Spreadsheet data updated daily

Updated on January 24th, 2024 by Bob Ciura

Individual products, businesses, and even entire industries (newspapers, typewriters, horse and buggy) go out of style and become obsolete.

Perhaps more than any other industry, agriculture is here to stay. Agriculture started around 14,000 years ago. It’s a safe bet we will be practicing agriculture far into the future.

And, the growth of the global population is tied to increasing agricultural efficiency. The agricultural revolution allowed greater population growth (and led to the industrial revolution).

As the global population grows, so does the need for improved agricultural production. This creates a long-term demand driver for agriculture stocks.

You can download the complete list of all 40+ agriculture stocks (along with important financial metrics such as price-to-earnings ratios, dividend yields, and dividend payout ratios) by clicking on the link below:

The agriculture stocks list was derived from two major exchange-traded funds. These are the AgTech & Food Innovation ETF (KROP) and the iShares Global Agriculture Index ETF (COW).

Investing in farm and agriculture stocks means investing in an industry that:

- Has stable long-term demand

- Has withstood the test of time, and is extremely likely to be around far into the future

- Benefits from advancing technology

This article analyzes 7 of the best agriculture stocks in detail. You can quickly navigate the article using the table of contents below.

Table of Contents

- Agriculture Stock #7: Scotts Miracle-Gro (SMG)

- Agriculture Stock #6: Nutrien Ltd. (NTR)

- Agriculture Stock #5: FMC Corporation (FMC)

- Agriculture Stock #4: Bunge Global SA (BG)

- Agriculture Stock #3: Lindsay Corporation (LNN)

- Agriculture Stock #2: Ingredion Inc. (INGR)

- Agriculture Stock #1: Archer Daniels Midland Corporation (ADM)

- Final Thoughts

We have ranked our 7 favorite agriculture stocks below. The stocks are ranked according to expected returns over the next five years, in order of lowest to highest.

Even better, all 7 agriculture stocks pay dividends to shareholders, making them attractive for income investors. Interested investors should view this as a starting off point to more research.

