Updated on February 25th, 2023 by Samuel Smith

Dynex Capital (DX) is a mortgage Real Estate Investment Trust (mREIT) that offers an appealing 11.4% yield, making it a potentially attractive high yield stock.

Dynex Capital also pays its dividends on a monthly basis. This is rare in a world where the vast majority of companies pay them quarterly.

There are currently over 80 companies with monthly dividend payments.

You can see the full list of monthly dividend stocks (along with relevant financial metrics such as dividend yields, payout ratios, and more) by clicking on the link below:

Dynex Capital’s high dividend yield and monthly dividend payments make it an intriguing stock for dividend investors, even though its dividend payment has been declining in recent years.

However, as with many high-dividend stocks, the sustainability of the dividend is an important consideration. This article will analyze the investment prospects of Dynex Capital.

Business Overview

Dynex Capital is a mortgage Real Estate Investment Trust. As a mortgage REIT, Dynex Capital invests in mortgage-backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non-agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest-only securities.

Agency MBS have a guaranty of principal payment by an agency of the U.S. government or a U.S. government-sponsored entity, such as Fannie Mae and Freddie Mac. Non-Agency MBS have no such guaranty of payment. Dynex Capital, Inc. was founded in 1987 and is headquartered in Glen Allen, Virginia.

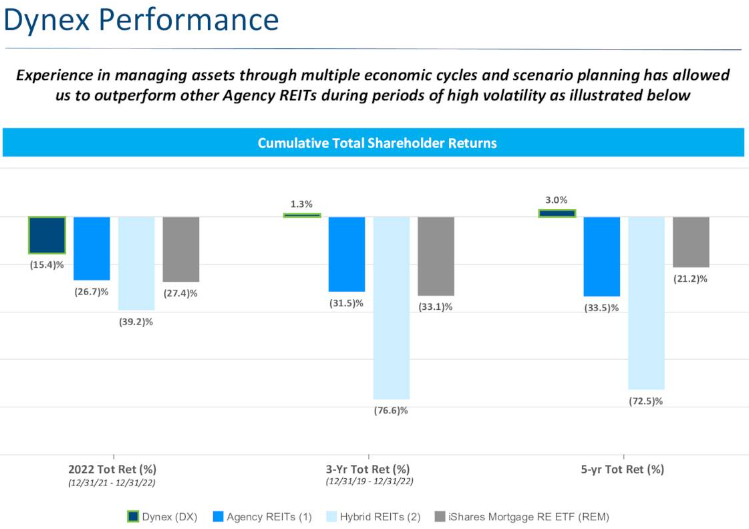

The company is structured to have internal management, which is generally positive because it can reduce conflicts of interest. Additionally, when they increase total equity, there is no material impact on operating expenses. Over time, Dynex’s management team has built a strong track record of generating attractive total returns for shareholders:

Source: Investor presentation

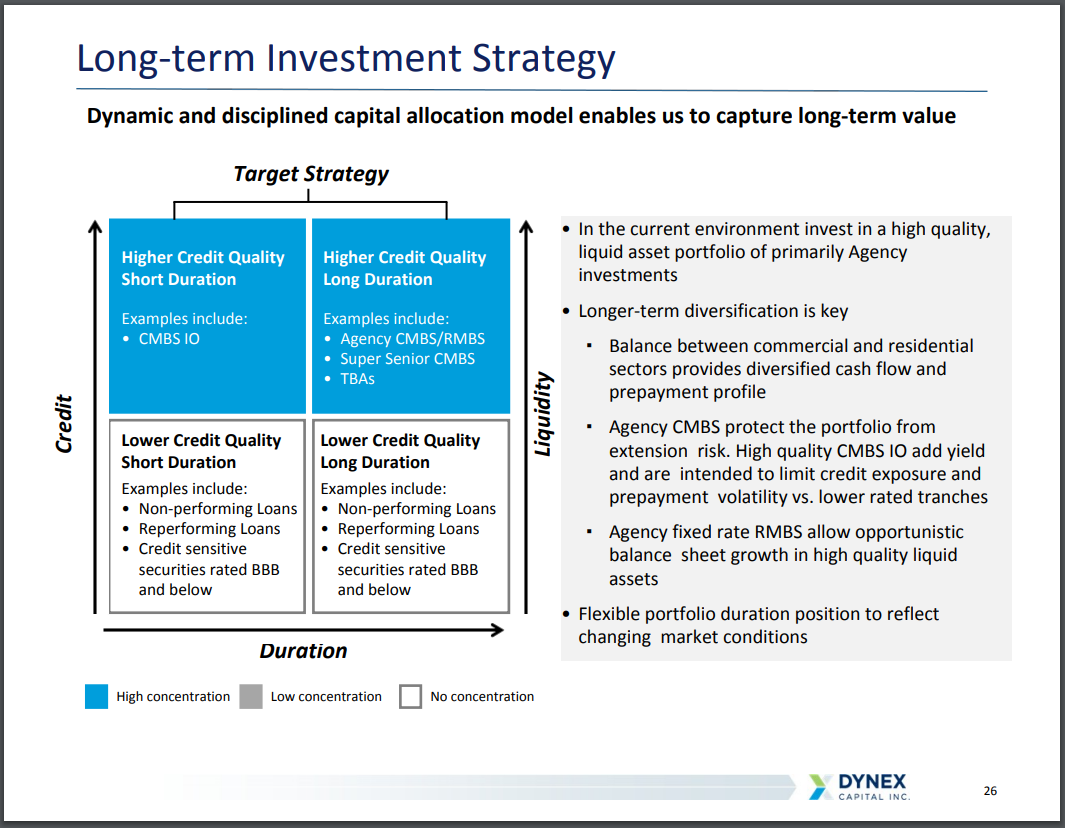

Dynex’s portfolio is structured to be widely diversified across residential and commercial agency securities. This diversified approach creates an attractive risk-to-reward balance that has benefited the company for many years. Over time, the mix of CMBS and RMBS investments has reduced the negative impacts of prepayments on portfolio returns. Furthermore, agency CMBS acts as a cushion in the event of unexpected volatility in interest rates.

Finally, the high-quality CMBS IO are selected for shorter duration and higher yield, with the intended impact of limiting portfolio volatility. A significant portion of Dynex’s Agency 30-year RMBS fixed rate portfolio has prepayment protection via limits on incentives to refinance.

Management anticipates opportunistically increasing leverage in the high-quality asset portfolio while avoiding credit sensitive assets that are leveraged with short term financing. As a result, the company enjoys a highly flexible portfolio that frees management to rapidly pivot to other attractive opportunities as markets remain volatile.

On January 30, 2023, Dynex Capital released its financial results for the fourth quarter and full year 2022. As of December 31, 2022, the book value per common share was $14.73. In the fourth quarter of 2022, the company achieved a total economic return of $0.89 per common share, equivalent to 6.2% of the beginning book value, while for the full year, the return was $(1.71) per common share, representing (9.5)% of the beginning book value.

For the fourth quarter of 2022, Dynex reported a comprehensive income of $1.17 per common share and a net income of $0.85 per common share, whereas for the full year, the comprehensive loss was $(1.24) per common share, and the net income was $3.19 per common share. The company’s realized gains on interest rate hedges, included in GAAP net income, were $204.8 million and $690.7 million for the fourth quarter and full year of 2022, respectively.

For the fourth quarter, the REIT taxable income benefited from an estimated $11.8 million, or $0.24 per common share, due to the amortization of deferred tax hedge gains, while for the full year, the benefit was $22.5 million, or $0.53 per common share.

As of December 31, 2022, the leverage, including TBA dollar roll positions, was 6.1 times shareholders’ equity. The company raised $92.4 million of equity capital during the fourth quarter by issuing common stock through at-the-market (“ATM”) transactions, bringing the total capital raised for 2022 to $246.9 million, net of $3.1 million issuance costs.

Growth Prospects

With interest rates rising rapidly and the mortgage market currently suffering from plummeting demand, Dynex may have a challenging time growing. On top of that, a recession is considered increasingly likely, which in turn could lead to a jump in defaults on Dynex’ investments, posing a further headwind to growth. As a result, when combined with Dynex’s sky-high payout ratio, we are expecting earnings to decline in the coming years, leading to a likely dividend cut.

Source: Investor Presentation

Finally, Dynex brings to the table several competitive advantages which should enable it to generate strong returns for investors throughout business cycles on the back of these long-term tailwinds.

Competitive Advantage & Recession Performance

Dynex possesses some competitive advantages, which may bolster investor returns throughout business cycles. These advantages include the accomplished management team with experience in managing securitized real estate assets through multiple economic cycles. Additionally, the trust’s focus on maintaining a diversified pool of highly liquid mortgage investments with the smallest amount of credit risk could be another advantage.

The trust’s normalized diluted earnings per share were actually quite stable through the last recession, though shares still sold off very heavily, losing about 40% of their market value. All in all, there’s little margin of safety here due largely to the payout ratio being so high, combined with highly volatile earnings-per-share.

Another risk is that prepayment speeds could rise due to seasonal factors. Additionally, the drop in mortgage rates could increase refinancing activity, further cutting into profits.

While some cash-out refinancing is already factored into the company’s prepayment expectations and their portfolio has been structured to hedge against some of this, there will still likely be some lost profits. This explains the company’s recent pattern of dividend reductions since 2019.

Dividend Analysis

The dividend was not fully covered by earnings in fiscal 2022, with $1.04 in earnings per share compared to a $1.56 per share dividend payout. In 2023, we are expecting this pattern to repeat itself with only $1.14 in earnings per share expected to be generated this year. As a result, we expect the dividend to be cut at some point over the next half decade.

Final Thoughts

Dynex Capital’s high dividend yield and monthly dividend payments make it stand out to high-yield dividend investors. However, we remain extremely cautious on the stock.

The company is not covering its dividend with earnings per share. Furthermore, the riskiness of the business model sets up Dynex for potentially steep losses if the economy slips into recession and defaults rise.

This makes the stock fairly risky. Despite the high dividend yield, investors looking for monthly income have better choices with more favorable growth prospects and safer dividends elsewhere.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more