pay dividends as studies have shown that owning income producing securities is an excellent way to build wealth while also protecting to the downside.

In bull markets, dividends can add to the gains from the stock while also purchasing additional shares. When prices decline, dividends can reduce the losses while being used to acquire more shares at a now lower price.

Most companies distribute dividends on a quarterly payment schedule, but there are some that pay dividends monthly.

However, the number of companies that distribute monthly dividends are limited in quantity. In fact, there are just 80 companies that currently offer a monthly dividend payment.

You can see all monthly dividend stocks here.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

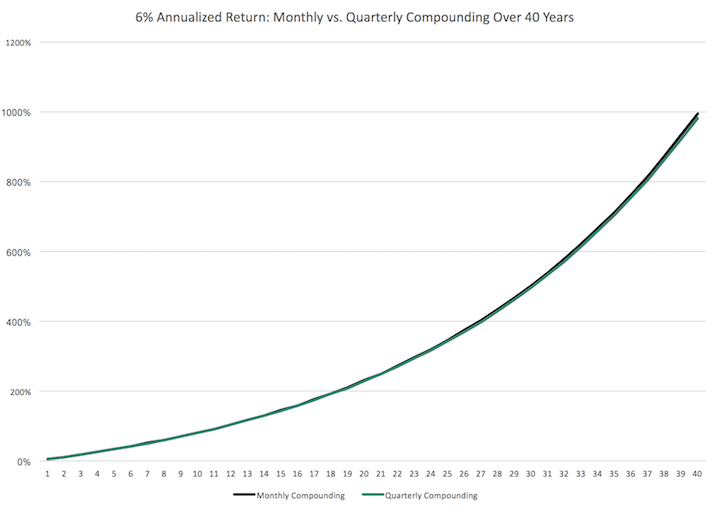

The monthly compounding of dividends provides several benefits to the investors. First, monthly dividend paying stocks can help provide consistent cash flow year round. With most companies paying dividends every three months, investors needing regular payments would need to create a portfolio from a wide variety of stocks to meet their needs. Identifying high-quality monthly dividend paying stocks can help create regular cash flows.

Second, monthly compounding of dividends can be a significant contributor to wealth building. All else being equal, monthly dividend compounding can, over time, outpace quarterly dividend compounding by a solid amount.

That being said, there are less than 90 names that provide monthly dividends, which means a limited number of investment options. And all monthly dividend paying companies are not created equal.

In fact, there are just three names that have raised distributions for at least 10 consecutive years in our database of monthly dividend paying companies.

We believe that a decade of dividend growth is the bare minimum for a stock to be considered a “hold forever” position. This means that the underlying company has a solid enough business model that can support continued dividend growth.

Table of Contents

- Hold Forever Stock #3: Agree Realty Corp. (ADC)

- Hold Forever Stock #2: STAG Industrial Inc. (STAG)

- Hold Forever Stock #1: Realty Income (O)

Hold Forever Stock #3: Agree Realty Corp. (ADC)

Agree Realty Corp. (ADC) is an integrated real estate investment trust (REIT) focused on ownership, acquisition, development, and retail property management. Richard Agree founded Agree Development Company in 1971, which is the predecessor to Agree Realty Corporation. Agree has developed over 40 community shopping centers throughout the Midwestern and Southeastern United States.

On April 23rd, 2024, Agree Realty Corp. reported first quarter results. The company invested $140 million in 50 retail net lease properties and initiated four development projects with a total committed capital of $18 million. Net income per share decreased by 2.4% to $0.43, while Core FFO per share increased by 3.5% to $1.01, and AFFO per share rose by 4.6% to $1.03.

A monthly dividend of $0.250 per common share was declared for April, a 2.9% increase year-over-year. The Company ended the quarter with over $920 million in total liquidity and maintained a strong balance sheet.

Click here to download our most recent Sure Analysis report on Agree Realty Corp. (ADC) (preview of page 1 of 3 shown below):

