Updated on August 27th, 2024 by Bob Ciura

To invest in great businesses, you have to find them first. That’s where Warren Buffett comes in…

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth approximately $280 billion.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all of Warren Buffett’s stock holdings (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

This article analyzes Warren Buffett’s top 20 stocks based on information disclosed in the Q2 2024 13F filing.

Table of Contents

You can skip to a specific section with the table of contents below. Stocks are listed by percentage of the total portfolio, from highest to lowest.

- How To Use Warren Buffett Stocks To Find Investment Ideas

- Warren Buffett & Dividend Stocks

- #1: Apple, Inc. (AAPL)

- #2: Bank of America Corporation (BAC)

- #3: American Express (AXP)

- #4: The Coca-Cola Company (KO)

- #5: Chevron Corporation (CVX)

- #6: Occidental Petroleum (OXY)

- #7: Kraft Heinz (KHC)

- #8: Moody’s Corporation (MCO)

- #9: Chubb Limited (CB)

- #10: Davita Inc. (DVA)

- #11: Citigroup (C)

- #12: Kroger Co. (KR)

- #13: VeriSign (VRSN)

- #14: Visa Inc. (V)

- #15: Amazon, Inc. (AMZN)

- #16: Mastercard Inc. (MA)

- #17: Liberty SiriusXM Group (LSXMK)

- #18: Nu Holdings (NU)

- #19: Capital One Financial (COF)

- #20: Aon plc (AON)

How To Use Warren Buffett Stocks To Find Investment Ideas

Having a database of Warren Buffett stocks is more powerful when you have the ability to filter it based on important investing metrics.

That’s why this article’s Excel download is so useful…

It allows you to search Warren Buffett stocks to find dividend investment ideas that match your specific portfolio.

For those of you unfamiliar with Excel, this section will show you how to filter Warren Buffett stocks for two important investing metrics – price-to-earnings ratio and dividend yield.

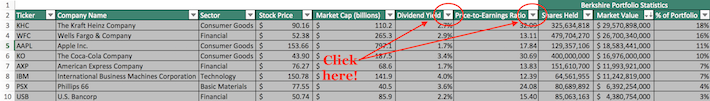

Step 1: Click on the filter icon in the column for dividend yield or price-to-earnings ratio.

Step 2: Filter each metric to find high-quality stocks. Two examples are provided below.

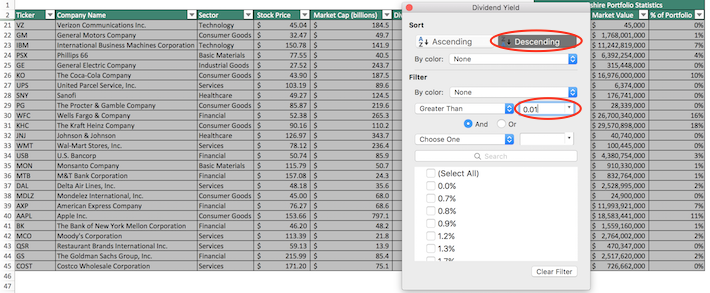

Example 1: To find stocks with dividend yields above 1% and list them in descending order, click the ‘Dividend Yield’ filter and do the following:

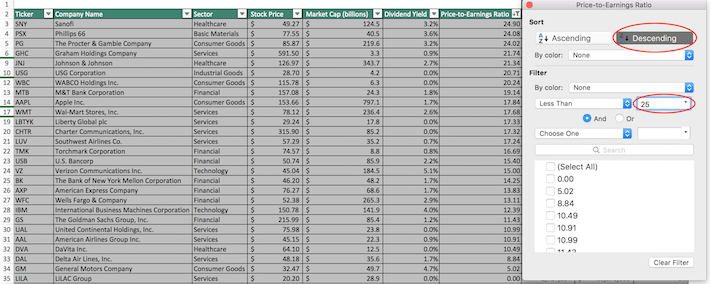

Example 2: To find stocks with price-to-earnings ratios below 25 and list them in descending order, click the ‘Price-to-Earnings Ratio’ filter and do the following:

Warren Buffett & Dividend Stocks

Buffett has grown his wealth by investing in and acquiring businesses with strong competitive advantages trading at fair or better prices.

Most investors know Warren Buffett looks for quality, but few know the degree to which he invests in dividend stocks:

- Over half of Warren Buffett’s top 10 stocks pay dividends

- His top 5 holdings have an average dividend yield of ~2.1% (and make up 78% of his portfolio)

- Many of his dividend stocks have paid rising dividends over decades

Warren Buffett prefers to invest in shareholder-friendly businesses with long track records of success.

Keep reading this article to see Warren Buffett’s 20 highest conviction stock selections analyzed. These are the 20 stocks with the highest value (most weight) in Berkshire Hathaway’s portfolio.

