Updated on October 10th, 2025 by Bob Ciura

DRIP stands for Dividend Reinvestment Plan. When an investor is enrolled in DRIP stocks, it means that incoming dividend payments are used to purchase more shares of the issuing company – automatically.

Many businesses offer DRIPs that require the investors to pay fees. Obviously, paying fees is a negative for investors. As a general rule, investors are better off avoiding DRIP stocks that charge fees.

Fortunately, many companies offer no-fee DRIP stocks. These allow investors to use their hard-earned dividends to build even larger positions in their favorite high-quality, dividend-paying companies – for free.

The Dividend Champions are a group of quality dividend stocks that have raised their dividends for at least 25 consecutive years.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Think about the powerful combination of DRIPs and Dividend Champions…

You are reinvesting dividends into a company that pays higher dividends every year. This means that every year you get more shares – and each share is paying you more dividend income than the previous year.

This makes a powerful (and cost-effective) compounding machine.

This article takes a look at the top 15 Dividend Champions that are no-fee DRIP stocks, ranked in order of expected total returns from lowest to highest.

The updated list for 2025 includes our top 15 Dividend Champions, ranked by expected returns according to the Sure Analysis Research Database, that offer no-fee DRIPs to shareholders.

You can skip to analysis of any individual Dividend Champion below:

- #15: Johnson & Johnson (JNJ)

- #14: California Water Service (CWT)

- #13: Realty Income (O)

- #12: A.O. Smith (AOS)

- #11: Universal Corporation (UVV)

- #10: Northwest Natural Holding (NWN)

- #9: Illinois Tool Works (ITW)

- #8: Nucor Corp. (NUE)

- #7: Nordson Corp. (NDSN)

- #6: Arrow Financial (AROW)

- #5: Universal Health Realty Trust (UHT)

- #4: Hormel Foods (HRL)

- #3: S&P Global (SPGI)

- #2: New Jersey Resources (NJR)

- #1: Tompkins Financial (TMP)

Additionally, please see the video below for more coverage.

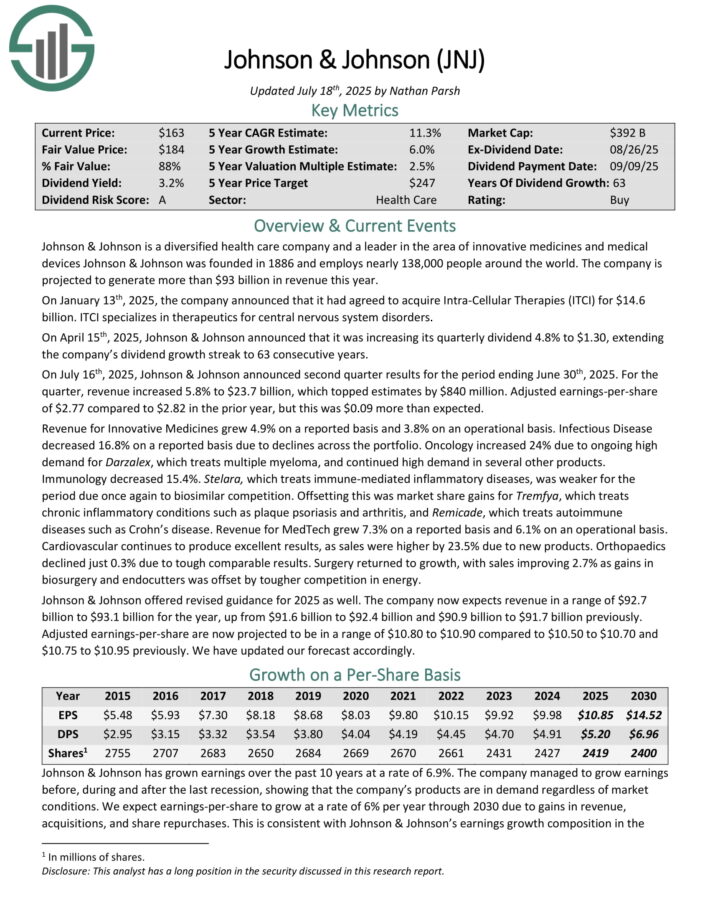

#15: Johnson & Johnson (JNJ)

- 5-year expected annual returns: 7.8%

Johnson & Johnson is a diversified health care company and a leader in the area of innovative medicines and medical devices Johnson & Johnson was founded in 1886.

On July 16th, 2025, Johnson & Johnson announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue increased 5.8% to $23.7 billion, which topped estimates by $840 million.

Adjusted earnings-per-share of $2.77 compared to $2.82 in the prior year, but this was $0.09 more than expected.

Revenue for Innovative Medicines grew 4.9% on a reported basis and 3.8% on an operational basis. Infectious Disease decreased 16.8% on a reported basis due to declines across the portfolio.

Oncology increased 24% due to ongoing high demand for Darzalex, which treats multiple myeloma, and continued high demand in several other products.

Johnson & Johnson offered revised guidance for 2025 as well. The company now expects revenue in a range of $92.7 billion to $93.1 billion for the year, up from $91.6 billion to $92.4 billion and $90.9 billion to $91.7 billion previously.

