The 8 Rules of Dividend Investing help investors determine what dividend stocks to buy and sell for rising portfolio income over time.

This can help you find the right securities to build or grow your retirement portfolio.

All of The 8 Rules are supported by academic research and ‘common sense’ principles from some of the world’s greatest investors.

Each of The 8 Rules of Dividend Investing are listed below:

- Rule #1: The Quality Rule

- Rule #2: The Bargain Rule

- Rule #3: The Safety Rule

- Rule #4: The Growth Rule

- Rule #5: The Peace of Mind Rule

- Rule #6: The Overpriced Rule

- Rule #7: The Survival of the Fittest Rule

- Rule #8: The Hedge Your Bets Rule

Dividend Investing Rules 1 to 5: What to Buy

Rule # 1 – The Quality Rule

“The single greatest edge an investor can have is a long term orientation”

– Seth Klarman

Common Sense Idea: Invest in high quality businesses that have a proven long-term record of stability, growth, and profitability. There is no reason to own a mediocre business when you can own a high quality business.

How We Implement: Dividend history (the longer the better) is a key component of our Dividend Risk scores.

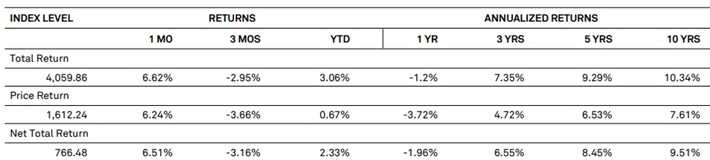

Evidence: The Dividend Aristocrats (S&P 500 stocks with 25+ years of rising dividends) have strong 9%+ annualized total returns over the last decade.

Source: S&P 500 Dividend Aristocrats Factsheet

Rule # 2 – The Bargain Rule

“Price is what you pay, value is what you get”

– Warren Buffett

Common Sense Idea: Invest in businesses that pay you the most dividends per dollar you invest. All things being equal, the higher the dividend yield, the better. Additionally, only invest in stocks trading below their historical average valuation multiple to avoid investing in overpriced securities.

How We Implement: In the Sure Dividend Newsletter, we only invest in stocks with dividend yields equal to or greater than the S&P 500’s dividend yield.

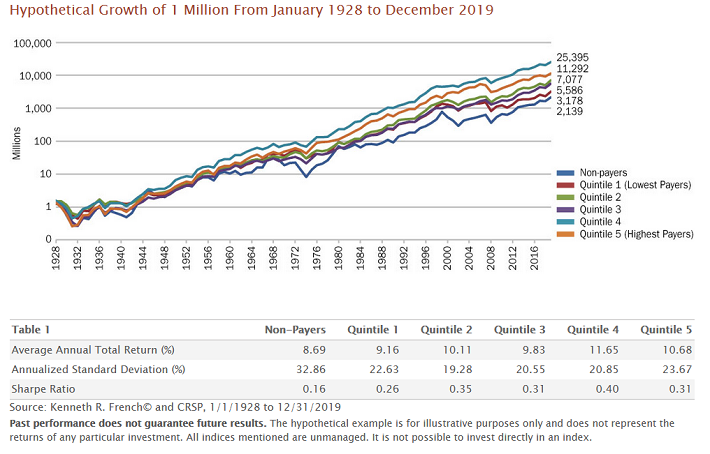

Evidence: The highest yielding quintile of stocks outperformed the lowest yielding quintile of stocks by 1.72% per year from 1928 through 2019.

Source: Dividends: A Review of Historical Returns by Heartland Funds

Rule # 3 – The Safety Rule

“The secret of sound investment in 3 words; margin of safety”

– Benjamin Graham

Common Sense Idea: If a business is paying out all its income as dividends, it has no margin of safety. When a business downturn occurs, the dividend must be reduced. It therefore makes sense to invest in businesses that are not paying out nearly all of their earnings as dividends.

How We Implement: The payout ratio (the lower the better) is a key component of our Dividend Risk scores.