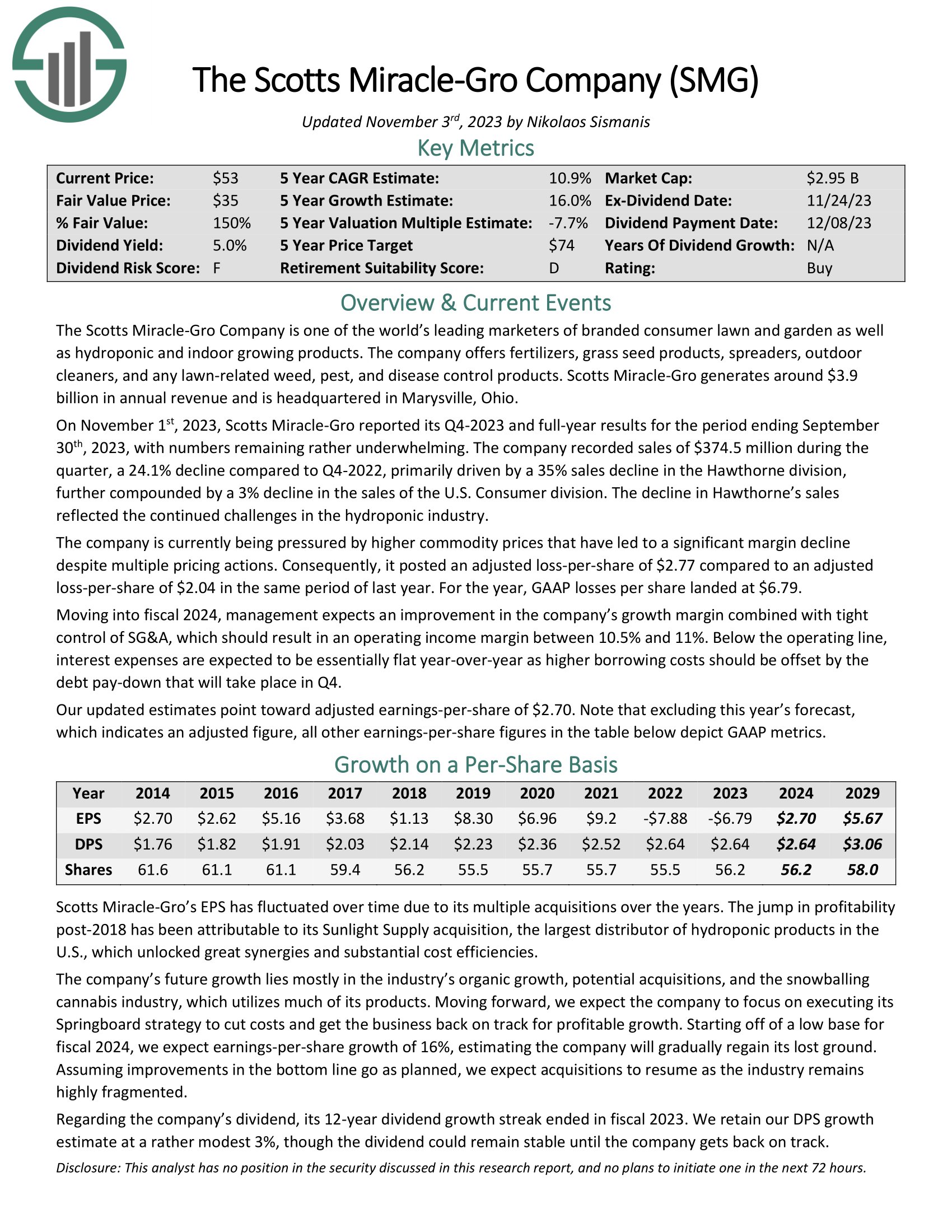

Agriculture Stock #7: Scotts Miracle-Gro (SMG)

- 5-year expected annual returns: 8.1%

Scotts Miracle-Gro is one of the world’s leading marketers of branded consumer lawn and garden as well as hydroponic and indoor growing products. The company offers fertilizers, grass seed products, spreaders, outdoor cleaners, and any lawn-related weed, pest, and disease control products. Scotts Miracle-Gro generates around $3.9 billion in annual revenue and is headquartered in Marysville, Ohio.

On November 1st, 2023, Scotts Miracle-Gro reported its Q4-2023 and full-year results for the period ending September 30th, 2023, with numbers remaining rather underwhelming.

The company recorded sales of $374.5 million during the quarter, a 24.1% decline compared to Q4-2022, primarily driven by a 35% sales decline in the Hawthorne division, further compounded by a 3% decline in the sales of the U.S. Consumer division. The decline in Hawthorne’s sales reflected the continued challenges in the hydroponic industry.

Click here to download our most recent Sure Analysis report on SMG (preview of page 1 of 3 shown below):