Adjusted earnings-per-share are now projected to be in a range of $10.80 to $10.90.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

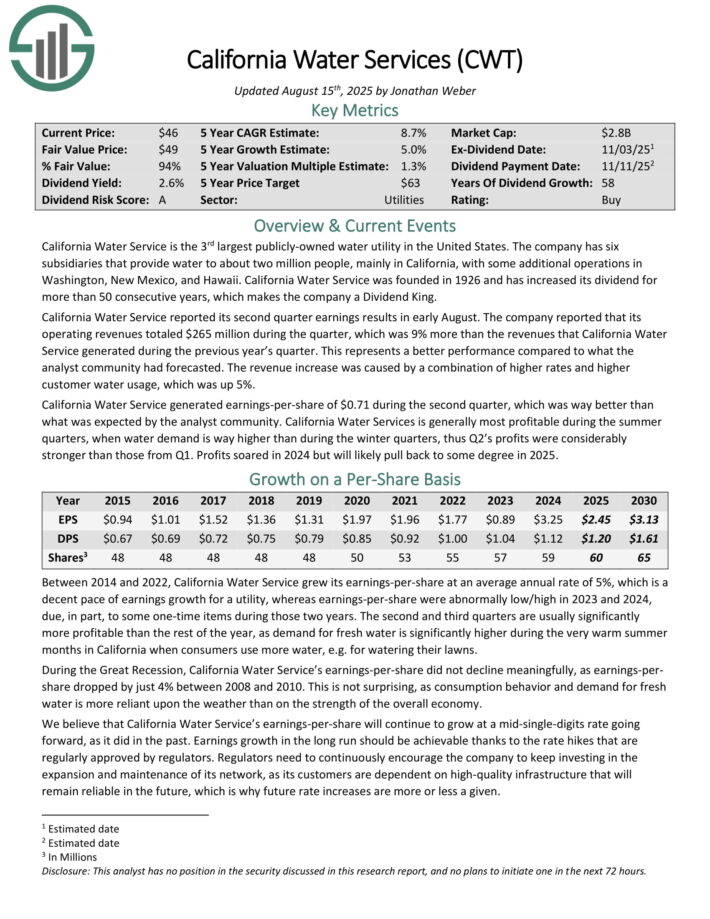

#14: California Water Service (CWT)

- 5-year expected annual returns: 8.1%

California Water Service is the 3rd largest publicly-owned water utility in the United States. The company has six subsidiaries that provide water to about two million people, mainly in California, with some additional operations in Washington, New Mexico, and Hawaii.

California Water Service reported its second quarter earnings results in early August. The company reported that its operating revenues totaled $265 million during the quarter, which was 9% more than the revenues that California Water Service generated during the previous year’s quarter.

This represents a better performance compared to what the analyst community had forecast. The revenue increase was caused by a combination of higher rates and higher customer water usage, which was up 5%. California Water Service generated earnings-per-share of $0.71 during the second quarter.

CWT has increased its dividend for 58 consecutive years.

Click here to download our most recent Sure Analysis report on CWT (preview of page 1 of 3 shown below):

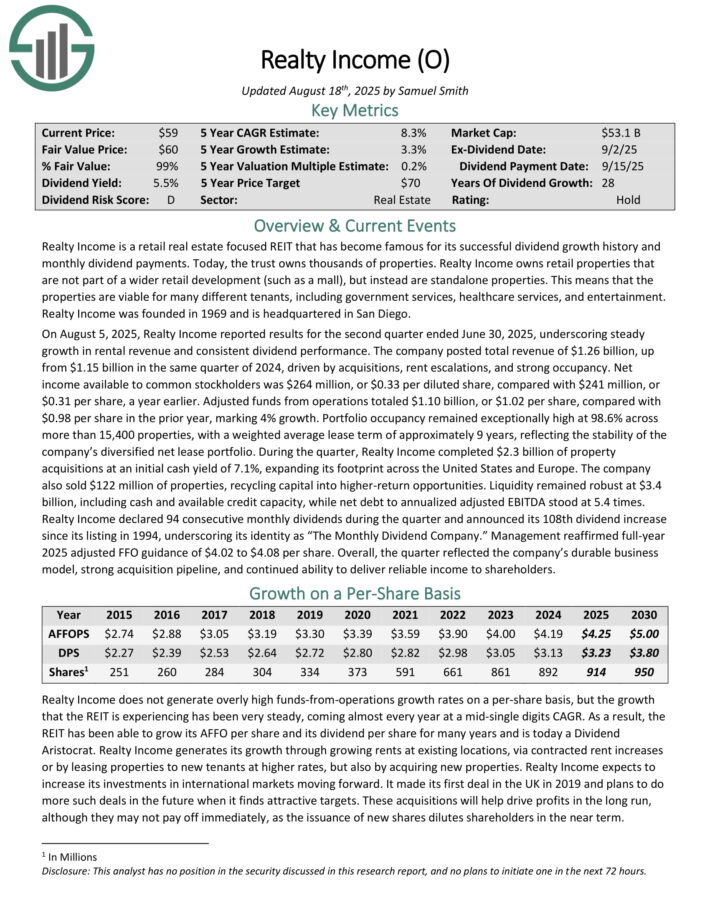

#13: Realty Income (O)

- 5-year expected annual returns: 8.5%

Realty Income is a retail real estate focused REIT that has become famous for its successful dividend growth history and monthly dividend payments.

Realty Income owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

Realty Income’s diversified portfolio comprises 15,627 commercial properties across eight countries, with 79.9% in

retail, 14.4% in industrial, 3.2% in gaming, and 2.5% in other sectors. Geographically, 84.6% of annualized base rent

originates from the United States, 12.6% from the United Kingdom, and 2.8% from continental Europe.

On August 5, 2025, Realty Income reported results for the second quarter ended June 30, 2025, underscoring steady growth in rental revenue and consistent dividend performance.

The company posted total revenue of $1.26 billion, up from $1.15 billion in the same quarter of 2024, driven by acquisitions, rent escalations, and strong occupancy. Net income available to common stockholders was $264 million, or $0.33 per diluted share, compared with $241 million, or $0.31 per share, a year earlier.