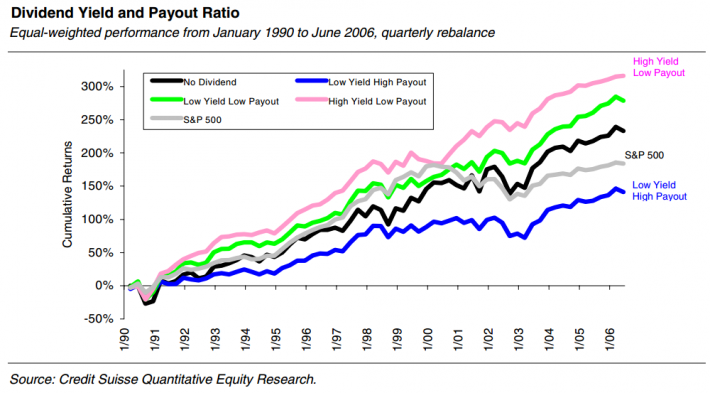

Evidence: High yield low payout ratio stocks outperformed high yield high payout ratio stocks by 8.2% per year from 1990 to 2006.

Source: High Yield, Low Payout by Barefoot, Patel, & Yao

Rule # 4 – The Growth Rule

“All you need for a lifetime of successful investing is a few big winners”

– Peter Lynch

Common Sense Idea: Invest in businesses that have a history of solid growth. If a business has maintained a high growth rate for several years, they are likely to continue to do so. The more a business grows, the more profitable your investment will become. Dividends cannot grow over the long run without rising earnings.

How We Implement: Growth rate is one of three components of expected total returns, along with dividend yield and valuation multiple changes. We create five year forward expected growth rates for all the 880+ securities in Sure Analysis, which powers our recommendations in the Sure Dividend Newsletter.

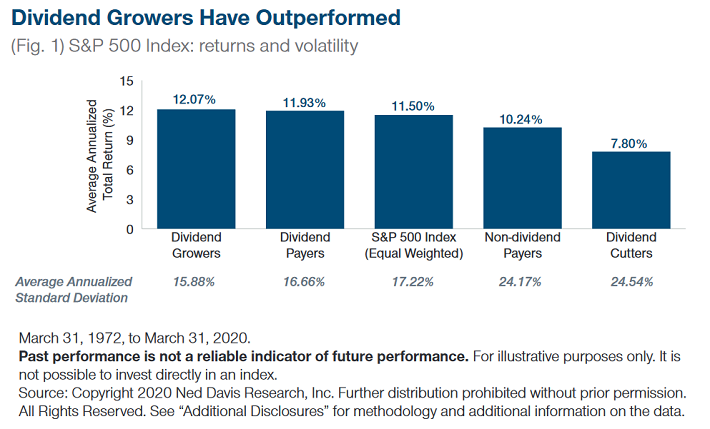

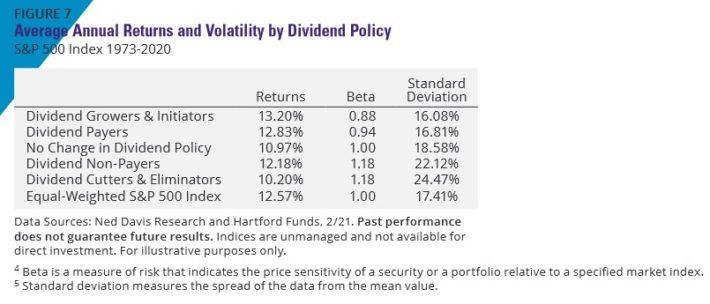

Evidence: Dividend growers have outperformed non-dividend paying stocks by 1.8% annually from March 31st 1972 through March 31st 2020.

Source: The Appeal of a Dividend Strategy Amid Chaotic Markets from T. Rowe Price

Rule # 5 – The Peace of Mind Rule

“Psychology is probably the most important factor in the market – and one that is least understood”

– David Dreman

Common Sense Idea: Look for businesses that people invest in during recessions and times of panic. These businesses will be more likely to continue paying rising dividends during a recession. We would also expect these securities to, in general, have lower stock price standard deviations.

How We Implement: We assign a qualitative recession score to every security in the Sure Analysis Research Database. This recession score factors in to our Dividend Risk scores. The Dividend Risk score factors into the selection process for the Sure Dividend Newsletter.

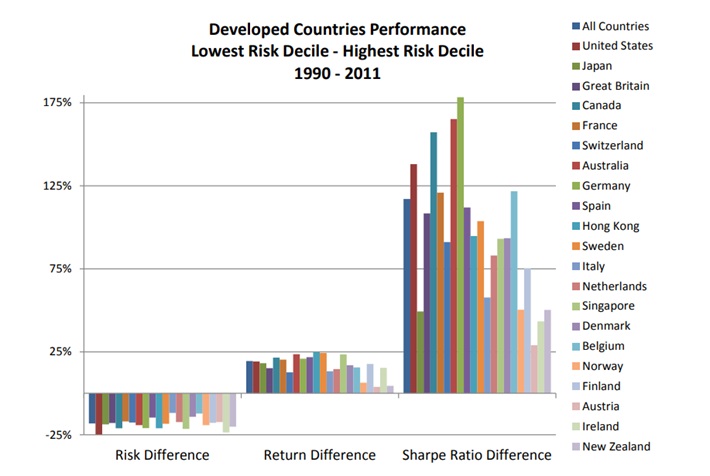

Evidence: Low volatility stocks outperformed high volatility stocks in many developed countries from 1990 through 2011.

Source: Low Risk Stocks Outperform within All Observable Markets of the World, page 5.

Dividend Investing Rules 6 & 7: When to Sell

Rule # 6 – The Overpriced Rule

“Pigs get fat, hogs get slaughtered”

– Unknown

Common Sense Idea: If you are offered $500,000 for a $250,000 house, you take the money. It is the same with a stock. If you can sell a stock for much more than it is worth, you should. Take the money and reinvest it into businesses that pay higher dividends.

How We Implement: We review past recommendations for sells in the Sure Dividend Newsletter when their expected total returns are below the minimum threshold of 3%. Low expected total return securities are typically overvalued and tend to have higher P/E ratios.

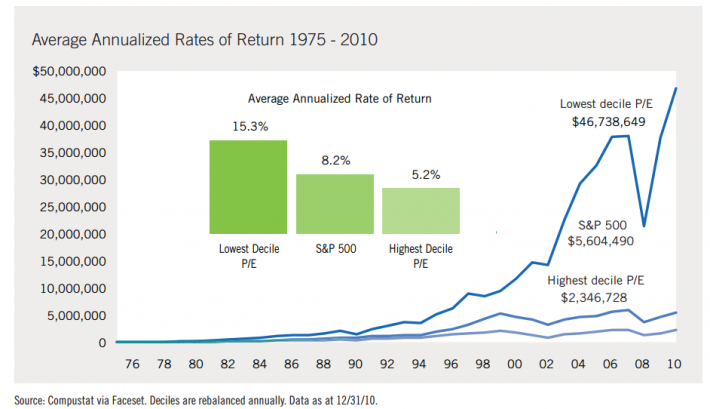

Evidence: The lowest decile of P/E stocks outperformed the highest decile by 9.02% per year from 1975 to 2010.

Source: The Case for Value by Brandes Investment Partners

Rule # 7 – The Survival of the Fittest Rule

“When the facts change, I change my mind. What do you do, sir?”

– John Maynard Keynes

Common Sense Idea: If a stock you own reduces its dividend, it is paying you less over time instead of more. This is the opposite of what should happen. You must admit the business has lost its competitive advantage and reinvest the proceeds of the sale into a more stable business.

Financial Rule: We issue a sell or pending sell rating for past recommendations in the Sure Dividend Newsletter when their dividend is reduced or eliminated. We also analyze past recommendations with an “F” Dividend Risk score for potential sells.

Evidence: Stocks that reduced or eliminated their dividends underperformed the S&P 500 and other dividend paying stock cohorts.

Source: The Power Of Dividends by Hartford Funds (data from Ned Davis Research)

Dividend Investing Rule 8: Portfolio Management

Rule # 8 – The Hedge Your Bets Rule

“The only investors who shouldn’t diversify are those who are right 100% of the time”

– John Templeton

Common Sense Idea: No one is right all the time. Spreading your investments over multiple stocks reduces the impact of being wrong on any one stock.

Financial Rule: Build a diversified portfolio over time. Use The 8 Rules of Dividend Investing as applied in the Sure Dividend Newsletter to find great income securities to buy. See the portfolio building guide in the Sure Dividend Newsletter for more on this.

Evidence: 90% of the benefits of diversification come from owning just 12 to 18 stocks.

Source: Frank Reilly and Keith Brown, Investment Analysis and Portfolio Management, page 213

Start Your Free Trial Of The Sure Dividend Newsletter

You can put the 8 Rules of Dividend Investing to work in your portfolio by starting your free trial of the Sure Dividend Newsletter.

The Sure Dividend Newsletter uses data from The Sure Analysis Research Database to find and rank high quality dividend growth stocks, so you always buy the best businesses at fair or better prices. Ranking criteria looks for businesses with:

- Dividend Risk Scores of A or B

- Market beating expected total returns

- Dividend yields in excess of 2.0% (with most significantly higher)

We have more than 880 securities we track and analyze in The Sure Analysis Research Database. The Sure Dividend Newsletter uses this information to create find and analyze our Top 10 dividend growth stocks every month.

“You and your team run the BEST research program in the country.”

– Sure Dividend member

Click the button below to start your risk-free 7 day trial now

The Sure Dividend Golden Rule Commitment

The Sure Dividend Golden Rule Commitment is our guarantee to treat our customers the way we’d want to be treated.

“Your skills and experience and brain has done so much for me and thousands of others. In reality though, it’s your transparency and integrity that sets you apart from the rest of the investment companies. Yes you are one of the few in the investment industry, who really does live by the Golden Rule. You are the last honest investment teacher. Never change. We’ll keep sending fellow retail customers to you only.”

– Sure Dividend member

Here’s what you get when you join The Sure Dividend Newsletter:

- 7 Day Free Trial – You aren’t billed for seven days. If the newsletter isn’t right for you, just email us (support@suredividend.com) or log in to the member’s area to cancel and you won’t be charged.

- 60 Day Full Refund Grace Period – If The Sure Dividend Newsletter isn’t right for you, just email us (again, support@suredividend.com) anytime during the first 60 days from the date you joined and you will receive a full refund; no explanation needed.

- Prorated Refunds After 60 Days – If you feel The Sure Dividend Newsletter isn’t right for you after the 60 day full refund grace period, just email us (once again, support@suredividend.com) to cancel and you will receive a prorated refund for unused time on your plan.

- Top-Notch Customer Service – Our customer service is handled by key team members. It’s not outsourced or farmed off to people who don’t understand the intricacies of dividend investing. Feel free to ask detailed investing questions. In almost all cases we will answer in one business day or less.

Note: As a newsletter provider, we can’t and won’t provide personalized investment advice.

The Sure Dividend Golden Rule Commitment is there because we care about our readers’ success. We are now trusted by more than 9,000 premium members.

Sure Dividend helps individual investors build high quality dividend growth portfolios for the long run. Part of the way we accomplish this is through fair business terms and quality customer support.

“I have followed Sure Dividend for two years and have found a wealth of information regarding dividend growth stocks, both those names with which I was previously familiar and stocks with which I had no previous experience. I find the information in the Sure Dividend newsletter to be most helpful in my investing.”

– Sure Dividend Member

The Sure Dividend Newsletter currently has a risk-free trial – pay nothing for 7 days. We are offering you this free trial because we know the value The Sure Dividend Newsletter offers and want to reach as many people as possible.

If you don’t feel the newsletter is the right fit for you, just notify me via email at support@suredividend.com to opt-out within your trial period and you will not be charged.

Join now and receive the newest edition of The Sure Dividend Newsletter immediately.

If you have any questions at all, please feel free to email us at support@suredividend.com

Notes: Some testimonials have been edited for privacy and grammar. Testimonials were written by people who were members at the time of writing the testimonial. We have far more positive testimonials than what is shown in this article. You can see them here.