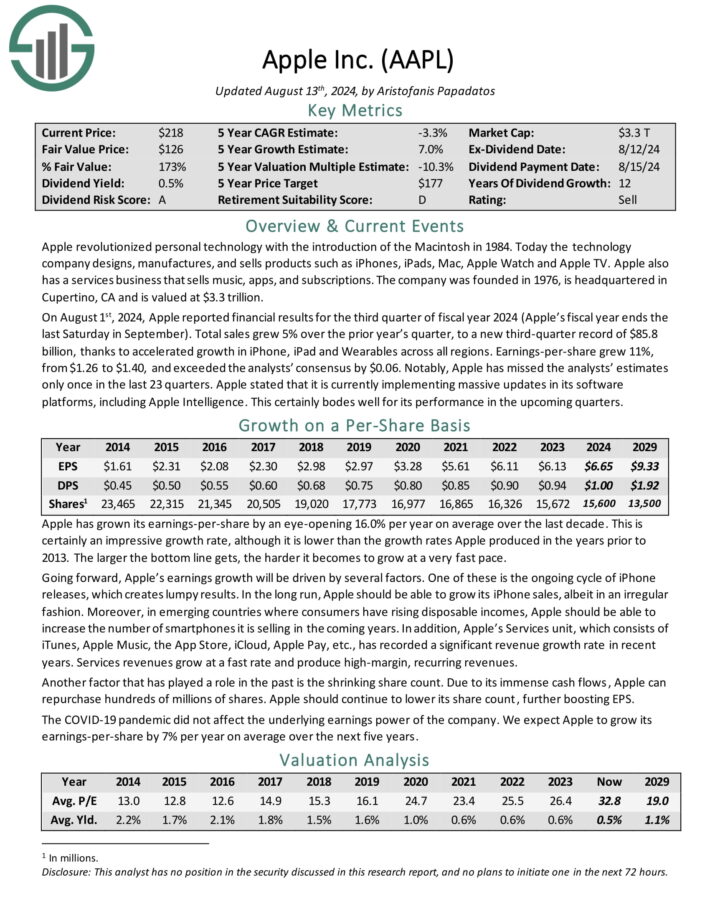

#1: Apple, Inc. (AAPL)

Dividend Yield: 0.4%

Percent of Warren Buffett’s Portfolio: 30.5%

Apple is Berkshire’s largest position by far, due in large part to Apple’s amazing rally over the past few years.

The technology company designs, manufactures and sells products such as iPhones, iPads, Mac, Apple Watch and Apple TV. Apple also has a services business that sells music, apps, and subscriptions.

Apple is also a top holding of other influential investors, such as Kevin O’Leary.

On August 1st, 2024, Apple reported financial results for the third quarter of fiscal year 2024 (Apple’s fiscal year ends the last Saturday in September).

Total sales grew 5% over the prior year’s quarter, to a new third-quarter record of $85.8 billion, thanks to accelerated growth in iPhone, iPad and Wearables across all regions. Earnings-per-share grew 11%, from $1.26 to $1.40, and exceeded the analysts’ consensus by $0.06.

Click here to download our most recent Sure Analysis report on AAPL (preview of page 1 of 3 shown below):

#2: Bank of America Corporation (BAC)

Dividend Yield: 2.6%

Percent of Warren Buffett’s Portfolio: 13.4%

Berkshire Hathaway owns just over 1 billion shares of Bank of America stock, worth roughly $40 billion as of the latest 13F filing.

Bank of America, headquartered in Charlotte, NC, provides traditional banking services, as well as non–banking financial services to customers all over the world. Its operations include Consumer Banking, Wealth & Investment Management and Global Banking & Markets.

Bank of America posted second quarter earnings on July 16th, 2024, and results were better than expected on both the top and bottom lines. Earnings-per-share came to 83 cents, which was three cents better than expected.

Revenue was up only fractionally from the year before, but at $25.4 billion, was $200 million ahead of expectations. Provisions for credit losses were $1.5 billion, up from $1.1 billion a year ago, and $1.3 billion in the first quarter.

Click here to download our most recent Sure Analysis report on Bank of America (preview of page 1 of 3 shown below):

#3: American Express Company (AXP)

Dividend Yield: 1.1%

Percent of Warren Buffett’s Portfolio: 12.7%

American Express is one of Berkshire’s longest-held stocks. American Express is a credit card company that operates the following business units: US Card Services, International Consumer and Network Services, Global Commercial Services, and Global Merchant Services. American Express was founded in 1850.

American Express reported its second quarter earnings results on July 19. The company generated revenues of $16.3 billion during the quarter, which was 9% more than during the previous year’s quarter. The revenue increase was driven by rising consumer spending, partially driven by inflation, while international travel also was a tailwind. Revenues were slightly lower than expected by the analyst community.

American Express was able to generate earnings-per-share to $3.49 during the second quarter on a non-GAAP basis, which was up 21% year over year. American Express’ earnings-per-share beat the analyst consensus, as analysts had forecasted net profits of $3.26 per share. American Express forecasts that revenues will grow at an attractive pace in the current year, currently forecasting full-year revenue growth of around 10%.