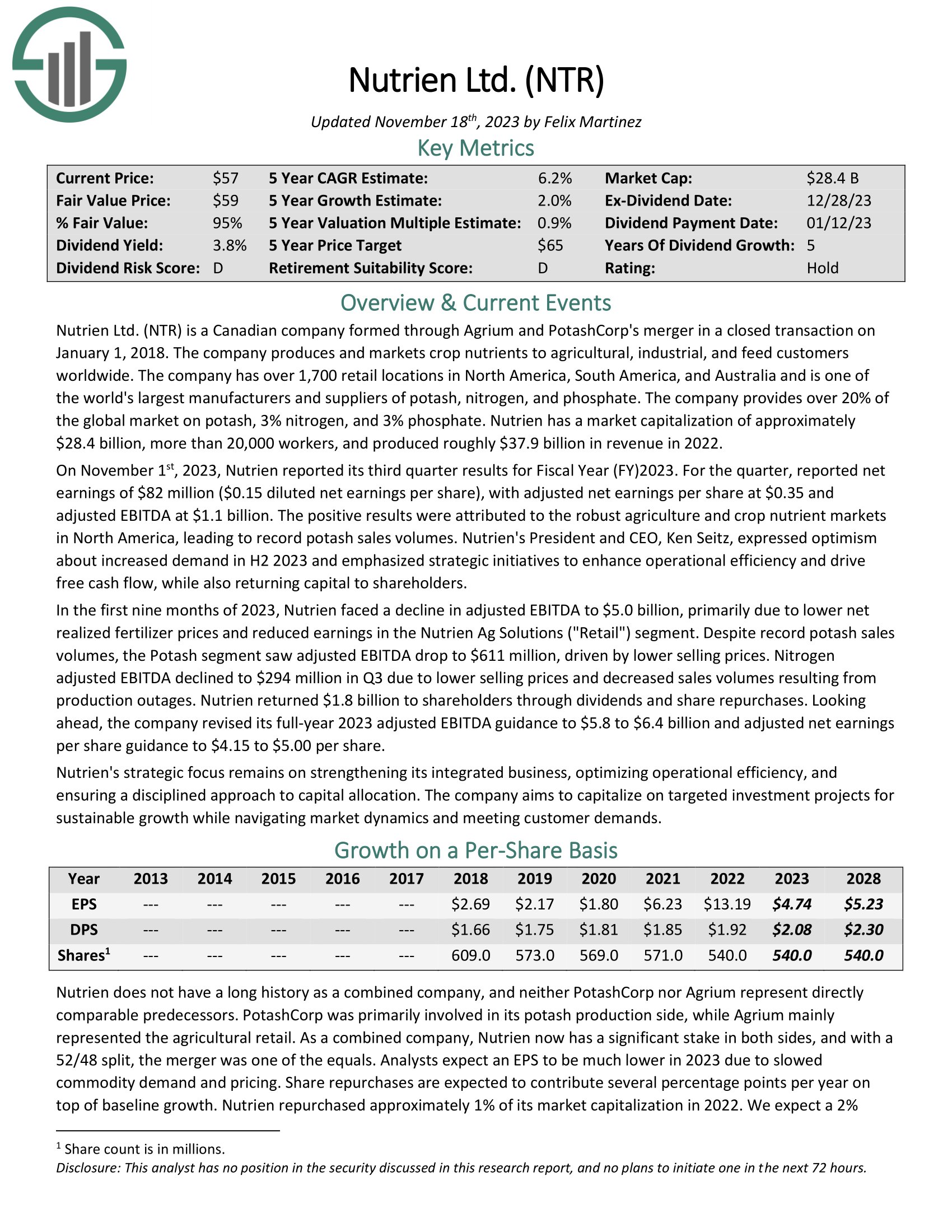

Agriculture Stock #6: Nutrien Ltd. (NTR)

- 5-year expected annual returns: 8.2%

Nutrien is a Canadian company formed through Agrium and PotashCorp’s merger in a closed transaction on January 1, 2018. The company produces and markets crop nutrients to agricultural, industrial, and feed customers worldwide.

The company has over 1,700 retail locations in North America, South America, and Australia and is one of the world’s largest manufacturers and suppliers of potash, nitrogen, and phosphate. The company provides over 20% of the global market on potash, 3% nitrogen, and 3% phosphate.

On November 1st, 2023, Nutrien reported its third quarter results for Fiscal Year (FY) 2023. For the quarter, reported net earnings of $82 million ($0.15 diluted net earnings per share), with adjusted net earnings per share at $0.35 and adjusted EBITDA at $1.1 billion. The positive results were attributed to the robust agriculture and crop nutrient markets in North America, leading to record potash sales volumes.

Click here to download our most recent Sure Analysis report on NTR (preview of page 1 of 3 shown below):