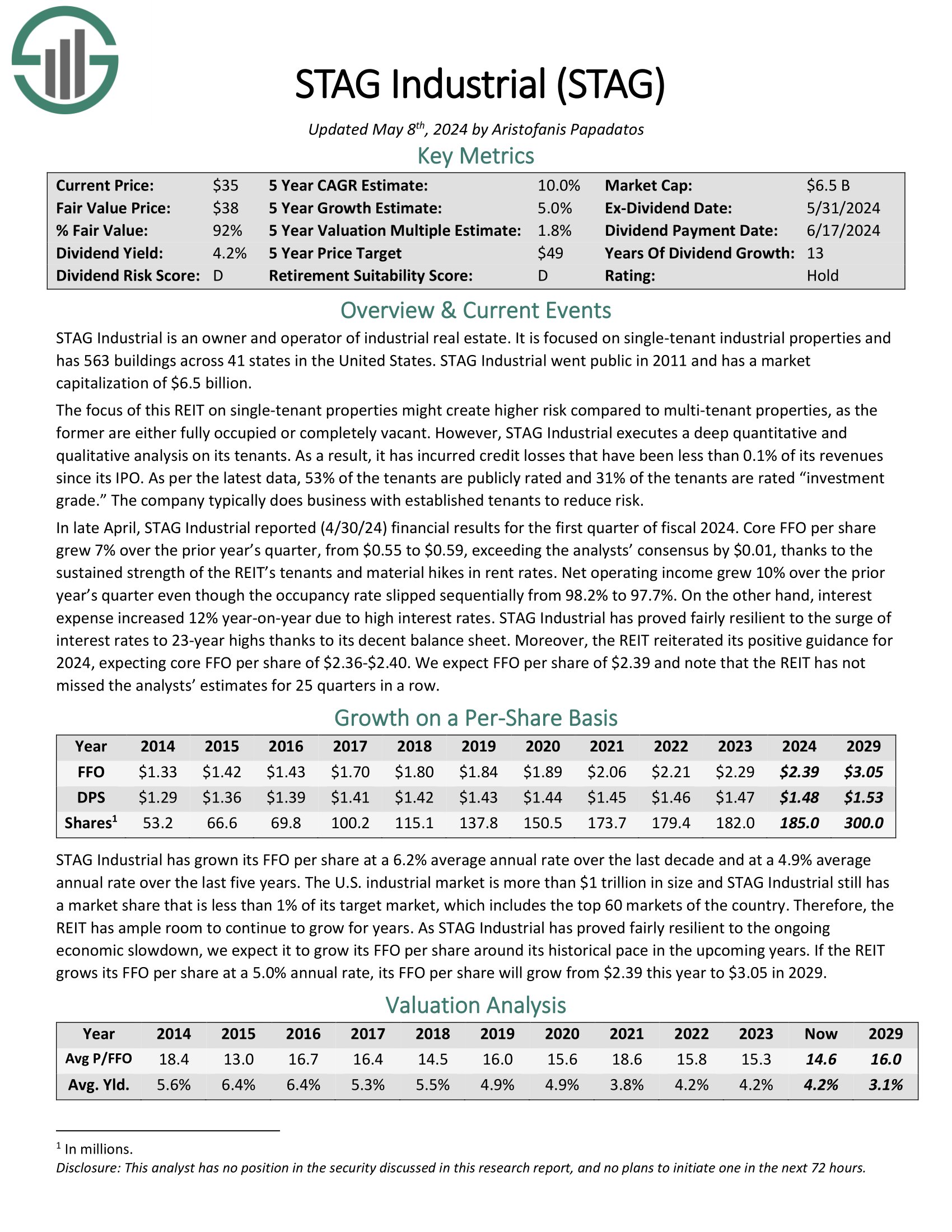

Hold Forever Stock #2: STAG Industrial Inc. (STAG)

STAG Industrial is an owner and operator of industrial real estate. It is focused on single-tenant industrial properties and has ~560 buildings across 41 states in the United States. The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant.

However, STAG Industrial executes a deep quantitative and qualitative analysis on its tenants. As a result, it has incurred credit losses that have been less than 0.1% of its revenues since its IPO. As per the latest data, 53% of the tenants are publicly rated and 31% of the tenants are rated “investment grade.” The company typically does business with established tenants to reduce risk.

In late April, STAG Industrial reported (4/30/24) financial results for the first quarter of fiscal 2024. Core FFO per share grew 7% over the prior year’s quarter, from $0.55 to $0.59, exceeding the analysts’ consensus by $0.01, thanks to the sustained strength of the REIT’s tenants and material hikes in rent rates. Net operating income grew 10% over the prior year’s quarter even though the occupancy rate slipped sequentially from 98.2% to 97.7%.

Click here to download our most recent Sure Analysis report on STAG Industrial Inc. (STAG) (preview of page 1 of 3 shown below):

Hold Forever Stock #1: Realty Income (O)

Realty Income is a real estate investment trust, or REIT, that operates more than 11,100 properties. The trust’s properties are standalone, which makes Realty Income’s locations appealing to a wide variety of tenants, including government services, healthcare services, and entertainment.

Realty Income had long been focused primarily on the U.S., but the trust has recently expanded its operations internationally, with a presence now in both the U.K. and Spain. The trust’s tenants are spread out over more than 70 different industries.

Unlike most companies, Realty Income pays a monthly dividend, including more than 600 payments since going public in 1994.

and entertainment.

Source: Investor Presentation

Realty Income exceeded revenue expectations in the first quarter of 2023, reporting $1.26 billion in revenue following $598 million in investment volume. Its earnings slightly surpassed predictions, with normalized FFO per share reaching $1.05, a penny higher than the analyst estimate.

Realty Income has increased its dividend for 27 years, and is on the exclusive list of Dividend Aristocrats.

Click here to download our most recent Sure Analysis report on Realty Income (O) (preview of page 1 of 3 shown below):

Final Thoughts

There are multiple benefits to owning stocks that pay monthly dividends, with regular distributions chief among them. However, there are a limited number of stocks that provide monthly income, limiting the investor’s choices. Further complicating matters is that not all companies that pay monthly dividends can be considered hold forever type of investments.

We believe that Agree Realty, STAG Industrial, and Realty Income are three exceptions to this as each has a sound business model that has supported dividend increases for at least a decade. These three names could be the most reliable of the monthly dividend payers, making them a possible investment for those looking for stocks to hold forever.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more