Click here to download our most recent Sure Analysis report on American Express (preview of page 1 of 3 shown below):

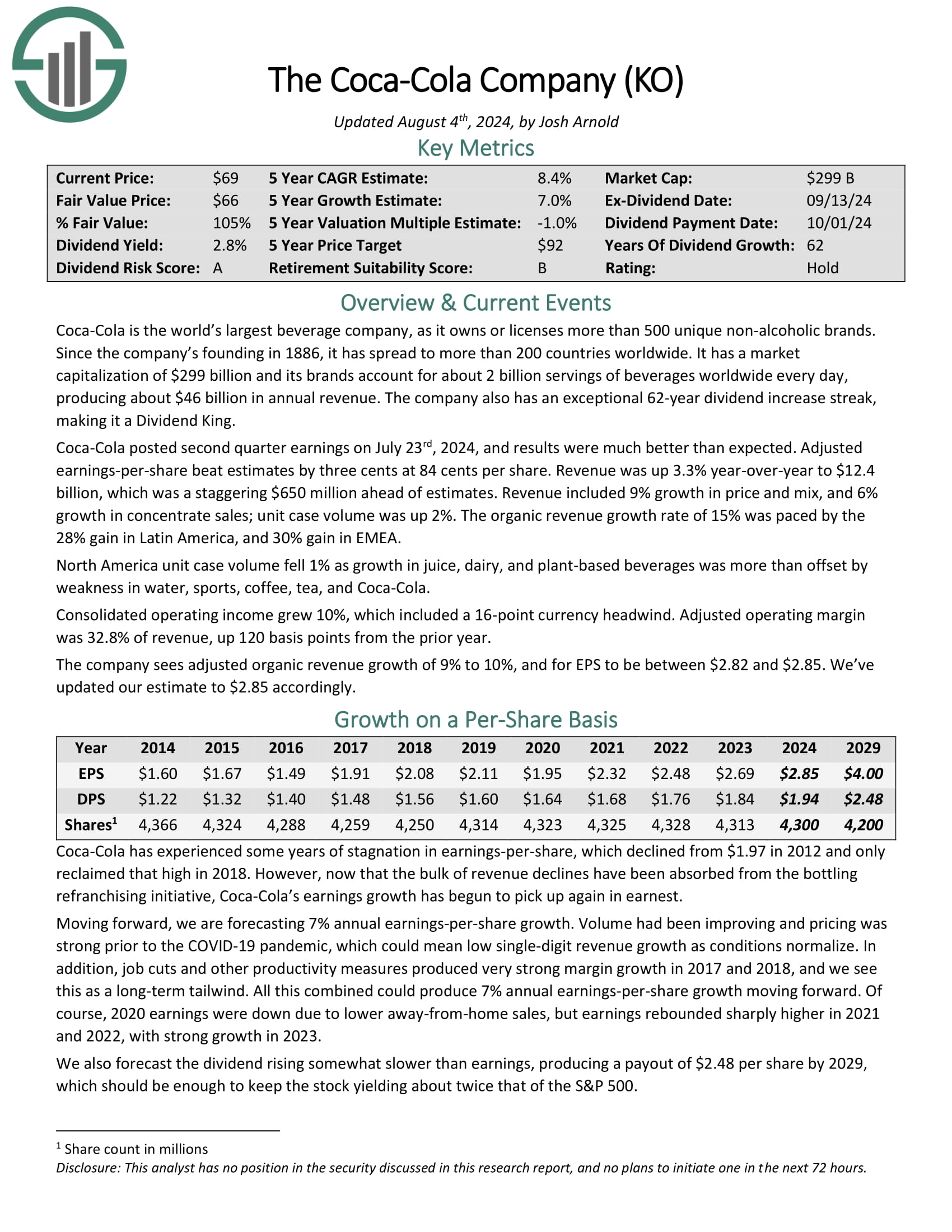

#4: The Coca-Cola Company (KO)

Dividend Yield: 2.7%

Percent of Warren Buffett’s Portfolio: 9.2%

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

Coca-Cola posted second quarter earnings on July 23rd, 2024, and results were much better than expected. Adjusted earnings-per-share beat estimates by three cents at 84 cents per share. Revenue was up 3.3% year-over-year to $12.4 billion, which was a staggering $650 million ahead of estimates.

Revenue included 9% growth in price and mix, and 6% growth in concentrate sales; unit case volume was up 2%. The organic revenue growth rate of 15% was paced by the 28% gain in Latin America, and 30% gain in EMEA.

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

#5: Chevron Corporation (CVX)

Dividend Yield: 4.4%

Percent of Warren Buffett’s Portfolio: 6.7%

Chevron is the fourth-largest oil major in the world based on market cap. Chevron prices some natural gas volumes based on the oil price, meaning nearly 75% of its output is priced based on the oil price. As a result, Chevron is more leveraged to the oil price than the other oil majors.

In early August, Chevron reported (8/2/24) results for the second quarter of fiscal 2024. The price of oil slightly improved while Chevron grew its production 11% thanks to its acquisition of PDC Energy. However, refining margins narrowed off blowout levels and gas prices decreased due to warm winter weather.

As a result, earnings-per-share dipped -17% over the prior year’s quarter, from $3.08 to $2.55, missing the analysts’ consensus by $0.45. Chevron will post strong production growth this year thanks to its recent acquisition of PDC Energy.

Chevron will post strong production growth this year thanks to its recent acquisition of PDC Energy and its pending acquisition of Hess.

Click here to download our most recent Sure Analysis report on CVX (preview of page 1 of 3 shown below):

#6: Occidental Petroleum (OXY)

Dividend Yield: 1.5%

Percent of Warren Buffett’s Portfolio: 5.8%

Occidental Petroleum is an international oil and gas exploration and production company with operations in the U.S., the Middle East, and Latin America. While the company also has a midstream and a chemical segment, it is much more sensitive to the price of oil than the integrated oil majors.