Adjusted funds from operations totaled $1.10 billion, or $1.02 per share, compared with $0.98 per share in the prior year, marking 4% growth. Portfolio occupancy remained exceptionally high at 98.6% across more than 15,400 properties, with a weighted average lease term of approximately 9 years.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

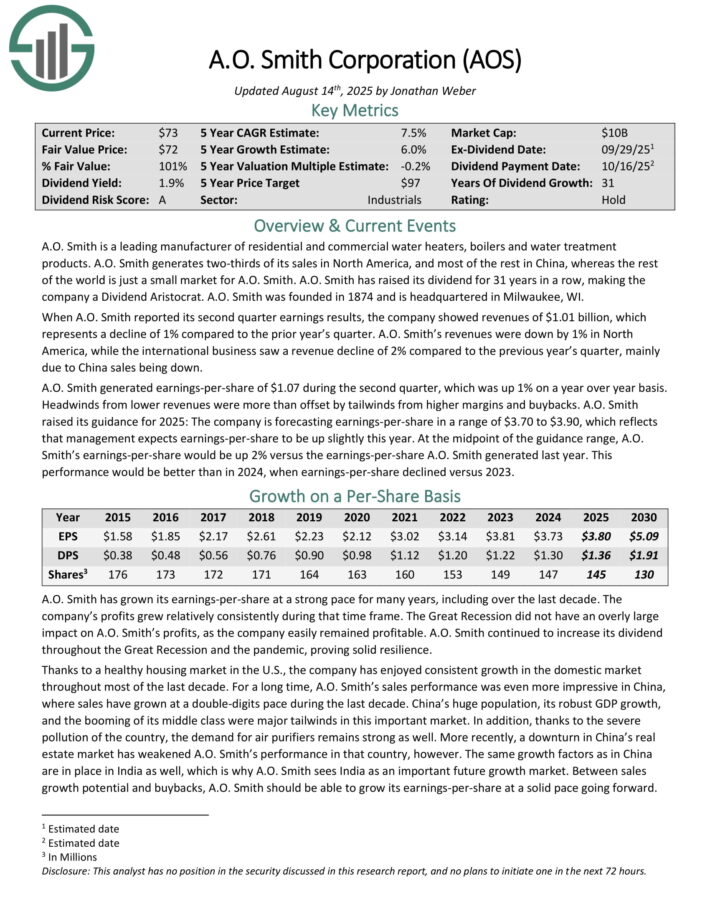

#12: A.O. Smith (AOS)

- 5-year expected annual returns: 8.5%

A.O. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment

products. It generates two-thirds of its sales in North America, and most of the rest in China.

A.O. Smith has raised its dividend for 30 years in a row, making the company a Dividend Aristocrat. The company was founded in 1874 and is headquartered in Milwaukee, WI.

When A.O. Smith reported its second quarter earnings results, the company showed revenues of $1.01 billion, which represents a decline of 1% compared to the prior year’s quarter.

A.O. Smith’s revenues were down by 1% in North America, while the international business saw a revenue decline of 2% compared to the previous year’s quarter, mainly due to China sales being down.

A.O. Smith generated earnings-per-share of $1.07 during the second quarter, which was up 1% on a year over year basis. Headwinds from lower revenues were more than offset by tailwinds from higher margins and buybacks. A.O. Smith raised its guidance for 2025.

Click here to download our most recent Sure Analysis report on AOS (preview of page 1 of 3 shown below):

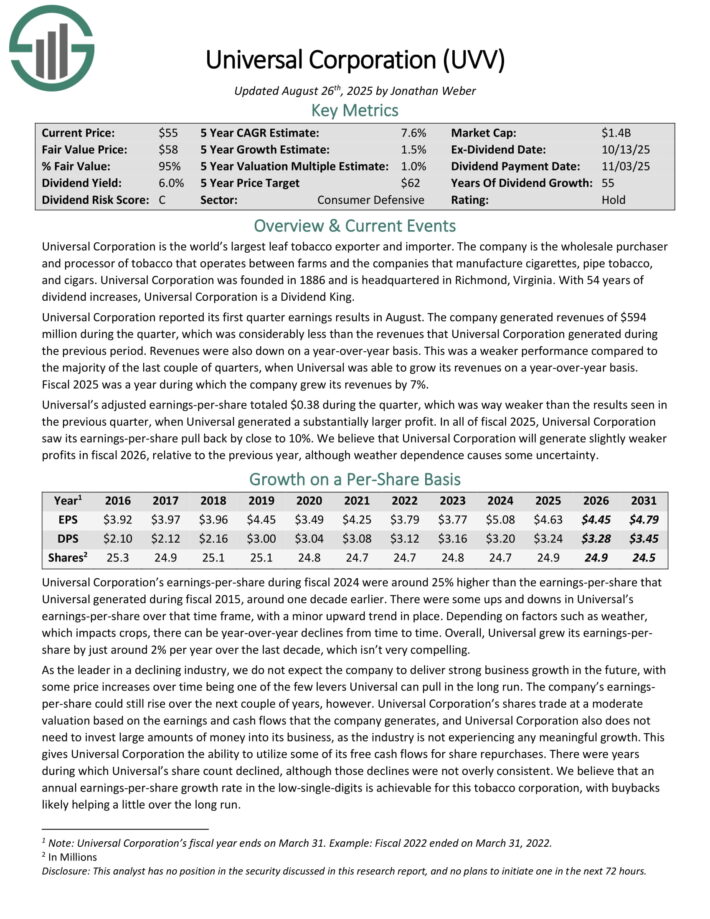

#11: Universal Corporation (UVV)

- 5-year expected annual returns: 8.5%

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal Corporation was founded in 1886 and is headquartered in Richmond, Virginia.

With 54 years of dividend increases, Universal Corporation is a Dividend King.

Universal Corporation reported its first quarter earnings results in August. The company generated revenues of $594 million during the quarter, which was considerably less than the revenues that Universal Corporation generated during the previous period. Revenues were also down on a year-over-year basis.

