Updated on October 29th, 2024 by Bob Ciura

Kevin O’Leary is Chairman of O’Shares Investment Advisors, but you probably know him as “Mr. Wonderful”.

He can be seen on CNBC as well as the television show Shark Tank. Investors who have seen him on TV have likely heard him discuss his investment philosophy.

Mr. Wonderful looks for stocks that exhibit three main characteristics:

- First, they must be quality companies with strong financial performance and solid balance sheets.

- Second, he believes a portfolio should be diversified across different market sectors.

- Third, and perhaps most important, he demands income—he insists the stocks he invests in pay dividends to shareholders.

You can download the complete list of all of O’Shares Investment Advisors stock holdings by clicking the link below:

OUSA owns stocks that display a mix of all three qualities. They are market leaders with strong profits, diversified business models, and they pay dividends to shareholders.

The list of OUSA portfolio holdings is an interesting source of quality dividend growth stocks.

This article analyzes the fund’s largest holdings in detail.

Table of Contents

The top 10 holdings from the O’Shares FTSE U.S. Quality Dividend ETF are listed in order of their weighting in the fund, from lowest to highest.

- McDonald’s Corporation (MCD)

- Comcast Corporation (CMCSA)

- Alphabet Inc. (GOOGL)

- MasterCard Inc. (MA)

- Merck & Co. (MRK)

- Johnson & Johnson (JNJ)

- Visa Inc. (V)

- Microsoft Corporation (MSFT)

- Apple Inc. (AAPL)

- Home Depot (HD)

- Final Thoughts

- Additional Resources

No. 10: McDonald’s Corporation (MCD)

Dividend Yield: 2.4%

Percentage of OUSA Portfolio: 3.38%

McDonald’s is the world’s leading restaurant chain with 41,822 locations in about 119 countries at end of 2022. The highest store counts are in the US (13,449), China (5,903), Japan (2,982), France (1,560), and Canada (1,466).

Approximately 95% of the stores are franchised or licensed and the rest are company owned. However, the company owns about 55% of the real estate and 80% of the buildings in its network.

Total system sales were approximately $129.5B in 2023 and total revenue was around $25.5B in 2023. On July 29th, McDonald’s reported Q2 2024 results. Total revenue came in at $6,490M, flat compared to $6,498M in Q2 2023 on a 1% drop in systemwide sales adjusting for currency headwinds.

Revenue declined 1% at company-owned stores, while revenue was flat at franchised restaurants. Diluted earnings dropped 11% to $2.80 per share compared to $3.15 per share in comparable periods on lower sales and pre-tax charges.

On a geographic basis, comparable sales decreased -0.7% in the US, -1.1% in the international operated markets, and -1.3% in the international developmental licensed markets.

Click here to download our most recent Sure Analysis report on MCD (preview of page 1 of 3 shown below):

No. 9: Comcast Corporation (CMCSA)

Dividend Yield: 3.0%

Percentage of Portfolio: 3.67%

Comcast is a media, entertainment and communications company. As of Q1 2023, Comcast began reporting in 2 key business segments: Connectivity & Platforms (Residential Connectivity & Platforms and Business Services Connectivity), and Content & Experiences (Media, Studios, Theme Parks).

Comcast reported its Q2 2024 results on 07/23/24. For the quarter, the company’s revenues fell 2.7% to $29.7 billion, and adjusted EBITDA (a cash flow proxy) was down marginally by 0.7% to $10.2 billion. However, it was able to increase adjusted earnings-per-share (EPS) by 7.0% to $1.21. And it generated free cash flow (FCF) of $1.3 billion.

The Connectivity & Platforms segment’s revenues were down 0.6% to $20.2 billion. The segment experienced adjusted EBITDA growth of 1.6% to $8.5 billion, helped by margins expansion of 0.9% to 41.9%. The Content & Experiences segment saw revenue fell 7.5% to $10.1 billion, while its adjusted EBITDA fell 10.9% to $1.9 billion.