In early August, Occidental reported (8/7/24) financial results for the second quarter of fiscal 2024. Its average realized price of oil grew 5% over the prior quarter while production grew 4%. Earnings-per-share jumped 63% sequentially, from $0.63 to $1.03, and beat the analysts’ consensus by $0.26.

Click here to download our most recent Sure Analysis report on OXY (preview of page 1 of 3 shown below):

#7: The Kraft-Heinz Company (KHC)

Dividend Yield: 4.4%

Percent of Warren Buffett’s Portfolio: 3.8%

Kraft–Heinz is a processed food and beverages company which owns a product portfolio that includes food products such as condiments, sauces, cheese & dairy, frozen & chilled meals, and infant diet & nutrition.

The Kraft-Heinz Company reported its second quarter earnings results on July 31. Revenue totaled $6.5 billion during the quarter, which was down 3.3% from the same quarter last year. This was slightly worse than what the analyst community had expected.

Kraft-Heinz’ organic sales were down by 0.5%. Organic sales were better than reported sales due to the impact of currency rate movements, as organic sales were down 2.4% compared to the previous year’s quarter. This was a weaker performance compared to the previous quarter.

Kraft-Heinz generated earnings-per-share of $0.78 during the second quarter, which was above the consensus estimate. Earnings-per-share were down 1% year-over-year.

Click here to download our most recent Sure Analysis report on Kraft-Heinz (preview of page 1 of 3 shown below):

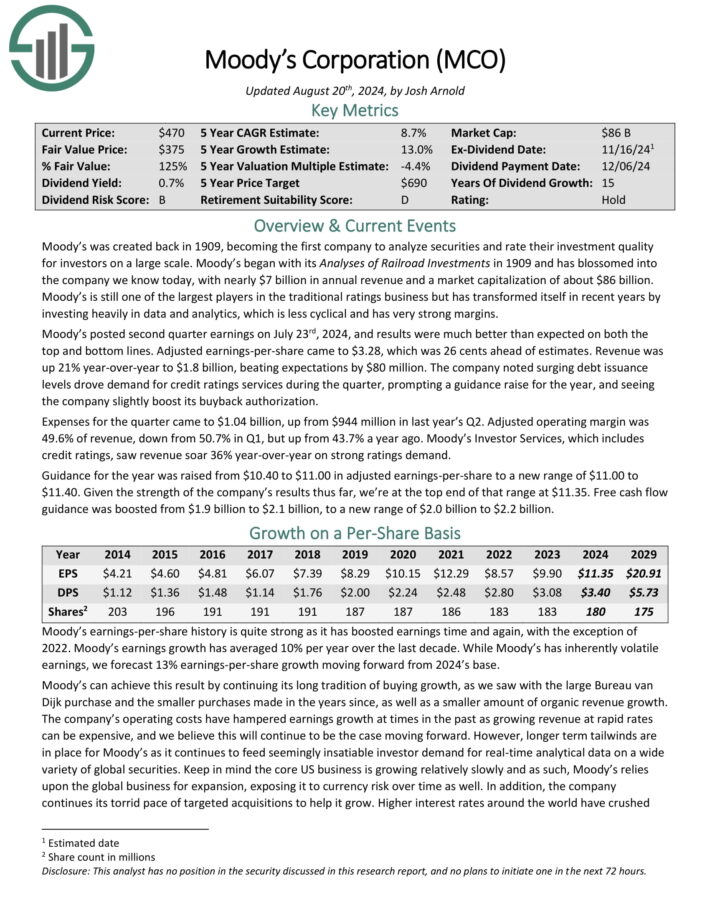

#8: Moody’s Corporation (MCO)

Dividend Yield: 0.7%

Percent of Warren Buffett’s Portfolio: 3.8%

Moody’s was created back in 1909, becoming the first company to analyze securities and rate their investment quality for investors on a large scale. Moody’s began with its Analyses of Railroad Investments in 1909 and has blossomed into the company we know today, with over $6 billion in annual revenue.

Moody’s posted second quarter earnings on July 23rd, 2024, and results were much better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $3.28, which was 26 cents ahead of estimates. Revenue was up 21% year-over-year to $1.8 billion, beating expectations by $80 million.

The company noted surging debt issuance levels drove demand for credit ratings services during the quarter, prompting a guidance raise for the year, and seeing the company slightly boost its buyback authorization.

Click here to download our most recent Sure Analysis report on Moody’s (preview of page 1 of 3 shown below):

#9: Chubb Limited (CB)

Dividend Yield: 1.3%

Percent of Warren Buffett’s Portfolio: 2.5%

Chubb Ltd is a global provider of insurance and reinsurance services headquartered in Zurich, Switzerland. The company provides insurance services including property & casualty insurance, accident & health insurance, life insurance, and reinsurance.

For its fiscal second quarter, Chubb Ltd reported net earned premiums of $12.3 billion, which was 12% year-over-year growth. Net written premiums were up 12% year-over-year in the company’s Global P&C business unit, while other business units such as Life saw solid growth as well.