This was a weaker performance compared to the majority of the last couple of quarters, when Universal was able to grow its revenues on a year-over-year basis.

Fiscal 2025 was a year during which the company grew its revenues by 7%. Universal’s adjusted earnings-per-share totaled $0.38 during the quarter, which was way weaker than the results seen in the previous quarter, when Universal generated a substantially larger profit.

In all of fiscal 2025, Universal Corporation saw its earnings-per-share pull back by close to 10%.

Click here to download our most recent Sure Analysis report on UVV (preview of page 1 of 3 shown below):

#10: Northwest Natural Holding (NWN)

- 5-year expected annual returns: 9.0%

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest.

The company’s locations served are shown in the image below.

Source: Investor Presentation

On August 7, 2025, Northwest Natural Holding Company reported results for the second quarter ended June 30, 2025, showing steady growth in customer base and rate recovery despite seasonal weakness typical of warmer months.

The company recorded net income of $7.4 million, or $0.19 per diluted share, compared with $5.8 million, or $0.16 per share, in the same quarter last year. Operating revenue totaled $219.6 million, slightly down from $222.3 million in the prior year, as lower gas usage from mild weather offset the benefit of rate increases and customer growth.

Operating income was $28.9 million, up from $25.7 million, reflecting disciplined cost control and contributions from utility margin improvement. The gas distribution segment added nearly 11,000 new customers year-over-year, maintaining annual growth of about 1.4%, while infrastructure services contributed modestly to earnings.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

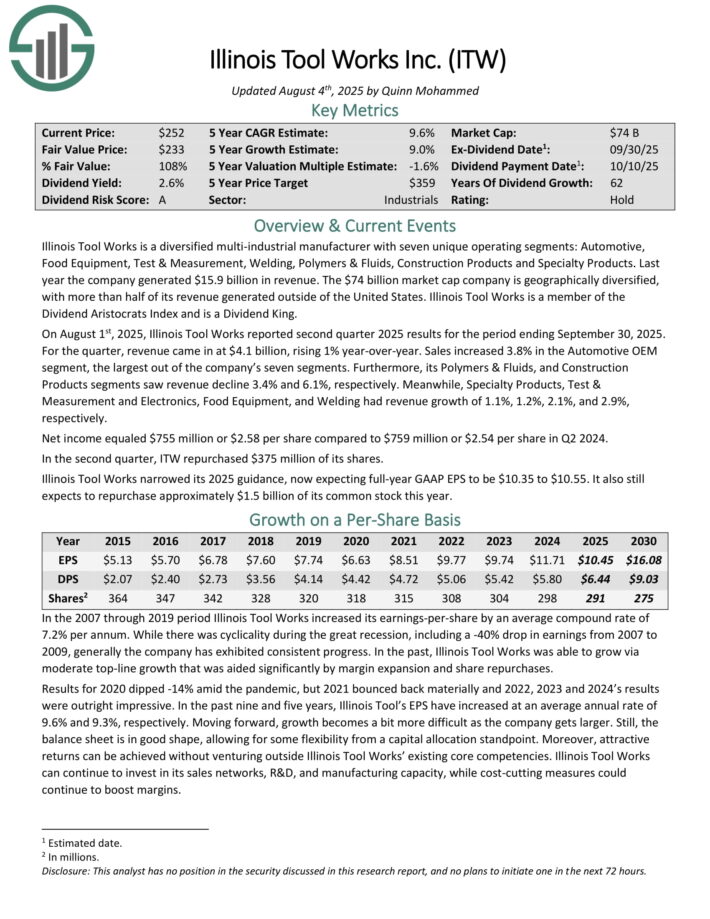

#9: Illinois Tool Works (ITW)

- 5-year expected annual returns: 9.8%

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products.

Last year the company generated $15.9 billion in revenue.

On August 1st, 2025, Illinois Tool Works reported second quarter 2025 results. For the quarter, revenue came in at $4.1 billion, rising 1% year-over-year. Sales increased 3.8% in the Automotive OEM segment, the largest out of the company’s seven segments.

Furthermore, its Polymers & Fluids, and Construction Products segments saw revenue decline 3.4% and 6.1%, respectively.

Meanwhile, Specialty Products, Test & Measurement and Electronics, Food Equipment, and Welding had revenue growth of 1.1%, 1.2%, 2.1%, and 2.9%, respectively. Net income equaled $755 million or $2.58 per share compared to $759 million or $2.54 per share in Q2 2024.

Click here to download our most recent Sure Analysis report on ITW (preview of page 1 of 3 shown below):

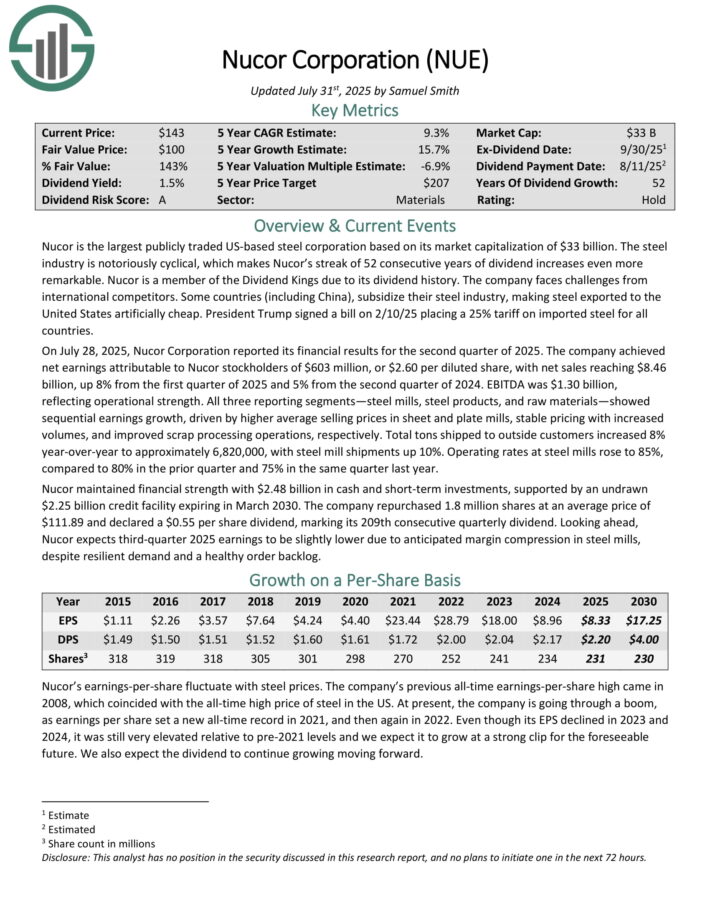

#8: Nucor Corp. (NUE)

- 5-year expected annual returns: 10.0%

Nucor is the largest publicly traded US-based steel corporation based on its market capitalization. The steel industry is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend increases even more remarkable.

On July 28, 2025, Nucor Corporation reported its financial results for the second quarter of 2025. The company achieved net earnings attributable to Nucor stockholders of $2.60 per diluted share, with net sales reaching $8.46 billion, up 8% from the second quarter of 2024. EBITDA was $1.30 billion, reflecting operational strength.

All three reporting segments—steel mills, steel products, and raw materials—showed sequential earnings growth, driven by higher average selling prices in sheet and plate mills, stable pricing with increased volumes, and improved scrap processing operations, respectively.

Total tons shipped to outside customers increased 8% year-over-year to approximately 6,820,000, with steel mill shipments up 10%. Operating rates at steel mills rose to 85%, compared to 80% in the prior quarter and 75% in the same quarter last year.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

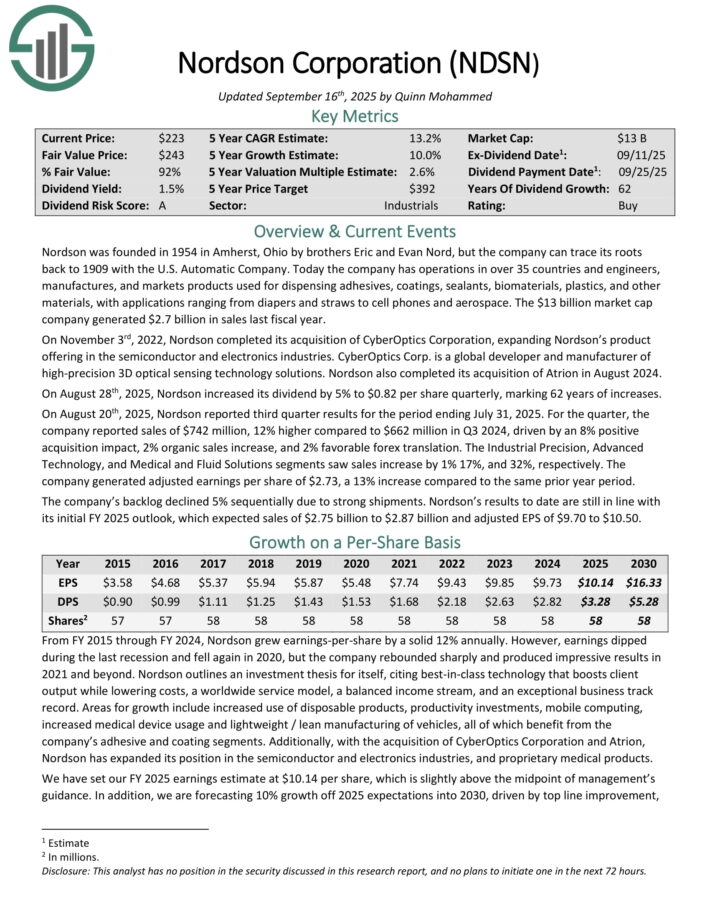

#7: Nordson Corporation (NDSN)

- 5-year expected annual returns: 12.1%

Nordson has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace. The company generated $2.7 billion in sales last fiscal year.

On August 20th, 2025, Nordson reported third quarter results for the period ending July 31, 2025. For the quarter, the company reported sales of $742 million, 12% higher compared to $662 million in Q3 2024, driven by an 8% positive acquisition impact, 2% organic sales increase, and 2% favorable forex translation.

The Industrial Precision, Advanced Technology, and Medical and Fluid Solutions segments saw sales increase by 1% 17%, and 32%, respectively.

The company generated adjusted earnings per share of $2.73, a 13% increase compared to the same prior year period. The backlog declined 5% sequentially due to strong shipments.

On August 28th, 2025, Nordson increased its dividend by 5% to $0.82 per share quarterly, marking 62 years of increases.

Nordson’s results to date are still in line with its initial FY 2025 outlook, which expected sales of $2.75 billion to $2.87 billion and adjusted EPS of $9.70 to $10.50.