Click here to download our most recent Sure Analysis report on CMCSA (preview of page 1 of 3 shown below):

No. 8: Alphabet Inc. (GOOGL)

Dividend Yield: 0.48%

Percentage of OUSA Portfolio: 3.83%

Alphabet is a holding company. With a market capitalization that exceeds $2 trillion, Alphabet is a technology conglomerate that operates several businesses such as Google search, Android, Chrome, YouTube, Nest, Gmail, Maps, and many more. Alphabet is a leader in many of the areas of technology that it operates.

Alphabet has a market cap above $2 trillion, making it a mega-cap stock.

There are two classes of Alphabet stock, Class A shares, which has voting rights, and Class C shares, that do not have voting rights. This report will reference the Class A shares. On July 23rd, 2024, Alphabet declared its second ever quarterly dividend of $0.20 per share.

Also on July 23rd, 2024, Alphabet announced second quarter results for the period ending June 30th, 2024. As had been the case for several quarters, the company delivered better than expected results.

Revenue improved 13.6% to $84.7 billion for the period, topping analysts’ estimates by $450 million. Adjusted earnings-per-share of $1.89 compared very favorably to $1.44 in the prior year and was $0.04 more than expected.

Click here to download our most recent Sure Analysis report on GOOGL (preview of page 1 of 3 shown below):

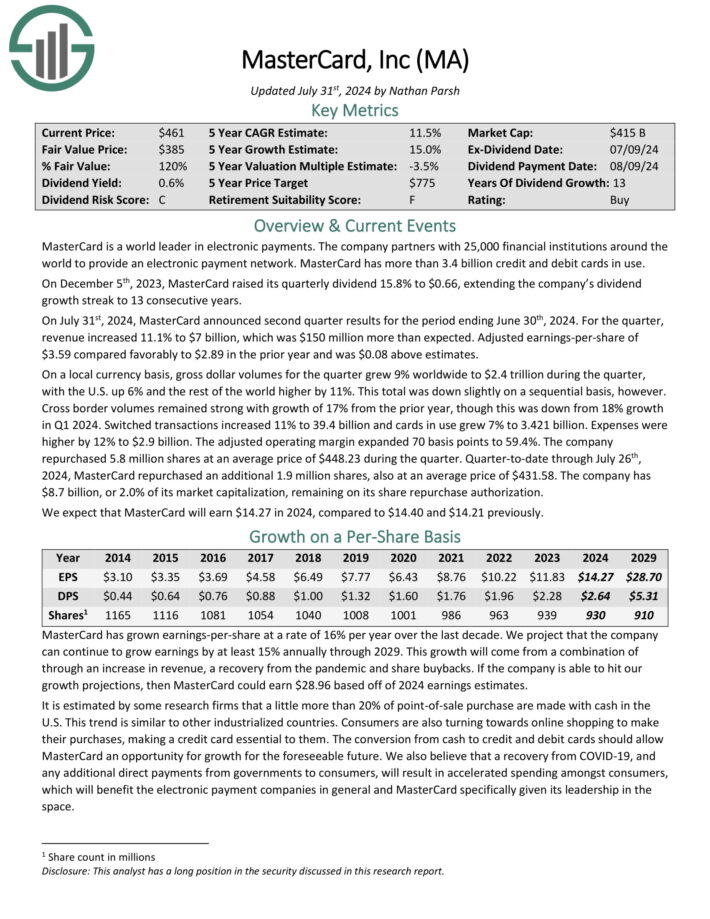

No. 7: MasterCard Inc. (MA)

Dividend Yield: 0.52%

Percentage of OUSA Portfolio: 3.87%

MasterCard is a world leader in electronic payments. The company partners with 25,000 financial institutions around the world to provide an electronic payment network. MasterCard has more than 3.1 billion credit and debit cards in use.

