Updated on March 29th, 2024 by Bob Ciura

Investors looking for high-quality dividend growth stocks should focus, in part, on companies that maintain long histories of dividend increases.

Steady dividend raises from year to year, regardless of the economic climate, is a sign of a company with durable competitive advantages and long-term growth potential.

With that in mind, every year, we review each of the Dividend Aristocrats, a group of 68 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can download your copy of the Dividend Aristocrats list, including important metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

The next Dividend Aristocrat in the series is healthcare giant Medtronic (MDT).

Medtronic has an impressive history of dividend growth. The company has increased its dividend for 46 years in a row. With an approximately 3.2% yield, Medtronic is not exactly a high-yield stock.

However, the stock’s yield is still higher than the average yield of the S&P 500.

And, Medtronic typically raises its dividend at a high rate each year, thanks to its strong earnings and leadership position within the medical devices industry.

These qualities make Medtronic an attractive dividend growth stock for long-term investors.

Business Overview

Medtronic was founded in 1949 as a medical equipment repair shop by Earl Bakken and his brother-in-law, Palmer Hermundslie. Today, Medtronic is one of the largest healthcare companies in the world.

Medtronic PLC is the largest manufacturer of biomedical devices and implantable technologies in the world. Medtronic currently has four operating segments: Cardiovascular, Neuroscience, Medical Surgical, and Diabetes.

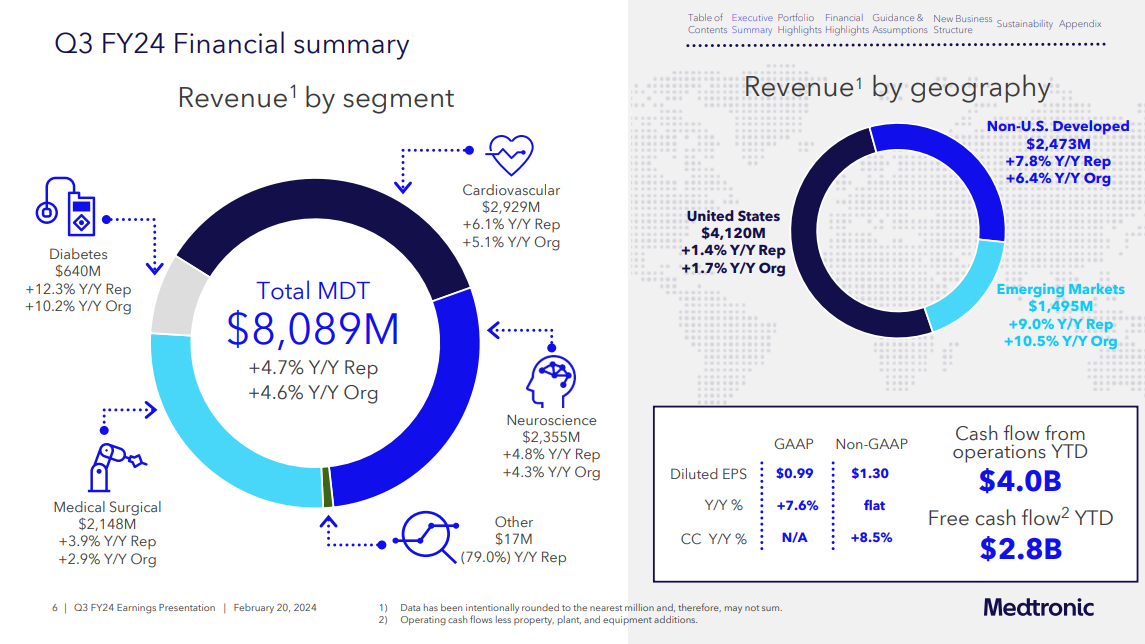

In mid-February, Medtronic reported (2/20/24) financial results for the third quarter of fiscal year 2024.

Source: Investor Presentation

Organic revenue grew 5% over the prior year’s quarter thanks to broad-based growth in all the four segments. Earnings-per-share remained flat at $1.30 due to an -8% currency headwind but exceeded the analysts’ consensus by $0.04.

Thanks to improved business momentum, Medtronic raised its guidance for fiscal 2024. It expects 4.75%-5.0% organic revenue growth (vs. 4.75% previously) and earnings-per-share of $5.19-$5.21.

Growth Prospects

Medtronic is investing in growth, both organically via R&D and through acquisitions. The first catalyst for Medtronic is the aging population. There are ~70 million Baby Boomers in the U.S., those aged 51-69 years. Thousands of people are entering retirement every day. Combined with longer life expectancy and rising healthcare spending, the operating environment is very attractive for Medtronic.