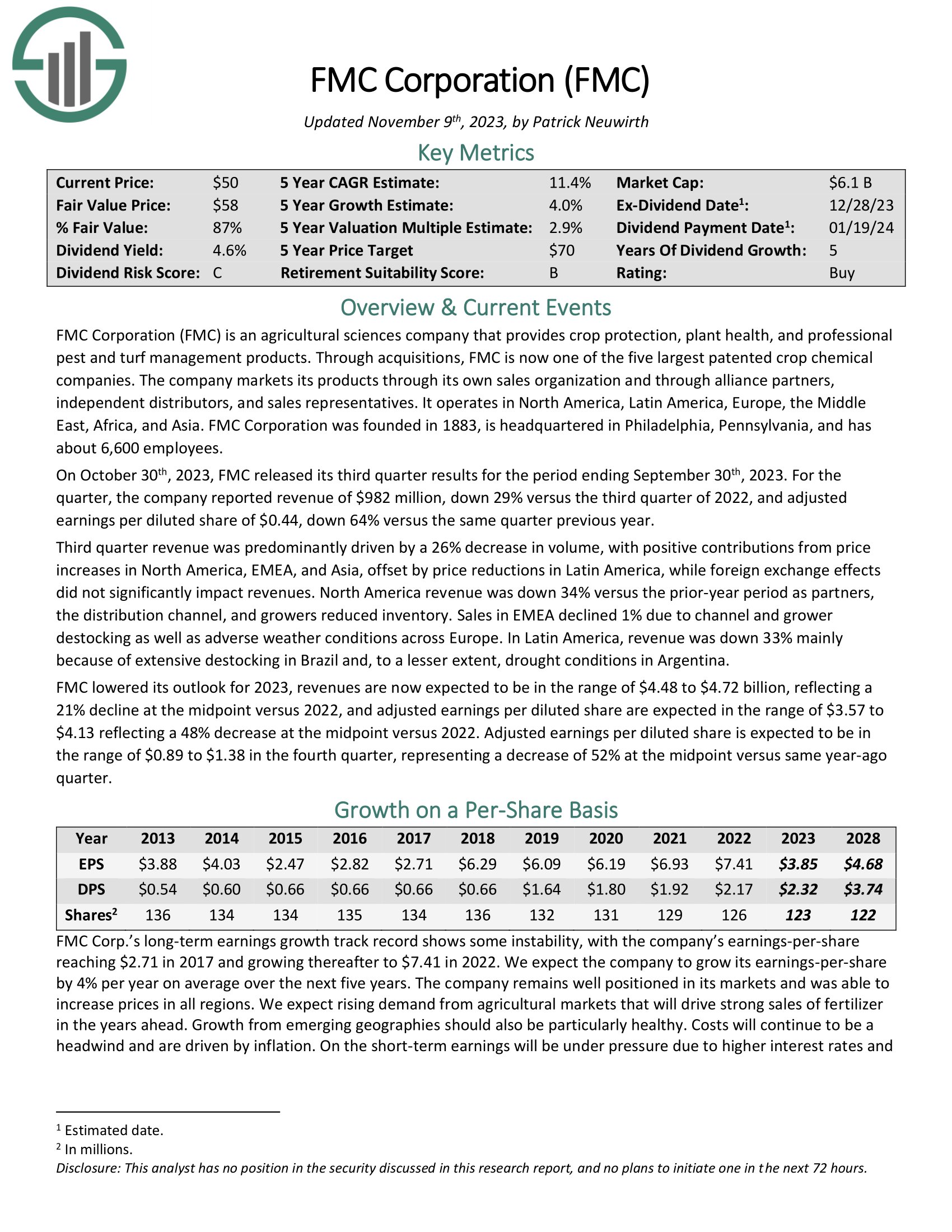

Agriculture Stock #5: FMC Corporation (FMC)

- 5-year expected annual returns: 8.3%

FMC Corporation is an agricultural sciences company that provides crop protection, plant health, and professional pest and turf management products. Through acquisitions, FMC is now one of the five largest patented crop chemical companies.

The company markets its products through its own sales organization and through alliance partners, independent distributors, and sales representatives. It operates in North America, Latin America, Europe, the Middle East, Africa, and Asia.

On October 30th, 2023, FMC released its third quarter results for the period ending September 30th, 2023. For the quarter, the company reported revenue of $982 million, down 29% versus the third quarter of 2022, and adjusted earnings per diluted share of $0.44, down 64% versus the same quarter previous year.

Click here to download our most recent Sure Analysis report on FMC (preview of page 1 of 3 shown below):

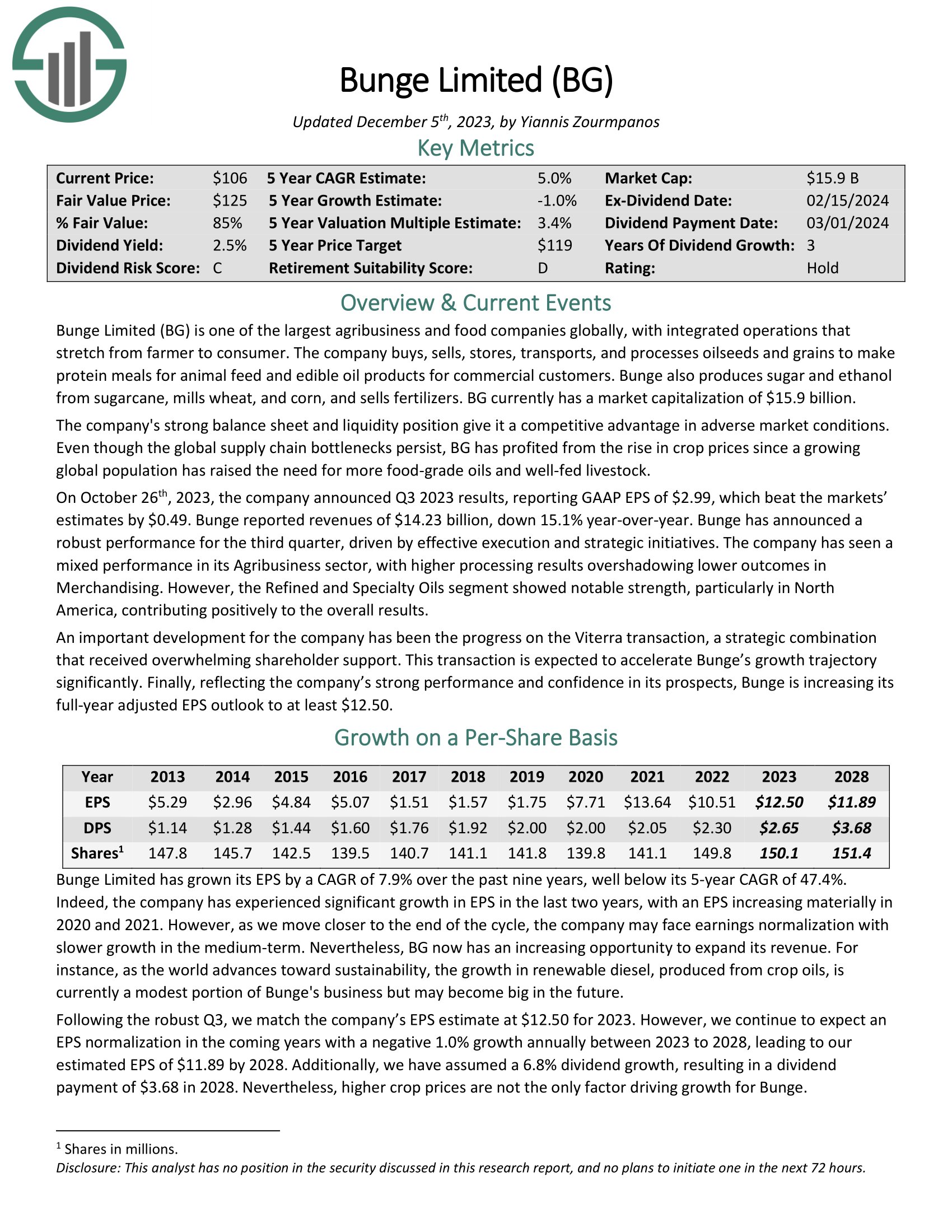

Agriculture Stock #4: Bunge Global SA (BG)

- 5-year expected annual returns: 8.4%

Bunge Limited is one of the largest agribusiness and food companies globally, with integrated operations that stretch from farmer to consumer. The company buys, sells, stores, transports, and processes oilseeds and grains to take protein meals for animal feed and edible oil products for commercial customers. Bunge also produces sugar and ethanol from sugarcane, mills wheat, and corn, and sells fertilizers.

The company’s strong balance sheet and liquidity position give it a competitive advantage in adverse market conditions. Even though the global supply chain bottlenecks persist, BG has profited from the rise in crop prices since a growing global population has raised the need for more food-grade oils and well-fed livestock.

On October 26th, 2023, the company announced Q3 2023 results, reporting GAAP EPS of $2.99, which beat the markets’ estimates by $0.49. Bunge reported revenues of $14.23 billion, down 15.1% year-over-year. Bunge has announced a robust performance for the third quarter, driven by effective execution and strategic initiatives.

Click here to download our most recent Sure Analysis report on BG (preview of page 1 of 3 shown below):