On July 31st, 2024, MasterCard announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue increased 11.1% to $7 billion, which was $150 million more than expected. Adjusted earnings-per-share of $3.59 compared favorably to $2.89 in the prior year and was $0.08 above estimates.

On a local currency basis, gross dollar volumes for the quarter grew 9% worldwide to $2.4 trillion during the quarter, with the U.S. up 6% and the rest of the world higher by 11%. This total was down slightly on a sequential basis, however. Cross border volumes remained strong with growth of 17% from the prior year.

Click here to download our most recent Sure Analysis report on Mastercard (preview of page 1 of 3 shown below):

No. 6: Merck & Co. (MRK)

Dividend Yield: 3.0%

Percentage of OUSA Portfolio: 4.29%

Merck & Company is one of the largest healthcare companies in the world. Merck manufactures prescription medicines, vaccines, biologic therapies, and animal health products. Merck employs 68,000 people around the world and generates annual revenues of more than $63 billion.

On May 29th, 2024, Merck completed its $1.3 billion purchase of EyeBio, which has a pipeline of drug candidates that target retinal diseases.

On July 30th, 2024, Merck announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 7.3% to $16.1 billion, which was $260 million above estimates. Adjusted earnings-per-share was $2.28 compared to -$2.06 in the prior year and was $0.14 better than expected.

Excluding currency exchange, revenue grew 11%. Keytruda, which treats cancers such as melanoma that cannot be removed by surgery and non-small cell lung cancer, continues to be the key driver of growth for the company and had revenue growth of 16% to $7.3 billion during the period.

Click here to download our most recent Sure Analysis report on MRK (preview of page 1 of 3 shown below):

No. 5: Johnson & Johnson (JNJ)

Dividend Yield: 3.1%

Percentage of OUSA Portfolio: 4.48%

Johnson & Johnson is a diversified health care company and a leader in the area of innovative medicines and medical devices Johnson & Johnson was founded in 1886 and employs nearly 132,000 people around the world. The company is projected to generate more than $89 billion in revenue this year.

On April 16th, 2024, Johnson & Johnson announced that it was increasing its quarterly dividend 4.2% to $1.24, extending the company’s dividend growth streak to 62 consecutive years.

On May 31st, 2024, Johnson & Johnson completed its $13.1 billion purchase of cardiovascular medical device company Shockwave Medical.

On October 15th, 2024, Johnson & Johnson reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue increased 5.4% to $22.5 billion, which topped estimates by $330 million. Adjusted earnings-per-share of $2.42 compared to $2.82 in the prior year, but this was $0.21 better than expected.

Excluding Covid-19 vaccine sales, the company’s revenue grew 5.6% in the third quarter. Revenue for Innovative Medicines grew 4.9% on a reported basis, but improved 6.3% when excluding currency translation.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

No. 4: Visa Inc. (V)

Dividend Yield: 0.74%

Percentage of OUSA Portfolio: 4.89%

Visa is the world’s leader in digital payments, with activity in more than 200 countries. The company’s global processing network provides secure and reliable payments around the world and is capable of handling more than 65,000 transactions a second.

On July 23rd, 2024, Visa reported third quarter 2024 results for the period ending June 30th, 2023. (Visa’s fiscal year ends September 30th.) For the quarter, Visa generated revenue of $8.9 billion, adjusted net income of $4.9 billion and adjusted earnings-per-share of $2.42, marking increases of 10%, 9% and 12%, respectively.

These results were driven by a 7% gain in Payments Volume, a 14% gain in Cross-Border Volume and an 10% gain in Processed Transactions. Visa processed 59.3 billion transactions in the quarter.

Click here to download our most recent Sure Analysis report on Visa (preview of page 1 of 3 shown below):

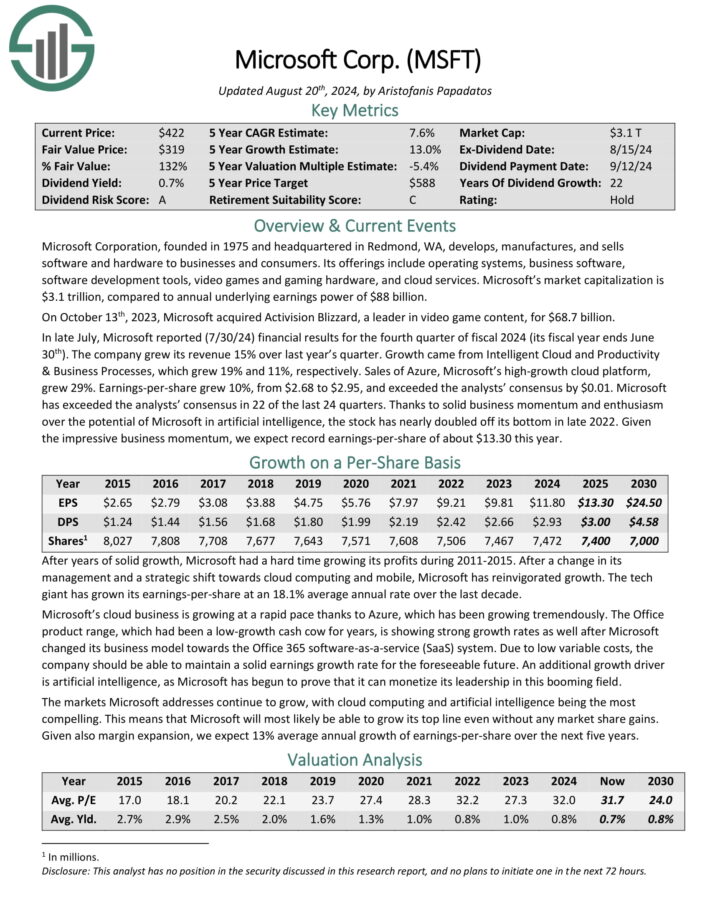

No. 3: Microsoft Corporation (MSFT)

Dividend Yield: 0.78%

Percentage of OUSA Portfolio: 4.96%

Microsoft Corporation manufactures and sells software and hardware to businesses and consumers. Its offerings include operating systems, business software, software development tools, video games and gaming hardware, and cloud services.

On October 13th, 2023, Microsoft acquired Activision Blizzard, a leader in video game content, for $68.7 billion. In late July, Microsoft reported (7/30/24) financial results for the fourth quarter of fiscal 2024 (its fiscal year ends June 30th).

The company grew its revenue 15% over last year’s quarter. Growth came from Intelligent Cloud and Productivity & Business Processes, which grew 19% and 11%, respectively. Sales of Azure, Microsoft’s high-growth cloud platform, grew 29%.

Earnings-per-share grew 10%, from $2.68 to $2.95, and exceeded the analysts’ consensus by $0.01. Microsoft has exceeded the analysts’ consensus in 22 of the last 24 quarters.

Click here to download our most recent Sure Analysis report on MSFT (preview of page 1 of 3 shown below):

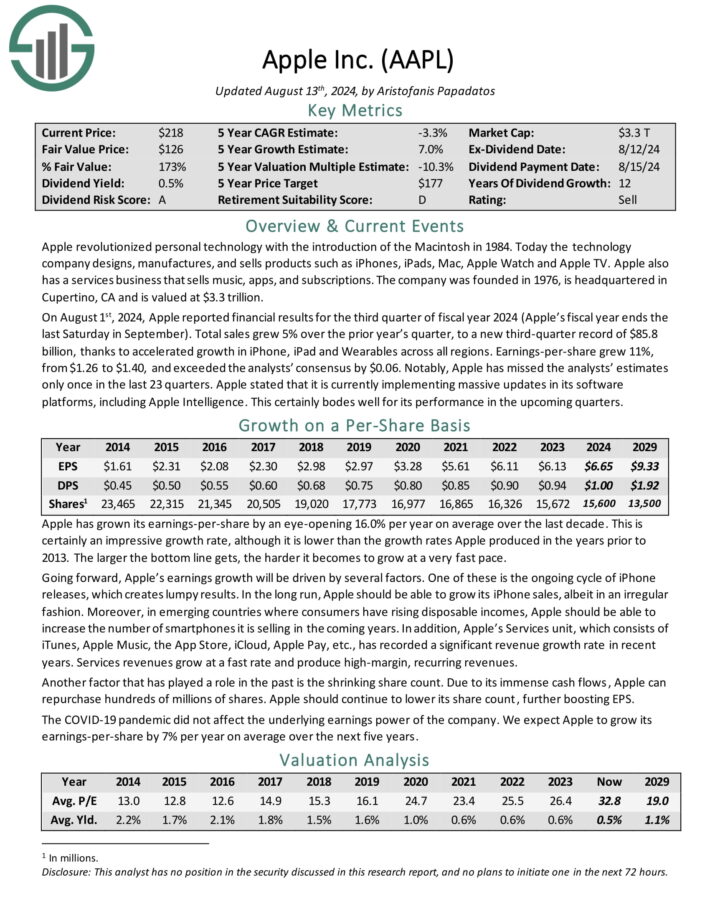

No. 2: Apple (AAPL)

Dividend Yield: 0.43%

Percentage of OUSA Portfolio: 5.14%

Apple designs, manufactures and sells products such as iPhones, iPads, Mac, Apple Watch and Apple TV. Apple also has a services business that sells music, apps, and subscriptions.

On August 1st, 2024, Apple reported financial results for the third quarter of fiscal year 2024 (Apple’s fiscal year ends the last Saturday in September).

Total sales grew 5% over the prior year’s quarter, to a new third-quarter record of $85.8 billion, thanks to accelerated growth in iPhone, iPad and Wearables across all regions. Earnings-per-share grew 11%, from $1.26 to $1.40, and exceeded the analysts’ consensus by $0.06.

Click here to download our most recent Sure Analysis report on AAPL (preview of page 1 of 3 shown below):

No. 1: Home Depot (HD)

Dividend Yield: 2.3%

Percentage of OUSA Portfolio: 5.27%

Home Depot was founded in 1978 and since that time has grown into a juggernaut home improvement retailer with over 2,300 stores in the US, Canada and Mexico that generate around $153 billion in annual revenue.

On February 20th, 2024, Home Depot announced a 7.7% increase to the dividend to $9.00 per share annualized.

On June 18th, 2024, Home Depot completed its acquisition of SRS Distribution, a leading residential specialty trade distribution company, for an enterprise value of $18.25 billion. This acquisition will expand Home Depot’s total addressable market by $50 billion to $1 trillion.

Home Depot reported second quarter 2024 results on August 13th, 2024. The company reported sales of $43.2 billion, up 0.6% year-over-year. However, comparable sales in the quarter decreased 3.3%.

Net earnings equaled $4.6 billion, or $4.60 per share, compared to $4.7 billion, or $4.65 per share in Q2 2023.

Click here to download our most recent Sure Analysis report on HD (preview of page 1 of 3 shown below):

Final Thoughts

Kevin O’Leary has become a household name due to his appearances on the TV show Shark Tank. But he is also a well-known asset manager, and his investment philosophy largely aligns with Sure Dividend’s.

Specifically, Mr. Wonderful typically invests in stocks with large and profitable businesses, with strong balance sheets and consistent dividend growth every year.

Not all of these stocks are currently rated as buys in the Sure Analysis Research Database, which ranks stocks based on expected total return due to a combination of earnings per share growth, dividends, and changes in the price-to-earnings multiple.

However, several of these 10 stocks are valuable holdings for a long-term dividend growth portfolio.

Additional Resources

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The 20 Highest Yielding Dividend Aristocrats

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The 20 Highest Yielding Dividend Kings

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: