Updated on August 23rd, 2024 by Bob Ciura

Monthly dividend stocks distribute their dividends on a monthly basis, with a smoother income stream to their shareholders.

In addition, many of these companies are shareholder-friendly, i.e., they do their best to maximize their distributions to their shareholders.

As a result, many of these stocks are great candidates for the portfolios of income investors.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yields and payout ratios) by clicking on the link below:

In this article, we will analyze the prospects of a relatively new monthly dividend stock in the public markets, namely Phillips Edison & Company (PECO).

Business Overview

Phillips Edison & Company is an experienced owner and operator that is exclusively focused on grocery-anchored neighborhood shopping centers. It is a Real Estate Investment Trust (REIT) that operates a portfolio of 286 properties wholly-owned properties.

Phillips Edison has a 30-year history, but it began trading publicly only in the summer of 2021. Its management owns 8% of the company, and its interests are aligned with those of the shareholders.

Shopping centers are going through a secular decline due to the shift of consumers from brick-and-mortar shopping to online purchases. This shift has accelerated in the last two years due to the coronavirus crisis.

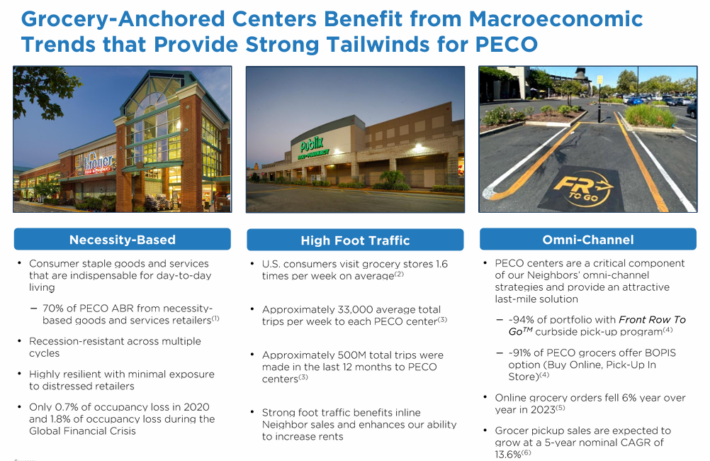

However, Phillips Edison is well protected from this trend. It generates 70% of its rental income from retailers that provide necessity-based goods and services and has minimal exposure to distressed retailers.

The strong foot traffic is a testament to the strength of the business model of the REIT, while it also enables the trust to increase its rents on a regular basis.

Source: Investor Presentation

On July 25th, 2024, Phillips Edison & Company released its Q2 results for the period ending June 30th, 2024. For the quarter, total revenues came in at $161.5 million, 6.2% higher year-over-year.

Same-store NOI rose by 1.9% to $105.6 million, new and renewal leasing spreads landed at 34.4% and 20.5%, respectively, while occupancy was strong at 97.5% – all of which were encouraging.

Along with only marginally higher interest and operating expenses, Nareit FFO for the quarter grew by 4.1% to $78.4 million. Nareit FFO per share was $0.57. However, this was down from $0.58 last year due to a higher share count.

During the quarter, the company acquired two shopping centers and one land parcel for a total of $59.5 million.

For fiscal 2024, management still expects Nareit FFO per share to land between $2.34 and $2.41. This implies a year-over-year growth of 5.8% at the midpoint.

Growth Prospects

As Phillips Edison became public only recently, it has a very short performance record and it is somewhat challenging to forecast its future growth with any degree of precision.

On the other hand, the REIT has several growth drivers in place.

First, it pursues growth by raising its rent on a regular basis. Rent hikes are included in its leases, while the trust raises its rents at a faster pace when it leases a property to a new tenant.

It also pursues growth by redeveloping its properties when the returns are attractive.

As Phillips Edison currently has only ~280 properties, it obviously has immense growth potential, though it will have to issue plenty of new units to fund its acquisitions.

Overall, Phillips Edison has several growth drivers in place and ample room for future growth but it is prudent to keep somewhat conservative expectations due to the short performance record of the trust.

Overall, based on the company’s historical leasing margins, same store NOI growth, and portfolio composition, we forecast FFO/share growth of 3% through 2029.

Competitive Advantages & Recession Performance

The competitive advantage of Phillips Edison lies in its focus on retailers that provide necessity-based goods and services. This focus renders the REIT more resilient to the secular decline of shopping centers than other retail-focused REITs. It also renders the REIT more resilient to recessions than most of its peers.

On the other hand, Phillips Edison performed its IPO less than a year ago, and hence it has not been tested during a recession. Therefore, its defensive business model has yet to be tested.

Dividend Analysis

Phillips Edison pays its dividends on a monthly basis and currently offers a 3.3% dividend yield. In addition, the trust has a payout ratio around 50% and an investment grade balance sheet, with a BBB credit rating from S&P.

Moreover, it has well-laddered debt maturities and no material debt maturities for the next two years. Furthermore, most of its total debt has a fixed rate, which is paramount in the current environment of rising interest rates. Overall, the dividend of Phillips Edison should be considered safe for the foreseeable future.

As a side note, while Phillips Edison has an investment-grade balance sheet, its leverage ratio (Net Debt to EBITDA) currently stands at 5.1. This is above the upper limit of our comfort zone (5.0) and reveals the eagerness of management to invest in the aggressive expansion of the trust.

Nevertheless, we believe that a lower leverage ratio is necessary in order to render the REIT more resilient to unexpected downturns.

Additionally, the 3.3% dividend yield of Phillips Edison is somewhat lower than the median dividend yield of the REIT sector. However, the 50% payout ratio of the stock is lower than the median payout ratio of the REIT sector.

This means that Phillips Edison prefers to retain a greater portion of its earnings in order to invest more aggressively in its expansion. Overall, the dividend proposition of Phillips Edison is in line with the average stock of the REIT sector.

Final Thoughts

Monthly dividend stocks are attractive because they enhance the positive effect of compounding. On the other hand, some of these stocks are highly speculative, with high payout ratios and vulnerability to recessions.

Therefore, investors should perform their due diligence carefully before investing in this group of stocks.

Phillips Edison seems much better than a typical monthly dividend stock, as it has a healthy payout ratio and a fairly resilient business model. Nevertheless, there is some uncertainty that results from its short history and somewhat leveraged balance sheet.

Overall, we have fairly low total return expectations for PECO, but we see the appeal of the stock for its high yield and monthly payouts.

Don’t miss the resources below for more monthly dividend stock investing research.

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more