Click here to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

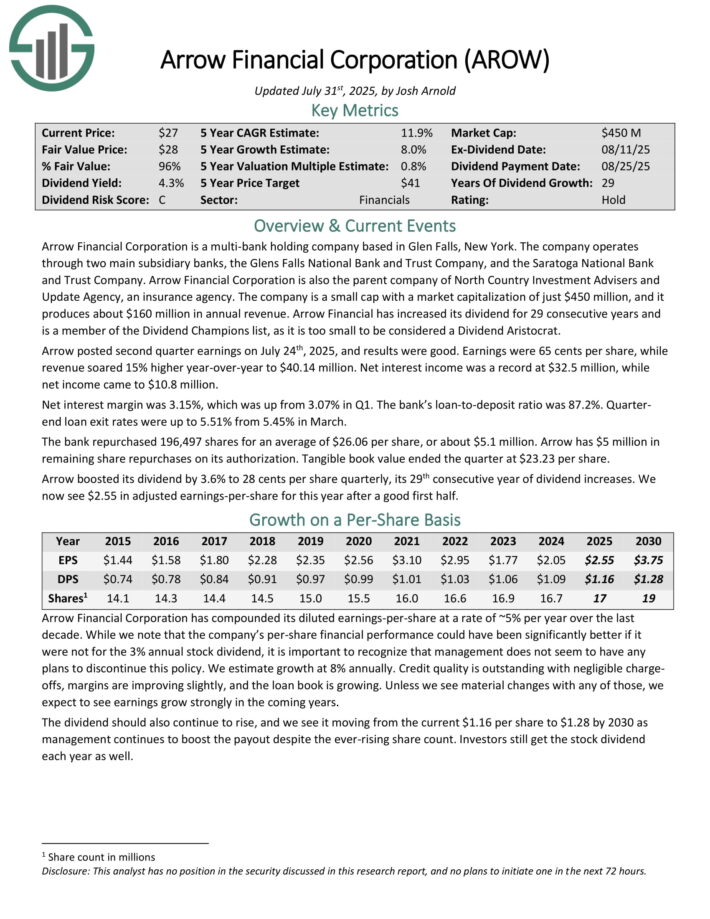

#6: Arrow Financial Corporation (AROW)

- 5-year expected annual returns: 12.1%

Arrow Financial Corporation is a multi-bank holding company based in Glen Falls, New York. The company operates through two main subsidiary banks, the Glens Falls National Bank and Trust Company, and the Saratoga National Bank and Trust Company.

Arrow Financial Corporation is also the parent company of North Country Investment Advisers and Update Agency, an insurance agency. The company is a small cap, and it produces about $163 million in annual revenue.

Arrow posted second quarter earnings on July 24th, 2025, and results were good. Earnings were 65 cents per share, while revenue soared 15% higher year-over-year to $40.14 million. Net interest income was a record at $32.5 million, while net income came to $10.8 million.

Net interest margin was 3.15%, which was up from 3.07% in Q1. The bank’s loan-to-deposit ratio was 87.2%. Quarter end loan exit rates were up to 5.51% from 5.45% in March.

The bank repurchased 196,497 shares for an average of $26.06 per share, or about $5.1 million. Arrow has $5 million in remaining share repurchases on its authorization. Tangible book value ended the quarter at $23.23 per share.

Arrow boosted its dividend by 3.6% to 28 cents per share quarterly, its 29th consecutive year of dividend increases.

Click here to download our most recent Sure Analysis report on AROW (preview of page 1 of 3 shown below):

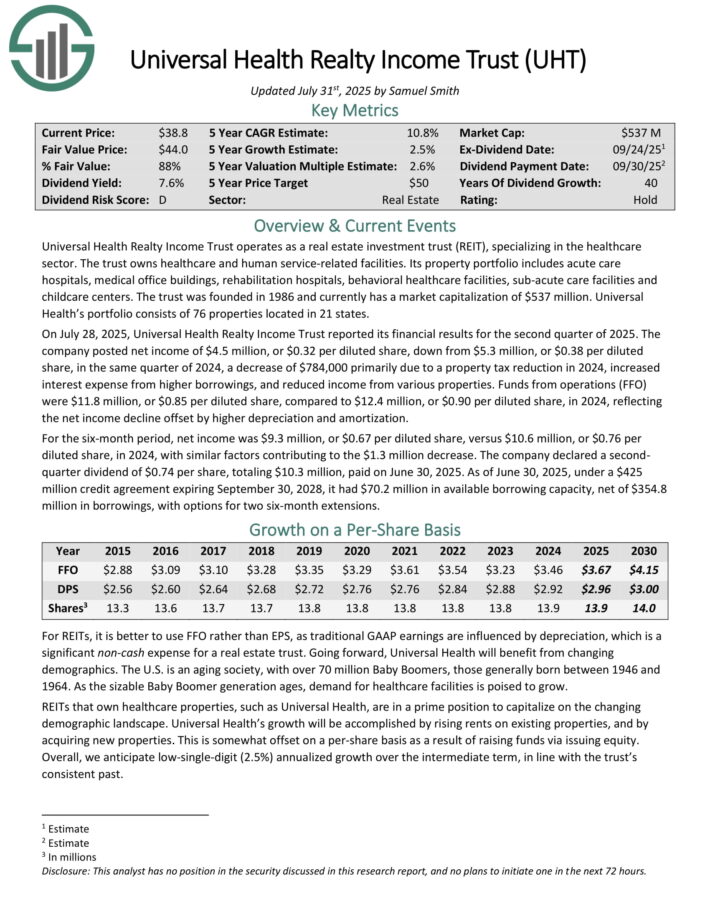

#5: Universal Health Realty Trust (UHT)

- 5-year expected annual returns: 12.3%

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities.

Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers. Universal Health’s portfolio consists of 76 properties located in 21 states.

On July 28, 2025, Universal Health Realty Income Trust reported its financial results for the second quarter of 2025. The company posted net income of $0.32 per diluted share, down from $0.38 per diluted share, in the same quarter of 2024, primarily due to a property tax reduction in 2024, increased interest expense from higher borrowings, and reduced income from various properties.

Funds from operations (FFO) were $11.8 million, or $0.85 per diluted share, compared to $12.4 million, or $0.90 per diluted share, in 2024, reflecting the net income decline offset by higher depreciation and amortization.

For the six-month period, net income was $9.3 million, or $0.67 per diluted share, versus $10.6 million, or $0.76 per diluted share, in 2024, with similar factors contributing to the $1.3 million decrease. The company declared a second quarter dividend of $0.74 per share.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

#4: Hormel Foods (HRL)

- 5-year expected annual returns: 12.6%

Hormel Foods was founded in 1891 in Minnesota. Since that time, the company has grown into a juggernaut in the food products industry with about $12 billion in annual revenue.

Hormel has kept its core competency as a processor of meat products for well over a hundred years but has also grown into other business lines through acquisitions.

The company sells its products in 80 countries worldwide, and its brands include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

Hormel posted third quarter earnings on August 28th, 2025, and results were very weak, including disappointing guidance for the fourth quarter.

Adjusted earnings-per-share came to 35 cents, which was six cents light of estimates. Revenue was up 4.5% year-over-year to $3.03 billion, beating estimates by $50 million. Organic net sales were up 6% year-over-year on volume gains of 4%, with price and mix comprising the other 2%.

The company also noted its cost savings program is working and helping save about $125 million annually. Gross profit was flat year-on-year, with inflationary headwinds offset by top line gains. The company noted 400 basis points of raw material cost inflation, a massive headwind to margins.

Cash flow from operations were $157 million, while capex was $72 million, and dividends paid were $159 million. Guidance for Q4 was for net sales of ~$3.2 billion, about $50 million light of consensus. Earnings are expected at ~39 cents.

Click here to download our most recent Sure Analysis report on HRL (preview of page 1 of 3 shown below):

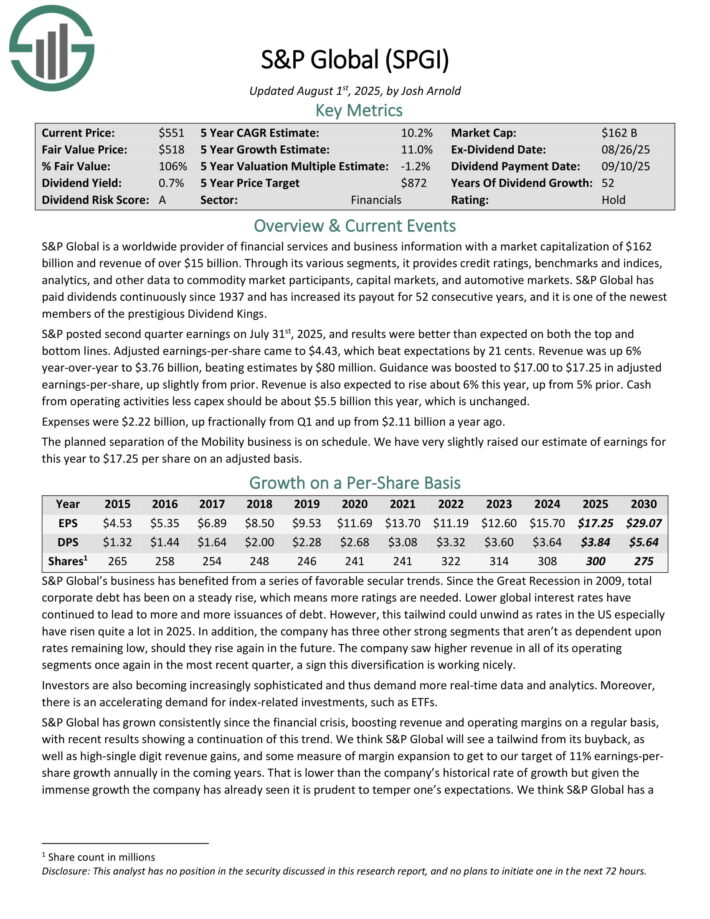

#3: S&P Global (SPGI)

- 5-year expected annual returns: 12.9%

S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion.

Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.

S&P posted second quarter earnings on July 31st, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $4.43, which beat expectations by 21 cents. Revenue was up 6% year-over-year to $3.76 billion, beating estimates by $80 million.

Guidance was boosted to $17.00 to $17.25 in adjusted earnings-per-share, up slightly from prior. Revenue is also expected to rise about 6% this year, up from 5% prior.

Cash from operating activities less capex should be about $5.5 billion this year, which is unchanged. Expenses were $2.22 billion, up fractionally from Q1 and up from $2.11 billion a year ago.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

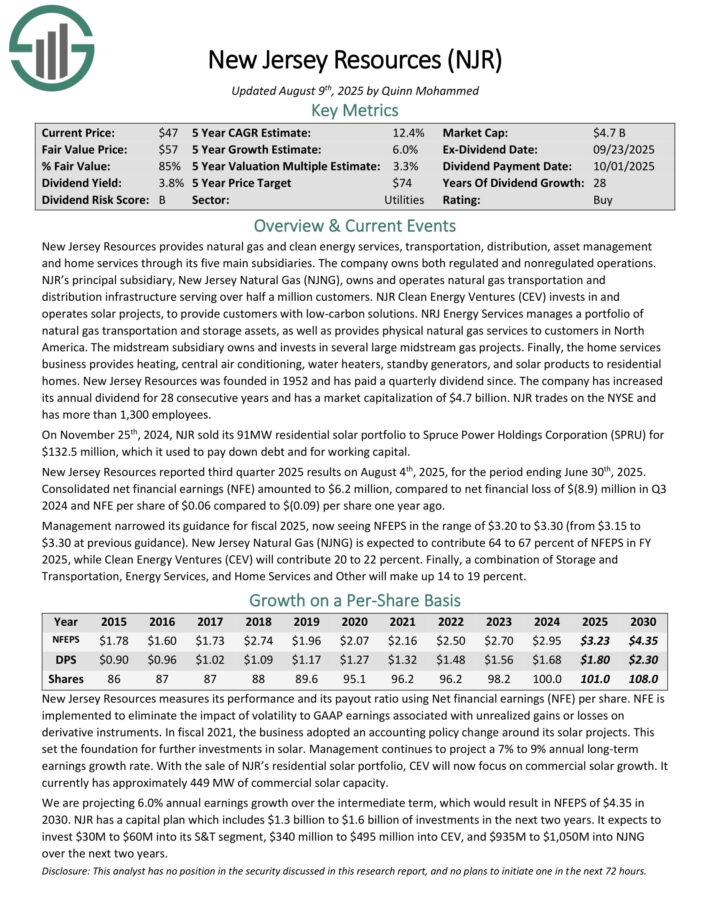

#2: New Jersey Resources (NJR)