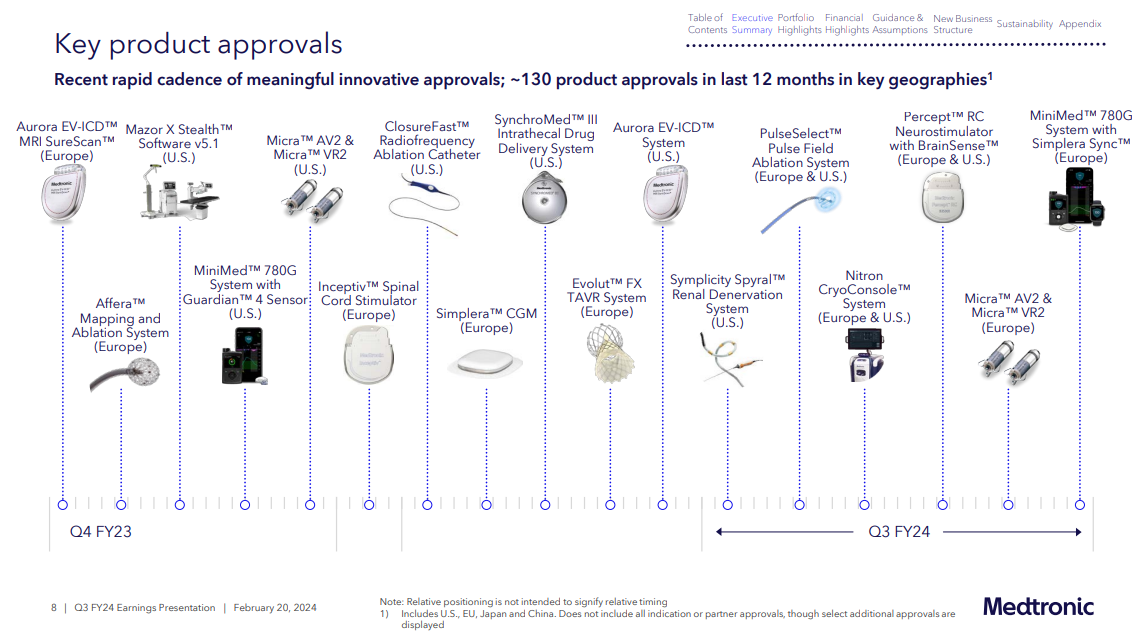

The company has had many regulatory product approvals in the past year. The new products should drive growth, allowing the company to maintain or even gain market share.

Source: Investor Presentation

Medtronic also has a major growth opportunity in new geographic markets. Specifically, Medtronic has a presence in several emerging markets, such as China, India, Africa, and more. These countries have large populations and high economic growth rates.

Medtronic’s emerging market revenue has consistently grown at a double-digit rate for many years. While the U.S. currently accounts for just over half of Medtronic’s revenue, emerging markets are growing faster.

Medtronic is acquiring tuck-in acquisitions and has spent more than $3.3 billion on nine acquisitions since 2021. These companies include Acutus Medical, Medicrea, RIST, Avenu Medical, Companion Medical, Sonarmed, intersect ENT, AFFERA, and AI Biomed.

Overall, we expect Medtronic to grow its earnings-per-share by 7.0% per year on average until 2029.

Competitive Advantages & Recession Performance

The main competitive advantage for Medtronic is its research and development capabilities. The company spends heavily on R&D each year, which provides it with product innovation. Medtronic’s R&D investments over the past few years exceed $2 billion each year.

The result of all this spending is that the company has a huge intellectual property portfolio with nearly 86,000 awarded patents. This fact has allowed Medtronic to build a strong product pipeline across each of its business segments.

In addition, Medtronic benefits tremendously from its global scale. The company operates in over 140 countries around the world. It has the operational flexibility to generate industry-leading profit margins, which helps fuel its growth.

Another competitive advantage for Medtronic is that it operates in a defensive industry. Consumers often cannot forego medical treatments, even when the economy is in recession.

Medtronic’s earnings-per-share during the Great Recession are as follows:

- 2007 earnings-per-share of $2.61

- 2008 earnings-per-share of $2.92 (12% increase)

- 2009 earnings-per-share of $3.22 (10% increase)

- 2010 earnings-per-share of $3.37 (5% increase)

Medtronic had the rare achievement of earnings growth each year during the recession. The company also showed remarkable strength during the pandemic. This demonstrates its recession-resistant business model.

Medtronic should be able to continue growing its dividend each year in both economic recessions and expansions.

Valuation & Expected Returns

Based on the recent share price of ~$87 and expected earnings-per-share of $5.20 in fiscal 2024, Medtronic stock trades for a price-to-earnings ratio of 16.7. The stock’s current valuation is below that of the broader S&P 500 Index and modestly below its long-term average.

In the last decade, shares of Medtronic have traded hands at an average price-to-earnings ratio of 17.0. We believe that this is a fair valuation baseline.

As a result, Medtronic shares appear to be slightly undervalued today. If the stock valuation expands to our fair value estimate by 2029, the corresponding multiple expansion will boost shareholder returns by approximately 0.4% per year over this period.

We expect 7% annual earnings growth for Medtronic through 2029, and the stock has a 3.2% dividend yield. There is plenty of room for continued dividend increases each year.

With a dividend payout ratio of just over 50%, and a positive earnings growth outlook, Medtronic should continue its streak of annual dividend increases.

Total returns would consist of the following:

- 7.0% earnings growth rate

- 0.4% multiple expansion

- 3.2% dividend yield

Medtronic is expected to return 10.6% annually over the next five years. This is an attractive potential rate of return, giving the stock a buy rating.

Final Thoughts

Medtronic has virtually all of the qualities dividend growth investors should look for. It possesses a highly profitable business, a leadership position in its core markets, and long-term growth potential. It also has multiple catalysts for future growth and the ability to keep growing its dividend even during recessions.

Medtronic has increased its dividend for more than four decades, which is highly impressive given the continued headwinds from a tough macroeconomic environment.

Medtronic stock appears to be offering a compelling investment opportunity for long-term dividend growth investors.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.