CB generated net investment income of $1.47 billion during the quarter, or $1.56 billion after adjustments, which was up by a nice 26% compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on Chubb (preview of page 1 of 3 shown below):

#10: DaVita Inc. (DVA)

Dividend Yield: N/A (DaVita does not currently pay a quarterly dividend)

Percent of Warren Buffett’s Portfolio: 1.79%

Berkshire’s investment portfolio contains just over 36 million shares of DaVita, Inc., equating to a total investment of $2.60 billion at the time of the last 13F filing. DaVita is slightly more than 1% of Berkshire’s overall investment portfolio.

DaVita provides kidney dialysis services for patients suffering from chronic kidney failure or end stage renal disease. The company operates kidney dialysis centers and provides related lab services in outpatient dialysis centers.

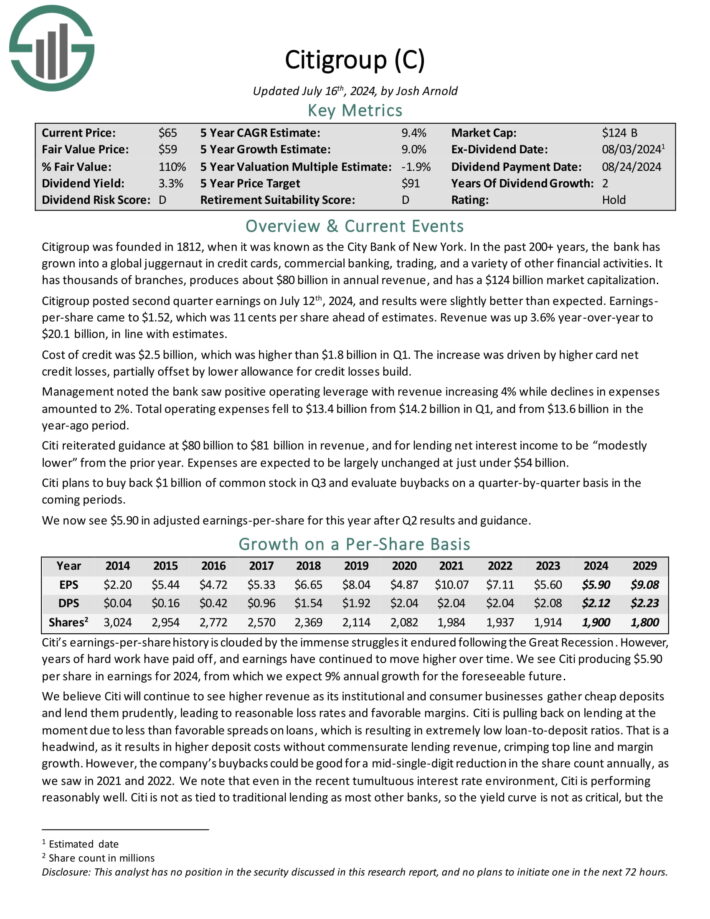

#11: Citigroup Inc. (C)

Dividend Yield: 3.6%

Percent of Warren Buffett’s Portfolio: 1.27%

Citigroup is a global juggernaut in credit cards, commercial banking, trading, and a variety of other financial activities. It has thousands of branches and produces about $75 billion in annual revenue.

Citigroup posted second quarter earnings on July 12th, 2024, and results were slightly better than expected. Earnings-per-share came to $1.52, which was 11 cents per share ahead of estimates. Revenue was up 3.6% year-over-year to $20.1 billion, in line with estimates.

Cost of credit was $2.5 billion, which was higher than $1.8 billion in Q1. The increase was driven by higher card net credit losses, partially offset by lower allowance for credit losses build.

Management noted the bank saw positive operating leverage with revenue increasing 4% while declines in expenses amounted to 2%. Total operating expenses fell to $13.4 billion from $14.2 billion in Q1, and from $13.6 billion in the year-ago period.

Click here to download our most recent Sure Analysis report on Citigroup (preview of page 1 of 3 shown below):

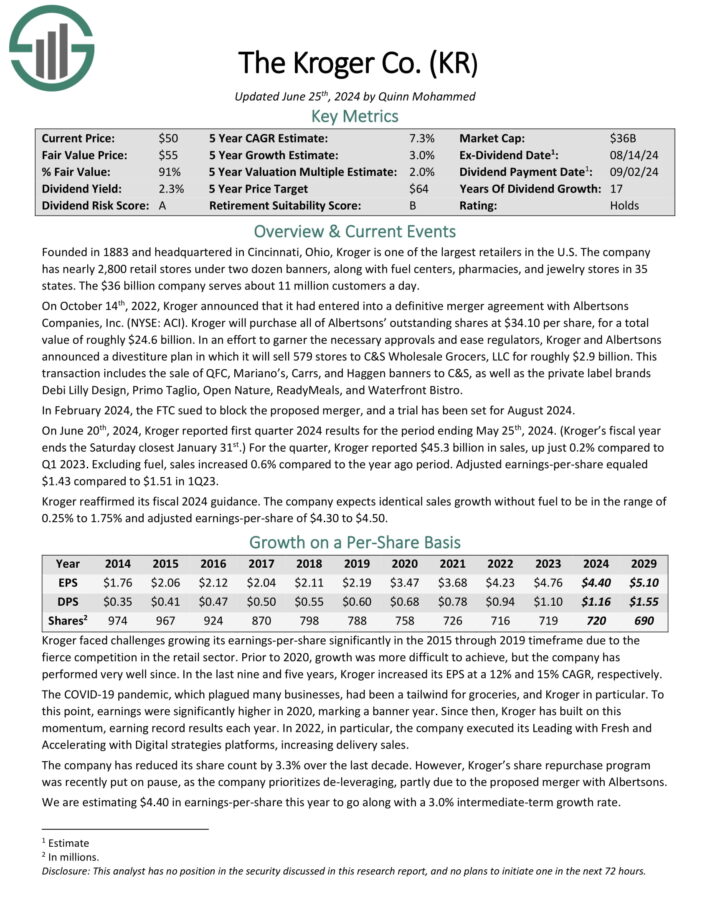

#12: The Kroger Co. (KR)