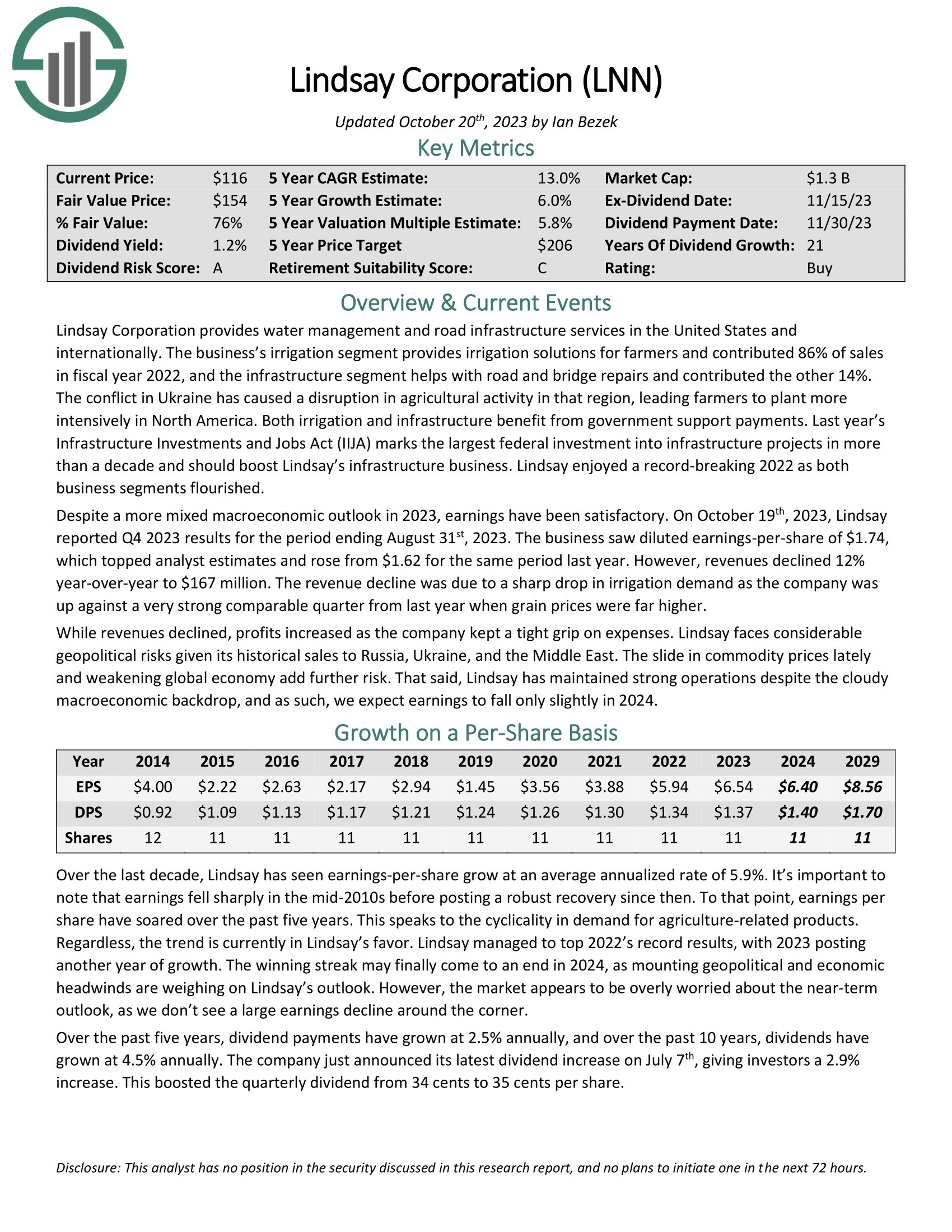

Agriculture Stock #3: Lindsay Corporation (LNN)

- 5-year expected annual returns: 10.1%

Lindsay Corporation provides water management and road infrastructure services in the United States and internationally. The irrigation segment provides irrigation solutions for farmers and contributed 86% of sales in fiscal year 2022. The infrastructure segment helps with road and bridge repairs and contributed the other 14%.

On October 19th, 2023, Lindsay reported Q4 2023 results for the period ending August 31st, 2023. The business saw diluted earnings-per-share of $1.74, which topped analyst estimates and rose from $1.62 for the same period last year. However, revenues declined 12% year-over-year to $167 million. The revenue decline was due to a sharp drop in irrigation demand as the company was up against a very strong comparable quarter from last year when grain prices were far higher.

Click here to download our most recent Sure Analysis report on Lindsay (preview of page 1 of 3 shown below):

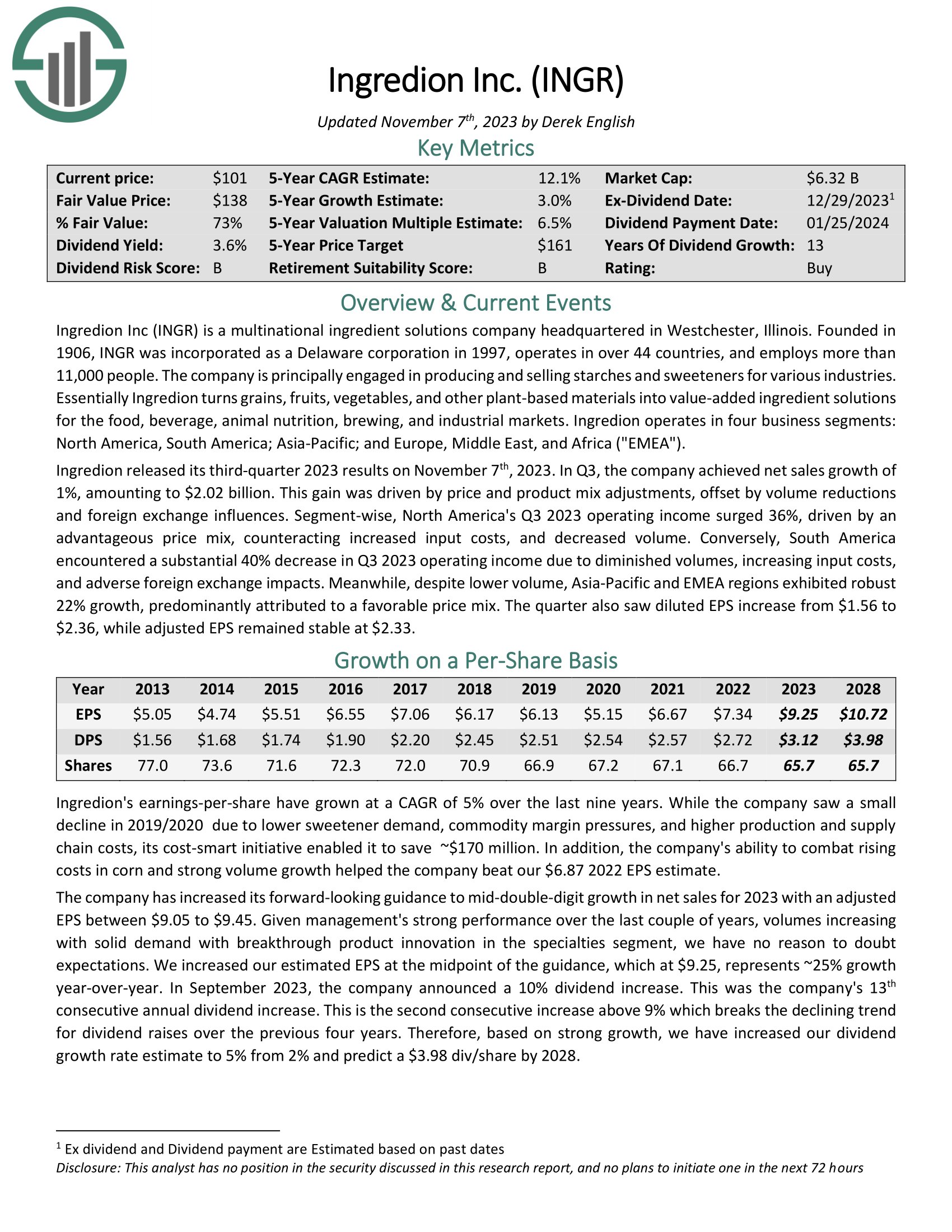

Agriculture Stock #2: Ingredion Inc. (INGR)

- 5-year expected annual returns: 10.3%

Ingredion Inc is a multinational ingredient solutions company engaged in producing and selling starches and sweeteners for various industries. Ingredion turns grains, fruits, vegetables, and other plant-based materials into value-added ingredient solutions for the food, beverage, animal nutrition, brewing, and industrial markets.

Ingredion operates in four business segments: North America, South America; Asia-Pacific; and Europe, Middle East, and Africa (“EMEA”).

Ingredion released its third-quarter 2023 results on November 7th, 2023. In Q3, the company achieved net sales growth of 1%, amounting to $2.02 billion. This gain was driven by price and product mix adjustments, offset by volume reductions and foreign exchange influences. North America’s Q3 2023 operating income surged 36%, driven by an advantageous price mix, counteracting increased input costs, and decreased volume.

Click here to download our most recent Sure Analysis report on INGR (preview of page 1 of 3 shown below):

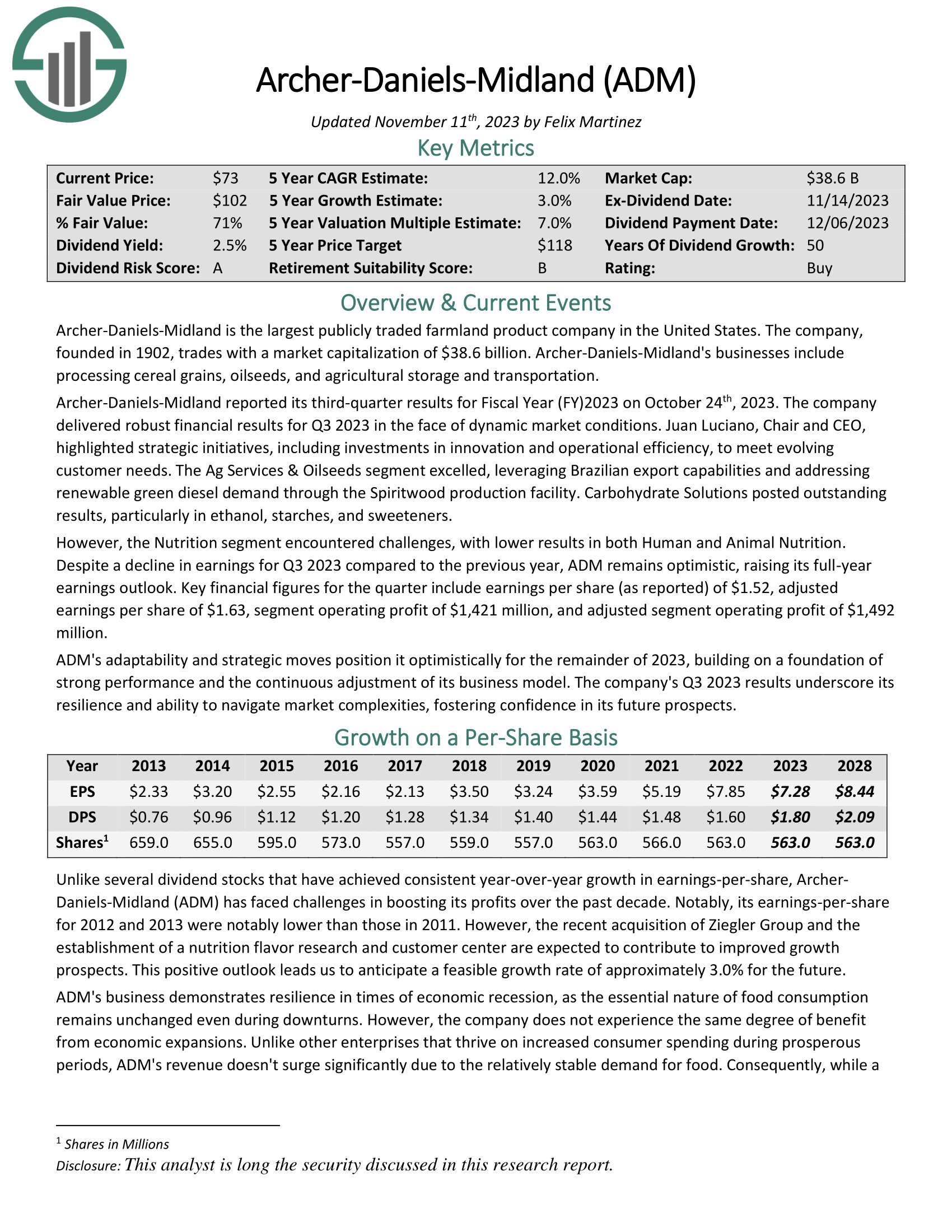

Agriculture Stock #1: Archer-Daniels-Midland (ADM)

- 5-year expected annual returns: 19.6%

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. The company, founded in 1902, trades with a market capitalization of $38.6 billion. Archer-Daniels-Midland’s businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter results for Fiscal Year (FY)2023 on October 24th, 2023. The company delivered robust financial results for Q3 2023 in the face of dynamic market conditions. Juan Luciano, Chair and CEO, highlighted strategic initiatives, including investments in innovation and operational efficiency, to meet evolving customer needs.

The Ag Services & Oilseeds segment excelled, leveraging Brazilian export capabilities and addressing renewable green diesel demand through the Spiritwood production facility. Carbohydrate Solutions posted outstanding results, particularly in ethanol, starches, and sweeteners.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

Final Thoughts

Agriculture stocks are a compelling place to look for long-term stock investments. That’s because the demand drivers of the industry make it extremely likely to be around far into the future.

We believe the 7 agriculture stocks examined in this article are the best within the industry.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 48 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.