Updated on March 31st, 2025 by Nathan Parsh

The industrial aerospace industry is not well-known for high dividends or even dividend growth in the U.S. and Canada. Exchange Income Corporation (EIFZF) is a unique Canadian business that acquires companies in the Aerospace, Aviation, and Manufacturing sectors.

Exchange Income’s acquisition and growth strategy have allowed the company to reward shareholders with regular dividend increases since its IPO. Combined with the high dividend yield of more than 5%, this stock should pique the interest of any income investor.

Beyond its high dividend yield, the stock is also quite unique because it pays monthly dividends instead of the traditional quarterly distribution schedule. Monthly dividend payments are highly superior for investors that need to budget around their dividend payments (such as retirees).

There are currently only 76 monthly dividend stocks. You can see the full list of monthly dividend stocks (along with important financial metrics such as dividend yields and price-to-earnings ratios) by clicking on the link below:

Exchange Income Corporation’s high dividend yield and monthly dividend payments are two big reasons why this company stands out to prospective investors.

This is especially true considering the average S&P 500 Index yields just 1.3% right now. By comparison, Exchange Income yields more than four times the average dividend yield of the S&P 500.

That said, proper due diligence is still required for any high-yield stock to ensure its sustainable payout. Fortunately, the dividend payout appears sustainable, making the stock attractive to income investors.

Business Overview

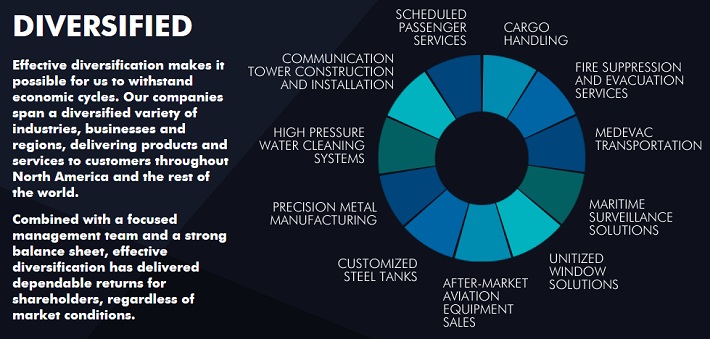

Exchange Income Corporation provides aerospace and aviation services, including scheduled airline and charter services, emergency medical services, after-market aircraft and engines, and pilot flight training services.

Additionally, the company is invested in manufacturing window wall systems used in skyscrapers, vessels, and other industrial purposes.

Finally, Exchange Income also owns telecom towers, which it leases to America’s and Canada’s major telecom providers. The company, which is based in Winnipeg, Canada, generates just over $1 billion in annual revenue.

The corporation has two operating segments: Aerospace & Aviation and Manufacturing.

Source: Investor Relations

Aerospace and aviation make up the bulk of the company’s EBITDA. The company’s strategy is to grow its portfolio of diversified niche operations through acquisitions to provide shareholders with a reliable and growing dividend.

The companies acquired are in defensible niche markets, and EIC has made well over 30 acquisitions since its inception in 2004.

Acquisition candidates must have a track record of profits and strong, continued cash flow generation with committed management focused on building the business post-acquisition.

Growth Prospects

Exchange Income’s results lagged in 2020 due to the negative impacts of COVID-19 on the aviation industry. Since then, the company has not only recovered but has also achieved new top—and bottom-line records.

On February 26th, 2025, the company released its Q4 results for the period ending December 31st, 2024. Revenues for the quarter grew by 7% (in constant currency) to $481.4 million, driven by a 12% increase in Aerospace & Aviation, increased leasing activity in Aircraft Sales & Leasing, and contributions from recent acquisitions, including Duhamel and Spartan.

Adjusted earnings per share (EPS) for the quarter grew 6% to $0.59, mainly due to higher margins in leasing operations and increased profitability from ISR flying activities.

For fiscal 2025, management confirmed their guidance, expecting adjusted EBITDA between C$690 million and C$730 million. This would increase 10% to 16% from the prior year. Based on this outlook, adjusted EPS could reach $2.51, excluding one-time items.

The annual dividend rate of C$2.64 equals approximately $1.82 at the current CAD/USD exchange rate.

The payout ratio was 104% in FY2024 but is expected to drop to slightly more than 70% this year, implying that the dividend is covered by earnings.

We have set our estimated 5-year compound annual growth rate of adjusted EPS to 3%, as much of the company’s post-pandemic recovery has now occurred.

We retain our dividend-per-share growth projections at around 2% during that period, slightly lower than the company’s historical (Canadian) average. The lower dividend growth rate will improve the dividend’s safety over the long term, ensuring adequate dividend coverage.

Dividend Analysis

As with many high-yield stocks, the bulk of Exchange Income’s future expected returns will come from its dividend payments. Management has been committed to increasing the dividend and rewarding shareholders, and they have done so since inception.

The cash dividend payment has increased 16 times since 2004, and it is impressive that the company was able to maintain the dividend even during the pandemic.

Source: Investor Relations

Today, the annualized dividend payout stands at C$2.64 per share annually in Canadian dollars. Of course, U.S. investors need to translate the dividend payout into U.S. dollars to calculate the current yield.

Based on prevailing exchange rates, the dividend payout is approximately $1.82 per share in U.S. dollars, representing a high dividend yield of 5.3%. Exchange Income’s dividend growth has been stable and consistent over the long term.

Using projected 2025 earnings-per-share of $2.51, the stock has a dividend payout ratio of 73%. This means underlying earnings cover the current dividend payout with a decent cushion.

We view the stock as slightly undervalued today. From a total return perspective, we see potential for nearly 10% total returns on an annual basis moving forward. This will consist of the 5.3% dividend yield, 3% annual EPS growth, and a low single-digit contribution from multiple expansions.

Final Thoughts

Exchange Income Corp’s high dividend yield and monthly dividend payments immediately appeal to income investors such as retirees.

Related: 3 Canadian Monthly Dividend Stocks With Yields Up To 6%.

This analysis suggests that the company’s dividend is safe, as measured by the non-GAAP metric of Free Cash Flow minus Maintenance Capital Expenditures.

The company appears slightly undervalued on a price-to-earnings basis. At the same time, it has a solid total return projection. As a result, Exchange Income Corporation appears to be a good stock pick for income investors and offers the potential for double-digit total returns over the next five years.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more