Dividend Yield: 2.2%

Percent of Warren Buffett’s Portfolio: 0.9%

Founded in 1883 and headquartered in Cincinnati, Ohio, Kroger is one of the largest retailers in the U.S. The company has nearly 2,800 retail stores under two dozen banners, along with fuel centers, pharmacies and jewelry stores in 35 states.

On June 20th, 2024, Kroger reported first quarter 2024 results for the period ending May 25th, 2024. (Kroger’s fiscal year ends the Saturday closest January 31st.)

For the quarter, Kroger reported $45.3 billion in sales, up just 0.2% compared to Q1 2023. Excluding fuel, sales increased 0.6% compared to the year ago period. Adjusted earnings-per-share equaled $1.43 compared to $1.51 in 1Q23.

Click here to download our most recent Sure Analysis report on Kroger (preview of page 1 of 3 shown below):

#13: VeriSign, Inc. (VRSN)

Dividend Yield: N/A

Percent of Warren Buffett’s Portfolio: 0.83%

VeriSign is a globally diversified provider of domain name registry services and Internet security software. The company operates in a single segment, and has a significant international presence.

#14: Visa Inc. (V)

Dividend Yield: 0.8%

Percent of Warren Buffett’s Portfolio: 0.79%

Visa is the world’s leader in digital payments, with activity in more than 200 countries. The company’s global processing network provides secure and reliable payments around the world and is capable of handling more than 65,000 transactions a second.

On July 23rd, 2024, Visa reported third quarter 2024 results for the period ending June 30th, 2023. (Visa’s fiscal year ends September 30th.) For the quarter, Visa generated revenue of $8.9 billion, adjusted net income of $4.9 billion and adjusted earnings-per-share of $2.42, marking increases of 10%, 9% and 12%, respectively.

These results were driven by a 7% gain in Payments Volume, a 14% gain in Cross-Border Volume and an 10% gain in Processed Transactions. Visa processed 59.3 billion transactions in the quarter.

Click here to download our most recent Sure Analysis report on Visa (preview of page 1 of 3 shown below):

#15: Amazon Inc. (AMZN)

Dividend Yield: N/A

Percent of Warren Buffett’s Portfolio: 0.70%

Amazon is a massive tech company. It is an online retailer that operates a massive e-commerce platform where consumers can buy virtually anything with their computers or smartphones. Amazon is a mega-cap stock with a market cap above $1 trillion. It operates through the following segments:

- North America

- International

- Amazon Web Services

The North America and International segments include the global retail platform of consumer products through the company’s websites. The Amazon Web Services segment sells subscriptions for cloud computing and storage services to consumers, start-ups, enterprises, government agencies, and academic institutions.

Amazon’s e-commerce operations fueled its massive revenue growth over the past decade. Sales reached $514 billion in 2022, an amazing level of growth over the past decade.

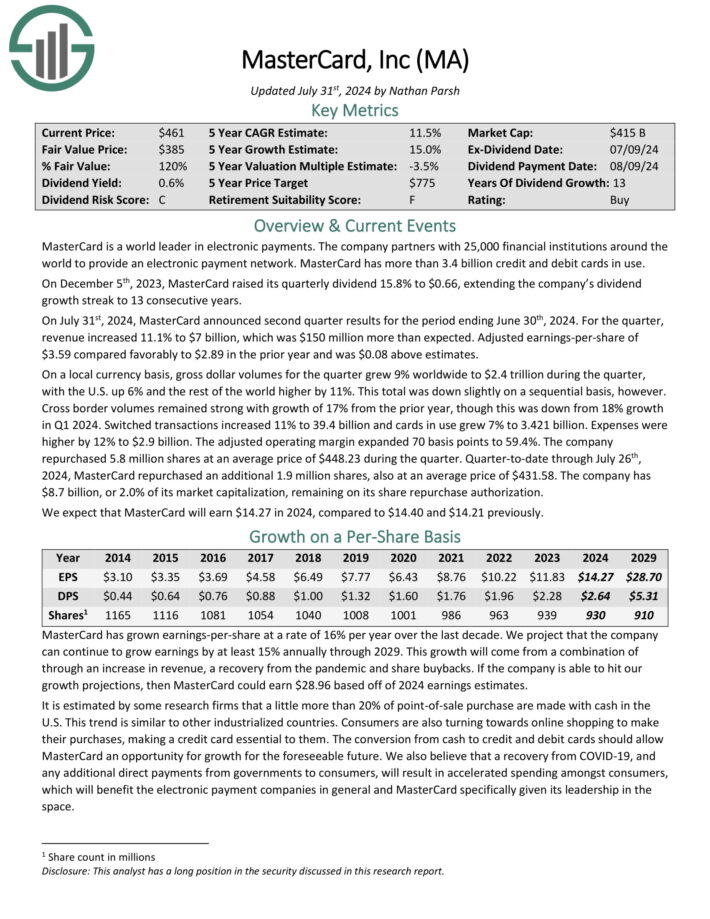

#16: Mastercard Inc. (MA)

Dividend Yield: 0.6%

Percent of Warren Buffett’s Portfolio: 0.64%

MasterCard is a world leader in electronic payments. The company partners with 25,000 financial institutions around the world to provide an electronic payment network. MasterCard has more than 3.1 billion credit and debit cards in use.

On July 31st, 2024, MasterCard announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue increased 11.1% to $7 billion, which was $150 million more than expected. Adjusted earnings-per-share of $3.59 compared favorably to $2.89 in the prior year and was $0.08 above estimates.

On a local currency basis, gross dollar volumes for the quarter grew 9% worldwide to $2.4 trillion during the quarter, with the U.S. up 6% and the rest of the world higher by 11%. This total was down slightly on a sequential basis, however. Cross border volumes remained strong with growth of 17% from the prior year.

Click here to download our most recent Sure Analysis report on Mastercard (preview of page 1 of 3 shown below):

#17: Liberty SiriusXM Group (LSXMK)

Dividend Yield: N/A

Percent of Warren Buffett’s Portfolio: 0.56%

The Liberty SiriusXM Group, through its subsidiaries, engages in the entertainment business in the United States, the United Kingdom, and internationally.

It features music, sports, entertainment, comedy, talk, news, traffic, weather channels, podcasts, and more.

#18: Nu Holdings (NU)

Dividend Yield: N/A

Percent of Warren Buffett’s Portfolio: 0.50%

Nu Holdings Ltd. provides a digital banking platform in Brazil, Mexico, Colombia, Cayman Islands, Germany, Argentina, the United States, and Uruguay.

It offers spending solutions comprising Nu credit and prepaid card, a digitally enabled card that acts as a credit and a prepaid card, and many more.

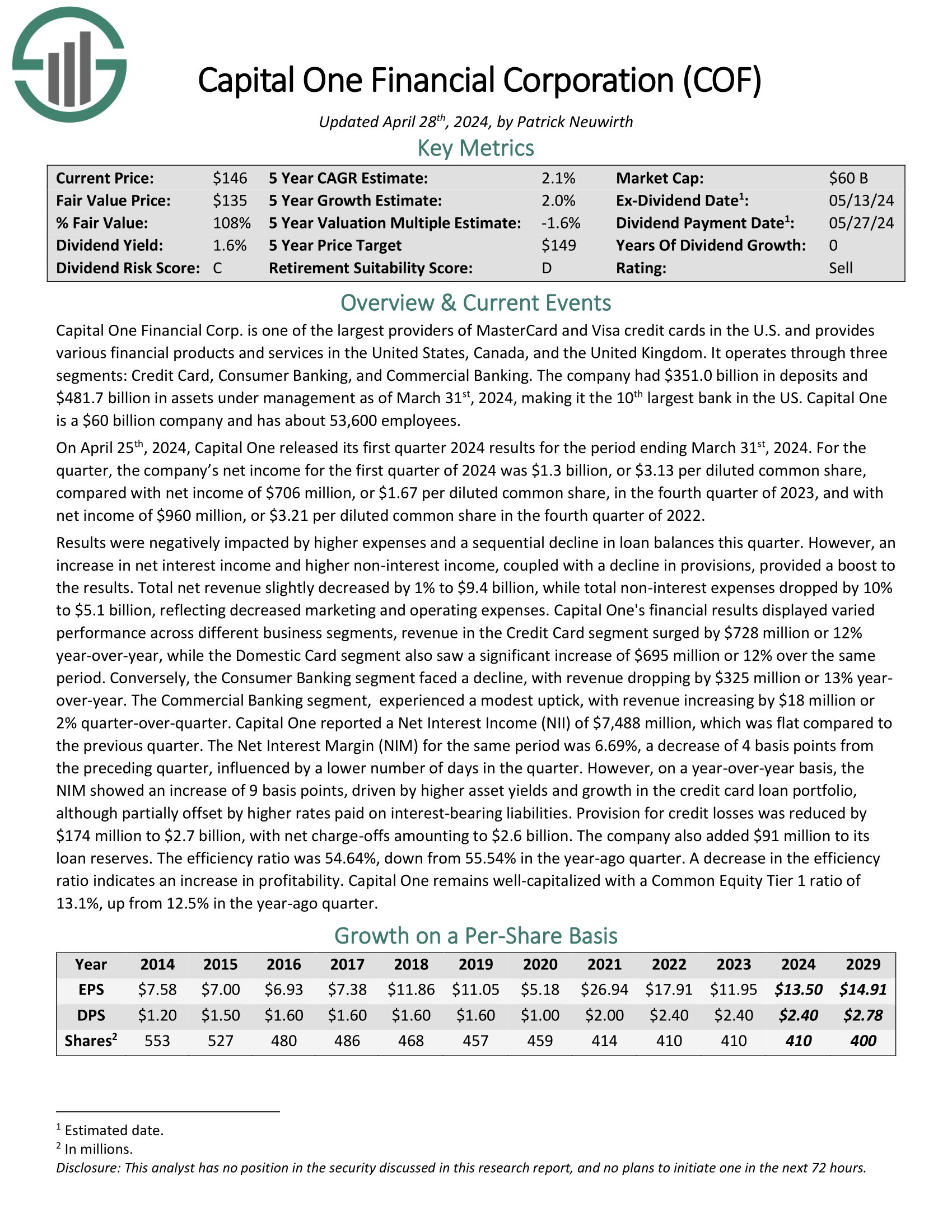

#19: Capital One Financial (COF)