- 5-year expected annual returns: 13.6%

New Jersey Resources provides natural gas and clean energy services, transportation, distribution, asset management and home services through its five main subsidiaries. The company owns both regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Natural Gas (NJNG), owns and operates natural gas transportation and distribution infrastructure serving over half a million customers.

NJR Clean Energy Ventures (CEV) invests in and operates solar projects, to provide customers with low-carbon solutions.

NRJ Energy Services manages a portfolio of natural gas transportation and storage assets, as well as provides physical natural gas services to customers in North America.

New Jersey Resources was founded in 1952 and has paid a quarterly dividend since. The company has increased its annual dividend for 28 consecutive years.

New Jersey Resources reported third quarter 2025 results on August 4th, 2025, for the period ending June 30th, 2025. Consolidated net financial earnings (NFE) amounted to $6.2 million, compared to net financial loss of $(8.9) million in Q3 2024 and NFE per share of $0.06 compared to $(0.09) per share one year ago.

Management narrowed its guidance for fiscal 2025, now seeing NFEPS in the range of $3.20 to $3.30 (from $3.15 to $3.30 at previous guidance).

Click here to download our most recent Sure Analysis report on NJR (preview of page 1 of 3 shown below):

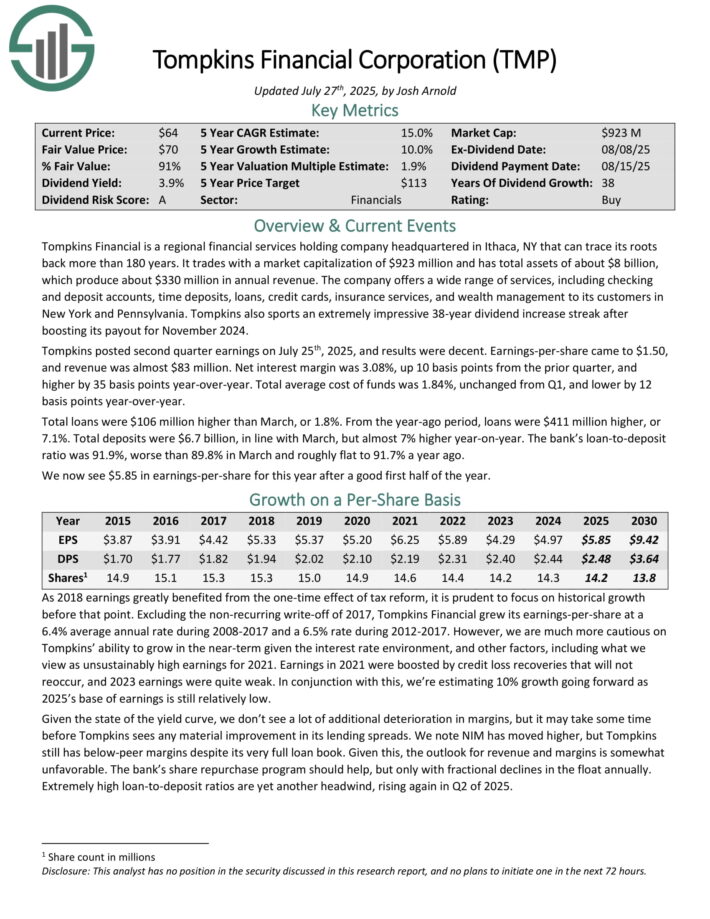

#1: Tompkins Financial (TMP)

- 5-year expected annual returns: 14.9%

Tompkins Financial is a regional financial services holding company headquartered in Ithaca, NY that can trace its roots back more than 180 years. It has total assets of about $8 billion, which produce about $300 million in annual revenue.

The company offers a wide range of services, including checking and deposit accounts, time deposits, loans, credit cards, insurance services, and wealth management to its customers in New York and Pennsylvania.

Tompkins posted second quarter earnings on July 25th, 2025. Earnings-per-share came to $1.50, and revenue was almost $83 million.

Net interest margin was 3.08%, up 10 basis points from the prior quarter, and higher by 35 basis points year-over-year. Total average cost of funds was 1.84%, unchanged from Q1, and lower by 12 basis points year-over-year.

Total loans were $106 million higher than March, or 1.8%. From the year-ago period, loans were $411 million higher, or 7.1%.

Total deposits were $6.7 billion, in line with March, but almost 7% higher year-on-year. The bank’s loan-to-deposit ratio was 91.9%, worse than 89.8% in March and roughly flat to 91.7% a year ago.

Click here to download our most recent Sure Analysis report on TMP (preview of page 1 of 3 shown below):

Final Thoughts and Additional Resources

Enrolling in DRIP stocks can be a great way to compound your portfolio income over time. Additional resources are listed below for investors interested in further research for DRIP stocks.

For dividend growth investors interested in DRIP stocks, the 15 companies mentioned in this article are a great place to start. Each business is very shareholder friendly, as evidenced by their long dividend histories and their willingness to offer investors no-fee DRIP stocks.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 56 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.