Dividend Yield: 2.0%

Percent of Warren Buffett’s Portfolio: 0.49%

Capital One Financial Corp. is one of the largest providers of MasterCard and Visa credit cards in the U.S. and provides various financial products and services in the United States, Canada, and the United Kingdom. It operates through three segments: Credit Card, Consumer Banking, and Commercial Banking.

The company had $348.0 billion in deposits and $478 billion in assets under management as of the end of 2023, making it the 10th largest bank in the US.

On April 25th, 2024, Capital One released its first quarter 2024 results for the period ending March 31st, 2024. For the quarter, net income was $1.3 billion, or $3.13 per diluted common share, compared with $1.67 per diluted common share, in the fourth quarter of 2023.

Click here to download our most recent Sure Analysis report on COF (preview of page 1 of 3 shown below):

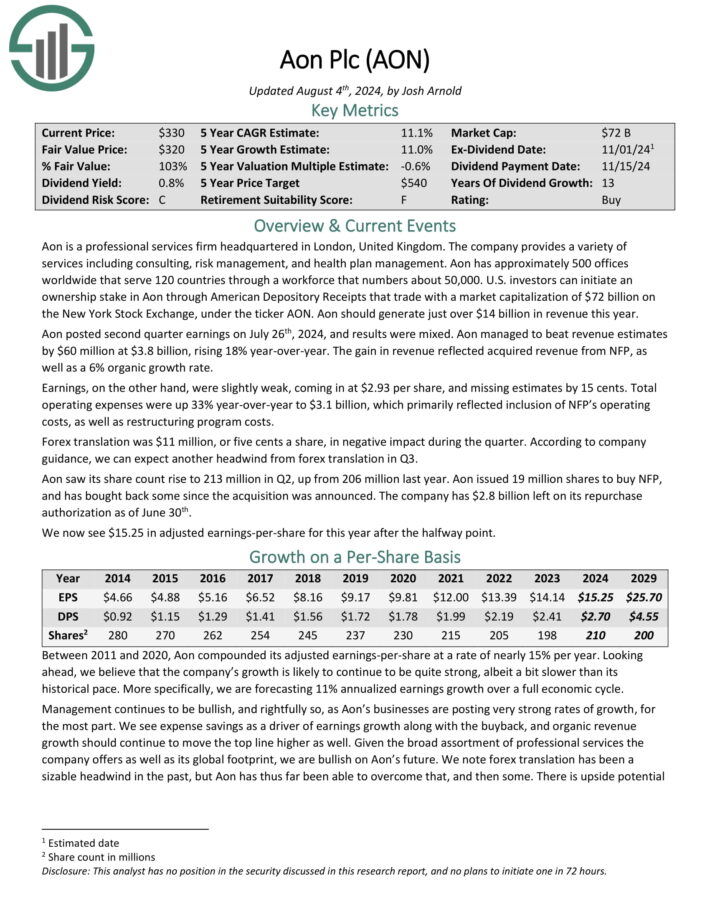

#20: Aon plc (AON)

Dividend Yield: 0.8%

Percent of Warren Buffett’s Portfolio: 0.44%

Aon is a professional services firm headquartered in London, United Kingdom. The company provides a variety of services including consulting, risk management, and health plan management.

Aon has approximately 500 offices worldwide that serve 120 countries through a workforce that numbers about 50,000.

Aon posted second quarter earnings on July 26th, 2024, and results were mixed. Aon managed to beat revenue estimates by $60 million at $3.8 billion, rising 18% year-over-year. The gain in revenue reflected acquired revenue from NFP, as well as a 6% organic growth rate.

Earnings, on the other hand, were slightly weak, coming in at $2.93 per share, and missing estimates by 15 cents. Total operating expenses were up 33% year-over-year to $3.1 billion, which primarily reflected inclusion of NFP’s operating costs, as well as restructuring program costs.

Click here to download our most recent Sure Analysis report on Aon (preview of page 1 of 3 shown below):

Final Thoughts

You can see the following additional articles regarding Warren Buffett:

- Warren Buffett’s 106 Best Quotes Of All Time

- Snowball Effect Investing | Compound Your Wealth Like Warren Buffett

Warren Buffett stocks represent many of the strongest, most long-lived businesses around. You can see more high-quality dividend stocks in the following Sure Dividend databases:

- The 2024 Dividend Kings List: Dividend Stocks With 50+ Years of Rising Dividends

- The 2024 Dividend Aristocrats List: 25+ Years of Rising Dividends

- The 20 Highest Yielding Dividend Aristocrats Now

- Blue Chips List: Stocks With 10+ Years of Rising Dividends

You might also be looking to create a highly customized dividend income stream to pay for life’s expenses.

The following two lists provide useful information on high dividend stocks and stocks that pay monthly dividends: